Macro Review Key Ideas

-

Upload

lynn-hollenbeck-breindel -

Category

Documents

-

view

223 -

download

0

Transcript of Macro Review Key Ideas

-

7/28/2019 Macro Review Key Ideas

1/13

It'i,\',il

-

7/28/2019 Macro Review Key Ideas

2/13

I

t

r

mMacroeconomics is the study of the econo-my as a whole; microeconomics is the studyof individual parts of the economy such asbusinesses, households and prices. Macro-economics looks at the forest; microeco-nomics looks at the trees.A circular flow diagram illustrates the majorflows of goods and services, resources andincome in an economy. It shows how changesin these flows can alter the level of goods andservices, employment and income.Gross domestic product (GDP) is the mar-ket value of all final goods and services pro-duced in a nation in one year. It is the mostimportant measurement of production andoutput.

: GDP counts only final goods and services;it does not count intermediate goods andservices.

I GDP also does not count secondhand goods;the buying and selling of stocks and bonds;and transfer Payments such as Social Securi-ty benefits, unemployment compensationand certain interest Payments.t GDP includes profits earned by foreign-owned businesses and income earned by for-eigners in the United States, but it excludesprofits earned by U.S.-owned companiesoverseas and income earned by U.S. citizenswho work abroad.

I GDP maybe calculated in two waYs:1. Add all the consumption, investmentand government expenditures plus netexports or2. Add all the incomes.received by ownersof productive resources in the economy.

I Price indexes measure price changes in theeconomy. They are used to compare theprices of a given bundle or market basket of

goods and services in one year with theprices of the same bundle or market basketin another year.

I A price index has a base year, and the pricelevel in that year is given an index numberof 100. The price level in all other years isexpressed in relation to the price level in thebase year.

weighted cost ofbase-period items incurrent-year prices x 100weighted cost ofbase-period items inbase-year pricesThe most frequently used price indexes arethe GDP price deflator, the consumer priceindex (CPI) and the producer price index(PPr).Real GDP is adjusted for price changes;nominal GDP is not adjusted for pricechanges.Inflation is a general increase in the overallprice level.

I Savers, lenders and people on fixed incomesgenerally are hurt by unanticipated infla-tion; borrowers gain from unanticipatedinflation.

I Unemployment occurs when people who arewilling and able to work cannot find jobs atsatisfactory wage rates.

I Unemployment is classified into three cate-gories: frictional, ryclical and structural.I The unemployment rate rePresents peoplewho are not working but who are activelylooking for a job.

I Full employment is not defined as zerounemployment because frictionhl and struc-tural unemployment exist even lvith zerocyclical unemployment.

Priceindex =numberI

IT

Advanced Placemcnt Economic Macroeonomics: Student Actiyitic 6 National Council on Economic Educstion, Nff York' N'Y. 59

-

7/28/2019 Macro Review Key Ideas

3/13

l

II

II

The unemployment rate at full employmentis called the natural rate of unemployment.The labor force is defined as peoplewhohave a job (employed) and people who areactively looking for a job (unemployed). Thelabor force participation rate is the percent-age ofthe population over the age of 16 thatis in the labor force.

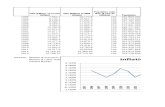

A business cycle describes the ups and downsof economic activity over a period of years.The phases of the business cycle are orPan-sion (recovery), peak, contraction(recession) and trough.

60 Adnnad Plaamt Economia Macrcc@nomic Studcnt Activitia O Nsti,ond Coucil on Eonomic Eduqtion, Ntr York' N.Y.

-

7/28/2019 Macro Review Key Ideas

4/13

-

7/28/2019 Macro Review Key Ideas

5/13

I The Keynesian aggregate erpenditure modelis a simple model of the economyand showsthe multiplied effect that changes in govern-ment spending, taxes and investment canhave on the economy.

I The marginal propensityto consume (MPC)is the additional consumption spendingfrom an additional dollar of income. Themarginal propensity to save (MPS) is theadditional savings from an additiond dollarof income.

