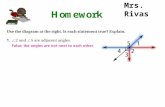

Mrs. Rivas Ida S. Baker H.S.. Mrs. Rivas International Studies Charter School.

LITE DEPALMA GREENBERG & RIVAS, LLC Joseph J. DePalma...

Transcript of LITE DEPALMA GREENBERG & RIVAS, LLC Joseph J. DePalma...

1

LITE DEPALMA GREENBERG & RIVAS, LLC Joseph J. DePalma Janet R. Bosi Two Gateway Center, 12th Floor Newark, New Jersey 07102 Tel: (973) 623-3000 Fax: (973) 623-0858 Liaison Counsel for Plaintiff [Additional counsel on signature page]

UNITED STATES DISTRICT COURT DISTRICT OF NEW JERSEY

DOCUMENT ELECTRONICALLY FILED _________________________________________ JOSEPH WITRIOL, Individually and On Behalf of All Others Similarly Situated,

Plaintiff,

vs. CONEXANT SYSTEMS INC., DWIGHT, W. DECKER, and ARMANDO GEDAY, et al,

Defendants. _________________________________________

)))))))))))))

Civil Action No.: 04-CV-6219 (SRC/TJB) JURY TRIAL DEMANDED

SECOND CONSOLIDATED AMENDED CLASS ACTION COMPLAINT

Lead Plaintiff, the Phillips Group (“Plaintiff”), on behalf of itself and all other persons or

entities that purchased or acquired the common stock of Conexant Systems, Inc. (“Conexant” or

the “Company”) between March 1, 2004 and November 4, 2004, inclusive (the “Class Period”),

alleges the following based upon information and belief, except as to those allegations

concerning Plaintiff, which are based upon personal knowledge. Plaintiff’s information and

belief allegations are based upon, among other things: (a) the investigation conducted by and

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 1 of 61

2

through its attorneys; (b) review and analysis of filings made by Conexant with the United States

Securities and Exchange Commission (“SEC”); (c) review and analysis of press releases, public

statements, news articles, securities analysts’ reports and other publications disseminated by or

concerning Conexant; (d) interviews with former Conexant employees; and (e) other publicly

available information about Conexant. Most of the facts supporting the allegations contained

herein are known only to Defendants (defined at ¶ 1) or are within their control. Plaintiff

believes that substantial additional evidentiary support will exist for the allegations set forth in

this Second Consolidated Amended Class Action Complaint (“Complaint”) after a reasonable

opportunity for discovery.

NATURE OF THE ACTION

1. This is a federal class action on behalf of all persons or entities that purchased or

acquired shares of Conexant common stock during the Class Period, seeking to pursue remedies

under the Securities Exchange Act of 1934 (the “Exchange Act”). The defendants are Conexant

and four of the Company’s most senior officers and directors: Armando Geday (“Geday”),

Dwight W. Decker (“Decker”), J. Scott Blouin (“Blouin”) and Robert McMullan (“McMullan”)

(collectively the “Individual Defendants” and together with Conexant “Defendants”).

2. This case arises from the failed integration of GlobespanVirata, Inc.’s

(“Globespan”) operations and personnel following Conexant’s acquisition of Globespan through

a stock-for-stock merger (the “Globespan Acquisition”). The Class Period begins on March 1,

2004, when Defendants issued a press release and held a conference call to announce that the

Globespan Acquisition had closed on February 27, 2004.

3. Throughout the Class Period, Defendants made numerous false and misleading

statements that the integration of Globespan’s operations and personnel was proceeding on track.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 2 of 61

3

In reality, the Globespan Acquisition was fraught with problems resulting in a combined

company with revenues that were no greater than Conexant’s revenues as a stand-alone

company, but with the burden of carrying the overhead and expenses from both entities. Former

Conexant employees, state that following the Globespan Acquisition, senior management began

to debate over a variety of issues, including which e-mail system to employ, resulting in a delay

in hiring critical staff and the release of new products causing Conexant to lose market share in

the critical digital subscriber line (“DSL”) and wireless local area network (“WLAN”) segments.

In order to conceal these problems, as well as the sagging demand for the Company’s WLAN

and DSL products, the Defendants knowingly stuffed the Company’s distribution channels with

far more product than was required to meet its true end-user demand.

4. The Individual Defendants were highly motivated to orchestrate the Globespan

Acquisition and, later, to engineer the fraud to cover up the merger’s failure by opportunities for

personal profit through accelerated vesting of options, hefty bonuses and more lucrative salaries.

The Individual Defendants possessed the motive and opportunity to conceal their true intentions

when they entered the Globespan Acquisition.

5. Ultimately, this fraudulent scheme proved unsustainable. On July 6, 2004, in a

press release, the truth started to unravel when Conexant disclosed that its excess channel

inventory began to catch up with the diminished demand for its products and the Company was

forced to issue an earnings warning that shocked the financial markets. Specifically, Conexant

stated:

In the third fiscal quarter, a shortfall in demand in our wireless LAN business led to overall company performance that was less than we expected at the beginning of the quarter. . . . [C]hannel inventory of

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 3 of 61

4

our customers’ products increased as new competitors’ products, based on low-priced Taiwanese solutions, caused our customers to lose market share.

6. This announcement sent the price of Conexant’s stock careening down $1.77 per

share, or 56.6 percent, by the close of trading on July 6, 2004. Despite this announcement,

however, Defendants continued to materially misrepresent the true state of affairs maintaining

that Conexant “continued to be wholly confident in the market positions, profitability and growth

prospects of our new combined company.”

7. On November 4, 2004, the last day of the Class Period, Conexant issued an

earnings warning for the fourth quarter of 2004 announcing losses of $367.5 million due to lower

demand for its products, excessive inventory build-up and the delayed release of new products.

Even more shocking was that Individual Defendant Geday admitted to knowing that inventory

had “been building for multiple quarters, maybe 4 or 5 quarters” and Conexant’s President,

Matthew Rhodes (“Rhodes”), disclosure that the integration was not successful.

8. The November 4, 2004, revelations caused the price of Conexant stock to

plummet 10 percent from $1.76 per share at the close of trading on November 4, 2004, to $1.60

per share at the close of trading on November 5, 2004. Shortly thereafter, Geday was forced to

resign and Decker was reinstated as the Company’s chief executive officer (“CEO”). In his first

public statement after being reinstated as CEO, Decker admitted that the Globespan Acquisition

was a failure: “[N]ot everything has gone as well as we’d like. Let me say that – so therefore, it

is the case that more work still needs to be done.”

9. On November 10, 2004, following Decker’s admission that the merger was a

failure, Dushyant J. Desai of C.E. Unterberg, Towbin, one of the leading securities analysts who

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 4 of 61

5

followed Conexant during the Class Period, issued a report stating: “for all practical purposes,

the integration (of the two companies) was attempted but not effective… In the end, one plus one

equals one, instead of two or more.”

10. In December 2004, Conexant announced that it would halt shipping new products

until the clogged channels were cleared of approximately $50 million in excess inventory.

JURISDICTION AND VENUE

11. This Court has jurisdiction over the subject matter of this action pursuant to

Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331.

12. The claims asserted herein arise under and pursuant to Sections 10(b), 18(a) and

20(a) of the Exchange Act, (15 U.S.C. §§ 78j(b), 78r(a) and 78t(a)), and Rule 10b-5 (17 C.F.R. §

240.10b-5), promulgated thereunder.

13. Venue is proper in this Judicial District pursuant to Section 27 of the Exchange

Act, 15 U.S.C. ' 78aa and 28 U.S.C. ' 1391(b). Many of the acts, practices and transactions

complained of herein, including the preparation and dissemination of materially false and

misleading information, occurred in substantial part in this Judicial District. Moreover, on April

6, 2005, this Court issued an Order transferring all related cases to this District and consolidating

these related cases under this caption. Additionally, the Company maintained a principal

executive office in this Judicial District at all times relevant to this action.

