Lecture Notes AMAF MAN Acc 09

Transcript of Lecture Notes AMAF MAN Acc 09

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

1/38

1

Advanced Management Accounting and FinanceLecture notes Managerial Accounting 2009 (Weeks 1 to 11)

The risk of going nowhere is the greatest risk of allThe risk of going nowhere is the greatest risk of allThe risk of going nowhere is the greatest risk of allThe risk of going nowhere is the greatest risk of all

If it is to be, it is up to me (Fat is not the spoons fault)

Course guidelines

First learn all the principles, concepts and techniques of each topic to enable you to identify problemsand solve these successfully.

Many students fail because they spot test/exam topics.

Assessment & DP: Of 3 tests 2 form 50% of the year mark, and 50% from a trial examination. If the DP is

met the final exam counts 70% of the final mark and the DP 30%.

Preliminary: Introduction, cost terms, cost assignment and job costing (Drury 1 4)

Chapter 1

Cost accounting: cost accumulation for inventory valuation, reporting and profit measurement

Management accounting: Providing information for internal users to facilitate managements decision making(figure 1.1 p9), planning, control and performance evaluation.

Overall goal: Maximise shareholder value by wealth creation (i.e. earning returns in excess of investors requiredreturns/WACC= WeKe+WdKd.

MANAGEMENT ACCOUNTING

Introduction, Cost Terms& Concepts

COST ACCUMULATION

Cost Assignment (Int.)

Job Costing (Int.)

Process Costing (Int)

Joint & By Products (Adv 1)

Absorption/Variable Costing(Int. & Adv. 1)

DECISION MAKING

CVP Analysis (Int. & Adv.1)

Relevant Costing (Int. &Adv.2)

Activity-Based Costing (Int.& Adv.3)

Pricing & Profitability (Adv4)

Risk & Uncertainty (Adv.4)

Cost Estimation (Adv.10)

Linear Programming(Adv.11)

PLANNING & CONTROL

Budgeting Process (Int.)

Standard Costing (Int. &Adv.5&6)

Divisional Performance(Adv.7)

Transfer Pricing (Adv.8)

Strategic Management(Adv.9)

Key: Int. = IntermediateAdv. =Advanced

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

2/38

2

Emphasis on customer satisfaction brings new management approaches (total quality management {TQM}benchmarking, value chain analysis and continuous improvement see later Study Weeks).

Chapter 2 Cost classification depends on the 3 main costing purposes:

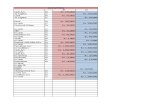

Costing Purpose Cost Object Cost ClassificationsInventoryvaluation andprofit measure-ment (pp 30 32)

Products Categories of production cost:Direct material & labourManufacturing overheadPeriod or product cost

Decision-making(pages 32 40)

Decision alternativese.g.:- make/buy- continue product/not- labour or automation

Cost behaviour Variable, Fixed, Semi-fixed (stepped)Semi-variable (mixed)

Relevant (unavoidable) cost / irrelevant cost (avoidable)Sunk/Allocated costOpportunity cost

Incremental (marginal) costControl &performanceevaluation (p41)

ProductCustomerDepartment etc.

Controllable / non-controllable cost/incomeWho is responsible for controlling the cost?

Draw a graph depicting the following scenarios (y-axis = Cost and x-axis = Volume):i A publisher pays a book royalty of R2 per copy to a maximum royalty of R10 000,ii A church pays no electricity until it uses more than 50 KW per month, when it has to pay a flat amount of R500

for that month,iii An enterprise pays sales commission of 4% on sales that exceed R15 000 per month,iv An enterprise pays a basic salary of R2 000 plus 4% commission on sales that exceed R15 000 per month,v Monthly materials cost R10 000 for the first 400 kilograms and R20/Kg thereafter,vi An enterprise pays a bonus of R5 for every unit produced after the first 1000 units per month,vii An enterprise pays its maintenance staff a fixed salary for maintaining 3 of its 9 machines each.Cost behaviour - Graph solutionsi A publisher pays a book royalty of R2 per copy to a maximum royalty of R10 000,ii Pays no electricity until 50 KW pm or more is used, when a flat amount of R500 is due for that month,

0

2000

4000

6000

8000

10000

12000

1 2 3 4 5 6 7 8 9 10 11 12 13

Books

Royalt

Series1

0

100

200

300

400

500

600

1 2 3 4 5 6 7 8

Kilowatt

Cos

Series1

iii An enterprise pays sales commission of 4% on sales that exceed R15 000 per month,iv An enterprise pays a basic salary of R2 000 plus 4% commission on sales that R15 000 per month,

0

50

100

150

200

250

300

1 3 5 7 9 11 13 15 17 19 21

Sales

Basic&Co

Series1

1850

1900

1950

2000

2050

2100

2150

2200

2250

2300

2350

1 3 5 7 9 11 13 15 17 19 21

Sales

Basic&Co

Series1

v Monthly materials cost R10 000 for the first 400 kilograms and R20/Kg thereafter,vi An enterprise pays a bonus of R5 for every unit produced after the first 1000 units per month,

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

3/38

3

0

5000

10000

15000

20000

25000

30000

1 2 3 4 5 6 7 8 9 10 11 12

Kilograms

Cost

Series1

0

200

400

600

800

1000

1200

1 2 3 4 5 6 7 8 9 10 11 12

Units

Bonu

Series1

vii An enterprise pays its maintenance staff a fixed salary for maintaining 3 of its 9 machines each.

