Making the Deal How Real Estate Deals are Getting … the Deal book.pdfNew York County Lawyers’...

Transcript of Making the Deal How Real Estate Deals are Getting … the Deal book.pdfNew York County Lawyers’...

2 TRANSITIONAL ANd NON-TRANSITIONAL MCLE CREdITS This course has been approved in accordance with the requirements of the New York State Continuing Legal Education Board for a maximum of 2 Transitional and Non-Transitional credit hours 2 Skills

NY

CL

A-

CL

E

IN

st

It

ut

E

Making the Deal How Real Estate Deals are

Getting Done Under Current Market Conditions

Prepared in connection with a Continuing Legal Education course presented at New York County Lawyersrsquo Association 14 Vesey Street New York NY

scheduled for January 26 2011

P r o g r A m C o - s P o N s o r

NYCLA Real Property Section

P r o g r A m C h A I r

Leo Genn Chair Real Property Section

F A C u L t Y

Paul M Giddins Giddins Claman LLPLisa Lippman Brown Harris Stevens

Information Regarding CLE Credits and Certification

Making the Deal How Real Estate Deals are Getting Done Under Current Market Conditions

Wednesday January 26 2011 630 PM ndash 815 PM

The New York State CLE Board Regulations require all accredited CLE providers to provide documentation that CLE course attendees are in fact present during the course Please review the following NYCLA rules for MCLE credit allocation and certificate distribution

i You must sign-in and note the time of arrival to receive your

course materials and receive MCLE credit The time will be verified by the Program Assistant

ii You will receive your MCLE certificate as you exit the room at

the end of each day The certificates will bear your name and will be arranged in alphabetical order on the tables directly outside the auditorium

iv If you arrive after the course has begun you must sign-in and note the time of your arrival The time will be verified by the Program Assistant If it has been determined that you will still receive educational value by attending a portion of the program you will receive a pro-rated CLE certificate

v Please note We can only certify MCLE credit for the actual time you are in attendance If you leave before the end of the course you must sign-out and enter the time you are leaving The time will be verified by the Program Assistant If it has been determined that you received educational value from attending a portion of the program your CLE credits will be pro-rated and the certificate will be mailed to you within one week

vi If you leave early and do not sign out we will assume that you left at the midpoint of the course If it has been determined that you received educational value from the portion of the program you attended we will pro-rate the credits accordingly unless you can provide verification of course completion Your certificate will be mailed to you within one week

Thank you for choosing NYCLA as your CLE provider

New York County Lawyersrsquo Association

Continuing Legal Education Institute 14 Vesey Street New York NY 10007 bull (212) 267-6646

Making the Deal How Real Estate Deals are Getting Done

Under Current Market Conditions Wednesday January 26 2011

630 PM ndash 815 PM

AGENDA Program Chair Leo Genn NYCLA Real Property Section Faculty Paul M Giddins Giddins Claman LLP Lisa Lippman Brown Harris Stevens 600 PM ndash 630 PM Registration 630 PM ndash 635 PM Introductions and Announcements 635 PM ndash 815PM Discussion There will be two ten minute breaks during the evening

New York County Lawyersrsquo Association Continuing Legal Education Institute 14 Vesey Street New York NY 10007 bull (212) 267-6646

Making the Deal How Real Estate Deals are getting Done under Current Market Conditions

Wednesday January 26 2011 630 PM ndash 815 PM

Table of Contents

1 Manhattan Residential Market Report Third Quarter 2010 Brown Harris Stevens

2 Manhattan Residential Market Report Fourth Quarter 2010 Brown Harris Stevens

3 Faculty Biographies

MARKET CONDITIONS

Brown Harris Stevens

Manhattan Residential Market Report

ManhattanResidential Market Report

Third Quarter 2010

Manhattan Cooperatives and Condominiums

2 Third Quarter 2010

Average and Median Sale Price

Cooperative Average Sale Price

Condominium Average Sale Price

Cover Property BrownHarrisStevenscom WEB 1136713

Average Sale Price Median Sale Price

Manhattan apartment prices continued to rise during the third quarter reaching their highest levels

since the first quarter of 2009 At $1423378 the average

apartment price was 12 higher than a year ago The median

price rose 14 from 2009rsquos third quarter reaching $890000

The number of reported apartment closings 2471 was 4 higher

than the same period a year ago

The average price rose sharply for all sizes of co-op apartments over the past year as high-end

activity comprised a higher percentage of sales The number

of co-op sales over $7 million doubled from the third quarter

of 2009 which brought the overall average co-op price 24

higher to $1156733

Condo prices rose 2 from the third quarter of 2009 to

an average of $1724180 After sharp declines the prior two quarters the average price for studio condos rebounded to

$495876

$1600000

$1400000

$1200000

$1000000

$800000

$400000

$600000

$1369883 $820000

1Q10

$1324504 $800000

4Q09

$1274563 $781000

3Q09

$1377135 $842779

2Q10

$1423378 $890000

3Q10

Studio 1-Bedroom 2-Bedroom 3+Bedroom All

3rd Q 10 $366086 $606444 $1206257 $3049980 $1156733

2nd Q 10 $356696 $597311 $1301392 $2872496 $1065814

1st Q 10 $334307 $587538 $1132150 $3098881 $1079195

4th Q 09 $345725 $585238 $1133967 $3001012 $990921

3rd Q 09 $331046 $538369 $1069517 $2616304 $934400

Studio 1-Bedroom 2-Bedroom 3+Bedroom All

3rd Q 10 $495876 $809514 $1596021 $3835376 $1724180

2nd Q 10 $464559 $840829 $1570772 $3922994 $1686690

1st Q 10 $529970 $819785 $1608375 $4250098 $1730415

4th Q 09 $554568 $772525 $1583362 $4574080 $1732362

3rd Q 09 $508546 $792866 $1650537 $3931684 $1685855

Third Quarter 2010 3

New Developments Lofts

Time on the Market

Excludes new developments and units listed over one year Based on the last asking price Excludes new developments

Average Price Per Square Foot

Apartments in new developments sold for an average of $1112 per square foot 5 less than a year ago A decline in the number of luxury developments on the market was a major factor in this change Loft prices averaged $1077 per square foot in the third quarter up 12 from the third quarter of 2009

Units that sold in the third quarter spent an average of 97 days on the market 24 less time than a year ago This was the lowest level for time on the market level since the third quarter of 2008 Sellers received 959 of their last asking price up from 951 in 2009rsquos third quarter

$700

$900

$1100

$1300

$700

$900

$1100

$1300

75 days

100 days

125 days

150 days

85

90

95

100

Asking Vs Selling Price

$1176

3Q09

$1238

4Q09

$1146

1Q10 2Q10

$1176 $960

3Q09

$1017

4Q09

$1037

1Q10

951

3Q09

954

4Q09

962

1Q10

128

3Q09

132

4Q09

119

1Q10

112

2Q10

$1066

2Q10

966

2Q10

$1112

3Q10

$1077

3Q10

97

3Q10

959

3Q10

Generally 59th to 96th Street Fifth Avenue to the East River

Cooperative Condominium

East sidE

4 Third Quarter 2010

Average Price Per Square Foot

Co-op apartments posted strong pricing gains in the East Side market over the past year

The co-op average price per room rose 17 for prewar units and

14 for postwar units compared to the third quarter of 2009

Condo prices on the East Side averaged $1213 per square foot

3 less than a year ago

Average Price Per Room

$100000

$300000

$150000

$200000

$250000

$350000

$400000

$50000

3Q09 3Q10

$200

$1000

$400

$600

$800

$1200

$1400

$0

Studio 1-Bedroom 2-Bedroom 3+Bedroom

Percent of Sales

3rd Q 09 12 34 28 26

3rd Q 10 7 31 37 25

Average Price

3rd Q 09 $386734 $590337 $1465894 $3852286

3rd Q 10 $375666 $658875 $1449023 $3514627

Change -3 12 -1 -9

Postwar

$203293 $232575

Prewar

$281354 $328648

3Q10

$1213

3Q09

$1249

Generally 59th to 110th Street Hudson River to West of Fifth Avenue

WEst sidE

Third Quarter 2010 5

Cooperative CondominiumAverage Price Per Room Average Price Per Square Foot

The West Side market saw strong gains in the average co-op price per room over the past

year At $280327 the prewar co-op average price per room was 29 higher than a year ago

while the postwar price rose 8 to $202193 West Side condo

prices fell 4 from 2009rsquos third quarter to an average of $1254 per square foot

