LIC MF AMC All Weather Asset Allocator PMS

Transcript of LIC MF AMC All Weather Asset Allocator PMS

LIC MF AMC

All Weather Asset Allocator

PMS

Multiasset strategy for all market conditions

Presentation Contents

Global & Domestic inter/intra asset class historical perspective

Asset Class performance keep varying

01

How Asset allocation addresses key conundrums of Investors

Asset Allocation

02

Insights into the construct of the unique asset allocation strategy

Introducing LIC MF All Weather Asset Allocator

03

Variables and guiding principles that go into deciding asset allocation mix

Invest Approach

04

Key Team members and statutory disclosures

About the Team

05

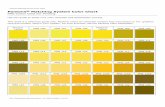

Asset Class performance keep varying … rotation between asset classes

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

US Treasury REITS S&P 500 S&P 500 S&P 500 Global HY MSCI EM Cash S&P 500 Gold Comm

9.80% 23.80% 32.40% 13.70% 1.40% 14.80% 37.80% 1.80% 31.50% 24.80% 20.00%

Gold Global HY MSCI EAFE REITS US Treasury S&P 500 MSCI EAFE US Treasury REITS S&P 500 REITS

8.90% 19.30% 23.30% 11.70% 0.80% 12.00% 25.90% 0.80% 27.40% 16.30% 12.10%

Global IG MSCI EM Global HY US Treasury Cash Comm S&P 500 Gold MSCI EAFE MSCI EM S&P 500

4.50% 18.60% 8.00% 6.00% 0.10% 11.80% 22.00% -1.90% 22.80% 15.80% 11.10%

Global HY MSCI EAFE Avg Port Global IG MSCI EAFE MSCI EM Avg Port Global HY Comm Global IG MSCI EAFE

2.60% 17.90% 2.22% 3.20% -0.80% 11.20% 14.04% -3.30% 20.10% 10.30% 5.60%

S&P 500 S&P 500 REITS Avg Port REITS Gold Gold Global IG MSCI EM US Treasury Avg Port

2.10% 16.00% 0.70% 1.13% -3.40% 8.60% 12.90% -3.40% 18.60% 8.20% 4.14%

Cash Avg Port Global IG Gold Global IG Avg Port REITS REITS Gold Global HY MSCI EM

0.10% 11.62% 0.10% 0.10% -3.80% 6.64% 11.50% -3.90% 17.90% 8.00% 3.50%

Avg Port Global IG Cash Cash Global HY Global IG Global HY S&P 500 Avg Port Avg Port Global HY

-2.46% 11.10% 0.10% 0.00% -4.20% 4.30% 10.20% -4.30% 17.26% 6.67% 1.10%

REITS Gold MSCI EM Global HY Avg Port REITS Global IG Avg Port Global HY MSCI EAFE Cash

-9.40% 8.30% -2.30% -0.10% -5.99% 1.30% 9.30% -5.46% 13.70% 5.40% 0.00%

MSCI EAFE US Treasury US Treasury MSCI EM Gold US Treasury Comm Comm Global IG Cash Global IG

-11.70% 2.20% -3.30% -1.80% -10.40% 1.10% 7.60% -12.90% 11.40% 0.50% -2.80%

Comm Cash Comm MSCI EAFE MSCI EM MSCI EAFE US Treasury MSCI EAFE US Treasury REITS US Treasury

-13.30% 0.10% -9.50% -4.50% -14.90% 1.00% 2.40% -13.20% 7.00% -7.60% -3.50%

MSCI EM Comm Gold Comm Comm Cash Cash MSCI EM Cash Comm Gold

-18.20% -1.10% -27.30% -17.00% -24.70% 0.30% 0.80% -14.30% 2.20% -15.00% -5.70%

Globally, Cross-Asset leaders keep changing

Historically, in risk-on years, equity, commodity & REITS do well.

In risk-off years, gold, Treasuries and cash do well.

Different asset class performance keep changing. A simple average

portfolio of all the asset may ensures reasonable risk adjusted returns.

