Marta Carnelli, Innovations for Poverty Action, Colombia, Research Symposium, Case Studies from the...

-

Upload

microcredit-summit-campaign -

Category

Presentations & Public Speaking

-

view

216 -

download

3

Transcript of Marta Carnelli, Innovations for Poverty Action, Colombia, Research Symposium, Case Studies from the...

3/29/16 1

#18M

CSum

mit

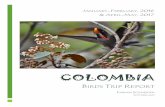

Tablet-based financial education, Colombia

Impact evaluation: Midline survey results

Principal Investigators:Orazio Attanasio

Matthew BirdPablo Lavado

3/29/16 23/29/16 2

#18M

CSum

mit

OutlineLISTA Project

Context and motivationAdvantages of the tablet

Evaluating LISTATheory of changeResearch design

Baseline analysisDemographicsSavings and budgetingPreferences

Preliminary midline resultsFinancial literacyFinancial practicesFinancial performance

3/29/16 3

#18M

CSum

mitLISTA Project

3/29/16 4

#18M

CSum

mit

Context and motivation 3 of 4 newly banked (375 to 600 million people) have

never received any form of financial training (Deb & Kubzansky 2012)

In-person or classroom-based interventions are difficult to scale at low cost (Cohen & Nelson 2011) and can be ineffective (Fernandes et al. 2014, Drexler et al. 2013)

Alternative solutions include use of new channels, including mobile phones, online courses, DVDs, videos, radio, and television (Lundberg & Mulaj 2014; Berg & Zia 2013; Karlan et al. 2011; Carpena et al. 2011).

3/29/16 53/29/16 5

#18M

CSum

mit

By “Freeing Financial Education” via a tablet application

By “Freeing Financial Education” via a tablet application

How to create a scalable, customizable, efficacious solution?

3/29/16 63/29/16 6

#18M

CSum

mit

Advantages of tablets

Can work in remote areas

Allows people to train

themselves

Simple user design

Can rotate within the communities taking

advantage of local social capital

3/29/16 7

#18M

CSum

mit

Register – Survey – Module Content – Program Information – Practice – Games

3/29/16 8

#18M

CSum

mitEvaluating LISTA

3/29/16 9

#18M

CSum

mit

OF CHANGE

INPUTS OUTPUTS IMPACTS

TabletsPrinted materialSMS

Information on CCT

Financial information

How to financially plan How to save Financial products

Acquire practice Using ATMs Using mobile-banking

CCT practices

Financial literacy

Financial practices

Financial performance

Theory of change

3/29/16 103/29/16 10

#18M

CSum

mit

+ +

Use LISTA Tablet Financial Capability KitSMS Rules of Thumb

1. Greater financial knowledge2. Higher financial practice

adoption3. Better financial performance

Research hypotheses

3/29/16 113/29/16 11

#18M

CSum

mit

Municipalities

Treatment neighborhoods

Randomization

3/29/16 12

#18M

CSum

mit

TreatmentControl

3/29/16 133/29/16 13

#18M

CSum

mit

Evaluation processTable

t SMS

Data

Col

lect

ion

BASELINE MIDLINEENDLINE

TELEMETRIC

ADMINISTRATIVE

May 2015 October 2015 April 2016

Rand

omiza

tion

3/29/16 14

#18M

CSum

mitBaseline analysis

3/29/16 15

#18M

CSum

mit

Sample characterizationDemographics

50% Rural91% WomenEducational level:

42% primary 43% secundary education

Household structure: Mean size: 5,2 Mean income contributers:

1,4 14% with nobody working

Relation with financial institutions

74% used an ATM at least once in his life

82% physically withdrawn the CCT

33% believe that cannot leave any money in their CCT account

3/29/16 163/29/16 16

#18M

CSum

mit

Informal savings

82% physically withdrawn the cash transfer

<15 15-30 30.1-75 75.1-150 150.1-260 260.1-300 300.1-600 >600

-10%

0%

10%

20%

30%

40%

50%

60%

PIGGY BANK/HOUSE SAVINGS CHAINPIGGY BANKS AND SAVINGS CHAIN

42% of the sample save

money informally

3/29/16 173/29/16 17

#18M

CSum

mit

Formal savings

82% physically withdrawn the cash transfer

<15 15-30 30.1-75 75.1-150 150.1-260 260.1-300 300.1-600 >6000%

10%

20%

30%

40%

50%

60%

BANK COOPERATIVE SAVINGS GROUP MULTIPLE

18% of the sample have

money saved

formally

3/29/16 183/29/16 18

#18M

CSum

mit

Budgeting practices

82% physically withdrawn the cash transfer

No 17%

Share the responsibility

16%Yes66%

Written22%

Mentally78%

3/29/16 19

#18M

CSum

mit

Today 7 months later

Intertemporal discount Today 1 month later

34$

25$

25$

5%95%

25$

26%

74%

34$

25$

29%

71%

25$25

$ 20%

80%

3/29/16 20

#18M

CSum

mit

Bank account Cash

Liquidity preference

25$

25$

62%

38% 31% of people

prefering cash would switch with 34$

3/29/16 21

#18M

CSum

mitPreliminary midline results

3/29/16 22

#18M

CSum

mit

Preliminary short term findingsIMPACT

• General financial knowledge• Savings knowledge• Budgeting knowledge

• Savings goal• Number of people saving in

a bank• Number of people saving in

a piggy bank

NO IMPACT

• Debts knowledge

• Number of people saving in a cooperative

• Number of people saving in savings group

FINANCIAL LITERACY

SAVINGS

3/29/16 23

#18M

CSum

mit

Preliminary short term findingsIMPACT

• Written budget

• Total amount of money saved• Amount of money saved

formally• Amount of money saved

informally

NO IMPACT

• Responsible person for household account management

FINANCIAL PERFORMANCE

BUDGETING

3/29/16 243/29/16 24

#18M

CSum

mit

ConclusionsPromising preliminary results:

improved savings habitshigher amounts of self-reported formal and informal savings

Final results will be analyzed to assess the impact of LISTA in the medium- and longer-term together with robustness tests of the midline analysis