14. In connection with the acts, conduct and other wrongs alleged in this Complaint,

Defendants, directly and/or indirectly, used the means and instrumentalities of interstate

commerce, including without limitation, the mails, and interstate telephone communications and

the facilities of the national securities markets and exchanges.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 5 of 61

6

PARTIES

15. Plaintiff purchased the publicly traded common stock of Conexant at artificially

inflated prices during the Class Period, as demonstrated by Plaintiff’s certifications previously

filed with the Court and has suffered damages as a result of the disclosure of the wrongful acts of

Defendants as alleged herein. By order dated April 6, 2005, the Court appointed Plaintiff as the

lead plaintiff in this case pursuant to 15 U.S.C. §78u-4.

16. Defendant Conexant is a corporation organized under the laws of Delaware. At

all times relevant to this action, the Company maintained principal executive offices located at

100 Schultz Drive, Red Bank, New Jersey 07701.

17. Defendant Decker was, at all relevant times, the Company=s Chairman. Decker

was the CEO and chairman of Conexant from December 1998 until February 27, 2004, when the

Globespan Acquisition closed. Decker reviewed, approved and signed certain of Conexant’s

false and misleading SEC filings during the Class Period. Decker was reinstated as CEO on

November 9, 2004.

18. Defendant Geday was, until his resignation on November 9, 2004, Conexant’s

CEO and a director. In 1997, Geday left Rockwell to join Globespan as its CEO and a director.

Geday reviewed, approved and signed certain of Conexant’s false and misleading SEC filings

during the Class Period.

19. Defendant McMullan was the Senior Vice President (“SVP”) and Chief Financial

Officer (“CFO”) of Conexant from February 27, 2004, until his resignation on August 12, 2004.

Prior to the Globespan Acquisition, McMullan was CFO of Globespan and worked closely with

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 6 of 61

7

Geday. McMullan reviewed, approved and signed certain of Conexant’s false and misleading

SEC filings during the Class Period.

20. Defendant Blouin was Conexant’s SVP and CFO from June 2003 until February

2004; SVP, CFO and Controller from March 2002 to June 2003; SVP and CFO from January

2001 to March 2002. Blouin was reinstated as SVP and CFO of Conexant when McMullan

resigned in August 2004. Blouin reviewed, approved and signed certain of Conexant’s false and

misleading SEC filings during the Class Period.

21. During the Class Period, each of the Individual Defendants, as senior executives

officers and/or directors of Conexant, were privy to material non-public information concerning

its business, finances, products, markets and present and future business prospects via access to

internal corporate documents, conversations and connections with other corporate officers and

employees, attendance at management and Board of Directors meetings and committees thereof

and via reports and other information provided to them in connection therewith. Because of their

possession of such information, the Individual Defendants knew or recklessly disregarded the

fact that adverse facts specified herein had not been disclosed to, and were being concealed from,

the investing public.

22. Because of the Individual Defendants’ positions with the Company, they had

access to the adverse undisclosed information about the Company’s (and Globespan’s) business,

operations, operational trends, financial statements, markets and present and future business

prospects via access to internal corporate documents (including both the Company’s and

Globespan’s operating plans, budgets and forecasts and reports of actual operations compared

thereto), conversations and connections with other corporate officers and employees, attendance

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 7 of 61

8

at management and Board of Directors meetings and committees thereof and via reports and

other information provided to them in connection therewith.

23. It is appropriate to treat the Individual Defendants as a group for pleading

purposes and to presume that the false, misleading and incomplete information conveyed in the

Company’s public filings, press releases and other publications as alleged herein are the

collective actions of the narrowly defined group of defendants identified above. Each of the

above officers of Conexant, by virtue of their high-level positions with the Company, directly

participated in the management of the Company, was directly involved in the day-to-day opera-

tions of the Company at the highest levels and was privy to confidential proprietary information

concerning the Company and its business, operations, growth, financial statements, and financial

condition, as alleged herein. The Individual Defendants were involved in drafting, producing,

reviewing and/or disseminating the false and misleading statements and information alleged

herein, were aware, or recklessly disregarded, that the false and misleading statements were

being issued regarding the Company, and approved or ratified these statements, in violation of

the federal securities laws.

24. As officers and controlling persons of a publicly-held company whose securities

were, and are, registered with the SEC pursuant to the Exchange Act, and were traded on the

NASDAQ and governed by the provisions of the federal securities laws, the Individual

Defendants each had a duty to disseminate promptly, accurate and truthful information with

respect to the Company’s financial condition and performance, growth, operations, financial

statements, business, markets, management, earnings and present and future business prospects,

and to correct any previously-issued statements that had become materially misleading or untrue,

so that the market price of the Company’s publicly-traded securities would be based upon

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 8 of 61

9

truthful and accurate information. The Individual Defendants’ misrepresentations and omissions

during the Class Period violated these specific requirements and obligations.

25. The Individual Defendants participated in the drafting, preparation, and/or

approval of the various public and shareholder and investor reports and other communications

complained of herein and were aware of, or recklessly disregarded, the misstatements contained

therein and omissions therefrom, and were aware of their materially false and misleading nature.

Because of their board membership and/or executive and managerial positions with Conexant,

each of the Individual Defendants had access to the adverse undisclosed information about

Conexant’s financial condition and performance as particularized herein and knew (or recklessly

disregarded) that these adverse facts rendered the positive representations made by or about

Conexant and its business issued or adopted by the Company materially false and misleading.

26. The Individual Defendants, because of their positions of control and authority as

officers and/or directors of the Company, were able to and did control the content of the various

SEC filings, press releases and other public statements pertaining to the Company during the

Class Period. Each Individual Defendant was provided with copies of the documents alleged

herein to be misleading prior to or shortly after their issuance and/or had the ability and/or

opportunity to prevent their issuance or cause them to be corrected. Accordingly, each of the

Individual Defendants is responsible for the accuracy of the public reports and releases detailed

herein and are therefore primarily liable for the representations contained therein.

27. Each of the Individual Defendants is liable as a participant in a fraudulent scheme

and course of business that operated as a fraud or deceit on purchasers of Conexant securities by

disseminating materially false and misleading statements and/or concealing material adverse

facts. The scheme: (i) deceived the investing public regarding Conexant’s business, operations,

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 9 of 61

10

management and the intrinsic value of Conexant securities by portraying that its integration with

Globespan’s operations and personnel was proceeding with outstanding success when in reality

there were significant integration problems causing Conexant to sustain a loss of market share in

its DSL and WLAN product lines, and (ii) caused Defendants to stuff the distribution channels

causing Plaintiff and other members of the Class to purchase Conexant securities at artificially

inflated prices.

SUBSTANTIVE ALLEGATIONS

About Conexant 28. Conexant is a “fabless” semiconductor company that provides semiconductor

system solutions for digital home information and entertainment networks. The Company’s

products include DSL and cable modem solutions, home network processors, broadcast video

encoders and decoders, digital set-top box components and systems solutions, and dial-up

modems. The Company also offers a suite of wireless data and networking components

solutions that includes HomePlug®, HomePNA™ and WLAN (802.11g) components and

reference designs.

29. During the three years prior to the Class Period, Conexant, like other high-

technology companies, experienced a severe decline in sales. In an effort to reverse this decline,

Conexant employed a strategy to divide the Company into three separate businesses. In

September 2000, Conexant spun-off of its Internet infrastructure business and in June 2002, it

spun-off its wireless chip business. Following the divestiture of these businesses, Conexant was

left to focus exclusively on its broadband business.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 10 of 61

11

About Globespan 30. Globespan was created in 1996 as a spin-off of Lucent Technologies.

