Magic Plus.xls

-

Upload

naveen-verma -

Category

Documents

-

view

86 -

download

1

description

Transcript of Magic Plus.xls

Name Plan

Age Term Mode

Premium Minimum premium required is Rs. 10000

Accident Benefit

Expected Growth in NAV

Fund

Current NAV

Insurance required

Minimum

Maximum

Custom

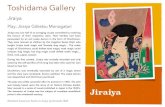

Magic Plus - ULIP Plan Presentation Softw...

Cteated by L J Anish, Development Officer, Nedumkandam Branch. www.ourlic.blogspot.com

Show presentation

Version 1.3

CIR

%

Magic Plus - ULIP Plan Presentation Softw...

Cteated by L J Anish, Development Officer, Nedumkandam Branch. www.ourlic.blogspot.com

Show presentation

2Joseph 0 2 800000 10.530 1 1200000 Secured Fund19 0 2200000 10

320000

Name Joseph Age Range Select

Plans Selected plan 2 2 PlanPension Plus 1 Endowment PlusEndowment Plus 2 10 10 0 7 7

3 11 11 0 8 84 12 12 0 9 9

13 13 0 10 1014 14 0 11 11

Age 30 15 15 0 12 12Term 19 16 16 0 13 13

10000 17 17 0 14 14Mode 3 20000 2 18 18 0 15 15Single 1 30000 1 19 19 1 16 16Yly 2 20000 1 20 20 0 17 17Hly 3 10000 2 21 0 18 18Qly 4 5000 4 22 0 19 19ECS 5 1750 12 23 0 20 20

24 0 21 21Yes 25 0 22 22No 26 0 23 23

1 2 1200000 27 0 24 240 1 800000 28 0 25 251 2 1 1200000 29 0 26 260 3 2200000 30 0 27 27

0 31 0 28 281 32 0 29 29

CAGR 10.5 1 33 0 30 30Curr_NAV 10 34 0 31 31

35 0 32 3210 36 0 33 33

Fund value 11.1 37 0 34 342283615 12.2 38 0 35 35

13.5 39 0 36 3614.9 40 0 37 3716.5 41 0 38 3818.2 42 0 39 3920.1 43 0 40 4022.2 44 0 41 4124.6 45 0 42 4227.1 46 0 43 4330.0 47 0 44 4433.1 48 0 45 4536.6 49 0 46 4640.5 50 0 47 4744.7 51 0 48 4849.4 52 0 49 4954.6 53 0 50 5060.3 54 0 51 5166.7 55 0 52 5273.7 56 0 53 5381.4 57 0 54 5489.9 58 0 55 5599.4 59 0 56 56

109.8 60 0 57 57121.4 61 0 58 58134.1 62 0 59 59148.2 63 0 60 60163.7 64 0 61180.9 65 0 62199.9 66 0 63220.9 67 0 64244.1 68 0 65269.7 69 0 66298.1 70 0 67

age range

329.4 71 0 68364.0 72 0 69402.2 73 0 70444.4 74 0 71

75 0 7276 0 7377 0 7478 0 7579 0 7680 0 7781 0 7882 0 7983 0 8084 0 8185 0 8286 0 8387 0 8488 0 8589 0 8690 0 8791 0 8892 0 8993 0 9094 0 9195 0 9296 0 9397 0 9498 0 9599 0 96

100 0 97101 0 98102 0 99103 0 100104 0 101105 0 102106 0 103107 0 104108 0 105109 0 106110 0 107111 0 108112 0 109113 0 110114 0 111115 0 112116 0 113117 0 114118 0 115119 0 116120 0 117121 0 118122 0 119123 0 120124 0 121125 0 122126 0 123127 0 124128 0 125129 0 126