Source : BoFA ; Global IG : Global Investment grade, Global HY : Global High Yield ; REITS : Real estate investment trusts ; MSCI EAFE : Europe,

Australasia, and the Far East, MSCI EM : MSCI Emerging Markets and Avg Port : is simple average of all asset classes

Key Global Equity Markets performance

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

USA India USA India USA USA China USA USA China

21% 32% 50% 28% 6% 14% 45% 4% 34% 33%

World China World USA World World Asia World World Asia

13% 27% 44% 16% 4% 11% 34% 0% 31% 28%

Europe Asia Europe China Europe Asia India India Europe USA

6% 26% 42% 11% 2% 8% 30% 0% 27% 24%

Asia Europe China World India China Europe Asia China World

-1% 23% 17% 8% 0% 4% 19% -6% 26% 19%

China World Asia Asia China Europe World Europe Asia India

-3% 20% 17% 8% -3% 3% 16% -6% 21% 11%

India USA India Europe Asia India USA China India Europe

-20% 19% 15% -4% -5% -1% 15% -11% 8% 9%

Indian markets has fared well despite short term volatility

Having a well diversified global equity allocation approach has done

well for equity Investors in the past.

Source : Bloombberg

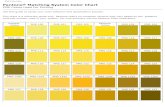

Indian financial Asset's performance keep

varying1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

Equity Equity Equity Equity Equity Gold Debt Equity Debt Equity Debt Debt Gold Equity Equity Equity

34.40% 82.10% 37.00% 27.90% 17.40% 13.30% 12.00% 18.60% 10.50% 63.80% 9.00% 8.50% 24.10% 71.90% 10.70% 36.30%

Avg Port Avg Port Avg Port Gold Debt Debt Cash Debt Gold Avg Port Cash Cash Debt Avg Port Cash Gold

13.43% 32.85% 16.60% 27.10% 13.00% 13.00% 9.40% 11.00% 8.10% 20.20% 5.60% 6.40% 12.70% 22.53% 4.00% 22.20%

Debt Gold Cash Avg Port Avg Port Cash Avg Port Cash Cash Debt Gold Gold Avg Port Gold Avg Port Avg Port

9.00% 31.30% 12.10% 16.47% 8.68% 8.80% 6.07% 7.00% 6.50% 9.00% 1.30% 5.90% 11.48% 13.50% 3.73% 16.98%

Cash Debt Debt Debt Cash Avg Port Equity Avg Port Avg Port Cash Avg Port Avg Port Cash Debt Gold Debt

8.00% 9.00% 11.00% 12.00% 7.00% 4.60% -0.80% 5.65% 2.15% 5.70% -2.00% 0.73% 6.40% 8.10% 0.50% 4.80%

Gold Cash Gold Cash Gold Equity Gold Gold Equity Gold Equity Equity Equity Cash Debt Cash

2.30% 9.00% 6.30% 10.30% -2.30% -20.80% -3.20% -14.00% -16.50% 2.40% -20.60% -17.90% 2.70% 4.60% -0.30% 4.60%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020*

Equity Equity Gold Equity Gold Gold Equity Cash Equity Debt Debt Equity Cash Gold Gold

39.80% 54.80% 31.00% 75.80% 24.50% 30.70% 27.70% 9.00% 31.40% 8.60% 12.90% 28.60% 7.60% 21.00% 28.00%

Gold Avg Port Debt Avg Port Equity Cash Avg Port Equity Debt Cash Gold Avg Port Gold Avg Port Avg Port

21.00% 21.45% 9.10% 25.70% 17.90% 8.20% 14.15% 6.80% 14.30% 8.20% 11.00% 11.70% 7.50% 12.65% 14.95%

Avg Port Gold Cash Gold Avg Port Debt Gold Debt Avg Port Avg Port Avg Port Gold Avg Port Equity Equity

17.70% 16.60% 8.40% 18.60% 13.13% 6.90% 11.00% 3.80% 13.85% 1.68% 8.60% 6.80% 6.05% 12.00% 14.90%

