Mahindra Logistics (MAHLO) -...

Transcript of Mahindra Logistics (MAHLO) -...

ICIC

I S

ecurit

ies –

Retail E

quit

y R

esearch

Init

iatin

g C

overage

August 28, 2019

CMP: | 338 Target: | 415 (23%) Target Period: 12-18 months

Mahindra Logistics (MAHLO)

BUY

Non-auto client additions to aid growth…

MLL is one of the largest 3PL players in the country, with over 650 clients

and operating locations. The company operates an asset light business with

investment in assets (vehicles, warehouses) being done by ~ 1500 business

partners. Post GST implementation, the 3PL industry is expected to grow at

16-18% in the medium to long term, amid a change in perspective of

manufacturers whereby higher proportion of logistics operation are being

outsourced to specialised 3PL players like MLL. We expect its SCM segment

(90% of revenue) to grow at 8% CAGR to | 4062 crore in FY19-21E and PTS

segment (10% of revenue) to grow at 13% CAGR to | 492 crore in FY19-21E.

Sustained revenue growth accompanied by a gradual improvement in

margins would provide thrust to earnings growth in FY19-21. We expect EPS

to grow at 16% CAGR to | 16.1 in FY19-FY21E. Hence, we initiate coverage

on Mahindra Logistics with a BUY recommendation, with a target price of

| 415/share (at 26x FY21).

Scalable asset light model amid huge market opportunity

MLL is one of the major players in the nascent but rapidly growing Indian

3PL industry (~US$6 billion in FY17) that has been growing at 18-20% CAGR

in the last few years. Growth is driven by a higher proportion of logistics

operations being outsourced by manufacturers to 3PL players. MLL

possesses key success enablers like bouquet of end-to-end logistic services,

asset light model & presence in high growth industries along with support

of anchor client (M&M) enabling it to grow in line with industry growth.

Non Mahindra SCM segment to drive revenue growth

MLL’s revenues are expected to grow across its three segments, with non-

Mahindra SCM segment growing at 12% CAGR, buoyed by healthy client

addition and moderate growth in revenue per client. On the Mahindra group

SCM segment, MLL is expected to moderately grow at 6% in spite of the

expected pressure in sales of automotive and farm equipment in the short

term, the growth is mainly led by the rising value added work performed by

MLL within the AFM group and growing penetration across various

companies within the Mahindra Group.

Rising client dependence on MLL to provide competitive edge

Increased revenue share from the non-Mahindra business (especially FMCG,

e-commerce) would enable higher warehousing revenues, providing higher

gross margins and translating into higher profitability for the company.

Considering the rising importance of services like inbound, outbound and

in-factory logistics along with prospects of performing further value added

services, enabling 3PL players to get a higher wallet share of the clients

business with increased client dependency, we initiate coverage on

Mahindra Logistics with a target price of | 415/share.

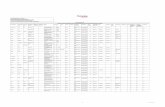

Key Financial Summary ss

| crore FY17 FY18 FY19 FY20E FY21E CAGR

Net Sales 2,666.6 3,416.1 3,851.3 4,098.6 4,554.3 8.7%

EBITDA 76.3 119.7 151.2 168.0 200.4 15.1%

PAT 45.6 64.0 85.6 94.6 114.6 15.7%

P/E (x) 53.0 37.7 28.2 25.5 21.1

M.Cap/Sales (x) 0.9 0.7 0.6 0.6 0.5

RoCE (%) 18.7 23.4 25.8 24.7 25.5

RoE (%) 13.1 15.3 17.2 16.3 16.8

Source: ICICI Direct Research, Company

Particulars s

Market Capitalisation (| cr) 2,414.9

52 Week High / Low (|) 605/326

Promoter Holding (%) 58.5

FII Holding (%) 17.3

DII Holding (%) 11.0

Dividend Yield (%) 0.3

Key Highlights

3PL industry expected to continue its

growth momentum over next few

years (16-18%) and reach ~US$11

billion by FY21

Asset light business with investment

in assets (vehicles, warehouses)

being done by ~1500 business

partners

Expect EPS to grow at 16% CAGR in

FY19-21E

Price Chart

0

100

200

300

400

500

600

700

12000

13000

14000

15000

16000

17000

Nov-17 May-18 Nov-18 May-19

BSE 500 Index Mahindra Log (RHS)

Research Analyst

Bharat Chhoda

Harshal Mehta

ICICI Securities | Retail Research 2

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Company Background

In FY2000, Mahindra & Mahindra (M&M) Ltd set up its logistics business as

a separate division, which served the transportation, warehousing and in-

factory needs of M&M Ltd. Mahindra Logistics (MLL) was formed in FY08

while the logistics business of M&M Ltd was transferred to MLL. Initially, the

company grew its operations by catering to a limited number of clients. Post

its business transformation exercise via a strategic consultancy firm in FY15,

it has reached over 650 clients and is operating in locations in FY19. The

company operates in two segments i.e. i) supply chain management (90%

of FY19 revenues) and ii) public transportation system (balance 10%).

In FY15, the company acquired a 60% stake in Lords Freight (India) Pvt Ltd

(LFI), which is primarily engaged in the business of freight forwarding and

warehousing logistics services. LFI clocked | 174 crore in revenues in FY19.

Subsequently, it increased its stake in Lords from 60% to 82.9% in FY19.

Also, in FY15, MLL partnered with Indian Vehicle Carriers Logistics (IVC) to

form 2X2 Logistics Pvt Ltd. The JV is primarily involved in automotive

outbound solutions for two and four wheeler industries. Currently, the JV

owns 150+ vehicle carriers. MLL also acquired a stake in Boston based

Transtech Logistics (ShipX), a software as a service (SAAS) based transport

management solution (TMS) platform provider, which serves the SCM

automation needs of 3PLs, shippers and transporters.

Exhibit 1: Key Events

FY2000

•Logistics

business set

up as

separate

division of

M&M Ltd

FY09

•Logistics

business of

M&M Ltd

transferred

to MLL

FY11

•Achieved

|1000 crore

revenues

FY14

•Investment by

Normandy and

Kedaara AIF

•Enters e-commerce

segment

FY15

•Business

transformatio

n exercise by

strategic

consultant

•Lords

acquisition

•2X2 logistics

JV formation

FY16

•Enters into

business

contract with

one of India's

largest steel

conglomerate

FY18

•Completes

IPO of

company

•Achieves |

3400 crore

consolidated

revenue

FY19

•Acquires

stake in

Transtech

Logistics

(ShipX)

•Increases

stake in

Lords from

60% to 82.9%

Source: Company, ICICI Direct Research

As on FY19, MLL achieved revenues of | 3851 crore, of which SCM

comprised | 3466 crore and PTS | 386 crore. Further, M&M’s portion of

SCM’s revenues was at | 2100 crore (61% of SCM revenues) with non-M&M

at | 1366 crore. Subsequently, revenues of transportation and warehousing

from the M&M SCM segment were at | 1934 crore (92%) and | 166 crore

(8%), respectively. Revenues of transportation and warehousing from the

non-M&M SCM segment were at | 1012 crore (74%) and | 354 crore (26%),

respectively. Overall, transportation and warehousing mix comprised | 2954

crore (85%) and | 520 crore (15%), respectively, of SCM revenues.