I The marginal propensity to consume andthe marginal propensity to save are relatedby MPC + MPS = 1. In the simple model,an additional dollar of income will either beconsumed or saved.

I The multiplier is a number that shows therelationship between changes in auton-omous spending and maximum changes inreal gross domestic product (real GDP).

I In a simple model, the formula for calculat-ing the multiplier isIncomeexpenditure

=I

=I

multiplier l-MpC MpSI The multiplier effects result from subse-quent rounds of induced spending thatoccur when autonomous spending changes.

I Investment and its response to changes inthe interest rate are important in under-standing the relationship benueen monetarFpolicy and GDP.

I Aggregate demand (AD) and aggregate sup-ply (AS) curves look and operate much likethe supply and demand curves used inmicroeconomics. However, these macroeco-nomic AD and AS curves depict differentconcepts, and they change for different rea-sons t}an do microeconomic demand andsupply curves. AD and AS curves can be

used to illustrate changes in real ouput andthe price level of an economy.

I The downward sloping aggregate demandcurve is explained by the interest rate effect,the wealth effect and the net export effect.The wealth effect is also called the real-balance effect.

I The aggregate supply curye can be dividedinto three ranges: the horizontal range, theupward sloping or intermediate range, andthe vertical range.

I Shifts in aggregate demand can change thelevel of oulput, the price level or both. Thedeterminants of aggregate demand includeconsumer spending, investment spending,government spending, net export spendingand money supply.

I Shifts in aggregate supply can also changethe level of output and the price level. Thedeterminants of AS include changes in inputprices, productiviry the legal institutionalenvironment and the quantity of availableresources.

I In the short run, economists think that equi-librium levels of GDP can occur at less than,greater than or at the full-employment level ofGDP. Economists believe that long-run equi-librium can occur only at full employment.

I In a dynamic aggregate demand and aggre-gate supply model of the economy, changes inwages and prices over time induce the econo-my to move to the long-run equilibrium.

I Fiscal policy consists of government actionsthat may increase or decrease aggregatedemand. These actions involve changes ingovernment expenditures and taxation.

I The government uses an expansionary fiscalpolicy to try to increase aggregate demandduring a recession. The government may

Adroccd Placemcnt Eonomis Macrcconomia Studcnt Activitis O Nationd Council on Econornic Education, Nsw York, N.Y. r07

-

7/28/2019 Macro Review Key Ideas

6/13

T

ilgdecrease taxes, increase spending or do acombination of the two.The government uses a contractionary fiscalpolicy to try to decrease aggregate demandwhen the economy is overheating. The gov-ernment may increase taxes, decrease spend-ing or do a combination of the two.A change in output can also be illustrated bythe Keynesian aggregate expenditure model.This model differs from the AD and ASmodel because in the Keynesian model theprice level is assumed to be constant.TheAD andAS model can be reconciledwith the Keynesian expenditure model.Inthe horizontal range of the AS curve, bothmodels are identical. The models differ inthe intermediate and vertical ranges of theAS curve.

Autonomous spending is that part of ADthat is independent of the current rate ofeconomic activity.Induced spending is that part of AD thatdepends on the current level of economicactivity.Discretionary fiscal policy means the federalgovernment must take deliberate action orpass a new law changing taxes or spending.The automatic or built-in stabilizers changegovernment spending or taxes without newlaws being passed or deliberate action beingtaken.Stagflation, when the economy simultane-ously experiences inflation and unemploy-ment, can be explained by a decrease inaggregate supply.

ilg

K g

108 Admnced Placement Economis Macroconomics: Student Activities Q National Council on Economic Education, New York, N.Y.

-

7/28/2019 Macro Review Key Ideas

7/13

-

7/28/2019 Macro Review Key Ideas

8/13

wI Throughout history there have been four

basic types of money: commodity money,representative money, fiat money and check-book money.ll Money has three main functions: a mediumof exchange, a standard ofvalue (or unit ofaccount) and a store ofvalue.

