Maximizing Impact: School and System Leadership Collaboration

Maximizing the Impact of DFSS

-

Upload

vijaybijaj -

Category

Documents

-

view

411 -

download

7

Transcript of Maximizing the Impact of DFSS

The Venetian, Las Vegas (June 8-10, 2005)

WCBF Design for Six Sigma Conference Maximizing the Impact of DFSS

Richard PaxtonMaster Black BeltSVP, Process Excellence and Lean ExecutiveBank of America

“Why is it so important to establish

a Design for Six Sigma culture?”

3

We Will Discuss…

• Combating psychological inertia, enabling and creating the

right mind-set

• Aligning DFSS to your business goals, organization and

integrating into company culture

• Establishing a sustainable innovation culture for Six Sigma

• Managing your resources to lead DFSS efforts

• Optimizing the involvement, support system and tools for

DFSS users

Combating Psychological Inertia and Enabling

& Creating the Right Mindset

5

Psychological Inertia – What Is It

Psychological inertia is possibly the single largest

obstacle between achieving breakthrough results

and incremental improvement. It is a boundary

between innovation and business as usual fueled by

“In the Box” thinking.

6

Combating PI

Design for Six Sigma breaks down these barriers by:

• Leveraging cross-functional teams

• Focusing on the customer

• Identifying negative correlations (competing CTQ’s)

• Developing product / process concepts independent of

technology

7

Focus on Organic Growth…

• Higher customer satisfaction

• Higher retention rates

• Lower cost to acquire these customers because we're

adding additional products and services to an existing

relationship, rather than initiating a new one

• Customers who consolidate their financial relationships with

one provider tend to maintain higher balances

Creating the Right Mindset

8

Demonstrate understanding of business needs…

• Establish appropriate Service Level Agreements (SLA’s)

• Ensure technology environments are stable (Availability)

• Accelerate time to market

Not only meet but EXCEED customer expectations

Customer Focused / Metrics Driven

9

CustomerIs

Delighted!

Internal customer facing groups have appropriate tools to Service Customers with confidence

The Customer

has a financial Need

Technology is built or

Enhanced based on

Customers Needs

Internal product / sales teams identify “Innovative

Ways” to Service the Customer

Organic Growth

Occurs

Provides a Stable Environment

and Repeatable Processes

Six Sigma / DFSSSix Sigma / DFSS

Making the Connection

10

Identify Identify Potential Potential

Concepts, Concepts, And Select And Select ConceptsConcepts

High-Level High-Level Design, Design, Detailed Detailed

Design, And Design, And Predict Predict Design Design

CapabilityCapability

Build, Test Build, Test And Pilot And Pilot DesignDesign

Deploy Design, Deploy Design, Execute Control Execute Control

Plan and Plan and Transition to Transition to

Process OwnersProcess Owners

DefineDefine MeasureMeasure AnalyzeAnalyze ImproveImprove ControlControlPre-DefinePre-Define

Business Business Alignment, Alignment, Start The Start The ProjectProject

Gather Gather Customer Customer

Needs Needs Define and Define and Prioritize Prioritize

CTQs CTQs

Optimize design across multiple CTQ’s and structures to meet or

exceed customer expectations at implementation

New product/process/service or system where none existed before

Redesign an existing product/process/service or system where the existing entitlement does not meet

customer requirements

Optimize an existing product/process/service or system where the change complexity (multiple CTQ’s) is

high

DFSS Approach

Aligning Your Business Goals and Organization

Around Design for Six Sigma

12

Alignment Starts at the TopN

S

W E

Top-Down Strategy, Driven and Owned by all Bank Associates

• Vision / Mission/ Goals• 3-5 Year Breakthrough

Strategies

1

Bank of America

Ken Lewis, Chairman and CEO

“Be Recognized As One of the World’s Most AdmiredCompanies”

Breakthrough Strategies

Provider of Choice92% Customer Satisfaction

Employer of Choice90% Associate Satisfaction

Investment of ChoiceFirst in Peer Group

Total Shareholder Return

1.1 Provide a world-class customer/client experiencethrough easy access and efficient, error-free service

C. Goslee / B. Desoer1.2 Attract and retain profitable customers/clients…and

continuously reward them for keeping and bringing moreof their business to us G. Taylor / R. DeMartini / B. Desoer

E. Brown1.1 Become the trusted advisor for financial solutions

R. DeMartini / E. Brown1.4 Develop and deliver innovative new products and

solutions which make financial services work in ways itnever has before B. Desoer / E. Brown

