Lubbock Health Facilities Development Corporation, Texas · 2011. 7. 8. · LUBBOCK HEALTH...

Transcript of Lubbock Health Facilities Development Corporation, Texas · 2011. 7. 8. · LUBBOCK HEALTH...

-

REOFFERING – NOT A NEW ISSUE Ratings: See “RATINGS” hereinBOOK-ENTRY ONLY

$105,385,000LUBBOCK HEALTH FACILITIES DEVELOPMENT CORPORATION

Variable Rate Refunding Revenue Bonds(ST. JOSEPH HEALTH SYSTEM)

Series 2008B

Conversion Date: July 14, 2011 Due: July 1, 2023

This Reoffering Circular contains certain information describing the remarketing of the above-captioned bonds (the “Bonds”) in connection with the election by St. Joseph Health System (the “Corporation”) to convert the Interest Rate Mode for the Bonds from the Daily Rate to the Long Term Rate. The Long Term Rate Period for the Bonds shall commence on (and include) the Conversion Date stated above and continue through (and include) June 30, 2023, the day next preceding the final maturity date of the Bonds. Morgan Stanley & Co. LLC will serve as the remarketing agent for the Bonds.

The Bonds are subject to optional and special redemption prior to maturity in certain circumstances, all as described in this Reoffering Circular.

The Bonds are registered in the name of Cede & Co., as nominee of The Depository Trust Company, New York (“DTC”). See APPENDIX E-“BOOK-ENTRY SYSTEM”. Upon conversion to the Long Term Rate, ownership interests in the Bonds will be in denominations of $5,000 or integral multiples thereof. Interest on the Bonds will accrue from the Conversion Date until their respective final maturity dates at the rates set forth on page (i) hereof and shall be payable initially on January 1, 2012 and thereafter on January 1 and July 1 of each year.

While the Bonds have accrued interest at the Daily Rate, payments of principal, interest and purchase price with respect to the Bonds have been secured by a letter of credit that will terminate pursuant to its terms upon conversion of the Interest Rate Mode to the Long Term Rate.

The Bonds are limited obligations of the Lubbock Health Facilities Development Corporation (“LHFDC” or the “Issuer”), are secured under the provisions of a Bond Indenture and Loan Agreement and will be payable from Loan Repayments as described herein to be made by St. Joseph Health System under the Loan Agreement and from certain funds held under the Bond Indenture. The obligation of the Corporation to make such Loan Repayments is evidenced and secured by Obligation No. 62 issued under the Master Indenture, described herein, whereunder the Corporation and certain of its affiliates (the “Members” of the “Obligated Group”) jointly and severally are obligated to make payments on Obligation No. 62 in amounts sufficient to pay principal of and premium, if any, and interest on the Bonds when due.

This cover page contains certain information for quick reference only. It is not intended to be a summary of the security or terms of this bond issue. Investors are advised to read this Reoffering Circular in order to obtain information essential to the making of an informed investment decision.

The Issuer has not participated in the preparation of this Reoffering Circular, and the Issuer makes no representations with respect hereto and is not responsible in any manner for any of the information contained herein.

MORGAN STANLEY

Dated: July 6, 2011

-

St. Joseph Home Care Network

St. Joseph Hospital, Eureka

Redwood Memorial Hospital, Fortuna

Queen of the Valley Hospital, Napa

Santa Rosa Memorial Hospital, Santa Rosa

Petaluma Valley Hospital, Petaluma

St. Mary Medical Center, Apple Valley

St. Jude Medical Center, Fullerton

St. Joseph Hospital, Orange

Mission Hospital, Mission Viejo

St. Joseph Health System

St. Joseph Heritage Healthcare

St. Joseph Health System Home Health

Covenant Medical Group

Covenant Health System

Covenant Medical Center, Lubbock, Texas

Covenant Medical Center Lakeside, Lubbock, Texas

Covenant Children’s Hospital, Lubbock, Texas

Covenant Hospital Levelland, Levelland, Texas

Covenant Hospital Plainview, Plainview, Texas

Covenant Medical Group

Covenant Home Health Care

West Texas/Eastern New Mexico

Southern California Region

Northern California Region

-

(i)

MATURITIES, AMOUNTS, INTEREST RATES AND YIELDS

$105,385,000

LUBBOCK HEALTH FACILITIES DEVELOPMENT CORPORATION Variable Rate Refunding Revenue Bonds

(ST. JOSEPH HEALTH SYSTEM) Series 2008B

Bond

Payment Dates July 1

Principal Amount Interest Rate Yield CUSIP†

2012 $10,960,000 5.00% 0.45% 549208EA0 2013 11,375,000 5.00% 1.25% 549208EB8 2014 11,810,000 5.00% 1.64% 549208EC6 2015 12,265,000 5.00% 2.09% 549208ED4 2016 12,740,000 5.00% 2.48% 549208EE2 2017 13,210,000 5.00% 2.92% 549208EF9 2018 9,025,000 5.00% 3.27% 549208EG7 2019 9,380,000 5.00% 3.59% 549208EH5 2020 9,745,000 5.00% 3.82% 549208EJ1 2021 2,045,000 5.00% 4.01% 549208EK8 2022 1,385,000 4.00% 4.18% 549208EL6 2023 1,445,000 4.25% 4.36% 549208EM4

____________________________________

† Copyright, American Bankers Association. CUSIP® is a registered trademark of the American Bankers Association. CUSIP data herein are provided by Standard & Poor’s, CUSIP Service Bureau, a Division of The McGraw Hill Companies, Inc.

-

(ii)

This Reoffering Circular does not constitute an offer to sell the Bonds or the solicitation of an offer to buy, nor shall there be any sale of the Bonds by any person in any state or other jurisdiction to any person to whom it is unlawful to make such offer, solicitation or sale in such state or jurisdiction. No dealer, broker, salesperson or any other person has been authorized to give any information or to make any representation other than those contained herein in connection with the reoffering of the Bonds, and, if given or made, such information or representation must not be relied upon. The remarketing agent, Morgan Stanley & Co. LLC (the “Remarketing Agent”), has provided the following sentence for inclusion in this Reoffering Circular. The Remarketing Agent has reviewed the information in this Reoffering Circular in accordance with and as part of its responsibilities to investors under the federal securities laws as applied to the facts and circumstances of this transaction, but the Remarketing Agent does not guarantee the accuracy or completeness of such information.

The information relating to DTC and the book-entry system set forth herein under the caption “THE BONDS – Description of the Bonds” and in APPENDIX E – BOOK-ENTRY ONLY SYSTEM has been furnished by DTC. All other information set forth herein has been obtained from the Corporation, other Members of the Obligated Group and other sources (other than the Issuer and DTC) that are believed to be reliable, but such information is not guaranteed as to accuracy or completeness and is not to be construed as a representation by the Issuer or the Remarketing Agent. The information and expressions of opinion herein are subject to change without notice, and neither the delivery of this Reoffering Circular nor any sale of the Bonds made hereunder shall create under any circumstances any indication that there has been no change in the affairs of the Issuer, the Members of the Obligated Group or DTC since the date hereof. This Reoffering Circular is submitted in connection with the remarketing of the Bonds and may not be used, in whole or in part, for any other purpose. The Issuer has not participated in the preparation of this Reoffering Circular, and the Issuer has made no representations with respect hereto and is not responsible in any manner for any of the information contained herein.

THE SOLE PURPOSE OF THIS REOFFERING CIRCULAR IS TO PROVIDE INFORMATION CONCERNING THE CONVERSION OF THE INTEREST RATE MODE WITH RESPECT TO THE BONDS.

_________________________

IN CONNECTION WITH THE REOFFERING OF THE BONDS, THE REMARKETING AGENT MAY OVERALLOT OR EFFECT TRANSACTIONS THAT STABILIZE OR MAINTAIN THE MARKET PRICE OF THE BONDS OFFERED HEREBY AT LEVELS ABOVE THOSE WHICH OTHERWISE MIGHT PREVAIL IN THE OPEN MARKET. SUCH STABILIZING, IF COMMENCED, MAY BE DISCONTINUED AT ANY TIME.