Globespan’s products included broadband system-level solutions for modems, routers,

residential gateways, and DSLAMs, as well as a variety of wireless networking chip sets and

reference designs enabling wireless connectivity in notebooks, PDAs, digital cameras, MP3

players and other handheld networking appliances.

31. In December 2001, Globespan completed a merger with Virata creating

GlobespanVirata, which was the leading supplier of silicon used in DSL modems. In July 2003,

Globespan acquired Intersil Corporation’s (“Intersil”) WLAN chip group. Intersil’s WLAN chip

group was one of the primary product lines that Conexant sought to acquire in the Globespan

Acquisition.

Decker And Geday Plan To Merge Conexant and Globespan

32. Geday and Decker were longtime business associates who together rose through

the ranks at Rockwell International (“Rockwell”) during the 1990s. In 1997, Decker and Geday

parted ways when Geday left Rockwell to become CEO of Globespan. Decker remained at

Rockwell until January 1999, when he left to become the CEO of Conexant, which was spun-off

from Rockwell as a stand-alone company.

33. At the time they orchestrated the Globespan Acquisition, Decker and Geday fully

understood that a merger of their respective companies could produce enormous financial

rewards for themselves. They schemed together for approximately three years to bring this

business combination to fruition. The history of Decker’s and Geday’s merger negotiations is

described in a Registration and Proxy Statement on Form S-4/A that Conexant filed with the

SEC on January 15, 2004 (the “Registration/Proxy Statement”). Specifically, the

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 11 of 61

12

Registration/Proxy Statement discloses that Decker and Geday had been engaged in on-

again/off-again negotiations to combine Conexant and Globespan since late November and

December 2000.

34. The Registration/Proxy Statement states that in June 2002 Conexant executed an

agreement to acquire Globespan’s iCompression business. Following the iCompression deal,

Geday and Decker resumed discussions concerning a combination of the two companies.

According to the Registration/Proxy Statement, “Between September and October 2002,

Conexant and GlobespanVirata had discussions regarding a potential combination of one or more

of Conexant’s businesses with GlobespanVirata.” Decker, Geday, and McMullan, as well as

representatives of Credit Suisse First Boston, financial advisor to Conexant, and representatives

of Morgan Stanley, financial advisor to GlobespanVirata, participated in the discussions.

35. According to the Registration/Proxy Statement, discussions between Geday,

Decker and McMullan resumed in August 2003 and September 2003. Following these

discussions, “both parties believed there was a strong strategic and business rationale to combine

their two companies and a means to integrate successfully both businesses to realize operational

scale and efficiencies.” In October 2003, the management teams from Conexant and Globespan,

including the general manager of the WLAN products group, met “to review and discuss the

operations and business plan of [Globespan’s] recently acquired WLAN products group.”

Finally, on November 2, 2003, the board of directors from both companies approved an

agreement whereby Conexant would acquire Globespan.

The Globespan Acquisition Is Announced

36. On November 3, 2003, Defendants issued a press release (the “November 3, 2003

Press Release”) announcing that Conexant had signed an agreement to acquire Globespan

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 12 of 61

13

through a stock-for-stock merger (the “Globespan Acquisition”). According to the

Registration/Proxy Statement, consideration for the Globespan Acquisition was valued at

approximately $1.1 billion. Under the terms of the merger agreement, Globespan shareholders

would receive 1.198 shares of Conexant stock for each share of Globespan stock, which

represented a 13.87 percent premium for Globespan shareholders. The merger agreement further

provided that Geday would become CEO of Conexant, replacing Decker who would serve as the

non-executive chairman and McMullan would replace Blouin as SVP and Chief Financial

Officer (“CFO”). According to the merger agreement, Conexant’s new board of directors would

consist of 12 members, including five Globespan designated directors and seven Conexant

designated directors. The combined company would retain the Conexant name and continue

trading its stock on the NASDAQ stock exchange under the symbol “CNXT.”

37. In the November 3, 2003 Press Release, Defendants claimed that the combined

company would be greater than the sum of its parts because of operational synergies,

complementary product lines -- particularly in the WLAN and DSL businesses -- and cross-

selling opportunities.

38. On January 16, 2004, Conexant announced that the SEC had declared the

Registration/Proxy Statement effective. The transaction was subject to customary closing

conditions, including the approval by the shareholders of both companies. Conexant

shareholders voted on the proposed merger at the Company’s annual shareholders meeting on

February 25, 2004. Globespan held a separate special shareholders meeting at the same time and

location to vote on the merger.

39. On February 25, 2004, Conexant issued a press release announcing that the

Company’s shareholders of record as of January 2, 2004 had voted to approve the Globespan

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 13 of 61

14

Acquisition, which provided in part: “The combined company will have an annual revenue run-

rate of approximately $1.2 billion, and will possess the industry’s most complete and most

advanced portfolio of semiconductor solutions targeting broadband communications, enterprise

networks and the digital home.” On this news, the price of Conexant stock jumped to close at

$7.30 per share, on February 25, 2004, up $0.42 from its previous close of $6.88 per share, on

February 24, 2004.

40. On March 1, 2004, the first day of the Class Period, Conexant issued a press

release (the “March 1, 2004 Press Release”) announcing the Globespan Acquisition had closed

on February 27, 2004. The March 1, 2004, Press Release promised that the newly combined

company would possess “leading positions in [DSL] connectivity, [WLAN], dial-up modems,

home networking, broadcast video products and digital set-top box system solutions.”

According to the March 1, 2004 Press Release, the combined company was valued at

approximately $3.4 billion, and had 2,400 employees worldwide.

41. News of the closing propelled the price of Conexant common stock to a new 52-

week high of $7.77 per share on March 1, 2004, up $0.42 from its previous close of $7.35 per

share, on February 27, 2004.

Defendants Reassure Investors That Globespan’s Integration Is “On Track”

42. After the closing of the Globespan Acquisition, Defendants repeatedly

represented that the integration of Globespan’s operations and personnel with Conexant was

proceeding as planned and that the Company would soon reap the benefits of stronger purchasing

power from suppliers and operational efficiencies. Indeed, Defendants made numerous

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 14 of 61

15

misrepresentations about the status of the Globespan Acquisition, including the March 1, 2004

Press Release in which Geday stated:

We have made outstanding progress toward integrating the organizations, systems, technologies and processes of Conexant and GlobespanVirata over the past two months and are in a strong position as we begin combined operations today.

Similarly, in an April 26, 2004 press release, Geday asserted:

Since the close of the Conexant-GlobespanVirata merger transaction, our team has done an outstanding job of integrating processes, systems, technologies and organizations, and we have a clear path to the successful completion of our integration work.

Also, in a July 6, 2004 conference call, Geday claimed:

In our leadership DSL business we have made significant progress in the consolidation of the former GlobespanVirata and Conexant productlines.

43. Unbeknownst to the investing public, however, the Globespan Acquisition was a

disaster due to significant problems integrating Globespan’s operations and personnel,

overlapping product lines, lagging designs, and delayed hiring of critical staff, which ultimately

caused Conexant to lose its market share in its DSL and WLAN businesses. In order to conceal

these problems from investors, Conexant stuffed its distribution channels, which artificially

boosted the Company’s sales and revenue figures by immediately recognizing revenue for

products that were shipped to customers.

