LESSON 9-4 Journalizing Other Transactions Using a General Journal.

Transcript of LESSON 9-4 Journalizing Other Transactions Using a General Journal.

LESSON 9-4

Journalizing Other Transactions Using a General Journal

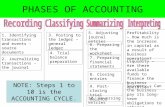

Other Transactions

Supplies purchased on Account (memorandum) What two accounts?

Accounts Payable and Supplies

Which Journal will you use? Purchases

Purchases (merchandise) on Account

Cash Payments Payments made with Cash

Cash Receipts Received payment on account, sales for cash

Sales Journal Sales on Account

General Journal

Using the General Journal

Use the General Journal to record transactions that do not fit in other journals. Purchasing Supplies on Account (items used in

operation of the business and not for resell) Returning merchandise that you can’t sell because

it is damaged or not usable.

MEMORANDUM FOR BUYING SUPPLIES ON ACCOUNT

BUYING SUPPLIES ON ACCOUNT

What two accounts are impacted?

November 6. Bought store supplies on account from Gulf Craft Supply, $210.00. Memorandum No. 52.

Supplies Store$210

Accounts Pay/Golf Craft Supply $210

BUYING SUPPLIES ON ACCOUNT

November 6. Bought store supplies on account from Gulf Craft Supply, $210.00. Memorandum No. 52.

Two Ledgers for Accounts Payables

One is Accounts Payable – One is Gulf Craft Subsidiary Ledger

Enter credit account title / vendor

Accounts Payable – Gulf Craft Supply = 1 ledger account

Accounts Payable / Gulf Craft Supply = 2 ledger accounts Place a diagonal line in the Post. Ref. column (two ledger accounts

impacted)

General Journal Page:

Date Account TitleDoc No

Post.Ref

General

Debit Credit

PURCHASE RETURNS & ALLOWANCE

PURCHASES RETURNS AND ALLOWANCES

Two Types of Returns:Purchase Returns:

Returned the entire product (damaged and unusable) – full refund

Purchases allowance: credit allowed for part of the purchase price of merchandise that is not returned

Decrease accounts payable (damaged but still usable)

Both are recorded in the Purchases Returns & Allowance Account.

PURCHASES RETURNS AND ALLOWANCES

New Account: Purchases Returns and Allowance: credit allowed for the

purchase price of returned merchandise to the vendor Contra Account to Purchases (reduces a related account) Returns decrease amount you owe (accts payable debit) Has opposite NB balance from the Parent or related account

Has a Normal Balance of a Credit

PURCHASES RETURNS

November 28. Returned merchandise to Crown Distributing, $252.00, covering Purchase Invoice No. 80. Debit Memorandum No. 78.

What accounts are impacted?

Purchase Returns and Allowance

Accounts Payable/Crown Distributing

PURCHASES RETURNS AND ALLOWANCES

New Source Document: Debit memorandum: form prepared showing the price deduction

taken by the business customer for returns and allowances DM45 Used for Returns only

Note: returning to the vendor…… Use the General Journal for returns

not a purchase, sale, receipt or payment

PURCHASES RETURNS AND ALLOWANCES

Reminders When Returning merchandise we purchased Debit Memorandum = source document DM18 General Journal = Journal Entered in Purchases and Returns account

Decreases the amount you owe - Accounts payable Increases the Purchases & Returns Allowance Account Contra account to Purchases Normal Balance = Credit (increases on credit, decrease on debit)

DEBIT MEMORANDUM

PURCHASES RETURNS

November 28. Returned merchandise to Crown Distributing, $252.00, covering Purchase Invoice No. 80. Debit Memorandum No. 78.

What accounts are impacted?

Purchase Returns and Allowance

Accounts Payable/Crown Distributing

252.00

252.00

3. Enter debit memorandum number.

November 28. Returned merchandise to Crown Distributing, $252.00, covering Purchase Invoice No. 80. Debit Memorandum No. 78.

What accounts are impacted?

JOURNALIZING PURCHASES RETURNS AND ALLOWANCES

4. Enter debit and credit amount.

1. Enter account title & vendor

2. Diagonal line in the Post. Ref. column (two ledger accounts)

General Journal Page:

Date Account TitleDoc No

Post.Ref

General

Debit Credit

Nov 06 Supplies-Store M52 2 1 0 00 Accounts Payable/Golf Craft Supply 2 1 0 00

TERMS REVIEW

purchases return purchases allowance debit memorandum

Practice

WTG 9-4

General Journal Page:

Date Account TitleDoc No

Post.Ref

General

Debit Credit

Lesson 9-4 PowerPoint Work Together