$200

$1000

$400

$600

$800

$1200

$1400

$0

$125000

$225000

$150000

$175000

$200000

$250000

$275000

$100000

3Q09 3Q10

Studio 1-Bedroom 2-Bedroom 3+Bedroom

Percent of Sales

3rd Q 09 7 40 41 12

3rd Q 10 9 30 36 25

Average Price

3rd Q 09 $401021 $629722 $1382135 $3470940

3rd Q 10 $399072 $697290 $1523268 $3353242

Change 0 11 10 -3

3Q09

$1306

3Q10

$1254

Prewar

$217459 $280327

Postwar

$186785 $202193

MidtoWn East Generally 34th to 59th Street Fifth Avenue to the East River

MidtoWn

MidtoWn WEst Generally 34th to 59th Street Hudson River to West of Fifth Avenue

6 Third Quarter 2010

Cooperative Condominium

Cooperative Condominium

Average Price Per Room Average Price Per Square Foot

Average Price Per Room Average Price Per Square Foot

The average condo price per square foot rose 14 over the past year in the Midtown East market to $1276 Co-op prices in this area were mixed with the average price per room down 2 for prewar

units but up 6 for postwar units

In the Midtown West market the average price per room for prewar co-ops jumped 96

from the third quarter of 2009 This was due to an unusually

weak number a year ago combined with a high number of Central Park South sales

inflating the figure in the third quarter of 2010

$150000

$75000

$100000

$125000

$175000

$200000

$750

$0

$250

$500

$1000

$1250

3Q09 3Q10

3Q09 3Q10

$1000

$250

$500

$750

$1250

$1500

3Q10

$1258$1237

3Q09

$200000

$50000

$100000

$150000

$250000

$300000

$138443 $271070

Prewar

$174573 $208409

Postwar

$201796 $198364

Prewar

$190801 $202708

Postwar

$1116

3Q09

$1276

3Q10

Cooperative Condominium

Third Quarter 2010 7

Average Price Per Room Average Price Per Square Foot

South of 34th Street

doWntoWn

Prices rose for both co-ops and condos in the Downtown market over the past year aided by a 43 increase in the average price for three-bedroom and

larger apartments The average co-op price per room rose 19 over the past year for prewar

units and 14 for postwar units Condo prices Downtown

averaged $1201 per square foot 5 more than during the third

quarter of 2009

3Q09 3Q10

Studio 1-Bedroom 2-Bedroom 3+Bedroom

Percent of Sales

3rd Q 09 15 47 28 10

3rd Q 10 15 45 29 11

Average Price

3rd Q 09 $426982 $711789 $1427071 $2643872

3rd Q 10 $461763 $755436 $1523264 $3776778

Change 8 6 7 43

Prewar

$196789 $234026

Postwar

$190826 $216683

3Q09

$1149

3Q10

$1201

$700

$1100

$800

$900

$1000

$1200

$1300

$600

$100000

$200000

$125000

$150000

$175000

$225000

$250000

$75000

Cooperative CondominiumAverage Price Per Room Average Price Per Square Foot

Generally North of 96th Street on the East Side and 110th Street on the West Side

NEW YORK CITY bull PALM BEACH bull THE HAMPTONS bull NORTH FORK 2129069200

EAST SIDE445 Park AvenueHall F Willkie PresidentRuth McCoy EVPManaging Director of Sales

UPPER EAST SIDE1121 Madison AvenuePeter R Marra EVPManaging Director of Sales

EDWARD LEE CAVE DIVISION790 Madison AvenueCaroline E Y GuthriePresident

WEST SIDE1926 BroadwayJames M Gricar EVP Managing Director of Sales

BROOKLYN HEIGHTS129 Montague StreetChristopher Thomas EVPManaging Director of Sales

PARK SLOPE100 Seventh AvenueMaryAnn Albano EVPManaging Director of Sales

NEW DEVELOPMENT445 Park Avenue James M GricarManaging DirectorBrown Harris Stevens On-Site Marketing and Sales

Prepared by Gregory Heym Chief Economist Brown Harris Stevenscopy2010 by Brown Harris Stevens All Rights Reserved This information may not be copied used or distributed without Brown Harris Stevensrsquo consent While information is believed true no guaranty is made of accuracy

The average price rose sharply over the past year for studio

and two-bedroom apartments in Northern Manhattan Studio

prices averaged $285719 a 24 increase from third

quarter of 2009 while the two-bedroom average price rose 20

to $621104 Condo prices averaged $618 per square foot

7 more than a year ago

This report is based on 2471 reported Manhattan apartment sales 4 more than were reported during last yearrsquos comparable period

VILLAGE2 Fifth AvenueKevin Kovesci EVPManaging Director of Sales

TRIBECA43 North MooreKevin Kovesci EVPManaging Director of Sales

northErn Manhattan

$100

$500

$200

$300

$400

$600

$700

$0

3Q09 3Q10

$60000

$100000

$70000

$80000

$90000

$110000

$120000

$50000

Studio 1-Bedroom 2-Bedroom 3+Bedroom

Percent of Sales

3rd Q 09 7 40 41 12

3rd Q 10 9 32 46 13

Average Price

3rd Q 09 $230833 $380770 $519583 $964950

3rd Q 10 $285719 $379154 $621104 $879888

Change 24 0 20 -9

3Q09

$579

3Q10

$618

Prewar

$103224 $114800

Postwar

$101221 $98244

IDENTIFYING THE

APARTMENT

A Sample Showsheet

B Cooperative Building Financials

Pure Perfection on Riverside Drive100 Riverside Drive Apartment 3A

This sprawling prewar 9 room home is simply exquisite The trees of Riverside Park greet you while you sit in

the new chefs kitchen open to a beautiful den (or dining room) on the park The gorgeous sunken living room

library and huge master bedroom also all have oversized picture windows on the park In addition there are

two more bedrooms a large formal dining room and a second windowed butlers kitchen that could easily be

made into an office The finishes of this home are perfect All of the bathrooms are brand new and outfitted

with custom stone There is central air and the closets have all been custom designed Currently configured as a

luxurious 3 bedroom plus maids and den the apartment could easily be a 4 bedroom plus library No detail has

been overlooked and there is fabulous sun trees and nature in almost every room Full service building with

storage and a new fitness center A truly unique and special home

WEB 917677

Full Service Prewar Coopbull Four Bedrooms and Four New Bathroomsbull

Maintenance $350634bull Central Air Conditioningbull

Financing Allowed 75bull New Chefs Kitchen with Large Double Ovenbull

Tax Deductability 39bull Custom Closetsbull

Storage Binbull Pets Allowedbull

Fitness Centerbull Laundry Room with Butlers Kitchenbull

$3999000 Listing Price

Exclusive Broker

Lisa Lippman bull 212-588-5606 bull fax 212-418-9733 bull llippmanbhsusacom

All information is from sources deemed reliable but is subject to errors omissions changes in price prior sale or withdrawal without notice No representation is made as to the accuracy of any description All measurements and squarefootages are approximate and all information should be confirmed by customer All rights to content photographs and graphics reserved to BHS Customer should consult with its counsel regarding all closing costs including without

limitation the New York State 1 tax paid by buyers on residential properties over $1 million BHS represents the sellerowner on BHSs own exclusives except if another agent of BHS represents the buyertenant in which case BHSwill be a dual agent with designated agents representing sellerowner and buyertenant BHS represents the buyertenant when showing the exclusives of other real estate firms In all instances BHS treats all parties fairly and honestly

BHS actively supports equal housing opportunities

Scott Moore bull 212-588-5608 bull fax 212-319-2633 bull smoorebhsusacom

Brown Harris Stevens Residential Sales LLC bull 212 906 9200 bull BrownHarrisStevenscomM A N H A T T A N bull B R O O K L Y N bull T H E H A M P T O N S bull N O R T H F O R K bull P A L M B E A C H

ldquoMAKING THE DEALrdquo

A REBNY Financial Statement

B Estimated Residential Closing Costs

C Sample Contracts (Co-op amp Condo)

D Sample Closing Breakdown

(Condo)

FINANCIAL STATEMENT

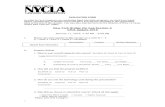

Name(s)

Address

The following is submitted as being true and accurate statement of the financial condition of the undersigned on the day of

