LIHEAP Performance Management Project Vulnerable Household Targeting Study

LIHEAP INCOME LIMITS AND ASSETS TESTS: A REVIEW OF STATE POLICIES.

-

Upload

jayden-dobbs -

Category

Documents

-

view

217 -

download

0

Transcript of LIHEAP INCOME LIMITS AND ASSETS TESTS: A REVIEW OF STATE POLICIES.

LIHEAP INCOME LIMITS AND ASSETS TESTS: A

REVIEW OF STATE POLICIES

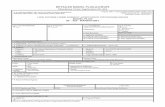

INCOME MAXIMUMS: LIHEAP STATUTE• NO LOWER THAN 110% OF THE

FEDERAL POVERTY INDEX

• NO HIGHER THAN 150% OF THE

FEDERAL POVERTY INDEX, OR 60%

OF THE STATE MEDIAN INCOME,

WHICHEVER IS GREATER

INCOME MAXIMUMS: 2005 HEATING ASSISTANCE• 110%: 4 STATES

• 111% - 149%: 14 STATES

• 150%: 20 STATES

• OVER 150%: 6 STATES

• 60% OF STATE MEDIAN INCOME: 6 STATES

• OTHER: 1 STATE (50% OF STATE MEDIAN

INCOME)

INCOME MAXIMUMS 2005: CRISIS ASSISTANCE• 110% OF POVERTY: 2 STATES

• 111% - 149%: 13 STATES

• 150%: 22 STATES

• OVER 150%: 6 STATES

• 60% OF STATE MEDIAN INCOME: 7 STATES

• OTHER: 1 STATE (50% OF STATE MEDIAN

INCOME)

INCOME MAXIMUM ISSUES

• FEDERAL FUNDING UNCERTAINTIES

• STATE STATUTORY, POLICY

RESTRICTIONS

• DILEMMA: PROVIDE SMALLER

BENEFITS TO MORE HOUSEHOLDS

OR LARGER BENEFITS TO FEWER

HOUSEHOLDS?

INCOME MAXIMUM CASE STUDY: INDIANA• INCOME MAX= 125% OF POVERTY

• RATIONALE – WITHOUT ADVANCED

FUNDING, STATE DOES NOT FEEL

SECURE RAISING LIMIT

INCOME MAXIMUM CASE STUDY: IOWA

• INCOME MAX = 150% OF POVERTY

• EXCEPTION – NON-REIMBURSED

MEDICAL EXPENSES CAN BE

DEDUCTED IF INCOME EXCEEDS

150%.

• LITTLE WORKLOAD ISSUE

INCOME MAXIMUM CASE STUDY: CONNECTICUT• INCOME MAX= 150% OF POVERTY

• INCREASED MAX TO 60% OF STATE

MEDIAN INCOME WHEN FEDERAL

CONTINGENCY FUNDS RECEIVED

• ISSUE – ARE DENIALS FOR OVER-

INCOME RECONSIDERED WHEN

MAXIMUM RAISED?

INCOME MAXIMUM CASE STUDY: UTAH• INCOME MAX = 125% OF POVERTY

• RATIONALE – DO NOT WANT TO

REDUCE BENEFITS TO SERVE MORE

• 20% REDUCTION FOR EARNED

INCOME

• DEDUCTIONS FOR MEDICAL, CHILD

SUPPORT AND ALIMONY EXPENSES

INCOME MAXIMUM CASE STUDY: FLORIDA• INCOME MAX = 150% OF POVERTY

• WENT FROM 125% TO 150% 3 YEARS

AGO

• RESISTANCE TO INCREASE: BENEFITS

WOULD BE TOO SMALL

• RATIONALE FOR INCREASE: CAN NOW

SERVE 2-MEMBER ELDERLY HOUSEHOLDS

INCOME MAXIMUM CASE STUDY: OKLAHOMA• INCOME MAX = 110% OF POVERTY

• RATIONALE – STATE VIEWS LIHEAP

AS “SAFETY NET” RATHER THAN

“INCOME SUBSIDY” PROGRAM

• SERVING ONLY 40% OF 110%

GROUP

INCOME MAXIMUM CASE STUDY: WISCONSIN• INCOME MAX = 150% OF POVERTY

• SET BY STATUTE, THUS DIFFICULT TO CHANGE

• CONSIDERING FUTURE DEDUCTIONS FOR MEDICAL EXPENSES

• CONSIDERING RE-DEFINITION OF SEASONAL INCOME

INCOME MAXIMUM CASE STUDY: COLORADO• INCOME MAX = 185% OF POVERTY

• RATIONALE 1 – BETTER TO HELP

MORE PEOPLE WITH FEWER

DOLLARS THAN FEWER PEOPLE

WITH MORE DOLLARS

• RATIONALE 2 – IMPORTANT TO HELP

THE “WORKING POOR”