0

5000

10000

15000

20000

1 2 3 4 5 6 7 8 9

Machines

Salaries

Series1

Chapter 3 Cost Assignment

Direct costs:Easily tracedand allocated to cost objects/productsIndirect costs (i.e. overheads): Allocated using arbitrary (e.g. labour hours) or cause-and effect (e.g. ABClabour/machine hours, m

2, Kilowatt)allocation bases. ABC provides more accurate cost allocations.

Main purposes of product costing: Inventory valuation/profit measurement (primary focus) and decision making(incorrectly viewed as secondary purpose) e.g. Asset depreciation forms part of full product cost for inventoryvaluation, but is ignored (sunk cost) for decision making purposes (e.g. discontinue a product line).

Cost systems design: Costing systems depend on the significance of indirect costs (costly errors), thecomplexity of the manufacturing environment and the cost versus benefit of the cost system.

Plant-wide vs. departmental overhead rates: Diverse product range and varying production times require multipledepartmental or cost centre/pool overhead rates (not blanket/plant wide). Thus overheads to service cost

centresproduction cost centrespredetermined/normal overheard absorption rate (budgeted cost/budgetedactivity)products/services/customers (e.g. based on machine/labour hours or ABC)

Reallocating service centre costs:

Repeated distribution - Allocate and reallocation service costs to service and production departmentsuntil immaterial or calculate final costs by simultaneous equation/reciprocal method (e.g. as reciprocacost = own cost (R) +0,1b and bs = own cost + 0,2a)

Specified order of closing (step-down) allocate from highest service cost to lowest. Once allocatedservice dept. costs remain nil.

Direct allocation method - Ignore inter-service department allocations. Allocate costs in any order toproduction departments only. This is the simplest but least accurate method.

Under- and over-recovery of overheads: Actual overheads and activitydiffer from budget. Predetermined rate

= Budgeted cost/Budgeted activity (hours/units)

Example absorption costing based on unit producedMachine centre X Production Overhead Control Account

R000 R000Actual overheads incurred(CB, etc)

4 500 Absorbed overhead (R4,3m/2m)2,1m 4 515

*Over-absorbed OH periodgain not in inventory

15 (budgeted rate x actual hours/units)

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

4/38

4

4 515 4 515

*Actual cost and actual hours/units differed from budget giving a net favourable variance of R0,015m split into: expense variance = Bud.cost(R4,3m)Act.cost(R4,5m)=R0,2m Unfav.

volume variance(VC) = (Act.Bud.hrs/units)bud.rate=(2,12m)R4,3m/2m =R0,215m Favourable volume variance(AC) = (Std Bud hrs/units)bud rate

When the FOAR is based on production (machine or labour) hours as opposed to product unitsproduction overheads are charged to WIP at the FOAR x STD hours for actual production units (not at

actual hours). See AC and VC fro example

Non-manufacturing overheads: Selling, administration and distribution costs are period costs and excluded fromstock values, but part of product costfor decision making purposes.

Chapter 4 Job Costing (assessed at level 2)

See Example 4.2 (p115123) for recording of typical transactions. Exhibit 4.3 on p116 summarises the transactionsFigure 4.1 on p133 illustrates the flow of accounting entries.

Ignore pages 123 (Interlocking accounting) 132 (up to the summary).

Chapter 5 Process costing (assessed at level 2)

Direct and indirect (depreciation/supervision)costs are allocated to a process not separate products. Pooled cosper output unit (e.g. kilogram or litre) =Total production cost in period/ number of full units of output in period

FIFO-cost excludes the costs of BWIP. Weighted average cost includes BWIP. Assuming only full units: Process cost per unit (R10) = Total process cost R120000/normal or expectedoutput 12 000

Normal (expected) losses reduces normal/expected output (to 10 000)(Cost pu rises to R12)and scrapvalue is deducted from total process cost to reduced cost pu,

Abnormal (unexpected) losses are valued at normal output cost (R12 after normal losses). Arise frominefficiencies and excluded from inventory values with costs written off separately in the income statementAbnormal scrap value is deducted from total abnormal losses cost.

