LSE LN 2007 Annual Report

Transcript of LSE LN 2007 Annual Report

-

8/14/2019 LSE LN 2007 Annual Report

1/77

DISCLAIMER

This PDF is an exact copy of the AnnualReport and Accounts of London StockExchange plc as provided to shareholders.The audit report is set out on page 45.

The maintenance and integrity of the LondonStock Exchange plc website is theresponsibility of the directors; the work

carried out by the auditors does not involveconsideration of these matters and,accordingly, the auditors accept noresponsibility for any changes that may haveoccurred to the financial statements sincethey were initially presented on the website.

Legislation in the United Kingdom governingthe preparation and dissemination offinancial statements may differ fromlegislation in other jurisdictions.

-

8/14/2019 LSE LN 2007 Annual Report

2/77

ANNUAL REPORT 2007

THE WORLDSCAPITAL MARKET

-

8/14/2019 LSE LN 2007 Annual Report

3/77

CONTENTS

INTRODUCTION 01

HIGHLIGHTS 02

GROUP AT A GLANCE 04

CHAIRMANS STATEMENT 06

CHIEF EXECUTIVES REVIEW 08

MARKETS AND TRENDS 10

BUSINESS REVIEW 12

FINANCIAL REVIEW 22

CORPORATE RESPONSIBILITY 26

PRINCIPAL RISKS AND UNCERTAINTIES 28

BOARD OF DIRECTORS 30

CORPORATE GOVERNANCE 32

REMUNERATION REPORT 35

DIRECTORS REPORT 42

DIRECTORS RESPONSIBILITY

FOR THE FINANCIAL STATEMENTS 44

INDEPENDENT AUDITORS REPORT 45

CONSOLIDATED INCOME STATEMENT 46

BALANCE SHEETS 47

CASH FLOW STATEMENTS 48

NOTES TO THE FINANCIAL STATEMENTS 49

FINANCIAL RECORD 71

INVESTOR RELATIONS 72

FINANCIAL CALENDAR 72

-

8/14/2019 LSE LN 2007 Annual Report

4/77

ANNUAL REPORT 2007 LOND N STO K EXCHAN E 01

THIS YEAR THE LONDON STOCK EXCHANGE BECAME THE WORLDSPRIMARY CENTRE FOR EQUITY CAPITAL, RAISING 29 BILLION THROUGHIPOS ALONE, AND FOR LIQUIDITY GROWTH AS VOLUMES ON SETS GREWBY 58 PERCENT, FASTER THAN ORDER BOOK TRADING ONANY OTHERMAJOR LISTED CASH EQUITY OR FINANCIAL DERIVATIVES EXCHANGE INTHE WORLD.

THE WORLDS CAPITAL MARKET

-

8/14/2019 LSE LN 2007 Annual Report

5/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200702

HIGHLIGHTS

OPERATIONAL HIGHLIGHTS

PRIMARY MARKET ACTIVITY WAS VERY STRONG,WITH 503 NEW ISSUES AND TOTAL MONEY RAISEDBY NEW AND FURTHER ISSUES UP 57 PER CENT TO

53.7 BILLION

THE NUMBER OF INTERNATIONAL COMPANIESJOINING THE MAIN MARKET ALMOST DOUBLED,AND IN TOTAL 139 INTERNATIONAL COMPANIES FROM25 COUNTRIES JOINED THE EXCHANGES MARKETS

TRADING VOLUMES ON SETS ACHIEVED NEWRECORDS, WITH A 58 PER CENT INCREASE TO ANAVERAGE 353,000 BARGAINS PER DAY, INCLUDINGA DOUBLING OF SETSMM BARGAINS TO 80,000AVERAGE DAILY BARGAINS

TOTAL NUMBER OF TERMINALS TAKING THEEXCHANGES REAL-TIME PRICE DATA REACHEDA NEW RECORD AT 116,000

SUBSTANTIAL PROGRESS WAS MADE FOR THELAUNCH OF TRADELECT, THE NEW PLATFORMFOR THE EXCHANGES ORDER BOOK TRADING

-

8/14/2019 LSE LN 2007 Annual Report

6/77

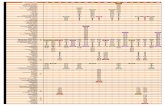

REVENUE BEFORE EXCEPTIONAL ITEMS (M)*YEARS ENDED 31 MARCH

350291244237226

IFRSUK GAAP

0706050403

OPERATING PROFIT BEFORE EXCEPTIONALITEMS AND GOODWILL AMORTISATION (M)*YEARS ENDED 31 MARCH

186120858381

IFRSUK GAAP

0706050403

ADJUSTED BASIC EARNINGS PER SHARE (PENCE)*YEARS ENDED 31 MARCH

56.237.424.221.220.8

IFRSUK GAAP

0706050403

CASH GENERATED FROM ONGOINGOPERATING ACTIVITIES (M)*YEARS ENDED 31 MARCH

19914610110575

IFRSUK GAAP

0706050403

REVENUE BEFORE EXCEPTIONAL ITEMS (%)YEAR ENDED 31 MARCH 2007

18

47

303 2

g Derivatives Servicesg Other

g Issuer Servicesg Broker Servicesg Information Services

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 03

FINANCIAL HIGHLIGHTS

* Based on IFRS for 2005, 2006 and 2007 and UK GAAP for 2003 and 2004, consistent withbasis of presentation of the Financial Record set out on page 71

Year ended 31 March 2007 2006 Growth

Revenue before exceptional items 350m 291m 20%

Operating profit before exceptional items 186m 120m 55%

Operating profit 174m 85m 104%

Profit before tax 162m 93m 73%

Basic earnings per share 50.5p 27.8p 82%

Adjusted basic earnings per share 56.2p 37.4p 50%

-

8/14/2019 LSE LN 2007 Annual Report

7/77

TOTAL NUMBER OF COMPANIESAS AT 31 MARCH

1,6371,4731,127792705

3,2453,1412,9162,6932,777

1,6081,6681,7891,9012,072

0706050403

g g AIMg g Main Market/PSM

REVENUE (M)YEARS ENDED 31 MARCH

6357434643

IFRSUK GAAP

0706050403

NUMBER OF SETS BARGAINS (M)YEARS ENDED 31 MARCH

8957433528

0706050403

REVENUE (M)YEARS ENDED 31 MARCH

1641251019588

IFRSUK GAAP

0706050403

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200704

GROUP AT A GLANCE

Companies across the world come to the London Stock Exchange to raisemoney for growth. Joining one of our primary markets the Main Market,Professional Securities Market (PSM) or AIM gives companies the opportunity

to access one of the worlds deepest and most liquid pools of low costinvestment capital.

ISSUER SERVICES

BROKER SERVICES

More than 350 firms worldwide trade as members of the London StockExchange. Our systems provide fast and efficient access to trading at very lowcost, allowing investors and institutions to tap quickly into equity, bond andderivatives markets. Internationally recognised standards of regulation and aleading market model put our markets among the most attractive and liquidin the world.

-

8/14/2019 LSE LN 2007 Annual Report

8/77

REVENUE (M)YEARS ENDED 31 MARCH

10694*878084

IFRSUK GAAP

0706050403

* before exceptional items

REVENUE (M)YEARS ENDED 31 MARCH

9876

IFRSUK GAAP

07060504

TOTAL NUMBER OF CONTRACTS TRADED (M)YEARS ENDED 31 MARCH

31221815

07060504

INFORMATION SERVICESTOTAL NUMBER OF TERMINALS (000)

1161049590

9688838088

94

0706050403

g g Overallg g Professional investors

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 05

INFORMATION SERVICES

DERIVATIVES SERVICES

Information is the lifeblood of the stock market. Fast provision of reliableinformation creates the transparency and liquidity that is the hallmark of theLondon Stock Exchange. We supply high-quality, real-time prices and trading

data, news and other information to the global financial community. We haveinvested in new technology to create the latest applications and deliverextremely low levels of latency on our market data.

EDX London is our derivatives exchange that offers trading and clearingservices in Nordic equity and fixed income futures and options and in RussianIOB equity derivatives.

-

8/14/2019 LSE LN 2007 Annual Report

9/77

SHARE PRICE PERFORMANCE

g London Stock Exchange Group plcg FTSE All-Share Index

Source: Bloomberg

90

100

110

120

130

31/3/06 31/3/07

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200706

During the year, we passed a number ofsignificant milestones on our path to becomethe worlds capital market. Your companyis both an important agent of change inglobal capital markets and a beneficiary of

the new opportunities that change brings.As international issuers look for new sourcesof capital, particularly those from emergingmarket economies whose rapid expansionis outpacing the supply of locally availablefunds, London offers a solution thatis tailored to their needs. Our choiceof primary markets, the Main Market,Professional Securities Market and AIM, hasproved highly attractive to UK and overseasissuers alike. In our dialogue with policymakers and regulators, we continue to makethe case for a supportive regulatory and taxregime to ensure the attractiveness of ourmarkets remains strong. This year we made

good progress on stamp duty with thepublication of research demonstrating thehigh cost it inflicts on savers, companiesand the economy. The evidence points toits removal as being revenue neutral for theTreasury and its abolition is now firmlyon the political agenda.