ICICI Securities | Retail Research 3

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 2: Business segments

Source: Company, ICICI Direct Research

On the basis of clients, Mahindra group constituted 56% (~| 2157 crore) of

MLL’s revenues whereas non-Mahindra clients comprised 44% (~| 1594

crore). Auto and farm segment dominates the Mahindra group pie (ex-

Mahindra PTS) at 90-95% of Mahindra group revenues. On the non-

Mahindra client side (ex-non-Mahindra PTS), auto comprised 25% while e-

commerce, engineering, consumer durables, bulk and pharma formed

~15% each of non-Mahindra (ex-non-Mahindra PTS) revenues.

Exhibit 3: Business segmentation based on clients

Source: Company, ICICI Direct Research

Mahindra Logistics Ltd (|3851 cr)

Business segments

SCM (|3466 cr) - 90%

Mahindra SCM (|2100

cr) - 55%

Transportation

(|1934 cr) - 50%

Warehousing

(|166 cr) - 5%

Non-Mahindra SCM

(|1366 cr) - 35%

Transportation

(|1012 cr) - 26%

Warehousing

(|354 cr) - 9%

PTS (|386 cr) - 10%

Mahindra Logistics Ltd (|3851

cr)

Client based segmentation

Mahindra Group (|2157 cr) - 56%

Auto and Farming - 48-51%

Others - 3-5%

PTS (~|57 cr) - 2%

Non-Mahindra Client (|1594 cr)

- 44%

Auto (~|340 cr) - 9%

Engineering - 5%

E-Commerce - 5%

Pharma - 5%

Cons Goods- 5%

Bulk- 5%

PTS (~|329 cr) - 9%

ICICI Securities | Retail Research 4

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Management Profile

Zhooben Bhiwandiwala

Chairman and non-executive Director

Zhooben Bhiwandiwala joined the Mahindra Group in 1985. He has over 31

years of experience in finance, legal, significant cross border M&A, HR,

marketing, strategy and other commercial functions. He had been involved

with international operations, investments in new businesses, start-ups, joint

ventures and mergers and acquisitions during his deputation to international

assignments in Mahindra Group. Mr Bhiwandiwala is currently the President

- Mahindra Partners and Group Legal and a member of the Mahindra Group

Executive Board. He currently heads the Mahindra Partners division. He is

on the boards of several Mahindra & Mahindra group companies. He has

been on the MLL board since April 28, 2009.

Pirojshaw Sarkari, 51 years

Chief-Executive Officer

He graduated from the University of Mumbai in 1987 with a bachelor’s

degree in Commerce. Also, he is a qualified Chartered Accountant. He has

also completed a course on Mahindra Universe from Harvard Business

School, Boston. Prior to joining MLL, he served as a managing director in

UPS Jetair Express Pvt Ltd and UPS International Inc, Philippines. He joined

MLL on April 1, 2010.

Rampraveen Swaminathan, 54 years

Chief-Executive Officer (Designate)

Mr Swaminathan has two decades of relevant industry experience spanning

the automotive, paper and energy sectors. He has a strong track record of

leading businesses including as CEO and MD of International Paper APPM,

a publicly listed company. He has done his MBA in Finance and Strategy, TA

Pai Management Institute, India and holds a bachelor’s degree in

accounting, from the University of Bangalore. His other stints include

positions with the Tata group, Cummins and Schneider. He is expected to

become the CEO and KMP of the company from October 1, 2019,

succeeding existing CEO, Pirojshaw Sarkari.

Yogesh Patel, 54 years

Chief-Finance Officer

Yogesh Patel was appointed chief financial officer of the company with effect

from September 1, 2018. He is a chartered accountant and has ~20 years of

experience in finance. His areas of expertise include pricing and commercial

structuring, procurement, treasury, etc. Mr Patel has held senior leadership

positions in finance with organisations like E&Y (Director –Finance), IBM

(Country Finance Planning Manager), Wipro (Vice President – Finance).

Sushil Rathi, 54 years

Chief Operating Officer

He currently manages the supply chain management business. He holds a

postgraduate diploma in Industrial Engineering from National Institute for

Training Industrial Engineering. Prior to joining MLL, he worked with

Anantara Solutions Pvt Ltd, Premier Automobiles and Satyam Computer

Services. He was awarded with the supply chain visionary of the year award

by Kami Kaze. He joined MLL on March 21, 2011.

ICICI Securities | Retail Research 5

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Industry Background

Logistics plays a key role in any organisation, mainly due to its influence on

customer satisfaction and costs, thereby providing a competitive edge to a

company over its peers. As per Crisil estimates, the Indian logistics industry

is expected to grow at 13% CAGR to | 9.2 trillion in FY20 from | 6.4 trillion

in FY17 (estimated). Transportation dominates the share at ~88% in FY17

(estimated) while warehousing constituted 12% of the pie. Globally, in

developed economies, the warehousing component is much higher than in

India (upwards of 20-30%). Road transportation and warehousing in India is

fragmented in nature, with unorganised players dominating the pie.

Exhibit 4: Indian logistics industry FY17 (estimated)

Source: RHP, ICICI Direct Research

Overall, logistics players can also be segmented on the basis of origin of

service provider and types of services it provides.

Exhibit 5: Logistics players

Source: RHP, Crisil Report, ICICI Direct Research

The 3PL business formed ~6% of the total logistics industry and is expected

to grow 16-17% till FY21E, mainly due to increased outsourcing trend,

higher value added services, increased scalability, etc. 3PL comprises about

one-fifth of the logistics spend of various sectors and is expected to rise to

one-fourth of the logistics spend.

Exhibit 6: 3PL market size

Source: Company, Crisil Report, ICICI Direct Research

Automobiles dominate the Indian 3PL share whereas highest growth is

expected to be seen in the e-commerce, consumer durables and organised

retail segment.