Abnormal (unexpected) gains are valued at normal output cost. Assume maximum production of 12 000

litres, normal losses of 2 000 litres and actual output of 11 000 litres, thus abnormal gains of 1 000 litres (11000 [12 000 2 000]). Cost per unit (R11) = Total cost less normal scrap value / Expected output =(R120 000 [R5x2000 normal losses]) /10000 litres)Abnormal gain is R6 000 (R11 000 gains [1 000 litres x R11 cost per unit] less scrap value of R5 000 [1 000x R5]).

Partially completed WIP: Convert to equivalent full units = physical units x percentage completion e.g. 2 000 unitsonly 60% (partially) complete equals 1 200 (2000 x 60%) equivalent full units

If raw material is added at the start of the process all WIP are full units (100% complete once in the process) in thecurrent period. Conversion costs (CC) are normally incurred evenly during a process and WIP units share in currentconversion costs to the extent (percentage) of their completion (say 60%) in the current period.

See the equivalent unit calculation and alternative set out (using the data in Example 5.2 on page 164) in your lecturenotes.

Partially complete BWIP: Equivalent full units (EFU) Material ConversionWeighted average value - 100% of physical units 2 000 2 000FIFO value % of physical units completed in current period 0 (0%) 800 (40%)

Do the Process Costing Question in the study notes

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

5/38

5

Advanced Managerial Accounting 2009

Chapter 6 Joint and by-products (assessed at level 2)

Joint products have significant relative sales value.By-products have minor sales value.Joint costs has little value in decision-making (based on decision relevantcost/revenue principles)

At split-off point joint products could be sold or processed further. Further processing costs (after split-off =separable costs [attributable or traceable to a specific product]). See Figure 6.1 on page 199.

Allocating joint costs: IAS 2 (AC108.12) - Conversion costs must be allocated between joint products on arational and consistent basis (e.g. relevant total sales value at completion or split-off). By-products are viewed asimmaterial and valued at net realisable value (deducted from the cost of the main/joint products).

Rational bases to allocate joint costs at split off include: Physical measures (used 75% of time) is suitable when outputs are solids, liquids or gas. This

method ignores MV. Profit/loss margins will differ and the lower of cost and NRV may apply.Assume the total joint cost to split-off point is R1 million to produce 50 Kg Gold and 30 Kg Silver.Physical method: Gold: 50/80xR1m= R,625m Silver: 30/80xR10m=R,375m

Relative market values (recognises earnings potential). It provides more meaningful resultswhen external or market prices are not available. Total sales value at split off if determinable/saleable (could use joint cost as a basis for the setting o

selling prices - circular thinking?) - Gross margins are equal, separable further processing costs areignored and identification of unprofitable products at split-off are ignored.If joint cost to split-off is R1m for 50Kg Gold (SP R40000/Kg) and 30Kg Silver (SP R22000/Kg).Cost: Gold:50x40000=R2m/2,66 x R1m=R0,752m Sales R2m Profit R1,248 (62,4%)Silver:30x22000=R,66m/2,66m x R1m=R0,248 Sales R0,66m Profit R0,412 (62,4%)

Net realisable value (after separable costs) Sales values and further processing costs are morereadily available. Gross margins of different joint products will differ under this method.Assume joint cost is R1 million to produce 50Kg Gold (SP R40000/Kg) and 30Kg Silver (SPR22000/Kg). Each product requires further purifying after split-off costing R300/Kg.NRV: Gold:R2m-(50x300) = R1,985m Silver: R0,66m-(30x300) = R0,651mJoint cost: Gold: R1,985m/2,636m xR1m=R0,753m Silver: R0,651m/2,636m xR1m=R0,247

Constant gross profit % method - Joint costs allocation ensures joint products (after furtherprocessing) earn the same gross margin as the total joint production. The method unrealistically

assumes a uniform relationship between the cost and sales value for all products.Assume the same information immediately preceding:Total Sales R2,66m Total cost R1+(80x300)=R1,024m Total Gross profit R1,636m (GP% 61,5)

Gold SilverSales R2m R0,66mJoint cost (Balance) COS 38,5% { -0,755 -0,245 (Total R1m)Own separable cost (50x300) { -0,015 -0,009Gross profit 61,5% R1,23m R0,406m (61,5%)

By-products:No joint production costs to split-off are allocated to by-products. Processing costs of by-productsbeyond split-off are charged to them. By-product revenues or net revenues (after deducting separable costs)should be deducted from joint process costs before allocation to joint products .

A joint process may produce material (waste) or residue that has no or a negative (i.e. disposal cost) sales value.Waste is not included in inventory.

Left over material (scrap or off cuts) from a joint process may have minor sales value which, net of any realisationcost, are also deducted from joint process costs.

