L&T

-

Upload

alok-sinha -

Category

Documents

-

view

96 -

download

0

Transcript of L&T

Financial Analysis and Valuation Project 2012

Financial Analysis: why L&T is good buy

Submitted To: Prof. KP Rajendran

Submitted By:Alok Kumar Sinha(ePGP-03-095)

Ramesh Saripalli(ePGP-03-228) Sanjay Bhatia(ePGP-03-162) Sreedevi Raghavan(ePGP-03-075)

IIMK Page 1

Financial Analysis and Valuation Project 2012

Table of Contents

Financial Analysis: why L&T is good buy..........................................................................1Company Description..........................................................................................................3Business Strategy.................................................................................................................3Strength and Weaknesses....................................................................................................3Competition Breakup...........................................................................................................5Balance Sheet.......................................................................................................................6Profit & Loss account..........................................................................................................7Cash Flow............................................................................................................................8Key Financial Ratios............................................................................................................8Recommendations:-...........................................................................................................16

IIMK Page 2

Financial Analysis and Valuation Project 2012

Company Description

L&T, headquartered in Mumbai, is a technology-driven engineering and construction Company, and one of the largest companies in India’s private sector. It has additional interests in manufacturing, services, and information technology. A strong customer focused approach and constant quest for top-class quality has enabled the company attain and sustain leadership in major lines of businesses over seven decades. L&T has international presence with a global spread of offices. L&T has recently build up a world class BTG facility in Hazira which can cater up to 5 sets per year. With factories and offices located around the country, further supplemented by a wide marketing and distribution network, L&T’s image and equity extend to virtually every district of India. The company aspires to increase its in-house manufacturing scope through its entry into power equipment (mainly BTG) manufacturing.

Business StrategyBest equipped to ride infrastructure capex cycle: L&T is India’s largest infrastructure andEPC company with presence across major verticals like process, hydrocarbons, power, core infrastructure like roads, ports, bridges, industrial structures etc. Diversified business dominance: L&T has a dominant position and market share in most operating verticals, be it oil & gas, process projects, roads, bridges, or industrial structures. It has dedicated key business divisions with skilled manpower. New business verticals to enhance revenue base: Ship building, Power BTG & Nuclear tie up to enhance revenue in the future.

Strength and WeaknessesEconomy slowdown: Being a play across the India growth spectrum, any slowdown in the broad economy will impact L&T’s operations. Also, given that a large part of the infrastructure capex is government-driven, any political instability could impact the roll-out plans and, in turn, the company’s growth plans. Raw material costs and execution risks: Any sudden surge in prices of base raw material comprising steel, aluminum, cement etc., could detrimentally affect the company’s margin/operations, despite most contracts having a built-in price escalation clause. Also, given the scale of projects being executed, any execution delay could cost the company dearly.

IIMK Page 3

Financial Analysis and Valuation Project 2012

IIMK Page 4

Financial Analysis and Valuation Project 2012

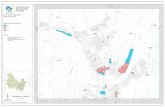

Competition Breakup

We prefer L&T over its peers, as it is a market leader and fundamentally the strongest infrastructure company.

IIMK Page 5

Financial Analysis and Valuation Project 2012

Balance Sheet ------------------- in Rs. Cr. -------------------

Mar '11 Mar '10 Mar '09 Mar '08 Mar '07

12 mths 12 mths 12 mths 12 mths 12 mths

Sources Of FundsTotal Share Capital 121.77 120.44 117.14 58.47 56.65Equity Share Capital 121.77 120.44 117.14 58.47 56.65Share Application Money 368.31 25.09 0.00 0.00 0.00Preference Share Capital 0.00 0.00 0.00 0.00 0.00Reserves 21,334.05 18,142.82 12,317.96 9,470.71 5,683.85Revaluation Reserves 22.13 23.29 24.59 25.90 27.93Networth 21,846.26 18,311.64 12,459.69 9,555.08 5,768.43Secured Loans 1,063.04 955.73 1,102.38 308.53 245.40Unsecured Loans 6,098.07 5,845.10 5,453.65 3,275.46 1,832.35Total Debt 7,161.11 6,800.83 6,556.03 3,583.99 2,077.75Total Liabilities 29,007.37 25,112.47 19,015.72 13,139.07 7,846.18