_________________________

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS IN THIS REOFFERING CIRCULAR

Certain statements included in this Reoffering Circular constitute “forward-looking statements.”

Such statements generally are identifiable by the terminology used, such as “plan,” “expect,” “estimate,” “budget” or other similar words. Such forward-looking statements include but are not limited to certain statements contained in the Reoffering Circular under the captions “BONDHOLDERS’ RISKS” and statements contained under the captions “INFORMATION CONCERNING NON-OBLIGATED GROUP MEMBERS—Integrated Physician Operations” and —“Health Maintenance Organizations,” and “HISTORICAL FINANCIAL INFORMATION—Liquidity,”“—Investment Portfolios and Policies,” and “—Compliance with California Seismic Standards” and “Other Information – Employees” in

-

(iii)

APPENDIX A – “INFORMATION CONCERNING ST. JOSEPH HEALTH SYSTEM AND THE OTHER OBLIGATED GROUP MEMBERS.”

The achievement of certain results or other expectations contained in such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements described to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The Corporation does not plan to issue any updates or revisions to those forward-looking statements if or when its expectations change or events, conditions or circumstances on which such statements are based occur or alter.

-

(iv)

TABLE OF CONTENTS

Page(s)

INTRODUCTION ..................................................................................................................................... 1

Purpose of this Reoffering Circular ........................................................................................ 1

Reoffering of the Bonds ......................................................................................................... 1

Failed Conversion................................................................................................................... 2 THE BONDS ............................................................................................................................................. 2

Description of the Bonds ........................................................................................................ 2

Interest on the Bonds .............................................................................................................. 2

Redemption ............................................................................................................................ 2 CONCURRENT FINANCING ................................................................................................................. 4 SECURITY AND SOURCE OF PAYMENT FOR THE BONDS ........................................................... 4

The Master Indenture ............................................................................................................. 5

Security and Enforceability .................................................................................................... 7 ANNUAL DEBT SERVICE REQUIREMENTS .................................................................................... 10 CONTINUING DISCLOSURE ............................................................................................................... 12 BONDHOLDERS’ RISKS ...................................................................................................................... 14

General ................................................................................................................................. 14

Significant Risk Areas Summarized ..................................................................................... 15

Investment Performance ....................................................................................................... 19

Nonprofit Health Care Environment .................................................................................... 19

State Budgets ........................................................................................................................ 21

Health Care Reform .............................................................................................................. 22

Patient Service Revenues ..................................................................................................... 23

Regulatory Environment ...................................................................................................... 29

Business Relationships and Other Business Matters ............................................................ 36

Tax-Exempt Status and Other Tax Matters .......................................................................... 41

Other Risk Factors ................................................................................................................ 44 TAX MATTERS ...................................................................................................................................... 47

General ................................................................................................................................. 47

Information Reporting and Backup Withholding ................................................................. 48

Future Developments ........................................................................................................... 48

-

(v)

RATINGS ................................................................................................................................................ 48 INDEPENDENT AUDITORS ................................................................................................................. 49 REMARKETING .................................................................................................................................... 49 MISCELLANEOUS ................................................................................................................................ 49

APPENDIX A – INFORMATION CONCERNING ST. JOSEPH HEALTH SYSTEM AND THE OTHER OBLIGATED GROUP MEMBERS ..................................................................................................... A-1

APPENDIX B-1 – AUDITED CONSOLIDATED FINANCIAL STATEMENTS AND OTHER FINANCIAL INFORMATION OF ST. JOSEPH HEALTH SYSTEM AND AFFILIATES FOR THE YEARS ENDED JUNE 30, 2010 AND 2009............................................................ B-1-1

APPENDIX B-2 – UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS AND OTHER FINANCIAL INFORMATION OF ST. JOSEPH HEALTH SYSTEM AND AFFILIATES FOR THE NINE MONTHS ENDED MARCH 31, 2011 AND MARCH 31, 2010 ........................................................................................ B-2-1

APPENDIX C-1 – SUMMARY OF MASTER INDENTURE .................................................. C-1-1

APPENDIX C-2 – SUMMARY OF PRINCIPAL BOND DOCUMENTS ............................... C-2-1

APPENDIX D-1 – FORM OF OPINION OF BOND COUNSEL .............................................D-1-1

APPENDIX D-2 – ORIGINAL OPINION OF BOND COUNSEL ...........................................D-2-1

APPENDIX E – BOOK ENTRY ONLY SYSTEM .................................................................. E-1

-

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

REOFFERING CIRCULAR

$105,385,000

LUBBOCK HEALTH FACILITIES DEVELOPMENT CORPORATION Variable Rate Refunding Revenue Bonds

(ST. JOSEPH HEALTH SYSTEM) Series 2008B

INTRODUCTION

Purpose of this Reoffering Circular

The purpose of this Reoffering Circular (the “Reoffering Circular”), including the cover page and appendices hereto, is to set forth information in connection with the conversion of the Interest Rate Mode on and reoffering of the Lubbock Health Facilities Development Corporation Variable Rate Refunding Revenue Bonds (St. Joseph Health System) Series 2008B (the “Bonds”), currently outstanding in the aggregate principal amount of $105,385,000, from a Daily Rate to a Long Term Rate to maturity, to be effective on the Conversion Date. The Bonds were issued on June 19, 2008, in the original aggregate principal amount of $136,185,000, pursuant to a Bond Indenture (the “Bond Indenture”), dated as of June 1, 2008, between the Lubbock Health Facilities Development Corporation (“LHFDC” or the “Issuer”) and Wells Fargo Bank, N.A., as trustee (the “Bond Trustee”). The proceeds of the Bonds were loaned to St. Joseph Health System (the “Corporation”), pursuant to a Loan Agreement, dated as of June 1, 2008 (the “Loan Agreement”), between LHFDC and the Corporation. While the Bonds have accrued interest at the Daily Rate, payments of principal, interest and purchase price with respect to the Bonds have been secured by a letter of credit that will terminate pursuant to its terms upon conversion of the interest rate on the Bonds to the Long Term Rate.

The Corporation is a California nonprofit public benefit corporation headquartered in Orange, California, and is exempt from federal income taxation under section 501(a) of the Internal Revenue Code of 1986, as amended (the “Code”), as an organization described in section 501(c)(3) of the Code. The Corporation serves as the parent corporation of a health care system that operates in California, western Texas and eastern New Mexico. The Corporation and certain of its subsidiaries and affiliates together form the Obligated Group, which is responsible for making payments on Obligation No. 62, which secures the Corporation’s obligation to make Loan Repayments. For more information about the security for the Corporation’s obligations with respect to the Bonds, see “SECURITY AND SOURCE OF PAYMENT FOR THE BONDS” herein.

Reoffering of the Bonds

The Bonds currently bear interest at a Daily Rate in Daily Rate Periods and are subject to mandatory tender and purchase on the conversion date (the “Conversion Date”), which is anticipated to be July 14, 2011. The Bonds are being reoffered in a Long Term Rate Period beginning on (and including) the Conversion Date and ending on June 30, 2023, the day next preceding the final maturity date of the Bonds. After the Conversion Date, interest on the Bonds shall be payable on January 1 and July 1 of each year, commencing January 1, 2012. See “THE BONDS—Interest on the Bonds—Payments of Interest” herein.

-

2

Failed Conversion

If on the Conversion Date any condition precedent to the conversion of the Bonds required under the Bond Indenture shall not be satisfied, including delivery of the required Favorable Opinion of Bond Counsel, the conversion of the Bonds shall not occur, the mandatory tender shall remain effective and the Bonds shall bear interest at a Weekly Rate.

THE BONDS

The following is a summary of certain provisions of the Bonds. Reference is made to the Bonds for the complete text thereof, to APPENDIX C-2 – “SUMMARY OF PRINCIPAL BOND DOCUMENTS” and to the Bond Indenture for a more detailed description of these provisions. The discussion herein is qualified by such reference.