January 20

ASSETS

Applicant

Co-Applicant

LIABILITIES

Applicant

Co-Applicant

Cash in Banks 550000 Notes Payable

Money Markets Funds 600000 To Banks

Contract Deposit 355000 To Relative

Investments Bonds amp Stocks To Others

- see schedule 1620000 Installment Accounts Payable

Investment in Own Business Automobile

Accounts amp Notes Receivable Other

Real Estate Owned-see schedule 1200000 Other Accounts Payable

Year Make Mortgages Payable on Real 535000

Automobiles 35000 Estate - see schedule

Personal Property amp Furniture 50000 Unpaid Real Estate Taxes

Life Insurance Unpaid Income Taxes

Cash Surrender Value 60000 Chattel Mortgages

Retirement FundsIRA Loans on Life Insurance

Policies

401K 200000 (Include Premium

Advances)

KEOGH Outstanding Credit Card

Loans

Profit SharingPension Plan Other Debts - Itemize

Other Assets TOTAL LIABILITIES 535000 0

TOTAL ASSETS 4670000 0 NET WORTH 4135000 0

COMBINED ASSETS

4670000

TOTAL LIABILITIES

amp NET WORTH 4670000 0

SOURCE OF INCOME

Applicant

Co-Applicant

COMBINED 4670000

Base Salary 350000 CONTINGENT LIABILITIES

Overtime Wages As Endorser or Co-Maker on Notes $ 0

Bonus amp Commissions 150000 Alimony $ 0

Dividends and Interest Income Child Support $ 0

Real Estate Income (Net) Are you defendant in any legal action Yes No

Explain

Other Income - Itemize Are there any unsatisfied judgments Yes No

TOTAL 500000 0 Have you ever taken bankruptcy Yes No

Explain GENERAL INFORMATION

Applicant

Co-Applicant

Personal Bank Accounts at

PROJECTED EXPENSES

MONTHLY

Maintenance $ 2857

Savings amp Loan Accounts at Apartment Financing $ 10078

Other Mortgages $ 2671

Bank Loans $

Purpose of Loan Auto Loan $

TOTAL $ 15606

The foregoing statements and details pertaining thereto both printed and written have been carefully read and the undersigned hereby

solemnly declares and certifies that the same is a full and correct exhibit of myour financial condition

Date 20 Signature __________________________________________

Signature __________________________________________

SCHEDULE OF BOND amp STOCKS

Amount of Shares

Description (Extended Valuation in Column)

Marketable Value

Non-Marketable Value

SCHEDULE OF REAL ESTATE

Description amp Location

Cost

Actual Value

Mortgage Amount

Maturity Date

SCHEDULE OF NOTES PAYABLE

Specify any assets pledges as collateral including the liabilities they secure

To Whom Payable

Date

Amount

Due

Interest

Pledged as Security

April 2009

ESTIMATED RESIDENTIAL CLOSING COSTS IN NEW YORK CITY

Broker As provided in exclusive with broker

Own Attorney Approx $2000 +- as negotiated

Managing Agentrsquos Fee Approx $500 + as determined by building

Move-out Deposit or Fee Approx $1000 as determined by building

New York City Transfer Tax 1 of entire gross purchase price if price is $500000 or under or 1425 of entire gross purchase price if price exceeds $500000

New York State Transfer Tax 04 (004) of gross purchase price

Bank Satisfaction of Mortgage Fees Approx $450 as determined by bank

Recording ACRIS other fees Approx $150

Gains Tax Withholding (Out of State Seller) 897 of gain

Non ndash US Resident (FIRPTA) 10 of price withheld or paid

Stock Transfer Tax (Co-ops Only) $005share

FOR The SelleR

Mortgage Recording Tax and Title Insurance not required for Co-ops though title insurance is available for Co-ops at other rates

For Bulk Sale Multi Family and Commercial Property NYC Transfer Tax Rates $1425 under $500000 2625 above Mortgage Recording Tax Rates 205 under $500000 28 above $500000

When purchasing a condominium unit directly from a Sponsor the Purchaser may be required to pay New York City and New York State Transfer Taxes (See ldquoFor The Sellerrdquo section above for amounts) as well as the Sponsorrsquos attorneyrsquos fee (typically around $1500)

All costs are estimated and will vary based on transaction specifics changes in rates and taxes and other factors No representation is made as to the accuracy of these estimates Parties to transactions must consult their own counsel and refer to transaction specifics for verification of all costs

Own Attorney Approx $2000 +- as negotiated

Bank Fees (application credit appraisal bank attorney and miscellaneous) Approx $2200 as determined by bank

Short-term Interest One month max (prorated for month of closing)

Miscellaneous Recording Fees Approx $500

Mortgage Recording Fee205 of entire amount of Mortgage on Loans $500000 or under or 2175 of entire amount of Mortgage on Loans exceeding $500000

Fee Title Insurance Approx $8000 for $2000000 NYC condo based on rate schedule

Mortgagee Title Insurance Approx $1500 for $1500000 NYC condo mortgage based on rate schedule

Miscellaneous Title Charges Approx $500

Managing Agentrsquos Fee Approx $500 as determined by building

Adjustments

Common Charges Approx 1 month (prorated for month of closing)

Real estate Tax escrow Approx 8 months (prorated to closing plus 6 month escrow may include insurance)

Mansion Tax 1 of entire gross purchase price if purchase price exceeds $1000000

Move-in Deposit or Fee Approx $1000 as determined by building

lien Search (Co-ops Only) Approx $350

FOR The PURChASeR

123 - Contract of sale cooperative apartment 7-01

Prepared by The Committee on Condominiums and Cooperatives of the Real Property Section of the New York State Bar Association

CONSULT YOUR LAWYER BEFORE SIGNING THIS AGREEMENT

Contract of Sale - Cooperative Apartment

This Contract is made as of October 2010 between the Seller and the Purchaser identified below

1 Certain Definitions and Information

11 The Parties are

111 Seller

Prior names used by Seller

Address

New York NY

S S No

112 Purchaserrdquo

Address

New York NY

S S No

12 The Attorneys are (name address and telephone fax)

121 Sellers Attorneyrdquo

Giddins Claman LLP

675 Third Avenue 29th Floor

New York NY 10017

Attn Paul M Giddins Esq

(212)573-6703 Fax (212)949-1923

pgiddinsgcl-lawcom

122 Purchasers Attorney

13 The Escrowee is the Sellers Attorney

14 The Managing Agent is (name address and telephone fax)

15 The real estate Broker(s) (see para 12) isare

Lisa Lippman

Company Name Brown Harris Stevens

16 The name of the cooperative housing corporation (Corporation) is

17 The Unit number is

18 The Unit is located in Premises known as

19 The Shares are the shares of the Corporation allocated to the Unit

110 The Lease is the Corporations proprietary lease or occupancy agreement for the Unit given by the Corporation which expires on

111 Personalty is the following personal property to the extent existing in the Unit on the date hereof the refrigerators freezers ranges ovens built-in microwave ovens dishwashers garbage disposal units cabinets and

counters lighting fixtures chandeliers wall-to-wall carpeting plumbing and heating fixtures central air conditioning andor window or sleeve units washing machines dryers screens and storm windows window treatments switch plates door hardware mirrors built-ins not excluded in Paragraph 112 and

112 Specifically excluded from this sale is all personal property not included in para 111 and

113 The sale [does] [does not] include Sellers interest in

Storage Servants Room Parking Space (Included Interests)

114 The Closing is the transfer of ownership of the Shares and Lease

115 The date scheduled for Closing is 2010

(Scheduled Closing Date) at 200 PM (See para 9 and 10)

116 The Purchase Price is $

1161 The Contract Deposit is $

1162 The Balance of the Purchase Price due at Closing is

$ (See para 222)

117 The monthly Maintenance charge is $ (See para 4)

118 The Assessment if any payable to the Corporation at the date of this Contract is $ payable as follows

119 SellerPurchaser shall pay the Corporations flip tax transfer fee (apart from the transfer agent fee) andor waiver of option fee (Flip Tax) if any

120 Financing Options (Delete two of the following parapara 1 20 1 1202 or 1203)

1201 Purchaser may apply for financing in connection with this sale and Purchasers obligation to purchase under this Contract is contingent upon issuance of a Loan Commitment Letter by the Loan Commitment Date (para 1812)

1202 Purchaser may apply for financing in connection with this sale but Purchasers obligation to purchase this Contract is not contingent upon issuance of a Loan Commitment Letter