VISION

GOALS

ASSOCIATE

SHAREHOLDER

CUSTOMER

2.1 Attract and retain a world-class work force S. Alphin

2.2 Define and align Associate roles, measures and rewardsto our strategy S. Alphin

2.3 Provide the support and tools Associates need to excel B. Desoer

2.4 Enable Associates to achieve professional growthbalanced with personal goals B. Desoer

2.5 Reflect in our work force the diversity of the communitiesand customers we serve S. Alphin

3.1 Double Shareholder Value Add (SVA) in the next 3 yearsJ. Hance

3.2 Consistently achieve double-digit year-over-year (EPS)growth J. Hance

3.3 Consistently achieve annual revenue growth targetsJ. Hance3.4 Substantially reduce volatility of market, credit and

operational losses B. Vandiver

3.5 Dramatically reduce the complexity of our business andachieve double-digit productivity each year

C. Goslee / T. Arnoult

Page 1The ‘What’

2002 Performance Plan Metric1.1 Provide a world-class customer/client experience through easy access and efficient, error-free service

1.1.1 Drive Six Sigma & re-engineering across priority processes to address customer experience gaps and achieve breakthrough quality and productivity improvements1.1.2 Develop and deliver the appropriate enablers (people/process/technology) to make the customer

experience come alive in a sustainable and differentiated way1.1.3 Implement a world-class problem resolution process

1.2 Attract and retain profitable customers/clients…and continuously reward them for keeping andbringing more of their business to us1.2.1 Establish and implement a disciplined customer/client continuum (selection/acquisition/service) process matched to individual customer group strategies…Align customers/clients with the right level and proactively up-tier them consistent with their needs1.2.2 Focus resources on a narrower set of corporate issuer clients where we can build a leading market

position and significantly increase emphasis and penetration of institutional investor clients1.2.3 Create value propositions by customer segment while ensuring profit for the bank1.2.4 Establish a meaningful loyalty program that allows customers/clients to choose from a variety of rewards1.2.5 Create an automated product aggregation capability that enables customers to bundle solutions in a way that creates value for them1.2.6 Create a distribution system with sufficient scale to cover the franchise and meet customer/client needs

1.3 Become the trusted advisor for financial solutions 1.3.1 Design and implement an industry leading financial advice process, tool-set, and associate competencies by customer segment1.3.2 Launch the brand building activities required to be recognized as a world-class investment provider1.3.3 Design & implement the relationship management process across customer segments1.3.4 Respond to our customer/client needs as they evolve (eg: insurance & retirement services capabilities)1.3.5 Increase the size and margin of advisory, capital raising, and risk management activities, while

significantly reducing the corporate loans held on our balance sheet1.4 Develop and deliver innovative new products and solutions which make financial services work in

ways it never has before1.4.1 Develop and implement a breakthrough product development process1.4.2 Develop a strategy for non-proprietary offerings1.4.3 Preserve and expand the bank's position in the payments/funds transfer process

1.1 Key Processes Sigma level% Very Satisfied

1.2 Relationship Net Income ($RNI)# Products Per RelationshipMarket Penetration (%)# Customer/Client RelationshipsConcentration Limits (#)

1.3 Relationship Net Income ($RNI)Market Penetration (%)

1.4 Relationship Net Income ($RNI)Market Penetration (%)

2.1 Attract and retain a world-class work force2.1.1 Implement Associate satisfaction surveys and address the most important issues2.1.2 Adopt a world-class internal & external selection/recruitment/staffing process2.1.3 Create a 6 month assimilation plan for new Associates2.1.4 Develop a world-class recognition & compensation program

2.2 Define and align Associate roles, measures & rewards to our strategy2.2.1 Define roles and complete performance management plans for all Associates, aligned to the corporate strategy and to the supporting business unit performance plans2.2.2 Align performance measures & incentives to re-enforce desired Associate behaviors2.2.3 Require non-customer facing Associates to experience direct customer/client input on a quarterly basis2.2.4 Implement success profiles for all positions

2.3 Provide the support and tools Associates need to excel2.3.1 Ensure learning & development opportunities to maximize current Associate performance & future potential…Develop and implement an effective coaching program2.3.2 Provide training to improve Associate capabilities in critical skills (relationship building, client management, quality tools & processes, scorecard drivers--SVA)….web-enable priority technical tools2.3.3 Complete all improvements required to achieve a world-class talent planning process

2.4 Enable Associates to achieve professional growth balanced with personal goals2.4.1 Develop and deliver a process & strategy to support career development2.4.2 Ensure Associates are aware of all benefits offered to them2.4.3 Provide our Associates the best value in financial services2.4.4 Develop comprehensive mentoring/networking programs

2.5 Reflect the diversity of the communities and customers we serve in our work force2.5.1 Attract, retain and develop associates with diverse skills and experiences2.5.2 Determine and achieve diversity targets by band level

2.1 % Very Satisfied% Positive responses for:

- Performance Plans- Training- Diversity

% Turnover – Total

2.2 % Positive responses forPerformance Management

2.3 # Training Hours Completed

2.4 % Positive responses forPerformance Management

2.5 % Minority / Women in Band 1-3positions

3.1 Double Shareholder Value Add (SVA) in the next 3 years3.1.1 Implement Breakthrough (Hoshin) Strategic Planning company-wide…achieve results on 1.1-2.5 above3.1.2 Strengthen compensation linkages to SVA3.1.3 Re-allocate resources and capital to high SVA growth businesses3.1.4 Modify pricing & profitability tools to include SVA generated at the customer/client level