71%

16%

1%

4%

7%1%

Road freight transportation

Rail freight transportation

Coastal freight transport

Cold chain warehouse

Warehouse

CFS/ICDs

1 PL Logistics services carried by an In-house team

2 PL Logistics player providing either transportation or warehousing services

3 PL Logistics player acting as a single vendor for all logistics related services

4 PL Logistics player which coordinates activities of various 3PL to a company

40000

55000

74000

0

20000

40000

60000

80000

FY17 FY19E FY21E

| c

rore

3PL market size

ICICI Securities | Retail Research 6

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 7: Sectors employing 3PL

Sector FY17 FY19EExpected CAGR between

FY19-FY21 (%)

Automotive Components 10800-11200 13900-14200 10-12

Cars and UV 6600-6800 9100-9500 10-12

Commercial Vehicles and tractors 2500-2700 2900-3100 8-10

Two and three wheelers 5400-5600 6900-7100 13-15

Engineering 300-500 430-500 20-22

E-Commerce 5900-6200 9970-10000 30-32

Consumer Durables and FMCG 2000-2200 3100-3200 24-26

Pharmaceuticals 2200-2400 2600-2800 8-10

Bulk 800-1000 900-1100 6-8

Organised Retail 2700-2900 4500-4700 29-31

Telecom 20-40 30-40 -

3PL market size (| cr)

Source: RHP, Crisil Report, ICICI Direct Research

A supply chain management logistics model (that employs 1PL, 2PL, 3PL

and 4PL) consists of an arm of a) inbound logistics, b) within factory logistics

and c) outbound logistics. Inbound relates to transport of raw material to the

factory while outbound relates to transport of finished product to the

warehouse/distributor/retailer. In and out movement from factory and

between warehouses is called primary logistics while movement from

warehouse to distributor/retailer is called secondary logistics.

Exhibit 8: Supply chain management model

Source: Company RHP, Crisil Report, ICICI Direct Research

Exhibit 9: Services provided by SCM

Source: Company presentation, ICICI Direct Research

ICICI Securities | Retail Research 7

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

PTS industry: The people transport solutions (PTS) business relates to

transport services provided by corporates for exclusive usage by

employees. The cost is borne by the corporate and not the employee.

Exhibit 10: Types of transportation

Source: Company RHP, Crisil Report, ICICI Direct Research

As per Crisil estimates, the PTS industry is expected to grow at a CAGR of

8.5-9.5% to | 8500-9500 crore in FY20E, mainly driven by IT and Information

Technology enabled Services (ITeS) sectors. IT and ITeS sector (3.8 million

employees) are the biggest users of PTS services.

Exhibit 11: PTS industry size

Source: Company RHP, ICICI Direct Research

The strong growth prospects of PTS can be attributed to the increasing

employee base of the IT and ITeS sector, shift of office to suburban areas,

an emerging trend of corporate shuttle buses, etc. Large organised players

with a technology platform and dedicated fleet are expected to grow at a

faster rate than only fleet provider players as companies outsource their

entire PTS function to a third-party player.

7000

9000

0

3000

6000

9000

12000

FY17 FY20E

| c

rore

PTS market size

ICICI Securities | Retail Research 8

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Investment Rationale

Indian logistics growth expected to outperform global peers

The India logistics market accounts for 13-17% of the country’s GDP spend.

As per a Knight Frank report (India warehousing market report 2018), this is

double the logistics cost to GDP ratio in developed countries, such as US,

Hong Kong and France (6-9%), lower only to China (18-19% of GDP) as the

Chinese economy is primarily driven by industrial sector (46% vs. 20% in

US and 18% in India). As per a McKinsey and Co report, of the total logistics

costs, indirect costs comprise 40% share, which includes theft, damage,

inventory carrying costs and losses in transit. In contrast, in developed

countries, these comprise nearly 10% of logistics costs, mainly due to an

efficient supply chain.

Exhibit 12: Logistics as percentage of GDP

Source: TCI Express presentation, ICICI Direct Research

As India is in its initial stages of evolution compared to its peers such as the

US and China, it has the potential to grow at higher rates for a longer period

of time, before it catches up with these countries.

Exhibit 13: Evolution of logistics sector

Source: Knightfrank research

89

5

4

6

3

1

2

0.5

0

2

4

6

8

10

12

14

16

18

India China US

Transportation Admin/others Warehousing

ICICI Securities | Retail Research 9

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

As per Crisil Research, India’s road freight traffic is expected to continue to

grow at 6-8% CAGR in FY20-24. At the same time, rail freight is expected to

grow at 7-9% in the same period, led by the commissioning of Dedicated

Freight Corridor and uptick in economic activity.

GST implementation aids greater adoption of 3PL model

The replacement of multiple taxes on manufacture, sale and consumption

of goods and services to a single tax regime is expected to greatly benefit

the organised logistics sector on both the transportation and warehousing

fronts. Post the GST bill implementation, clients have been able to benefit

from input tax credit over the tax charged on transport of goods and

services, when they deal with a tax compliant logistics player. Over the

medium to longer term, GST & E-way bill are expected to result in a shift of

market share in favour of organised players. This is on account of the fact

that unorganised players are expected to become less competitive owing to

increased cost of compliance providing an opportunity to larger organised

players to capture a higher market share on a sustained basis.

On the transportation front, previously, services provided by the Goods

Transport Agencies (GTA) were liable to pay service tax via a reverse charge

mechanism (RCM), in which the receiver of goods and services is

responsible for paying the taxes. The GST regime respects the previous tax

regime while the GTA may also opt to pay via forward charge mechanism

(FCM). Mahindra Logistics has migrated from RCM to FCM, by convincing

both its clients and supply side players (transporters) to move to FCM,

thereby deriving benefit of input tax credit.

Exhibit 14: GST tax regime

Source: Company, ICICI Direct Research

On the warehousing front, one of the biggest changes that GST

implementation has brought to the supply chain of various businesses is the

consolidation in the warehousing sector. Earlier, on account of various

indirect taxes (octroi duty, entry tax, CST), instead of operational efficiency,

tax efficiency was the key parameter in setting up warehouses. This had

resulted in setting up of multiple inefficient stocking and distribution location

in each state. Post implementation of GST, warehousing has moved from

being “tax-efficient” to “supply chain efficient”. Thus, the number of

warehouses has drastically reduced (moved from being more region

specific to centrally located) and become bigger in size at strategic locations.