Further processing decisions: Joint products should beprocessed further after split off if incremental revenuesexceed incremental/separable costs (i.e. attributable or traceable to a specific product). Further processingdecisions should incorporate capital budgeting procedures (i.e. Net present value study week 17) when the time

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

6/38

6

value of money is significant and relevant qualitative aspects (e.g. customer/employee satisfaction) should alsobe considered.

See the joint and by-product costing question in the study material.

Chapter 7Chapter 7Chapter 7Chapter 7 Absorption and variable costing (assessed at level 3)

QE 2009 P2Q3: Discuss, with reasons, whether or not direct labour expense is a fixed manufacturing overheadcost.

Variable costs are defined as cost items that vary according to different levels of activity (production in thepresent scenario).

Labour costs have traditionally being regarded as variable on the assumption that management can retrenchworkers in the event that production levels decline. In practice, downsizing and retrenching workers is not aunilateral decision and negotiations are required with unions and others before wide-scale retrenchments can beimplemented. Retrenchments and downsizing are not an everyday occurrence. To assume that labour costs arevariable because of the potential to reduce these may be inappropriate.

Labour costs are incurred irrespective of production activity and, in the short term, labour costs are fixed in natureprovided production is within normal capacity/relevant levels.

Overtime costs are certainly variable in nature. The company forecast to have excess production personnel in 2008. If this transpired it would be inaccurate to

assume production personnel was a variable cost and be misleading from a decision making perspective.Conclusion:

Direct labour is a fixed cost as it can only be reduced through the drastic and unusual occurrence of retrenchinglabour. At worst, direct labour is a short term fixed cost.

The wage rate would be variable, but the number of employees would be fixed. If there was an alternative use for employees, the labour costs would be variable.

Absorption costing

Under- and over-recovery of overheads: Actual overheads and activitydiffer from budget. Predetermined rate= Budgeted cost/Budgeted activity (hours/units)

Example absorption costing based on unit producedMachine centre X Production Overhead Control Account

R000 R000Actual overheads incurred(CB, etc)

4 500 Absorbed overhead (R4,3m/2m)2,1mhrs

4 515

*Over-absorbed OH periodgain not in inventory

15 (budgeted rate x actual hours/units)

4 515 4 515

*Actual cost and actual hours/units differed from budget giving a net favourable variance of R0,015m split into:

expense variance = Bud.cost(R4,3m)Act.cost(R4,5m)=R0,2m Unfav. volume variance(VC) = (Act.Bud.units)bud.rate=(2,12m)R4,3m/2m =R0,215m Favourable volume variance(AC) = (Std Bud units)bud rate

When the FOAR is based on production (machine or labour) hours as opposed to product units

production overheads are charged to WIP at the FOAR x STD hours for actual production units (not atactual hours).

Example: From the absorption costing information given below, calculate the over/under recovery of fixed productionoverheads in Department P, divided into an expenditure and volume variance:

Budgeted ActualAnnual production of product A 17 000 units 17 500 unitsAnnual production of product B 19 500 units 18 500 units

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

7/38

7

Standard machine hours per unit of A 3 hoursStandard machine hours per unit of B 2 hoursTotal machine hours 90 000 hours 88 000 hoursFixed production overheads for the year R5 490 000 R5 400 000

Fixed production overheads are recovered per machine hour.

Suggested solution:FOAR: Budgeted FC 5 490 000 / 90 000 budgeted hrs = R61 per hourUnder recovery:

Actual FO - (Std hrs x FOAR) = R5,4m ({17500x3}+{18500x2})61= R59 500 FFO Expenditure variance: Budget Actual = R5,49m R5,4 = R90 000 FFO Volume variance: Bud hrs - Std hrs for Act Prod)FOAR= (90000 - [{17500x3} +{18500x2}])61 = (90000-89500)61 = R30 500 U

Or balancing amount : 90 000 59 500 = 30 500 U

If a variable costing system was in use above, there would be no under/over recovery of fixed production overheadsand there would be no volume variance. The fixed overhead Expenditure variance would be:

Budget Actual = R5,49m R5,4 = R90 000 F

Variable costingVariable or marginal or direct costing, assigns only variable production costs to products/inventory.The difference between the profits of these two costing systems is fixed production overheads in opening and

closing inventory.

Assume UKZN Limited manufactures and sells 66 centimetre television sets. Actual data for 20X6 was:Opening stock 2 000 unitsSales 24 000 unitsProduction 26 000 unitsSelling price per unit R90Variable costs per unit: R

Direct materials 20Direct labour 10Direct overheads 6Selling costs 4

Fixed costs for the year:

Production overhead Actual R324 000 (Budgeted R300 000)Selling costs 110 000Administration costs 80 000

The fixed production overhead rate is based on a budgeted production volume of 25 000 units for the next year.

