Optimal lengths of moving averages for the MACD oscillator ...

· PDF fileIndicators like MACD (moving average convergence divergence), Williams %R, ......

Transcript of · PDF fileIndicators like MACD (moving average convergence divergence), Williams %R, ......

www.stockoptionsystem.com

Disclaimer

• It should not be assumed that the methods, techniques, or indicators presented in these products

will be profitable or will not result in net losses. Past results are not necessarily indicative of

future results. Examples presented here are for educational purposes only. These examples are

not solicitations to buy or sell. The author, publisher, and all affiliates assume no responsibility

for your trading results.

• There is a high risk in trading.

• HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS.

UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL

TRADING. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY

HAVE UNDER- OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET

FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO

SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO

REPRESENTATION BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR

LOSSES SIMILAR TO THOSE SHOWN.

• U.S. Government Required Disclaimer -Stock trading has large potential rewards, but also large

potential risk. You must be aware of the risks and be willing to accept them in order to invest in

the stock markets. Don’t trade with money you can’t afford to lose. This web site is neither a

solicitation nor an offer to Buy/Sell stock. No representation is being made that any account will

or is likely to achieve profits or losses similar to those discussed on this web site. The past

performance of any trading system or methodology is not necessarily indicative of future results.

www.stockoptionsystem.com

Modern technology has made the stock market

more accessible than any other time in the

financial history of the world yet traders still

struggle to find worthy investments to trade.

Despite having access to advanced charting

packages, real-time news, and instant access to

a company’s financial performance, finding

worthy stocks to trade continues to be as much

of a challenge in the 21st century as it was in

the past centuries.

Explanations as to why this is so difficult are as numerous as the challenges that they attempt to

explain away. Like the Hydra, you chop off one head only to have another head grow back to

take its place, and you’re left with more unanswered questions leading to frustration and

overwhelm.

The focus of this article is to offer a framework to find winning stocks to trade. Rather than offer

some step-by-step, “one-size fits all” approach, this framework will act as a guide to find stocks

that stand the greatest chance of emerging as a potential leader in the stock market. It is a flexible

approach that is based on what works that allows some deviation. Flexibility is important

because if you get too locked in to the “right” way or become to rigid in your approach then you

will fail to miss out on viable opportunities. Later on, I’ll go into more detail about that later but,

for now, understand that these 4 keys will act as a guide to help you find stocks with leadership

potential in the stock market.

Stock leaders are responsible for taking the overall market to higher levels but, more importantly

to you, they offer the greatest overall return. They have “runaway” potential where they outrun

the overall market and go on to rack up returns of 25%, 50%, 100%, and even greater.

To help, you’ll need an understanding of the two dominant schools of trading: fundamental and

technical.

Fundamental vs. Technical

There are two schools of speculation that are often at odds with one another which are

fundamental and technical.

www.stockoptionsystem.com

The fundamental school teaches that a

company’s performance in its marketplace is the

sole focus of determining its worth as an

investment. Fundamentalists focus a great deal

on all of the company’s operations with a

particular focus on earnings growth and cash

flow but also spend countless hours deciphering

everything from earnings, return on capital,

accounts receivable turnover, average in-store

sales, sales revenue, asset value, debt-to-income,

and more.

The strength of this approach is that by understanding how a company is operating and

generating profits at a core level allows you to “see” whether a company is being managed

properly.

Going back to earnings, its also important to note that the stock market lives on earnings, or

rather is fueled by earnings reports. Four times a year, earnings are reported faithfully by every

publicly-traded company and their stock price lives or dies based on what they report. If they are

achieving sales and market-share, then it should be reflected positively in their share price.

If it isn’t, then eventually a company’s bad fundamentals are going to catch up to it’s share price.

Key Point: no stock’s price action can outrun bad fundamentals forever.

This is important to keep in mind as you read the rest of this report and when considering a stock

as a trade candidate.

The weakness of this approach is that a company that is fundamentally sound could still be

under-performing the stock market despite superior fundamental performance. This can be

maddening for you as a speculator when you find an undervalued company with great profits and

earnings but the stock stays flat and there is no share appreciation.

