Magseis ASA Q1 2017 · (Q1 2016 also included source vessel costs) • Research and development •...

Transcript of Magseis ASA Q1 2017 · (Q1 2016 also included source vessel costs) • Research and development •...

Magseis ASA Q1 2017

30 May 2017

Highlights

Best quarter to date

Awarded extensionIn Red Sea

Pursuing substantial shooting efficiency

improvements

New equity in place, growth initiatives

well underway

2

• Raised USD 40 million new equity to finance growth plans

• Mobilisation for ConocoPhillips 4D ROV project ongoing

• Vessel tender process for Crew #3 in final stages and long-lead items on order

• Strong financial performance, Revenue of USD 21.1m and EBITDA of USD 8.3m• First phase of S-78 Red Sea survey completed on time

• Exclusive license agreement for Source Isolation technology applied to OBS

• Implementation of technology targeting 30-50% acquisition cost reduction

• Awarded Extension to S-78 project by BGP and Saudi Aramco

• Expected duration of more than six months

KEY FIGURES Q1 2017

Source: Magseis

21.1REVENUE

8.3EBITDA

3.5NET INCOME

54.2CASH BALANCE

$ MILLION

$ MILLION $ MILLION

$ MILLION $ MILLION

21.1

18.1

8.3

REVENUE

Q1 2017

REVENUE

Q12016

EBITDA

Q12016

EBITDA

Q12017

1.6

3

First quarter 2017 results - Key figures

• Solid underlying operational performance during Q1 (EBITDA of USD 8.3m)

• USD 1.3m in capitalised mobilisation costs amortised in Cost of Sales

• USD 1.0m in late start compensation included in Cost of Sales

• Cost of Sales for Q1 2016 included fuel and source vessel costs

• Closing cash position of USD 54.2m and robust Equity ratio of 71.2%

• Strong cash flow from operations during Q1• Cash flow from operations USD 10.1m

• Reiterating full-year guidance• Expected EBITDA for 2017 of > USD 20 million

4Source: Magseis

Profit and loss Q1 2017 Q1 2016 Year End 2016

Revenue 21 076 18 115 58 905

Cost of sales 9 997 13 630 39 038

EBITDA 8 329 1 559 8 506

EBIT 4 762 -2 487 -11 114

Net profit/loss 3 511 -3 942 -16 695

Basic earnings per share 0.06 -0.13 -0.44

Financial position

Cash 54 195 15 218 18 974

Working Capital1) 6 173 537 4 812

Total equity 91 134 49 826 49 045

Equity ratio 71.2% 65.7% 56.6%

Gross interest bearing debt 12 460 7 027 16 263

Cash flow

Net cash from operating activities 10 074 1 533 -2 117

Net cash from investing activities -9 449 -2 316 -16 463

Net cash from financing activities 34 596 4 565 26 120

1): Working Capital defined as Trade Receivables less Trade Payables

OBS provides superior image quality - gaining market share over high-end streamer seismic

Streamer Seismic Ocean Bottom Seismic (OBS)

90%Market share

10%Market share

5Source: Magseis/Statoil

Marine Autonomous Seismic SystemMiniaturised node sensors

Handling system Applications

ROV deployment

Ultra deep water deployment

Cable deployment

6Source: Magseis

Larger spread driving substantial cost reductions

100K$ per.km² 25K$ per.km²

201475km

2015150km

2016350km

2018>600kmCable length

Large spreads -rolling operations

Multiple patch deployment

7Source: Magseis

New, exclusive source technology agreement- Significant potential to reduce costs further • Improved efficiency and data quality by new Source Isolation technology

• Improved source efficiency though simultaneous shooting by one source vessel• Improved shot sampling over conventional technologies

• Exclusive agreement for OBS

• Commercially available in 2018

8

Source Isolation Conventional shooting25m 50m

Source: Magseis

Established as a leading OBS provider

Solid customer baseProven track record Ongoing projects

• Completed >1,300 sq.km2

• More than 140,000 nodes deployed

• Excellent reputation for high quality data

• Strong QHSE culture

• Saudi Aramco’s S-78 Extension project in the Red Sea

• Mobilising for 4D survey for ConocoPhillips in North Sea

9Source: Magseis

Source: Magseis

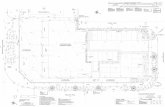

Aramco Red Sea project

10

Operational highlights• Efficient transition from phase 1 of S-78 to

Extension (rolling cables from one survey to the next)

• Planned yard stay and delays caused by sandstorm meant that source acquisition could only commence on April 28th

• Very similar survey conditions with water depths varying form approximately 1,000m to transition zone and in some cases over dry land (islands) on the same receiver line.