You are required to:a) Prepare UKZN Ltds profit statement for the 20X6 year based on absorption costing as well as

variable costing principles.

b) Explain the difference in net profit reported in the two profit statements in (a) and reconcile anysuch difference.

c) Comment on a claim by UKZN Ltds operations manager that, when production fluctuates but salesremain constant, variable costing net profit will likewise fluctuate.

Suggested solution

a) WorkingsFOAR: Budgeted cost/Budgeted prod units = R300 000/25000 = R12 per unitAbs. product cost pu: Materials 20, Labour 10, Direct cost 6, Fixed prod.12 = R48Variable product cost per unit: Materials 20, Labour 10, Direct expenses 6 = R36Under recovery: 26000UxR12 =R312000R324000 Actual= R12000

Absorption Variable Difference

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

8/38

8

R R RSales (24 000 @ R90) 2 160 000 2 160 000Cost of sales 1 152 000 864 000

Opening stock (2000 @ R48) & R36VC 96 000 72 000 -24 000Cost of production (26000 @ R48) & R36 1 248 000 936 000Closing stock (4 000 @ R48) & R36 (192 000) (144 000) 48 000

Gross profit 1 008 000 1 296 000Under-absorbed overheads 12 000 -Selling overhead: Variable 24000@4+110000 Fixed 206 000 96 000Contribution 1 200 000Admin. R80000+Other FC(Prod. 324+Sell110+Admin80) 80 000 514 000 .Net profit 710 000 686 000 24 000

b) Stock increased by 2 000 units and the fixed production overheads in absorption stock values increased byR24000 (increase in absorption profit).

c) The Operations Managers claim is incorrect. Marginal costing profits fluctuate with sales volume only.Absorption costing profits fluctuate with changes in both sales and production volumes, assuming that thereis no difference between budgeted and actual production volumes (no over/under recoveries of fixed productionoverheads).

The format of the above income statements is important and should be used at all times.

High-Low method: Variable costing requires all costs to be divided into fixed and variable cost elements. Dividethe change in cost by the change in activity between the highest and lowest levels of activity for the variable costper unit. The fixed cost element is the total cost less the total variable cost.

Example: Two products with different variable overhead costs per unit, but same FO cost per unit.Products A and B have the same fixed cost per unit within a relevant range (combined 200 units). Total overhead costs:

100 units of A and 50 units of B is R45 000

150 units of A and 50 units of B is R50 000

75 units of A is R5 750.Required: The total fixed cost and variable cost per unit for both products A and B.

SolutionTotal overhead cost for 100 units of product A and 50 units of B R45 000 or R300pu

Total overhead cost for 150 units of product A and 50 units of B R50 000 or R250puTotal overhead cost of 50 units of A 0 units of B R 5 000 or R100pu TFO

Total overhead cost of 75 units of A R 5 750

Total variable cost of 25 units of A R 750 or R30pu VC

FOH pu =R100-R30 = R70puFOH for 100 A and 50 B: R70 pu x 150 (100A+50B) = R10 500

Total OH for 100 A & 50B given as R45 000Variable cost for 100 A & 50 B 34 500

Less Variable cost for 100 A 100xR30pu 3 000

Variable cost for 50 B 31 500 /50 = R630 pu

External and internal financial reporting/Inventory valuation

Financial accounting Managerial accounting

IAS 2 (AC108) regulates inventoryvaluation

Relevant variable cost principles apply

Cost is added until inventory is in acondition and location, ready for sale orintended use

Same criteria as for absorption costing apply,but only variable production cost is included

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

9/38

9

Values inventory consistently on anabsorption cost basis (including fixedproduction cost)

Values inventory on Variable production costbasis and views fixed cost as a period cost

Cost is actual FIFO or Weighted-averagecost

LIFO can be used to charge current cost tosales for internal purposes.

Direct production costs include asystematic allocation of fixed and variableconversion cost at normal capacity

Same criteria as absorption costing apply, butonly direct variable production cost isincluded

Both external reports (absorption costing) and internal reports (variable costing):

exclude abnormal waste from inventory (as discussed in process costing),

deduct trade (not cash) discounts from the cost of materials, value inventory at the lower of cost or net realisable value (i.e. after cost essential for realisation/sale e.g.

commission, trade discount and delivery cost), can value inventory at standard product cost if it approximates actual cost.