1203 Purchaser shall not apply for financing in connection with this sale

121 If para 120 1 or 1202 applies the Financing Terms for para 18 are A loan of $ for a term of 30 years or such lesser amount or shorter term as applied for or acceptable to Purchaser and the Loan Commitment Date for para 18 is 30 calendar days after the Delivery Date

122 The Delivery Date of this Contract is the date on which a fully executed counterpart of this Contract is deemed given to and received by Purchaser or Purchasers Attorney as provided in para 173

123 All Proposed Occupants of the Unit are

1231 persons and relationship to Purchaser

Purchasers

1232 pets

124 The Contract Deposit shall be held in [a non] [an] IOLA escrow account If the account is a non-IOLA account then interest shall be paid to the Party entitled to the Contract Deposit The Party receiving the interest shall pay any income taxes thereon The escrow account shall be a segregated bank account at

Depository XXXX Bank

Address (See para 27)

125 This Contract is [not] continued on attached rider(s)

2 Agreement to Sell and Purchase Purchase Price Escrow

21 Seller agrees to sell to Purchaser and Purchaser agrees to purchase from Seller the Sellers Shares Lease Personalty and any Included Interests and all other items included in this sale for the Purchase Price and upon the terms and conditions set forth in this Contract

22 The Purchase Price is payable to Seller by Purchaser as follows

221 the Contract Deposit at the time of signing this Contract by Purchasers good check to the order of Escrowee and

222 the Balance at Closing only by cashiers or official bank check or certified check of Purchaser payable to the direct order of Seller The check(s) shall be drawn on and payable by a branch of a commercial or savings bank savings and loan association or trust company located in the same City or County as the Unit Seller may direct on reasonable Notice (defined in para 17) prior to Closing that all or a portion of the Balance shall be made payable to persons other than Seller (see para 177)

3 Personalty

31 Subject to any rights of the Corporation or any holder of a mortgage to which the Lease is subordinate this sale includes all of the Sellers interest if any in the Personalty and the Included Interests

32 No consideration is being paid for the Personalty or for the Included Interests nothing shall be sold to Purchaser if the Closing does not occur

33 Prior to Closing Seller shall remove from the Unit all the furniture furnishings and other property not included in this sale and repair any damage caused by such removal

4 Representations and Covenants

41 Subject to any matter affecting title to the Premises (as to which Seller makes no representations or covenants) Seller represents and covenants that

4 11 Seller is and shall at Closing be the sole owner of the Shares Lease Personalty and Included Interests with the full right power and authority to sell and assign them Seller shall make timely provision to satisfy existing security interest(s) in the Shares and Lease and have the same delivered at Closing (See para 101)

412 the Shares were duly issued fully paid for and are non-assessable

413 the Lease is and will at Closing be in full force and effect and no notice of default under the Lease is now or will at Closing be in effect

414 the Maintenance and Assessments payable as of the date hereof are as specified in para 117 and 118

415 as of this date Seller neither has actual knowledge nor has received any written notice of any increase in Maintenance or any Assessment which has been adopted by the Board of Directors of the Corporation and is not reflected in the amounts set forth in parapara 117 and 118

416 Seller has not made any material alterations or additions to the Unit without any required consent of the Corporation or to Sellers actual knowledge without compliance with all applicable law This provision shall not survive Closing

417 Seller has not entered into shall not enter into and has no actual knowledge of any agreement (other than the Lease) affecting title to the Unit or its use andor occupancy after Closing or which would be binding on or adversely affect Purchaser after Closing (eg a sublease or alteration agreement)

418 Seller has been known by no other name for the past 10 years except as set forth in para 111

419 at Closing in accordance with para 152

4191 there shall be no judgments outstanding against Seller which have not been bonded against collection out of the Unit (Judgments)

4192 the Shares Lease Personalty and any Included Interests shall be free and clear of liens (other than the Corporations general lien on the Shares for which no monies shall be owed) encumbrances and adverse interests (Liens)

4193 all sums due to the Corporation shall be fully paid by Seller to the end of the payment period immediately preceding the date of Closing

4194 Seller shall not be indebted for labor or material which might give rise to the filing of a notice of mechanics lien against the Unit or the Premises and

4195 no violations shall be of record which the owner of the Shares and Lease would be obligated to remedy under the Lease

42 Purchaser represents and covenants that

421 Purchaser is acquiring the Shares and Lease for primary residential occupancy of the Unit solely by the Proposed Occupants identified in para 1 23

422 Purchaser is not and within the past 7 years has not been the subject of a bankruptcy proceeding

423 if para 1203 applies Purchaser shall not apply for financing in connection with this purchase

424 Each individual comprising Purchaser is over the age of 18 and is purchasing for Purchasers own account (beneficial and of record)

425 Purchaser shall not make any representations to the Corporation contrary to the foregoing and shall provide all documents in support thereof required by the Corporation in connection with Purchasers application for approval of this transaction and

426 there are not now and shall not be at Closing any unpaid tax liens or monetary judgments against Purchaser

43 Each Party covenants that its representations and covenants contained in para 4 shall be true and complete at Closing and except for para 416 shall survive Closing but any action based thereon must be instituted within one year after Closing

5 Corporate Documents

Purchaser has examined and is satisfied with or (except as to any matter represented in this Contract by Seller) accepts and assumes the risk of not having examined the Lease the Corporations Certificate of Incorporation By-laws House Rules minutes of shareholders and directors meetings most recent audited financial statement and most recent statement of tax deductions available to the Corporations shareholders under Internal Revenue Code (IRC) sect216 (or any successor statute)

6 Required Approval and References

61 This sale is subject to the unconditional consent of the Corporation

62 Purchaser shall in good faith

621 submit to the Corporation or the Managing Agent an application with respect to this sale on the form required by the Corporation containing such data and together with such documents as the Corporation requires and pay the applicable fees and charges that the Corporation imposes upon Purchaser All of the foregoing shall be submitted within 10 business days after the Delivery Date or if para 1201 or 1202 applies and the Loan Commitment Letter is required by the Corporation within 3 business days after the earlier of (i) the Loan Commitment Date (defined in para 12 1) or (ii) the date of receipt of the Loan Commitment Letter (defined in para 1812) whether said commitment letter is conditional or unconditional

622 attend (and cause any Proposed Occupant to attend) one or more personal interviews as requested by the Corporation and

623 promptly submit to the Corporation such further references data and documents reasonably requested by the Corporation 63 Either Party after learning of the Corporations decision shall promptly advise the other Party thereof If the Corporation has not made a decision on or before the Scheduled Closing Date the Closing shall be adjourned for 30 business days for the purpose of obtaining such consent If such consent is not given by such adjourned date either Party may cancel this Contract by Notice provided that the Corporations consent is not issued before such Notice of cancellation is given If such consent is refused at any time either Party may cancel this Contract by Notice In the event of cancellation pursuant to this para 63 the Escrowee shall refund the Contract Deposit to Purchaser 64 If such consent is refused or not given due to Purchasers bad faith conduct Purchaser shall be in default and para 131 shall govern 7 Condition of Unit and Personalty Possession 71 Seller makes no representation as to the physical condition or state of repair of the Unit the Personalty the Included Interests or the Premises Purchaser has inspected or waived inspection of the Unit the Personalty and the Included Interests and shall take the same as is as of the date of

