MATH 373 Test 4 Spring 2017jbeckley/WD/MA 373/S17/MA373 S1… · The bond was priced based on the...

Transcript of MATH 373 Test 4 Spring 2017jbeckley/WD/MA 373/S17/MA373 S1… · The bond was priced based on the...

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

MATH 373

Test 4

Spring 2017 May 5, 2017

1. The Bell Life Insurance Company has a two year annuity where it has promised to pay Elizabeth

25,000 at the end of each year for the next two years.

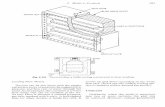

Bell wants to absolutely match the annuity payments using the following bonds:

a. Bond A is a one year bond with annual coupons of 100 and a maturity value of 2000.

b. Bond B is a two year bond with annual coupons of 200 and a maturity value of 1500.

Determine the number of Bond A that Bell should buy. Assume that you can purchase partial

bonds.

Solution:

End of Year 1 End of Year 2

Annuity 25,000 25,000

Bond A 2100

Bond B 200 1700

25,0001700 25,000 14.70588235

1700

200 2100 25,000 200(14.70588235) 2100 25,000

25,000 200(14.70588235)10.5042 of Bond A

2100

B B

B A A

A

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

2. An annuity due makes annual payments at the beginning of each year for four years.

Using an interest rate of 7%, calculate the Macaulay Convexity of this annuity.

Solution:

2 2 0 2 1 2 2 2 3

0 1 2 3

1 2 3

1 2 3

( ) (0 )(1.07) (1 )(1.07) (2 )(1.07) (3 )(1.07)

(1.07) (1.07) (1.07) (1.07)

(1.07) 4(1.07) 9(1.07) 11.775015243.2

1 (1.07) (1.07) (1.07) 3.624316044

t

t

t

t

C t v P P P PMacCon

C v P P P P

489

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

3. A 20 year bond issued by Talbot Industries has a par value of 10,000. The bond matures for its

par value and pays semi-annual coupons at a rate of 8% convertible semi-annually.

Calculate the Modified Duration of this bond using an annual effective rate of 10.25%.

Solution:

0.5 1 1.5 20 20

1

0.5 1

400(0.5)(1.1025) 400(1)(1.1025) 400(1.5)(1.1025) ... 400(20)(1.1025) (10, 000)(20)(1.1025)(1.1025)

400(1.1025) 400(1.1025) 400(1

(10,000)(0.08 / 2) 400

( ) t

t

t

t

Coupon

C t vModDur v

C v

1.5 20 20

1 2 3 40 20

1

1 2 3 40

.1025) ... 400(1.1025) (10, 000)(1.1025)

200(1.05) 400(1.05) 600(1.05) ... 8000(1.05) (10, 000)(20)(1.1025)(1.1025)

400(1.05) 400(1.05) 400(1.05) ... 400(1.05) (10, 000)(1

40

2

40 4040

1

.05)1.1025

The numerator except for the last term is the P&Q formula with P=200 and Q=200.

=

since (1.05)

1 (1.05) 200 1 (1.05)200 (40)(1.05) (10,000)

0.05 0.05 0.05(1.1025)

20

4040

1

(20)(1.1025)

1 (1.05)400 (10,000)(1.05)

0.05

77,749.99(1.1025) 8.5129

8284.091365

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

4. A three year bond pays annual coupons of 500 and has a maturity value of 6000.

Using an interest rate of 6%, calculate the Modified Convexity of the bond.

Solution:

2

1 2 32

1 2 3

2

( )( 1)

500(1)(2)(1.06) 500(2)(3)(1.06) 6500(3)(4)(1.06)(1.06)

500(1.06) 500(1.06) 6500(1.06)

69,103.6896(1.06) 9.6486

6374.2217

t

t

t

t

C t t vModCon v

C v

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

5. Using an interest rate of 5%, calculate the Macaulay duration of a perpetuity immediate with

payments of 500 at the end of each year.

Solution:

2 3 2

2 3

500 500

( ) 500(1) 500(2) 500(3) ... 0.05 (0.05)21

500500 500 500 ...

0.05

t

t

t

t

C t v v v vMacDur

C v v v v

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

6. A bond has a price of 100,000 using an interest rate of 6%. The bond also has a modified

duration of 22 and a modified convexity of 400 using an interest rate of 6%.

1st Order

MACE is the estimated price of the bond using the first order Macaulay approximation if the

interest rate changes to 8%.