3.2 Consistently achieve double-digit Y-O-Y EPS growth3.2.1 Achieve results on 1.1-3.1 above3.2.2 Establish disciplined pricing/return hurdles at relationship level, inspect results & remedy as appropriate

3.3 Consistently achieve annual revenue growth targets

3.0 Total Shareholder Return (Rankin Peer Group)

3.1 Change in SVA ($)

3.2 EPS ($ / % growth)

3.3 Revenue Growth (%)

• 12 Month Tactical Plan• Key Performance

Metrics

Page 2The ‘How’

• Performance Measures to track progress

Bank of America Performance Plan Measures

2002 Milestones 2001 2002

METRIC Performance Goal Q1 Q2 Q3 Q4 Benchmark Source

Customer

Key Processes Sigma level - Deposits - Payments - Problem Resolution

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

% Very Satisfied - Consumer/Comm/AMG - GCIB Issuer - GCIB Investor (rank)

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

RNI Per Relationship ($) - Consumer/Comm/AMG - GCIB (rev/strategic issuer

client)

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

# Products Per Relationship - Consumer/Comm/AMG

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

% Market Penet (target mkts) - Consumer - Premier - Small Business - Commercial - Private - GCIB Issuer - GCIB Investor

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

% Lead Bank Penet (target mkts) Commercial

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

# Cust/Client Relationships - Consumer/Comm/AMG

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

Concentration Limits (#) TBD TBD TBD TBD TBD TBD TBD TBD

Associate % Very Satisfied TBD TBD TBD TBD TBD TBD TBD TBD

% positive responses for: - Performance mgmt. - Training - Diversity

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

% Turnover – Total TBD TBD TBD TBD TBD TBD TBD TBD

# Training Hours Completed (per associate per year)

TBD TBD TBD TBD TBD TBD TBD TBD

% Minority / Women in Band 1-3 positions

TBD TBD TBD TBD TBD TBD TBD TBD

Shareholder Total Shareholder Return (Rank in Peer Group)

TBD TBD TBD TBD TBD TBD TBD TBD

Change in SVA ($) TBD TBD TBD TBD TBD TBD TBD TBD

EPS ($ / % growth) TBD TBD TBD TBD TBD TBD TBD TBD

Revenue Growth (%) TBD TBD TBD TBD TBD TBD TBD TBD

Trading Rev. Stability (%) TBD TBD TBD TBD TBD TBD TBD TBD

NII Sensitivity ($) - Rising - Declining

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

Credit Loss Stability (bp/qtr) TBD TBD TBD TBD TBD TBD TBD TBD

Operational Risk Stability TBD TBD TBD TBD TBD TBD TBD TBD

Capital Adequacy (%) (Tier 1)

TBD TBD TBD TBD TBD TBD TBD TBD

Productivity ($) - Efficiency Ratio

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

Page 3‘Balanced Scorecard’

13

2002 Performance Plan Metric1.1 Provide a world-class customer/client experience through easy access and efficient, er ror-free service

1.1.1 Drive Six Sigma & re-engineering across priority processes to address customer experience gaps and achieve breakthrough quality and product ivity improvements1.1.2 Develop and deliver the appropriate enablers (people/process/ technology) to make the customer

experience come alive in a sustainable and different iated way1.1.3 Implement a world-class problem resolution process

1.2 Attract and retain profitable customers/clients…and continuously reward them for keeping andbr inging more of their business to us1.2.1 Establish and implement a disciplined customer/client continuum (selection/acquisit ion/service) process matched to individual customer group strategies…Align customers/clients with the right level and proactively up-t ier them consistent with their needs1.2.2 Focus resources on a narrower set of corporate issuer clients where we can build a leading market

posit ion and significantly increase emphasis and penetration of inst itutional investor clients1.2.3 Create value propositions by customer segment while ensuring prof it for the bank1.2.4 Establish a meaningful loyalty program that allows customers/clients to choose from a variety of rewards1.2.5 Create an automated product aggregat ion capability that enables customers to bundle solut ions in a way that creates value for them1.2.6 Create a dist ribution system with suff icient scale to cover the franchise and meet customer/client needs

1.3 Become the trusted advisor for financial solutions 1.3.1 Design and implement an industry leading financial advice process, tool-set , and associate competencies by customer segment1.3.2 Launch the brand building act ivities required to be recognized as a world-class investment provider1.3.3 Design & implement the relationship management process acros s customer segments1.3.4 Respond to our customer/client needs as they evolve (eg: insurance & retirement services capabilit ies)1.3.5 Increase the size and margin of advisory, capital raising, and risk management activities, while

significantly reducing the corporate loans held on our balance sheet1.4 Develop and deliver innovative new products and solutions which make financial services work in

ways it never has before1.4.1 Develop and implement a breakthrough product development process1.4.2 Develop a st rategy for non-proprietary offerings1.4.3 Preserve and expand the bank's position in the payments/ funds transfer process