Description of the Bonds

The Bonds were delivered in fully registered form only and are registered in the name of Cede & Co., as nominee of The Depository Trust Company, referred to as DTC. DTC acts as securities depository for the Bonds. Ownership interests in the Bonds may be purchased in book-entry form only. See APPENDIX E – “BOOK-ENTRY SYSTEM”. Upon conversion of the interest rate on the Bonds to the Long Term Rate, ownership interests in the Bonds will be in denominations of $5,000 and integral multiples thereof.

Interest on the Bonds

The Long Term Rate. Upon conversion of the Interest Rate Mode on the Bonds to the Long Term Rate, the Bonds will accrue interest from (and including) the Conversion Date at the rates specified on page (i) of this Reoffering Circular. Interest on the Bonds shall be computed on the basis of a 360-day year, consisting of twelve 30-day months.

Payments of Interest. Interest on the Bonds shall be payable on January 1 and July 1 of each year, commencing January 1, 2012 (each, an “Interest Payment Date”). Payment of interest on a Bond (other than with respect to defaulted interest) will be made on each Interest Payment Date for unpaid interest accrued during the Interest Period (generally the period from and including each Interest Payment Date to and including the day preceding the next Interest Payment Date) to the holder of record on the applicable Record Date. Interest will also be paid on the Mandatory Tender Date as part of the purchase price and in the amount accrued since the prior Interest Payment Date.

As long as the Bonds are registered in the name of Cede & Co., as nominee of DTC, such payments for the Bonds will be made directly to DTC. See APPENDIX E – “BOOK-ENTRY SYSTEM”.

Redemption

Optional Redemption. The Bonds are subject to optional redemption prior to their respective stated maturities, at the option of the Issuer (exercised upon the Request of the Corporation), in whole or in part, in such amounts as may be specified by the Corporation on and after January 1, 2022 and on any date thereafter, at the principal amount thereof plus accrued interest thereon to the date fixed for redemption, without premium.

Special Redemption. The Bonds are subject to redemption prior to their stated maturity, at the option of the Issuer (which option shall be exercised upon Request of the Corporation) in whole or in part

-

3

on any date (in such amounts as may be specified by the Corporation), from hazard insurance or condemnation proceeds received with respect to the facilities of any of the Members and deposited by the Corporation in the Special Redemption Account, at the principal amount thereof, together with interest accrued thereon to the date fixed for redemption, without premium.

The Bonds are also subject to redemption prior to their stated maturity as a whole (but not in part) on any date at the option of the Issuer (which option shall be exercised as directed by the Corporation) at the principal amount thereof and interest accrued thereon to the date fixed for redemption, without premium, if as a result of final judgment, order or determination of a court of competent jurisdiction or of legislative or administrative action, the Corporation or any Member of the Obligated Group obligated under the Master Indenture (by the Corporation being a party to the issuance of the Bonds by the Issuer or the loan of the proceeds thereof to the Corporation) shall be required to take any action which the Corporation believes to be contrary to the principles and beliefs of the Roman Catholic Church.

Notice of Redemption. Notice of redemption shall be mailed by the Bond Trustee by first-class mail not less than thirty (30) days nor more than sixty (60) days prior to the date fixed for redemption to the registered Holder of each Bond subject to redemption, at the Holder’s address as shown on the bond registration books of the Bond Trustee. The Bond Trustee shall also give notice of redemption by overnight mail or courier service to such securities depositories and/or securities information services designated by the Corporation. Failure by the Bond Trustee to give notice to any one or more of the securities information services or depositories or any insufficiency therein in respect of any Bond will not affect the sufficiency of the proceedings for redemption. Failure by the Bond Trustee to mail notice of redemption to any one or more of the respective Holders of any Bonds designated for redemption shall not affect the sufficiency of the proceedings for redemption of the Bonds with respect to the Holder or Holders to whom such notice was mailed. All Bonds so called for redemption will cease to accrue interest on the specified redemption date, provided that funds for their redemption are on deposit with the Bond Trustee at that time, and will no longer be considered Outstanding under the Bond Indenture.

So long as the book-entry system is in effect, the Bond Trustee will send each notice of redemption to Cede & Co., as nominee of DTC, and not to the Beneficial Owners. So long as DTC or its nominee is the sole registered owner of the Bonds under the book-entry system, any failure on the part of DTC or a Direct Participant or Indirect Participant to notify the Beneficial Owner so affected will not affect the validity of the redemption.

Rescission of Notice of Redemption. Any notice of redemption may be rescinded by written notice given to the Bond Trustee by the Corporation no later than five (5) Business Days prior to the date specified for redemption. The Bond Trustee shall give notice of such rescission as soon thereafter as practicable in the same manner, and to the same persons, as notice of such redemption was given.

Mandatory Purchase in Lieu of Redemption

Each Holder or Beneficial Owner, by purchase and acceptance of any Bond, irrevocably grants to the Corporation the option to purchase such Bond at any time such Bond is subject to optional redemption, such Bond to be purchased at a purchase price equal to the then applicable Redemption Price of such Bond. Moneys for such purchase shall be derived solely from Available Moneys. In the event the Corporation determines to exercise such option, the Corporation shall deliver a Favorable Opinion of Bond Counsel to the Bond Trustee, and shall direct the Bond Trustee to provide notice of mandatory purchase and to select Bonds subject to mandatory purchase, in accordance with the terms of the Bond Indenture. On the date fixed for purchase of any Bond as described herein, the Corporation shall pay the purchase price of such Bond to the Bond Trustee in immediately available funds, and the Bond Trustee shall pay the same to the Holders of the Bonds being purchased against delivery thereof. No purchase of any Bond pursuant to the provisions described herein shall operate to extinguish such Bond or the

-

4

indebtedness of the Corporation evidenced by such Bond. No Holder or Beneficial Owner may elect to retain a Bond subject to mandatory purchase in lieu of redemption.

CONCURRENT FINANCING

On or about July 14, 2011, the California Health Financing Facilities Authority is expected to issue bonds on behalf of the Corporation (the “Series 2011 California Bonds”) in the aggregate principal amount of $302,110,000. The Series 2011 Bonds are being offered pursuant to a separate official statement. The reoffering of the Bonds is not contingent on the issuance of the Series 2011 California Bonds.

SECURITY AND SOURCE OF PAYMENT FOR THE BONDS

For information relating to the security and source of payment for the Bonds, see “SECURITY AND SOURCE OF PAYMENT FOR THE BONDS” herein.

General

The Bonds are limited obligations of the Issuer payable from Revenues, which consist primarily of payments made by the Corporation under the Loan Agreement and the Obligated Group under Obligation No. 62. These payments are required to be in an amount sufficient to pay in full, when due, the total interest payable on the Bonds to their stated maturity or earlier redemption, and the total principal amount of the Bonds and the premium, if any, payable on redemption prior to their stated maturity or at maturity.

Pursuant to the provisions of the Bond Indenture, the Issuer has pledged and assigned all amounts held in any fund or account established under the Bond Indenture (other than the Rebate Fund and the Purchase Fund) to the Bond Trustee, and granted a security interest in and assigned to the Bond Trustee all Revenues and any other amounts held in any fund or account established pursuant to the Bond Indenture (other than the Rebate Fund and the Purchase Fund) and all right, title and interest in the Loan Agreement (except certain rights to receive administrative fees and the right to indemnification) and Obligation No. 62.

-

5

Reserve Account

A Reserve Account has been created pursuant to the Bond Indenture, but the Reserve Account is required to be funded only in the event that either (1) the Debt Service Coverage Ratio for any Fiscal Year is less than 2.0:1.0, or (2) the Members of the Obligated Group have less than 85 Days Cash On Hand at the end of any Fiscal Year (the “Days Cash On Hand Requirement”). In the event that the Members of the Obligated Group fail to meet such conditions at any of the required calculation dates, they will be required to fund the Reserve Account in an amount equal to the Reserve Account Requirement within seven days of such calculation date. The Debt Service Coverage Ratio is calculated twice for each fiscal year. The first calculation is based on the unaudited consolidated financial statements of the Obligated Group and is performed within 60 days after the end of the fiscal year, and the second calculation is based on the audited consolidated financial statements of the Obligated Group and is performed within 150 days after the end of the fiscal year. Days Cash on Hand is calculated three times for each fiscal year. The first calculation is for the first six-month period of each fiscal year, is based on the unaudited consolidated financial statements of the Obligated Group and is performed within 60 days of the end of the six-month period. The second calculation is for the fiscal year, is based on the unaudited consolidated financial statements of the Obligated Group and is performed within 60 days of the end of the fiscal year. The third calculation also is for the fiscal year but is based on the audited consolidated financial statements of the Obligated Group and is performed within 150 days of the end of the fiscal year.

