Legal Principles

-

Upload

manoj-solankar -

Category

Documents

-

view

220 -

download

0

Transcript of Legal Principles

-

7/30/2019 Legal Principles

1/16

Revised: 12/27/09

-

7/30/2019 Legal Principles

2/16

Topic Objectives

Outline basic legal principlesunderlying insurance contracts.

Explain their purpose and how theywork.

Why do we care?

Legal provisions

enforce economicprinciples.

They also determine

our rights in contracts.

-

7/30/2019 Legal Principles

3/16

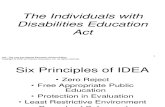

Important Legal Principles

Indemnity

Actual Cash Value

Insurable Interest

Subrogation

Utmost Good Faith

Company/Agent Relationship

-

7/30/2019 Legal Principles

4/16

Principle of Indemnity

Insured should be restored toapproximate financial position priorto loss, not better.

Purposes prevent insured from profiting from

insurance

reduce moral hazard

-

7/30/2019 Legal Principles

5/16

Actual Cash Value

Basis of loss settlement thatsupports principle of indemnity

ACV = replacement cost -depreciation

-

7/30/2019 Legal Principles

6/16

ACV Example

Couch cost $800 when new.

5 years later, couch isdestroyed by fire fromcigarette.

Couch is estimated to be60% depreciated.

Cost of replacing couch is$1,000.

ACV = $1,000 - .6 x $1,000= $400

-

7/30/2019 Legal Principles

7/16

Variations of ACV

Fair Market Value price that would be paid in free mkt.

FMV may be less than ACV

market value policies common in homeinsurance

Broad Evidence Rule

ACV determination includes all relevant

factors considered by expert

-

7/30/2019 Legal Principles

8/16

-

7/30/2019 Legal Principles

9/16

Why would insurers offer

replacement cost coverage?

May be viewed as accommodation toinsureds that they value.

In certain circumstances, insurers maybelieve that risk of moral hazard is low.

Insured may be required to actually

replace property damaged or destroyed toreceive replacement cost payment.

-

7/30/2019 Legal Principles

10/16

Insurance to Value

Insurers have encouraged homeowners tochoose adequate policy limits; why?

If insured has inadequate coverage, they

could suffer uninsured losses in event oftotal loss.

This problem has arisen in the aftermath

of California wildfires. Property owners may fail to raise policy

limits when the value of their homes

increases.

-

7/30/2019 Legal Principles

11/16

Insurable Interest

Any contingency that will cause lossor harm to person or firm.

Purposes

prevent gambling reduce moral hazard

measure loss

-

7/30/2019 Legal Principles

12/16

Basis for Insurable Interest

Property-Liability Contracts ownership of property

potential legal liability

secured creditors

contractual rights

Life InsuranceContracts family

pecuniary interest

-

7/30/2019 Legal Principles

13/16

When does insurable interest

exist?

Would insurer sell me a life insurance policytaken out on my wife?

Would insurer sell me a life insurance policyI took out on a student?

Would insurer sell me a home insurancepolicy I took out on a neighbors home?

-

7/30/2019 Legal Principles

14/16

Subrogation

Allows insurer to collect loss

payments to insured from 3rd party. Purposes

prevent dual payments

discourage negligence Conditions

insured must be fully indemnified

only used for property-liability ins. How might subrogation be used in

insurance claims stemming fromFirestone tire problems?

-

7/30/2019 Legal Principles

15/16

Utmost Good Faith

Higher degree of honesty imposedon parties to insurance contracts.

Representations: statements by

insurance applicant Insurance contracts voidable if

representation is:

material

false

relied upon by insurer

-

7/30/2019 Legal Principles

16/16

Company-Agent Relationship

Participants

principal - insurance company

agent - acts on behalf ofcompany

Agent has authority to bindcompany under certainconditions.

Principal is responsible foracts of agents.

Potential conflicts?