Application Of FundsGross Block 8,897.02 7,235.78 5,575.00 4,188.91 2,876.30Less: Accum. Depreciation 2,220.82 1,727.68 1,421.39 1,242.47 1,122.83Net Block 6,676.20 5,508.10 4,153.61 2,946.44 1,753.47Capital Work in Progress 785.00 857.66 1,040.99 699.00 471.22Investments 14,684.82 13,705.35 8,263.72 6,922.26 3,104.44Inventories 1,577.15 1,415.37 5,805.05 4,305.91 3,001.14Sundry Debtors 12,427.61 11,163.70 10,055.52 7,365.01 5,504.64Cash and Bank Balance 1,518.98 1,104.89 693.13 779.86 993.68Total Current Assets 15,523.74 13,683.96 16,553.70 12,450.78 9,499.46Loans and Advances 19,499.23 12,662.55 7,198.85 3,861.10 2,449.14Fixed Deposits 211.37 326.98 82.16 184.60 100.75Total CA, Loans & Advances 35,234.34 26,673.49 23,834.71 16,496.48 12,049.35Deffered Credit 0.00 0.00 0.00 0.00 0.00Current Liabilities 26,139.56 19,443.77 15,211.04 11,892.75 8,362.01Provisions 2,233.43 2,188.36 3,066.53 2,035.42 1,180.13Total CL & Provisions 28,372.99 21,632.13 18,277.57 13,928.17 9,542.14Net Current Assets 6,861.35 5,041.36 5,557.14 2,568.31 2,507.21Miscellaneous Expenses 0.00 0.00 0.26 3.06 9.84Total Assets 29,007.37 25,112.47 19,015.72 13,139.07 7,846.18

Contingent Liabilities 1,647.66 1,719.39 1,371.86 1,013.51 270.22Book Value (Rs) 352.40 303.28 212.32 325.98 202.65

IIMK Page 6

Financial Analysis and Valuation Project 2012

Performance in-line with estimates: On the top-line front, L&T reported decent top-line growth of 20.0% yoy. On the EBITDA front, with the company reporting a yoy dip of 130bp to 13.9%

IIMK Page 7

Financial Analysis and Valuation Project 2012

Top line grows by healthy 20%For 4QFY2012, L&T reported decent top-line growth of 20.0% yoy. This was mainly on account of pick-up in the E&C segment, which recorded 23.4% top-line growth.

Profit & Loss account

------------------- in Rs. Cr. -------------------

Mar '11 Mar '10 Mar '09 Mar '08 Mar '07

12 mths 12 mths 12 mths 12 mths 12 mths

IncomeSales Turnover 44,055.55 37,187.50 34,249.85 25,280.49 17,983.37Excise Duty 398.84 317.31 393.31 334.38 338.08Net Sales 43,656.71 36,870.19 33,856.54 24,946.11 17,645.29Other Income 1,781.28 2,321.67 1,612.58 616.69 459.80Stock Adjustments 559.49 -422.99 105.11 746.17 121.76Total Income 45,997.48 38,768.87 35,574.23 26,308.97 18,226.85

ExpenditureRaw Materials 12,372.32 9,593.53 9,316.38 8,256.46 5,320.98Power & Fuel Cost 355.45 334.08 456.39 365.25 308.13Employee Cost 2,884.53 2,379.14 1,998.02 1,535.44 1,258.21Other Manufacturing Expenses

19,886.12 16,913.31 15,659.17 10,632.83 7,451.07

Selling and Admin Expenses 2,103.38 1,854.23 1,844.83 1,393.80 1,222.80Miscellaneous Expenses 773.70 325.58 569.32 280.69 166.15Preoperative Exp Capitalised -37.87 -36.25 -24.48 -11.42 -3.30Total Expenses 38,337.63 31,363.62 29,819.63 22,453.05 15,724.04

Operating Profit 5,878.57 5,083.58 4,142.02 3,239.23 2,043.01PBDIT 7,659.85 7,405.25 5,754.60 3,855.92 2,502.81Interest 1,199.23 995.37 770.00 501.83 331.46PBDT 6,460.62 6,409.88 4,984.60 3,354.09 2,171.35Depreciation 575.81 383.65 284.83 195.94 160.13Other Written Off 23.41 30.95 21.16 15.66 0.00Profit Before Tax 5,861.40 5,995.28 4,678.61 3,142.49 2,011.22Extra-ordinary items -49.05 -45.13 -21.09 12.21 -5.34PBT (Post Extra-ord Items) 5,812.35 5,950.15 4,657.52 3,154.70 2,005.88

