Manufacturing in Melbourne’s South East - Pitcher is universally acknowledged that for the...

Transcript of Manufacturing in Melbourne’s South East - Pitcher is universally acknowledged that for the...

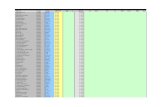

44% of Victoria’s total manufactured product

20% jobs market share

101,233 full time equivalent jobs

82,000 people employed

24% share of output

$16bn worth of products exported

14% of gross regional product

$29.5bn output value

16% share of value added

$9,062m total value added

OverviewIt is universally acknowledged that for the manufacturing sector to move to a profitable and sustainable platform, it needs to transition to a globally-integrated, sophisticated domestic industry.

Manufacturing in Melbourne’s South East RegionThe industry needs to gain a footing on which to build its future – a reform agenda that encompasses better market access for exporters, workplace reform, tax, infrastructure and procurement.

While there are a number of federal and state government initiatives to support the industry as it transitions, it is imperative that businesses within the sector determine their own future and direction they may wish to take, including diversifying into different supply chains and global markets or repositioning products, processes and business models.

A handful of manufacturers are already carving out their own future path – with some investing 15% of their annual profits into new product innovation, determined they can develop and feed a healthy export market from Australia.

Knowing up to 90% of their sales will be abroad, they are also re-designing products to make them more exportable: smaller, cheaper, easier to ship, set up and manage. But nearly one in 10 manufacturers abandoned investment in innovation in 2012, according to the Australian Bureau of Statistics.

Highly differentiated niche manufacturers have been singled out as high-growth sectors, with good job creation prospects by The Business Council of Australia, alongside mining, liquid natural gas, agriculture, tourism, food production and education.

However, not all manufacturers are in this enviable position, to innovate or export their products so readily.

Take automotive component makers, for instance. They need to diversify and look for new products to develop and manufacture, but they need to invest the capital required to undertake research and development and secure new markets for IP, products and services. Business owners and managers may not necessarily have the capital required or requisite expertise to achieve this on their own, but with the right help and expert advice, will realise and maximise, outcomes.

1

Our South East commitmentSince opening in the South East, Pitcher Partners has been an active member of the local community and is committed to supporting the region. Our community involvement over the past year has included:• Gold sponsor of the Manufacturing Hall of Fame

• Active involvement in local associations and networking groups such as SEMMA, SEBN, SEMIP and ‘A Positive Move’

• Thought leadership on the Port of Hastings

• Attended and supported multiple Business Awards, events, including judging involvement with the Casey and Cardinia Councils’ Business Awards

• Supported charitable fundraising such as Chisholm Foundation Charity Golf Day, the Dandenong Chamber of Commerce’s ‘Take a Swing for Charity’ Golf Day, and the Biggest Blokes BBQ for Mental Health

• Sponsorship of the Dandenong Drum Theatre

• Sponsorship of the Casey Scorpions Football Club

• Support for Women in Business events

• Co-hosted charity choir “With One Voice”, in conjunction with the Dandenong City Council

• Provided discounted rates under our CSR policy to local disability services’ providers

Our South East office means we are locally situated to better service our clients in the region.

2

Activity in the sector

Active Display GroupActive Display Group (ADG), Australia’s largest Point of Purchase Display and Signage organisation, has significant design and manufacturing facilities in Melbourne’s South East. Founded in 1985, ADG experienced exponential growth, both organically and through acquisitions, constantly expanding its service offering to meet market demand and opportunity.

Today, it leads the Point of Purchase display industry, employing more than 390 staff and setting industry benchmarks with innovative technological printing and processing solutions.

Its recent acquisition by ASX TOP 200 listed company, STW Group Limited, is testimony to its commitment to high-end technology printing processes which enable its clients an end-to-end digital process: from digital graphic files, on-line costings and quotes, through to digital approvals and full digital production.

As a long standing Pitcher Partners’ client, we have worked closely with, and continue to work closely with, ADG assisting them with their growth aspirations.