1) Reverse Charge Mechanism

2) Forward Charge Mechanism

Supplier

•No GST charged

Transporter (GTA)

•No GST charged

Recipient

•GST paid to the Govt and no Input Tax Credit

Supplier

•GST charged to GTA and paid to the Govt

Transporter (GTA)

•GST charged to recipient

Recipient

•GST paid to GTA and can avail Input Tax Credit

ICICI Securities | Retail Research 10

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 15: Changes in supply chain post-GST

Source: Company, ICICI Direct Research

Typically, post-GST, supply chains are being designed in such a way that

the run from the factory to the central warehouse has reduced while the

secondary run from the warehouse to the regional distributor/stockist has

increased. Thus, the challenge before various companies remains two-

pronged: i) optimise the supply chain so that assets do not remain

underutilised (i.e. trucks carrying capacity not efficiently utilised) and ii)

higher investments into building bigger warehouses, tracking capabilities.

Outsourcing of various supply chain activities has a beneficial effect on both

players, the client and the 3PL firm. It is a “win-win” game, as it helps the

client to focus on its core capabilities of manufacturing, building brands, etc.

On the other hand, it helps the 3PL firm achieve greater scale and optimal

asset utilisation i.e. lower empty running costs, network optimisation, etc,

thereby, lowering logistics costs for all clients. Thus, a shift in the supply

chain model provides an opportunity for 3PL players like MLL to optimise

routes, locations and provide customised logistics solutions to its clients.

Asset light MLL well poised to capture 3PL growth opportunity

Assets required by a 3PL player for its functioning depends on four functions

a) transportation, b) employees c) technology and d) warehousing. MLL

selects its business partners that own these assets, based on past

experience, financial condition, service commitment and track record on

performance on KPIs. Overall, the company has ~1500 business partners,

which cater to its requirements in the SCM, PTS division. MLL has also set

up business partner development and loyalty programmes to motivate its

existing business partners to contribute more assets while improving

service quality and performance and also expand MLL’s network of business

clients.

Transportation: The road transportation segment in India is characterised by

an average low fleet ownership and is highly fragmented. MLL has contracts

with various truck owners, truck and fleet aggregators, passenger vehicle

owner and aggregators. The company typically has long term partnerships

with these players. They provide MLL access to various vehicles like 1-tonne

to more than 40-tonne capacity. The large fleet provides MLL with flexibility

to scale up its operations whenever required and cover various routes and

enables MLL to avoid heavy investment into assets before entering into a

dealing with existing and newer clients. The business partner is required to

1) Pre-GST scenario

State 1

State 2

2) Post-GST scenario

State 1

State 2

Distributor/

stockist

Distributor/

stockist

Regional

warehouse

Regional

warehouse

Factory

FactoryCentral

warehouse

Distributor/

stockist

Distributor/

stockist

ICICI Securities | Retail Research 11

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

carry out safety checks and preventive maintenance of the vehicle for longer

vehicle life.

Exhibit 16: Transporter operating cost structure

Source: ICRA, ICICI Direct Research

MLL helps its business partners like small fleet operators to gain more

business, reduce idle time and provide training to drivers. By having a fuel

pass through clause with its clients, MLL is able to cover the volatile fuel cost

(biggest cost for fleet owners) for the transporter.

Manpower: MLL being a 3PL service provider is in a people intensive

business with 17840 employees (including permanent, fixed term contract

and third party payrolls). As on March 31, 2019, Mahindra Logistics had 3631

permanent employees on its payroll, with a median salary of | 3.2 lakh.

Exhibit 17: Growth in MLL permanent employee base

17471871

2256

2656

3004

3631

7.1

20.6

17.7

13.1

20.9

0

5

10

15

20

25

0

700

1400

2100

2800

3500

4200

FY13 FY14 FY16 FY17 FY18 FY19

Permanent employees Growth (%) (RHP)

Source: Company, ICICI Direct Research

A significant chunk of the total employee base comprises temporary and

fixed term employees, who are recruited, trained and retained by third-

parties (MLL business partners).

Exhibit 18: Segmentation of 17840 employees (FY19)

20%

72%

8%

Permanent employees

Temporary employees

Fixed term contract

Source: Company, ICICI Direct Research

In addition to the recruitment of several employees, MLL has also been

enhancing its return on employed human capital (both permanent and

60%

7%

12%

7%

8%

1%5%

Fuel

Tyre

Toll

Human

Investment

Government

Other expenses

ICICI Securities | Retail Research 12

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

contractual workers). MLL was able to earn a return of $0.74 in FY19, from

earlier $0.71 levels in FY15.

Exhibit 19: Human capital RoI (%)

70.7

65.0

73.374.1 74.2

60.0

62.0

64.0

66.0

68.0

70.0

72.0

74.0

76.0

FY15 FY16 FY17 FY18 FY19

Return on Human Capital (%)

Source: Company, ICICI Direct Research

Technology: Network optimisation and establishment of an asset light

model for 3PL players relies greatly on technology usage. Hence, there has

been an increasingly greater adoption of it among logistics players.

Technology enables real time monitoring of operations and consignment

deliveries from control towers, which are connected to various hubs and

spokes. The company continues to invest in technology, both internally

developed and through external partnership. MLL spends | 25-30 crore each

year as capex (majority of which goes towards building technology). Major

MLL investment in technology includes:

a) Transportation monitoring system (TMS): Provides control over

transportation operations, which includes planning, vehicle

allocation, vehicle traceability, route and freight optimisation and

reduction in billing cycles for clients. MLL has developed two

varieties of TMS i) MILES (transportation of finished automobiles) ii)

MyCargo360 (deployed across all industry verticals)

b) Central Control Tower System (CT): Provides enhanced control over

transportation operations and is used along with TMS and enables

MLL to provide entire segment of logistics activities to clients (e.g.

from production plant to central storage facility)

c) Mahindra Warehouse Management System (MWMS): It is an

internally designed system and is used to manage warehouse and

logistics operations. It can interface with multiple client’s ERP

systems and enables MLL to operate multiple clients in a single

warehouse as well as single client in multiple warehouse

d) Other platforms like solutions design systems, E-auction platform,

etc

ICICI Securities | Retail Research 13

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 20: MLL technology platform

Source: Company, ICICI Direct Research

Warehouse: MLL operates warehouses across India. As on FY19, the

company operated on 15.3 million square feet (mn sq ft) of space. MLL also

manages its client’s warehouses (roughly 35-40% of overall managed

space). All remaining facilities have been acquired by the company on a

lease or license agreements with third parties. MLL typically enters into three

to five years contract with its clients while the lease and license agreement

matches the warehousing arrangements with third parties (five years with

an option to extend for another five years with infra players).