1.1 Key Processes Sigma level% Very Satisfied

1.2 Relationship Net Income ($RNI)# Products Per RelationshipMarket Penetration (%)# Customer/Client RelationshipsConcentration Limits (#)

1.3 Relationship Net Income ($RNI)Market Penetration (%)

1.4 Relationship Net Income ($RNI)Market Penetration (%)

2.1 Attract and retain a world-class work force2.1.1 Implement Associate sat isfaction surveys and address the most important issues2.1.2 Adopt a world-class internal & external select ion/ recruitment/staffing process2.1.3 Create a 6 month assimilation plan for new Associates2.1.4 Develop a world-class recognit ion & compensat ion program

2.2 Define and al ign Associate roles, measures & rewards to our strategy2.2.1 Define roles and complete performance management plans for all Associates, aligned to the corporate strategy and to the support ing business unit performance plans2.2.2 Align performance measures & incentives to re-enforce desired Associate behaviors2.2.3 Require non-customer facing Associates to experience direct customer/client input on a quarterly basis2.2.4 Implement success profiles for all positions

2.3 Provide the support and tools Associates need to excel2.3.1 Ensure learning & development opportunities to maximize current Associate performance & future potential…Develop and implement an effective coaching program2.3.2 Provide t raining to improve Associate capabilities in crit ical skills (relationship building, client management, quality tools & processes, scorecard drivers--SVA)….web-enable priority technical tools2.3.3 Complete all improvements required to achieve a world-class talent planning process

2.4 Enable Associates to achieve professional growth balanced with personal goals2.4.1 Develop and deliver a process & strategy to support career development2.4.2 Ensure Associates are aware of all benefits offered to them2.4.3 Provide our Associates the best value in f inancial services2.4.4 Develop comprehensive mentoring/networking programs

2.5 Reflect the diversity of the communities and customers we serve in our work force2.5.1 Att ract, retain and develop associates with diverse skills and experiences2.5.2 Determine and achieve diversity targets by band level

2.1 % Very Satisfied% Positive responses for:

- Performance Plans- Training- Diversity

% Turnover – Total

2.2 % Positive responses forPerformance Management

2.3 # Training Hours Completed

2.4 % Positive responses forPerformance Management

2.5 % Minority / Women in Band 1-3posit ions

3.1 Double Shareholder Value Add (SVA) in the next 3 years3.1.1 Implement Breakthrough (Hoshin) Strategic Planning company-wide…achieve results on 1.1-2.5 above3.1.2 Strengthen compensation linkages to SVA3.1.3 Re-allocate resources and capital to high SVA growth businesses3.1.4 Modify pricing & profitability tools to include SVA generated at the customer/client level

3.2 Consistently achieve double-digit Y-O-Y EPS growth3.2.1 Achieve results on 1.1-3.1 above3.2.2 Establish disciplined pricing/ return hurdles at relationship level, inspect results & remedy as appropriate

3.3 Consistently achieve annual revenue growth targets

3.0 Total Shareholder Return (Rankin Peer Group)

3.1 Change in SVA ($)

3.2 EPS ($ / % growth)

3.3 Revenue Growth (%)

Bank of America Performance Plan Measures

2002 Milestones 2001 2002

METRIC Performance Goal Q1 Q2 Q3 Q4 Benchmark Source

Customer

Key Processes Sigma level - Deposits - Payments - Problem Resolution

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

% Very Sat isfied - Consumer/Comm/AMG - GCIB Issuer - GCIB Investor (rank)

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

RNI Per Relationship ($) - Consumer/Comm/AMG - GCIB (rev/strategic issuer

client)

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

# Products Per Relations hip - Consumer/Comm/AMG

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

% Market Penet (target mkts) - Consumer - Premier - Small Business - Commercial - Private - GCIB Issuer - GCIB Investor

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

TBD TBD TBD TBD TBD TBD TBD

% Lead Bank Penet (target mkts) Commercial

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD

# Cust/Client Relations hips

- Consumer/Comm/AMG

TBD

TBD

TBD

TBD

TBD

TBD

TBD

TBD Concentrat ion Limits (#) TBD TBD TBD TBD TBD TBD TBD TBD

Associate % Very Sat isfied TBD TBD TBD TBD TBD TBD TBD TBD

% positive responses for: - Performance mgmt. - Training - Diversity

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

TBD TBD TBD

% Turnover – Total TBD TBD TBD TBD TBD TBD TBD TBD

# Training Hours Completed (per as sociate per year)

TBD TBD TBD TBD TBD TBD TBD TBD

% Minority / Women in Band 1-3 posit ions

TBD TBD TBD TBD TBD TBD TBD TBD

Shareholder Total Shareholder Return (Rank in Peer Group)