• Crew and nodes shows an excellent performance despite the challenging environment.• The robust Magseis “node in a cable” solution proving it’s suitability on the rugged seabed.• Production in line with project plan

ConocoPhillips North Sea project

MASS modular solution

11Source: Magseis

Contract highlights

• 4D, full-azimuth survey over the Eldfisk field

• ROV and source vessels operated by ConocoPhillips

• Magseis provides crew, nodes and handling

• Potential for repeat work

High capacity, mobile ROV operation

• Unlimited capacity of nodes• Modular handling system • Very strong interest from clients• Smart operations

Crew #3 preparations ongoing

Source: Magseis12

• Vessel tender process in final stages of negotiation

• Highly efficient platforms available at attractive terms• Significant component of vessel owner funding ensures that Magseis growth plan is fully financed

• Commitments for up to 6,000 MASS sensors and associated handling systems being prepared

• Long-lead items are being ordered

• Target start of operations by April 1st, 2018

• Already bidding on projects

Strong market outlook

20202019201820172005 2016

2 250

2 000

1 575

1 500

1 250

1 000

750

500

250

0

Source: Magseis/Arkwright/Rystad Energy/Statoil13

USD>750 m

$ MILLION

OBS market drivers

IORFocus

Increasing geological complexity

Technology development

Customer confidence & adoption

Growth strategy- Towards $25K/km²

Historical OBS surveys

No observed OBS survey

Source: Magseis/Rystad Energy

COM

PLEX

ITY

Reduced costs and maturity of technology

• Main motives for OBS-IOR:– Complex reservoirs– Image reservoirs beneath gas clouds– Pre- and sub-salt basins– Image reservoirs below infrastructure

• Business model:– Operate large equipment spreads– Share pool of nodes across platforms – Build a flexible OPEX base

• By 2020:– Node pool of >30,000 nodes– 2-3 high capacity cable vessels– 2-3 modular ROV/Node Deployer systems

14

FIELD SIZE (mmboe)

Marlim Leste

Roncador

Parque das BaleiaValhall

EldfiskThunder HorseNowruz

AlbacoraLobsterParque das Conchas

GraneBalder/Ringhorne/Jotun

Andrew

Champion

MarlinEdvard Grieg

Golden Eagle Area Development Dan

Agbami Ekoli BongaShearwater

Torpille MarineArne South Beryl

Stones

Jack/St Malo

Nene Marine Bokor BuzzardHeidrun

Ceiba Alwyn NorthKnarr

Kristin

RavvaNorne

Captain

Valemon

VisundClair

Sepinggan KvitebjornBBLTFoinaven

AkpoSalsa

Bahar

Shah

Cleeton

Daman Offshore

Dalia

SnohvitSole West

Deniz

Summary & Outlook

• Strong operational and financial performance

• Awarded Extension in the Red Sea

• Raised USD 40m in growth financing

• Fully financed to expand from 1 to 3 operations

• New, exclusive source technology cooperation

15

20202019201820172005 2016

2 250

2 000

1 575

1 500

1 250

1 000

750

500

250

0

Larger spread driving cost reductions

Excellent operational performance Strong financial results

Strong market outlook

100K$ per.km² per.km²

201475km

2015150km

2016350km

2018>600km

Cable length

25K$16

First quarter 2017 results- Comprehensive income

• Revenue• USD 21.1m, strong performance on the Aramco S-78 project

• Cost of sales • Full quarter of production• Amortisation of capitalised mobilisation cost USD 1.3m• Late start compensation of USD 1.0m• Lower Cost of Sales due to fuel provided on survey