Exhibit 21: Warehousing space (million square feet) and lease rentals paid (| crore)

10.013.5

15.3

39.9

56.6

67.4

0

10

20

30

40

50

60

70

80

FY17 FY18 FY19

Warehousing space (million square feet) Rent (| crore)

Source: Company, ICICI Direct Research

Mahindra warehouse can be split into various subcategories:

a) Multi-user warehouses: Provides space to multiple users and

operates on a variable cost model with fixed minimum prices for

services. These are typically used as regional distribution centres,

satellite warehouses with certain large format warehouses in central

locations

b) Built to suit warehouses: Built based on client needs. These are

typically used in central distribution centres or regional distribution

centres and allow consolidation synergies due to economies of scale

(suited to a client)

c) Stockyards: Used for storage and further transportation of finished

vehicles (operated 50 stockyards in FY19). Provides services such as

inventory management services

ICICI Securities | Retail Research 14

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

d) Cross-docks and network hubs: Used to feed component and parts

into manufacturing plants across India as various parts are collected

from several locations and consolidated at the cross-dock facility

Group companies provide multiple opportunities to grow

Mahindra group is a conglomerate of 130 plus companies and is diversified

over 20 industries and countries. The brand enables the company to build

long standing relationship with its several business partners (that helps it to

stay asset light) and also acquire a large number of non-Mahindra clients.

Exhibit 22: MLL FY19 SCM revenue bifurcation

Source: Company, ICICI Direct Research

However, the group also provides MLL with an opportunity to cater to its

wide number of companies. MLL currently caters to four of its companies

while M&M auto and farm segment (AFS) comprises ~90-95% of MLL’s

revenues. MLL currently captures a smaller wallet share (lower than 25-30%)

of the estimated potential groups spend. Thus, going ahead, the other

Mahindra group businesses (non-AFS), are expected to increasingly

contribute higher share of MLL revenues.

Exhibit 23: MLL Mahindra group SCM revenue bifurcation

Source: Company, ICICI Direct Research

Within the AFS division, MLL’s growth is dependent on the type of vehicle

getting produced (2-W, 4-W, CV, tractor, etc), location of manufacture (more

than 10 locations across India) and the demand pattern. For example, MLL

gains greater revenue if the vehicle is produced in the south location and

higher demand is seen in the east location (i.e. greater miles to transport the

vehicle). Over the years, MLL has been able to provide almost entire logistics

services for the Mahindra group’s AFS division. MLL now also competes for

newer entity JVs formed by the Mahindra group in diverse areas like solar,

defence, retail, auto-components, etc.

We expect the Mahindra group’s SCM revenues to remain largely at 57-59%

in FY20 and FY21. This is in spite of the expected subdued volume growth

in automotive and farm equipment, led by the rising MLL share of value

added services per vehicle (including higher in-factory logistics) and higher

contribution from the non-AFS pie.

| 2100,cr 61%

| 1366,cr 39% Mahindra Group SCM revenues

Non-Mahindra SCM revenues

95%

5%

AFS

Non-AFS

ICICI Securities | Retail Research 15

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 24: MLL Mahindra group SCM revenues (| crore)

1419.0

1820.0

2100.02171.3

2338.4

0.0

500.0

1000.0

1500.0

2000.0

2500.0

FY17 FY18 FY19 FY20E FY21E

MLL Mahindra Group SCM revenues

6% FY19-21 CAGR

Source: Company, ICICI Direct Research

MLL focus on client acquisition to drive SCM sales ahead

Auto comprises roughly 25% of the MLL non-Mahindra SCM revenues while

the rest of the pie is equally distributed (~15% each) between e-commerce,

engineering, FMCG & consumer durables and pharmaceuticals & bulk. As a

3PL entity, MLL has historically possessed expertise in the auto segment

[just-in-time (JIT)] inventory practice), which it is actively seeking to replicate

in other high growth segments. On an overall SCM basis (both Mahindra,

non-Mahindra) share of auto has come down from ~85% in FY15 to ~66%

in FY19. The management expects the trend to further continue, going

ahead.

Exhibit 25: MLL non-Mahindra SCM revenue pie

25%

15%

15%

15%

15%

15%

Auto

E-Commerce

FMCG & Consumer Goods

Engineering

Bulk

Pharma

Source: Company, ICICI Direct Research

MLL served 650 plus client and operating locations in the non-Mahindra

SCM segment in FY19. Post GST implementation, MLL has witnessed

changes in the clients’ organisation of logistics and supply chain networks,

which also provides it an opportunity to gain more clients as MLL can assist

them to optimise their new routes, supply chain and provide value added

services. For example, e-commerce can provide opportunities for labelling,

boxing, un-boxing, inventory management, bill generation, etc.

A diversity in service portfolios allows the company to service existing and

potential clients across multiple industry verticals. In SCM business, MLL

serves clients such as Volkswagen India Pvt Ltd, Vodafone India, Thermax,

JSW Steel, Ashok Leyland, Siemens, Bosch, BMW India Pvt Ltd, 3M India

and Mercedes-Benz India Pvt Ltd in the automotive, engineering, consumer

goods, pharmaceuticals, e-commerce and bulk industry verticals,

respectively.

ICICI Securities | Retail Research 16

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 26: MLL non-Mahindra SCM clients

Source: Company, ICICI Direct Research

MLL offers customised logistics solutions developed by the solutions design

team that improves supply chain elements for its clients, including service

levels, cost, quality, scalability & visibility. They also plan & design

transportation networks and can remodel storage layouts to bring efficiency

in clients warehousing and in-factory logistics operations. MLL boasts a

client retention rate of 100% for top 25 SCM, non-Mahindra group clients.

Exhibit 27: Opportunities for MLL in non-auto sectors

Sectors Opportunities for MLL

E-commerce Trend seen in putting up smaller warehouses near consumption centres for quicker

deliveries. MLL can service these smaller warehouses (less than 1 lakh square feet) that

have been set up by e-commerce players

FMCG, Retail & Cons

Durable

1) Post GST, to put up a large distribution centre and integrate the company server IP

with the logistics player to have visibility

2) To service the rising need of distributor such as increased visibility and predictability,

once order is placed by them.

Engineering Customised service required as parts are costly, differ in size

Pharmaceuticals 1) Reduction in C&F agents serving to various states and consolidation of warehouses

2) Transportation constitutes major share, hence requires greater optimisation in post

GST scenario

3) Complex distribution chain, in case of exports, 3PL can provide integrated end to end

logistics

Bulk Cost sensitive towards handling of raw material (makes up 18-20% of sales) and hence

requires greater optimization of truck run

Source: Company, ICICI Direct Research

We expect a net addition of 35-40 clients every year till FY21, backed by its

strong brand pull and satisfaction of existing customers. The MLL non-

Mahindra SCM revenue is expected to grow at 15% in FY19-21E to | 1820

crore, led by strong customer addition, gaining share from competitors and

increasing wallet share from existing clients (by outsourcing existing

functions and further providing value added services).