2nd Order

MODE is the estimated price of the bond using the second order Modified approximation if

the interest rate changes to 8%.

Calculate 1st Order 2nd Order

MAC MODE E .

Solution:

1st Order 00

1

1( )

1

Modified Duration = (Macaulay Duration)==>22 (1.06) (Macaulay Duration)

Macaulay Duration = (22)(1.06) 23.32

1.06(100,000)

1.08

MacaulayDuration

MAC

MAC

iE P i

i

v

E

23.32

22nd Order 0

0 0

2

1st Order 2nd Order

64,668.20

( )( ) 1 ( )( ) ( )

2

(0.08 0.06)=(100,000) 1 (0.08 0.06)(22) (400) 64,000

2

64,668.20 64,000 668.20

MOD

MAC MOD

i iE P i i i ModDur ModCon

E E

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

7. The Trout Life Insurance Company owns the following bonds:

a. Bond A is a zero coupon bond maturing for 100,000 at the end of 6 years. This bond can

be purchased to yield an annual effective rate of 10%.

b. Bond B is a 20 year bond with a Macaulay duration of 12 and a Macaulay convexity of

100. This bond has a price of 90,000. The duration, convexity, and price are calculated

at an annual effective interest rate of 10%.

Determine the Modified Convexity of this portfolio.

Solution:

2

2

2

6 6Modified Convexity of Bond A = 34.71074

(1 ) 1.21

12 100Modified Convexity of Bond A = 92.56198

(1 ) 1.21

Modified Convexity of Portfolio =

(100,000)(1.10

A A B B

A B

MacCon MacDur

i

MacCon MacDur

i

P C P C

P P

6

6

) (34.71074) (90,000)(92.56198)70.2635

(100,000)(1.10) 90,000

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

8. William must pay Zai 1,000,000 at the end of 12 years.

William has used Reddington immunization using the following to bonds to protect himself from

interest rate changes.

a. Bond 1 is a zero coupon with a maturity value of 25,000 at the end of X years.

b. Bond 2 is a zero coupon bond maturing for 15,000 at the end of 19 years.

Based on an interest rate of 7.5%, William purchased 46.0847 bonds identical to Bond 2.

Determine .X

Solution:

19

12

Price of Bond 2 = (15,000)(1.075) 3796.04

Total Spend on Bond 2 = (Number)(Price) = (46.0847)(3796.04) = 174,939.36

Present Value of Payment = (1,000,000)(1.075) 419,854.13

Total Amount Spend on Bo

nd 1 + Total Amount Spend on Bond 2 = Present Value of Payment

Total Amount Spend on Bond 1 419,854.13 174,939.36 244,914.76

19 12 (7)(419,854.13)Using the shortcut = (419,854.13) 244,914.76

19 244,91X

19

4.76

(7)(419,854.13)19 7

244,914.76

If you do not use the shortcut, then you set the duration of the assets equal to the duration of

the liabilities:

( )(244,914.76) (19)(174,939.36)12

419,854.13

X

X

X

(12)(419,854.13) (19)(174,939.36)7

244,914.76X

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

9. Lauren purchased a two year bond with semi annual coupons of 200 and a maturity value of

6000. The bond can be purchased to yield 4.2% convertible semi-annually.

The bond was priced based on the following spot interest rate curve:

Time t Spot Rate rt

0.5 0.0350

1 0.0375

1.5 0.0400

2.0 2r

2.5 2.5r

Determine 2r .

Solution:

0.5 1 1.5 2

0.5 1 1.5 2

4

4

0.5 1 1.5 2

2

We can calculate the price of the bond as

200 200 200 6200

1 1 1 1

200 6000 where the interest rate is the yield rate

200 200 200 6200 1 (1.021==> 200

1.035 1.0375 1.04 1

r r r r

or

a v

r

44

2

2 22

2

)6000(1.021)

0.021

6200 6200577.9336 6281.0895 1 1.087117 4.265%

6281.0895 577.93361r r

r

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

10. Using the following spot interest rate curve, calculate the present value of an annuity due with

annual payments of 40,000 for three years:

Time t Spot Rate rt

1 0.060

2 0.062

3 0.065

Solution:

2

40,000 40,00040,000 113,201.75

(1.06) (1.062)PV

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

11. Lauren can purchase the following three bonds:

a. Bond 1 is a one year bond with annual coupons of 500 and a maturity value of 4500.

The bond sells for 4700.

b. Bond 2 is a two year bond with annual coupons of 1000 and a maturity value of 5000.

