Lifestyle Planning | Jester Financial

-

Upload

jesterfinancial -

Category

Economy & Finance

-

view

179 -

download

0

Transcript of Lifestyle Planning | Jester Financial

Lifestyle Planning

www.JesterFinancial.com

Goal of Jester Financial

1. Focuses on YOUR goals for today2. Prepares YOU for your goals of tomorrow

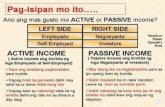

What is Lifestyle Planning?

Goal of Jester Financial

1. Housing2. Leisure and Recreation3. Transportation and Communication4. Miscellaneous Goods and Services5. Food and Beverages6. Education7. Clothing and Footwear

What’s YOUR Lifestyle?

17%

1%

13%11%

15%

2%8%

Miscellaneous Goods & Services

Education

Leisure & Recreation

Transportation & Communication

Housing

Clothing & Footwear

Food & Beverages

The breakdown

Credit Suisse Euro Monitor

Average Lifestyle Expenditures over the age of 60

What’s different about your Lifestyle?

• Education?• Housing?• Clothing?

www.JesterFinancial.com

What can effect your Lifestyle?

1. Interest Rates (Rate of Return)2. Investment (Market Volatility)3. Family (Help) Emergencies4. Taxes 5. Healthcare

www.JesterFinancial.com

The breakdown

Credit Suisse Euro Monitor

Something was Missing?

17%

1%

13%

11%

33%

15%

2% 8%

Miscellaneous Goods &Services

Education

Leisure & Recreation

Transportation &Communication

Health Goods & Services

Housing

Clothing & Footwear

Food & Beverages

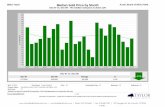

The Facts

Goal of Jester Financial

“My ability to afford retirement, including post-retirement health care” Deloitte Survey, 83% of respondents

“52% of workers have little or no confidence that they will have enough money to pay for medical expenses in retirement” ERBI 2013 confidence survey

“What concerns you?”

Employee Concerns

The FactsGallup survey, May 2013Sources of expected income in

retirement

Common Chacteristic?

Most are taxable sources of income

Health Care Programs

MedicarePart A-Hospitalization coveragePart B-Doctors, Lab and X-rayPart C-Medicare Advantage PlansPart D-Prescription Drug CoverageSupplemental Coverage-Medi-Gap

“Since 2000, Social Security’s annual COLA has resulted in a cumulative benefit increase of about 36%, significantly less than the Part B premium growth of close to 120%.”*

Medicaid Coverage for medical costs and long term care costs, provided to low income individuals and those with little or no assets.

*congressional research service, June 11, 2013

Retiree Health Care Programs

Taxes

Taxes take away from your net spendable dollars in retirement, leaving you with the potential for a lower standard of living.

Planning for or limiting the exposure to taxes enables families to better afford expected and unexpected health care costs in retirement.

•The tax which has the potential to cost the most is also unknown to the majority of people; Medicare means testing•Taking income that subjects you to taxes on your social security •The most overlooked opportunity to save taxes is the medical expense deduction. It has a floor of 10%, meaning that the first 10% of medical expenses as a percentage of your adjusted gross income cannot be deducted.

By our estimates it is a $100 billion annual lost opportunity for those over the age of 65.

Taxes

Income that triggers taxes

Modified adjusted gross income (MAGI)

Income that triggers taxes

What is not Income (MAGI)

Current Solutions to Taxation1. Health Savings Account (HSA’s) distributions*2. VEBA distributions*3. 401(h) plan distributions*4. Long Term Care Planning-(Access to Care)5. Critical Illness Insurance-(Access to Care)6. Roth 401(k)/IRA’s/Sep’s distributions7. Properly structured loans and withdrawals from life

insurance policies8. Reverse Mortgage Payments9. Some Annuity Payments (SPIA, Long Term Care qualified or

longevity)

* Must be for qualified health care expenses otherwise penalties may apply

What is not considered Income(MAGI)

What is not Income (MAGI)

What happens when a parent gets sick?Possible Solutions for Parents &

Grandparents

1. Life insurance policies2. Long Term Care Planning Solutions3. Reverse Mortgage Payments4. Annuities with Long Term Care Benefit5. Longevity Annuities

Sandwich Generation

Medicare Means Testing

Income Part B (monthly) Part D (monthly)

Individuals MAGI

$85,000 < Premium of $104.90 Premium (varies)

$85,001 To $107,000 Premium + $42.00=$146.90 Premium + $11.60

$107,001 to $160,000 Premium + 104.90=$209.80 Premium + $29.90

$160,001 to $214,000 Premium + 167.80=$272.70 Premium + $48.10

Over $214,000 Premium + $230.80=$335.70 Premium + $66.40

For Couples the MAGI bracket is twice the amount with corresponding increases based on total income.

Monthly Medicare premiums for 2013

Planning Solutions

Your income in retirement is going to impact your income in retirement!

What you don’t know will hurt you!