Its not unheard of to buy a stock that goes nowhere for years despite record-breaking

fundamental performance. Starting in 1973, Warren Buffett began buying shares in the

Washington Post but experienced no return for almost 3 years before the stock began to show a

pulse. That can be a frustrating test of patience for any trader or investor, no matter how

experienced.

Adding to that frustration, a stock with no earnings or profits or any compelling fundamental

criteria can soar to breathtaking heights in a short time. When Amazon first went public it had no

earnings or profits for years but if you had invested a $1,000 in the stock it would have

appreciated to over $65,000 in just 18 months after its initial public offering (IPO)!

The technical school prefers the study of price action rather than the company’s fundamental

performance. The technical approach takes into account that all data - both known and unknown

- are reflected in a stock’s price action. Whether the company is recording huge profits,

www.stockoptionsystem.com

encountering stiff competition, retaining earnings, or losing key leadership, students of the

technical approach brush off such events as irrelevant as they believe that everything is

accounted for in a stock’s price action.

Price action is the movement that take place as a stock is traded in the stock market. Price charts

are used by technicians to track the open, close, high, and low of a stock’s movement over a set

period of time. By tracking a stock’s movement this way, the market technician seeks to uncover

the trend in the stock’s price movement. Trends, to a trader, and a technician, are the cornerstone

of profitable trading because they believe that they determine the future direction of the stock.

Then, the technical method of trading uses a series of tools like chart patterns, trendlines,

support/resistance, price/volume to pinpoint the ideal place to enter and exit the price trend.

For the purist, price action is the only key factor when making a trading decision. Setup

conditions, the triggering of the trade, and when to take profits are all based on what price is

doing in the present, not value or future potential.

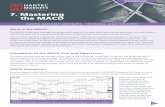

However, there are technical indicators that can be used to help the technician confirm their

trading decisions. Indicators like MACD (moving average convergence divergence), Williams

%R, Relative Strength Indicator (RSI), and others are examples of technical indicators that can

help the technician make reliable trading decisions.

The benefits of such an approach is that it will let you find stocks that are trending and allow you

to take advantage of that price movement. You won’t have to worry about earnings or the stock’s

intrinsic value, just the price action. As a result, you won’t have to sit in a position for years

waiting for the stock to appreciate and, instead, will just concentrate on trading in stock’s that are

trending either upward or downward.

The weakness of such an approach is that there are almost as many technical methods of trading

as there are stocks to trade themselves. Elliot Wave, astral movement, breakout trading,

stochastics, trend-trading, Fibonacci Zones, Two-step Bearish Patterns, Keltner Channels,

Bullish Butterflies, Wolfe Waves, Bollinger Bands, moving averages, and on and on. To the

novice, and even the veteran traders, the technical school can be confusing and overwhelming.

Worse, you’re left with the challenge of how to put all these different methods and indicators

into a workable framework that assists you in knowing where to trade along with when to enter

and exit.

Now that you have an overview of the two primary schools of trading, as well as their strengths

and weaknesses, which should you use to help you find winning stocks? The answer is that by

indicating the best aspects of both approaches work best.

The leads to the question of what parts to eliminate, which to keep, and how to combine them for

the best results?

The cornerstone to picking the best stocks to trade centers around 4 key factors:

www.stockoptionsystem.com

Rocket Fuel and the Stock Market

The stock market lives, breathes, and dies by earnings. Let me repeat: The stock market lives,

breathes, and dies by earnings.

Repeat this to yourself till you sear into your mind and soul. Everything on Wall Street revolves

around earnings reports because their lives and careers are dictated solely on how well they

interpret them.

On Main Street, people’s lives are impacted by what happens when a company that they’ve

invested in or are considering investing in by what that company’s earnings are or predicted to

be. An elderly couple’s pension benefits are going to be impacted by the earnings by the

companies that their pension has invested in; what college a mother and father are going to be

able to send their children to from the investment they made in a fund; someone hoping to retire

early will find their investments impacted by the earnings a company makes and then reports.

Earnings are to the stock market what air is to both you and I - it is the very foundation to life.

For stocks with homerun potential, earnings are an indicator of runaway potential.