Cash Cash Avg Port Cash Cash Avg Port Debt Avg Port Cash Equity Cash Cash Debt Debt Debt

6.00% 7.50% 21.45% 4.90% 5.10% 5.30% 9.40% 0.05% 9.20% -4.10% 7.50% 6.70% 5.90% 10.70% 12.30%

Debt Debt Equity Debt Debt Equity Cash Gold Gold Gold Equity Debt Equity Cash Cash

4.00% 6.90% -51.80% 3.50% 5.00% -24.60% 8.50% -19.40% 0.50% -6.00% 3.00% 4.70% 3.20% 6.90% 4.60%

Mutliasset approach works well in Indian context. A simple avg portfolio

has generated second highest returns (only next to equities) in the past,

with a much better sharpe ratio

Based on historical data available in public domain, Equity has generated highest absolute returns in the last 30 years

While Gold and Debt has generated higher risk adjusted returns

Source : MOSL Alpha Strategist

Within an asset class well there is varied performance

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Mid Cap Large Cap Mid Cap Large Cap Small Cap Mid Cap Mid Cap Small Cap Large Cap Large Cap

17.7 -24.8 40.4 7.6 71.1 8.7 9.3 61.1 2.6 10.9

Small Cap Mid Cap Small Cap Mid Cap Mid Cap Small Cap Large Cap Mid Cap Mid Cap Mid Cap

17.3 -33.3 34.8 -4 56.9 7.7 5 50 -12.5 -2.1

Large Cap Small Cap Large Cap Small Cap Large Cap Large Cap Small Cap Large Cap Small Cap Small Cap

17.2 -41.7 32 -9.7 34.2 -2 2.7 33.4 -22.8 -5.9

Equ

ity

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

ST Debt ST Debt LT Debt ST Debt LT Debt ST Debt LT Debt ST Debt ST Debt LT Debt

4.7 7.9 10.6 8.3 14.1 8.7 14.9 6 6.7 10.5

LT Debt LT Debt ST Debt LT Debt ST Debt LT Debt ST Debt LT Debt LT Debt ST Debt

3.1 1.9 9.1 -0.7 10.5 7.4 9.8 0 6 9.5

De

bt

Top performers within Equity : Large Cap 5 Yrs , Midcap 4 Yrs & Small Cap 2 Yrs

Top performer within Debt : Short term Debt 6yrs & Long term Debt 5 yrs

Source : Bloomberg

Indian Financial Assets : Insights

Assets Equity-IND Debt Cash Gold Avg Port

CAGR from 1990 to 2020* 13.8% 8.7% 7.2% 10.2% 12.0%

Standard Deviation 28.0% 2.6% 0.6% 15.8% 8.2%

Maximum Drawdown -55.1% -6.3% 0.0% -25.3% -11.4%

Maximum Returns - 3Y 59.6% 12.7% 10.6% 32.6% 27.1%

Minimum Returns - 3Y -15.7% 2.4% 4.4% -8.7% 0.1%

Average Returns - 3Y 12.5% 8.5% 7.2% 10.0% 11.3%

Positive Observations (%) - 3Y 84.0% 100.0% 100.0% 84.6% 100.0%

Asset Class CAGRStandard

Deviation

Max

Drawdown

Equity – IND 13.8% 28.0% -55.1%

Gold - INR 10.2% 15.8% -25.3%

Debt 8.7% 2.6% -6.3%

Cash 7.2% 0.6% 0.0%

CorrelationEquity -

India

Equity –

USA

Gold

(INR)Debt Cash

Equity – IND 1

Equity –USA (INR) 0.25 1

Gold (INR) -0.01 0.03 1

Debt 0.1 -0.06 -0.07 1

Cash -0.03 0.02 -0.07 0.3 1

Equity-IND Debt Cash Gold Avg Port

-20% to -10% 3.3%

-10% to 0% 12.8% 15.4%

0% to 6% 22.0% 16.0% 21.7% 23.4% 10.8%

6% to 10% 15.7% 54.0% 72.7% 13.4% 25.5%

10% to 20% 22.3% 30.0% 5.6% 28.5% 58.2%

20% to 30% 8.6% 18.4% 5.6%

Above 30% 15.6% 0.9%

Returns Distribution

(3Y Rolling Returns)