Absorption/Full costing Variable/Direct/Marginal costing

Includes a systematic allocation of both fixed andvariable production costs in inventory values

Includes only variable production costs in inventoryvalues

Fixed production overheads are assigned toproducts by means of an FOAR

Fixed production overheads are excluded frominventory values and treated as a period cost

Matches sales and COS (FC & VC) and treats fixedcosts as a necessary product costs

FC creates production capacity and is a period cost(not linked to specific products sold or produced)

Profits changes with sales volumes andproduction/inventory levels (FC in stock)

Total contribution changes with sales and the impactof decisions on profit is consistent and clear

Production cost per unit and profits changes withincreased/decreased production output Reflects a consistent contribution per unit or grossprofit percentage at all levels of production output

Arbitrary allocation of fixed overheads may over-/understate costs/selling prices/inventory

Variable overheads are more easily linked with andallocated to production volumes

Is IAS reporting standard, valuing inventory at fullcost to its condition and location for use or sale

Is useful for internal (management) decision-makingas it clearly identifies the impact of decisions on profits

Is less costly to implement as fixed and variableproduction costs need not be split

Controls variable cost per unit and total fixed cost perperiod. Resulting benefits may justify the extra costs

Presumed to improve financial statementcomparability by matching FC and revenues.

Losses may occur when sales volumes are low duringout-of season periods but production/inventory levelsneed to be high to meet impending seasonal demand.

Mathematical model of profit functions: Ignore (including Appendix 7.1)

Arguments in support of variable costing (p 237)

More useful incremental/relevant information for decision-making (e.g. buy or make). Separates fixed and variable costs facilitating cost estimation at different activity levels.

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

10/38

10

Eliminates profit manipulation by means of increased inventory/production levels (deferring fixed costs). Thisstrategy can also be discouraged by fixed inventory or stock turnover level requirements.

Excludes capitalising fixed overheads in unsaleable/obsolete/surplus inventory.

Arguments in support of absorption costing (p 238)

Considers fixed production costs as essential for production and inclusion in products/inventory costs.

Emphasises the recovery of fixed costs in sales revenue in the long run. Consistent with IAS 2 used by financial markets to appraise an entitys performance and share price. The same

reporting standards should be used to evaluate/reward managerial performance internally.

Alternative denominator (i.s.o. budgeted volume) level measures:Problem: FOAR used budgeted production output determined at a specific time (discrete). FOAR is appliedconstantly during the budget period when production volume fluctuates and actual fixed cost may increasepermanently in the short term (e.g. acquisition of new machinery) or unused capacity exists. Variable costs iscontinually adjusted.

Alternative production activity levels include:

Budgeted activity for the next budgeted period (most realistic and most widely used in practice). Fluctuatesover time giving varying cost rates.

Theoretical maximum capacity, which is most unlikely. Practical capacity allowing for unavoidable machine maintenance and plant holiday closures. It does not

allow for bottle necks and unplanned delays resulting from machinery breakdowns and unavailability ofmaterials, labour, energy (i.e. electricity) or other resource requirements. Does not fluctuate annually,providing more consistent cost rates.

Normal activity required for average customer demand over the medium term (say 3 years) to factor in seasonaland cyclical fluctuations.

IAS 2 (AC108) requires a systematic allocation of fixed and variable conversion cost at normalcapacity per department (not firm-wide) over periods of normal circumstances, including plannedmaintenance but excluding periods with abnormally low production or high idle periods. Unallocatedoverheads, during periods with low production, are expensed as a period cost (excluded from inventoryvalues) whilst lower fixed overheads per unit during abnormally high production periodsshould notincrease inventory cost to normal capacity allocations. Thus, as a rule simply use the higher of actual ornormal capacity. AC 108.11 states: inventory is not measured above cost. Inventory value should beconservative (prudently lowest cost).Example: Assume fixed overheads of R120 000 pa in years 1 and 2 and production levels pa of:Year 1: Normal production units 12 000 and Actual production units 15 000

Year 2: Normal production units 12 000 and Actual production units 10 000Required: Calculate the fixed overheads per unit to be included in closing inventory in years 1 and 2.Solution: Year 1 - Fixed OH/Higher of normal & actual production= 120000/15000 =R8pu (lowest cost)Year 2 - Fixed OH/Higher of normal & actual production= 120000/12000normal =R10pu (lowest cost)

Chapter 8 Cost-VolumeVolumeVolumeVolume-Profit (assessed at level 3)

Economists CVP graph: Total revenue and total cost functions are curvilinear. To increase sales volume oneneeds to reduce the selling price per unit. At low volume levels the total cost function rises quite steeplybecause it is not efficient to operate a plant at a low volume. As the production volume rises total cost functionrises less steeply as economies of scale begin to filter through. At very high volume levels, total costs begin torise quite steeply again as bottlenecks develop. The model applies to all expected ranges of activity (long term).

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

11/38

11

Marginal revenue per unit is constantly declining. Profit maximising output is at the point at which marginalrevenue equals marginal cost. The economists model applies to all ranges of activity expected in the longterm.