In a study of the biggest stock winners in the last century, there was a common thread that

signaled their spectacular performance which was accelerated earnings being reported. This

performance indicator gives you the ability to discern which stocks are run-of-the-mill and which

are set to emerge as leaders.

www.stockoptionsystem.com

Consider the following examples from William O’Neil’s classic “How To Make Money In

Stocks” book:

“Dell Computer’s earnings per share surged 74% and 108% in the two quarters prior to

its price increase from November 1996.

Cisco posted earnings gains of 150% and 155% in the two quarters ending October

1990, prior to its giant run-up over the next three years.

Google showed earnings gains of 112% and 123% in the two quarters before it made it

runaway move after its IPO.

Going back as far as 1914, Studebaker’s earnings were up 296% before it sped from $45

to $190 in eight months.

In 1916, Cuban American Sugar’s earnings skyrocketed 1,175% and climbed from $35 to

$230 during the same year.

In 1926, du Pont de Nemours showed earnings up 259% before its stock took off from

$41 and surged to $230 before the 1929 stock market crash.”

Earnings are what allow competitive companies to break free of the stock market’s gravity and

ratchet up superior returns.

They are the match that lights the charge that leads to…

Explosive Price Moves

The school of technical trading teaches that there are two forms of price action: contraction and

expansion.

When price is contracting, it appears to be trading back and forth with no real direction or

movement. Neither the bulls nor the bears have control of the stock’s price movement and until

one side gains enough critical mass, then the status quo will remain and the stock will remain

range-bound.

When price enters a period of expansion, however, price will trade with noticeable conviction in

a given direction. If a stock is bullish, then price action will trade upward in a steady series of

higher highs and higher lows. For a bearish stock, price action will trade downward in a steady

series of lower highs and lower lows.

www.stockoptionsystem.com

When a stock is experiencing a period of contraction it will take a catalyst of some type to ignite

either the bulls or bears to enter a position in sufficient number to force the stock’s price action

into expansion.

Like the Yin/Yang philosophy, price will move back and forth between contraction and

expansion with each containing the seed of potential of another. Accelerated earnings act as the

spark that sets off a change reaction and drives one side to act to push the stock over the tipping

point where it explodes in a given direction.

But, leading up to that breakaway run, you can spot stocks with runaway potential as they trade

close to…

New Price Highs

Stocks that are racking up big earnings are followed by explosive price moves which then lead to

new price highs.

New price highs are indicator of strength and

separate the wheat from the chafe by revealing

potential stock leaders from average stocks. Those

that emerge as leaders will outperform any other

class of stocks, including blue-chip, value, dividend

yielding, and take the overall market higher as well.

For this reason, look at stocks that are trading near

their all-time price highs because they are where

you find emerging leaders.

Trading at new price highs give you a strong edge by:

1) Avoiding overhead resistance,

2) taking advantage of momentum,

3) and riding the path of least resistance.

Avoiding Overhead Resistance

Blackstar Funds, an adviser in long-term trend-following systems in commodity pools, wrote a

report on whether trend-following would work in the stock market (you can read the report in

full by clicking here).

The conclusion was that by entering as a stock achieved a new record high and then trailed the

position with a 10-period Average True Range stop you could achieve a greater overall return

that what the traditional buy-and-hold strategy offered.

www.stockoptionsystem.com

One of the reasons was no “overhead resistance”. Overhead resistance forms when a stock

declines and begins to reverse its direction and make up lost ground but encounters resistance at

each significant price point on the way back up. This resistance occurs at these levels because

investors who had bought at these price points before the stock declined have been sitting there

and waited for the stock to come back rather than sell and take a loss. As price begins trading

back up through those price points then those investors sell at breakeven to get out the position.

When they do this, volatility enters the market and throws off the stock’s price trend that was in

motion.

Taking Advantage of Momentum

This can slow the upward momentum of the stock’s movement and even shake you out of your

position by hitting your trailing stop.

Without any overhead resistance, momentum can accelerate the stock’s trend in absence of any

drag on its price action.

Momentum is the ability of a stock’s price to get from Point A to Point B in as little time as

possible.

Stocks that have strong earnings attract legions of investors but, most importantly, they attract

institutional investors like mutual funds or pensions. These institutions command billions of

dollars and can literally move the market higher or lower due to the shear size of the capital that

they have at their disposal. Earnings drive the majority of the investment decisions by major

institutions who are hungrily looking for new up-and-coming companies to get in early and

invest in.

