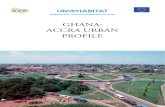

Markets opengecko.com. Accra Friday Market, Ghana.

-

date post

21-Dec-2015 -

Category

Documents

-

view

236 -

download

0

Transcript of Markets opengecko.com. Accra Friday Market, Ghana.

Floating Market in Damnoen Sukuak, West of BangkokFloating Market in Damnoen Sukuak, West of Bangkok

Market – A definition• SIMPLE: A meeting of buyers and sellers.• A market is a situation where potential buyers

are in contact with potential sellers. It enables the needs and wants of both parties to be fulfilled whilst establishing a price and allowing an exchange to take place.

• Source: Economics from a Global Perspective Alan Glanville (2003)

• Markets may be local, national or international. Can you think of examples?

• Futures Market An auction market in which participants buy and sell commodity/future contracts for delivery on a specified future date.

• Trading is carried on through open yelling and hand signals in a trading pit. Volume in the futures market usually increases when the stock market outlook is uncertain.

• Stocks in publicly traded companies are bought and sold at a stock market (also known as a stock exchange). The New York Stock Exchange (NYSE) is an example of such a market. In your neighborhood, you have a "supermarket" that sells food. The reason you go the supermarket is because you can go to one place and buy all of the different types of food that you need in one stop -- it's a lot more convenient than driving around to the butcher, the dairy farmer, the baker, etc. The NYSE is a supermarket for stocks. The NYSE can be thought of as a big room where everyone who wants to buy and sell shares of stocks can go to do their buying and selling.

• The exchange makes buying and selling easy. You don't have to actually travel to New York to visit the New York Stock Exchange -- you can call a stock broker who does business with the NYSE, and he or she will go to the NYSE on your behalf to buy or sell your stock. If the exchange did not exist, buying or selling stock would be a lot harder. You would have to place a classified ad in the newspaper, wait for a call and haggle on a price whenever you wanted to sell stock. With an exchange in place, you can buy and sell shares instantly.

Source: http://money.howstuffworks.com/personal-finance/financial-planning/stock.htm/printable

• The stock exchange has an interesting side effect. Because all the buying and selling is concentrated in one place, it allows the price of a stock to be known every second of the day. Therefore, investors can watch as a stock's price fluctuates based on news from the company, media reports, national economic news and lots of other factors. Buyers and sellers take all of these factors into account. So, for example, when the FAA (Federal Aviation Administration) shut down the company ValuJet for a month in June 1996, the value of the stock plummeted. Investors could not be sure that the airline represented a going concern and began selling, driving the price down. The asset value of the company acted as a floor on the share price.

• The price of a stock also reflects the dividend that the stock pays, the projected earnings of the company in the future, the price of tea in China (especially Lipton stock) and so on.

Source: http://money.howstuffworks.com/personal-finance/financial-planning/stock.htm/printable