Economic theory (From pricing decisions): Economic theory assumes rational enterprises prefer selling pricesthat maximise profits (most return with least risk/soonest) and that prices/profits can be estimated at eachpotential demand level enablingprofit maximisation decisions (where marginal revenue equals marginal cost

[see economists revenue/cost graph]) when the optimum output is sold at the optimum price.Some difficulties include:

enterprises have multiple products and different demand curves, various factors, apart from pricing, affect demand e.g. quality, packaging, advertising and credit terms,

marginal cost curves for individual products are complicated by joint/indirect costs.

Accountants cost- volume- profit model/ Break-even chart: Linear revenue and cost functions are assumed,including a constant variable cost and selling priceper unit within a relevant range.

Mathematical approach to CVP analysis: NP = Px (a + bx) or NP = SPpuX (FC + VCpuX) (X=units sold)Breakeven: 0 = Px (a + bx) or FC/(P-b) or FC/Contribution pu BE at fixed profit (+FC)/Variable profit pu (-Cont.pu)

Breakeven sales value = FC/profit-volume ratioTotal sales = Breakeven sales + Safety salesBreakeven sales x PV% = FC and Safety sales x PV% = NPSales units at fixed profit: (FC + NP)/(P-b) or NP = Px (a + bx)Sales units at variable profit: FC/(P-b-variable profit)Selling price to achieve profit: P = [NP + (a + bx)]/xMargin of safety: Safety Sales = Sales units BE units; MOS% = (Sales units BE units)/Sales unitsContribution margin/Profit-volume ratio: contribution/sales.Contribution = sales x profit-volume ratio

BE

FC

BE

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

12/38

12

NP = sales x profit-volume ratio (contribution margin ratio) fixed costs.NP = Margin of safety sales x profit-volume ratio

Min sales value = (fixed costs + required contribution)/ P/V ratio

Examples:i. Calculate the total sales value when breakeven sales value is R1 million and the safety margin is 40%.ii. Calculate total fixed costs when the total sales value is R1,667 million, the safety margin is 40% and PV

ratio 30%.iii. Calculate total fixed costs when the total contribution is R0,5 million and the safety margin is 20%.iv. Calculate the total profit when total sales is R1,429 million, the breakeven sales value is 70% and the PV

ratio is 20%.v. Calculate the contribution when breakeven sales are R420 000, the margin of safety is 30% and the

profit margin is 10%.

Solutions:i. Safety sales = 40%. Breakeven sales = 60%. Thus BE sales of R1m/0,6 = R1,667m total sales.ii. FC = BE sales x PV% Thus R1,667m x 0,6 = R1m BE sales x 0,3 PV% = R0,3m FCiii. Total fixed costs = Total contribution x (1-Safety margin) thus R0,5m x (1-0,2) = R0,4 mil or NP = Cont. x

Safety margin = R0,5m x 20% = R0,1m FC = Cont. NP = 0,5m-0,1m = 0,4miv. NP = Safety sales x PV% = (1,429x0,3)0,2 = R85 740.v. Total sales = BE sales/BE% = 0,42m/0,7 = 0,6 m and NP at 10% = R0,06m NP=Safety sales x PV%

Thus 0,06m= (0,6mx0,3)PV% and 0,06/0,18 = PV% of 33,3% Contribution is R0,6m/3 = R0,2m

Profit-volume graph:

Profit-Volume Graph

-1000

-500

0

500

1000

1 3 5 7 9

Volume (Units)

Rands

(Sales&

Costs)

This graph measures profits/losses on the vertical axis. The lower cash breakeven may enable the enterprise tosurvive in the short term in spite of operating losses (below normal breakeven but above the cash breakevenpoint). Short term survival becomes a valid business strategy only if long term recovery of profitable operations andadequate funding are feasible.

Multi-product CVP analysis: A fixed sales mix (basket of products) is assumed with a weighted averagecontribution (multiply each products unit contribution by the number of units of that product in the sales mix).

Example: Assume two products (A and B) are sold in fixed proportions of 2A:3B, contribution per product is R15 (A)and R25 (B) and total fixed costs R787 500. The multi-product breakeven can be calculated as follows:

Total contribution per sales mixTotal contribution for A (2x15 =R30) and B (3x25=R75) is R105 (R30+R75) and

Profit

Profit + Dep =

Cash breakeven

Breakeven

Breakeven = Total

fixed

cost/Contribution per

unit

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

13/38

13

Breakeven is 787500/105 = 7500 sales mixes or 15 000 A (7500x2) and 22 500 B (7500x3)Note that the total contribution is R787 500 [(15 000A x R15)+(22500 x R25)

Weighted average contribution per sales mixWeighted average contribution: A R6 (2/5 x R15) plus B R15 (3/5 x R25) = WA R21 (R6+R15)Breakeven is 787500/21 = 37500 units with 2/5ths or 15 000 of A and 3/5ths or 22 500 of BAgain, total contribution is R787 500 [(15 000A x R15)+(22500 x R25)

Note the CVP analysis assumptions.(a) All variables other than volume remain constant so that volume is the only factor that influences costs andrevenues.(b) The entity sells a single product or if a range of products is sold the sales mix is constant.(c) Selling price and variable cost per unit are constant resulting in linear total costs and revenue functions.(d) A variable costing system is used for reporting purposes.(e) The analysis applies to the accountants relevant range only.(f) Costs can be accurately classified as fixed or variable. Semi-variable costs can be separated into their fixed andvariable elements.(g) The analysis applies to the short term only, typically one year.(h) Complexity related fixed costs do not change as a result of increasing the range of products.