this Contract except for reasonable wear and tear However at the time of Closing the appliances shall be in working order and required smoke detector(s) shall be installed and operable 72 At Closing Seller shall deliver possession of the Unit Personalty and Included Interests in the condition required by para 71 broom clean vacant and free of all occupants and rights of possession 8 Risk of Loss 81 The provisions of General Obligations Law Section 5-1311 as modified herein shall apply to this transaction as if it were a sale of realty For purposes of this paragraph the term Unit includes built-in Personalty 82 Destruction shall be deemed material under GOL 5-1311 if the reasonably estimated cost to restore the Unit shall exceed 5 of the Purchase Price 83 In the event of any destruction of the Unit or the Premises when neither legal title nor the possession of the Unit has been transferred to Purchaser Seller shall give Notice of the loss to Purchaser (Loss Notice) by the earlier of the date of Closing or 7 business days after the date of the loss 84 If there is material destruction of the Unit without fault of Purchaser this Contract shall be deemed canceled in accordance with para 163 unless Purchaser elects by Notice to Seller to complete the purchase with an abatement of the Purchase Price or 85 Whether or not there is any destruction of the Unit if without fault of Purchaser more than 10 of the units in the Premises are rendered uninhabitable or reasonable access to the Unit is not available then Purchaser shall have the right to cancel this Contract in accordance with para 163 by Notice to Seller 86 Purchasers Notice pursuant to para 84 or para 85 shall be given within 7 business days following the giving of the Loss Notice except that if Seller does not give a Loss Notice Purchasers Notice may be given at any time at or prior to Closing 87 In the event of any destruction of the Unit Purchaser shall not be entitled to an abatement of the Purchase Price (i) that exceeds the reasonably estimated cost of repair and restoration or (ii) for any loss that the Corporation is obliged to repair or restore but Seller shall assign to Purchaser without recourse Sellers claim if any against the Corporation with respect to such loss 9 Closing Location The Closing shall be held at the location designated by the Corporation or if no such designation is made at the office of Sellers Attorney 10 Closing 101 At Closing Seller shall deliver or cause to be delivered 1011 Sellers certificate for the Shares duly endorsed for transfer to Purchaser or accompanied by a separate duly executed stock power to Purchaser and in either case with any guarantee of Sellers signature required by the Corporation 1012 Sellers counterpart original of the Lease all assignments and assumptions in the chain of title and a duly executed assignment thereof to Purchaser in the form required by the Corporation 1013 FIRPTA documents required by para 25 1014 keys to the Unit building entrance(s) and if applicable garage mailbox storage unit and any locks in the Unit 1015 if requested an assignment to Purchaser of Sellers interest in the Personalty and Included Interests 1016 any documents and payments to comply with para 152 1017 If Seller is unable to deliver the documents required in para 1011 or 1012 then Seller shall deliver or cause to be delivered all documents and payments required by the Corporation for the issuance of anew certificate for the Shares or a new Lease 102 At Closing Purchaser shall 1021 pay the Balance in accordance with para 222 1022 execute and deliver to Seller and the Corporation an agreement assuming the Lease in the form required by the Corporation and 1023 if requested by the Corporation execute and deliver counterparts of a new lease substantially the same as the Lease for the balance of the Lease term in which case the Lease shall be canceled and surrendered to the Corporation together with Sellers assignment thereof to Purchaser

103 At Closing the Parties shall complete and execute all documents necessary 1031 for Internal Revenue Service (IRS) form 1099-S or other similar requirements 1032 to comply with smoke detector requirements and any applicable transfer tax filings and 1033 to transfer Sellers interest if any in and to the Personalty and Included Interests 104 Purchaser shall not be obligated to close unless at Closing the Corporation delivers 1041 to Purchaser a new certificate for the Shares in the name of Purchaser and 1042 a written statement by an officer or authorized agent of the Corporation consenting to the transfer of the Shares and Lease to Purchaser and setting forth the amounts of and payment status of all sums owed by Seller to the Corporation including Maintenance and any Assessments and the dates to which each has been paid 11 Closing Fees Taxes and Apportionments 11 1 At or prior to Closing 1111 Seller shall pay if applicable 11111 the cost of stock transfer stamps and 11112 transfer taxes except as set forth in para 11122 1112 Purchaser shall pay if applicable 11121 any fee imposed by the Corporation relating to Purchasers financing and 11122 transfer taxes imposed by statute primarily on Purchaser (eg the mansion tax) 112 The Flip Tax if any shall be paid by the Party specified in para 119 113 Any fee imposed by the Corporation and not specified in this Contract shall be paid by the Party upon whom such fee is expressly imposed by the Corporation and if no Party is specified by the Corporation then such fee shall be paid by Seller 114 The Parties shall apportion as of 1159 PM of the day preceding the Closing the Maintenance and any other periodic charges due the Corporation (other than Assessments) and STAR Tax Exemption (if the Unit is the beneficiary of same) based on the number of the days in the month of Closing 115 Assessments whether payable in a lump sum or installments shall not be apportioned but shall be paid by the Party who is the owner of the Shares on the date specified by the Corporation for payment Purchaser shall pay any installments payable after Closing provided Seller had the right and elected to pay the Assessment in installments 116 Each Party shall timely pay any transfer taxes for which it is primarily liable pursuant to law by cashiers official bank certified or attorneys escrow check This para 116 shall survive Closing 117 Any computational errors or omissions shall be corrected within 6 months after Closing This para 117 shall survive Closing 12 Broker 121 Each Party represents that such Party has not dealt with any person acting as a broker whether licensed or unlicensed in connection with this transaction other than the Broker(s) named in para 15 122 Seller shall pay the Brokers commission pursuant to a separate agreement The Broker(s) shall not be deemed to be a third-party beneficiary of this Contract 123 This para 12 shall survive Closing cancellation or termination of this Contract 13 Defaults Remedies and Indemnities 131 In the event of a default or misrepresentation by Purchaser Sellers sole and exclusive remedies shall be to cancel this Contract retain the Contract Deposit as liquidated damages and if applicable Seller may enforce the indemnity in para 133 as to brokerage commission or sue under para 134 Purchaser prefers to limit Purchasers exposure for actual damages to the amount of the Contract Deposit which Purchaser agrees constitutes a fair and reasonable amount of compensation for Sellers damages under the circumstances and is not a penalty The principles of real property law shall apply to this liquidated damages provision 132 In the event of a default or misrepresentation by Seller Purchaser shall have such remedies as Purchaser is entitled to at law or in equity including

specific performance because the Unit and possession thereof cannot be duplicated 133 Subject to the provisions of para 43 each Party indemnifies and holds harmless the other against and from any claim judgment loss liability cost or expense resulting from the indemnitors breach of any of its representations or covenants stated to survive Closing cancellation or termination of this Contract Purchaser indemnifies and holds harmless Seller against and from any claim judgment loss liability cost or expense resulting from the Lease obligations accruing from and after the Closing Each indemnity includes without limitation reasonable attorneys fees and disbursements court costs and litigation expenses arising from the defense of any claim and enforcement or collection of a judgment under this indemnity provided the indemnitee is given Notice and opportunity to defend the claim This para 133 shall survive Closing cancellation or termination of this Contract 134 In the event any instrument for the payment of the Contract Deposit fails of collection Seller shall have the right to sue on the uncollected instrument In addition such failure of collection shall be a default under this Contract provided Seller gives Purchaser Notice of such failure of collection and within 3 business days after Notice is given Escrowee does not receive from Purchaser an unendorsed good certified check bank check or immediately available funds in the amount of the uncollected funds Failure to cure such default shall entitle Seller to the remedies set forth in Paragraph 131 and to retain all sums as may be collected andor recovered 14 Entire Agreement Modification 141 All prior oral or written representations understandings and agreements had between the Parties with respect to the subject matter of this Contract and with the Escrowee as to para 27 are merged in this Contract which alone fully and completely expresses the Parties and Escrowees agreement 142 The Attorneys may extend in writing any of the time limitations stated in this Contract Any other provision of this Contract may be changed or waived only in writing signed by the Party or Escrowee to be charged 15 Removal of Liens and Judgments 151 Purchaser shall deliver or cause to be delivered to Seller or Sellers Attorney not less than 10 calendar days prior to the Scheduled Closing Date a Lien and Judgment search except that Liens or Judgments first disclosed in a continuation search shall be reported to Seller within 2 business days after receipt thereof but not later than the Closing Seller shall have the right to adjourn the Closing pursuant to para 16 to remove any such Liens and Judgments Failure by Purchaser to timely deliver such search or continuation search shall not constitute a waiver of Sellers covenants in para 4 as to Liens and Judgments However if the Closing is adjourned solely by reason of untimely delivery of the Lien and Judgment search the apportionments under Paragraph 113 shall be made as of 1159 PM of the day preceding the Scheduled Closing Date in para 115 152 Seller at Sellers expense shall obtain and deliver to the Purchaser the documents and payments necessary to secure the release satisfaction termination and discharge or removal of record of any Liens and Judgments Seller may use any portion of the Purchase Price for such purposes 153 This para 15 shall survive Closing 16 Sellers Inability 161 If Seller shall be unable to transfer the items set forth in para 21 in accordance with this Contract for any reason other than Sellers failure to make a required payment or other willful act or omission then Seller shall have the right to adjourn the Closing for periods not exceeding 60 calendar days in the aggregate but not extending beyond the expiration of Purchasers Loan Commitment Letter if para 1201 or 1202 applies 162 If Seller does not elect to adjourn the Closing or (if adjourned) on the adjourned date of Closing Seller is still unable to perform then unless Purchaser elects to proceed with the Closing without abatement of the Purchase Price either Party may cancel this Contract on Notice to the other Party given at any time thereafter 163 In the event of such cancellation the sole liability of Seller shall be to cause the Contract Deposit to be refunded to Purchaser and to reimburse Purchaser for the actual costs incurred for Purchases lien and title search if any