As the international primary market ofchoice, we work with business, the Cityof London and for the wider UK economy,as well as helping to fund growth anddevelopment around the world. Oursecondary market business, the provisionof trading services, is also becoming

increasingly international as our networkgrows in scale and value, with more memberfirms from more countries than ever before.Many of our customers are taking advantageof the revolution in technology andconnectivity that now links markets andcontinents in milliseconds, using theExchanges systems to help manage theirinvestments in multiple asset classes andacross time zones.

Rapid growth of our primary and secondarymarkets, facilitated by new technology, isfeeding through into strong revenue growthfor the Exchange up by 20 per cent overthe year. Buoyant revenues, combined with

a reduction in costs during the year, haveenabled your company to create significantvalue for shareholders. We have been able toreturn additional capital to shareholders andto commence our share buyback programme,further enhancing the efficiency of ourcapital structure. Taken together with theprevious returns of capital, the Exchangewill have returned 974 million since 2004 37 per cent of current market capitalisation.As we forecast in our circular to shareholderson 18 January, our final dividend will be12 pence per share an overall returnof 18 pence per share for the year and anincrease of 50 per cent. Adjusted basic

earnings per share, excluding exceptionalitems, rose by 50 per cent to 56.2 penceper share.

During a period of considerable challengethe management team has remained focusedand delivered another outstanding setof results. Strong performance acrossthe business justifies your Boardsdetermination for London to play a centralrole in the future development of globalequity markets. I believe that we shouldtake great confidence from the outcomeof the takeover approach from Nasdaq.That unwelcome diversion ended with the

overwhelming majority of our shareholdersendorsing the Boards view of the inadequatevalue of the offer and of the inherentqualities of the business, our uniquefranchise, and exciting prospects for growth.

CHAIRMANS STATEMENTCHRIS GIBSON-SMITH

ANOTHER MOMENTOUS YEAR FOR YOUR COMPANY AS WEMOVE TO THE NEXT PHASE IN DELIVERING OUR VISION TOBECOME THE WORLDS CAPITAL MARKET.

DELIVERING VALUE ONYOUR INVESTMENT

DIVIDEND

6.0 PENCEInterim dividend per share

12.0 PENCEFinal dividend per share

CAPITAL RETURN

512 MILLIONReturn to shareholders equivalentto 200 pence per share

-

8/14/2019 LSE LN 2007 Annual Report

10/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHAN E 07

The Board is determined to continueour growth strategy and is confident ofour ability to deliver continued strongperformance. However, we have consistentlystated that a combination, on the right

terms, with another exchange could bein the best interests of shareholders andcustomers and we continue to exploreopportunities. We are forging stronger linkswith other major markets around the worldand our agreement to explore business co-operation with the Tokyo Stock Exchangeis a recent example. The Exchanges uniquestrategic position, combined with itsoutstanding performance and technologyinvestment in the future, ensure that yourcompany is increasingly well positioned inthe rapidly evolving global exchange sector.

Chris Gibson-SmithChairman

CHRIS GIBSON-SMITH:

THE EXCHANGES UNIQUE STRATEGICPOSITION, COMBINED WITH ITS OUTSTANDINGPERFORMANCE AND TECHNOLOGY INVESTMENTIN THE FUTURE, ENSURE THAT YOUR COMPANYIS INCREASINGLY WELL POSITIONED IN THERAPIDLY EVOLVING GLOBAL EXCHANGE SECTOR.

-

8/14/2019 LSE LN 2007 Annual Report

11/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHAN E ANNUAL REPORT 200708

CHIEF EXECUTIVES REVIEWCLARA FURSE

THEEXCHANGE HAS DELIVERED VERYSTRONG PERFORMANCE,

SETTING NEW RECORDS IN ALL DIVISIONS AS THE BUSINESS

CAPITALISES ON THE GLOBAL MARKET TRENDS THAT ARE

DRIVING GROWTH.

CLARA FURSE:

THROUGH OUR COMMITMENT TO EXCELLENCEACROSS THE BUSINESS AND OUR DETERMINATIONTO DELIVER WHAT OUR MARKET WANTS WE WILLCONTINUE TO DEMONSTRATE THAT LONDON ISTHE WORLDS CAPITAL MARKET.

OUR PERFORMANCE CONTINUESTO SET NEW RECORDSThis year we have consolidated our positionas the primary centre for capital raising byinternational companies while volumes on

our SETS order book have grown faster thanelectronic trading on all other major cashequity and derivatives exchanges. Very strongperformance across all our business areas hasdelivered an increase in operating profitsexcluding exceptional items of 55 per cent.

This outstanding result would not havebeen possible without the efforts of ourtalented and dedicated staff and the driveand professionalism of our members, ourcompanies and investors.

BRINGING THE WORLD TO LONDONThe London Stock Exchange is central to the

international character of the City of Londonand Londons leading position is becomingever more widely recognised the 2007Global Financial Centres Index ranks Londonahead of New York and the rest of the world.New issues on the Main Market from overseascompanies almost doubled during theyear. Taken with the new issues on theProfessional Securities Market and AIM,a total of 139 international companies from25 countries came to London, as IPOs raised29 billion in total. London-based investorsdemonstrated a healthy interest ininternational companies by trading theirdepositary receipts on our International

Order Book which saw an increase of89 per cent over the year.

We also extended the reach and scale of ourdata and information network. The numberof terminals outside the UK taking informationfrom the Exchange rose by more than 15 percent to 60,000, taking the total number ofterminals to 116,000 another record.

-

8/14/2019 LSE LN 2007 Annual Report

12/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 09

OUR STRATEGY

BRINGING THEWORLD TO LONDON

We have brought more internationalIPOs to market than all our majorcompetitors.

TRANSFORMING THETRADING LANDSCAPE

We have grown electronic tradingvolumes faster than all other majorlisted equity and financialderivatives exchanges in the world.

COMPETING THROUGHTECHNOLOGY

We have built the worlds mostadvanced exchange tradinginfrastructure, setting new

standards for speed and certaintyof execution.

TRANSFORMING THETRADING LANDSCAPEOur investment in new technology and ourincreasingly efficient electronic order book isdriving ever greater trading volumes on SETS

as we facilitate a structural shift in equitytrading. High-velocity and electronically-managed trading strategies are increasinglybeing used by new customer groups,including hedge funds and specialistintermediaries. We are also seeing a sharpincrease in derivatives-linked business asSETS is increasingly used to hedge exposurein over-the-counter equity markets. Over theyear, SETS volumes averaged 353,000 dailybargains, up 58 per cent, and in March 2007we recorded no fewer than 14 of our 20busiest trading days ever.

The Exchanges success generates network

effects to the advantage of everyone whois linked in to the London market, eitherthrough capital raising, trading, or usingour information products to manage theirequities businesses. As more business comesto our markets, costs fall and that in turnstimulates additional business, extending thevirtuous circle.

COMPETING THROUGH TECHNOLOGYAs our customers demand higher levelsof service, the Exchange is providing theadvanced trading and information technologythat meets their needs. As we move into thefinal phase of our four-year programme of

investment in next-generation systems, weremain ahead of the curve. By launchingTradElect, first in South Africa in Aprilthrough our technology partnership withthe Johannesburg Securities Exchange andthen for the London market in June, we aredelivering a step change in the performance,capacity, and flexibility of our tradingengine at significantly lower cost. It will beexceptionally fast with end-to-end executionlatency falling from 140 to around 10milliseconds, meeting our customersdemands for immediacy and executioncertainty, thereby accelerating the growthof equity trading in London.

We continue to thrive in Londons open andcompetitive market structure soon to becopied in other parts of Europe when theMarkets in Financial Instruments Directive(MiFID) comes into force, sweeping away

rules that still force share trading onto thelocal exchange in several EU Member States.

We believe that the quality of our technology,our market model and regulatory integrity,and our ability to deliver best execution willensure that the Exchange continues to improvethe quality of the market for our companies,our members and investors, therebycreating increasing value for shareholders.

Our record in attracting growing internationalcompanies to our market is a key element inwhat makes the City of London the worldsleading financial centre. We are committed

to playing a pivotal role in Londons success,widening the choice of securities availableand bringing new products and servicesto the market. Through our commitmentto excellence across the business and ourdetermination to deliver what our marketwants we will continue to demonstrate thatLondon is the worlds capital market.

Clara FurseChief Executive

-

8/14/2019 LSE LN 2007 Annual Report

13/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200710

MARKETS AND TRENDSTHE CONTEXT IN WHICH WE OPERATE

LONDON IS THE CENTRE FORGLOBAL CAPITALA 2006 study by Oxera, an independentresearch firm, demonstrated that the costof capital at both IPO stage and beyondis lower in London than in other majorEuropean and US financial centres. Inaddition, London hosts the largest assetmanagement community in the worldwith more than $13 trillion in assets under

management, $3 trillion ahead of itsnearest rival. This means that growingcompanies from all countries, sectors andstages of development are able to findspecialist investors in London who will offerthem access to cost-effective capital.