This bond has a price of 6180.

c. Bond 3 is a three year zero coupon bond with a maturity value of 10,000 and a price of

8025.

Instead, Lauren decides to purchase a three year annuity immediate with payments of 13,000 at

the end of each year for three years.

Determine the present value of Lauren’s annuity.

Solution:

1

1

2

1 2 2

First, we need to find the spot interest rates using bootstrapping:

500 4500 5000Using Bond 1==> 4700 1 0.063829787

1 4700

1000 1000 5000 1000 6000Using Bond 2==> 6180

1 (1 ) 1.063829787 (1

rr

r r r

2

0.5

2

1/3

33

3

2 3

)

60001 0.070064563

10006180

1.063829787

10,000 10,000Using Bond 3==> 8025 1 0.076097576

80251

13,000 13,000 13,00034,005.83

1.063829787 (1.070064563) (1.076097576)

r

rr

PV

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

12. You are given the following spot interest rates:

Time t Spot Rate rt

1 0.043

2 0.046

3 0.051

4 0.054

5 0.056

Calculate [2,4]f .

Solution:

4 2 2 4 2 2

4 2 [2,4] [2,4]

4

[2,4] 2

(1 ) (1 ) (1 ) (1.054) (1.046) (1 )

(1.054)1 0.06206

(1.046)

r r f f

f

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

You are given the following spot interest rates and information for problems 13-14:

Time t Spot Rate rt

1 0.043

2 0.046

3 0.051

4 0.054

5 0.056

Katarina has a loan from Hemenway Bank. The loan is for 300,000 the first year. At the end of

one year, Katarina repays 100,000 leaving a loan of 200,000 during the second year. At the end

of the second year, Katarina repays another 100,000 leaving a loan of 100,000 during the third

year.

Katarina will pay Hemenway Bank a variable interest rate equal to the one year spot interest

rate at the beginning of each year.

Katarina would like to have a fixed interest rate so she enters into an interest rate swap with

Lily. Under the interest rate swap, Katarina will pay a fixed rate to Lily and Lily will pay a variable

rate to Katarina. The variable rate will be the same rate that Katarina is paying to Hemenway

Bank. The other terms of the swap will mirror the loan that Katarina has.

13. Questions a. through d. are considered one question:

a. This is an accreting swap.

True or False

This is false. It is an amortizing swap.

b. What is the settlement period for this swap?

The settlement period is one year

c. State the notional amount of this swap?

The notional amount of this swap changes each year. It is 300,000 for the first year,

200,000 for the second year and 100,000 for the third year.

d. List the counterparties to the swap.

The counterparties are Katarina and Lily.

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

14. Calculate the swap interest rate for Katarina’s swap.

Solution:

1

2 32 3

* *2 3

[1,2] [2,3]1 2 2

1 2

** * *[ , ]

1 [0,1] 1 2 [1,2] 2 3 [2,3] 31

1 1 2 2 3 3

1

1 1(1.046) (1.051)1 1 0.049008629 and 1 1 0.061071816

1.043 (1.046)1 1

(300,000

i i i i

i i

n

t t t t

i

n

t t

i

r rf f

r r

Q f PQ f P Q f P Q f P

RQ P Q P Q P

Q P

1 2 3

1 2 3

)(0.043)(1.043) (200,000)(0.04901)(1.046) (100,000)(0.06107)(1.051)

(300,000)(1.043) (200,000)(1.046) (100,000)(1.051)

0.04777 4.78%

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

15. You are given the following spot interest rates:

Time t Spot Rate rt

1 0.043

2 0.046

3 0.051

4 0.054

5 0.056

Tommy purchases a deferred interest rate swap with a term of five years. Under the swap,

there is no swapping of interest rates during the first two years. During the last three years, the

settlement period will be one year. Under this swap, Tommy will be the payer. The variable

interest rate will be based on the one year spot rate at the start of each settlement period.

The notional amount of this swap is 500,000.

Calculate the swap rate for this swap.

Solution:

0

2 5

2 5

3 4 5

3 4 5

1

(1.046) (1.056)0.06266 6.27%

(1.051) (1.054) (1.056)

n

i

t t

n

t

i

P P P PR

P P PP

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

16. Miaoqi and Nui entered into a four year interest rate swap on May 5, 2015. The notional

amount of the swap was a level 250,000 for all four years. The swap has annual settlement

periods with the first period starting on May 5, 2015.