17 Notices and Contract Delivery 171 Any notice or demand (Notice) shall be in writing and delivered either by hand overnight delivery or certified or registered mail return receipt requested to the Party or and simultaneously in like manner to such Partys Attorney if any and to Escrowee at their respective addresses or to such other address as shall hereafter be designated by Notice given pursuant to this para 17 172 The Contract may be delivered as provided in para 171 or by ordinary mail 173 The Contract or each Notice shall be deemed given and received 1731 on the day delivered by hand 1732 on the business day following the date sent by overnight delivery 1733 on the 5th business day following the date sent by certified or registered mail or 1734 as to the Contract only 3 business days following the date of ordinary mailing 174 A Notice to Escrowee shall be deemed given only upon actual receipt by Escrowee 175 The Attorneys are authorized to give and receive any Notice on behalf of their respective clients 176 Failure or refusal to accept a Notice shall not invalidate the Notice 177 Notice pursuant to parapara 222 and 134 may be delivered by confirmed facsimile to the Partys Attorney and shall be deemed given when transmission is confirmed by senders facsimile machine 18 Financing Provisions 181 The provisions of parapara 181 and 182 are applicable only if para 1201 or 1202 applies 1811 An Institutional Lender is any of the following that is authorized under Federal or New York State law to issue a loan secured by the Shares and Lease and is currently extending similarly secured loan commitments in the county in which the Unit is located a bank savings bank savings and loan association trust company credit union of which Purchaser is a member mortgage banker insurance company or governmental entity 1812 A Loan Commitment Letter is a written offer from an Institutional Lender to make a loan on the Financing Terms (see para 1 2 1) at prevailing fixed or adjustable interest rates and on other customary terms generally being offered by Institutional Lenders making cooperative share loans An offer to make a loan conditional upon obtaining an appraisal satisfactory to the Institutional Lender shall not become a Loan Commitment Letter unless and until such condition is met An offer conditional upon any factor concerning Purchaser (eg sale of current home payment of outstanding debt no material adverse change in Purchasers financial condition etc) is a Loan Commitment Letter whether or not such condition is met Purchaser accepts the risk that and cannot cancel this Contract if any condition concerning Purchaser is not met 182 Purchaser directly or through a mortgage broker registered pursuant to Article 12-D of the Banking Law shall diligently and in good faith 1821 apply only to an Institutional Lender for a loan on the Financing Terms (see para 121) on the form required by the Institutional Lender containing truthful and complete information and submit such application together with such documents as the Institutional Lender requires and pay the applicable fees and charges of the Institutional Lender all of which shall be performed within 5 business days after the Delivery Date 1822 promptly submit to the Institutional Lender such further references data and documents requested by the Institutional Lender and 1823 accept a Loan Commitment Letter meeting the Financing Terms and comply with all requirements of such Loan Commitment Letter (or any other loan commitment letter accepted by Purchaser) and of the Institutional Lender in order to close the loan and 1824 furnish Seller with a copy of the Loan Commitment Letter promptly after Purchasers receipt thereof 1825 Purchaser is not required to apply to more than one Institutional Lender 183 If Paragraph 1201 applies then 1831 provided Purchaser has complied with all applicable provisions of para 182 and this para 183 Purchaser may cancel this Contract as set forth below if

18311 any Institutional Lender denies Purchasers application in writing prior to the Loan Commitment Date (see Paragraph 121) or 18312 a Loan Commitment Letter is not issued by the Institutional Lender on or before the Loan Commitment Date or 18313 any requirement of the Loan Commitment Letter other than one concerning Purchaser is not met (eg failure of the Corporation to execute and deliver the Institutional Lenders recognition agreement or other document financial condition of the Corporation owner occupancy quota etc) or 18314 (i) the Closing is adjourned by Seller or the Corporation for more than 30 business days from the Scheduled Closing Date and (ii) the Loan Commitment Letter expires on a date more than 30 business days after the Scheduled Closing Date and before the new date set for Closing pursuant to this para and (iii) Purchaser is unable in good faith to obtain from the Institutional Lender an extension of the Loan Commitment Letter or a new Loan Commitment Letter on the Financing Terms without paying additional fees to the Institutional Lender unless Seller agrees by Notice to Purchaser within 5 business days after receipt of Purchasers Notice of cancellation on such ground that Seller will pay such additional fees and Seller pays such fees when due Purchaser may not object to an adjournment by Seller for up to 30 business days solely because the Loan Commitment Letter would expire before such adjourned Closing date 1832 Purchaser shall deliver Notice of cancellation to Seller within 5 business days after the Loan Commitment Date if cancellation is pursuant to para 18311 or 18312 and on or prior to the Scheduled Closing Date if cancellation is pursuant to para 18313 or 18314 1833 If cancellation is pursuant to Paragraph 18311 then Purchaser shall deliver to Seller together with Purchasers Notice a copy of the Institutional Lenders written denial of Purchasers loan application If cancellation is pursuant to para 18313 then Purchaser shall deliver to Seller together with Purchasers Notice evidence that a requirement of the Institutional Lender was not met 1834 Seller may cancel this Contract by Notice to Purchaser sent within 5 days after the Loan Commitment Date if Purchaser shall not have sent by then either (i) Purchasers Notice of cancellation or (ii) a copy of the Loan Commitment Letter to Seller which cancellation shall become effective if Purchaser does not deliver a copy of such Loan Commitment Letter to Seller within 10 business days after the Loan Commitment Date 1835 Failure by either Purchaser or Seller to deliver Notice of cancellation as required by this para 183 shall constitute a waiver of the right to cancel under this para 183 1836 If this Contract is canceled by Purchaser pursuant to this para 183 then thereafter neither Party shall have any further rights against or obligations or liabilities to the other by reason of this Contract except that the Contract Deposit shall be promptly refunded to Purchaser and except as set forth in para 12 If this Contract is canceled by Purchaser pursuant to para 18314 then Seller shall reimburse Purchaser for any non-refundable financing and inspection expenses and other sums reimbursable pursuant to para 16 1837 Purchaser cannot cancel this Contract pursuant to 18314 and cannot obtain a refund of the Contract Deposit if the Institutional Lender fails to fund the loan 18371 because a requirement of the Loan Commitment Letter concerning Purchaser is not met (eg Purchasers financial condition or employment status suffers an adverse change Purchaser fails to satisfy a condition relating to the sale of an existing residence etc) or 18372 due to the expiration of a Loan Commitment Letter issued with an expiration date that is not more than 30 business days after the Scheduled Closing Date 19 SingularPlural and JointSeveral The use of the singular shall be deemed to include the plural and vice versa whenever the context so requires If more than one person constitutes Seller or Purchaser their obligations as such Party shall be joint and several 20 No Survival No representation andor covenant contained herein shall survive Closing except as expressly provided Payment of the Balance shall constitute a discharge and release by Purchaser of all of Sellers obligations hereunder except those expressly stated to survive Closing 21 Inspections