UK CORPORATE GOVERNANCE ANDREGULATION IS WORLD LEADINGThe UK is consistently the clear leader inglobal corporate governance rankings andour regulatory standards are ones to whichmany foreign companies aspire. Access toinvestors can be via the EU standards thatapply to all companies across Europe or via

the unique UK gold standard of a primarylisting on the Main Market that enablesaccess to a wider pool of investors.A proven risk-based approach to regulationcombined with the Citys world renownedreputation for integrity and the Exchangesregulation of markets are central to oursuccess. Londons leading regulatoryframework underpins the 2007 GlobalFinancial Centres Index ranking of Londonas the No. 1 financial centre in the world.

GLOBALISATIONOur ability to attract ever more internationalsecurities to our markets has increased thechoice of products available for traders andinvestors. As capital markets drive globalgrowth, the Exchange increasingly oils thewheels. London is the venue of choice forinternational issuers and for cross-bordercapital markets business. This provides uswith a customer franchise of exceptional

quality. We help to facilitate and speedglobal economic development by providingan essential link to the equity funding thatfinances it. Our success can be measuredby the 380 international companies thathave come to our markets since 1 April 2004and the fact that in calendar year 2006the Exchange raised more new moneyon its markets than the NYSE andNasdaq combined.

MAJOR STRUCTURAL CHANGE INGLOBAL EQUITY MARKETSThe nature of order flow in the UK equitymarket is undergoing rapid change. Black

box and algorithmic trading enable hedgefunds, intermediaries and technical tradersto conduct higher frequency trading. Insimple terms, much of the trading previouslydone by people is now done by computerswhich can enter many more orders muchmore quickly. This trend is just beginningas banks and brokers invest heavily inincreasingly sophisticated trading technology.Furthermore the highest frequency traders,such as hedge funds, are growing rapidly.Growth in hedge fund assets undermanagement in Europe is running at 53 percent annually and equities are the asset ofchoice for much of this investment.

The combination of the worldslowest cost of capital, efficientand transparent markets,deep investor pools and worldclass technology creates anincreasingly virtuous circlefor both our customers and

shareholders, driving growthin a global economy.

THE LONDON STOCK EXCHANGE IS BOTH AN AGENT AND A COREBENEFICIARY OF THE GLOBALISATION OF CAPITAL MARKETS. AS THENATURAL CENTRE OF THE WORLDS EQUITY FLOWS AND AT THE

HEART OF EUROPES GLOBAL FINANCIAL SERVICES INDUSTRY, WEARE REALISING OUR VISION TO BE THE WORLDS CAPITAL MARKET.

-

8/14/2019 LSE LN 2007 Annual Report

14/77

THE SIZE OF THE EUROPEAN HEDGEFUNDS MARKET ($BN)

0602

0

100

200

300

400

g Other Europeg UK

Source: EuroHedge, IFSL estimates

ASSETS UNDER MANAGEMENT BY CITY ($BN)

3,235 2,8153,9745,4929,69613,387

SanFrancisco

Frankfurt

Paris

New

York

Boston

London

Source: Bigdough

THE 2007 GLOBAL FINANCIALCENTRES INDEX (RATING)

656 647660684760765

Frankfurt

Zurich

Singapore

New

York

Hong

Kong

London

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 11

TECHNOLOGY LEADERSHIPTo enable our customers to deploy theirhigh velocity trading strategies we havebuilt a next-generation trading platform. Itis designed to provide an exceptionally fast,high capacity platform for our electronicorder book and is helping to accelerate thedevelopment of equities trading in London.The final piece of the jigsaw, the new tradeexecution engine, is due for completion in

June 2007 and will improve the speed ofexecution by a factor of 30 while instantlyincreasing capacity fourfold.

A CULTURE OF COMPETITIONWe operate in a pro-competitive frameworkwhere intermediaries have always executeda major portion of their UK business awayfrom SETS. SETS is succeeding in thisenvironment because it has delivereddeclining transaction costs, product andtechnology innovation as well as 100 percent availability over the last seven years.The advent of MiFID, the EU directive thatopens up European securities markets to

competition, validates our open marketmodel. This will mean radical change forsome EU countries but for the Exchangeit is very much business as usual.

MAJOR GLOBAL TRENDS AREDRIVING OUR GROWTH

> GLOBALISATIONInternational capital flows havequadrupled since 2003

> VELOCITY GROWTH

UK velocity is steadily catching

up on Europe and the US

> REGULATORY REFORMKey markets in Europe and Asiaare opening up

> ASSET MANAGEMENTThe structural shift to absolutereturn strategies increasesdemand for efficient tradingmechanisms and platforms

> TRADING PRACTICESDirect market access andalgorithmic trading drive liquidity,efficiency and volume growth

> TECHNOLOGY REVOLUTIONA step change in capacity,speed and cost is acceleratingvolume growth

-

8/14/2019 LSE LN 2007 Annual Report

15/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200712

BUSINESS REVIEWBRINGING THEWORLD TO LONDON

RECORD CAPITAL RAISEDA record amount of money was raised onthe London Stock Exchange in FY 2007. IPOmoney raised exceeded the amounts raisedon any other equities exchange. Companiesfrom every corner of the globe are drawn toLondon by:

The Exchanges leading global brand,underpinned by the UKs world renowned

and respected regulation and our choice ofmarkets which enables companies to picka route to investment capital that is rightfor them.

The depth and liquidity of our secondarymarkets, supported by one of the mostadvanced trading technologies of any majorequities exchange.

The lowest cost of capital a studypublished in 2006 showed that the costof capital at both IPO stage and beyond islower in London than in any other majorEuropean or US financial centre.

503 NEW COMPANIES, 108 ON THE MAINMARKET AND PSM, 395 ON AIM

29.2 BILLION CAPITAL RAISED THROUGHIPOS, UP 44 PER CENT

95 INTERNATIONAL IPOS, MORE THAN ALLOUR MAJOR COMPETITORS

The Main Market continues to lead the way:

The worlds most attractive blue-chipmarket for international IPOs.

Unrivalled investor base with over$13 trillion assets under managementin London.

108 new companies, including PSM, raised20.8 billion in FY 2007.

AIM is becoming a brand in its own right:

The worlds most successful venue forsmaller growth companies.

Investor appetite for AIM companiescontinues to grow with institutionalinvestors owning 57 per cent.

395 new companies raised 9.0 billionin FY 2007.

We continue to build our markets to makethem more attractive for issuers andinvestors. New products have been added

to the Main Market and a comprehensivereview of AIMs regulatory regime hasbeen completed to ensure that its rapidinternational expansion can continuein the context of a strong but flexibleregulatory environment.

WE ARE REALISING OUR VISION TO BECOME THE WORLDS CAPITALMARKET. THIS YEAR WE HAVE BROUGHT MORE INTERNATIONALIPOS TO MARKET THAN ALL OUR MAJOR COMPETITORS, TRADED

STOCKS FROM MORE COUNTRIES THAN EVER BEFORE ANDEXPANDED OUR INFORMATION SERVICES OVERSEAS THROUGHNEW INTERNATIONAL TERMINALS.

DID YOU KNOW?

647 INTERNATIONALCOMPANIES FROM68 COUNTRIES AREON OUR MARKETS

-

8/14/2019 LSE LN 2007 Annual Report

16/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 13

AIM is rapidly developing its credentials in the US andChina as a venue for smaller innovative companies to raisecapital that is not available to them in their domesticmarket. US AIM companies come from a range of sectorsfrom environmental technologies to finance. The quality

of Chinese companies is high, with the Seymour PierceAIM China index growing by 29 per cent over the year.

China, Shanghai, Nanjing Lu

-

8/14/2019 LSE LN 2007 Annual Report

17/77

TOTAL MONEY RAISED (BN)

15.311.34.72.7153.734.118.821.217.9

38.422.814.118.516.9

0706050403

g g AIMg g Main Market/PSM

IPOS (NUMBER OF COMPANIES)

243315302945432340936711882

8094652428

0706050403

g g AIMg g Main Market/PSM

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200714

BUSINESS REVIEWBRINGING THEWORLD TO LONDON

WORLDS CAPITAL MARKETOur reach extends from the UK to developingand established markets throughout theworld. It was an excellent year for MainMarket new listings from the UK, Russia,Kazakhstan and South Korea as well as theMiddle East and Latin America. AIM didparticularly well in China, the US and Europe.

Highlights

In the UK the significant new listingsincluded Standard Life raising 2.2 billionand Debenhams returning to the market afterthree years to raise 950 million. Overall 364UK companies came to the Main Market andAIM, raising 16.8 billion during the year.

Rosneft was the largest Russian companyto list in FY 2007, raising a record 3.6 billionin July. Russian companies coming to themarket are from an increasingly diversifiedrange of sectors, including companies suchas Sitronics, one of the largest hi-techcompanies in CIS and Eastern Europe, TMKSteel and Sistema-Hals, one of Russias

largest property developers.

Kazakhstan is a new and increasinglyimportant market for the Exchange. Thequality of companies joining this year wasparticularly impressive, representing theleading economic sectors in Kazakhstan,such as property (Chagala), gas(Kazmanaigas) and banking (Halyk Bank).