Ego PharmaceuticalsLong term Pitcher Partners’ client, Ego Pharmaceuticals (Ego) is a flourishing family business. As leaders in the development, manufacture and marketing of innovative skincare products – backed by science – Ego have a vision to be as well known internationally as they are here in Australia. Having just returned from their first global conference, they are even more committed to expanding their products into the global arena.

Ego has already doubled their production from 10 million units in 2008 to 20 million units in 2014 and have significant plans to maximise capacity of their Braeside facility by 2020 to produce around 50 million units.

Further adding to their manufacturing and filling capacity is a $15 million dollar project to build a new flammable manufacturing suite in 2015 and they will be investing in a new 5T processing plant in 2016.

Ego’s recent acquisition of a 10 hectare site on the Logis Eco Industrial Estate in Melbourne’s South East has been earmarked for a large new corporate office and warehousing facility. This will be closely followed by a new manufacturing site at Dandenong around 2020.

These long term investment strategies are evidence of their commitment to the ongoing manufacture of Ego pharmaceutical products in Australia for the domestic and international marketplace.

3

Activity in the sector

Riverina Oils and Bio-Energy Pitcher Partners has been working with Riverina Oils and Bio-Energy (ROBE) during some of its most challenging and exciting growth phases. As one of the largest value added investments in the Agri-Food processing sectors in regional Australia, they continue to seek expansion opportunities and explore new markets for growth.

In 2013, ROBE completed its state of the art, fully integrated crushing and refining plant in the hub of the Riverina region, complete with supporting infrastructure to provide some of the best logistics and storage facilities available in Australia, which cater for 16,000 truck movements each year. This resulted from an inbound manufacturing investment of around $150 million, where Pitcher Partners were able to assist through structuring and tax advice, advocacy and provision of value added auditing services.

ROBE exports over $100 million worth of products to Asia, USA and New Zealand, plus a $150 million import substitute of vegetable protein meal for animal feeds (equivalent to 100,000 tonnes). Today, its integrated manufacturing process produces all production on one site, ensuring consistent quality products and cost efficiencies for price and quality competitiveness in the marketplace. Its production run is 75 million litres of oil per annum.

ROBE will continue to partner with Pitcher Partners on its journey of growth and expansion in domestic and international marketplaces.

Offshore expansionLong-standing Pitcher Partners’ client, ARB is Australia’s largest manufacturer and distributor of 4x4 accessories. Over the past 10 years ARB has pursued a long term strategy that has now culminated in an international presence that includes an offshore facility in Thailand for their volume manufacturing, whilst retaining a high skilled workforce here in Melbourne for its customised and specialised services.

ARB continues to focus on the after-market and maintains its position as an innovator in the industry, met by highly advanced Computer Numerically Controlled (CNC) sheet fabrication facilities – for highly tailored and customised accessories. At the same time, it develops products suitable for high scale manufacturing that can be pushed through international and national distribution channels that include an export network extending through more than 100 countries.

4

For manufacturing businesses to complete their transition to a more profitable and sustainable footing, they need to successfully compete in a more open and disciplined global market. To achieve this outcome, they need to tap into global production platforms by adapting, exporting or diversifying – whichever scenario is most likely or appropriate.

It may be they require capital to assist to restructure and position themselves for the future, or to source a joint partner with offshore manufacturing facilities. Alternatively, they may require assistance locating a foreign buyer for their business and/or operations in Australia.

Foreign markets represent prime opportunities for either growth through expansion by opening up new markets, or growth capital through foreign investment.

Pitcher Partners has, over many years, developed and nurtured strong relationships with governments, government agencies, private businesses and advisors throughout the Asian region.