Purchaser and Purchasers representatives shall have the right to inspect the Unit within 48 hours prior to Closing and at other reasonable times upon reasonable request to Seller 22 Governing Law and Venue This Contract shall be governed by the laws of the State of New York without regard to principles of conflict of laws Any action or proceeding arising out of this Contract shall be brought in the county or Federal district where the Unit is located and the Parties hereby consent to said venue 23 No Assignment by Purchaser Death of Purchaser 231 Purchaser may not assign this Contract or any of Purchasers rights hereunder Any such purported assignment shall be null and void 232 This Contract shall terminate upon the death of all persons comprising Purchaser and the Contract Deposit shall be refunded to the Purchaser Upon making such refund and reimbursement neither Party shall have any further liability or claim against the other hereunder except as set forth in para 12 24 Cooperation of Parties 241 The Parties shall each cooperate with the other the Corporation and Purchasers Institutional Lender and title company if any and obtain execute and deliver such documents as are reasonably necessary to consummate this sale 242 The Parties shall timely file all required documents in connection with all governmental filings that are required by law Each Party represents to the other that its statements in such filings shall be true and complete This para 242 shall survive Closing 25 FIRPTA The parties shall comply with IRC sectsect 897 1445 and the regulations thereunder as same may be amended (FIRPTA) If applicable Seller shall execute and deliver to purchaser at Closing a Certification of Non-Foreign Status (CNS) or deliver a Withholding Certificate from the IRS If Seller fails to deliver a CNS or a Withholding Certificate Purchaser shall withhold from the Balance and remit to the IRS such sum as may be required by law Seller hereby waives any right of action against Purchaser on account of such withholding and remittance This para 25 shall survive Closing 26 Additional Requirements 261 Purchaser shall not be obligated to close unless all of the following requirements are satisfied at the time of the Closing 2611 the Corporation is in good standing 2612 the Corporation has fee or leasehold title to the Premises whether or not marketable or insurable and 2613 there is no pending in rem action tax certificatelien sale or foreclosure action of any underlying mortgage affecting the Premises 262 If any requirement in para 261 is not satisfied at the time of the Closing Purchaser shall give Seller Notice and if the same is not satisfied within a reasonable period of time thereafter then either Party may cancel this Contract (pursuant to para 163) by Notice 27 Escrow Terms 271 The Contract Deposit shall be deposited by Escrowee in an escrow account as set forth in para 124 and the proceeds held and disbursed in accordance with the terms of this Contract At Closing the Contract Deposit shall be paid by Escrowee to Seller If the Closing does not occur and either Party gives Notice to Escrowee demanding payment of the Contract Deposit Escrowee shall give prompt Notice to the other Party of such demand If Escrowee does not receive a Notice of objection to the proposed payment from such other Party within 10 business days after the giving of Escrowees Notice Escrowee is hereby authorized and directed to make such payment to the demanding party If Escrowee does receive such a Notice of objection within said period or if for any reason Escrowee in good faith elects not to make such payment Escrowee may continue to hold the Contract Deposit until otherwise directed by a joint Notice by the Parties or a final non-appealable judgment order or decree of a court of competent jurisdiction However Escrowee shall have the right at any time to deposit the Contract Deposit and the interest thereon if any with the clerk of a court in the county as set forth in para 22 and shall give Notice of such deposit to each Party Upon disposition of the Contract Deposit and

interest thereon if any in accordance with this para 27 Escrowee shall be released and discharged of all escrow obligations and liabilities 272 The Party whose Attorney is Escrowee shall be liable for loss of the Contract Deposit If the Escrowee is Sellers attorney then Purchaser shall be credited with the amount of the contract Deposit at Closing 273 Escrowee will serve without compensation Escrowee is acting solely as a stakeholder at the Parties request and for their convenience Escrowee shall not be liable to either Party for any act or omission unless it involves bad faith willful disregard of this Contract or gross negligence In the event of any dispute Seller and Purchaser shall jointly and severally (with right of contribution) defend (by attorneys selected by Escrowee) indemnify and hold harmless Escrowee from and against any claim judgment loss liability cost and expenses incurred in connection with the performance of Escrowees acts or omissions not involving bad faith willful disregard of this Contract or gross negligence This indemnity includes without limitation reasonable attorneys fees either paid to retain attorneys or representing the fair value of legal services rendered by Escrowee to itself and disbursements court costs and litigation expenses 274 Escrowee acknowledges receipt of the Contract Deposit by check subject to collection

275 Escrowee agrees to the provisions of this para 27 276 If Escrowee is the Attorney for a Party Escrowee shall be permitted to represent such Party in any dispute or lawsuit 277 This para 27 shall survive Closing cancellation or termination of this Contract 28 Margin Headings The margin headings do not constitute part of the text of this Contract 29 Miscellaneous This Contract shall not be binding unless and until Seller delivers a fully executed counterpart of this Contract to Purchaser (or Purchasers Attorney) pursuant to para 172 and 173 This Contract shall bind and inure to the benefit of the Parties hereto and their respective heirs personal and legal representatives and successors in interest 30 Lead Paint If applicable the complete and fully executed Disclosure of Information on Lead Based Paint and or Lead-Based Paint Hazards is attached hereto and made a part hereof

In Witness Whereof the Parties hereto have duly executed this Contract as of the date first above written

ESCROW TERMS AGREED TO SELLER PURCHASER GIDDINS CLAMAN LLP ESCROWEE

Rider to and Part of Contract of Sale Between as Seller and as Purchaser for Unit at New York NY

31 Purchasers Additional Representations and Covenants 3 11 Supplementing para 42 of the Contract Purchaser also represents and covenants that 3111 Purchaser has and will at Closing have available unencumbered cash and cash equivalents (including publicly traded securities) in a sum at least equal to (and having a then current value of) the Balance and 3112 Purchaser has and will at and immediately following the Closing have a positive net worth 312 the Maintenance and the monthly amount of the Assessment (if any) do not aggregate more than 25 of the current total gross monthly income of the individuals comprising the Purchaser

313 (if para 1201 or para 1202 applies) the monthly debt service (interest and amortization of principal if any) of the proposed financing together with the Maintenance and the monthly Assessment amount (if any) do not aggregate more than 35 of said current total gross monthly income 32 Supplementing paragraph 4 1 Seller has no actual knowledge of a material default or condition which the Lessee is required to cure under the Lease and which remains uncured If prior to Closing Seller acquires knowledge of a such default or condition which the Lessee would be required to cure then Seller shall cure same at or prior to Closing This provision shall not survive closing

The Parties have duly executed this Rider as of the same date as the Contract SELLER PURCHASER ______________________________ _______________________________

Note This form is intended to deal with matters common to most transactions

involving the sale of a condominium unit Provisions should be added altered or

deleted to suit the circumstances of a particular transaction No representation is

made that this form of contract complies with Section 5-702 of the General

Obligations Law (ldquoPlain Language Lawrdquo)

CONSULT YOUR LAWYER BEFORE SIGNING THIS AGREEMENT

Contract of Sale - Condominium Unit

Agreement made as of 2010 between residing at Street Apt

New York NY (ldquoSellerrdquo) and residing at (ldquoPurchaserrdquo)

1 Unit Seller agrees to sell and convey and Purchaser agrees to purchase Unit

No (ldquoUnitrdquo) in the building (ldquoBuildingrdquo) known as Condominium

(ldquoCondominiumrdquo) and located at New York NY New York together with a

XXXXX percent undivided interest in the Common Elements (as defined in para 6)

appurtenant thereto all upon and subject to the terms and conditions set forth herein The

Unit shall be as designated in the Declaration of Condominium Ownership (as the same

may be amended from time to time the ldquoDeclarationrdquo) of the Condominium recorded in

New York County New York or the By-Laws (as the same may be amended from time

to time the ldquoBy-Lawsrdquo) of the Condominium

2 Personal Property (a) The sale includes all of Sellerrsquos right title and

interest if any in and to

(i) the refrigerators freezers ranges ovens built-in microwave

ovens dishwashers washing machines clothes dryers cabinets and counters lighting

and plumbing fixtures chandeliers air conditioning equipment venetian blinds shades

screens storm windows and other window treatments wall-to-wall carpeting

bookshelves switchplates door hardware and mirrors built-ins and articles of property

and fixtures attached to or appurtenant to the Unit except those listed in subpara 2(b) all

of which included property and fixtures are represented to be owned by Seller free and

clear of all liens and encumbrances other than those encumbrances (ldquoPermitted

Exceptionsrdquo) set forth on Schedule A annexed hereto and made a part hereof (strike out

inapplicable items) to the extent any of the foregoing exist in the Unit on the date

hereof and

- 2 -

(ii)

(b) Excluded from this sale are

(i) furniture and furnishings (other than as specifically provided

in this Contract) and

(ii)

(c) The property referred to in subpara 2(a)(i) and (ii) may not be

purchased if title to the Unit is not conveyed hereunder

3 Purchase Price (a) The purchase price (ldquoPurchase Pricerdquo) is $

payable as follows

(i) $ (ldquoDownpaymentrdquo) on the signing of this Contract by

good check subject to collection the receipt of which is hereby acknowledged to be held

in escrow pursuant to para 16 and

(ii) $ constituting the balance of the Purchase Price by

certified check of Purchaser or official bank check (except as otherwise provided in this