I To accomplish its functions, the characteris-tics of money include portabiliry uniform-ity, acceptabiliry durability, divisibiliry andstability in value.

t M1 is the narrowest definition of money andconsists of checkable deposits, traveler'schecks and currency. Checkable depositsinclude demand deposits and account forabout 75 percent of M1.

J MZ and M3 are broader definitions ofmoney and include savings accounts andother time deposits.

I The demand for money is the sum of trans-actions demand, precautionary demand andspeculative demand. The demand for moneyis determined by interest rates, income andthe price level.il MV = PQ is the eguation of exchange:Money times velocify equals price timesquantity of goods. PQ is the nominal GDP.

I Velocity is the number of times a year thatthe money supply is used to make paymentsfor final goods and services:V=GDPMI Money is created when banks make loans.One bankt loan becomes another banktdemand deposit. Demand deposits aremoney. When a loan is repaid, money isdestroyed.

I Banks are required to keep a percentage oftheir deposits as reserves. Reseryes can becurrency in the bank vault or deposits at theFederal Reserve Banks. This reserve require-ment limits the amount of moneybanks cancreate.The simple deposit expansion multiplier isequal to I divided by the required reserveratio (rr).Deposit expansion multiplier - IrrThe higher the reserve requirement, the lessmoney can be created; the lower the reserverequirement, the more money can be created.The Federal Reserve regulates financial insti-tutions and controls the nation's money sup-ply. The three main tools that the Fed uses tocontrol the money supply are buying andselling government bonds on the open mar-ket (open market operations), changing thediscount rate and changing the reserverequirement.If the Fed wants to encourage bank lendingand increase the money supply, it will buybonds on the open market, decrease the dis-count rate or decrease the reserve require-ment. This is referred to as expansionarymonetary policy or an easy money policyand is used by the Fed to reduce unemploy-ment.If the Fed wants to hold down or decreasethe money supply, it will discourage banklending by selling bonds on the open mar-ket, increasing the discount rate or increas-ing the reserve requirement. This is called acontractionary monetary policy or a tightmoney policy and is used by the Fed to dis-courage bank lending during periods ofinflation.

I

rI

I

t

Admnced Placement Economic lvtacroeconomics: Studcnt Actiyities @ National Council on Economic Education, New York, N.Y. 181

-

7/28/2019 Macro Review Key Ideas

9/13

wwwOpen market operations are the most fre-quently used tool because they permit the Fedto make small changes in the money supplyand can be implemented immediately.Changes in the reserve requirement can havesubstantial economic effects, and thus theFed rarely changes the reserye requirement.The Fed uses changes in the discount rateprimarily as a signal of a change in the direc-tion of monetary policy.

I

tI The Fed cannot target both the money sup-

ply and interest rates simultaneously, so itmust doose which variable to target.

I The Fed currently targets the federal fundsrate rather than the money supply to imple-ment monetary policy. It targets the federalfunds rate because the Fed believes that thisrate is closely tied to economic aaivity.I The federal funds rate is the interest rate abank charges when it lends excess reserves toother banks.

182 Advaned Placment Eonomia Macrocconomic.s; Studcnt Activitics I National Council on Econonric Eduqtion' Ncw York' N.Y.

-

7/28/2019 Macro Review Key Ideas

10/13

-

7/28/2019 Macro Review Key Ideas

11/13

T

f

I

T

IIT

W ,pWMacroeconomic policy involves combina-tions of fiscal and monetarypolicies.The inside lag is the amount of time it takespolicy makers to recognize the economic sit-uation and take action. The outside orimpact lag is the amount of time it takes theeconomy to respond to the poliry changes.The inside lag is long for fiscal policy andshort for monetary poliry. The outside lag isvery short for fiscai poliry and variable formonetarypolicy.Crowding-out is the effect on investmentand consumption spending of an increase ininterest rates caused by increased borrowingby the federal government. The higher inter-est rates crowd out business and consumerborrowing.A Phillips curve illustrates the trade-offbetween inflation and unemployment. Thetrade-offdiffers in the short and long run,varies at different times and is often differ-ent for increases and decreases in output.The short-run Phillips curve shows a trade-offbenveen the inflation rate and the unem-ployment rate.The long-run Phillips curve is vertical.Both monetary and fiscal policies are pri-marily aggregate demand policies, but notall of the macroeconomic problems in theeconomy are aggregate demand problems.