The Reserve Account Requirement is defined in the Bond Indenture, as of any date of calculation, as the least of (i) Maximum Annual Bond Service on all Bonds then Outstanding, (ii) 125% of average annual debt service on all Bonds then Outstanding, assuming a rate per annum equal to the then applicable 10 year average of the SIFMA Municipal SWAP Index and (iii) 10% of the original principal amount of the Bonds. The Reserve Account Requirement under the Bond Indenture may be satisfied in whole or in part through the provision of a letter of credit and/or surety bond policy or both, satisfying the requirements of the Bond Indenture. Amounts, if any, deposited in the Reserve Account shall be used and withdrawn by the Bond Trustee solely for the purpose of making up any deficiency in the Interest Account or the Principal Account or (together with any other money available therefor) for the redemption of all Bonds then outstanding. Once the Reserve Account is funded either in cash or through the provision of a letter of credit and/or surety bond policy, the Members of the Obligated Group will be entitled to the release of such amounts or security interest if the Debt Service Coverage Ratio and the Days Cash On Hand Requirement are satisfied for a subsequent fiscal year. See APPENDIX C-2 — “SUMMARY OF PRINCIPAL BOND DOCUMENTS—BOND INDENTURE—Revenues and Funds – Reserve Account.”

The Master Indenture

Joint and Several Obligations. The obligation of the Corporation to make Loan Repayments under the Loan Agreement (the “Loan Repayments”) is absolute and unconditional and is secured by Obligation No. 62. Payments of the principal of, premium, if any, and interest on Obligation No. 62 are required to be sufficient to pay the principal of, redemption premium, if any, and interest on the Bonds secured thereby, when due. Under the Master Indenture, all Members of the Obligated Group are jointly and severally obligated with respect to the payment of all Obligations issued under the Master Indenture.

The Corporation and the other Members of the Obligated Group have issued and may also issue additional Obligations under the Master Indenture and incur or assume other indebtedness or financial obligations, as summarized under APPENDIX C-1 — “SUMMARY OF MASTER INDENTURE — MASTER INDENTURE — Particular Covenants of Each Member of the Obligated Group – Limitations on Incurrence of Additional Indebtedness.”

-

6

All Obligations issued under the Master Indenture are secured on a parity basis. See “SECURITY AND SOURCES OF PAYMENT FOR THE BONDS—The Master Indenture—Outstanding Indebtedness” below.

Unsecured Debt. Obligation No. 62 is not secured by a security interest in any revenues or moneys of the Obligated Group or by a mortgage or lien on the physical assets of any Member of the Obligated Group, although the Bond Trustee, as Holder of Obligation No. 62, will receive the benefit of a prior pledge of Gross Revenues given to other Obligation Holders as described below under the section entitled “Parity Pledge of Gross Revenues,” so long as one or more of such other Obligations that are directly secured by the security interest in Gross Revenues remains Outstanding. Notwithstanding the foregoing, Obligation No. 62 is an unsecured general obligation of the Obligated Group. Accordingly, the holder of Obligation No. 62, including the Bond Trustee, would be an unsecured creditor in any bankruptcy or insolvency proceeding involving a Member. For a description of the limitations on the enforceability of the Master Indenture, see “BONDHOLDERS’ RISKS—Security and Enforceability—Enforceability of the Master Indenture, the Loan Agreement and Obligation No. 62” herein.

Parity Pledge of Gross Revenues. The Obligated Group Members have not made a pledge of Gross Revenues to the Bond Trustee, as holder of Obligation No. 62, to secure the payments due under Obligation No. 62. However, the Obligated Group Members have granted a security interest in the Gross Revenues of the Obligated Group to holders of certain other Obligations (the “Secured Obligations”) previously issued under the Master Indenture and still Outstanding. Under the terms of the supplements to the Master Indenture pursuant to which the pledge of the Obligated Group’s Gross Revenues was made to holders of Secured Obligations, the security interest in the Gross Revenues secures all Obligations Outstanding under the Master Indenture on a parity basis while any of the Secured Obligations is Outstanding. Accordingly, the holders of the Bonds will have the benefit of such pledge of the Gross Revenues so long as at least one of the Secured Obligations is Outstanding. The Holders of Secured Obligations that are currently Outstanding and are expected to remain Outstanding following the Conversion Date are the bond insurers for revenue bonds issued in 2000 and 2007 for the benefit of the Corporation, and Wells Fargo Bank, National Association, as bond trustee for revenue bonds issued in 2009 for the benefit of the Corporation.

Outstanding Indebtedness. As of March 31, 2011, Obligations in the aggregate principal amount of $1,297,200,000 were outstanding. Such Obligations are secured on a parity basis with Obligation No. 62 by the joint and several obligation and guarantee of each Member of the Obligated Group. As of March 31, 2011, Members of the Obligated Group also were obligated on approximately $81,696,000 of additional Long-Term Indebtedness, none of which is secured by any Obligations. See APPENDIX A – “INFORMATION CONCERNING ST. JOSEPH HEALTH SYSTEM AND THE OTHER OBLIGATED GROUP MEMBERS—HISTORICAL FINANCIAL INFORMATION,” APPENDIX B-1 – “AUDITED CONSOLIDATED FINANCIAL STATEMENTS AND OTHER FINANCIAL INFORMATION OF ST. JOSEPH HEALTH SYSTEM AND AFFILIATES FOR THE YEARS ENDED JUNE 30, 2010 AND 2009” and APPENDIX B-2 – “UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS AND OTHER FINANCIAL INFORMATION OF ST. JOSEPH HEALTH SYSTEM AND AFFILIATES FOR THE NINE MONTHS ENDED MARCH 31, 2011 AND MARCH 31, 2010” for a description of such Obligations and other Long-Term Indebtedness. The Corporation also expects to issue additional obligations in connection with the issuance of the Series 2011 Bonds to secure payment obligations of the Corporation to the Holders of, and Credit Facility Providers for, the Series 2011 Bonds.

Proposed Amendments to Master Indenture. The Corporation intends to seek and obtain consent from the Holders of Master Indenture Obligations to amend the definition of “Income Available for Debt Service” in the Master Indenture, through the adoption of an amendment to the Master Indenture. The amendment to the Master Indenture (the “Master Indenture Amendment”) will not go into effect until Holders representing not less than a majority of the principal amount of the Obligations Outstanding

-

7

under the Master Indenture consent to the amendment. By purchasing the Bonds offered hereunder, the Purchasers and the Beneficial Owners will be deemed to have consented to the Master Indenture Amendment. Upon the conversion of the Interest Rate Mode on the Bonds to the Long Term Rate and the issuance of the Series 2011 California Bonds, which is anticipated to occur on or about the Conversion Date, the Corporation will have received the requisite consent of the Holders of Obligations for the Master Indenture Amendment to take effect. See APPENDIX C-1 – “SUMMARY OF MASTER INDENTURE—DEFINITIONS—“Income Available for Debt Service” and “—Proposed Amendments to Master Indenture.”

In addition to the Master Indenture Amendment requiring the consent of the Holders of Obligations described immediately above, the Corporation may propose at a later date amendments to certain provisions of the Master Indenture that do not require the consent of the Holders of Obligations. The provisions that may be amended without the consent of or notice to any Holders of the Obligations and the conditions that must be satisfied before any amendment may be adopted are described in APPENDIX C-1 – “SUMMARY OF MASTER INDENTURE—MASTER INDENTURE—Proposed Amendments to Master Indenture”. Any such amendment could materially and adversely affect the interests of the Holders of Obligations and the holders of the indebtedness secured thereby, including the Bonds.