TBD TBD TBD TBD TBD TBD TBD TBD

Change in SVA ($) TBD TBD TBD TBD TBD TBD TBD TBD

EPS ($ / % growth) TBD TBD TBD TBD TBD TBD TBD TBD

Revenue Growth (%) TBD TBD TBD TBD TBD TBD TBD TBD Trading Rev. S tability (%) TBD TBD TBD TBD TBD TBD TBD TBD

NII Sensitivity ($) - Rising - Declining

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

Credit Loss Stability (bp/qtr) TBD TBD TBD TBD TBD TBD TBD TBD

Operational Risk Stability TBD TBD TBD TBD TBD TBD TBD TBD

Capital Adequacy (%) (Tier 1)

TBD TBD TBD TBD TBD TBD TBD TBD

Productivity ($) - Efficiency Ratio

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

TBD TBD

Belk

Ken Lewis, Chairman and CEO

To be the financial services “Provider of Choice” by flawlessly delivering innovative solutions and advice through customer-

focused associates in a way tha t enables customers and

communities to realize their dreams.

1.1 Improve the customer experience by making it easy for

customers to do business with us (Tim Arnoult, Chuck Goslee)

1.2 Build customer satisfaction, loyalty and share of wallet by

enhancing customer value through differentiated service,

pricing and product (Amy Brinkley, Gene Taylor) 1.3 Become the trusted advisor for chosen financial services

and products (Rich DeMartini, Ed Brown)1.4 Develop innovative new products and services, which

make banking work in ways it never has before (Barbara Desoer, Amy Brinkley)

“Be Recognized As One of the World’s Most

Admired Companies” VISION

MISSION

3 - 5 YEAR STRATEGIES GOALS

CUSTOMER SATISFACTION

Provider of Choice

92% Customer Satisfaction

2.1 Attract, develop and retain a world-class work force (Steele Alphin)

2.2 Align all associates to our vision and customer & shareholder deliverables (Steele Alphin)

2.3 Ensure our associates excel in their role by providing the attention, support and tools they need to be successful (Barbara Desoer) 2.4 Enable associates to realize their career aspirations by rewarding success and providing access to growth opportunities (Barbara Desoer, Steele Alphin) 2.5 Reflect the diversity of the communities and customers

we serve in our work force (Barbara Desoer, Steele Alphin)

ASSOCIATE SATISFACTION

Employer of Choice 90% Associate Satisfaction

SHAREHOLDER SATISFACTION

Investment of Choice Top-10 (S&P 500)

Total Shareholder Return

3.1 Double SVA over the next five years by achieving consistent quarter over quarter growth (Greg Curl, Marc Oken)

3.2 Double income over the next 5 years (Greg Curl, Marc Oken) 3.3 Improve productivity by 40% over the next 5 years

(Chuck Goslee, Tim Arnoult)

1. Hoshin plans set direction &

align the organization

2. MBF’s plan how toclose gaps

Cause & effect learnings from

MBFs refine tactics in Hoshin Plan Six Sigma

DFSS

Black Belt

Green Belt

3. Nested MBF’s, DFSS, Black Belt, and Green Belt projects flow from MBF’s

4. Scorecard Reviewsmonitor performance

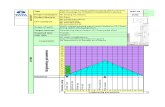

Problem Sta tem ent: Eastman Kodak Company's Order to Cash Supply Chain ranges are 62 to 165 days, as compared to Best in Class of 2-5 days orderto receipt and 20 days DSO contributing to a lost revenue opportuni ty exceeding $1B.

Overall Customer S atisfaction (Top 2 Boxes)

71.1% 69% 68%

91%

0%

20%

40%

60%

80%

100%

1996 1997 1998 1Q99 P& G/Mercedes

US Perfect Orde r Delivery ( SAP Metric)

43%48%

58%

90 %

0%

20%

40%

60%

80%

1 00%

Dec- 98 Jan-9 9 Feb -99 Mar -99 BIC

Overall Revenu e Chart

14.7

13. 8

13

1 3

1212.5

13

13.514

14.5

15

1996 1997 1998 1Q 99 Plan

$1BOppor tunity

OTC S upply Chain A verages

0

50

100

150

200

C I BIS HI KPRO D&AI

Nu

mbe

r o

f D

ay

s

Key Dr iversCa tegor ies Causing Perf orma nce Gap

0%

10%

20%

P ri ci ng Po l ic ie s/F in an ci a l Te ch . /Cu st . S up po rt Sa l es S u pp ort Orde r & De li ve ry

Comm./Info. Ease of Contact Pr oblem Resolution

Eas tman Kodak Overall DSO (# o f Day s)

0

10

20

3040

50

6070

YE98 Jan -99 Feb- 99 Be st In Class1

PRIORITIZA TION & ROOT CAU SE COUN TER MEA SU RES & AC TIVITIES WHO WHE N PROCE SS C APA BILITY

1. DS OHigh % of credits/refunds/delays Implement fail-safe process All BU’s 12/1/99 C ustomer Sat., Perfect Order Deliver yToo many and varying rebates Eliminate rebates All BU’s 12/1/99 5 D ays Cycle TimeUnfriendly payment plans Implement e-commer ce, small order cr edit cards and

standardize terms and conditionsAll BU’s 12/1/99 C ycle Time, C ustomer Sat.