On the tail-end of strong earnings, these big institutions will jump in and aggressively take

positions in these companies which causes a change reaction of events that all lead to greater

momentum in the stock’s price action. By focusing in on these key factors, you can take

advantage of the momentum caused by these events and find stocks that make 25%, 50%, 100%,

or greater in a short period of time. It happens every day if you know where to look and what to

look for.

By taking this approach, you will find yourself on the right side of the market more often than

not. This is the “path of least resistance” which is a by-product of trading on the side of the trend.

The Path of Least Resistance

The easiest way to come out ahead in the stock market is to find good stocks and then enter as

they form a price trend. Trend-trading in the stock market is the most reliable method of scoring

huge returns and avoiding losses.

www.stockoptionsystem.com

Everything that you’re reading in the report is designed to give you a number advantages in order

to model successful stocks that are likely to emerge as a stock leader and move in your favor.

This is the “Path of Least Resistance” that you want to strive for when selecting stocks because it

keeps you on the side of the winners.

Too many people attempt to buy stocks as they are

going down but find that their investment

continues to decline. They obviously are trying to

catch the stock on the cheap, maybe even time its

movement to catch it as it turns back up, but this is

a painful exercise. In trading, this is called trying

“to catch a falling knife”.

Trading in the right side of the trend is infinitely

more profitable over the long-run and much less

stressful.

Still, millions of investors avoid buying as a stock goes up and avoid selling when the stock goes

down. Why?

Conventional stock market wisdom has taught generations of investors that trading is risk and

that you should buy-and-hold stocks forever. The problem with that mentality is that stocks can

stay stuck at certain price levels or, worse, keep declining. Trading stocks is about finding the

strongest companies and then having a method to separate stocks with potential and avoid the

laggards.

For decades, people have been conditioned by the big brokerage houses and investment firms to

buy a stock because its “cheap”. Cheap stocks are synonymous with value in the eyes of Wall

Street but that doesn’t mean that their idea of value translates into a decent return for you.

Facebook (FB) was going to be the next big growth stock and was hyped more than any other

IPO in recent memory yet the stock tanked within days of its launch. It may recover or it may

not, but how would you like to have your life savings tied up in a stock that is going down with

no idea of when its going to stop?

That is the problem with value investing as a whole. If that is your cornerstone strategy to build

your assets and get rich, how do you know which stocks are a value and when those stocks are

going to throw off a decent return? Warren Buffett may be a legend and icon of value investing

but his ability to pick winning stocks on the cheap is a talent built through a combination of hard

work and decades of experience. Not many people can match that skill, not even most traders.

But, the ability to read price action and identify strong stocks can help you stay on the Path of

Least Resistance and, as a result, end up on the winning side of the trend instead of being run

over by it.

www.stockoptionsystem.com

Trading Where the Market is the Strongest

In the stock market, the prevailing thought is that when a stock has fallen by a wide margin then

it is a “bargain” that should be bought.

On the opposite end of that thought, when a stock is soaring higher, the Novice becomes nervous

and waits for it to come down a bit before considering buying into the move.

Profitable trading is a bit of a paradox where though the two above examples make sense on the

surface, unfortunately, they will lead to losses more often than profits. The reason is that

“bargains” in the stock market are often bargains for a reason - they have no inherent value until

they rise in price. Warren Buffett and Benjamin Graham - two of the most recognized value

investors in the financial world - may have gotten rich by picking value stocks that no one else

wants but many people, including you, are not going to be able to match their performance. Also,

you may have a hard time sitting on a position for years and waiting for it come back.

But, by looking for the strongest stocks in the stock market in the present moment may yield

quicker results as well as much better returns.

Profitable trading then is more about focusing on market selection than market timing.

So, the first method to find winning stocks is to find the strongest sectors of the stock market and

then track the stocks that make up those sectors.

