Lessons from PPP Fiscal Stimulus in Korea

Transcript of Lessons from PPP Fiscal Stimulus in Korea

___________________________________________________________________________

2011/FMP/CON/010 Session 4

Lessons from PPP Fiscal Stimulus in Korea

Submitted by: Korea Development Institute (KDI)

Conference on the Framework and Options for Public and Private Financing of

Infrastructure Washington, D.C., United States

22-23 June 2011

Jay-Hyung Kim ([email protected])

Public and Private Infrastructure Investment Management Center (PIMAC)

Korea Development Institute (KDI)

APEC Finance Ministers’ Process Conference on

The Framework and Options for Public and Private Financing of Infrastructure

June 22-23, 2011, Washington DC

Lessons from

PPP Fiscal Stimulus in Korea

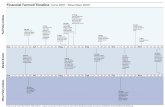

1. Global Financial Crisis and Fiscal Stimulus

2. Fiscal Stimulus and PPP

3. PPP Revitalization Initiatives

4. Lessons Learned

• Korean economy is showing signs of a continued recovery, pulling

out from the serious recession caused by the global financial crisis.

1

GDP and Manufacturing Sector Growth Rates (at 2005 Constant Prices)

Source: KDI, Monthly Economic Trends (March, 2011)

1. Global Financial Crisis and Fiscal Stimulus

Economic Recovery in Korea

2

• Estimated size of fiscal stimulus package

An official report from the Ministry of Strategy and Finance (April,

2010) confirmed that the size of fiscal stimulus package was 38.8

trillion KRW (3.6% of GDP) in 2009.

It also announced that additional 17.1 trillion KRW (1.5%) would be

used in 2010.

• The fiscal stimulus package consists of various fiscal items but

seems to concentrate more on social-overhead-capital (SOC)

investment and support for SMEs and the self-employed.

These are the items known to have bigger or more persistent

multiplier effects.

• Simultaneous implementation of the expanded fiscal expenditure

appears to have contributed to a recovery of the economy.

Fiscal Stimulus Package Appears to Contribute the Recovery

1. Global Financial Crisis and Fiscal Stimulus

3Source: KDI, Monthly Economic Trends (March, 2011)

Trends of Construction Investment

• During the period of financial crisis in 2008-2009, other construction

investment including civil construction by the government increased

sharply, while private building construction decreased abruptly.

1. Global Financial Crisis and Fiscal Stimulus

Trends of Construction Investment

4

• Proportion of PPP investment to government investment in

infrastructure was merely 0.5% in 1997, but dramatically increased to

18.4% in 2008. In 2009 after Global Financial Crisis, the proportion

decreased to15.4%, and is expected to be around 16.3% in 2010.

Footnote: 2010 estimate is the government forecasted figure.

Source: Ministry of strategy and Finance

2. Fiscal Stimulus and PPP

Trends of PPP investment to government investment

BTO

BTO Total BTL TOTALNational Projects

Local Covernment

Projects

Under Operation45

(233,301)

86

(38,133)

131

(271,433)

214

(85,252)

345

(356,685)

Under Construction29

(198,054)

14

(12,066)

43

(210,120)

119

(91,078)

162

(301,198)

Preparing

Construction

9

(78,501 )

5

(5,460)

14

(83,961)

35

(21,082 )

49

(105,044)

Negotiating19

(112,366)

15

(18,192)

34

(130,558)

22

(50,165)

56

(180,722)

Inviting Participants -5

(5,870)

5

(5,870)

11

(9,514)

16

(15,384)

TOTAL102

(622,222)

125

(79,721)

227

(701,943)

401

(257,091)

628

(959,034)

* PPP projects that were publicly announced as of end of September 2010

PPP Projects by Implementation Scheme and Phase

• Total PPP Projects: 628 publicly

announced projects with total investment

amount of 95.9 trillion KRW.

• Concession Awarded: 556 projects that

reached concession agreement with total

investment amount of 76.3 trillion KRW.number of projects

(amount in 100 million KRW)

• under operation: 345 worth 35.7 trillion KRW

• under construction: 162 worth 30 trillion KRW

• preparing construction: 49 worth 10.5 trillion KRW

• BTO projects: 227 worth 70 trillion KRW

• BTL projects: 401 worth 25.7 trillion KRW

5

Status of PPP Projects (BTO and BTL, as of September 2010)

2. Fiscal Stimulus and PPP

Public Announcement of PPP Projects

6

• Total 628 PPP projects were publicly announced

17 PPP projects in 1999 (implementation as unsolicited projects was first introduced),

which increased to 20 and to 25 in 2000 and 2001, respectively.

Number of PPP projects increased drastically to 92 in 2005 (implementation as BTL

projects was first introduced) and to 136 in 2006, but are in decrease since 2007.

Nu

mb

er o

f Pro

jects

Introduction of BTL

Introduction of unsolicited project proposal

Total Public

Announcement

BTO Project

Announcement

BTL Project

Announcement

* PPP projects that were publicly announced as of end of September 2010

2. Fiscal Stimulus and PPP

Public Announcement of PPP Projects by Year

• To ease the financial burdens from the Global Financial Crisis, the first

revitalization initiative, which revised the PPP Basic Plan, was announced in

February 2009.