I If factors other than excess aggregate demandare contributing to inflation, it is difficuit formonetary policy to control inflation.

I The Barro-Ricardo effect is the possibilirythat government deficits will lead to anincrease in private savings and a decrease inconsumption, thus offsetting the effects ofexpansionary fiscal poliry.

I Economic growth is concerned with increas-ing an economy's total productive capacityat full employment or its natural rate of out-put. This output is represented by a verticallong-run aggregate supply curye.

I Economic growth can be shown graphicallyas a rightward shift of a nation's long-runaggregate supply curve or a rightward shiftof its production possibilities curve.

I Short-run economic growth is usually meas-ured by changes in real gross domestic prod-uct or by changes in real GDP per capita.

I The rate of economic growth is affected by avariety of aggregate supply and aggregatedemand factors,

I Different economic theories are only onereason why economists disagree. Other rea-sons are different assumptions, different val-ues, different interpretations about economichistory and diflerent ideas about policy lags.

Adwnced Placement Economics Macreconomis: StudentActivities @ National Council on Economic Education, NewYork, N.Y. 237

-

7/28/2019 Macro Review Key Ideas

12/13

-

7/28/2019 Macro Review Key Ideas

13/13

III

w 7:,WPeople and nations trade to improve theirstandard of living.Because trade is the voluntary exchange ofgoods and services, the decision to trade willoccur only if both parties to the exchangeexpect to gain from it.Voluntary trade promotes economicprogress because it allows people andnations to specialize in what they do best.

I The law of comparative advantage explainswhy there are mutual gains from specializa-tion and trade. Through specialization andtrade, nations are able to get beyond, or out-' side of, their production possibilities curve.I A nation has an absolute advantage overanother nation in the production of a goodwhen it can produce more of that goodusing the same amount of resources.

I Comparative advantage occurs when anation can produce a good at a lower oppor-tunity cost than another nation. Relativecosts determine comparative advantage.

I Every nation has a comparative advantage insome good or service.I Tiade barriers such as tariffs and quotas limit

the potential gains from trade. These bar-riers generally protect domestic sellers at theexpense of domestic buyers. Trade barriersreduce efficienry in the allocation of scarceresources and slow economic progress.

I The balance of payments is a broader meas-ure of international transactions than thebalance oftrade. The balance oftrade con-siders only a nation's exPorts and importsof goods, while the balance of paymentsconsiders all international economic trans-actions including the current account, thecapital account and official reserves.

lE There are three accounts within the balanceof payments. The current account records anation's exports and imports of goods, ser-vices, net investment income and net trans-fers. The capital account records the flows ofmoney from the purchase and sale of realand financial assets domesticaily and abroad.The official transactions account is an offset-ting account for government controls.

I For the current and capital accounts, if for-eign currency is used to complete the inter-national transaction, the transaction is adebit (negative). Ifthe transaction earns for-eign currency, it is a credit (positive).

t To trade, nations must exchange currencies'An exchange rate is the price of one curren-cy in terms of another and is generally set bysupply and demand.

I Appreciation is an increase in the value ofa nation's currency in foreign-exchangemarkets. Appreciation of a nation's cur-rency tends to reduce exports and increaseimports.

3 Depreciation is a decrease in the value ofa nation's currency in foreign-exchangemarkets. Depreciation of a nation's cur-rency tends to increase exports and reduceimports.

* Monetary and fiscal policies can affectexchange rates, the international balance oftrade and the balance of PaYments-3 Domestic economic policies affect inter-national trade, and international tradeaffects the domestic economy' influencingeconomic growth, unemployment and therate of inflation.

Advmced Placement Economis Macmeconomia: Studnt Actiyities I National Council on Economic Education, NswYork, N.Y 283