(Q1 2016 also included source vessel costs)

• Research and development• Capitalised USD 0.1m related to deep Water R&D project and

development of MASS III

• Depreciation• Amortisation of capitalised mobilisation cost USD 0.4m

• Amortisation and Impairment• USD 0.2m related to damaged equipment during Red Sea Survey

• Finance • Primarily interest related to BGP pre-funding, GIEK and

Innovation Norway

• Tax• USD 0.8m for withholding tax in Saudi Arabia

In USD thousandsQ1 2017

(unaudited)Q1 2016

(unaudited)2016

(audited)

17

Revenue 21 076 18 115 58 905Cost of sales 9 997 13 630 39 282Research and development 499 492 2 022SG&A and other expenses 2 250 2 435 9 339EBITDA 8 329 1 559 8 262Depreciation 3 219 2 991 10 769Amortisation 116 1 010 1 409Impairment 233 46 7 441EBIT 4 762 -2 487 -11 357Net interest and fx (gain)/loss 462 478 1 386Other finance cost 0 7 7Net finance costs 462 485 1 393EBT 4 299 -2 972 -12 750Tax 789 970 4 218Net income 3 511 -3 942 -16 968Currency translation differences 0 0 0Total comprehensive income 3 511 -3 942 -16 968

Source: Magseis

First quarter 2017 results- Balance sheet

• Trade receivables primarily Aramco• Feb and Mar production (paid in Q2)

• Other current assets:• Primarily capitalised mobilisation costs

• Equity ratio of 71.2%• Debt covenants at 30%

• Non-current liabilities• Senior debt drawn down from Export Credit Norway and

Innovation Norway: USD 6.9m• Shell Deep Water R&D funding: USD 6.8m (contingent liability)

• Current tax liabilities– Withholding tax and corporate tax Saudi Arabia– Corporate tax in Singapore and Malaysia

• Other current liabilities– Short-term debt BGP USD 2.1m– Current portion of long-term debt USD 2.9m– Accruals for vessel operational costs USD 7.4m

In USD thousands Q1 2017(unaudited)

YE 2016(audited)

18

Equipment and other intangibles 54 111 49 314Multi-client library 0 0Cash and cash equivalents 54 195 15 218Trade receivables 12 602 8 027Stock (fuel and batteries) 1 003 582Other current assets 6 156 2 711TOTAL ASSETS 128 067 75 852

Share capital 657 254Share premium 140 741 90 945Retained earnings and other reserves -50 264 -41 374TOTAL EQUITY 91 134 49 826

Obligation under finance lease 704 1 668Other non-current financial liabilities 14 063 9 523TOTAL NON-CURRENT LIABILITIES 14 767 11 191

Trade payables 6 429 7 913Current tax liability 2 875 330Other current liabilities 12 862 6 592TOTAL CURRENT LIABILITIES 22 166 14 835

TOTAL LIABILITIES 36 933 26 026

TOTAL EQUITY AND LIABILITIES 128 067 75 852

Source: Magseis

First quarter 2017 results- Cash flow

19

• Cash flow from operations• Variance from EBITDA resulting from:

• Non-cash costs in OPEX (amortised transit costs & provisions)• Less 10% withheld by Aramco

• Cash from investments• Relates mainly to investments for the ROV crew

• Cash flow from financing • Cash from equity raise of net USD 38.5m• Instalments of USD 3.8m• Financing from Shell under Deepwater R&D agreement of USD 0.4m

Earnings before tax 4 299 -2 972 -12 750Depr, Amor,Impair,Finance, etc. 4 178 4 258 19 836Net working capital adjustments 1 597 247 -9 204Net cash flow from operating activities 10 074 1 533 -2 117

Net cash flow from investing activities -9 449 -2 316 -16 463

Net cash flow from financing activities 34 596 4 565 26 120

Net change in cash and cash equivalents 35 221 3 783 7 539Cash balance at the beginning of the period 18 974 11 435Cash balance at period end 54 195 15 218 7 539

In USD thousandsQ1 2017

(unaudited)Q1 2016

(unaudited)2016

(audited)

Source: Magseis