1

1500001 2 3 4 without 150000

0 0 0 0 s/ns/min 8000000 30 1 0 0 0 1.46 s/nsmax 12000000 31 2 0 0 0 1.460 32 3 0 0 0 1.5 Allocation charge Admn charge0 33 4 0 0 0 1.56 7.5 10 34 5 0 0 0 1.64 5 3600 35 6 0 0 0 1.73 5 370.80 36 7 0 0.5 0.5 1.85 5 381.9240 37 8 0 0.5 0.5 1.99 5 393.381720 38 9 0 0.5 0.5 2.15 3 405.18317160 39 10 0 0.48 0.48 2.33 3 417.33866670 40 11 0 0.56 0.56 2.57 3 429.85882680 41 12 0 0.66 0.66 2.81 3 442.75459160 42 13 0 0.81 0.81 3.02 3 456.03722930 43 14 0 0.89 0.89 3.25 3 469.71834620 44 15 0 0.96 0.96 3.54 3 483.80989660 45 16 0 1.03 1.03 3.89 3 498.32419350 46 17 0 1.09 1.09 4.3 3 513.27391930 47 18 0 1.15 1.15 4.77 3 528.67213680 48 19 0 1.2 1.2 5.3 3 544.53230090 49 20 0 1.25 1.25 5.9 3 560.868270 50 21 0 1.29 1.29 6.56 3 577.69431810 51 22 0 1.33 1.33 7.27 3 595.02514761 52 23 0 1.36 1.36 8.05 3 612.8759020 53 24 0 1.39 1.39 8.9 3 631.26217910 54 25 0 1.42 1.42 9.8 3 650.20004450 55 26 0 1.43 1.43 10.76 3 669.70604580 56 27 0 1.45 1.45 11.79 3 689.79722720 57 28 0 1.46 1.46 12.87 3 710.4911440 58 29 0 1.46 1.46 13.78 3 731.80587830 59 30 0 1.46 1.46 14.94 3 753.76005470 60 31 0 1.46 1.46 16.34 3 776.37285630 61 32 0 1.5 1.5 17.99 3 799.6640420 62 33 0 1.56 1.56 19.88 3 823.65396330 63 34 0 1.64 1.64 22.01 3 848.36358220 64 35 0 1.73 1.73 24.39 3 873.81448960 65 36 0 1.85 1.85 27.02 3 900.02892430 66 37 0 1.99 1.99 28.4 3 927.0297920 67 38 0 2.15 2.15 32.02 3 954.84068580 68 39 0 2.33 2.33 36.03 3 983.48590640 69 40 0 2.57 2.57 40.47 3 1012.9904840 70 41 0 2.81 2.81 3 1043.3801980 71 42 0 3.02 3.02 3 1074.6816040 72 43 0 3.25 3.25 3 1106.9220520 73 44 0 3.54 3.54 3 1140.1297140 74 45 0 3.89 3.89 3 1174.3336050 75 46 0 4.3 4.3 3 1209.5636130 76 47 0 4.77 4.77 3 1245.8505220 77 48 0 5.3 5.3 3 1283.2260370 78 49 0 5.9 5.9 3 1321.7228180 79 50 0 6.56 6.56 3 1361.3745030 80 51 0 7.27 7.27 3 1402.2157380 81 52 0 8.05 8.05 3 1444.282210 82 53 0 8.9 8.9 3 1487.6106770 83 54 0 9.8 9.8 3 1532.2389970 84 55 0 10.76 10.76 3 1578.2061670 85 56 0 11.79 11.79 3 1625.5523520 86 57 0 12.87 12.87 3 1674.3189220 87 58 0 13.78 13.78 3 1724.548490 88 59 0 14.94 14.94 3 1776.2849450 89 60 0 16.34 16.34 3 1829.573493

Risk cover

Select risk

Max i single with cir

0 90 61 0 17.99 17.99 3 1884.4606980 91 62 0 19.88 19.88 3 1940.9945190 92 63 0 22.01 22.01 3 1999.2243540 93 64 0 24.39 24.39 3 2059.2010850 94 65 0 27.02 27.02 2120.9771170 95 66 0 28.4 28.4 2184.6064310 96 67 0 32.02 32.02 2250.1446240 97 68 0 36.03 36.03 2317.6489630 98 69 0 40.47 40.47 2387.1784320 99 70 0 2458.7937840 100 71 0 2532.5575980 101 72 0 2608.5343260 102 73 0 2686.7903560 103 74 0 2767.3940660 104 75 00 105 76 00 106 77 00 107 78 00 108 79 00 109 80 00 81 0 #N/A0 82 0 #N/A0 83 0 #N/A0 84 0 #N/A0 85 0 #N/A0 86 0 #N/A0 87 0 #N/A0 88 0 #N/A0 89 0 #N/A0 90 0 #N/A000000 Pension Rate Pension start0 490 Yearly Mly0 40 36650 29200 41 36700 29330 42 36750 29330 43 36750 29370 44 36800 29370 45 36800 29420 46 36850 29420 47 36900 29420 48 36950 29460 49 36950 29460 50 37000 29500 51 37050 29500 52 37100 29540 53 37150 29580 54 37200 29580 55 37250 29620 56 37300 29620 57 37350 29670 58 37400 29710 59 37450 29710 60 37550 29751 61 37600 2979