Under the swap, Miaoqi agreed to pay a variable rate based on the one year spot rate at the

beginning of each settlement period. Nui will pay Miaoqi the fixed rate of 4% on each

settlement date.

On May 5, 2017, the spot interest rate curve was as follows:

Time t Spot Rate rt

1 0.038

2 0.041

3 0.043

4 0.045

5 0.047

Miaoqi decides that she wants to sell the swap on May 5, 2017.

Calculate the market value of the swap on May 5, 2017 from Miaoqi’s position in the swap.

Solution:

Miaoqi is receiving the fixed interest rate and paying the variable rate. This means that the first year

she will receive the fixed interest rate of 4% and pay the variable rate of 3.8%. During the s

[1,2]

2

[1,2]

econd

year, Miaoqi will receive the fixed interest rate of 4% and pay the variable rate of .

(1.041)1 0.044008671

1.038

Market Value = Present Value of Expected Cash Flows =

(250,000)(0.04

f

f

2

0.038) (250,000)(0.04 0.044008671)443.09

1.038 (1.041)

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

17. Beckley Farms has a 500,000 loan from Bailey Bank. Under the terms of the loan, Beckley will

pay interest annually to Bailey Bank based on LIBOR plus 120 basis points. Additionally, Beckley

will pay the principal of 500,000 at the end of five years.

Beckley would prefer to know the annual interest cost that will be incurred. To fix the interest

rate on the loan, Beckley enters into a five-year interest rate swap with a notional amount of

500,000 and annual settlement dates. The terms of the swap are that Beckley will make swap

payments based on a fixed rate of 5.35% and will receive swap payments based on a variable

rate of LIBOR plus 50 basis points.

During the third year of the loan, LIBOR is 5.6%.

Determine the net interest payment made by Beckley at the end of the third year.

Solution:

The net interest payment is the interest paid on the loan plus any net swap payment made by the loan

holder less any net swap payment received by the loan holder.

The interest paid on the loan (500,000 )( 0.012) (500,000)(0.056 0.012) 34,000

Net swap payment received by Beckley (500,000)( 0.005 0.0535)

(500,000)(0.056 0.005 0.0535) 3750

Net interest payment 34,000 3750 30,250

Note that this c

LIBOR

LIBOR

an also be calculated as the notional amount multipled by the sum of the

interest rate paid by the loan holder under the swap plus any spread between the loan and

the swap. This means the net interest payment is:

(500,000)(0.0535 0.012 0.005) 30,250

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

18. The current spot interest rate curve is as follows:

t tr t

tr

0.25 1.50% 1.75 2.40%

0.50 1.65% 2.00 2.48%

0.75 1.79% 2.25 2.80%

1.00 1.92% 2.50 3.10%

1.25 2.10% 2.75 3.35%

1.50 2.25% 3.00 3.50%

Rafael has a one year loan for 1,000,000 which has a variable interest rate that resets at the

beginning of each three month period. The interest rate will be the spot interest rate at the

beginning of each three month period.

Rafael enters into an interest rate swap where he is the payer with the characteristics of the

swap exactly match the loan.

Determine the quarterly swap rate that Rafael will pay.

Solution:

1

1

0.25 0.5 0.75 1

0.25 0.5 0.75 1

1 1 (1.0192)

(1.015) (1.0165) (1.0179) (1.0192)

0.0047612

Note that this is a quarterly effective interest rate.

PR

P P P P

May 1, 2018 Copyright Jeffrey Beckley 2017, 2018

19. You are given the following zero coupon bond prices for a zero coupon bond that matures for 1

on the maturity date:

Maturity Date Price

1 Year 0.965

2 Years 0.920

3 Years 0.875

4 Years 0.825

5 Years 0.770

Josh and Phillip enter into a four year swap with a notional amount of 200,000. The swap has

annual settlement periods. Under the swap, Josh will pay Phillip the fixed swap rate at the end

of each year while Phillip will pay Josh the variable rate where the variable rate is the one year

spot rate at the beginning of each year.

Determine the net swap payment at the end of the first year. Be sure to state who makes the

payment and who receives the payment.

Solutions:

4

1 2 3 4

First we need to find the swap rate.

1 1 0.8250.0488145

0.965 0.92 0.875 0.825

At the end of the first year, Josh owes the fixed rate so he owes (200,000)(0.0488145) = 9762.90

At the end

PR

P P P P

of the first year, Phillip owes the variable rate so (200,000)(1/0.965 1) = 7253.89

Josh pays 9762.90 7253.89 2509.01