Replacement of Obligations. The Bond Indenture also provides that, at the option of the Corporation, Obligation No. 62 may be replaced with a note or obligation issued under another obligated group’s master indenture without the consent of Holders and Beneficial Owners of the Bonds under the conditions described therein. Any such substitution of notes or obligations, in certain circumstances, could lead to substantial changes to the current covenant restrictions on the Members in connection with the Bonds. Moreover, any such obligated group could be different financially and operationally than the existing Obligated Group and could have substantial outstanding debt. See APPENDIX C-2 – “SUMMARY OF PRINCIPAL BOND DOCUMENTS—BOND INDENTURE—Replacement of Obligation No. 62” for a description of the conditions that must be satisfied before Obligation No. 62 may be replaced.

Any future amendment to the Master Indenture or replacement of Obligation No. 62 could materially and adversely affect the interests of the Holders and the Beneficial Owners of the Bonds. Other than the proposed amendments to the Master Indenture described above, the Corporation has no current plans to accomplish amendments of the Master Indenture and no current plan to replace Obligation No. 62.

Security and Enforceability

Bankruptcy. In the event of bankruptcy of an Obligated Group Member, the rights and remedies of the Bondholders are subject to various provisions of the federal Bankruptcy Code. If an Obligated Group Member were to file a petition in bankruptcy, payments made by that Obligated Group Member during the 90-day (or perhaps one-year) period immediately preceding the filing of such petition may be avoidable as preferential transfers to the extent such payments allow the recipients thereof to receive more than they would have received in the event of such Obligated Group Member’s liquidation. Security interests and other liens granted to the Bond Trustee or the Master Trustee and perfected during such preference period also may be avoided as preferential transfers to the extent such security interest or other lien secures obligations that arose prior to the date of such perfection. Such a bankruptcy filing would operate as an automatic stay of the commencement or continuation of any judicial or other proceeding against such Member and its property and as an automatic stay of any act or proceeding to enforce a lien upon or to otherwise exercise control over such property, as well as various other actions to enforce, maintain or enhance the rights of the Bond Trustee and the Master Trustee. If the bankruptcy court so ordered, the property of such Member, including Gross Revenues, could be used for the financial

-

8

rehabilitation of such Member despite any security interest of the Bond Trustee therein. The rights of the Bond Trustee and the Master Trustee to enforce their respective security interests and other liens could be delayed during the pendency of the rehabilitation proceeding.

Such Member could file a plan for the adjustment of its debts in any such proceeding, which plan could include provisions modifying or altering the rights of creditors generally or any class of them, secured or unsecured. The plan, when confirmed by a court, binds all creditors who had notice or knowledge of the plan and, with certain exceptions, discharges all claims against the debtor to the extent provided for in the plan. No plan may be confirmed unless certain conditions are met, among which are conditions that the plan be feasible and that it shall have been accepted by each class of claims impaired thereunder. Each class of claims has accepted the plan if at least two-thirds in dollar amount and more than one-half in number of the class cast votes in its favor. Even if the plan is not so accepted, it may be confirmed if the court finds that the plan is fair and equitable with respect to each class of non-accepting creditors impaired thereunder and does not discriminate unfairly.

In addition, the obligations of the Corporation under the Loan Agreement and the Members under the Master Indenture are not secured by a lien on or security interest in any assets or revenues of any Member, other than the lien on Gross Revenues as described herein under “SECURITY AND SOURCE OF PAYMENT FOR THE BONDS” securing all Obligations under the Master Indenture while certain Obligations remain Outstanding. Except with respect to such lien on Gross Revenues, in the event of a bankruptcy of any Member, Bondholders would be unsecured creditors and would be in an inferior position to any secured creditors and on a parity with all other unsecured creditors. Any such plan could adversely affect the owners and beneficial owners of the Bonds.

In the event of bankruptcy of a Member, there is no assurance that certain covenants, including tax covenants, contained in the Loan Agreement or certain other documents would survive. Accordingly, a bankruptcy trustee could take action that would adversely affect the exclusion of interest on the Bonds from gross income of the Bondholders for federal income tax purposes.

In addition, the bankruptcy of a health plan or physician group that is party to a significant managed care arrangement with the Members or any of their affiliates, or that of any significant contract payor obligated to any one or more of the Members or their affiliates, could have material adverse effects on the Members.

Enforceability of the Master Indenture, the Loan Agreement and Obligation No. 62. The legal right and practical ability of the Bond Trustee to enforce its rights and remedies under the Loan Agreement and of the Master Trustee to enforce its rights and remedies under the Master Indenture and under Obligation No. 62 may be limited by laws relating to bankruptcy, insolvency, reorganization, fraudulent conveyance or moratorium and by other similar laws affecting creditors rights. The state of insolvency, fraudulent conveyance and bankruptcy laws relating to the enforceability of guaranties or obligations issued by one corporation in favor of another corporation’s creditors or of an Obligated Group Member’s obligation to make debt service payments on behalf of another Obligated Group Member is unsettled. In particular, such obligations may be voidable under the Federal Bankruptcy Code or applicable state fraudulent conveyance laws if the obligation is incurred without “fair” and/or “fairly equivalent” consideration to the obligor and the incurrence of the obligation renders the Obligated Group Member insolvent. The standards for determining the fairness of consideration and the manner of determining insolvency are not clear and may vary under the Federal Bankruptcy Code, state fraudulent conveyance statutes and applicable cases. Consequently, the Bond Trustee’s and the Master Trustee’s ability to enforce the rights and remedies under the Loan Agreement, the Master Indenture, or Obligation No. 62 against any Obligated Group Member that would be rendered insolvent thereby could be subject to challenge. In addition, enforcement of such rights and remedies will depend upon the exercise of various remedies specified by such documents, which, in many instances, may require judicial actions that are subject to discretion and delay, that otherwise may not be readily available or that may be limited by certain legal principles, including fraudulent conveyance or moratorium and other similar laws.

-

9

In addition, a court could determine, in the event of a bankruptcy of a Member, that payments made on Obligation No. 62 by a bankrupt Member could constitute payments to or for the benefit of an insider, within the meaning of Section 547(b) of the Bankruptcy Code, which payments, if made within one year of the filing of the bankruptcy petition, might be recoverable by the bankruptcy court from the owners of the Bonds.

The joint and several obligation described herein of each Member of the Obligated Group to pay debt service on Obligation No. 62 may not be enforceable against a Member under any of the following circumstances:

(i) to the extent payments on Obligation No. 62 are requested to be made from assets of such Member which are donor-restricted or which are subject to a direct, express or charitable trust that does not permit the use of such assets for such payments;

(ii) if the purpose of the debt created and evidenced by Obligation No. 62 is not consistent with the charitable purposes of such Member, or if the debt was incurred or issued for the benefit of an entity other than a nonprofit corporation that is exempt from federal income taxes under sections 501(a) and 501(c)(3) of the Code and is not a “private foundation” as defined in section 509(a) of the Code;

(iii) to the extent payments on Obligation No. 62 would result in the cessation or discontinuation of any material portion of the health care or related services previously provided by such Member; or

(iv) if and to the extent payments are requested to be made pursuant to any loan violating applicable usury laws.

These limitations on the enforceability of the joint and several obligations of the Members of the Obligated Group on Obligation No. 62 also apply to their obligations on all Obligations. If the obligation of a particular Member of the Obligated Group to make payment on an Obligation is not enforceable and payment is not made on such Obligation when due in full, then Events of Default will arise under the Master Indenture.

There exists common law precedent and legal basis under certain statutes for the ability of the courts to terminate the existence of a nonprofit corporation or undertake supervision of its affairs on various grounds, including a finding that such corporation has insufficient assets to carry out its stated charitable purposes. Such court action may arise on the court’s own motion or pursuant to a petition of the state Attorney General or such other persons who have interests different from those of the general public, pursuant to the common law and statutory power to enforce charitable trusts and to see to the application of their funds to their intended charitable uses.