South Korean electronics giant Samsungjoined our markets in December 2006. MCBBank became the first Pakistani company tolist in London and Hochschild Mining becamethe first Latin American company to IPOin London. We believe that Latin Americawill become increasingly important asour recognition and attractiveness in thisregion grows.

Napo Pharmaceuticals became the first USincorporated company to IPO on the MainMarket. In addition, 23 US companies came

to AIM taking the total number to 67. AIMhas also had considerable success in China,attracting 25 companies in FY 2007 takingthe total to 46.

AIMs push into Europe, launched in October2005, is progressing very positively with 49companies joining since launch, taking thenumber of non-UK European companies onAIM to 110. AIMs nearest European competitorhas just 4 non-domestic companies.

Strategic allianceIn February we signed a Letter of Intent withthe Tokyo Stock Exchange with the aim of

jointly enhancing our international presenceand bringing benefits for our investors,issuers and member firms. We are lookingat collaboration in growth markets, jointlytraded products and member firms access.

A major attraction of the Main Market tointernational companies is the liquidity of ourInternational Order Book (IOB) which offerscompanies a uniquely effective secondarymarket for their depositary receipts. In OctoberFTSE introduced a Russia IOB index to track theperformance of the ten largest Russian companiestraded on the IOB.

A major attraction of the Main Market tointernational companies is the liquidity of ourInternational Order Book (IOB) which offerscompanies a uniquely effective secondarymarket for their depositary receipts. In OctoberFTSE introduced a Russia IOB index to track theperformance of the ten largest Russian companiestraded on the IOB.

DID YOU KNOW?

67 US COMPANIES ARE

NOW LISTED ON AIM

In February we issued a new rule book for AIMnominated advisers codifying the roles andresponsibilities of Nomads. Based on existingmarket best practice, it supplements the existingrules for companies. The new rule book is anincremental step to build on the quality andintegrity of the market.

-

8/14/2019 LSE LN 2007 Annual Report

18/77

NUMBER OF INTERNATIONAL IPOS

9518

22

11 10

g Euronext

g Deutsche Brse

g London

g Nasdaqg NYSE

TOTAL NUMBER OF TERMINALS (000)

6052484751116104959094

5652474343

0706050403

g g International terminalsg g UK terminals

TOTAL NUMBER OF COMPANIES

g g AIMg g Main Market/PSM

0706050403

1,6371,4731,1277927053,2453,1412,9162,6932,777

1,6081,6681,7891,9012,072

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 15

GLOBAL INFORMATION SERVICESInternational terminal growthThe total number of terminals taking real-time London Stock Exchange data rose by12,000 to 116,000 at year end, a rise of12 per cent on the previous year. Of the newterminals, 8,000 were international, drivenby a rise in the professional customer base,much of it in North America. The richnessand scale of the information gathered

from trading over 3,000 stocks from aroundthe world explains why our terminalnumbers continue to grow in an expandingglobal market for data and value addedinformation services.

12,000 NEW TERMINALS, UP 12 PER CENT

8,000 NEW INTERNATIONAL TERMINALS

Other global products and servicesSEDOL, our database of global securitiesidentifiers, continues to expand, growingthe number of securities covered by 50 percent over the year. Covering fixed income,

derivatives and global equities, SEDOL isa multi-asset class service with 40 per centof licence users based outside the UK.

Through our communications network Extranex,data travels from London to New York in only30 milliseconds. This premium quality productprovides a level of service to overseas customersthat is comparable with the service levels enjoyedby those based in London and drives order flow aswell as terminal sales.

Through our communications network Extranex,data travels from London to New York in only30 milliseconds. This premium quality productprovides a level of service to overseas customersthat is comparable with the service levels enjoyedby those based in London and drives order flow aswell as terminal sales.

Proquote, the Exchanges integratedtrading and market data system, has addedover 1,000 new international terminalsrepresenting 125 corporate clients followingthe launch of Proquote International last year.

RNS, the Exchanges company news service,had its highest volumes ever in FY 2007 withannouncements up 18 per cent driven partlyby the growing number of internationalcompanies using its services.

DID YOU KNOW?

60,000 TERMINALSOUTSIDE THE UK TAKEOUR REAL-TIME DATA

Active in more than 48 countr ies worldwide, FTSE,the Exchanges joint venture with the FT, is theglobally recognised provider of indices for theUK market and overseas. In addition to its worldrenowned product the FTSE 100 index of thebiggest UK registered companies FTSE nowcalculates over 100,000 indices covering all majorasset classes. These products help investors tomake better informed decisions and to benchmarkperformance. We work alongside FTSE to developnew products that will support our own trading andinformation services.

Signing the Letter of Intent with Taizo Nishimuro, President & CEO of the Tokyo Stock Exchange, February 2007 2007 Annual Russian Capital Markets Conference,Moscow

-

8/14/2019 LSE LN 2007 Annual Report

19/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200716

BUSINESS REVIEW

TRANSFORMING THETRADING LANDSCAPE

RECORD ORDER BOOK VOLUMESFY 2007 saw records tumble in our coretrading business on SETS, the electronicorder book. The key factors driving thisgrowth are:

Our customers leveraging technologyto deliver scale efficiencies across theequities trading chain.

A permanent shift in the nature of orderflow as new, higher velocity electronictrading strategies are increasingly deployedby hedge funds, intermediaries andspecialist technical trading firms.

Our investment in a fast, efficient andscalable trading platform to support andaccelerate the growth of our customersbusiness.

FY 2007 AVERAGE DAILY SETS BARGAINS:353,000, UP 58 PER CENT

TOTAL SETS BARGAINS IN FY 2007:89.0 MILLION, UP 57 PER CENT

Trading grew during every month of FY 2007over the same month in the previousfinancial year, with the average dailybargains up by an average of 58 per cent.

In the final quarter the average growthin daily trading was 62 per cent:

The highest number of SETS trades on asingle day was 732,000 on 28 February.

17 of the 20 busiest days ever were in thefinal quarter of the year.

Order book volumes easily beat the targetswe set a year ago, up 38 per cent on theforecast of February 2006.

TOTAL VALUE TRADED ON SETS IN FY 2007:1.6 TRILLION, UP 37 PER CENT

AVERAGE MONTHLY GROWTH OF SETSMMBARGAINS: 122 PER CENT

TOTAL VALUE OF SETSMM BARGAINS INFY 2007: 151.2 BILLION, UP 86 PER CENT

SETS TRADING GROWTH HAS BEEN PHENOMENAL. THIS YEAR OURELECTRONIC TRADING VOLUMES HAVE GROWN MORE QUICKLY THANTHOSE ON ALL OTHER MAJOR LISTED EQUITY AND FINANCIAL

DERIVATIVES EXCHANGES IN THE WORLD, BEATING ALL TRADINGRECORDS ON OUR INTERNATIONAL ORDER BOOK AND PRODUCINGRECORD VOLUMES IN OUR DEVELOPING DERIVATIVES BUSINESS.

DID YOU KNOW?

3.4 TRILLION WORTHOF UK SHARES WERETRADED ON OURMARKETS THIS YEAR

-

8/14/2019 LSE LN 2007 Annual Report

20/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 17

Our ability to attract ever more international securities toLondon is driving increased trading activity. We add diverseinternational products for traders and investors whichjustifies their investment in cutting edge technology toaccess our markets efficiently. Clients of all types, but

especially global firms, can now access London in a way theycould not before. Aggregators, brokers and hedge funds arebringing in business from around the world to trade here.They are building fast, efficient systems in order to tradeefficiently into London from almost anywhere in the world.

USA, California, San Francisco, Golden Gate Bridge

-

8/14/2019 LSE LN 2007 Annual Report

21/77

SETS VALUE TRADED (BN)

1,6351,190881776687

0706050403

SETS VOLUMES (BARGAINS, MILLIONS)

20.19.34.00.9089.056.842.834.727.5

68.947.538.833.827.5

0706050403

g g SETSmm volumesg g SETS volumes (excluding SETSmm)

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200718

BUSINESS REVIEWTRANSFORMING THETRADING LANDSCAPE

INNOVATION IN NEW PRODUCTS,SERVICES AND PRICINGExchange Traded Funds receiveda significant boostIn the 2006 pre-budget report theGovernment announced that non-residentETFs would no longer be subject to stampduty. We had lobbied policy makers for yearsto remove this anomaly, a clear competitivedisadvantage to our market. By creating

a level playing field with other Europeanexchanges we have seen a step change inETF issuance and trading.

NUMBER OF ETFS TRADED ON THE EXCHANGEIN FY 2007: 73, UP 44 PER CENT

VALUE TRADED IN ETFS ON THE EXCHANGE INFY 2007: 21.7 BILLION, UP 90 PER CENT

First Exchange to launch ExchangeTraded CommoditiesETCs are open-ended securities that offerinvestors simple and secure access to a broadrange of commodities. We are the worlds

first exchange to offer ETCs to investors,lowering many of the barriers that preventedinvestment in this major asset class.

At launch, 32 ETCs were issued includingindividual commodity trackers and securitiestracking a range of commodities indicescovering the energy, metals and agriculturemarkets.