2. Shipment & DeliveryUnacceptable delivery predictability and order fulfi llment Develop strategy to maximize flexibil ity , ensure full orders,

and meet customer deliver y requirementsAll BU’s 9/15/99 $ Inv., 2-5 pp OTC C ustomer Sat.

Ineffective stocking strategy Review customer needs, maximize velocity matching withEK capability

All BU’s 7/1/99 2 D ays Cycle Time, 2- 5 pp OTC Customer S at.,$ Inv.

3. ManufacturingLong manufacturing cycle times Implement customer order demand pull and build to order All BU’s 9/1/99 C ycle Time, $ Inv.Inflexible manufacturing Reduce set up time/cost and mfg. in small lots All BU’s 9/1/99 C ycle Time, $ Inv.4. Order A dminist rationComplex order configuration Develop, s implify and implement order configurator All BU’s 10/1/99 P er fect Order D eliveryUncompetitive forecasting variability Improve mfg./supplier flexibil ity All BU’s 7/1/99 2 D ays Cycle TimeInsufficient per sonnel capability Train, certify and empow er key roles All BU’s 9/1/99 E mployee S at., Perfect Or der D eliveryLabor extensive and complex order entry Implement e-commer ce All BU’s 12/1/99 C ycle Time, Employee Sat., Perfect Order

D elivery5. Comp lexityLarge/complex product portfolio (000’sK C at #’s) Rationalize product por tfolio and bundle pr oducts All BU’s 10/1/99 2-3 pp OTC C ustomer Sat., Perfect Order

D elivery6. Pr oduct DevelopmentLack of OTC partic ipation in commercialization process Review and fix gate process All BU’s 7/15/99 2-3 pp OTC C ustomer Sat.7. MetricsSupply Chain managed on cost in functional silos Implement end to end S /C metr ics and service level

agr eementsAll BU’s 8/15/99 C ustomer Sat., Perfect Order Deliver y

8. System sStandard ER P doesn’t meet customer needs Identify impact enhancing alternatives and implement All BU’s 8/15/99 2-3 pp OTC C ustomer Sat.

BENCHMARK

Target

Target = 22Problem Statement: Eastman Kodak Company's Order to Cash Supply Chain ranges are 62 to 165 days, as compared to Best in Class of 2-5 days orderto receipt and 20 days DSO contributing to a lost revenue opportunity exceeding $1B.

Overal l Customer Satisfac tion

( Top 2 Box es)

71.1% 69% 68%

91%

0%

20%

40%

60%

80%

100%

1996 1997 1998 1Q99 P&G/Mercedes

US Perfect Order Delivery (SAP Metric)

43%48%

58%

90%

0%

20%

40%

60%

80%

100%

Dec-98 Jan-99 Feb-99 Mar-99 BIC

Overall Revenue Chart

14.7

13.8

13

13

12

12.5

13

13.5

14

14.5

15

1996 1997 1998 1Q99 Plan

$1BOpport unity

OTC Supply Chain Averages

0

50

100

150

200

CI BIS HI KPRO D&AI

Num

be

r o

f D

ays

Key DriversCategories Causing Performance Gap

0%

10%

20%

Pricing Pol icies/Financi al Tech. /Cust. Support Sales Support O rder & Delivery

Comm./Info. Ease of Contac t Problem Res olution

Eastman Kodak Overall DSO (# of Days)

0

10

20

30

40

50

60

70

YE98 Jan-99 Feb-99 Best In Class

1

PRIORITIZATION & ROOT CAUSE COUNTER MEASURES & ACTIVITIES WHO WHEN PROCESS CAPABILITY

1. DSOHigh % of cr edits/refunds/delays Implement fail -safe process A ll BU’s 12/1/99 Customer Sat., Per fect Order Deliv eryToo many and v arying rebates El im inate rebates A ll BU’s 12/1/99 5 Days Cy cle TimeUnfriendly payment plans Implement e-commerc e, small order credi t cards and

standardize terms and conditionsA ll BU’s 12/1/99 Cycle Time, Customer Sat.

2. Shipment & DeliveryUnacceptable delivery predictabil ity and order ful fillment Develop strategy to max imize flexibi lity, ensur e ful l or ders,

and meet c ustomer deliv ery requirementsA ll BU’s 9/15/99 $ Inv., 2-5 pp OTC Cus tomer Sat.

Ineffective s tocking s trategy Review cus tomer needs, maximize velocity matc hing withEK c apabil ity

A ll BU’s 7/1/99 2 Days Cy cle Time, 2-5 pp OTC Customer Sat.,$ Inv.