The various legal opinions delivered concurrently with the issuance of the Bonds were qualified as to the enforceability of the various legal instruments by limitations imposed by state and federal laws, rulings, policy and decisions affecting remedies and by bankruptcy, reorganization or other laws of general application affecting the enforcement of creditors’ rights or the enforceability of certain remedies or document provisions.

Perfection of a Security Interest. As discussed under the section entitled “Parity Pledge of Gross Revenues” and for so long as any of the Secured Obligations remains Outstanding, each Member of the Obligated Group has granted a security interest in the Gross Revenue Fund and all of the Gross Revenues of the Obligated Group (to the extent permitted by law) and has perfected the grant of a security interest in the Gross Revenues to the extent that such security interest may be perfected under the Uniform Commercial Codes of the State of California, the State of New Mexico and the State of Texas. The grant of a security interest in Gross Revenues may be subordinated to the interest and claims of others in

-

10

several instances. Some examples of cases of subordination of prior interests and claims are (i) statutory liens, (ii) rights arising in favor of the United States of America or any agency thereof, (iii) present or future prohibitions against assignment in any federal statutes or regulations, (iv) constructive trusts, equitable liens or other rights impressed or conferred by any state or federal court in the exercise of its equitable jurisdiction, and (v) federal or state bankruptcy laws that may affect the enforceability of the Master Indenture or grant of a security interest in Gross Revenues. In addition, it may not be possible to perfect a security interest in any manner whatsoever in certain types of Gross Revenues (e.g., gifts, donations, certain insurance proceeds, Medicare and Medicaid payments) prior to actual receipt by any Member for deposit in the Gross Revenue Fund.

FOR A FURTHER DESCRIPTION OF THE PROVISIONS OF THE INDENTURE, THE LOAN AGREEMENT AND THE MASTER INDENTURE, SEE APPENDIX C –1 AND C-2 “SUMMARY OF MASTER INDENTURE AND SUMMARY OF PRINCIPAL BOND DOCUMENTS.”

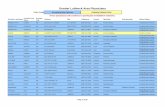

ANNUAL DEBT SERVICE REQUIREMENTS

The table on the following page sets forth, for each year ending July 1, the estimated amounts required to be made available for the payment of principal and interest due on the Bonds. The following table also includes the estimated debt service due on the Series 2011 Bonds, the debt service on all other outstanding bonds issued previously for the benefit of the Corporation, and the Corporation’s total debt service following the reoffering of the Bonds and the issuance of the Series 2011 Bonds.

-

11

ANNUAL DEBT SERVICE REQUIREMENTS

Year Ending July 1, Principal of the

Bonds Interest on the

Bonds

Principal of the Series 2011 California

Bonds

Interest on the Series 2011 California

Bonds (1)

Total Debt Service on Other Outstanding

Bonds(2) Total Debt

Service

2012 $10,960,000 $5,055,176 $7,412,638 $76,228,600 $99,656,413 2013 11,375,000 4,696,563 7,661,244 76,396,286 100,129,093 2014 11,810,000 4,127,813 7,673,594 76,301,038 99,912,444 2015 12,265,000 3,537,313 7,673,594 75,317,946 98,793,852 2016 12,740,000 2,924,063 7,685,944 74,684,275 98,034,281 2017 13,210,000 2,287,063 7,661,244 74,222,978 97,381,284 2018 9,025,000 1,626,563 7,673,594 78,461,163 96,786,319 2019 9,380,000 1,175,313 7,673,594 78,180,788 96,409,694 2020 9,745,000 706,313 7,685,944 77,733,325 95,870,581 2021 2,045,000 219,063 7,661,244 84,825,750 94,751,057 2022 1,385,000 116,813 7,673,594 84,892,606 94,068,013 2023 1,445,000 61,413 7,673,594 84,591,194 93,771,200 2024 $11,515,000 7,685,944 60,579,981 79,780,925 2025 11,835,000 7,369,234 60,577,531 79,781,765 2026 12,120,000 7,080,504 60,579,613 79,780,116 2027 12,430,000 6,772,656 60,580,013 79,782,668 2028 12,735,000 6,467,326 60,577,688 79,780,013 2029 13,080,000 6,123,594 60,580,413 79,784,006 2030 13,400,000 5,801,233 60,580,863 79,782,096 2031 13,740,000 5,460,873 60,580,988 79,781,861 2032 14,085,000 5,120,104 60,578,925 79,784,029 2033 14,460,000 4,746,467 60,577,275 79,783,742 2034 14,820,000 4,386,834 60,576,388 79,783,221 2035 15,195,000 4,010,406 60,577,275 79,782,681 2036 15,575,000 3,630,286 60,576,488 79,781,774 2037 15,980,000 3,223,652 60,580,263 79,783,914 2038 16,380,000 2,822,956 60,577,700 79,780,656 2039 16,800,000 2,406,904 60,576,938 79,783,841 2040 38,200,000 1,983,371 39,600,500 79,783,871 2041 39,760,000 1,008,279 39,011,688 79,779,966 2042 38,374,313 38,374,313 2043 37,938,375 37,938,375 2044 37,315,000 37,315,000 2045 36,636,125 36,636,125 2046 36,026,750 36,026,750 2047 35,279,938 35,279,938 TOTAL: $105,385,000 $26,533,469 $302,110,000 $177,910,445 $2,211,276,980 $2,823,215,877

(1) Assumes an interest rate of 2.54% on the Series 2011 California Bonds. (2) Debt service on the Issuer’s Revenue Bonds (St. Joseph Health System) Series 2008A and the California Health Facilities Financing Authority Revenue Bonds (St. Joseph Health System) Series 2009C and Series 2009D

assumes an interest rate of 4% from their respective Mandatory Tender Dates of October 16, 2012, October 16, 2014 and October 18, 2016; debt service for all other outstanding bonds at fixed rates of between 4.00% and 5.75%.

-

12

CONTINUING DISCLOSURE

Under a Master Continuing Disclosure Undertaking dated as of October 1, 1997, as amended as of July 1, 2011 (the “Master Continuing Disclosure Undertaking”), the Corporation, acting as Obligated Group Representative (the “Obligated Group Representative”) and as initial dissemination agent thereunder (the Corporation in such capacity and any other person appointed as replacement dissemination agent pursuant to the terms thereof are referred to herein as the “Dissemination Agent”), has agreed to provide certain financial information and operating data (collectively, the “Annual Report”) for each of the Obligated Group’s fiscal years in accordance with Rule 15c2-12 promulgated by the Securities and Exchange Commission (the “SEC”). The Corporation will prepare and, as Dissemination Agent, will deliver to the Remarketing Agent a Continuing Disclosure Certificate (the “Continuing Disclosure Certificate”), dated as of the date of the Conversion of the Bonds that will designate the Bonds as Related Bonds under the Master Continuing Disclosure Undertaking. The financial information and operating data that will be provided with respect to those consolidated entities that were Members of the Obligated Group during the fiscal years to which such information and data relate will consist of the following:

Annual Report. The audited consolidated financial statements of the Corporation and affiliates, prepared in accordance with generally accepted accounting principles (except as disclosed in the independent auditors report and footnotes to the financial statements), will be provided on a comparative basis for the two most recent fiscal years.

The Annual Report also will contain financial information consisting of an update of the information contained in the tables under the following captions under “HISTORICAL FINANCIAL INFORMATION” in APPENDIX A to this Reoffering Circular: “—Summary of Revenues and Expenses of the Obligated Group,” “—Historical Debt Service Coverage,” “—Capitalization,” and “—Sources of Revenue” each for the most recent Fiscal Year to the extent not otherwise included in the audited consolidated financial statements of the Corporation and its affiliates.

The Annual Report also will contain operating data consisting of aggregate operating data for the Obligated Group of the type which is set forth in APPENDIX A to this Reoffering Circular in the tables under the captions “INFORMATION CONCERNING THE OBLIGATED GROUP MEMBERS—General” and “—Historical Utilization,” and the number of employees employed by the Obligated Group and the percentage of those employees who were unionized.

Replacement Continuing Disclosure Certificate. The Corporation may deliver a Continuing Disclosure Certificate (a “Replacement Continuing Disclosure Certificate”) that may specify other types of financial information or operating data to be contained in the Annual Report which shall be in addition to, or instead of, the types of financial information and operating data described above.

