Margill Loan Manager Overview

-

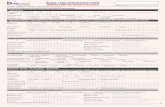

Upload

marietta-fragata-ramiterre -

Category

Documents

-

view

18 -

download

3

description

Transcript of Margill Loan Manager Overview

2

Contents

Main window

Search window

Record window Data

Compute / Results Table

Fees / Tax / Insurance Module

Borrower

Posting payments

Electronic Funds Transfer (ACH, Credit card)

Reporting

Custom reports

Export to General Ledger

Merge tool to create contracts, letters, invoices or statements

Bulk email of invoices / statements

Software customization (by the user)

Custom fields

Custom pull-down menus

Custom payment types

Mathematical Equations

Import your existing data in seconds

Other distinctive features

Clients and Comments

Creditor

Credit Report

APR, Advanced, Alerts / Reminders

3

Main Window

• See all your loans in the Main window

• Display records according to certain criteria including custom fields

• Sort records as you wish

• Display according to your

preferences from over 350 fields (name, email, loan type, loan amount, dates, balances, ageing, payment ratio, etc.)

• For larger databases, use the search engine to display only the desired records

5

Record Window

All data is contained in this

window and its various tabs:

o Compute (becomes Results

Table)

o Data

o Borrower

o Creditor

o Credit Report

o APR, Alerts, Advanced

o Detailed Notes may also be

added

o Send the payment

schedule by email, print

various reports in one click…

6

Data

Data Tab:

o Basic math data

A preliminary schedule

can be completely customized after pressing on “Compute”

o Basic loan information

o Payments can be monthly,

twice monthly, quarterly, ,

every week (7 days), etc.

o Attach documents

o Unknown variable computed

o Custom fields and custom

menus

o Electronic Funds Transfer

data

7

Compute / Results Table

Compute / Results Table Tab

o A preliminary payment

schedule is first created

o You adapt to just about any payment scenario:

Interest-only

Fixed principal

Lump sum payments

Unpaid payments

Partial and late payments

Extra payments

Fees, Insurance, Tax:

Recurring or occasional

Added as lines or as columns

Amount or percentage

Amounts accrued, paid, balances

Add principal any time

Insert and delete rows

Extend the loan and recompute

the payments

Add a Comment to lines

Trick: Use the right mouse click!!!

8

Results Table

Results Table

43 columns; 14 of which data may be changed

Information includes:

o Accounting data

Paid Interest versus Accrued Interest

Paid Principal

o Alerts

o Comment line

o Outstanding amounts

o Multiple Balances:

Total Balance before payment Interest Principal

o Fees accrued, paid, balance

o And many others, for maximum information

9

Results Table

Right mouse click offers

multiple options including:

o Change multiple payment

amounts at once

o Re-compute (adjust) payments

for a final balance = 0.00 or

other amount

o Change interest rates

o Re-compute interest rates

o Add or change Column Fees

o No interest on new Principal,

Fees, Insurance or other

o Special calculation methods

o Interest-only payments for part

of the loan

o Export table to Excel

o And many more…

10

Fees / Tax / Insurance Module

Powerful module to add regular and occasional fees:

o Column Fees (3 types) o Line Fees (6 types)

o Column Fees for recurring amounts (or

occasional) Amount or as a percentage of the

balance or of accrued interest

Included in the payment

Can also be used for insurance or taxes

o Line Fees for occasional fees

Paid separately from the payment itself

o All names may be customized by the

user

11

Borrower

Borrower Tab

o Borrower data

o Co-borrowers data

o Employer

o Custom fields

o A Borrower can also be

created independently of a loan

12

Creditor

Creditor Tab

o Creditor data

o Syndicated loans (multiple co creditors for a loan (on a percentage basis or amount))

o Loan officer associated to loan

o Custom fields

13

Credit Report

Credit Reporting Tab

o For United States and Canada

o Metro 2 reporting fields

o Most fields are automatically updated based on payments

o Module to be used with

Credit Manager software from The Service Bureau

14

APR / APY

APR / APY

o Extremely sophisticated Annual Percentage Rate

calculation

o Up to 5 types of fees with custom names

o Fees can be:

Paid up front

Financed (added to the principal)

Paid subsequently

o Recurring fees can be factored in

o APR and APY are automatically calculated

o Rate up to 9999%

o Compliant with the majority of jurisdictions

Including, US Truth in Lending

15

Alerts / Reminders

Alerts / Reminders

o Reminders advising you that

something must be accomplished

o These tasks are then

managed: accomplished

or to do

o Five (5) types of alerts are available:

General

Linked to a Record

Example: ask client for financials

Linked to a Line status

Example: advise me when a payment is 5 days late

Added on a payment line in the schedule

Based on mathematical conditions

16

Advanced

Advanced Tab:

o Payment method:

o Compound interest

o Simple interest

o Day count:

o Actual/Actual

o 30/360

o Actual/360

o Actual /365

o “Short” periods special method

o Payment on last day of

month

o And many others to obtain a truly precise calculation!