Defendants’ Scheme Begins to Unravel 44. Defendants’ deceptions began to unravel on July 6, 2004, when Conexant issued

an earnings warning for the third quarter 2004 and lowered the Company’s anticipated quarterly

revenues by $55 million. Conexant announced that it expected revenues for the third quarter of

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 15 of 61

16

2004 to be between $265 million and $270 million, compared to earlier projections of $308

million to $323 million. Conexant blamed its revenue shortfall on several Taiwanese suppliers

who offered low-priced WLAN chips that purportedly “diluted the consumption” of Conexant’s

competitive models. Despite the foregoing, Defendants maintained that Conexant “continued to

be wholly confident in the market positions, profitability and growth prospects of our new

combined company.”

45. This news shocked the market and the price of Conexant stock plummeted $1.77

per share from its previous closing price of $4.08 per share, on July 2, 2004, to close at $2.31 per

share, on July 6, 2004.

46. Nonetheless, Conexant continued to mislead the investing public that its business

plan remained on a successful track. For example, during a July 29, 2004 conference call to

securities analysts, Geday promised that, “[Conexant] continue[s] to build a lasting franchise

offering competitive products and selling technology and world class support. . . . Our design

wins and customer focus will drive long-term operating margin improvement, as we successfully

execute on our business plan.”

47. On August 12, 2004, Conexant issued a press release announcing that McMullan

had resigned for purported “personal reasons” and that Blouin was replacing him.

48. Conexant again shocked the market on November 4, 2004, the last day of the

Class Period, when Geday admitted during an analysts’ conference call, “the inventory has been

building for multiple quarters, maybe 4 or 5 quarters.” During that conference call Conexant’s

President also disclosed the difficulties Conexant was experiencing integrating Globespan’s

offices. In a press release issued that day, the Company also reported revenues of $213 million

for the fourth quarter of 2004, representing a loss of $367.5 million, or $0.79 per share, which

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 16 of 61

17

the Company attributed to diminished demand for its products, inventory buildup and delayed

releases of new products.

49. The market swiftly reacted to these disclosures, driving the price of Conexant

common stock down 10 percent from $1.76 per share at the close of trading on November 4,

2004, to $1.60 per share at the close of trading on November 5, 2004.

50. On November 9, 2004, Conexant confirmed its partial disclosure of November 4,

2004, that the Company had failed to integrate Globespan’s operations and personnel.

Specifically, on that day, the Company held a conference call for securities analysts during

which Decker announced that Geday had resigned for purported “personal reasons” and that

Decker would resume his role as CEO. During the conference call Decker finally admitted that

with regard to the Globespan Acquisition, “not everything has gone as well as we’d like. Let me

say that – so therefore, it is the case that more work still needs to be done.”

The Confidential Witnesses

51. Former Conexant employees confirm that there were severe problems integrating

Globespan’s operations and personnel that caused Conexant to postpone critical hiring, delay

releasing new products and, ultimately, to lose market share. In order to mask these problems,

Conexant stuffed its distribution channels with excess products that caused the Company’s

revenues to be artificially inflated and not a reflection of the true end-user demand for its

products.

52. A former Conexant product manager in the WLAN group, who worked for

Intersil from 2001 until it was acquired by Globespan and then worked for Conexant following

the Globespan Acquisition until February 2005 (“CW-1”), stated that during the merger, and

immediately after, a “turf war” was waged between senior management involving “petty

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 17 of 61

18

bickering” that went on for months after the Globespan Acquisition. Specifically, CW-1

confirmed that these debates were between Geday and Rhodes, who had the backing of Decker,

concerning the leadership of the combined company and whether to expand Conexant’s Newport

Beach WLAN facility or Globespan’s Florida WLAN facility. CW-1 also noted that the friction

and confusion about the direction of the newly combined company, as well as a hiring freeze,

injured WLAN’s relationship with its customers. In particular, CW-1 stated that Conexant was

no longer able to inform its customers when a new product would be launched or what features it

would possess. CW-1 noted, “We weren’t able to meet the commitment to our customers, which

led to the loss of business.”

53. According to CW-1, after the Globespan Acquisition, WISOC, a WLAN program,

was transferred from the Netherlands facility to the Newport Beach facility, at a time when its

release was already four months behind schedule. CW-1 observed that WISOC still had not been

launched when CW-1 left the Company in February 2005. The delay in releasing WISOC,

according to CW-1, cost Conexant between $4 million and $5 million per quarter. CW-1 stated

that the Company’s decision to transfer Longbow, a next generation dual-band wireless chip, to

Newport Beach from another facility resulted in a delay in development and ultimately caused

Conexant to cancel the product altogether. According to CW-1, this product loss cost Conexant

millions in revenues. Since Longbow was supposed to be the next generation in wireless, CW-1

believed its cancellation caused Conexant lose its status as cutting-edge in the wireless field.

54. Most notably, CW-1 relayed the tremendous pressure that Geday placed on his

unit to make numbers. CW-1 affirmed that at the time of the merger and its ensuing months,

Conexant was receiving customer complaints from Dell, Gemtek, Z-com, and Arcadian. CW-1

stated that because of the Globespan Acquisition, and the product delays that followed, Conexant

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 18 of 61

19

lost its credibility with vendors and these companies shifted their business (in a “steep slide”) to

other vendors, such as Atheros, Broadcom, and Marvell. CW-1 estimated that these losses

represented approximately $10 million over the Class Period. CW-1 also confirmed that during

the Class Period, Conexant lost IBM, Hewlett Packard and Microsoft as customers

55. A former Conexant product manager, who worked for the Company from April

2001 to December 2004 (“CW-2”), confirmed the severe problems with the integration of

Globespan. CW-2 reported that senior management of Conexant and Globespan were openly

“jockeying for positions” in an “East Coast versus West Coast” rift. Specifically, CW-2

complained that significant product overlap in the DSL and WLAN lines and lagging designs led

to significant losses in market share, causing Conexant to stuff its distribution channels in order

to artificially boost its sales and revenue figures by immediately recognizing revenue for

products that were shipped to customers.

56. Another former Conexant employee, who worked as a customer manager from the

time of the Globespan Acquisition until February 2005 (“CW-3”), corroborated that after the

Globespan Acquisition, Conexant’s WLAN group began to suffer, resulting in customer

complaints that products were not being timely delivered. CW-3 recalled that Conexant tried to

boost its revenues by increasing product shipments at the end of each calendar quarter.

57. According to a former Conexant employee in shipping and receiving, who worked

for the Company for five years until August 2004 (“CW-4”), Conexant regularly stuffed its

distribution channels. CW-4 was instructed by managers to prematurely ship products at the end

of each quarter. CW-4 commented that there was a lot of excess inventory at Conexant, which

“sat on the back burner” and was sometimes sold to third world countries while Conexant

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 19 of 61

20

introduced new products. In addition, CW-4 noted the significant decrease in orders from Cisco

Systems, Inc., one of Conexant’s major customers.

58. A former member of Conexant senior management in the WLAN division, who

worked for the Company from the Globespan Acquisition until January 2005 (“CW-5”), said that

there were obvious integration problems that far exceeded what one would expect with a merger

of this sort. CW-5 confirmed that these problems included senior management debating over

mundane issues such as whether the Company should use Microsoft Outlook Express versus

Lotus Notes as the e-mail system. CW-5 stated that this rift prevented Conexant employees from

using e-mail for months following the Globespan Acquisition. CW-5 also stated that senior

management could not agree on where to locate the Company’s headquarters or the WLAN

division. As a result, CW-5 confirmed that the post-merger disarray caused delays in purchasing

major equipment and hiring critical employees, causing Conexant to rapidly lose an already

dwindling market share.

59. A former Conexant WLAN team leader, who worked for the Company until

September 2004 (“CW-6”), noted that the integration problems led to the delayed introduction of

new WLAN products. CW-6 also acknowledged the lack of hiring critical staff contributed to

the integration problems.