Inbound investment opportunities

1. Other investment includes portfolio investment and financial derivatives

Source: Australian Bureau of Statistics, Cat. No. 5302.0 Balance of Payments and International Investment Position, Australia, Table 79. International Investment: Levels of Foreign Liabilities – Financial Year (released 3 September 2013); Austrade

An attractive destination for foreign investmentAustralia remains an attractive destination for foreign investment, both direct and portfolio investment. The total stock of foreign investment in Australia reached A$2.2 trillion in June 2013. Foreign direct investment and portfolio investment have both recorded strong growth, up 8.2 per cent and 9.9 per cent each year respectively since 1993. As a percentage of GDP, Australia’s value of total foreign investment stock has remained around 140 per cent since 2007, an impressive rise from 83 per cent two decades ago.

Foreign investment stock in Australia

0

300

600

900

1,200

1,500

1,800

2,100

2,400

0

30

60

90

120

150

180

210

240

A$ b

illio

n

% o

f GD

P

Total Investment % of GDP (Right-hand axis)Direct Investment

Other Investment1

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

5

Leveraging our relationshipsOur ability to call on networks in government, private business and advisors throughout Asia creates opportunities for manufacturing businesses with a future offshore.Already we have used these relationships in India and Thailand to identify parties who may be interested in investing in, acquiring, or joint venturing with businesses to leverage Australian IP into new markets.

We are also exploring interest in Japan, Korea, China and the Philippines, but see India and Thailand as the primary markets.

Recently, Thai delegates spoke at Pitcher Partners on how businesses can internationalise their operations and expand into Asia. This provided an excellent vehicle to explore manufacturing opportunities in Thailand, considered a practical gateway for today’s global markets and a cost effective link to new key global customers and supply chains.

We are uniquely positioned to explore opportunities for Victorian manufacturers and suppliers to connect with buyers, investors and joint venture partners from China and other Asia-Pacific countries.

We found the opportunities in the region for businesses prepared to work on developing relationships to be extremely exciting and quite extraordinary.

The market size and need for product and expertise is almost boundless for businesses with a strategic vision and preparedness to embrace these opportunities.

6

Key

23Asia Paci�c Firms

30North America

Firms

58European Firms

34Middle East and

African Firms

15Latin America

Firms

About Pitcher Partners Pitcher Partners is an independent member of Baker Tilly International (BTI), the 8th largest network in the world by fee income. Our strong relationship with other BTI member firms, particularly in Asia Pacific, has allowed us to open many doors across borders for our clients.

In Australia, Pitcher Partners is a full service accounting and business advisory firm, with a strong reputation for providing quality advice to privately-owned, corporate and public organisations. We have offices in Adelaide, Brisbane, Melbourne, Perth, Sydney and Newcastle. We collaboratively leverage from each other’s networks and draw on the skills and expertise of 1000+ staff, in order to service our clients.

In Melbourne, we are the leader in the middle-tier market and are the fifth largest accounting services firm after the Big 4 multinational firms.

Our globalreach

7

Key

23Asia Paci�c Firms

30North America

Firms

58European Firms

34Middle East and

African Firms

15Latin America

Firms

Pitcher PartnersPartners: 90 Total Staff: 1000+Audit and Assurance Investment AdvisoryBusiness Advisory SuperannuationTaxation IT ConsultingTransaction Services Risk ServicesBusiness Recovery and Insolvency Business ConsultingPrivate Clients Corporate Finance South East office

8

Pitcher the differencePitcher Partners is an association of accounting and business advisory firms located in Melbourne, Sydney, Newcastle, Perth, Adelaide and Brisbane. We have a strong reputation for providing personal service and quality commercial advice to our clients across a broad range of industries.

Our Clients We specialise in providing services to family controlled, privately owned and small public businesses as well as high net worth individuals, the public sector and Not for Profit organisations. Our clients require high technical standards, matched with a personal understanding and involvement in their affairs.

Audit and AssuranceBusinesses that are audited perform better. The cost and effort of compliance with financial regulations is an increasing burden on business. We believe audit and assurance should add value to the organisation by identifying opportunities as well as risks. Furthermore, we understand the importance of working closely with Boards of Directors and Audit Committees to resolve audit issues within the agreed timeframe and work to deliver a truly value added service.