Any Replacement Continuing Disclosure Certificate shall (a) identify the information that will no longer be included in the Annual Report; (b) state that the deletion of such information is being made in connection with a change in (1) the identity, nature or status of any Member of the Obligated Group, (2) the types of business conducted by the Members of the Obligated Group and/or (3) the laws applicable to the Members of the Obligated Group.

In addition, a determination by a party unaffiliated with any Obligated Group Member or any issuer of related bonds that the substitution or the deletion of information will not adversely affect the Bondholders in any material respect or, the consent of the majority of the Bondholders to such substitution or deletion, is required in connection with such Replacement Continuing Disclosure Certificate.

The Replacement Continuing Disclosure Certificate also shall explain, in narrative form, the reasons for the Replacement Continuing Disclosure Certificate and the impact of the change in the type of operating data or financial information being provided.

-

13

Delivery of Information. The Master Continuing Disclosure Undertaking requires the Corporation to provide the Annual Report not later than the end of the sixth month after the end of each of the Obligated Group’s Fiscal Years. Pursuant to the Master Continuing Disclosure Undertaking, the Dissemination Agent agrees to provide the Annual Report within five (5) business days after receipt to the Municipal Securities Rulemaking Board (“MSRB”) or the SEC by filing with the MSRB through the MSRB Electronic Municipal Market Access System (“EMMA”), currently located at http://emma.msrb.org.

Notices. Pursuant to the Master Continuing Disclosure Undertaking, the Dissemination Agent is required to give notice to EMMA if the Corporation fails to provide the Annual Report within the required time period.

The Master Continuing Disclosure Undertaking also requires the Corporation to provide on a timely basis, for dissemination by the Dissemination Agent to EMMA, if any, notice of the occurrence of any of the following events within ten (10) business days of occurrence:

(1) principal and interest payment delinquencies;

(2) nonpayment related defaults, if material;

(3) unscheduled draws on debt service reserves reflecting financial difficulties;

(4) unscheduled draws on credit enhancements reflecting financial difficulties;

(5) substitution of credit provider or its failure to perform;

(6) adverse tax opinions, the issuance by the Internal Revenue Service of proposed or final determinations of taxability, Notices of Proposed Issue (IRS Form 5701-TEB) or other material notices or determinations with respect to the tax status of the Bonds, or other material events affecting the tax status of the Bonds;

(7) modifications to rights of Holders, if material;

(8) bond calls, if material, or tender offers;

(9) defeasances;

(10) release, substitution or sale of property securing repayment of the Bonds, if material;

(11) rating changes;

(12) bankruptcy, insolvency, receivership or similar event of an Obligated Group Member;

(13) the consummation of a merger, consolidation, or acquisition involving an Obligated Group Member or the sale of all or substantially all of the assets of an Obligated Group Member, other than in the ordinary course of business, the entry into a definitive agreement to undertake such an action or the termination of a definitive agreement relating to any such actions, other than pursuant to its terms, if material; and

(14) appointment of a successor or additional trustee or the change of name of a trustee, if material.

The Master Continuing Disclosure Undertaking will remain in effect as long as any Bonds or any Related Bonds remain Outstanding and shall require the Corporation to provide financial information and operating data for a consolidated entity as long as such consolidated entity is a Member of the Obligated Group during the Fiscal Years to which such information and data relate. The Master Continuing Disclosure Undertaking has been entered into for the benefit of the Holders and Beneficial Owners of the Bonds. The Master Continuing Disclosure Undertaking may be enforced by any Holder or Beneficial Owner of the Bonds and shall be enforced by the Dissemination Agent at the direction of the Holders or

-

14

Beneficial Owners of at least 25% in aggregate principal amount of the Bonds or any series of Related Bonds.

Within the prior five years, the Corporation has not failed to comply in all material respects with any previous undertaking with regard to Rule 15c2-12 to provide financial information, operating data or events notices.

Quarterly Disclosure. Pursuant to the Continuing Disclosure Certificate, the Corporation will provide to the MSRB through EMMA, not later than 90 days after the end of the first three fiscal quarters, unaudited financial information for the Obligated Group for such fiscal quarter, including a balance sheet, a cash flow statement and a consolidated statement of operations.

BONDHOLDERS’ RISKS

The purchase of the Bonds involves certain investment risks that are discussed throughout this Reoffering Circular. Accordingly, each prospective purchaser of the Bonds should make an independent evaluation of all of the information presented in this Reoffering Circular in order to make an informed investment decision. This section on Bondholders’ Risks focuses primarily on the general risks associated with hospital or health system operations, whereas APPENDIX A describes the Obligated Group specifically. These should be read together. This discussion is not intended to be comprehensive or definitive, but rather to summarize certain matters that could affect payment of the Bonds. Investors should recognize that the discussion below does not cover all such risks, that payment provisions for, and regulations and restrictions on, hospitals change frequently and that additional material payment limitations and regulations or restrictions may be created, implemented or expanded while the Bonds are Outstanding, any of which could materially and adversely affect the Obligated Group.

General

Except as noted herein under “SECURITY AND SOURCE OF PAYMENT FOR THE BONDS,” the Bonds are payable solely from and secured by Loan Repayments made pursuant to the Loan Agreement and payments made pursuant to Obligation No. 62. No representation or assurance can be made that revenues will be realized by the Corporation or other Obligated Group Members in amounts sufficient to make the payments under the Loan Agreement or Obligation No. 62 and, thus, to pay principal of and interest on the Bonds.

The Members of the Obligated Group are subject to a wide variety of federal and state regulatory actions and legislative and policy changes by those governmental and private agencies that administer Medicare, Medicaid, and other third-party payors and are subject to actions by, among others, the National Labor Relations Board, The Joint Commission, the Centers for Medicare and Medicaid Services (“CMS”) of the U.S. Department of Health and Human Services (“DHHS”), the Attorneys General of California and Texas, and other federal, state and local government agencies. New legislation, regulatory actions or policy shifts by such governmental and non-governmental oversight agencies could negatively affect the business operations and financial condition of the Corporation and the other Obligated Group Members.

In addition, the future financial condition of Obligated Group Members could be adversely affected by, among other things, changes in reimbursement levels or payment and coverage practices of, or the decline in the financial viability of, government health care programs, commercial payors and other purchasers of health care services; increased competition from other health care providers; escalation of the costs of providing services; demographic shifts affecting the population’s health care needs or demand for health care services in areas where the Obligated Group Members operate; changes in the type, source

-

15

and benefit composition of health care insurance coverage held by patients of the Obligated Group Members; worsening of local or national economic conditions generally; changes in the supply of physicians and nurses or the Obligated Group Members’ ability to recruit such health care professionals; the availability and affordability of insurance; increases in the occurrence or successfulness of malpractice claims and other litigation affecting health care providers; and the capability of the management of the Corporation and the Obligated Group Members to respond to changes in the health care industry. Such factors, consequently, also may affect payment by the Corporation and the Obligated Group of principal, premium, if any, and interest on the Bonds. There can be no assurance that the financial condition of the Obligated Group Members and/or utilization of the Obligated Group Members’ facilities will not be adversely affected by any of these factors.

Several of the key risks inherent in the business operations of health care providers such as the Corporation and the other Obligated Group Members are described below.

Significant Risk Areas Summarized

Certain of the primary risks associated with the operations of the Obligated Group are briefly summarized in general terms below and are explained in greater detail in subsequent sections. The occurrence of one or more of these risks could have a material adverse effect on the financial condition and results of operations of the Obligated Group Members and, in turn, the ability of the Obligated Group to make payments under the Loan Agreement and Obligation No. 62.

Federal Health Care Reform. The federal health care reform legislation enacted in March 2010 contains extensive provisions and calls for the development of regulations that will take effect and be implemented over the course of the next eight years. This legislation addresses almost all aspects of hospital and provider operations, health care delivery and reimbursement. These changes will likely result in lower hospital and provider reimbursement, utilization changes, increased government enforcement and the necessity for health care providers to assess, and potentially alter, their business strategy and practices, among other consequences.