60. A former Conexant district sales manager, who worked for the Company from

August 1999 through December 2004 (“CW-7”), confirmed the severity of the integration

problems describing the acquisition as one of “animosity.” As a district manager, CW-7 was

instructed to ship products early and stated that Conexant had “the habit of pushing products out

the door at the end of every quarter” to make each quarter “look good.” CW-7 confirmed that

Conexant would offer discounts to customers who agreed to accept products early.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 20 of 61

21

The Individual Defendants’ Scienter 61. Each of the Individual Defendants was highly motivated by opportunities for

personal profit when structuring the Globespan Acquisition and concealing its problems

throughout the Class Period.

62. Decker and Geday remained in contact for three years prior to the Globespan

Acquisition. As described in the Registration/Proxy Statement, during that time Decker and

Geday engaged in numerous discussions concerning the potential for combining their respective

companies. The cozy relationship between Geday and Decker was highly conducive to

structuring a deal that allowed the senior officers of Conexant and Globespan to personally profit

from the acquisition, while disregarding the interests of their shareholders.

63. Former Globespan executives, Geday and McMullan, were willing participants in

the Globespan Acquisition because they were poised to receive millions from the generous 13.87

percent premium that was being offered for their personally held shares of Globespan stock. In

addition, they were motivated by the accelerated vesting of their Globespan options, hefty

bonuses and more lucrative salaries.

64. Geday’s new employment agreement provided him with a $550,000 annual salary

as compared to the $350,000 annual salary he received from Globespan. In addition, Geday

received options to purchase more than 1 million shares of Conexant stock and eligibility to

receive an annual bonus of up to 100 percent of his base salary, as compared to the $280,000

bonus he received during his last year at Globespan.

65. McMullan’s new employment agreement provided him with a $360,000 annual

salary with the eligibility to receive an annual bonus of up to 70 percent of his annual base salary

as compared to the $250,000 annual salary and $120,000 bonus he received from Globespan. In

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 21 of 61

22

addition, McMullan received options to purchase 250,000 shares of Conexant common stock,

plus an additional 175,000 in “retention options.”

66. Decker’s new employment agreement after the Globespan Acquisition provided

him with a $575,000 annual salary, a signing bonus of $718,000, options to purchase 125,000

shares of Conexant and eligibility to receive an annual bonus of up to 100 percent of his annual

base salary. In addition, Decker’s new employment agreement provide that his 1,172,041

unvested Conexant options, worth approximately $7,149,450 as of September 30, 2003, would

immediately vest if he resigned or was terminated other than for cause.

67. Blouin’s new employment agreement provided him with a $300,000 annual

salary; eligibility to receive an annual bonus of up to 60 percent of his base salary; a signing

bonus of $125,000 and an additional bonus of $75,000 to be paid one year after the “Effective

Date,” defined in Blouin’s employment agreement as 14 days after closing of the Globespan

Acquisition. In addition, Blouin was immediately granted options to purchase 200,000 shares of

Conexant stock and options to purchase an additional 175,000 shares within one year of the

Effective Date.

PRE-CLASS PERIOD STATEMENTS

The November 3, 2003 Press Release

68. On November 3, 2003, Conexant issued a press release and concurrently filed

with the SEC a report on Form 8-K (“November 3, 2003 Press Release”) announcing, the signing

of an agreement to combine Conexant and Globespan. Commenting on the Globespan

Acquisition, Decker stated that he anticipated the integration process to be complete within two

to three quarters. Specifically, Decker stated:

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 22 of 61

23

From a financial perspective, we have the opportunity to capture significant operating efficiencies, and we anticipate that the merger will be accretive within six to nine months from the close of the transaction....Together, we will have the scale and scope to make the necessary R&D investments for continued innovation leadership in wired and wireless communications and multimedia applications for the digital home.

(Emphasis added.)

The November 3, 2003 Conference Call

69. On November 3, 2003, Conexant and Globespan held a conference call for

securities analysts (the “November 3, 2003 Conference Call”), during which Defendants

announced the proposed Globespan Acquisition. Commenting on the Globespan Acquisition,

Decker stated: “This is an outstanding combination that results in a company that is unique in

scope and breadth of technology and that will possess the world’s most complete and most

advanced portfolio of semiconductor solutions targeting the broadband digital home.” Geday

added that after the acquisition, “[Conexant] will be the clear leader in both broadband and

narrowband access, as well as wireless networking, and will have a strong and growing position

in digital media processing.” Decker also added that he anticipated the integration to be

complete within two to three quarters:

We will expect this transaction to be accretive within six to nine months of the close, so in two or three quarters we are confident that the transaction will be accretive.

(Emphasis added.)

The Registration/Proxy Statement

70. On January 15, 2004, Conexant filed with the SEC a registration statement and

proxy statement on Form S-4/A (the “Registration/ Proxy Statement”), in which Defendants

solicited shareholder approval of the proposed Globespan Acquisition.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 23 of 61

24

71. Under the heading, “Recommendations of the Boards of Directors of Conexant

and GlobespanVirata,” the Registration/Proxy Statement implored Conexant shareholders to

approve the Globespan Acquisition because the “Conexant board believes that the merger is fair

to, and in the best interests of, Conexant and Conexant stockholders.”

72. Under the heading, “Question and Answer,” the Registration/Proxy Statement

further induced shareholders to vote in favor of the Globespan Acquisition:

Q: “Why are Conexant and GlobespanVirata proposing the merger? A: We want to merge our two companies because we believe that the combined company will be a worldwide leader in semiconductor solutions for broadband communications and the digital home. While no assurances can be made, we believe that by combining we have the opportunity to capture significant operating efficiencies through scale and synergy. We believe that the combined company will deliver stronger financial performance and create more value for our stockholders, customers and employees than either company could operating independently.

The January 28, 2004 Conference Call 73. On January 28, 2004, Conexant held conference call for securities analysts (the

“January 28, 2004 Conference Call”), during which Decker and Geday commented on the

impending Globespan Acquisition. Decker promised shareholders as a combined company

Conexant would possess “the strongest overall market positions of the broadband digital home,

with market leadership DSL, wireless LAN, and universal access positions, and a growing

number 2 worldwide share position in the broadband media processing market.” In addition

Geday further promised that the new company would “take advantage of strong financial

synergies and significant economies of scale by combining our operations, and we expect the

merger to be immediately earnings accretive to current Conexant performance estimates.”

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 24 of 61

25

FALSE AND MISLEADING STATEMENTS DURING THE CLASS PERIOD

The March 1, 2004 Press Release

74. On March 1, 2004, the beginning of the Class Period, Conexant issued a press

release announcing the completion of the Globespan Acquisition (the “March 1, 2004 Press

Release”). In the March 1, 2004 Press Release, Geday promised shareholders the new Conexant

would secure market leadership in DSL and WLAN, and that Conexant had been working to

successfully integrate Globespan’s operations and products. The March 1, 2004 Press Release

provided in part:

We successfully combined the highly complementary product and technology portfolios of Conexant and GlobespanVirata to create a worldwide leader in semiconductor solutions for broadband communications, enterprise networks and the digital home, three of the industry’s most exciting and fastest growing segments....The new Conexant has leading positions in [DSL] connectivity, [WLAN], dial-up modems, home networking, broadcast video products and digital set-top box system solutions. Our unique combination of products and technologies will drive broader, deeper engagements with worldwide customers that are recognized leaders in broadband communications and consumer electronics.

(Emphasis added).

75. In the March 1, 2004 Press Release, Geday further represented “outstanding

progress” had been made towards integrating Conexant’s and Globespan’s operations and the

combined company would deliver better financial results than either company could on its own.