ICICI Securities | Retail Research 17

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 28: Non Mahindra SCM revenues (| crore)

952.8

1256.0

1366.0

1491.7

1723.6

0.0

500.0

1000.0

1500.0

2000.0

FY17 FY18 FY19 FY20E FY21E

Non-Mahindra SCM revenues

12% FY19-21 CAGR

Source: Company, ICICI Direct Research

SCM margins to benefit from higher warehousing

As part of its SCM business, MLL consults and designs supply chain for

clients, ranging from transportation, warehousing, international freight

forwarding and other value added services. MLL’s SCM segment, on a

blended basis (both M&M group, non-M&M businesses) can be segmented

into transportation (~85% of SCM revenues) and warehousing (~15%) in

FY19. Further, M&M group’s SCM pie can be bifurcated into ~92%

transportation and ~8% warehousing with the non-M&M SCM segment into

74% transportation and 26% warehousing. Typically, MLL’s Mahindra group

SCM segment deals in delivery of finished vehicles (outbound: inbound

roughly at 75:25), which requires higher transportation component (inbound

for auto usually deals in delivery of spare parts and ancillaries to the auto

manufacturers). On the other hand, MLL’s non-Mahindra SCM has been

seeing the share of revenues of newer clients from warehousing at 40%.

Exhibit 29: Net additions in warehousing space

Source: Company, ICICI Direct Research

Gross margins in transportation are between 6% and 8% compared to 10-

18% seen in case of warehousing. In case of transportation, gross margins

are dependent on the scale of operations i.e. higher vehicle runs at optimal

loads, as driver salary, insurance is fixed. Therefore, for a 3PL company,

greater gross margins from transportation segment depends on the number

of runs as well as on the route and network optimisation, so that truck run is

optimised for load and is not empty in both directions of the run. On the

other hand, an improvement in gross margins in warehousing is time bound

(efficiency through learning and doing the same stuff again and again),

region dependent, type of warehouse (Grade A warehouses can demand

even better margins than usual).

10

13.5

15.3

16.5

17.8

0

5

10

15

20

FY17 FY18 FY19 FY20E FY21E

Warehousing space (million square feet)

ICICI Securities | Retail Research 18

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 30: Trends in gross margins

Source: Company, ICICI Direct Research

PTS division expected to remain strong

In the public transportation system (PTS) division, MLL primarily serves the

IT, ITeS business process outsourcing, banking & financial services,

consulting & manufacturing industries. Crisil defines PTS as transport

services provided by corporates for exclusive use by their employees to

commute from home to office and back. These services are generally

outsourced to third parties with the cost being borne by the company.

PTS services are offered by MLL using its network of 500 business partners

that provide the company with buses and drivers. It also has a presence in

150 plus client and operating location across India. Certain key clients in

India for MLL PTS business include Tech Mahindra, AXISCADES

Engineering Technologies and ANZ Support Services India Pvt Ltd.

MLL’s PTS division is expected to grow at 13% CAGR in FY19-21E led by a

rising employee base, regulations required by companies to provide safety

to its employees and lower transportation costs to clients by optimisation of

routes and connectivity using MLL’s technology platform.

Exhibit 31: MLL PTS division (| crore)

295.1

340.5

385.5

435.6

492.2

0.0

100.0

200.0

300.0

400.0

500.0

600.0

FY17 FY18 FY19 FY20E FY21E

PTS revenues

13% FY19-21 CAGR

Source: Company, ICICI Direct Research

0

5

10

15

20

Transportation Warehousing

Gross margins ranges in

6-8% levels

Gross margins ranges in

10-18% levels

ICICI Securities | Retail Research 19

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Inorganic routes open to build capacity in freight forwarding

MLL has two subsidiaries viz. 2X2 Logistics that provides logistics and

transportation services to OEMs, to carry finished automobiles from

manufacturing locations to stockyards or directly to distributors. The other

subsidiary, Lords Freight is its freight forwarding arm (acquired in FY14), in

which the stake has been recently increased to 83.9%. Its service offerings

include air freight and sea freight forwarding operations for exports and

imports, customs brokerage operations, project cargo services and charters.

Lords is a member of a worldwide partner alliance (WPA) and world cargo

association (WCA) freight forwarding networks.

Currently, freight forwarding makes up 5-6% of revenues of MLL. The

management expects it to reach 10-15% of revenues, going ahead. The

increase in capacity is expected via both the organic and inorganic route.

This would catapult the organisation to a level where it can provide services

in line with its peers. Expansion in international freight forwarding would

enable the company to provide its clients a global reach.

Exhibit 32: MLL subsidiaries (| crore)

16.0

37.8

52.759.2

75.066.8

177.8 174.4

0

50

100

150

200

FY16 FY17 FY18 FY19

2X2 Logistics Lords Freight

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 20

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Financials

Revenues expected to grow at 9% CAGR to | 4554 crore in FY19-21E

MLL’s blended revenues are expected in grow in double digits, with non-

Mahindra SCM segment growing the fastest at 15% CAGR, buoyed by

healthy client addition and moderate growth in revenue per client (both top

20 and ex-top 20 clients). On the Mahindra group SCM segment, MLL is

expected to grow at 6%. This is in spite of the expected moderation in sales

of automotive and farm equipment in the short to medium term, led mainly

by the rising value added work performed by MLL within the AFM group and

also increasing its penetration across various companies within the

Mahindra Group. The PTS segment is expected to grow at 13%, mainly led

by continued outsourcing of logistics related activities and higher employee

addition within IT and ITeS firms. On an overall basis, we expect blended

MLL revenues to grow at 9% CAGR to | 4554 crore in FY19-21E.

Exhibit 33: Revenues expected to clock 9% CAGR in FY19-21 to | 4554 crore

1419.01820.0

2100.0 2171.3 2338.4

952.8

1256.0

1366.01491.7

1723.6

295.1

340.5

385.5435.6

492.2

0

1000

2000

3000

4000

5000

FY17 FY18 FY19 FY20E FY21E

| crore

MLL Mahindra Group division MLL non-Mahindra SCM division PTA division

Source: Company, ICICI Direct Research

EBITDA margins expected to grow 20-40 bps each year to 4.4% in FY21E

MLL reached margins of 3.9% in FY19 from 2.9% in FY17 (an increase of 100

bps in two years). Higher margins in the SCM segment are dependent on

optimisation of transportation as the MLL network grows (also applicable in

case of PTS division) and higher efficiency through skill based handling of

the newer warehouses (timebound). Thus, MLL’s growing investments in

technology are expected to help the company stay asset light as well as

optimise its operations (higher truck utilisation, lower idle asset time, etc),

thus lowering costs. We expect EBITDA margins to grow 20-40 bps each

year to 4.4% in FY21E. Hence, we expect absolute EBITDA to grow 15% to

| 200 crore.