3. Manuf acturingLong manufac turing cy cle times Implement customer order demand pul l and build to or der A ll BU’s 9/1/99 Cycle Time, $ Inv.Inflexible manufacturing Reduc e set up time/cost and mfg. in small lots A ll BU’s 9/1/99 Cycle Time, $ Inv.4. Order AdministrationComplex or der configuration Develop, simpl ify and implement order configurator A ll BU’s 10/1/99 Per fect Order Deliv eryUncompetitive forecasting variabi li ty Improv e mfg./supplier flexibil ity A ll BU’s 7/1/99 2 Days Cy cle TimeInsufficient personnel capabi li ty Train, certify and empower key roles A ll BU’s 9/1/99 Employee Sat., Per fect Order Deliv eryLabor extensive and complex order entr y Implement e-commerc e A ll BU’s 12/1/99 Cycle Time, Employee Sat., Per fect Order

Delivery5. Complexit yLarge/complex product portfolio (000’sK Cat #’s) Rational ize product portfolio and bundle products A ll BU’s 10/1/99 2-3 pp OTC Customer Sat., Perfect Or der

Delivery6. Product DevelopmentLack of OTC partic ipation in commercial ization pr ocess Review and fix gate proces s A ll BU’s 7/15/99 2-3 pp OTC Customer Sat.7. MetricsSupply Chain managed on cost in functional si los Implement end to end S/C metr ics and s ervice level

agreementsA ll BU’s 8/15/99 Customer Sat., Per fect Order Deliv ery

8. SystemsStandar d ERP does n’t meet customer needs Identi fy impact enhancing alter natives and implement A ll BU’s 8/15/99 2-3 pp OTC Customer Sat.

BENCHMARK

Target

Target = 22

Problem Statement: Eastman Kodak Company's Order to Cash Supply Chain ranges are 62 to 165 days, as compared to Best in Class of 2-5 days orderto receipt and 20 days DSO contributing to a lost revenue opportunity exceeding $1B.

Overal l Customer Satisfac tion

( Top 2 Box es)

71.1% 69% 68%

91%

0%

20%

40%

60%

80%

100%

1996 1997 1998 1Q99 P&G/Mercedes

US Perfect Order Delivery (SAP Metric)

43%48%

58%

90%

0%

20%

40%

60%

80%

100%

Dec-98 Jan-99 Feb-99 Mar-99 BIC

Overall Revenue Chart

14.7

13.8

13

13

12

12.5

13

13.5

14

14.5

15

1996 1997 1998 1Q99 Plan

$1BOpport unity

OTC Supply Chain Averages

0

50

100

150

200

CI BIS HI KPRO D&AI

Num

be

r o

f D

ays

Key DriversCategories Causing Performance Gap

0%

10%

20%

Pricing Pol icies/Financi al Tech. /Cust. Support Sales Support O rder & Delivery

Comm./Info. Ease of Contac t Problem Res olution

Eastman Kodak Overall DSO (# of Days)

0

10

20

30

40

50

60

70

YE98 Jan-99 Feb-99 Best In Class

1

PRIORITIZATION & ROOT CAUSE COUNTER MEASURES & ACTIVITIES WHO WHEN PROCESS CAPABILITY

1. DSOHigh % of cr edits/refunds/delays Implement fail -safe process A ll BU’s 12/1/99 Customer Sat., Per fect Order Deliv eryToo many and v arying rebates El im inate rebates A ll BU’s 12/1/99 5 Days Cy cle TimeUnfriendly payment plans Implement e-commerc e, small order credi t cards and

standardize terms and conditionsA ll BU’s 12/1/99 Cycle Time, Customer Sat.

2. Shipment & DeliveryUnacceptable delivery predictabil ity and order ful fillment Develop strategy to max imize flexibi lity, ensur e ful l or ders,

and meet c ustomer deliv ery requirementsA ll BU’s 9/15/99 $ Inv., 2-5 pp OTC Cus tomer Sat.

Ineffective s tocking s trategy Review cus tomer needs, maximize velocity matc hing withEK c apabil ity

A ll BU’s 7/1/99 2 Days Cy cle Time, 2-5 pp OTC Customer Sat.,$ Inv.

3. Manuf acturingLong manufac turing cy cle times Implement customer order demand pul l and build to or der A ll BU’s 9/1/99 Cycle Time, $ Inv.Inflexible manufacturing Reduc e set up time/cost and mfg. in small lots A ll BU’s 9/1/99 Cycle Time, $ Inv.4. Order AdministrationComplex or der configuration Develop, simpl ify and implement order configurator A ll BU’s 10/1/99 Per fect Order Deliv eryUncompetitive forecasting variabi li ty Improv e mfg./supplier flexibil ity A ll BU’s 7/1/99 2 Days Cy cle TimeInsufficient personnel capabi li ty Train, certify and empower key roles A ll BU’s 9/1/99 Employee Sat., Per fect Order Deliv eryLabor extensive and complex order entr y Implement e-commerc e A ll BU’s 12/1/99 Cycle Time, Employee Sat., Per fect Order