New era of Real Estate Investment TrustsThe conversion of nine UK propertycompanies to REITs in January 2007 markedthe beginning of a new era for the propertyindustry and for investors. The Exchangeworked closely with the UK propertyindustry and Government to ensure theright framework was established for UK-REITs.The result will be cheaper capital-raisingfor companies and more opportunities

for investors.

Pricing strategyOur pricing strategy is designed to stimulatefurther growth in equities trading both on-book and off-book. This year we announced:

Further significant price reductions foroff-book business.

A deepening of our volume discountscheme for SETS business for the 2007/8financial year.

Competitive pricing will continue to drive

trading on our markets, attracting liquidity toa greater range of companies and investmentopportunities and enhancing the efficiency ofthe market for all participants.

Boosting liquidity and delivering a truly globalmarketplace for smaller cap companies is a keyobjective for the Exchange. SETSmm is our uniquehybrid midcap stock trading order book. Since itslaunch in 2003, SETSmm has contributed to a 267per cent increase in the value traded of mid capstocks and, by centralising liquidity and increasingtransparency, it has reduced headline spreads bymore than 80 per cent. In November we introduceda Larger Size Market Maker scheme to encourageliquidity at greater sizes and tighter spreads inboth order and quote driven trading in stocksoutside the FTSE 350.

Boosting liquidity and delivering a truly globalmarketplace for smaller cap companies is a keyobjective for the Exchange. SETSmm is our uniquehybrid midcap stock trading order book. Since itslaunch in 2003, SETSmm has contributed to a 267per cent increase in the value traded of mid capstocks and, by centralising liquidity and increasingtransparency, it has reduced headline spreads bymore than 80 per cent. In November we introduceda Larger Size Market Maker scheme to encourageliquidity at greater sizes and tighter spreads inboth order and quote driven trading in stocksoutside the FTSE 350.DID YOU KNOW?

375 FIRMS TRADE ON OURMARKETS, MORE THAN ANYEXCHANGE IN EUROPE

Market opening for launch of UK-REITs, January 2007

-

8/14/2019 LSE LN 2007 Annual Report

22/77

YIELD PER SETS TRADE ()

1.321.521.541.721.76

0706050403

IOB VOLUMES (BARGAINS, THOUSANDS)

763403274203140

0706050403

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 19

GLOBAL SECURITIESOur International Order Book (IOB) is themost successful electronic trading platformfor international securities in the world:

The IOB demonstrates that we do not justdraw international companies to London,we capture liquidity from internationalinvestors located here and abroad whichis channelled through our global network

of member firms.

Trading of international depositary receipts(DRs) on the IOB reached record levels thisyear driven by 255 companies from 40countries who have DRs traded in London.

Particularly well represented are companiesfrom Russia, South Korea, Kazakhstanand India.

TOTAL VALUE OF IOB BARGAINS IN FY 2007:$124.7 BILLION, UP 107 PER CENT

GLOBAL DERIVATIVES GROWTHOur leadership in the listing and trading of

international securities and the high levelsof liquidity on the IOB in shares of companiesfrom countries such as Russia enabled us tooffer new derivatives products in this space:

Experience in derivatives markets with EDXLondon helped us to launch derivativesproducts based on the most liquid of theindividual depositary receipts from Russia.

Of EDXs existing membership, 26 havetaken positions in the new Russian productsand six new members have joined to gainaccess to this market. The Exchangesdistribution network has meant that more

firms, including those in Russia, can tradethese products.

Following the launch of the products inDecember 2006, average daily volumes inRussian single stock and index derivativesmore than doubled month on month to over10,000 contracts per day in March.

EDXs Nordic derivative offering alsoreached unprecedented levels of tradingthis year, with trading across all productsshowing 40 per cent year-on-year growth.

TOTAL VALUE TRADED IN RUSSIAN IOBDERIVATIVES SINCE 1 DECEMBER 2006: $2.2 BN

GLOBAL MEMBERSHIPOur increasingly global presence is reflectedin the profile of our member firms who aremore numerous and diverse than ever before:Brokers access our markets from 42 differentcountries following the admission ofnew members this year from Estonia andDenmark via the EU passporting process.

This year also saw the admission of ourfirst hedge fund member, reflecting a newapproach from investors who want directaccess from their advanced computersystems straight to our order book.

NEW MEMBER FIRMS JOINING THIS YEAR: 37

Our growing range of products is a demonstrationof our ability to innovate and our commitment togive investors more efficient and transparent waysto create balanced investment portfolios, drawingliquidity to our markets across a range of assetclasses. With ETCs providing direct access toworldwide commodities, an expanding ETFssegment giving access to global equity and bondindices, and REITs offering pure property exposure,the London Stock Exchange is increasinglybecoming a diversified market both for issuersand investors.

UKTI India Business Awards at the London Stock Exchange, June 2006

-

8/14/2019 LSE LN 2007 Annual Report

23/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200720

BUSINESS REVIEW

COMPETING THROUGHTECHNOLOGY

EQUITY TRADINGIS CHANGING RAPIDLYIn recent years we have seen the startof a permanent shift in the nature and scaleof order flow as our customers are engagingin a technology race in search of ever moresophisticated ways to interact with theelectronic order book:

Higher velocity electronic trading by

algorithmic, black box and hedge fundtraders is generating record volumes.

Equity derivatives traders are increasinglyrelying on our order book as the most costefficient venue to hedge their trades bytaking positions in the underlying equity.

Many of these clients are active on a globalscale and our execution venue has tocompete to win their order flow and theliquidity it generates.

TECHNOLOGY STRATEGYThe new technology platform being delivered

through our Technology Roadmap providesus with a significant competitive advantage.Our technology strategy has been to build anexceptionally fast trading infrastructure:

Offering much greater capacity.

Enabling customers to deploy new highvelocity trading strategies.

Accelerating the development of equitiestrading in London.

WORLD LEADING BROADCAST SPEEDSInfolect, our information disseminationservice launched in 2005, cut the speed ofinformation broadcast to two milliseconds.We believe this is one of the fastest of anymajor exchange in the world. It providescustomers, whose trading strategies executein much less than the blink of an eye,with increased certainty of execution,encouraging more orders to be entered

into the system.

FASTEST TRADE EXECUTIONTradElect will do the same for our core tradeexecution engine when it goes live, bringingoverall end-to-end execution latency on SETSto around 10 milliseconds. It will:

Be exceptionally fast, providing coretrade execution latency of around twomilliseconds, compared to around 60milliseconds today.

Increase trading capacity more thanfourfold initially and have the capacity to

trade all European equities at the outset.Be highly scalable, providing the ability todouble capacity again on demand at a fifthof todays cost.

Support multiple market models: orderdriven, quote driven, hybrid and othercomplex order types.

Be multi-asset capable, a key advantage ina rapidly evolving market environment.

Significantly cut development andoperational costs and implementation times.

TradElect is due to go live on 18 June 2007.

WE HAVE BUILT THE WORLDS MOST ADVANCED EXCHANGETRADING INFRASTRUCTURE, WHICH IS ATTRACTING EVERGREATER LIQUIDITY TO OUR ELECTRONIC ORDER BOOK,

SETTING NEW STANDARDS FOR SPEED AND CERTAINTYOF EXECUTION AND ENSURING THAT WE OFFER THE MOSTEFFICIENT CENTRAL MARKETPLACE FOR TRADING EQUITIES.

DID YOU KNOW?

WE HAVE MAINTAINED OUR100 PER CENT AVAILABILITYRECORD FOR THE SEVENTHYEAR RUNNING

-

8/14/2019 LSE LN 2007 Annual Report

24/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 21

TradElect is already proving itself, having gone live for theJohannesburg Securities Exchange on 2 April 2007. For thelast five years the London Stock Exchange has supplied theJSE with its trading system and the contract was renewedfor another five years in March. JSE market participants

access the trading system via a dedicated communicationslink between Johannesburg and London. The new platformis performing as hoped with 100 per cent reliability and theexpected step-change in execution speeds.

Japan, Yokohama, 700 Series Shinkansen bullet train

-

8/14/2019 LSE LN 2007 Annual Report

25/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200722

FINANCIAL REVIEWJONATHAN HOWELL

HIGHLIGHTS

REVENUE BEFORE EXCEPTIONAL ITEMS AT349.6 MILLION (2006: 291.1 MILLION) WASUP 20 PER CENT.

OPERATING PROFIT BEFORE EXCEPTIONALITEMS INCREASED 55 PER CENT TO 185.6MILLION (2006: 120.1 MILLION).

ADJUSTED BASIC EARNINGS PER SHARE,BEFORE EXCEPTIONAL ITEMS, INCREASED50 PER CENT TO 56.2 PENCE PER SHARE(2006: 37.4 PENCE).

OPERATING PROFIT WAS 174.2 MILLION(2006: 85.4 MILLION) AND BASICEARNINGS PER SHARE WERE 50.5 PENCE(2006: 27.8 PENCE).

CASH GENERATED FROM ONGOINGOPERATING ACTIVITIES INCREASED TO198.6 MILLION (2006: 145.9 MILLION).

512 MILLION WAS RETURNED TOSHAREHOLDERS UNDER THE SCHEMEOF ARRANGEMENT IN MAY 2006, INPART FINANCED BY A 2016 CORPORATEBOND ISSUE.