Exhibit 34: EBITDA expected to grow 16% to | 200 crore

76.3

119.7

151.2

168.0

200.4

2.9

3.5

3.9

4.1

4.4

0.0

1.0

2.0

3.0

4.0

5.0

0

50

100

150

200

250

FY17 FY18 FY19 FY20E FY21E

%

| crore

EBITDA EBITDA margins

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 21

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

PAT expected to grow at 16% CAGR to | 115 crore in FY19-21E

PAT has grown at 37% CAGR in FY17-19 to | 86 crore in FY19, led by the

strong growth in the MLL SCM and PTS businesses with a 100 bps increase

in EBITDA margins. We expect capex to remain range bound at | 25-30

crore. Thus, the business is expected to stay asset light. Thus, the interest

and depreciation component will likely stay low and not impact the expected

strong operational performance, which would likely lead to PAT growth in

sync with EBITDA growth.

Exhibit 35: PAT expected to grow 16% to | 115 crore

45.6

64.0

85.6

94.6

114.6

1.7

1.9

2.22.3

2.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

0

20

40

60

80

100

120

140

FY17 FY18 FY19 FY20E FY21E

%

| crore

PAT PAT margins

Source: Company, ICICI Direct Research

Return ratios, free cash flows to remain strong, going ahead

MLL primarily being an asset light company deals with multiple business

partners to procure the asset it needs (drivers, trucks, buses, etc). MLL

clocked RoE & RoCE of 17.2% & 25.8%, respectively, in FY19. Going ahead,

we expect return ratios to remain strong at similar levels, led by a continued

strong operational performance and lower capex requirements.

Exhibit 36: Return ratios to remain stable

13.1

15.3

17.216.3 16.8

18.7

23.4

25.824.7

25.5

0

5

10

15

20

25

30

FY17 FY18 FY19 FY20E FY21E

%

RoE RoCE

Source: Company, ICICI Direct Research

Similarly, with the end of volatility in cash flow related to the GST

implementation era, FCF is expected to remain strong at | 120 crore in FY21E

(implied 5% yield).

ICICI Securities | Retail Research 22

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 37: Free cash flow yield expected to remain strong

-57.3

-25.3

60.8

78.7

119.5

-2.4

-1.0

2.5

3.3

5.0

-3.0

-2.0

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

-100

-50

0

50

100

150

FY17 FY18 FY19 FY20E FY21E

%

| crore

FCF FCF yield

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 23

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Risks & Concerns

High dependence on auto sector in SCM segment

MLL’s exposure to the auto sector is ~66-68% in the SCM segment.

Although it has reduced the exposure from 85% in FY15, yet the exposure

remains concentrated. Further, with a slowdown in auto sales expected in

the short to medium term, if the company fails to bring further value added

services in the segment or penetrate into other businesses within the

Mahindra group or bring in more clients from non-auto segments, it could

impact its operational performance. Also, a significant slowdown in auto

production in the long term can lead to lower demand for the logistics

company. Seasonality of auto sales, adverse developments like low rainfall

along with perception of Mahindra group as a competitor by OEM clients

could also negatively impact MLL revenues.

MLL serves in fragmented, competitive industry

Segments such as transportation suffer from large oversupply, with truck

aggregators having low barriers to entry and exit. Also, it is commoditised.

Thus, clients can also have low switching costs to competitors, if the service

levels deteriorates. Also, segments such as PTS can suffer from competing

modes of public transportation like car-pooling services (which employers

may reimburse).

High dependence on business partners for staying asset light

Non-availability or delays in obtaining hired vehicles or breakdowns, on-

road repairs or service interruptions may result in a loss of orders or delays

in delivery of goods, any of which could lead to client dissatisfaction and

loss of business. Also, with expanding business in other geographical

locations in India, there may be a shortage of business partners that meet

MLL’s quality standards and other selection criteria. As a result, the

company may be unable to engage a sufficient number of high quality

business partners in a timely manner.

ICICI Securities | Retail Research 24

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Valuations

Asset light model within underpenetrated segment

Increased revenue share from the non-Mahindra business (especially FMCG,

e-commerce) would enable higher warehousing revenues, providing higher

gross margins and translating into higher profitability for the company.

Considering the rising importance of services like inbound, outbound and

in-factory logistics along with prospects of performing further value added

services, enabling 3PL players to get a higher wallet share of the clients

business with increased client dependency, we initiate coverage on

Mahindra Logistics with a target price of | 415/share (at 26x FY21).

Exhibit 38: Valuation summary

Year Sales

(| cr)

Sales Gr.

(%)

EPS

(|)

EPS Gr.

(%)

PE

(x)

EV/EBITDA

(x)

RoNW

(%)

RoCE

(%)

FY17 2666.6 29.2 6.4 26.8 53.0 31.3 13.1 18.7

FY18 3416.1 28.1 9.0 40.3 37.7 19.8 15.3 23.4

FY19 3851.3 12.7 12.0 34.2 28.2 15.7 17.2 25.8

FY20E 4098.6 6.4 13.3 10.2 25.5 13.8 16.3 24.7

FY21E 4554.3 11.1 16.1 21.1 21.1 11.0 16.8 25.5

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 25

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Financial Summary

Exhibit 39: Profit & Loss Statement (| crore)