• Reducing Financial Burdens : Ease the financial burdens on concessionaires by lowering the equity

capital requirement ratio.

Expand the upper limit of the payment guarantee provided by the

Infrastructure Credit Guarantee Fund by 50% to help ease difficulties in

debt financing.

Ease regulation in case of change in composition of equity investors:

projects that do not have MRG provisions are now exempt from refinancing

profit sharing obligation in the case of simple changes in composition of

equity investors.

7

Classification Before After

Build-Transfer-Operate (BTO) 25% 20%

(when financial investors account for 50% or more) (20%) (15%)

Build-Transfer-Lease (BTL) 5% - 15% 5%

Lowering Required Equity Capital Rato

3. PPP Revitalization Initiatives

The First Revitalization Initiative in February 2009 (Ⅰ)

8

• Easing Burdens from Abrupt Changes in Interest Rates:

For BTO projects, when there is a change of 0.5 percentage point or more

in the base interest rate, the government can make up for the change. The

level of compensation depends on the extent of interest rate fluctuation.

For BTL projects, the government has reduced the period for readjusting

the benchmark bond yield from 5 years to 2 years, while replacing or

redeeming 60%-80% of excesses or shortages based on the interest rate

gap of 50 basis points between government bonds and bank bonds.

• Shortening of the Project Implementation Periods:

To prevent delay in the negotiation period, competent authorities are

required to complete the settlement of various points of contention and

civil petitions through consultation with related agencies.

3. PPP Revitalization Initiatives

The First Revitalization Initiative in February 2009 (Ⅱ)

9

• The government further announced in August 2009 measures to

create an enabling environment for active private investment through

PPPs.

• Improvement of PPP Project Structure:

Revitalize supplementary and ancillary projects. The private

concessionaire needs to be provided with a motive to maximize the use of

supplementary and ancillary projects in connection with the main projects

so that user fees can be lowered.

Permit special cases of estimating compensation for termination of

agreement.

Introduction of new investment sharing method with abolishment of

minimum revenue guarantee (MRG). Under the new risk-sharing structure,

the government shares investment risk with the private company by

compensating the base cost of the project, calculated as the sum of

private investment cost and the amount of shortfall in the actual

operational revenue compared to the share of investment risks by the

government.

3. PPP Revitalization Initiatives

The Second Revitalization Initiative in August 2009 (Ⅰ)

• Improvement of Conditions for Funding :

Improve investment environment at financial institutions and others by

reducing burdens caused by diverse regulations and restrictions of

financial institutions.

Regulation of refinancing is eased in order to facilitate financing. As a

temporary measure, refinancing gains will not shared with the government

if the following conditions are satisfied: ⅰ) the expected ROI after

refinancing is smaller than ROI in the financial model of concession

agreement, ⅱ) no MRG is provided ; and ⅲ) the level of user fee is

lower than 1.2 times that of government procured projects.

• Enhancement of Reliability

To reduced MRGs through refinancing, a system for requesting

refinancing by the competent authority needs to take place.

• Expand Eligible Infrastructure Types for Green-Growth Fields:

renewal energies, etc.

10

3. PPP Revitalization Initiatives

The Second Revitalization Initiative in August 2009 (Ⅱ)

• After the First and the Second Revitalization Initiatives, the government

worked out the Third Initiative to further promote private financing for PPPs.

• Easing the regulations on termination payment, equity capital ratio, and

refinancing:

Along with a temporary arrangement for termination payment as one of the special

cases in the Second Initiative, the Third Initiative adjusted calculation method of

termination payment from the declining balance depreciation to the straight line

depreciation.

To further ease the regulation on equity capital requirement, the government

allowed the concessionaire to submit construction performance bond in place of

equity within the limit of 5%.

To ease the regulation on refinancing profit sharing (50:50), public share shall be

less than 50% in cases of projects without MRG.

• Diversifying the Type of Infrastructure Fund:

Expand the type of infrastructure fund from mutual fund to investment trust type.

• Establishing the Dispute Mediation Committee for PPP projects:

PPP Act revision is currently under review by the National Assembly.11

The Third Revitalization Initiative in December 2010

3. PPP Revitalization Initiatives

12

4. Lessons Learned (Ⅰ)

2005 2006 2007 2008 2009 2010.9

BTO 9(16) 11(12) 18(17) 14(15) 13(10) 14(0)

BTL 83(8) 125(66) 76(104) 60(64) 46(89) 11(37)

Total 92(24) 136(78) 94(121) 74(79) 59(99) 25(37)

• The effects of fiscal stimulus packages have contributed to

moderating the serious contraction in the economy.

• The active role and policy support of the government, shown in a

series of PPP Revitalization Initiatives, have demonstrated a strong

commitment to the PPP program, thus strengthening the private

sector’s confidence in participation.

• Still some decline in new PPP announcements and delay in financial

closure.

Unit: number of new project announcements (number of concession awards)

Trends of New PPP Projects and Concession Awards

13

• Less trouble in financing was found in BTL (low-risk, low-return)

than in BTO (high-risk, high-return) procurement.

• Interest rates and access to financing were identified as the main

channels through which the financial crisis has affected or is

expected to affect PPP projects.

• A new model of PPP scheme, such as a combination of BTO and

BTL type, is currently under review to provide better value for

money.

4. Lessons Learned (Ⅱ)