IIMK Page 8

Financial Analysis and Valuation Project 2012

Tax 1,858.47 1,577.02 1,176.19 982.05 601.87Reported Net Profit 3,957.89 4,375.52 3,481.66 2,173.42 1,403.02Total Value Addition 25,965.31 21,770.09 20,503.25 14,196.59 10,403.06Preference Dividend 0.00 0.00 0.00 0.00 0.00Equity Dividend 882.84 752.75 614.97 495.32 368.25Corporate Dividend Tax 112.82 110.25 101.83 76.26 53.34Per share data (annualised)Shares in issue (lakhs) 6,088.52 6,021.95 5,856.88 2,923.27 2,832.71Earning Per Share (Rs) 65.01 72.66 59.45 74.35 49.53Equity Dividend (%) 725.00 625.00 525.00 850.00 650.00Book Value (Rs) 352.40 303.28 212.32 325.98 202.65

Cash Flow ------------------- in Rs. Cr. -------------------

Mar '11 Mar '10 Mar '09 Mar '08 Mar '07

12 mths 12 mths 12 mths 12 mths 12 mths

Net Profit Before Tax 5832.91 5880.67 3940.41 3155.47 2004.89Net Cash From Operating Activities

3861.30 5482.75 1478.57 1945.24 2130.45

Net Cash (used in)/fromInvesting Activities

-2437.98 -6071.73 -3308.53 -5241.89 -1588.17

Net Cash (used in)/from Financing Activities

-1124.84 1245.56 1640.79 3166.68 -31.05

Net (decrease)/increase In Cash and Cash Equivalents

298.48 656.58 -189.17 -129.97 511.23

Opening Cash & Cash Equivalents

1431.87 775.29 964.46 1094.43 583.20

Closing Cash & Cash Equivalents

1730.35 1431.87 775.29 964.46 1094.43

Bottom line beats estimates owing to lower tax rateOn the bottom-line front, L&T reported yoy growth of 13.9%, marginally higher due to exceptional and lower tax rate (26.9%).

Key Financial Ratios

IIMK Page 9

Financial Analysis and Valuation Project 2012

IIMK Page 10

Financial Analysis and Valuation Project 2012

Mar '11 Mar '10 Mar '09 Mar '08 Mar '07

Investment Valuation RatiosFace Value 2.00 2.00 2.00 2.00 2.00Dividend Per Share 14.50 12.50 10.50 17.00 13.00Operating Profit Per Share (Rs)

96.55 84.42 70.72 110.81 71.77

Net Operating Profit Per Share (Rs)

717.03 612.26 578.06 853.36 622.91

Free Reserves Per Share (Rs) 347.12 294.74 205.21 319.09 197.15Bonus in Equity Capital 73.86 74.67 76.77 53.71 55.44Profitability RatiosOperating Profit Margin(%) 13.46 13.78 12.23 12.98 11.52Profit Before Interest And Tax Margin(%)

11.82 12.41 11.14 11.97 10.34

Gross Profit Margin(%) 12.14 12.74 11.39 12.19 13.24Cash Profit Margin(%) 8.96 9.21 8.50 8.78 8.63Adjusted Cash Margin(%) 8.96 9.21 8.50 8.78 8.60Net Profit Margin(%) 8.82 11.56 10.06 8.54 7.74Adjusted Net Profit Margin(%)

8.82 11.56 10.06 8.54 7.72

Return On Capital Employed(%)

22.35 22.49 24.14 26.72 29.82

Return On Net Worth(%) 18.44 23.95 27.99 22.81 24.44Adjusted Return on Net Worth(%)

15.94 16.81 21.21 21.21 24.39

Return on Assets Excluding Revaluations

352.40 303.28 212.31 325.87 202.30

Return on Assets Including Revaluations

352.76 303.66 212.73 326.76 203.29

Return on Long Term Funds(%)