INCOME MAXIMUM CASE STUDY: COLORADO (CONT.)• TWO-PAYMENT METHOD ALLOWS

STATE TO ADJUST BENEFITS UP OR DOWN BASED ON AMOUNT OF AVAILABLE FUNDS

• LIHEAP RECIPIENTS RECEIVE AUTOMATIC 60-DAY SHUTOFF HOLD

• LOCAL FUEL FUND AIDS THOSE ABOVE LIHEAP INCOME MAX

INCOME MAXIMUM RECOMMENDATIONS1. SET HIGH TO HELP AS MANY HOUSEHOLDS AS

POSSIBLE, ESPECIALLY THE “WORKING POOR”

2. DO NOT LOWER INCOME MAX – COLORADO EXPERIENCE RESULTED IN PERMANENT LOST CLIENTS

3. PAY IN 2 INSTALLMENTS TO ALLOW MID- COURSE BENEFIT ADJUSTMENTS

4. COORDINATE WITH LOCAL FUEL FUNDS, SO THEY HELP THOSE LIHEAP CAN’T

INCOME MAXIMUM RECOMMENDATIONS (CONT.)5. PUSH FOR FORWARD FUNDING

6. PUSH FOR INCREASED FUNDING

7. MAXIMIZE LEVERAGING EFFORTS

ASSETS TESTS: STATE BREAKOUTS• 11 STATES CURRENTLY APPLY ASSETS TESTS

• MAXIMUM ASSETS RANGE FROM $1,500 TO

$10,000

• VARIOUS STATES ADJUST FOR HOUSEHOLD

SIZE, ELDERLY, ILLNESS

• NO STATE COUNTS HOME AS AN ASSET

• MOST STATES CONSIDER “LIQUID” ASSETS

ASSETS TESTS: PRO

• GUARDS AGAINST HOUSEHOLDS WITH EXCESSIVE RESOURCES FROM QUALIFYING FOR LIHEAP

• PRESERVES FUNDS FOR THOSE IN THE GREATEST NEED

• KEEPS LIHEAP CONSISTENT WITH PUBLIC ASSISTANCE PROGRAMS LIKE TANF

ASSETS TESTS: CON

• DISCRIMINATES AGAINST PEOPLE WHO SAVE, ESPECIALLY THE ELDERLY

• MUCH FALSE REPORTING – PUNISHES THOSE WHO REPORT ACCURATELY

• LOCAL OFFICE WORKLOAD

• IF PRIMARY CAR IS EXEMPT, WHAT IF IT’S A MERCEDES?

ASSETS TESTS: CON (CONT.)• LENGTHENS THE LIHEAP

APPLICATION FORM

• THOSE WITH HIGH VALUE ASSETS

GENERALLY WILL NOT SEEK LIHEAP

ASSISTANCE ANYWAY

• WHERE DO YOU DRAW THE LINE?

ASSETS TEST ELIMINATION: COLORADO EXPERIENCE• AS HEATING COSTS ROSE, ELDERLY

COMPLAINED TO LEGISLATURE (2001)

• ELDERLY DID NOT WANT TO DEPLETE SAVINGS TO QUALIFY FOR LIHEAP

• LOCAL LIHEAP OFFICES, CLIENT ADVOCATES STRONGLY SUPPORTED END TO ASSETS TEST

ASSETS TEST ELIMINATION: COLORADO EXPERIENCE (CONT.)

• ONLY .4% REPORTED ASSETS OF OVER $10,000 IN FIRST TWO YEARS AFTER TEST ENDED

• ESTIMATED 10-15 MINUTES PER CASE SAVED IN PROCESSING TIME

• LIHEAP APPLICATION FORM SHORTENED BY ¼ PAGE