SHARE BUYBACK PROGRAMMES FOR UPTO 50 MILLION PER ANNUM ANNOUNCEDIN FEBRUARY 2006 AND FOR UP TO 250MILLION ANNOUNCED IN JANUARY 2007 HAVEPROGRESSED WELL DURING THE YEAR. BY

31 MARCH 2007, ON-MARKET PURCHASES OF9.0 MILLION SHARES HAD BEEN COMPLETEDAT AN AGGREGATE COST OF 109.9 MILLION.

TOTAL DIVIDEND PER SHARE INCREASED 50PER CENT TO 18.0 PENCE (2006: 12.0 PENCE).

FINANCIAL PERFORMANCE CONTINUES TOREFLECT STRONG GROWTH IN REVENUE ANDEARNINGS PER SHARE

VERY STRONG OPERATING PROFIT AND OPERATINGCASH FLOW GROWTH ACHIEVED

GOOD DIVIDEND GROWTH

MAJOR CAPITAL RETURN TO SHAREHOLDERSFOLLOWING SCHEME OF ARRANGEMENT

CORPORATE BOND ISSUED

GOOD PROGRESS ON THE SHARE BUYBACKPROGRAMME

-

8/14/2019 LSE LN 2007 Annual Report

26/77

REVENUE BEFORE EXCEPTIONAL ITEMS (M)*YEARS ENDED 31 MARCH

350291244237226

IFRSUK GAAP

0706050403

REVENUE BEFORE EXCEPTIONAL ITEMS (%)YEAR ENDED 31 MARCH 2007

18

47

303 2

g Derivatives Servicesg Other

g Issuer Servicesg Broker Servicesg Information Services

BROKER SERVICES FIVE-YEAR REVENUE (M)*YEARS ENDED 31 MARCH

1641251019588

IFRSUK GAAP

0706050403

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 23

REVENUEIssuer ServicesIssuer Services revenue increased 11 percent to 63.2 million (2006: 56.9 million)reflecting increases in admission fee and

annual fee revenues. Capital raised by newand further issues increased to 53.7 billion(2006: 34.1 billion) with the average moneyraised by a Main Market new issue increasingto 196 million (2006: 118 million). MainMarket new issues remained strong at 106(2006: 107) and AIM saw another recordyear with 9 billion raised by 395 new issues(2006: 8 billion; 510). The internationalprofile of the Exchanges primary marketswas enhanced further with 35 internationallistings on the Main Market (2006: 18),making a total of 139 international companiesjoining our markets (2006: 154), includingPSM and AIM. As at 31 March 2007, the total

number of companies on our markets hadincreased to 3,245 (2006: 3,141), including an11 per cent increase in companies traded onAIM to 1,637 (2006: 1,473). RNS had a recordyear with an 18 per cent increase in thenumber of company announcements anda 10 per cent increase in revenue to10.1 million (2006: 9.2 million).

Broker ServicesBroker Services revenue increased 31 percent to 163.8 million (2006: 125.5 million),reflecting a very substantial uplift ofperformance for SETS, our electronic orderbook. The structural shift in equities trading

facilitated by investments in technology hascontinued to benefit SETS. The total numberof SETS bargains for the year ended 31 March2007 increased to 89.0 million (2006: 56.8million), reflecting a 58 per cent increaseto an average of 353,000 bargains per day(2006: 223,000). Value traded on SETSincreased 37 per cent to 1,635 billion (2006:1,190 billion). SETSmm, the Exchanges

hybrid trading platform, continued its stronggrowth with 80,000 daily average bargains,more than double the previous year(2006: 36,000). Furthermore, with an89 per cent increase in bargains traded

on the International Order Book (IOB),the international profile of the Exchangessecondary market saw very strong growth.

Information ServicesInformation Services delivered strong growthin revenue before exceptional items of 13 percent to 105.9 million (2006: 94.1 million).Total terminals delivering real-time marketdata increased 12 per cent to 116,000(2006: 104,000), including 96,000 terminalsattributable to professional users (2006:88,000). Proquote, the Exchanges providerof financial market software and dataincreased the number of screens at year end

by 23 per cent to 3,700 (2006: 3,000). SEDOL,the securities numbering service, saw goodgrowth with the number of securitiescovered increasing to more than 1.8 million(2006: 1.2 million).

Derivatives ServicesDerivatives Services revenue increased 21per cent to 9.3 million (2006: 7.7 million).EDX London, our 76 per cent owned equityderivatives business, moved into profitfor the year with strong growth in activity,trading a total of 31.4 million contracts(2006: 22.2 million), representing anaverage of 124,000 per day (2006: 86,000),

up 44 per cent. EDX also successfullyintroduced Russian derivative productsin December 2006.

Other incomeOther income, primarily from propertysubletting, increased from 6.9 millionto 7.4 million.

* Based on IFRS for 2005, 2006 and 2007 andUK GAAP for 2003 and 2004, consistent withbasis of presentation of the Financial Recordset out on page 71

-

8/14/2019 LSE LN 2007 Annual Report

27/77

ADJUSTED BASIC EARNINGS PER SHARE (PENCE)*YEARS ENDED 31 MARCH

56.237.424.221.220.8

IFRSUK GAAP

0706050403

OPERATING PROFIT BEFORE EXCEPTIONALITEMS AND GOODWILL AMORTISATION (M)*YEARS ENDED 31 MARCH

186120858381

IFRSUK GAAP

0706050403

CASH GENERATED FROM ONGOINGOPERATING ACTIVITIES (M)*YEARS ENDED 31 MARCH

19914610110575

IFRSUK GAAP

0706050403

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200724

FINANCIAL REVIEW

JONATHAN HOWELL

EXPENDITUREAdministrative expenses (excludingexceptional items) decreased four per centto 164.0 million (2006: 171.0 million)principally from business efficiencies and

contract negotiations. Net exceptional itemstotalling 11.4 million mainly reflect advisersfees in respect of the Nasdaq bid defence(13.5 million), partially reduced by releaseof provision in respect of EDX London(3.1 million).

PROFIT FOR THE YEAROperating profit before exceptional itemsincreased 55 per cent to 185.6 million (2006:120.1 million). Operating profit includingexceptional revenues and costs increased104 per cent to 174.2 million (2006: 85.4million). Profit before taxation of 161.5million was 73 per cent above last year

(2006: 93.5 million). The taxation charge of50.9 million is above the standard tax ratedue mainly to expenses being treated as non-deductible. After tax and minority interests,profit attributable to equity holders for theyear was 109.6 million (2006: 70.7 million).

Basic earnings per share increased 82 percent to 50.5p per share (2006: 27.8p) andadjusted basic earnings per share (excludingexceptional items) increased 50 per centto 56.2p per share (2006: 37.4p), principallyreflecting growth across all core businessareas and continued strong cost control.

CASH FLOW AND BALANCE SHEETCash flow from operationsCash flow from operating activities increasedto 180.4 million (2006: 140.6 million), withcash flow from operating activities before

exceptional items increasing to 198.6 million(2006: 145.9 million), due to the strongoperating performance during the year.

Capital restructuring and share buybackKey cash outflows were due to the 512million capital return undertaken in May2006, and the Companys buyback of9.0 million of its own shares at an aggregatecost of 109.9 million.

This reflects the completion of the buybackof up to 50 million of shares during the yearended 31 March 2007, announced in February2006, and good progress on a subsequent

commitment by the Group to an additionalshare buyback programme of up to 250million.

The Company has entered into an irrevocablecommitment with its brokers to purchaseown shares which in part covers the closeperiod from 1 April 2007 up to the releaseof our preliminary announcement. This hasresulted in a 60 million liability beingrecognised at 31 March 2007 in respectof shares purchased in the close period.

* Based on IFRS for 2005, 2006 and 2007 andUK GAAP for 2003 and 2004, consistent withbasis of presentation of the Financial Recordset out on page 71

-

8/14/2019 LSE LN 2007 Annual Report

28/77

-

8/14/2019 LSE LN 2007 Annual Report

29/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200726

CORPORATE RESPONSIBILITY

Our approach gives priority to thoseactivities that are of real relevance to ourstakeholders and where we consider we canhave most impact. These priorities are:

COMMUNITYOur Community Programme is designed tosupport charity and other good causes and tomotivate our people to raise money and worktogether. Through our matching scheme we

double charitable donations by our staff. Themain focus of our charitable activity duringthe year has been our partnership withBrainwave, a charity dedicated to providingtherapy for children with developmentaldelay whether caused by a brain injurylike cerebral palsy or a genetic disorder(www.brainwave.org.uk).

The partnership has now ended after threehighly successful years during which theExchange generated over 400,000 in newfunds for Brainwave. Corporate donationsmade by the Exchange were more thandoubled by the fundraising efforts of our

staff. The partnership benefited from thecreative talent of our people as teams drawnfrom different departments competed to seewho could raise the most money. Describedby Brainwave Chief Executive David Davies astransformational, the partnership enabledBrainwave to scale up its activities and toopen a new therapy centre in Witham, Essex.