The March 1, 1004 Press Release provided in part:

We have made outstanding progress toward integrating the organizations, systems, technologies and processes of Conexant and GlobespanVirata over the past two months and are in a strong position as we begin combined operations today....The new Conexant has the scale and scope to make the necessary R&D investments for continued innovation leadership. We remain

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 25 of 61

26

completely confident that the merged company will deliver stronger financial performance and will create more value for our shareholders, customers and employees than either Conexant or GlobespanVirata could have operating independently.

(Emphasis added.)

The Second Quarter 2004 Earnings Release

76. On April 26, 2004, Conexant issued a press release announcing its results for the

quarter ended March 31, 2004 (the “Second Quarter 2004 Earnings Release”). The Second

Quarter 2004 Earnings Release reported combined revenues of $243.8 million for the quarter.

Specifically, the Second Quarter 2004 Earnings Release reported:

[R]evenues of $243.8 million for the second quarter of fiscal 2004, which ended April 2, 2004. This is the company’s first earnings report following the completion of the merger with GlobespanVirata, Inc. on February 27, 2004 . Conexant’s second fiscal quarter report incorporates the results of GlobespanVirata from February 28, 2004 through April 2, 2004.

As reported, including the results of GlobespanVirata from February 28, 2004, second fiscal quarter 2004 revenues of $243.8 million increased 38 percent over first fiscal quarter 2004 revenues of $177.3 million, and increased 74 percent over second fiscal quarter 2003 revenues of $140.1 million. The net loss for the second quarter of fiscal 2004 was $143.4 million, or $0.41 per diluted share, compared to a net loss of $68.0 million, or $0.26 per diluted share, in the second quarter of fiscal 2003, and net income of $40.6 million, or $0.13 per diluted share, in the first fiscal quarter of 2004. The second quarter of fiscal 2004 included a merger-related, non-cash charge of $160.8 million for in-process research and development.

Second fiscal quarter pro forma operating profit was $20.1 million, or 8.2 percent of revenues, compared to $0.4 million in the year-ago quarter. Second fiscal quarter 2004 pro forma operating profit increased by 16.9 percent from $17.2 million in the first fiscal quarter of 2004. On a pro forma basis, net profit for the second fiscal quarter of 2004 was $0.06 per diluted share, compared to $0.02 per diluted share in the second fiscal quarter of 2003.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 26 of 61

27

77. In the Second Quarter Earnings Release, Geday again assured the investing public

that integration of Globespan was on track:

Since the close of the Conexant-GlobespanVirata merger transaction, our team has done an outstanding job of integrating processes, systems, technologies and organizations, and we have a clear path to the successful completion of our integration work....Combined company revenues of $293.3 million in our second fiscal quarter reflected strength in our growth platforms, which include products for digital subscriber line connectivity and wireless local area networking as well as digital set-top box and PC video solutions. This strength was partially offset by normal seasonal weakness in our universal access business.

(Emphasis added.) With respect to the Company=s Fiscal 2004 outlook, Geday stated:

The June quarter will be our first complete quarter as a combined company, and we are enthusiastic about the prospects for the new Conexant…The combined company is addressing high-growth opportunities in broadband communications, enterprise networks and the digital home with a world-leading portfolio of products and technologies differentiated by its depth and breadth.

In the third fiscal quarter, we expect revenues to grow in a range of 5 percent to 10 percent sequentially to between $308 million and $323 million....We anticipate that gross margin will be between 42 percent and 44 percent of sales, and we expect to deliver pro forma non-GAAP net earnings per share of $0.03 to $0.05, based on approximately 525 million fully diluted shares.

The April 26, 2004 Conference Call

78. On April 26, 2004, Conexant held a conference call for securities analysts during

which it reiterated the financial results reported in the Company’s Second Quarter 2004 Earnings

Release (the “April 26, 2004 Conference Call”). During the April 26, 2004 Conference Call,

Geday once again assured investors that the integration of Globespan was on track:

We have secured the world’s largest wireless local area networking [WLAN] market position.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 27 of 61

28

* * * Since the close of the merger, roughly seven weeks ago, our team has done an outstanding job of integrating processes, systems, technologies and organizations and we have a clear path to the successful completion of our integration work.

(Emphasis added.)

The Second Quarter 2004 10-Q 79. On May 17, 2004, Conexant filed with the SEC its quarterly report on Form 10-Q

for the quarter ended March 31, 2004 (the “Second Quarter 2004 10-Q”). McMullan signed the

Second Quarter 2004 10-Q. The Second Quarter 2004 10-Q reiterated the financial results

reported in the Company’s Second Quarter 2004 Earnings Release.

80. Under the headings, “Results of Operations” and “Inventories,” the Second

Quarter 2004 10-Q represented that the Company regularly assessed its inventory levels to

ensure that the Company’s inventories would not exceed the foreseeable demand for its products:

On an operational basis and unrelated to any significant single event we assess the recoverability of our inventories at least quarterly through a review of inventory levels in relation to foreseeable demand (generally over six to twelve months). Foreseeable demand is based upon all available information, including sales backlog and forecasts, product marketing plans and product life cycles. When the inventory on hand exceeds the foreseeable demand, we reserve for the excess which, at the time of our review, we expect to be unable to sell. The amount of the inventory reserve is the excess of historical cost over estimated realizable value. We base our assessment of the recoverability of our inventories, and the amounts of any reserves, on currently available information and assumptions about future demand and market conditions.

81. The statements in paragraphs 74 through 80 were each false and misleading when

made because they misrepresented and omitted material adverse facts, in that:

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 28 of 61

29

a. The Individual Defendants knew or recklessly disregarded the fact that the

Globespan Acquisition was neither in the best interests of Conexant shareholders or

the Company and that the combined entity had far worse prospects for success than

Conexant as a stand-alone company;

b. The Individual Defendants knew and failed to disclose that their sole motivation for

entering into the Globespan Acquisition was the opportunity for personal profit;

c. The combined company failed to gain “leading positions” in WLAN and DSL

solutions because the Company was suffering from severe problems integrating

Globespan’s operations and personnel, resulting in the delay in hiring of critical staff

and the release of new products that caused the Company to lose its market share in

its DSL and WLAN businesses;

d. Defendants knew and failed to disclose that the Company already lost significant

customers such as IBM, Hewlett Packard and Microsoft;

e. Defendants knew or recklessly disregarded the fact that there was too much overlap

between Conexant’s and Globespan’s products, particularly in the DSL and WLAN

divisions of the two companies, that made efficient integration of the Companies

impossible;

f. The Company failed to regularly assesses its inventory levels to ensure that the

Company’s inventories would not exceed the foreseeable demand and continued to

stuff its distribution channels, which caused its revenues to be artificially inflated and

not a reflection of the true end-user demand for its products, to conceal the integration

problems afflicting Conexant;

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 29 of 61

30

g. The Company’s financial results were inherently unsustainable because its excessive

channel inventories would inevitably lead to lowered revenues as distributors and

retailers would need to exhaust existing inventory before ordering and purchasing

new products from Conexant; and

h. Statements concerning the performance of the combined company were knowingly

false when made because Defendants knew that the Company’s financial results were

the product of channel stuffing and, therefore, were inherently unsustainable in the

absence of fraud.

The Fraud Begins To Unravel

The July 6, 2004 Earnings Warning

82. On July 6, 2004, Conexant issued a press release announcing results for the third

quarter 2004 (the “July 6, 2004 Earnings Warning”). Conexant stated that revenues would come

in between $265 million and $270 million, compared to expectations of revenues between $308

million and $323 million. Specifically, the July 6 2004 Earnings Warning reported that

Conexant expected “total third fiscal quarter revenues to be between $265 million and $270

million and pro forma non-GAAP net earnings per share (EPS) of $0.02, compared to

expectations in April of revenues between $308 million and $323 million and pro forma non-

GAAP EPS of $0.03 to $0.05.”