There are several sources but I use a free service over at Barchart.com to help navigate my way

through 185 industry groups, stock, and Exchange Traded Funds (ETF’s) and locate the strongest

sectors that are leading the market in real-time. I prefer the 6-month performance which you can

find at -

http://www.barchart.com/stocks/sectors/change.php?page=6mo

The securities that make up these sectors are displaying the highest Relative Strength in the

market. Relative Strength (RS) is a technical indicator that compares the performance of a given

security in comparison with the overall market. Stocks are scored from 1 to 99 with 1 being the

weakest score and 99 being the strongest score. In that range, you will find which stocks have the

strongest performance to determine where to go long and, on the opposite end of the spectrum,

which stocks to ignore or short.

I prefer to look at the 6-month RS but you can look at any time depending on your preference.

Once you have a list of high RS stocks that also match the previous criteria, you’ll have list of

candidates to trade.

www.stockoptionsystem.com

Flexibility in the Application of the 4 Keys

I mentioned in the beginning that this is a flexible approach that allows for some deviation. That

seems a bit confusing but now that you understand the foundational principles involved allow me

to expand on that statement.

Stock selection is a bit of an art and a science. If you’ve been trading for awhile then I’m sure

you realize that. If not, let me explain that you can go through the painstaking hard work of

checking out every financial ratio of a stock and double check every analyst’s report but still fall

short of finding a winner. The reason is that the market is fickle and just because a stock has

every trait you look for in a winning stock, it can still fail.

There is no hard and fast rules to stock selection that leads to the perfect trade but guidelines are

offered to help you find the winners and avoid the dogs. A stock may have poor earnings but its

still in a strong trend, trading at a new high while displaying explosive price movement. A stock

may not display explosive price movement but its fundamentals are strong and it trades in a

steady trend with high RS. Each stock has to be judged on the merits of the key traits that it is

displaying and in its own context.

For example, I like stocks that are over $100 a share. It’s been my experience that high-priced

stocks trend better and have compelling price action that can be exploited easier than stocks that

are below that price point.

Go look at a chart of Chipotle (CMG) or Priceline (PCLN) and you’ll see what I mean. It takes

less for them to gain a quick 10%, 20%, or more than lower-priced stocks. I have alot of theories

as to why - volatility, big volume, strong institutional sponsorship - but the bottom line is that it

takes less effort for those stocks to gain a quick 10 - 20%.

So, when I’m scanning for stocks, I always take notice of what this class of stocks is doing.

When I use a scanner to uncover potential stock trades, I have a separate set of criteria of looking

at this stock class by themselves. I then use these 4 keys to help filter out the best of the best and

see what I find.

If I can’t find a perfect match for all 4 keys, I may alter my trading approach and use options or

trade with half the risk in mind (quick tip: this is one of the reasons why understanding how to

trade with options can give you an edge in the market).

Using the 4 Keys in Real-Time

In the past decade, give or take a few years, sorting through thousands of stocks to find these

common characteristics was an overwhelming task. The amount of work that it took made it

www.stockoptionsystem.com

almost not worth it for the smaller trader with a few thousand dollars to trade. Only the uber-

motivated with lots of time on their hands were able to apply themselves to the huge task of

sifting through papers and reports to find a kernel of gold, and even then there was no guarantee

that they would find anything worth trading.

Fast forward to present, the internet has opened up a wealth of resources for today’s traders.

Whether on Main Street or Wall Street, you can get access to institutional-level information and

sort through it with the touch of a button. Some charge a fee but there are others that are free and

the information is just as good, if not better.

To help you sort through the stock market universe, you’re going to need a scanner. I’ve listed

several scanners and other valuable resources on my site at www.StockOptionSystem.com, and

am constantly updating them, but in this

report I am going to use FinViz.com.

FinViz.com is short for “Financial

Visualizations”. Its an impressive

scanner that has both free and paid for

features. The paid for features are

mostly for real-time data but you can

setup a free account and use its scanning

capabilities at no charge.

Before going any further, let me warn

you that FinViz.com has alot of features.

The information can be overwhelming

and counter-productive if you try to use

every feature to find the “perfect” stock

to trade. The site has everything from maps, groups, futures, Forex, and more. Its a great tool but

in the beginning be mindful of information overload and keep it simple.

Remember: The essence of trading mastery (or mastery of anything) boils down to the beautiful

simplicity of what you do.

That said, the scanner section of FinViz.com allows you input a number of fundamental and

technical criteria for the type of stock you’re looking for.