In addition to fundraising, the Exchangealso assisted Brainwave in other ways, forexample making our Media and BusinessComplex available to record a promotionalDVD by Brainwaves President, HRH TheCountess of Wessex, and providing marketingexpertise and advice.

The Exchange has begun the search for anew charity partner to succeed Brainwave

and will announce the outcome shortly.

GOVERNANCEThe Exchange is committed to delivering thehighest standards in boardroom practice andfinancial transparency through:

Clear and open communication withinvestors;

Maintaining accurate financial recordswhich transparently and honestly reflectthe financial position of our business; and

Endeavouring to maximise shareholderreturns.

A full programme of investor relationsactivity ensures appropriate contact withinstitutional and private shareholders,with regular meetings, presentations anddisclosure of important information. Greatcare is taken to provide suitably detailedinformation on the Exchanges activities andresults to enable various stakeholders tounderstand the performance and prospectsof the Company.

AS A HIGH-PROFILE PUBLICLY-LISTED COMPANY AT THEHEART OF GLOBAL FINANCIAL MARKETS, ABSOLUTEINTEGRITY IS CRUCIAL TO OUR SUCCESS. WE ARE AS PROUD

OF THE WAY WE DO BUSINESS AS WE ARE OF THE LEVELSOF PERFORMANCE THAT THIS HAS GENERATED.

During the past year, directors andmanagement of the Exchange haveconducted over 250 calls and meetings withmajor UK and international shareholders andfinancial analysts. Presentations of resultsare accessible by webcasts through theCompanys website, which also providespress releases, financial reports, tradingdata and other information released bythe Exchange.

The Annual General Meeting is held incentral London and is the principalopportunity for private shareholders tomeet directors and management of theCompany and put questions to the Board.

EMPLOYEESThe Exchanges excellent performancewould not be possible without employeesof the highest calibre with the motivationto perform to their full potential. We aimto create the right conditions for peopleto do their best work by:

Creating an environment which enablesall employees to develop their skills andknowledge. All employees have theopportunity to formally discuss theirdevelopment with their manager at leastonce a year which includes both internaldevelopment programmes and externaltraining courses;

-

8/14/2019 LSE LN 2007 Annual Report

30/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 7

Encouraging open and honest assessmentof employee performance and behaviourthrough regular performance feedbackand annual appraisal which for more seniorexecutives includes 360o feedback fromcolleagues and their teams; and

Providing all staff with the opportunity tobuild an equity interest in the Exchangethrough all-employee share plans.

In addition, the importance of operatingwith integrity, openness and respect isrecognised by:

Encouraging a working environment inwhich employees feel comfortable abouthighlighting wrongdoing and providing themwith a formal procedure in which to do so;

Promoting an environment of equalityof opportunity which is intolerant ofdiscrimination, harassment or victimisation;

Providing regular business briefings wherestaff are updated on business performance

and new developments and have theopportunity to ask questions of the seniormanagement team; and

Maintaining healthy and safe workingconditions.

A full health and safety audit is completedannually which includes advice from externalconsultants on new or changing legislationand best practice. There were no reportableillnesses, dangerous occurrences or liabilities,nor were any health and safety enforcementnotices received.

ENVIRONMENTWe recognise that our activities have an

impact on the environment and we continueto take steps to manage this in a responsibleand appropriate manner.

During the year, we completed a full reviewof our environmental impact across our threeprincipal sites in partnership with the CarbonTrust. A number of efficiencies in energyutilisation were identified and implementedand further steps taken to increase ouruse of recycling facilities. We continueto purchase only green energy and havemaintained the significant reduction in CO

2

emissions achieved on our relocation toPaternoster Square.

During the year, we received the GoldAward under the Clean City Awards Scheme,which recognises good practice to reduceconsumption and reuse and recycle wherepracticable. Our environmental strategyand performance also contributed to ourcontinued inclusion in the FTSE4Good index.

During the coming year, we will maintainour ongoing programme of environmental

management and continue to work with theCarbon Trust to identify additional ways toreduce our CO

2emissions.

Our Environmental Policy Statement,which provides a framework for developingand reviewing environmental objectives,can be found on our website atwww.londonstockexchange.com.

Hannah, aged 10 months, who has Cerebral Palsy, receiving sensory stimulation at Brainwaves National Centre

-

8/14/2019 LSE LN 2007 Annual Report

31/77

-

8/14/2019 LSE LN 2007 Annual Report

32/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 29

Competitive pressureThe terms under which business is conductedin the UK have been further liberalised byrecent EU directives (e.g. MiFID), presentingthe opportunity to conduct and publishtrades in different ways and on alternativevenues. The Exchange also faces competitionfrom other exchanges as well as fromelectronic communication networks andalternative trading and trade reporting

systems. These developments mightadversely impact revenue growth. TheExchange is very well placed to addresscompetitive pressures through the steps ithas taken and continues to take, for example,to develop new products and services andprovide advanced trading and informationtechnology to meet customers needs.In particular, our new trading platformTradElect scheduled for implementationfor the London market in June 2007 willdeliver a step change in performance,capacity and flexibility.

IT infrastructureKey services depend on technology whichis secure, stable and performs to high levelsof availability and throughput. The failureof these systems could adversely impactrevenue and customer goodwill. The groupmaintains alternative computer facilities toreduce the risk of system disruptions. Therehave been no trading outages in the lastseven years.

The Exchange is currently renewing its ITinfrastructure to create a more modern,scalable and agile platform which can beoperated at lower cost (the TechnologyRoadmap). Major IT replacements of thiskind have high levels of risk attached tothem. Failure to deliver the expectedbenefits could hamper the Exchangesstrategic flexibility and reduce its ability torespond to customer needs for services orkeener pricing. The Exchange, in conjunctionwith Accenture, the Exchanges primary ITservice provider, is employing rigoroussoftware design methodologies, logistics

planning and assembly and testing regimesto minimise the risk.

FinancingIn order to develop its business, theBoard expects that the Exchanges capitalrequirements will be met from existing cashresources, internally generated funds andaccess to lending facilities. However, capitalrequirements may vary from those currentlyplanned. There can be no guarantee thatcapital will be available on a timely basisor on favourable terms or at all.

EmployeesThe support of its employees and, inparticular, the Executive Directors and seniormanagers within business divisions, is crucialto the continued success of the Exchange.The loss of key members of the Exchangesstaff could have a material adverse effect onits performance. To prevent this, successionplans are in place and reward and incentivesystems are regularly reviewed.

-

8/14/2019 LSE LN 2007 Annual Report

33/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200730

BOARD OF DIRECTORS

CHRIS GIBSON-SMITH (61) 3

ChairmanAlso Chairman of The British Land Companyplc and Non-Executive Director of QatarFinancial Centre Authority. He is a Trusteeof the London Business School. He waspreviously Chairman of National Air TrafficServices Ltd from 2001 to 2005, Director ofLloyds TSB plc from 1999 to 2005, GroupManaging Director of BP plc from 1997 to

2001, and a past Trustee of the Instituteof Public Policy Research and the arts charityArts & Business.

CLARA FURSE (49)Chief ExecutiveAppointed Chief Executive in January 2001.Group Chief Executive of Credit LyonnaisRouse from 1998 to 2000. At Phillips & Drew(now UBS) from 1983 to 1998; became aDirector in 1988, Executive Director in 1992,Managing Director in 1995 and Global Head ofFutures in 1996. Director of LIFFE from 1991to 1999; Deputy Chairman from 1997 to 1999.

She is a Non-Executive Director of Fortis,Euroclear plc and LCH.Clearnet.

-

8/14/2019 LSE LN 2007 Annual Report

34/77

THE WORLDS CAPITAL MARKET ANNUAL REPORT 2007 LONDON STOCK EXCHANGE 31

JONATHAN HOWELL (44)Director of FinanceDirector of Finance since December 1999,responsible for Finance and BusinessOperations. He was previously Head ofMarket Regulation from 1998 and Directorof Regulation from March 1999. He is a Non-Executive director of Emap plc and Non-Executive Chairman of FTSE InternationalLtd. He joined the Exchange in 1996 from

PricewaterhouseCoopers.

GARY ALLEN CBE DL (62) 1

Non-Executive DirectorChairman IMI plc from May 2001 untilDecember 2004, Chief Executive from 1986to January 2001. Board director of IMI plcfrom 1978 until 2005, having joined thecompany in 1965. Chairman of the NationalExhibition Centre until December 2006. He isa Non-Executive Director of NV Bekaert SA,Belgium and Temple Bar Investment Trust plc.

ROBERT WEBB QC (58) 2,3

Non-Executive DirectorGeneral Counsel of British Airways plcsince September 1998, responsible for law,government and industry affairs, safety,security, risk management, communicationsand the environment. Board member of theBBC, London First, and Hakluyt Ltd. Bencher,Inner Temple.

NIGEL STAPLETON (60) 1,2,3Non-Executive DirectorChairman Postal Services Commission.Previously Chairman of Reed International plcfrom 1997 to 1999, Co-Chairman of ReedElsevier plc from 1996 to 1998, ChiefFinancial Officer of Reed Elsevier plc from1993 to 1996 and Chairman of Uniq plc from2001 to 2006.