62 37650 297963 37750 298364 37800 298765 37900 298766 37950 2992

67 38050 299668 38150 299669 38200 300070 38300 300071 38400 300472 38500 300473 38600 300474 38700 300875 38800 300876 38900 300877 39050 300878 39150 300879 39300 3008

36950.00 2946.00

1 2 3 4 5 Secured Fund 1 2 3 4 5 0.6Debt Fun Balanced Fund Balanced Fund 0.7 0.7 0.7Mixed F Bond Fund Bond Fund 0.8 0.5 0.5

Growth Fund Growth Fund 0.8 0.8Secured Fund Secured Fund 0.6 0.6

2 3 4 5 Select360 360 1 A great pension plan with great returns from Life Insurance Corporation of India

370.8 370.8 2 A great plan with high returns and flexibility from Life Insurance Corporation of India381.924 381.924 3393.382 393.382 4405.183 405.183 5417.339 417.339 Select A great plan with high returns and flexibility from Life Insurance Corporation of India429.859 429.859442.755 442.755456.037 456.037469.718 469.718

483.81 483.81498.324 498.324513.274 513.274528.672 528.672544.532 544.532560.868 560.868577.694 577.694595.025 595.025612.876 612.876631.262 631.262

650.2 650.2669.706 669.706689.797 689.797710.491 710.491731.806 731.806

753.76 753.76776.373 776.373799.664 799.664823.654 823.654848.364 848.364873.814 873.814900.029 900.029

927.03 927.03954.841 954.841983.486 983.486

1013 10131043.38 1043.381074.68 1074.681106.92 1106.921140.13 1140.131174.33 1174.331209.56 1209.561245.85 1245.851283.23 1283.231321.72 1321.721361.37 1361.371402.22 1402.221444.28 1444.281487.61 1487.611532.24 1532.241578.21 1578.211625.55 1625.551674.32 1674.321724.55 1724.551776.28 1776.281829.57 1829.57

1884.46 1884.461941 1941

1999.22 1999.222059.2 2059.2

2121 21212184.61 2184.612250.14 2250.142317.65 2317.652387.18 2387.182458.79 2458.792532.56 2532.562608.53 2608.532686.79 2686.792767.39 2767.39

A great pension plan with great returns from Life Insurance Corporation of IndiaA great plan with high returns and flexibility from Life Insurance Corporation of India

A great plan with high returns and flexibility from Life Insurance Corporation of India

Plan name Plans 2nd 3rd 4th 5th Single Single ECS

Pension Plus 1 18 75 10 52 6.75 4.5 4.5 4.5 4.5 2.5 3.3 15000 30000 1500

2 7 60 10 20 7.5 5 5 5 5 3 3.3 20000 30000 1750345

7 60 10 20 7.5 5 5 5 5 3 3.3 20000 30000 1750

Min Age entry

Max Age entry

Min Term

Maximum Term

First year AC

Other

Minimum prem Reg

Endowment Plus

Min Insurance Max ins ins singmax AB

0 0 0 0 0 0 0

800000 1200000 37500 150000 1 1 1

800000 1200000 25000 100000 1 1 0

Single insurance min

Insurance

CIR available

Endowment Plus

Plan presentation specially customised for Joseph aged 30 years.Presentation based on an assumed NAV growth rate of 10.5 % per annum.*

Year Age Premium NAV Risk Cover

1 30 40000 3000 37000 10.0 3700.0 3434.7 1200000 1200000 379532 31 40000 2000 38000 11.1 3438.9 6903.4 1200000 1200000 842923 32 40000 2000 38000 12.2 3112.1 10039.0 1200000 1200000 1354494 33 40000 2000 38000 13.5 2816.4 12875.8 1200000 1200000 1919665 34 40000 2000 38000 14.9 2548.8 15442.8 1200000 1200000 2544116 35 40000 1200 38800 16.5 2355.2 17815.0 1200000 1200000 3243107 36 40000 1200 38800 18.2 2131.4 19961.7 1200000 1200000 4015458 37 40000 1200 38800 20.1 1928.8 21905.1 1200000 1200000 4869059 38 40000 1200 38800 22.2 1745.6 23664.9 1200000 1200000 581254