83. In addition, in the July 6, 2004 Earnings Warning Geday stated:

[W]e are absolutely confident in the long-term prospects for the combined company. Several factors affected our wireless LAN business during the course of the quarter.... A number of Taiwan-based chip suppliers emerged with extremely low-priced solutions, displacing incumbent suppliers in certain high-volume applications. These additional competitors

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 30 of 61

31

exacerbated pricing pressure in a market already characterized by severe price competition. Also, channel inventory of our customers= products increased as new competitors= products, based on low-priced Taiwanese solutions, caused our customers to lose market share.

The July 6, 2004 Conference Call

84. On July 6, 2004, Conexant held a conference call for securities analysts (the “July

6, 2004 Conference Call”) during which Defendants reiterated the financial results it reported in

the Company’s July 6, 2004 Earnings Warning. Commenting on these results, Geday stated:

In our leadership DSL business we have made significant progress in the consolidation of the former GlobespanVirata and Conexant productlines. We are seeing increased recognition from our customer base that our portfolio leads the market in performance/cost ratio. As a result of our team’s superior performance we have generated more revenues from high-speed ADSL than any other chip set vendor.

* * *

[A]n extremely competitive wireless LAN market has become considerably more crowded, impacting our business results this past quarter. We have every intention to aggressively expand our position by leveraging our best in class capabilities. We will become laser focused on combining a differentiated marketing strategy with innovative product features and roadmaps to extract value from our product offerings resulting in increased share and profitability.

The Third Quarter 2004 Earnings Release

85. On July 29, 2004, Conexant issued a press release announcing its financial results

for the quarter ended July 2, 2004 (the “Third Quarter 2004 Earnings Release”). Specifically, the

Third Quarter 2004 Earnings Release reported:

Third fiscal quarter 2004 revenues of $267.6 million decreased 9 percent from the second fiscal quarter revenues of $293.3 million the company would have reported if its merger with GlobespanVirata, which closed on February 27, 2004, had closed on January 1, 2004. Third fiscal quarter revenues increased 77 percent over third fiscal quarter 2003 revenues of $151.0 million. The net loss for the third

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 31 of 61

32

quarter of fiscal 2004 was $71.4 million, or $0.15 per diluted share, compared to a net loss of $49.1 million, or $0.18 per diluted share, in the third quarter of fiscal 2003, and a net loss of $143.4 million, or $0.41 per diluted share, in the second quarter of fiscal 2004.

Third fiscal quarter 2004 pro forma operating profit was $8.1 million, or 3.0 percent of revenues, compared to $3.3 million in the year-ago quarter.

86. In the Third Quarter 2004 Earnings Release, Geday attributed the increased

inventory and decreased revenue to lower sales and a shortfall in demand from the WLAN

business. Geday nonetheless continued to reassure investors. More specifically, the Third

Quarter Earnings Release stated:

Conexant’s overall third fiscal quarter performance was adversely impacted by a shortfall in demand in our wireless LAN business. . . .We are intensifying our effort to regain and expand our market position.

While our other businesses came in essentially flat for the third fiscal quarter, we remain optimistic about the growth prospects for our company.

* * *

We expect revenues for Conexant’s fourth fiscal quarter to be between $250 million and $255 million. . . .We anticipate that gross margin will be in a range between 40 and 42 percent, and we expect to further reduce our pro forma operating expenses by $3 million to $4 million. Finally, we anticipate that our pro forma non-GAAP net earnings per share will be in a range from $0.00 to $0.02 per share based on approximately 500 million fully diluted shares.

The July 29, 2004 Conference Call

87. On July 29, 2004, Conexant held a conference call for securities analysts during

which Defendants reiterated the financial results reported in the Company’s Third Quarter 2004

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 32 of 61

33

Earnings Release (the “July 29, 2004 Conference Call”). During the July 29, 2004 Conference

Call Geday stated:

The [WLAN] market has been characterized by rapid growth and severe price competitions. . . . [T]his sequential drop in [WLAN] revenues was primarily the result of severe price declines resulting in market share loss. This situation was compounded by excess inventory in the channel. Although we anticipate that tier recapture will take some time, and will likely impact our gross margins, we are committed to regaining market share in [WLAN].

* * * Our design wins and customer focus will drive long-term operating margin improvement, as we successfully execute on our business plan.

The Third Quarter 2004 10-Q 88. On or about August 16, 2004, Conexant filed with the SEC its quarterly report on

Form 10-Q for the quarter ended June 30, 2004 (the “Third Quarter 2004 10-Q”). The Third

Quarter 2004 10-Q, which was signed by Defendant Blouin, reiterated the financial results

reported in the in the Company’s Third Quarter 2004 Earnings Release.

The September 30, 2004 Press Release 89. On September 30, 2004, Conexant issued a press release announcing that it had

lowered its financial outlook for the quarter ending October 1, 2004 (the “September 30, 2004

Press Release”). Specifically, the Company announced that it expected revenues for the quarter

ended October 1, 2004, to be down by $50 million. Geday attributed these results to “excess

channel inventory in Asia that is a result of lower-than-expected demand.” Geday also disclosed

that “Conexant=s lowered fourth fiscal quarter expectations are a direct result of excess channel

inventory in our service-provider and PC-related businesses. . . . Ongoing softness in customer

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 33 of 61

34

demand, reduced product lead times and price erosion also resulted in weakness in our turns

business.” Geday also discussed the future prospects of the Company:

For our fourth fiscal quarter, we expect gross margin to be at the low end of the range of 40 to 42 percent that we anticipated in July, and we expect to reduce pro forma operating expenses by considerably more than the $3 million to $4 million we anticipated in July, to a level approaching $95 million from $104.4 million last quarter.

90. The statements in paragraphs 82 through 89 were each false and misleading when

made because they misrepresented and omitted material adverse facts, in that:

a. The Individual Defendants knew or recklessly disregarded the fact that the

Company’s decline in revenues for the third quarter 2004 and loss of market share in

the WLAN and DSL groups were due to severe problems integrating Globespan’s

operations and personnel resulting in a delay in hiring of critical staff and the release

of new products, and not only the result of lower customer demand and/or increased

competition;

b. The combined company could not “execute on its business plan” because the

Company was suffering from severe problems integrating Globespan’s operations and

personnel that caused the Company to lose its market share in its DSL and WLAN

businesses;

c. The Company could not have seen increased recognition from its customer base that

its portfolio led the market because the Company was losing significant customers

such as IBM, Hewlett Packard and Microsoft;

d. Defendants knew or recklessly disregarded the fact that there was too much overlap

between Conexant’s and Globespan’s products, particularly in the DSL and WLAN

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 34 of 61

35

divisions of the two companies, that made efficient integration of the Companies

impossible;

e. The Company continued to stuff its distribution channels, which caused its revenues

to be artificially inflated and not a reflection of the true end-user demand for its

products, to conceal the integration problems afflicting Conexant;

f. The Company’s financial results were inherently unsustainable because its excessive

channel inventories would inevitably lead to lowered revenues as distributors and

retailers would need to exhaust existing inventory before ordering and purchasing

new products from Conexant; and

g. Statements concerning the performance of the combined company were knowingly

false when made because Defendants knew that the Company’s financial results were

the product of channel stuffing and, therefore, were inherently unsustainable in the

absence of fraud.