% Observations

Avg portfolio generates higher risk adjusted returns Weak Correlation augurs diversification

Returns dispersion suggestive of Multiasset Allocation Other Statistical attributes

Source : MOSL Alpha Strategist

Asset Allocation …as 90% of returns are derived through asset allocation

Questions in Investors mind …

▪ Has one missed the bottom ?

▪ Is one entering at higher levels ?

▪ Will markets correct significanly ?

▪ Should one focus on Quality or Value ?

▪ Should one focus on large or mid cap ?

Equity

• Should one stay in liquid in back

drop of current rally ?

• Should cash buffer be kept for

allocation at lower market levels?

• Considering valuation, should one

invest in a staggered manner or

lumpsum ?

Cash

02

0403

01• Have the rates bottomed out for this cycle ?

• For higher yield, can one Invest in credit ?

• Have the interest rates bottomed out globally ?

• Where is domestic inflation heading ?

Bonds

• Has gold topped out ?

• Will other assets perform better now ?

• As the rates rise, how would gold perform ?

• Is there any risk-off event in the offing ?

Gold

When Investor plans to Invest, he is faced with following options !!!

Asset Allocation can help overcome this dilemma

Various Asset classes follow different cycles over a

period

Helps in Optimal Portfolio Diversification

Helps in overcoming timing issues related with

each asset class

Asset allocation is the key driver of portfolio

returns

Why Asset

Allocation

Asset Allocation is the key

More than 90% of portfolio returns are

based on asset allocation decisions.*

*Source: “Does Asset Allocation Policy Explain 40%, 90% or 100% of Performance? “ Study by Roger Ibbotson & Paul Kaplan in 2001

Equity Bond/Gold

An Investor deals with the Dilemma of

choosing between Debt/ gold vs Equities

Asset Allocation

(90%)

Stock selection &

Others (10%)

Allocation Strategy …

Provides

Hedge

Gold ETFs

Gold Funds

Sovereign gold

bonds

Allocation

5-25%

Gold

Provides

buffer

Arbitrage Funds

Liquid Funds

Overnight Funds

Allocation

10-20%

Cash

Generates

Alpha

Large/Mid/Small

Cap/Thematic MFs

Index ETFs

REITs/INVITs

Direct Equity

Allocation 15-

75%

Equity

Provides Safety

& Accrual

Debt MFs (Majorly

AAA)

Liquid & Gilt MFs

Debt ETFs

Listed Corporate

bonds

Allocation

10-15%

Bond

Introducing LIC MF All Weather Asset Allocator

PMS strategy for all market conditions..

Investment Process

Volatility and Historical

based analysis to

accomplish ball-park

weights

1. Asset Allocation

StrategyAsset class based economic,

fundamental & relative assessments

to optimize weights

2. Fundamental Assessment

Optimize weights

Bottom up & top-down fund

selection framework with due

consideration to Performance, Risk,

and Liquidity profiles

3. Asset Class Selection

Investor to choose from

curated Conservative,

Moderate and Aggressive

portfolios

4. Bucketing Portfolios

Portfolios are rebalanced

on opportunity based with

due consideration to risk &

post tax returns

5. Rebalancing Portfolios

Steps in Portfolio creation…

3 4

Volatility and Historical based analysis to determine the

targeted asset allocation

Asset Allocation Strategy

Asset class based economic, fundamental &

relative assessments to optimize weights

Fundamental analysis to optimize weights

Bottom up & top-down fund selection framework

with due consideration to Performance, Risk, Liquidity

profile

Asset Class Selection

Investor to choose from curated Conservative

Moderate and Aggressive portfolio .