17

Post Payment Tool

Post Payment Tool:

o Very powerful tool that allows you to see which payments are due and to update these

o Update to Paid or Unpaid

o You can add a Comment on each payment (check

number for example, or unpaid because…)

o You can also specify the payment that should have been paid, as well as the true payment date in case a Grace period is offered

o For irregular (partial and late payments, penalties, fees, etc.) right click with the mouse to change the schedule directly

18

Electronic Funds Transfer

Electronic Funds Transfer:

o For US and Canada (other countries on a

need basis)

o For the US, NACHA file

with Wells Fargo Bank

o In Canada, we work

with Perceptech, an EFT

processor

o Preauthorized payments, ACH (electronic check), Credit card payments

o Submit all future payments of a loan or on

a monthly (weekly or other) basis

19

Reporting

Multiple reports:

o Standard reports

o Reports you customize

o Amortization tables

o Accounting reports

Export to various accounting packages including QuickBooks and Simply Accounting (Sage 50))

Export to Excel, CSV and Text formats

o Data merges for your letters, contracts , invoices and statements

o Print, export to Excel or PDF

o We can create highly sophisticated reports based on your very specific needs

20

Custom Reports

Custom reports:

o Create your reports using over 350 fields easily

accessible by theme

o Obtain monthly, quarterly, yearly, etc. reports…

o Examples:

o Record List

o Total monthly payments

o Total fees

o Ageing of accounts

o Outstanding amounts

o Balances

o And hundreds of others

you create

21

Custom Reports (Results)

Custom Reports

o Choose the dates you want

o Convert currencies

o Compute totals

o Export to Excel, CSV, etc.

o Predict the future ;-)

22

Export directly to General Ledger

Export to your accounting system’s GL

o Export to

o Quick Books Pro (and above)

o Sage 50 o CSV, TXT or Excel o Others on a custom basis

o Create your own custom

reports in seconds

o Enter GL Credit and Debit account numbers

o Debit and Credit totals by account

o Reports may include a fixed GL number or unique numbers for each Record

o Reverse exported entries

(in case of error)

23

Contracts, Letters, Invoices & Statements

Merge to PDF or Rich Text Format (Word document)

o Produce contracts, letters,

statements or invoices

o Draft your documents in

Word and copy/paste to

Margill

o Insert any of the 350+ data

fields available.

o Add totals, subtractions, etc.

with Mathematical Equations

that you create

Option to create finely tuned PDF formats

o You send us your PDF, we

create the personalized

document

Merge field (for the current date)

24

Contracts, Letters, Invoices & Statements

One click:

o Save file(s)

o Print

o Email

Batch along with Subject and Message

o Attach merged document to the Record

Each user can send from his/her email

account (Sent from…)

25

Customize – Custom Fields / Custom Menus

Custom fields

o Create custom fields for

o Borrower

o Creditor

o Loan itself (Record)

o Various formats (text, monetary, date, etc.)

o Unlimited number

Custom Menus

o Create custom drop-down menus in seconds for:

o Custom fields

o Other fields (Loan type,

Country…)

26

Payment Type Line Statuses

Line Statuses

o 70 Line statuses allow you to customize how your

payment is applied:

o Paid, Unpaid, Partial Pmt,

Fees, Penalties, Insurance,

Tax, Additional Principal,

Investment, Adjustment,

etc.

o Name you own type of

Payment (Paid Cash,

Visa, ACH…), Fees

(Admin, NSF…) and

Additional Principal

o Hide and move the Line

statuses based on YOUR

needs (not ours)

27

Mathematical Equations

Mathematical Equations

o Create your own

Mathematical Equations using hundreds of fields. Used for:

o Reporting special

data not included in

the regular fields

o Totals in invoices or

statements

o Portfolio analysis

(ratios…)

28

Import your existing data in seconds

Import Borrowers, Creditors and Employers

o Using an Excel sheet with headers and your data, import to Margill in seconds.

o Simply indicate what

each Excel column

corresponds to in

Margill…

o For importing the loans (payment

schedules), we can help you.

29

Other Distinctive Features

Multi-Currency

Fixed or variable interest rates

Change interest rates for multiple loans in one operation

Multi-User (Network)

Intuitive WYSIWIG interface – What You See Is What You Get

Learn basics in 30 minutes

Our pretty excellent, fantastic customer support ;-). We are there

for you!

30

Clients and Comments

Margill clients are located in over 34 countries

Including:

Lenders (personal, employee, corporate, auto, bridge, construction, factoring)

Governments

Economic Development Agencies (business, community, rural, native and energy efficiency)

Accountants

Law firms (judgment collection, collection, tax loans)

Public and private companies (inter-company loans, employee loans

Margill has greatly improved the efficiency and organization of our Local Producer Loan Program. Margill is a vast improvement from our former technology, and we are grateful to have it.

Whole Foods Market, Inc.

Margill has made our lives much easier here since we installed it. It has cut down the time it takes to perform my month-end accounting procedures greatly!!!

Antony Relou

Director of Corporate Accounting

The Broe Group

31

Demo / Contact us

Free 30-day fully functional trial:

www.margill.com/ncm

More information:

Phone: (001) 450 621-8283

Tool-free North America: 1-877-683-1815

Skype: MargillSolutions