The Fourth Quarter 2004 Earnings Warning 91. On November 4, 2004, the last day of the Class Period, Conexant issued a press

release announcing disappointing revenues of $213 million for the fourth quarter of 2004,

including a loss of $367.5 million, or $0.79 per share (the “Fourth Quarter 2004 Earnings

Warning”). Specifically, the Fourth Quarter Earnings Warning reported:

Fourth fiscal quarter 2004 revenues of $213.1 million decreased 20 percent from the third fiscal quarter revenues of $267.7 million. Fourth fiscal quarter 2004 revenues increased 29 percent over fourth fiscal quarter 2003 revenues of $164.7 million as a result of the merger. The net loss for the fourth quarter of fiscal 2004 was $367.5 million, or $0.79 per diluted share, compared to net income of $37.2 million, or $0.12 per diluted share, in the fourth quarter of fiscal 2003, and a net loss of $71.4 million, or $0.15 per diluted share, in the third quarter of fiscal 2004.

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 35 of 61

36

Fiscal year 2004 revenues of $901.9 million increased 50 percent over fiscal 2003 revenues of $600.0 million as a result of the merger. The net loss for fiscal 2004 was $541.6 million, or $1.39 per diluted share, compared to a net loss in fiscal 2003 of $705.3 million, or $2.56 per diluted share. The net loss in fiscal 2003 includes a $728.9 million loss from discontinued operations.

92. In the Fourth Quarter Earnings Warning, Conexant attributed its financial

hardships to lower demand, inventory buildup and, for the first time, the delayed release of new

products. In the Fourth Quarter 2004 Earnings Warning, Geday stated:

Conexant’s sequential decline in revenues to $213.1 million in the fourth fiscal quarter was largely due to excess channel inventory that resulted from lower-than-expected customer demand. . . . As is often the case during an inventory correction, our revenue decline was exacerbated by average selling price erosion caused by an unfavorable product mix as newer, more valuable products were slower to ramp. While our visibility continues to be limited, we remain confident in Conexant=s long-term prospects.

(Emphasis added.)

The November 4, 2004 Conference Call 93. On November 4, 2004, Conexant held a conference call for securities analysts (the

“November 4, 2004 Conference Call”) during which the Company reiterated the financial results

reported in the Company’s Fourth Quarter 2004 Earnings Warning. During the November 4,

2004 Conference Call, Geday revealed for the first time that the Company’s channel stuffing had

been occurring for as long as four to five quarters, even before the Globespan Acquisition.

Indeed, Geday admitted, “it looks like the inventory has been building for multiple quarters,

maybe 4 or 5 quarters.” Defendant Blouin also confirmed that channel stuffing was a problem

that needed to be rectified: “I think the biggest thing that has to change, is we have to work

through the inventory that’s in the channel.”

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 36 of 61

37

94. During the November 4, 2004 Conference Call, when directly asked by an analyst

from Morgan Stanley about the transition since the Globespan Acquisition and the relocation of

company headquarters to New Jersey, Rhodes was unable to say that the integration was

successful. Instead, Rhodes explained that the Company was still juggling how to manage a

business operating out of four major sites, rather than operating as a single entity. Specifically,

Rhodes stated:

As far as integration with Red Bank, it is the case that the integrated company has four major business locations. . . . And I think like any modern company, we maintain strong presence in these business centers and have design centers, and we have had to learn to manage on a worldwide basis, because we go and we work with the talent where the talent is. And I think we’re settled into that configuration and continuing to learn how to be a best in class managing across multiple sites.

95. Sophisticated securities analysts understood the November 4, 2004 disclosures to

mean that Conexant’s restructuring effort, including the Globespan Acquisition, was a dismal

failure. For example, Kintishef Research in a report dated November 5, 2004, concluded:

[W]e believe it is safe to say at this point that Conexant’s restructuring efforts over the past couple of years, which have included a number of divestitures and acquisitions, have failed to improve the competitive positioning of the company.

THE AFTERMATH

96. On November 9, 2004, Conexant held a conference call for securities analysts (the

“November 9, 2004 Conference Call”) during which Decker announced that Geday had resigned

for purported personal reasons and that he would assume the role as CEO. During the November

9, 2004 Conference Call, in response to a question posed by an Unterberg analyst concerning the

integration effort, Decker confirmed there were problems:

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 37 of 61

38

I have found with mergers in the past that completing the merger really takes a year; and really integrating the mindset and the full dedication of the team sometimes can take as long as two years. So it is a merger in process. And not everything has gone as well as we’d like. Let me say that – so therefore, it is the case that more work still needs to be done.

97. On that same day, my-esm.com (“Electronics Supply & Manufacturing”)

published an article entitled “Geday Out, Decker Back in as Conexant CEO.” The article quoted

Decker:

We made bets that were significant . . .Those bets weren’t right.

I think the weakness in DSL is almost all price, but overall, inventory build in the channel. . . We expect the DSL business to start growing again.

We have a strong position in that market due to the timing of our products. . . . We have products ready to go to production. We have secured design wins.

98. On November 10, 2004, the Los Angeles Times published an article entitled

“Conexant Founder Returns as CEO.” The article, in relevant part, read:

Conexant has racked up more than $439 million in losses since the deal closed in late February. Those losses have been “unexpected and unacceptable,” said Decker, who had been serving as chairman of the combined company.

Decker blamed the losses on a decline in the market for DSL equipment for high-speed Internet access -- especially in Japan and China -- and on internal mismanagement that led to delays in new products that cost market share. He did not specifically criticize outgoing CEO Armando Geday, who had been CEO of GlobespanVirata. Geday resigned Tuesday for personal reasons, the company said.

Conexant has underperformed this whole year compared to what we expected, and we all agreed that this was the best thing to do. . . . Slumping demand and product delays will slash Conexant’s revenue

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 38 of 61

39

in the quarter that ends in December to about $180 million, down from $297 million a year earlier, Decker said. Conexant=s shares have lost 78% of their value since the company completed its purchase of GlobespanVirata. They rose 1 cent to $1.62 in regular NASDAQ trading Tuesday and moved only slightly in extended trading after the executive changes were announced.

99. In an analyst report issued on November 10, 2004, Unterberg also abandoned

hope that the union of Conexant and Globespan would succeed: “Can CNXT do better than ‘one

plus one equals one’? Our current estimates for CNXT’s FY2005 are at the same level as

FY2002 prior to the merger with GSPN.” In the wake of the merger fiasco, Unterberg wrote the

Globespan Acquisition’s epitaph: “Not only the opportunity for post merger synergies and

operational efficiency has all but disappeared, but the combined company revenue and outlook is

also lower than standalone Conexant in the past.”

100. On December 13, 2004, the extent of the channel stuffing was confirmed when

Conexant revealed during a conference call that it was undertaking actions that would result in

the consumption of approximately $50 million in channel inventory. Indeed, Conexant’s

distribution channels were so saturated that during the conference call, Decker announced that

Conexant would not be shipping “anything to distributors” until the inventory was consumed.

Thus, Conexant had finally disclosed the full extent of its channel stuffing, which boosted the

Company’s financial results during the first and second quarters of 2004, by robbing the

Company of revenue for numerous future quarters. Entering the fourth quarter, Conexant

expected revenues to be $175-185 million, with and inventory consumption of between $10-20

million.

101. Also during the December 13, 2004 conference call, Decker attributed the

revenue decline and excess inventory to “a combination of market conditions and company

Case 2:04-cv-06219-SRC-CCC Document 66-1 Filed 12/05/2005 Page 39 of 61

40

execution problems, primarily in our wireless networking and DSL businesses.” He conceded

that Conexant’s WLAN business suffered from significant share loss resulting from delays in

new product introduction, particularly its 802.11g chip solutions, which was already saturated by

the market. He also admitted that the DSL business suffered from a significant revenue decline