General Economic Conditions; Bad Debt, Indigent Care and Investment Performance. Health care providers are affected by the economic environment in which they operate. To the extent that employers reduce their workforces or budgets for employee health care coverage or private and public insurers seek to reduce payments to health care providers or curb utilization of health care services, health care providers may experience decreases in insured patient volume and reductions in payments for services. In addition, to the extent that state, county or city governments are unable to provide a safety net of medical services, pressure is applied to local health care providers to increase free care. Furthermore, economic downturns and lower funding of Medicare and state Medicaid and other state health care programs may increase the number of patients who are unable to pay for their medical and hospital services. These conditions may give rise to increases in health care providers’ uncollectible accounts, or “bad debt,” and, consequently, to reductions in operating income. Declines in investment portfolio values may reduce or eliminate non-operating revenues. Losses in pension and benefit funds may result in increased funding requirements. Potential failure of lenders, insurers or vendors may negatively impact the results of operations and the overall financial condition of health care providers. Philanthropic support may also decrease or be delayed.

Interest Rate Swaps and Hedge Risk. Interest rate swaps, which are relatively common in connection with certain tax-exempt bonds, have experienced negative trading patterns, causing many to cease to function effectively to hedge interest rate exposure. Some swap counterparties have ceased to exist and others have suffered repeated downgrading and negative market perception. Further, certain swap arrangements may not be terminable except upon the payment of termination fees by the borrowing party, which may be substantial in amount. In the interim, negative mark-to-market valuation of certain

-

16

swap arrangements must be recorded on a borrower’s balance sheet. These factors may have a material adverse impact on hospitals and health systems involved in such financial arrangements. For a discussion of the interest rate swap agreements that the Corporation has entered into, see APPENDIX A – “INFORMATION CONCERNING ST. JOSEPH HEALTH SYSTEM AND THE OTHER OBLIGATED GROUP MEMBERS – HISTORICAL FINANCIAL INFORMATION – Interest Rate Swap Arrangements.”

Rate Pressure from Insurers and Purchasers. Certain health care markets, including many communities in California, are strongly impacted by large health insurers and, in some cases, by major purchasers of health services. In those areas, health insurers may have significant influence over the rates, utilization and competition of hospitals and other health care providers. Rate pressure imposed by health insurers or other major purchasers, including managed care payers, may have a material adverse impact on health care providers, particularly if major purchasers put increasing pressure on payers to restrain rate increases. Business failures by health insurers also could have a material adverse impact on contracted hospitals and other health care providers in the form of payment shortfalls or delay and continuing obligations to care for managed care patients without receiving payment. In addition, disputes with non–contracted payers may result in an inability to collect billed charges from these payers.

Nonprofit Health Care Environment. The significant tax benefits received by nonprofit, tax-exempt hospitals may cause the business practices of such hospitals to be subject to scrutiny by public officials and the press, and to legal challenges of the ongoing qualification of such organizations for tax-exempt status. Practices that have been examined, criticized or challenged have included pricing practices, billing and collection practices, charitable care and executive compensation. Challenges to entitlement to exemption of property from real property taxation have succeeded from time to time. Multiple governmental authorities, including state attorneys general, the Internal Revenue Service (the “IRS”), Congress and state legislatures have held hearings and carried out audits regarding the conduct of tax-exempt organizations, including tax-exempt hospitals. These efforts will likely continue in the future. Citizen organizations, such as labor unions and patient advocates, have also focused public attention on the activities of tax-exempt hospitals and raised questions about their practices. Proposals to increase the regulatory requirements for nonprofit hospitals’ retention of tax-exempt status, such as by establishing a minimum level of charity care, have also been introduced repeatedly in Congress. Significant changes in the obligations of nonprofit, tax-exempt hospitals and challenges to or loss of the tax-exempt status of non-profit hospitals generally, or the Corporation in particular, could have a material adverse effect on the Corporation.

Capital Needs vs. Capital Capacity. Hospital and other health care operations are capital intensive. Regulation, technology and expectations of physicians and patients require constant and often significant capital investment. In California, seismic safety standards mandated by the State may require that many hospital facilities be substantially modified, replaced or closed. Nearly all hospitals in the state are affected. Estimated construction costs are substantial and actual costs of compliance may exceed estimates. Total capital needs may exceed capital capacity.

Construction Risks. Construction projects are subject to a variety of risks, including but not limited to delays in issuance of required building permits or other necessary approvals or permits, including environmental approvals, strikes, shortages of materials and labor, and adverse weather conditions. Such events could delay occupancy. Cost overruns may occur due to change orders, delays in the construction schedule, scarcity of building materials and labor and other factors. Cost overruns could cause the costs to exceed available funds.

Reliance on Medicare. Inpatient hospitals rely to a high degree on payment from the federal Medicare program. Recent changes in the underlying law and regulations, as well as in payment policy and timing, create uncertainty and could have a material adverse impact on hospitals’ payment stream

-

17

from Medicare. The ACA (as defined herein) contains provisions for decreasing Medicare expenditures for health care, in particular inpatient hospital care, during the next decade.

Government “Fraud” Enforcement. “Fraud” in government funded health care programs is a significant concern of federal and state regulatory agencies overseeing health care programs and is one of the federal government’s prime law enforcement priorities. The federal government and, to a lesser degree, state governments impose a wide variety of extraordinarily complex and technical requirements intended to prevent over-utilization based on economic inducements, misallocation of expenses, overcharging and other forms of “fraud” in the Medicare and Medicaid programs, as well as other state and federally-funded health care programs. This body of regulation impacts a broad spectrum of hospital and other health care provider commercial activity, including billing, accounting, recordkeeping, medical staff oversight, physician contracting and recruiting, cost allocation, clinical trials, discounts and other functions and transactions.

Violations and alleged violations may be deliberate but also frequently occur in circumstances where management is unaware of the conduct in question, as a result of mistake, or where the individual participants do not know that their conduct is in violation of law. Violations may occur and be prosecuted in circumstances that do not have the traditional elements of fraud, and enforcement actions may extend to conduct that occurred in the past. Violations carry significant sanctions. The government periodically conducts widespread investigations covering categories of services or certain accounting or billing practices.

Violations and Sanctions. The government and/or private “whistleblowers” often pursue aggressive investigative and enforcement actions. The government has a wide array of civil, criminal, monetary and other penalties, including the suspension of essential hospital and other health care provider payments from the Medicare or Medicaid programs or exclusion from those programs. Aggressive investigation tactics, negative publicity and threatened penalties can be, and often are, used to force health care providers to enter into monetary settlements in exchange for releases of liability for past conduct, as well as agreements imposing prospective restrictions and/or mandated compliance requirements on health care providers. Such negotiated settlement terms may have a materially adverse impact on hospital and other health care provider operations, financial condition, results of operations and reputation. Multi-million dollar fines and settlements for alleged intentional misconduct, fraud or false claims are not uncommon in the health care industry. These risks are generally uninsured. Government enforcement and private whistleblower suits may increase in the hospital and health care sector. Many large hospital and other health care provider systems are likely to be adversely impacted.

Personnel Shortage. From time to time, shortages of physicians and nursing and other technical personnel occur, which may have its primary impact on hospitals and health care systems. Various studies have predicted that physician and nurse shortages will become more acute over time, as practitioners retire and patient volume exceeds the growth in new professionals. For example, in California, regulation of nurse staff ratios intensifies the shortage of nursing personnel. In addition, shortages of other professional and technical staff such as pharmacists, therapists, laboratory technicians and others may occur. Hospital operations, patient and physician satisfaction, financial condition and future growth could be negatively affected by personnel shortages, resulting in material adverse impact to hospitals and health care systems.

Technical and Clinical Developments. New clinical techniques and technology, as well as new pharmaceutical and genetic developments and products, may alter the course of medical diagnosis and treatment in ways that are currently unanticipated, and that may dramatically change medical and hospital care. These could result in higher health care costs, reductions in patient populations, lower utilization of hospital service and new sources of competition for hospitals.

-

18