Contract) on the delivery of the deed as hereinafter provided

(b) All checks in payment of the Purchase Price shall represent United

States currency and be drawn on or issued by a bank or trust company authorized to

accept deposits in New York State All checks in payment of the Downpayment shall be

payable to the order of Escrowee (as hereinafter defined) All checks in payment of the

balance of the Purchase Price shall be payable to the order of Seller (or as Seller

otherwise directs pursuant to subparas 6(a)(viii) or 18(b))

(c) Except for the Downpayment and checks aggregating not more than

one-half of one percent of the Purchase Price One Thousand Dollars ($100000)

including payment for closing adjustments all checks delivered by Purchaser shall be

certified or official bank checks as hereinabove provided

4 Closing of Title The closing documents referred to in para 6 shall be

delivered and payment of the balance of the Purchase Price shall be made at the closing

of title (ldquoClosingrdquo) to be held on or about at AM at the offices of

Giddins Claman LLP 675 Third Avenue 29th

Floor New York NY or at the office

of Purchaserrsquos lending institution or its counsel provided however that such office is

located in either the City or County in which either (a) Sellerrsquos attorney maintains an

office or (b) the Unit is located

5 Representations Warranties and Covenants Seller represents warrants

and covenants that

- 3 -

(a) Seller is the sole owner of the Unit and the property referred to in

subpara 2(a) and Seller has the full right power and authority to sell convey and transfer

the same

(b) The common charges (excluding separately billed utility charges) for

the Unit on the date hereof are $xxxxx per month

(c) Seller has not received any written notice of any intended assessment

or increase in common charges not reflected in subpara 5(b) Purchaser acknowledges

that it will not have the right to cancel this Contract in the event of the imposition of any

assessment or increase in common charges after the date hereof of which Seller has not

heretofore received written notice

(d) The real estate taxes for the Unit for the fiscal year of ________

through ________ are $_________ Purchaser may verify the real estate taxes on the

website of the New York City Department of Finance A printout from the website

is attached

(e) Seller is not a ldquosponsorrdquo or a nominee of a ldquosponsorrdquo under any plan of

condominium organization affecting the Unit

(f) All refrigerators freezers ranges dishwashers washing machines

clothes dryers and air conditioning equipment included in this sale will be in working

order at the time of Closing

(g) If a copy is attached to this Contract the copy of the Certificate of

Occupancy covering the Unit is a true and correct copy and

(h) Seller is not a ldquoforeign personrdquo as defined in para 17 (If inapplicable

delete and provide for compliance with Code Withholding Section as defined in para

17)

6 Closing Documents (a) At the Closing Seller shall deliver to Purchaser the

following

(i) Bargain and sale deed With covenant against grantorrsquos acts

(ldquoDeedrdquo) complying with RPL sect 339-o and containing the covenant required by LL sect

13(5) conveying to Purchaser title to the Unit together with its undivided interest in the

Common Elements (as such term is defined in the Declaration and which term shall be

deemed to include Sellerrsquos right title and interest in any limited common elements

attributable to or used in connection with the Unit) appurtenant thereto free and clear of

all liens and encumbrances other than Permitted Exceptions The Deed shall be executed

and acknowledged by Seller and if requested by the Condominium executed and

acknowledged by Purchaser in proper statutory form for recording

- 4 -

(ii) If a corporation and if required pursuant to BCL sect 909 Seller

shall deliver to Purchaser (1) a resolution of its board of directors authorizing the delivery

of the Deed and (2) a certificate executed by an officer of such corporation certifying as

to the adoption of such resolution and setting forth facts demonstrating that the delivery

of the Deed is in conformity with the requirements of BCL sect 909 The Deed shall also

contain a recital sufficient to establish compliance with such law

(iii) A waiver of right of first refusal of the board of managers of

the Condominium (ldquoBoardrdquo) if required in accordance with para 8

(iv) A statement by the Condominium or its managing agent that

the common charges and any assessments then due and payable the Condominium have

been paid to the date of the Closing

(v) All keys to the doors of and mailbox for the Unit

(vi) Such affidavits andor other evidence as the title company

(ldquoTitle Companyrdquo) from which Purchaser has ordered a title insurance report and which

is authorized to do business in New York State shall reasonably require in order to omit

from its title insurance policy all exceptions for judgments bankruptcies or other returns

against Seller and persons or entities whose names are the same as or are similar to

Sellerrsquos name

(vii) New York City Real Property Transfer Tax Return if

applicable and New York State Real Estate Transfer Tax Return prepared executed and

acknowledged by Seller in proper form for submission

(viii) Checks in payment of all applicable real property transfer

taxes except a transfer tax which by law is primarily imposed on the purchaser

(ldquoPurchaser Transfer Taxrdquo) due in connection with the sale In lieu of delivery of such

checks Seller shall have the right upon reasonable prior notice to Purchaser to cause

Purchaser to deliver said checks at the Closing and to credit the amount thereof against

the balance of the Purchase Price Seller shall pay the additional transfer taxes if any

payable after the Closing by reason of the conveyance of the Unit which obligation shall

survive the Closing

(ix) Certification that Seller is not a foreign person pursuant to

para 17 or a withholding certificate from the Internal Revenue Service (If inapplicable

delete and provide for compliance with Code Section as defined in para 17) and

(x) Affidavit that a single station smoke detecting alarm device is

installed pursuant to New York Executive Law sect378(5)

(b) At the Closing Purchaser shall deliver to Seller the following

- 5 -

(i) Checks in payment of (y) the balance of the Purchase Price in

accordance with subpara 3(b) and (z) any Purchaser Transfer Tax

(ii) If required by the Declaration or By-Laws power of attorney

to the Board prepared by Seller in the form required by the Condominium The power of

attorney shall be executed and acknowledged by Purchaser and after being recorded

shall be sent to the Condominium

(iii) New York City Real Property Transfer Tax Return executed

and acknowledged by Purchaser and an Affidavit in Lieu of Registration pursuant to New

York Multiple Dwelling Law each in proper form for submission if applicable and

(iv) If required New York State Equalization Return executed

and acknowledged by Purchaser in proper form for submission

(c) It is a condition of Purchaserrsquos obligation to close title hereunder that

(i) All notes or notices of violations of law or governmental

orders ordinances or requirements affecting the Unit and noted or issued by any

governmental department agency or bureau having jurisdiction which were noted or

issued on or prior to the date hereof shall have been cured by Seller

(ii) Any written notice to Seller from the Condominium (or its

duly authorized representative) that the Unit is in violation of the Declaration By-Laws

or rules and regulations of the Condominium shall have been cured and

(iii) The Condominium is a valid condominium created pursuant

to RPL Art 9-B and the Title Company will so insure

7 Closing Adjustments (a) The following adjustments shall be made as of

1159 PM of the day before the Closing

(i) Real estate taxes and water charges and sewer rents if

separately assessed on the basis of the fiscal period for which assessed except that if

there is a water meter with respect to the Unit apportionment shall be based on the last

available reading subject to adjustment after the Closing promptly after the next reading

is available provided however that in the event real estate taxes have not as of the date

of Closing been separately assessed to the Unit real estate taxes shall be apportioned on

the same basis as provided in the Declaration or By-Laws or in the absence of such

provision based upon the Unitrsquos percentage interest in the Common Elements

(ii) Common charges of the Condominium and

(iii) If fuel is separately stored with respect to the Unit only the

value of fuel stored with respect to the Unit at the price then charged by Sellerrsquos supplier

- 6 -

(as determined by a letter or certificate to be obtained by Seller from such supplier)

including any sales taxes

(b) If at the time of Closing the Unit is affected by an assessment which is

or may become payable in installments then for the purposes of this Contract only the

unpaid installments which are then due shall be considered due and are to be paid by

Seller at the Closing All subsequent installments at the time of Closing shall be the

obligation of Purchaser

(c) Any errors or omissions in computing closing adjustments shall be

corrected This subpara 7(c) shall survive the Closing

(d) If the Unit is located in the City of New York the ldquocustoms in respect

to title closingsrdquo recommended by The Real Estate Board of New York Inc as amended

and in effect on the date of Closing shall apply to the adjustments and other matters

therein mentioned except as otherwise provided herein

8 Right of First Refusal If so provided in the Declaration or By-Laws this

sale is subject to and conditioned upon the waiver of a right of first refusal to purchase

the Unit held by the Condominium and exercisable by the Board Seller agrees to give

notice promptly to the Board of the contemplated sale of the Unit to Purchaser which