So, for a basic scan of the 4 keys, create a free account and click the “Screener” tab at the top of

the screen.

When you get to the screener, you’ll see 4 tabs at the top: Descriptive, Fundamental, Technical,

and All.

Just go to the “All” tab and click it. The All selection is just what it sounds like and pulls up all

the criteria from the other tab selections.

www.stockoptionsystem.com

Locate the following criteria and input the following:

1) 52-Week High/Low - select “New High” from the drop down box.

2) EPS Growth Qtr Over Qtr - select “Over 30%”.

Next, you’ll pull up a series of stocks that meet this criteria and have their charts displayed for

your review.

Depending on the quality of the economy and the state of the stock market, this list could be as

many as 100 to as little as a dozen. You’re job is to find the best of the best and ignore the rest.

Remember, you are striving to identify the stars among a universe of stocks.

If you have a large number of results, you can use the link mentioned previously at

BarCharts.com to identify the strongest sectors currently in the market -

http://www.barchart.com/stocks/sectors/change.php?page=6mo

Now, you’ll want to visually scan through these charts and confirm that the stocks are in a

uptrend. A quick method is to identify whether the stock’s price action starts at the bottom of the

left-hand side of the screen and is trading up towards the upper right-hand side of the screen,

then the stock is trending upward, which is what you want to see. If not, or if the price action is

jagged versus trading in a smooth, easily identified bullish trend, then scratch off your list of

candidates.

You also want to look for explosive price action in the stock’s movement. This can be breakouts

above resistance points, price laps, price gaps, breakaway price bars, and other types of price

action that display runaway movement in the stock’s price action.

If you go through and filter through the stock results from you scan, you’ll begin to develop a list

of strong candidates for your “hit list” of candidates. Each day, you will look to this list to find

potential trades that are triggered by your trading system.

One shortcoming of FinViz.com that keeps it from being a perfect scanner, in my opinion, is that

it doesn’t screen for Relative Strength. Of course, you can go and search the internet for a stock’s

RS reading and find several sources. Or, you can use one of the paid, inexpensive services like

the scanner at MorpheusTrading.com by clicking here -

https://www.morpheustrading.com/services/stock-screener

They offer a $4.95 30-day trial and then its $11.95 every 30 days which is pretty cheap. There

scanner allows you to screen the stock market for stocks using several similar features found at

FinViz.com as well.

Whichever way you decide to go, you can play with several types of filters to find the best stocks

with runaway potential by using these 4 key criteria as the foundation for your research.

www.stockoptionsystem.com

The Wrap-Up

In closing, I want to warn you of one thing when trading stocks.

Be cautious of trading in front of earnings releases. The fact is that you don’t know how a

stock’s price action will react when earnings are released and how the market will react.

Naturally, you want to be in front of a stock when it breaks higher after an earnings report where

accelerated earnings blow past the expectations of Wall Street. After a company announces that

kind of success, everyone wants a piece and that’s when you can ride the momentum to huge

returns.

If you try to play earnings in advance of the announcement, tighten up your risk control. Use

options for a straight trade by themselves or create an option spread or use as a hedge with a

stock position. At the very least, when using stocks alone, take a small position and then scale in

if the stock acts favorably to your outlook. That way, you won’t take on more risk than you

should but still have the potential to gain a windfall by getting in early in a stock with runaway

potential.

Also, trading stocks with these 4 key factors can be enormously profitable but, keep in mind,

there is risk that comes with that potential. Overall, these 4 keys in stock selection are just one

part of your overall strategy in trading stocks. Use them wisely and you’ll have a real edge in

finding winning stocks but don’t mistake this one part as a total strategy. Instead, see it for what

it is - one part of many that make up a winning strategy.

No method of stock selection will help you if you don’t have a system of risk control in place.

But, if you understand the risks and have a reliable trading method, then these 4 keys should help

find the stocks with the greatest potential for large gains and avoid the ones with lesser potential.

Actions To Take:

Go now and start using what you learned.

Create a list of worthy trade candidates and begin tracking their performance.

Over time, you’ll be able to screen and select the best stocks to trade with your system and prove

to yourself what works and, more importantly, what works for your style of trading.

Good luck and good trading.