(Year-end March)/ (| crore) FY18 FY19 FY20E FY21E

Total Operating Income 3,416.1 3,851.3 4,098.6 4,554.3

Growth (%) 28.1 12.7 6.4 11.1

Freight Expense and Charges 3,001.0 3,372.4 3,590.4 3,980.4

Gross Profit 415.2 478.9 508.2 573.8

Gross Profit Margins (%) 12.2 12.4 12.4 12.6

Employee Expenses 229.1 263.8 278.7 305.1

Other Expenditure 66.3 63.9 61.5 68.3

Total Operating Expenditure 3,296.4 3,700.1 3,930.6 4,353.9

EBITDA 119.7 151.2 168.0 200.4

Growth (%) 57.0 26.3 11.1 19.2

Interest 3.8 3.5 3.1 2.4

Depreciation 19.7 22.0 26.4 29.6

Other Income 5.9 7.6 8.2 9.1

PBT before Exceptional Items 102.1 133.4 146.7 177.4

Less: Exceptional Items 0.0 0.0 0.0 0.0

PBT after Exceptional Items 102.1 133.4 146.7 177.4

Total Tax 36.8 46.8 51.4 62.1

PAT before MI 65.3 86.7 95.4 115.3

Minority Interest 1.3 0.8 0.8 0.8

PAT 64.0 85.9 94.6 114.6

EPS Growth (%) 40.3 34.2 10.2 21.1

EPS (Adjusted) 9.0 12.0 13.3 16.1

Source: Company, ICICI Direct Research

Exhibit 40: Balance Sheet (| crore)

(Year-end March) FY18 FY19 FY20E FY21E

Equity Capital 71.1 71.5 71.5 71.5

Reserve and Surplus 348.5 426.8 508.5 610.2

Total Shareholders funds 419.6 498.2 580.0 681.7

Minority Interest 7.0 5.7 5.7 5.7

Total Debt 26.2 28.5 23.5 18.5

Deferred Tax Liability 3.6 0.0 0.0 0.0

Long-Term Provisions 0.0 0.0 0.0 0.0

Other Non Current Liabilities 14.8 16.4 16.7 17.0

Source of Funds 471.1 548.8 625.9 722.9

Gross Block - Fixed Assets 120.7 145.3 165.3 185.3

Accumulated Depreciation 59.2 78.3 104.8 134.4

Net Block 61.6 67.0 60.5 50.9

Capital WIP 0.6 2.6 2.6 2.6

Fixed Assets 62.1 69.6 63.1 53.5

Investments 50.1 87.9 89.6 91.4

Goodwill on Consolidation 4.3 4.3 4.3 4.3

Deferred Tax Assets 17.7 18.7 18.7 18.7

Other non-Current Assets 123.2 120.3 122.7 125.1

Inventory 0.0 0.0 0.0 0.0

Debtors 520.0 631.7 617.6 686.3

Loans and Advances 146.1 202.7 204.7 206.7

Other Current Assets 0.0 0.0 0.0 0.0

Cash 66.0 70.0 123.9 219.2

Total Current Assets 732.2 904.3 946.2 1,112.2

Creditors 486.3 600.1 561.5 623.9

Provisions 3.3 5.2 5.3 5.4

Other Current Liabilities 28.9 51.1 52.1 53.1

Total Current Liabilities 518.5 656.3 618.8 682.4

Net Current Assets 213.7 248.0 327.4 429.8

Application of Funds 471.1 548.8 625.9 722.9

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 26

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

Exhibit 41: Cash Flow Statement

(Year-end March)/ (| crore) FY18 FY19 FY20E FY21E

Profit/(Loss) after taxation 64.0 85.6 94.6 114.6

Add: Depreciation & Amortization 19.7 22.0 26.4 29.6

Add: Interest Paid 3.8 3.5 3.1 2.4

Net Increase in Current Assets -106.4 -168.2 12.1 -70.7

Net Increase in Current Liabilities 95.2 137.8 -37.5 63.6

Others -64.4 14.3 0.0 0.0

CF from Operating activities 11.9 95.0 98.7 139.5

(Purchase)/Sale of Fixed Assets -37.2 -34.2 -20.0 -20.0

Long term Loans & Advances 0.0 0.0 0.0 0.0

Investments 8.5 -25.3 -1.8 -1.8

Others 10.7 -54.3 -22.1 -22.1

CF from Investing activities 19.2 -79.7 -23.8 -23.9

(inc)/Dec in Loan -1.8 2.3 -5.0 -5.0

Dividend & Dividend tax -12.9 -12.9 -12.9 -12.9

Less: Interest Paid -3.8 -3.5 -3.1 -2.4

Other 3.1 2.7 0.0 0.0

CF from Financing activities -15.3 -11.3 -20.9 -20.3

Net Cash Flow 15.9 3.9 54.0 95.3

Cash and Cash Equivalent at the beginning 50.2 66.0 70.0 123.9

Cash 66.0 70.0 123.9 219.2

Source: Company, ICICI Direct Research

Exhibit 42: Ratio Analysis

(Year-end March) FY18 FY19 FY20E FY21E

Per share data (|)

Reported EPS 9.0 12.0 13.3 16.1

BV per share 58.8 69.8 81.3 95.5

Cash per Share 9.3 9.8 17.4 30.7

Dividend per share 1.8 1.8 1.8 1.8

Operating Ratios (%)

Gross Profit Margins 12.2 12.4 12.4 12.6

EBITDA margins 3.5 3.9 4.1 4.4

PAT Margins 1.9 2.2 2.3 2.5

Inventory days 0.0 0.0 0.0 0.0

Debtor days 55.6 59.9 55.0 55.0

Creditor days 52.0 56.9 50.0 50.0

Asset Turnover 28.3 26.5 24.8 24.6

Return Ratios (%)

RoE 15.3 17.2 16.3 16.8

RoCE 23.4 25.8 24.7 25.5

RoIC 25.9 28.3 29.5 35.4

Valuation Ratios (x)

P/E 37.7 28.2 25.5 21.1

EV / EBITDA 19.8 15.7 13.8 11.0

EV / Net Sales 0.7 0.6 0.6 0.5

Market Cap / Sales 0.7 0.6 0.6 0.5

Price to Book Value 5.7 4.8 4.2 3.5

Solvency Ratios

Debt / EBITDA 0.2 0.2 0.1 0.1

Debt / Equity 0.1 0.1 0.0 0.0

Current Ratio 1.3 1.3 1.3 1.3

Quick Ratio 1.3 1.3 1.3 1.3

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 27

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

RATING RATIONALE

ICICI Direct endeavors to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as

the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research [email protected]

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

ICICI Securities | Retail Research 28

ICICI Direct Research

Initiating Coverage | Mahindra Logistics

RATING RATIONALE

ICICI Direct endeavors to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as

the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research [email protected]

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

ANALYST CERTIFICATION

I/We, Bharat Chhoda, MBA; Harshal Mehta MTech (Biotech) , Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views

about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that above

mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in

the report

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI

Securities Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities Limited Sebi Registration is INZ000183631 for stock broker. ICICI

Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance,

general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons

reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no

obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate

that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where

ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe

for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat

recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy

is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign

exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily

a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies

mentioned in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did

not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI

Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day

of the month preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come

are required to inform themselves of and to observe such restriction