10 39 40000 1200 38800 24.6 1579.7 25258.7 1200000 1200000 68554311 40 40000 1200 38800 27.1 1429.6 26701.9 1200000 1200000 80080512 41 40000 1200 38800 30.0 1293.7 28010.2 1200000 1200000 92824613 42 40000 1200 38800 33.1 1170.8 29196.5 1200000 1200000 106915414 43 40000 1200 38800 36.6 1059.6 30271.8 1224927 1224927 122492715 44 40000 1200 38800 40.5 958.9 31241.2 1396888 1396888 139688816 45 40000 1200 38800 44.7 867.8 32111.3 1586550 1586550 158655017 46 40000 1200 38800 49.4 785.3 32898.7 1796127 1796127 179612718 47 40000 1200 38800 54.6 710.7 33611.3 2027712 2027712 202771219 48 40000 1200 38800 60.3 643.1 34256.2 2283615 2283615 22836150 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 0

Allocation charge

Invested amount

Units allocated

Units After deduction

Accident cover

Fund Value at year end

www.ourlic.blogspot.com

A plan with high returns and flexibility for your family from

Life Insurance Corporation Of India

0 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 00 0 0 0 0 0.0 0.0 0.0 0 0 0

*Agents training material not for public circulation. NAV rate shown is just for illustration purpose only and is not guaranteed.

Fund value available at the end of 19 years at the projected rate will be Rs. 2283614

www.ourlic.blogspot.com

A plan with high returns and flexibility for your family from

Life Insurance Corporation Of India

Endowment Plus

Plan presentation specially customised for Joseph aged 30 years.Presentation based on an assumed NAV growth rate of 10.5 % per annum.*

Year Age Premium NAV Total Charges

1 30 40000 3000 37000 10.0 5931.8 265.3 3434.7 37953

2 31 40000 2000 38000 11.1 4876.2 235.6 6903.4 84292

3 32 40000 2000 38000 12.2 4861.4 212.1 10039.0 135449

4 33 40000 2000 38000 13.5 4857.1 191.6 12875.8 191966

5 34 40000 2000 38000 14.9 4858.3 173.5 15442.8 254411

6 35 40000 1200 38800 16.5 4047.0 156.4 17815.0 324310

7 36 40000 1200 38800 18.2 4037.8 141.1 19961.7 401545

8 37 40000 1200 38800 20.1 4011.4 126.5 21905.1 486905

9 38 40000 1200 38800 22.2 3957.2 112.3 23664.9 581254

10 39 40000 1200 38800 24.6 3863.3 98.1 25258.7 685543

11 40 40000 1200 38800 27.1 3736.2 84.6 26701.9 800805

12 41 40000 1200 38800 30.0 3520.6 70.0 28010.2 928246

13 42 40000 1200 38800 33.1 3196.2 54.5 29196.5 1069154

14 43 40000 1200 38800 36.6 2767.7 38.7 30271.8 1224927

15 44 40000 1200 38800 40.5 2462.4 28.2 31241.2 1396888

16 45 40000 1200 38800 44.7 2480.4 25.9 32111.3 1586550

17 46 40000 1200 38800 49.4 2499.0 23.8 32898.7 1796127

18 47 40000 1200 38800 54.6 2518.1 21.8 33611.3 2027712

19 48 40000 1200 38800 60.3 2537.8 20.1 34256.2 2283615

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

Allocation charge

Invested amount

Deducted units

Units after deduction

Fund Value at year end

www.ourlic.blogspot.com

A plan to secure the future and ensure a

joyful retired life from Life Insurance Corpor...

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

0 0 0 0 0 0.0 0.0 0.0 0.0 0

Total pension fund available at the end of 19 years will be Rs.2283614*Pension Availble without commutattion Pension available with 1/3rd commutation

Pension Fund Pension Fund Yearly pension Monthly pension

2283615 168759 13455 2283614 761204 112506 8970*Pension with return of purchase price of Jeevan Akshay VI is taken for illustration

* Actual pension rate may varry depending on the performance of fund and annuity rate at the time of maturity.

*Agents training material not for public circulation.

Yearly pension

Monthly pension

Commuted amount

Main menu