Bucketing Portfolios

1 2

Step 1.Asset Allocation Strategy

Asset Allocation Strategy

➢ Cross asset (Equity, Bond, Gold &

Arbitrage Funds) historical asset

allocation is done based on volatility

adjusted returns

➢ The simulation (after considering tax

implications) suggests ball-park weights

➢ Suggestive weights are compared with

benchmark to check the performance

➢ Rebalancing criteria is performance and

portfolio type base.

Aggressive Moderate Conservative

Standard Deviation 6.66% 6.47% 4.64%

Maximum Drawdown 55.21% 46.48% 32.80%

Maximum Returns - 3Y 27.7% 32.8% 23.2%

Minimum Returns - 3Y 5.0% -0.3% 3.9%

*The above table is for illustrative purposes only

Step 2. Fundamental Assessment to Optimize weights

Fundamental Assessment

➢ Each asset class is evaluated based on its

Fundamental assessment vs its historical

range.

➢ For Equity, key variables include Trail P/E,

PB and Forward P/E apart from Market

Cap to GDP ratio and Nifty/Mid Cap ratio

➢ For Debt, key variables include Earnings

yield vs. Dividend yield & Real Rates

➢ For Gold ,Key variables include increase in

Global Money Supply, Dollar movement

and Real rates.

➢ For Liquid ,the overall level of risk in

portfolio and summation of all asset class

expensiveness/ cheapness is considered

➢ Weights from step 1 are then optimized.

Equity Bond Gold Liquid

Cheap

Expensiv

eMar 20

Mar 21

Mar 20

Mar 21

Mar 20

Mar 21

Mar 20

Mar 21

Step 3: Asset Class Selection

Building Portfolio for each asset class

➢ Expression of asset weights into different

asset classes is done by implementing a

Bottom-up approach for each asset class

component.

➢ For Equity, key variables include relative

attractiveness of Large vs mid cap, Quality vs.

Value, Cyclical vs Defensives ,etc

➢ Allocation in asset classes (as per step 2) is

via direction exposure through equity and/or

bonds is supplemented by MFs & ETFs.

➢ For selecting MF’s ,due consideration is given

to returns vs peers, AuM, Semi standard

deviation, Treynor ratio for equities. And for

Debt, YTMs, Expenses, AUM, Avg Maturity,

Modified Duration , Composition ,etc is

considered.

✓ Quantitative

✓ Qualitative

✓ Micro/Macro

MFs/ETFs & Direct

Stocks/Bonds/Eq. Arbitrage &

Gold is selected based on :

Step 4. Bucketing Portfolios

Tailor made portfolios based on risk

➢ Entire universe of assets selected is then

bucketed into 3 tailor-made portfolios, i.e

Aggressive, Moderate and Conservative.

➢ Conservative portfolio has predominantly

debt & liquid allocation .Hence ,less volatile

and suitable for risk averse investor

➢ Moderate portfolio has a good balance of

equity and debt . Hence, slightly volatile and

suitable for balanced investor, who can endure

short term volatility

➢ Aggressive portfolio has a larger equity

allocation and suitable for Investor who has

higher risk appetite and could see higher

volatility in medium term and potential loss of

capital, in return for higher returns in long run.

ConservativeAggressive Moderate

Investor can choose between…

01

Aggressive investor is one who

is usually willing to take high risk

for the potential of substantially

higher long-term capital

growth. These investors can

bear volatility

in returns & potential loss of

capital

Aggressive 02

Moderate investor is one who is

generally looking for moderate

capital growth over the long term

and are cautious towards

taking high level of risk. These

investors are, however,

comfortable with short-term

fluctuations in returns

Moderate 03

Conservative investor is one

who is prepared to take a small

amount of short-term risk for

potential returns that are

higher than risk free rate over

the medium to long term.