BARONESS (JANET) COHEN (66) 1,2,3

Non-Executive DirectorA Life Peer, Non-Executive Chairmanof Inviseo Media Holdings Ltd, and Non-Executive Director of Management Consulting

Group plc, and Proudfoot Trustees Limited.Previously Chairman of BPP Holdings plc andAdvisory Director of HSBC Investment Bank,a Non-Executive Director of CharterhouseManagement Services Ltd from 1988 to 1999and Charterhouse Financial Services Ltd from1989 to 1993.

PETER MEINERTZHAGEN (61) 2

Non-Executive DirectorFrom 1999 until retiring in 2007, Chairmanof Hoare Govett Ltd, Hoare GovettCorporate Finance Ltd and Hoare GovettSmall Companies Index Trust plc. He joinedHoare Govett in 1965.

OSCAR FANJUL (58) 1,3

Non-Executive Director

Vice-Chairman and Chief Executive of OmegaCapital. Honorary Chairman of REPSOL-YPF.Non-Executive Director of Acerinox, Marsh &McLennan Companies, Lafarge Group, Areva(Conseil de Surveillance) and InmobiliariaColonial. He is also Trustee of theInternational Accounting StandardsCommittee (IASC) Foundation and theAmigos del Museo del Prado Foundation.

1 MEMBER OF THE AUDIT COMMITTEE2 MEMBER OF THE REMUNERATION COMMITTEE3 MEMBER OF THE NOMINATION COMMITTEE

-

8/14/2019 LSE LN 2007 Annual Report

35/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200732

CORPORATE GOVERNANCE

Following the Scheme of Arrangement inMay 2006, London Stock Exchange Group plcadopted the same corporate governancepractices and Board Committees as LondonStock Exchange plc.

APPOINTMENTS TO THE BOARDThe Board had previously commenced aprocess to recruit additional non-executivedirectors which ceased when the Companyentered an Offer Period in December 2004.In order to refresh the Board and itsCommittees, the Board is now seeking torecruit additional directors. This processis being led by the Nomination Committeeworking alongside recruitment consultants.

BOARD OF DIRECTORSThe Board is the principal decision makingforum for the Company and is responsible

to shareholders for achieving its strategicobjectives and for its financial andoperational performance. The Board hasadopted a formal schedule of mattersspecifically reserved to it including:

The Exchanges corporate strategy;

The annual budget;

Policies in relation to risk management,health and safety and environmentalmatters;

Increases or variations to borrowingfacilities;

Committing to major capital expenditureor acquisitions; and

Dividend policy.

The Board also views the Exchanges brandand reputation as a Recognised InvestmentExchange as important assets of theCompany and protection of brand andreputation are key parts of the Boards role.

As the Company was in an Offer Periodduring the year, there were a large numberof Board and Committee meetings oftenconvened on short notice. Non-attendance

at meetings was due to prior business orpersonal commitments and illness. On theoccasions when a director has been unableto attend a Board or Committee meeting,any comments which he or she has arisingout of the papers have been relayed inadvance to the relevant chairman.

At each of its meetings the Board receives afull written report from the Chief Executiveon financial performance, key matters ineach of the divisions and progress againstkey performance indicators. The executivemanagement team present to the Board ontheir business responsibilities on a regularbasis and also present at the Boards periodicstrategy sessions.

The roles of Chairman and Chief Executiveare distinct and separate with a clear divisionof responsibilities. The Chairman leads theBoard and is responsible for ensuring itseffectiveness. The Chairmans other current

significant commitments are set out in hisbiography on page 30. During the year theonly change has been his appointment asChairman of The British Land Company plc.The Chief Executive has delegated authorityfrom, and is responsible to, the Board formanaging the Companys business. The Boardhas six scheduled meetings in addition to twooffsite strategy sessions. In the year ended31 March 2007 the Board held 18 meetings.The Chairman meets non-executive directorswithout the presence of executive directorson a number of occasions throughout the year.

Directors have the benefit of indemnityarrangements from the Company in respectof liabilities incurred as a result of theiroffice and execution of their powers, dutiesand responsibilities. In respect of thoseliabilities for which directors may not beindemnified, the Company purchased andobtained a directors and officers liability

insurance policy throughout 2006. Thisinsurance cover was renewed at thebeginning of 2007. Neither the Companysindemnity nor insurance provides coverin the event that the director is proved tohave acted fraudulently or dishonestly.

BOARD BALANCE AND INDEPENDENCEThe Board comprises nine directors,the Chairman (who was independent onappointment), two executive directors andsix non-executive directors. Directors servingon the Boards committees together withbiographical details are identified on theBoard of Directors pages 30 and 31 which

demonstrate a range of business experiencethat provide the right mix of skills andexperience given the size of the Company. TheBoard considers all non-executive directors tobe independent in character, that there are norelationships or circumstances which are likelyto affect their independent judgement and noundue reliance is placed on any individual.

The senior director, Gary Allen, and PeterMeinertzhagen, who sit on the Audit andRemuneration Committees respectively,are not independent according to the lengthof service criterion of the Combined Codebut are considered by the Board to beindependent in character and in particularboth continue to challenge rigorously theexecutive directors, the Board, and theCommittees on which they sit.

Gary Allen was appointed Senior Directorin 2004 and is also Chairman of the Audit

BOARD AND COMMITTEE MEETINGS 2007Board

Board Audit Remuneration Nomination Committee1

Total number of Meetings inthe year ended 31 March 2007 18 4 5 1 10

Dr Chris GibsonSmith 18 1 1 10

Mrs Clara Furse 16 9

Mr Jonathan Howell 18 10

Mr Gary Allen 14 4 9

Baroness Janet Cohen 16 3 4 0

Mr Oscar Fanjul 16 4 1

Mr Peter Meinertzhagen 15 4 9

Mr Nigel Stapleton 14 2 5 1 8

Mr Robert Webb 14 4 1

1 Established when the Company entered an Offer Period

LONDON STOCK EXCHANGE GROUP PLC IS COMMITTED TO

HIGH STANDARDS OF CORPORATE GOVERNANCE, AND BUSINESSINTEGRITY IN ALL ITS ACTIVITIES. THE COMPANY HAS COMPLIEDWITH ALL PROVISIONS OF THE COMBINED CODE THROUGHOUTTHE YEAR ENDED 31 MARCH 2007 EXCEPT AS EXPLAINED IN THEREPORT BELOW.

-

8/14/2019 LSE LN 2007 Annual Report

36/77

-

8/14/2019 LSE LN 2007 Annual Report

37/77

THE WORLDS CAPITAL MARKETLONDON STOCK EXCHANGE ANNUAL REPORT 200734

CORPORATE GOVERNANCE

with the objectivity and independence ofthe Companys external auditors.

Nomination CommitteeThe Nomination Committee members as

at 31 March 2007 were: Chris Gibson-Smith(Chairman), Janet Cohen, Oscar Fanjul, NigelStapleton and Robert Webb. The Committeenormally invites the Chief Executive to attend.The Committee meets as necessary to makerecommendations to the Board on all newBoard appointments and to review executiveand Board succession planning. Since theCompany exited the Offer Period on 11February, the Committee has met to considerthe appointment of additional non-executivedirectors to the Board. The Committee hasworked alongside external recruitmentconsultants to evaluate and meet prospectivecandidates. If appropriate, candidates will

be recommended to the whole Board forapproval. The Committee has written termsof reference which are available from theCompany Secretary or on the corporatewebsite at www.londonstockexchange.com.

INTERNAL CONTROLThe Board confirms that procedures havebeen in place throughout the year and upto the date of this report which comply fullywith the guidance Internal Control: RevisedGuidance for Directors on the CombinedCode (October 2005) (published by theFinancial Reporting Council (FRC)).

The Companys systems of internal controlover business, operational, financial andcompliance risks are designed to help theCompany meet its business objectives byappropriately managing, rather thaneliminating, the risks to those objectives.The controls can only provide reasonable,not absolute, assurance against materialmis-statement or loss. The Board has ultimateresponsibility for the systems of internalcontrol and, through the Audit Committee,has reviewed the effectiveness of thesystems. The Board is committed to theircontinual enhancement. The Board confirmsthat the actions it considers necessary havebeen or are being taken to rectify such failingsand weaknesses which it considers to besignificant from its review of the systemof internal control. The Board also confirmsthat it has not been advised of materialweaknesses in that part of the internal controlsystem that relates to financial reporting.

The principal features of the Companyscontrol framework are described under thefollowing headings:

Delegation of authority matters reserved

for Board approval only are clearly defined.Executive directors have generalresponsibility for making and implementingoperational decisions and for overseeingthe Companys business. All directorshave access to the advice and servicesof the Company Secretary. In addition alldirectors are able, if necessary, to obtainindependent professional advice at theCompanys expense.

Planning and reporting the Board approvesstrategic decisions and the budget for theforthcoming year and receives a reporton key business matters from the Chief

Executive at each meeting. Monthly reportsto management contain key performanceindicators and compare actual financialperformance with the annual budget orforecast. Management action is takenwhere variances arise and revised forecastsare prepared on a regular basis.