23.23 23.19 25.62 28.73 32.59

Liquidity And Solvency RatiosCurrent Ratio 1.20 1.19 1.22 1.09 1.16Quick Ratio 1.18 1.15 0.97 0.86 0.93Debt Equity Ratio 0.33 0.37 0.53 0.38 0.36Long Term Debt Equity Ratio 0.30 0.33 0.44 0.28 0.25Debt Coverage RatiosInterest Cover 10.01 11.17 13.09 28.57 25.07Total Debt to Owners Fund 0.33 0.37 0.53 0.38 0.36Financial Charges Coverage Ratio

5.90 6.09 6.35 7.41 7.52

Financial Charges Coverage 4.80 5.81 5.92 5.75 5.72

IIMK Page 11

Financial Analysis and Valuation Project 2012

Ratio Post TaxManagement Efficiency RatiosInventory Turnover Ratio 29.73 28.73 6.01 6.00 6.03Debtors Turnover Ratio 3.70 3.48 3.89 3.88 3.42Investments Turnover Ratio 29.73 28.73 6.01 6.00 6.11Fixed Assets Turnover Ratio 5.03 5.20 6.23 6.09 9.52Total Assets Turnover Ratio 1.52 1.48 1.80 1.92 2.27Asset Turnover Ratio 5.03 5.20 6.23 6.09 6.21 Average Raw Material Holding

25.77 32.32 38.11 34.14 34.05

Average Finished Goods Held 4.21 3.54 4.02 5.21 5.56Number of Days In Working Capital

56.58 49.22 59.09 37.06 51.15

Profit & Loss Account RatiosMaterial Cost Composition 28.34 26.01 27.51 33.09 30.15Imported Composition of Raw Materials Consumed

36.78 54.43 44.34 39.78 49.28

Selling Distribution Cost Composition

0.80 0.83 0.92 1.28 1.13

Expenses as Composition of Total Sales

14.58 18.62 21.70 22.67 21.36

Cash Flow Indicator RatiosDividend Payout Ratio Net Profit

25.15 19.72 20.58 26.29 30.04

Dividend Payout Ratio Cash Profit

21.84 18.01 18.92 23.96 26.97

Earning Retention Ratio 70.90 71.91 72.84 71.72 69.85Cash Earning Retention Ratio 75.24 75.25 75.66 74.40 72.95Adjusted Cash Flow Times 1.78 1.95 2.23 1.61 1.33

Interpretation of Ratios

From the Liquidity ratios of the company it seems that company is not having a lot many current assets. Company's Current and Quick ratio have gotten better per year, debt is decreasing, liquidity position is getting strengthened.

Interpretation of Profitability ratios of company shows that profit percentage of the company decreased and then increased. Turnover ratios of the company are showing very good performance of the company.

IIMK Page 12

Financial Analysis and Valuation Project 2012

Even the solvency ratios of the company show an improving performance of the company.The increase in Interest coverage ratio means less and less risk for long-term creditors. Company's long term debt is decreasing as compared to the total capital. Even, its total liabilities have not increased much as compared to its total assets. As performance of the company is improving investors can invest money in this company with more assurance.

IIMK Page 13

Financial Analysis and Valuation Project 2012

From the common size balance sheet of the company we find that sources of funds and loansof the company are increasing every year. We see that proportion of reserves and surplus is increasing in total liabilities. So company is securing its future at large. However percentage changes are fluctuating. Assets of the company are also increasing. Current liabilities are also increasing. So we can say that company is working well.

IIMK Page 14

Financial Analysis and Valuation Project 2012

In common size income statement we find that change in operating income has declined from100.624 to 100.5318. There is negligible change in material consumed and manufacturing expenses. It means has not increased its consumption of material to be consumed so this leads

IIMK Page 15

Financial Analysis and Valuation Project 2012

to same manufacturing expenses. Almost company is trying to decrease its all the expenses. Because of this profit of the company has increased and company stores more of itsfunds to reduce the future uncertainties.

Interpretation• Sales of the concern have continuously increased over the period of two years.

• Overall expenses of the company are increasing continuously.

IIMK Page 16

Financial Analysis and Valuation Project 2012

• Retained earnings has increased by approximately 10% in 2010 compared to previous year.