Conservative

Investor can choose between…

6515

15

5

Aggressive

Equity (%) Arb Equity (%)

Bond (%) Gold (%)

40

1530

15

Moderate

Equity (%) Arb Equity (%)

Bond (%) Gold (%)

20

2040

20

Conservative

Equity (%) Arb Equity (%)

Bond (%) Gold (%)

Aggressive Moderate Conservative

Equity (%) 65 40 20

Arb Equity (%) 15 15 20

Bond (%) 15 30 40

Gold (%) 5 15 20

Benchmark Crisil Hybrid

80/20 :

Aggersive

Index

Crisil 50/50 :

Moderate

Index

Crisil Hybrid

20/80 :

Conservative

Index

An Investor can select a portfolio based on his risk appetite.

➢ Conservative portfolio has predominantly debt & liquid allocations

➢ Moderate portfolio has a good balance of equity and debt

➢ Aggressive portfolio has a larger equity allocation

These portfolios are constructed with flexibility to generate alpha while not

compromising on the overall asset allocation balance.

% can vary based market conditions

Investment ApproachComponents that go into deciding the portfolio..

Equity Investment Approach

Unique combination of two key approaches

Bottom up and Factor based stock

selection Stocks/fund’s are Market-cap agnostic

Multicap Investment Strategy

Selection of MF schemes

based on bottom up

Equity MF’s & ETF’sNo explicit bias to value or growth stocks

by using factor rotation

Style agnostic

Combination of direct stocks/MFs

And ETF’s removes concentration risk

& excessive beta

Limiting over all risk (beta) Selecting stocks having

scalable business models.

Focus on Scalability

Debt & Gold Investment Approach

Moderate Duration profile is maintained for the portfolio

Moderate Duration

Selecting Issuer and Instrument that has strongest credit profile

Pristine Credit Quality Papers/Schemes

Endeavor to capture short end of the yield curve with a focus on stable returns with moderate

volatility

Stability of Returns

Focused on Accrual Income and may outperform in a bull steepening environment.

Accrual Income

Gold will offer diversifier given low correlation to Equity & Debt. Gold is also a great hedge against

Inflation and currency Deprecation and plays a pivotal role in economic duress conditions .

Gold allocation

About the team Team responsible for putting strategy in play…

Meet our team

Azeem Ahmad

(Head PMS & Principal officer)

➢ He is spearheading the PMS vertical at LIC AM Ltd.

➢ In his last assignment, he was the Fund Manager, PMS (Discretionary & Non-

discretionary portfolios) at ICICI Securities. He has over 20 years of

experience, the last 12 years being with ICICI Securities.

➢ He has expertise in the areas of portfolio management, fundamental research,

global macro, equity, FX and derivatives research & product development.

➢ He also held roles including Chief Macro Strategist, Derivatives Strategist at

ICICI Securities Research team.

➢ By Qualification, he is an MBA (Finance) from SP Jain and an Associate

Company Secretary (ACS) from ICSI.

Saket Kumar

Fund Management & Ops

Total 13 Years' experience.

Worked as Assist to Debt

Fund Manager, as an Equity

Dealer and assist to Hybrid

Fund Manager. Educational

Background-CFA-MFA

(ICFAI), MBA, B.Com.

Under Head PMS guidance

he will be assisting Fund

Management & operations

Shreya Raka

Ops & Communications

Bachelor of Commerce in

Accounting and Finance (BAF)

& Master of Commerce

(M.com). In her last

assignment, she worked with

ICICI Prudential Asset

Management Co. Ltd – PMS

Operation Team. More than 2

years of experience in PMS

Nikita Torka

Compliance Officer

Experience – 5 years of

experience in handling

Compliances of Mutual fund. By

Education Qualification she is

BFM, CS, M.Com and MBL.

Scope of work in PMS –

Compliance with SEBI PMS

Regulations and any other

applicable laws

Meet Our Team

Terms of InvestmentType of Portfolio Open Ended Discretionary Portfolio

Scheme Name LIC MF All Weather Asset Allocator PMS

Investment objective To generate long term capital appreciation from a portfolio of different asset classes

Description of types of securities Listed Equity, Gold ETF, REITs, InvITs, Debt, MF, Bonds and Other Alternative Investments.