Delivery5. Complexit yLarge/complex product portfolio (000’sK Cat #’s) Rational ize product portfolio and bundle products A ll BU’s 10/1/99 2-3 pp OTC Customer Sat., Perfect Or der

Delivery6. Product DevelopmentLack of OTC partic ipation in commercial ization pr ocess Review and fix gate proces s A ll BU’s 7/15/99 2-3 pp OTC Customer Sat.7. MetricsSupply Chain managed on cost in functional si los Implement end to end S/C metr ics and s ervice level

agreementsA ll BU’s 8/15/99 Customer Sat., Per fect Order Deliv ery

8. SystemsStandar d ERP does n’t meet customer needs Identi fy impact enhancing alter natives and implement A ll BU’s 8/15/99 2-3 pp OTC Customer Sat.

BENCHMARK

Target

Target = 22

Kanri = Execution

One Organization, One Methodology

Establishing a sustainable innovation culture

for Six Sigma

15

Understanding Innovation

Innovation is defined as…

• Introduction of something new, a new idea, method or device1. In

technology, an improvement to something already existing2.

• In process design, innovation could be defined through achieving

breakthrough performance – 25-30% increase in productivity

…Innovation changes the game

1 Webster, 2 Britannica

16

Making Innovation User Friendly

Associates – quickly adopted tools that were. . .

• Simple to use & intuitive

• Integrated

• Graphical

• Mentally challenging & stimulating

• Yielded fast, credible results

Associates Disliked:

• “Warm & fuzzy” innovation techniques . . . meditation, relaxation, etc.

• Complex tools . . .

• Time consuming tools w/ marginal results

…Get out of the BOX!

17

Leveraging Design for Six Sigma to Drive Innovation

Examples include:• Creating synergies across products,

assets classes and geography• Deployment of open source, Web

services and grid and utility computing• Global process standardization• Shift from product focus to customer

focus• Seamless service delivery

CustomerNeeds

Technical Comparison

Correlation

IMPORTANCE

H O W I M P O R T A N T

Competition Comparison

Targets And Limits

Measures (How)

Direction of Improvement

Relationships(What vs. How)

Optimizing conflicting CTQ’s

Strategic Positioning

18

Innovation and Development Center

Critical Success Factors:DisciplinedFlexibleFast

Critical Success Factors:DisciplinedFlexibleFast

Design IdeaDesign

PlanningBuild

DesignEvaluate

Test

Ideation AssessIdea

Operate the Test

Export

ImproveAnalyzeAssessment Control

= Work in Process = Inventory = Reject/Fail

= Tollgate = Checkpoint

Legend

Define Measure

Critical Success Factors:DisciplinedFlexibleFast

Critical Success Factors:DisciplinedFlexibleFast

Design IdeaDesign

PlanningBuild

DesignEvaluate

Test

Ideation AssessIdea

Operate the Test

ExportExport

ImproveAnalyzeAssessment Control

= Work in Process = Inventory = Reject/Fail

= Tollgate = Checkpoint

Legend

Define Measure

All Innovation and Development Projects Use Design for Six SigmaAll Innovation and Development Projects Use Design for Six Sigma

Managing your resources to lead DFSS efforts

20

Eliminating Competing CTQ’s

• DFSS should be managed the same as BAU with a robust prioritization

process

• Needs to be aligned with business goals and supported by a business

case including cost / benefit analysis

• Heavy lifting completed at team offsites

• Lead by seasoned MBB / BB

Sound familiar… “we have other priorities”

“I would like to support but…do not have the resources”

“Don’t have time…we just need it fixed”

“this is the way we have always done it”

21

Project Management Methodology Rooted in Six Sigma Project Management Methodology Rooted in Six Sigma

PMI – Project Management InstitutePMBOK – Project Management Book of Knowledge

Customer / Business PartnerIdentify need

Create business case

Operational Excellence

PMI* PMBOK

Actual Results = Predicted Capability

Value 6σ

Project Management DisciplinesEnsure clear direction

Time managementDeliver quality

Design for Six SigmaFocused on the customer

Robust product / process designPredicted capability

Bringing It All Together

Optimizing the involvement, support system and

tools for DFSS users

23

Integrate Into Company Culture

What it takes…

• A fully committed CEO

• Q&P Executive reporting directly to CEO

• Hoshin Kanri planning process

• Executive leadership buy-in

• Certified Six Sigma Professionals

• Structured Training

• Standards and Governance

…Leaders Become Role Models

24

Tools

Quality Function Deployment

Books

Surveys

Fishbone

KANO

Process Modeling

Statistical Software

AHP

TRIZ

Process MapsFMEA

6-Thinking Hats

Blind Variation

Benchmarking

Pugh Matrix

Real World Applications

“Why is it so important to establish

a Design for Six Sigma culture?”

Richard Paxton

Master Black Belt

SVP, Process Excellence and Lean Executive

Bank of America

Thank You!