IIMK Page 17

Financial Analysis and Valuation Project 2012

Revenue and order inflow guidance for FY2013 at 15-20%

For FY2013, management has given a guidance of 15-20% growth for both revenue and order inflow. L&T’s order backlog currently stands at, 11.0% yoy growth. Order inflow for the quarter declined by 30.2%, taking the order inflow for FY2012 to down 12% yoy. However, management is confident of achieving order inflow of `80,000cr-84,000cr during FY2013. We believe although the company can achieve this guidance on the revenue front, given its robust order backlog, it would be difficult to achieve 15-20% growth on the order inflow front, considering the challenging macro environment.EBITDA margin in-line with estimatesOn the EBITDA front, performance was as per expectations, with the company reporting a yoy dip of 130bp to 13.9% against expectation of 13.7% for the quarter. For FY2012, EBITDAM stood lower by 100bp to 11.8%. EBITDAM was lower as: 1) MCO expenses were impacted by higher input costs; and 2) staff cost increased primarily due to compensation restructuring and manpower buildup. We note that the dip in EBITDAM is in the range guided by the management (75-125bp for FY2012). This guidance was on the back of change in order bookmix towards infrastructure projects (which yields lower margins compared to the other segments), enhanced competition witnessed in all segments with no respite in sight and fluctuations in commodity prices. Further, going ahead, management believes that EBITDAM should be at 11.3-12.3%.Outlook and valuation: For FY2013, management has given a guidance of 15-20% growth for both revenue and order inflow. We believe although the company can achieve this guidance on the revenue front, given its robust order backlog, it would be difficult to achieve 15-20% growth on the order inflow front, considering the challenging macro environment and hence are factoring order inflow growth of 10.6% for FY2013. We believe L&T is best placed to benefit from the gradual recovery in capex cycle, given its diverse exposure to sectors, strong balance sheet and cash flow generation as compared to peers.

Larsen and Toubro (L&T) posted a good set of numbers for 4QFY2012, which were broadly in-line with expectations; however, the company disappointed on the order inflow front. As of 4QFY2012, L&T’s order backlog stands at 11.0% yoy growth. Order inflow for the quarter declined by 30.2% to `21,159cr, taking the order inflow for FY2012 to `70,574cr (down 12% yoy).

Segmental performance

Engineering and construction (E&C): The E&C segment, which contributed ~90% to the company’s gross revenue, witnessed good traction and recorded growth of

IIMK Page 18

Financial Analysis and Valuation Project 2012

22.3% yoy for the quarter to `16,709cr, primarily on account of strong execution of its order book. On the margin front, the segment witnessed a dip of 100bp on a yoy basis to 13.6%, but reported a jump of 330bp on a sequential basis.

Machinery and industrial products (MIP): The MIP segment witnessed pressures of low level of mining activities and slowing industrial capex, resulting into a decline of 5.7% on a yoy basis to `817cr; however, the segment grew by 13.5% on a sequential basis. EBIT margin, at 16.3%, also witnessed contraction of 370bp yoy and 180bp qoq during the quarter.

Electrical and electronics (E&E): The E&E segment witnessed decent revenue duringthe quarter, as it recorded 14.2% yoy growth to `1,143cr. EBIT margin came in at13.9%, registering a dip of 130bp on a yoy basis

IIMK Page 19

Financial Analysis and Valuation Project 2012

Subsidiary performanceL&T InfoTech registers decent performance L&T InfoTech, the company’s technology subsidiary, reported a decent performance for 4QFY2012, registering 16.5% yoy growth in revenue to `817cr. On the profitability front, the subsidiary reported NPM of 13.2% with profit of `110cr during the quarter.

Order book analysisAs of 4QFY2012, L&T stands tall on an order backlog of `1,45,723cr. Order inflow for 4QFY2012 came in at `21,159cr, down 30.2% yoy, taking the order inflow for FY2012 to `70,574cr. For FY2012, ~18% orders came from the international market, owing to traction on the hydrocarbon/T&D space. L&T’s order book is majorly dominated by the infra (43%) and power

IIMK Page 20

Financial Analysis and Valuation Project 2012

(28%) segments. Process (15%), hydrocarbon (10%) and others (4%) constitute the remaining part of the order book. The company has given a guidance of 15-20% for order booking in FY2013, which is above expectations. Client wise, 35% of L&T’s outstanding order book comes from the public sector and 48% comes from the private sector. Captive work orders account for the balance 17%. Notably, there has been a drop in the share of public sector orders in the past few quarters

Recommendations:- It definitely very good to invest in this company as its fundamental are very

strong from equity investor point of view. Its financials which include liquidity and solvency are equally good hence it will

not harm to lend money to this company either.

IIMK Page 21