Business AdvisoryThrough close and active involvement in our clients’ business, Pitcher Partners provides informed, practical assistance to make the most of opportunities and emerging issues. We ensure the advice we give is practical and takes into account the full set of circumstances facing the company.

TaxationPitcher Partners is the most experienced taxation advisory team in Australia outside the Big 4 accounting firms. We have specialists in all relevant areas of taxation law supported by a large team of experienced professionals who can manage any issue regardless of size or complexity.

Transaction ServicesCorporate transactions are not an end in themselves, but part of the progress towards a goal – be it growth, higher profitability, improved market share or competitive advantage. Pitcher Partners has extensive experience providing independent advice on investments and business transactions. We work quickly, providing excellent response and value for money.

Business Recovery and InsolvencyEven the healthiest business will come into contact with an insolvency situation at some time. It could be one of your suppliers, or perhaps a problem debtor. Pitcher Partners has developed a reputation for providing organisations with a range of Business Recovery and Insolvency services that are successful in achieving maximum recovery levels.

Private ClientsWe have an in-depth understanding of the profit drivers and key performance indicators for private businesses as well as the commercial and business imperatives underpinning their success. We have a full view of our client’s financial situation including both business and personal affairs as well as an understanding of the ramifications of legislative changes. Our complete service approach means we can provide business related advice to take account of personal long-term goals as well.

Investment AdvisoryWe provide our clients with rigorously researched and customised investment advice suitable to the needs, objectives and risk profiles of each individual family, fund or Not for Profit organisation. At Pitcher Partners we offer clients fee only service that is truly independent.

SuperannuationWe also have extensive experience in the superannuation industry, working with trustees, members and employers. Our experience covers all segments of the industry: large fund compliance, self- managed funds, administration, employer obligations, member retirement planning and estate planning.

IT ConsultingWith an in-depth understanding of business, we are able to provide independent advice and create tailored IT solutions that provide real benefits. We have experience in developing unique solutions, running complex projects and delivering value to clients.

Risk ServicesWe are able to undertake a broad range of risk management services to support our audit efforts including enterprise risk management, internal audit, disaster recovery and business continuity planning, advanced data mining and specialised information technology security assurance.

Business ConsultingOur consultants work collaboratively with senior management and stakeholders to deliver measurable outcomes. We use approaches and methodologies in the conduct of assignments that are founded and renewed on leading edge thinking, whilst maintaining commercial relevance and practicality. Areas of expertise include strategic business planning, feasibility studies, viability studies, contract negotiations, financial analysis and modelling, and organisational reviews.

Pitcher Partners has the resources and depth of expertise of a major firm, but with a smaller firm feel. We give our clients the highest level of personal service and attention. That’s the difference.

9

Investment Advisory

Private Clients

Superannuation

IT Consulting

Risk Services

Business Consulting

Audit and Assurance

Business Advisory

Taxation

Transaction Services

Business Recoveryand Insolvency

Pitcher Partners services

27,000+ $3.4BN Partners and staff globally Billion worldwide revenue 2013 (USD)

90 1000+Partners nationwide People nationally

137 161Countries Firms worldwide

Independent member of the Baker Tilly International global network

10

Get in touch...

Proposal_ManufacturingCapability_141013

MELBOURNE

+61 3 8610 5000 [email protected]

ADELAIDE

+61 8 8179 2800 [email protected]

SYDNEY

+61 2 9221 2099 [email protected]

BRISBANE

+61 7 3222 8444 [email protected]

PERTH

+61 8 9322 2022 [email protected]

PITCHER.COM.AU

NEWCASTLE

+61 2 4911 2000 [email protected]

Pitcher Partners is an association of independent firms. Liability limited by a scheme approved under Professional Standards Legislation.

Vicki Macdermid Partner

+61 3 8610 [email protected]

David Knowles Partner

+61 3 8610 [email protected]