Basis of selection of such types of

securities as part of the investment

approach

Allocation is done by combining active & passive investing in different asset class from defined

securities universe powered by Bloomberg tools.

Allocation of portolio across types of securitesBased on model porfolio Selected*

Indicative tenure or investment horizonLong Term Capital Appreciation (3 Years +)

Risks associated with the investment

approach

Based on the securities selected from defined universe and continues to have concentration

and systematic risks

Minimum Investment Amount for

New Account Opening 50 Lacs (as per regula ons) or as decided by the por olio manager at its sole discre on

Redemption On all working days

Appropriate benchmark to compare performance and basis for choice of benchmarkBased on model porfolio Selected

Key Risk

Market Risk : Equity Investments are volatile and subject to market conditons. Capital Loss Risk:

There is no capital protection guaranteed in this strategy and due to adverse market

movements, client may incur capital loss. Execution Risk: There can be deviation from the

benchmark index given cash allocation & time lag/price differentials in order executions.

Please note that Investment made on the basis of Investment objective of the strategy may or

may not match with Investment/risk profile of the client.

*Change in allocation of portfolio: Subject to regulatioon, the asset allocation pattern indicated above may change from time to time,

keeping in view market conditions, market opportunities, applicable regulations and political and economic factors. It must be clearly

understood that the percentages stated above are only indicative and not absolute and that they can vary substanially, depending

upon the perception of the Investment Manager, the intention being at all times to seek to protect the interests of the Investors.

Such changes in the investment pattern will be for short term and defensive consideration

Simple Portfolio

Presentation

Designed

Industrial Assurance Building, 4th Floor,

Opp.Churchgate Station, Mumbai –

400020

CIN: U67190MH1994PLC077858

LIC Mutual Fund Asset Management

Limited

General Disclaimer: All returns are in percentage. Performance disclosure is at aggregate portfolio level and the portfolio information (i.e. market cap, sector allocations, etc.) is at model client’s level.

Securities investments are subject to market risks and there is no assurance or guarantee that the objective of the investments will be achieved. Past performance of the portfolio manager does not

indicate its future performance. Performance related information provided herein is not verified by SEBI. Detailed Disclaimer: This document is issued by LIC MF Asset Management Ltd. (Portfolio

Managers). This document is produced for information purposes only and not a complete disclosure of every material fact and terms and conditions. It does not constitute a prospectus or disclosure

document or an offer or solicitation to buy any securities or other investment. All opinions, figures, charts/graphs, estimates and data included in this document is subject to change without notice. It

should not be construed as investment advice to any party. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on

our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied

in such statements. Investors shall be fully responsible/ liable for any decision taken on the basis of this document. Clients under Portfolio Management Services are not being offered any

guaranteed/assured returns. The name of the strategies do not in any manner indicate their prospects or return. The investments may not be suited to all categories of investors. The material is

based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Neither LIC MF Asset Management Ltd. nor any

person connected with it, accepts any liability, losses and/ or damages arising from the use of this material. The recipient of this material should rely on their investigations and take their own

professional advice. Opinions, if any, expressed are our opinions as of the date of appearing on this material only. While we endeavor to update it on a reasonable basis, there may be regulatory,

compliance, or other reasons that prevent us from doing so. The Portfolio Manager is not responsible for any loss or shortfall resulting from the operation of the strategy. The recipient shall

understand that the statements cannot disclose all the risks and characteristics. The recipient is requested to take into consideration all the risk factors including their financial condition, suitability to

risk-return, etc. As with any investment in securities, the value of the portfolio under management may fluctuate depending on the various factors and forces affecting the capital market. Disclosure

Document shall be obtained and read carefully before executing the PMS agreement. For tax consequences, each investor is advised to consult his / her own professional tax advisor. This document

is not for public distribution and has been furnished solely for information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come

are required to observe these restrictions. Distribution Restrictions – This material should not be circulated in countries where restrictions exist on soliciting business from potential clients residing in

such countries. Recipients of this material should inform themselves about and observe any such restrictions.

Disclaimer

Thank you