Sensitivity analysis (BE) and profit elements:R000

Actual Sales 100 000 units at R20 2 000

Variable cost 1 200 /100000 = R12 puContribution 40% 800 /100 000 = R 8 puFixed cost 500Profit 15% 300 /100 000= R 3 puBreakeven FC/Contr. pu = 500 000/8 = 62 500 unitsBreakeven sales value = 62 500 units x R20 = R1,25m

A change in which profit element (i.e. SP, Sales volume, VC and FC) will have the greatest impact on profit?

Sensitivity analyses: Using changes to breakeven or an arbitrary % change:a) Breakeven units-based sensitive test Total Breakeven Safety %

Revenue/cost elementActual Sales Volume 100 000 units 100 62,5 (100-62,5/100) 37,5%Actual sales value 2 000 1 250 (2-1,25)/2m 37,5%

S/Price (BE SP R20-R3 Profit pu =R17) R20 R17 ( 20-17)/20 15%VC to BE (R12 + R3 Profit pu) R12 R15 (15-12)/12 25%FC to BE (R500 + 300 profit = R800) R500 R800 (800-500)/500 60%

The profit is most sensitive (lowest safety margin) to changes in selling price, then variable cost, sales volume andlastly fixed cost.

b) Arbitrary percentage (10%) change sensitive testTotal Vol-10% SP-10% VC+10% FC+10%

Actual Sales 2 000 1 800 1 800 2 000 2 000Variable cost -1 200 1 080 1 200 1 320 1 200Contribution 800 720 600 680 800Fixed cost -500 500 500 500 550Profit 300 220 100 180 250Effect on profit - Sensitivity -27% -67% -40% -17%

80/300 200/300 120/300 50/300The profit is most sensitive (largest decrease in profit) to changes in selling price, then variable cost, sales volumeand lastly fixed cost.

The above sensitivity test calculations could be shortened as follows:Vol-10% SP-10% VC+10% FC+10%

Profit before changes in elements 300 300 300 30010% change in contribution/element 80 200 120 50

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

14/38

14

Profit 220 100 180 250Effect on profit Sensitivity (80/300) -27% -67% -40% -17%

Main limitation of the sensitivity analysis: Only one variable is changed at a time when, in reality, managementrequires the implications of simultaneous changes in a number of variables (spreadsheet model/analysis). Seescenario analysis in later weeks.

CVP analysis applied to absorption costing: The results of decisions made using variable costing based CVP

analysis are not reflected in the absorption costing reporting system ifthere are changes in inventory levels.

Absorption costing breakeven point formula: Assumeeither a:

production level (see below) and determine breakeven unitsor

level of sales (less appropriate) and determine breakeven unitsBE = [All FC Prod. FC recovered] / [Contr. pu Production FC per unit]Example: Assume a selling price of R10 pu, variable cost of R6 pu, total fixed cost of R400 000 and 150 000 unitsproduced (as budgeted). Budgeted production FC were R300 000. What is the breakeven point?Solution: FOAR R300 000/150 000 = R2 and budgeted prod. FC of R300 000 were absorbed as actual productionwas 150 000 units. Thus:

BE = [All FC Prod. FC recovered] / [Contr. pu Production FC per unit]= (400 000 300 000)/(10-6 -2) = 50 000 units

A target profit can be added to the fixed costs in the above formula and a variable profit factor per unit

deducted from the contribution per unit.

Financial performance evaluation (QE : PV%, FC% of revenue/total cost, Operating profit % before/afterHO costs, Breakeven, Margin of safety, other ratios/component percentages.

Chapter 9 - Relevant costing(Level 3)Introduction: Relevant costs and revenues are changes (incremental/ marginal) resulting from non-routinedecisions such as:

Special pricing Consider (all) costs and revenues for all alternatives under consideration ororororexclude the

irrelevant costs and revenues because they are identical for both alternatives ororororconsiderdifferential/incremental relevant costs/revenues. Also consider:

o effects of short term low priced sales on future selling prices,

o spare capacity in short term and long term (if special prices will continue). Must meet orders atnormal selling prices and avoid decline in demand/costly reduction in capacity,o the opportunity cost of resources used for the special order ando unavoidable/committed fixed costs are irrelevant.

Labour or capital intensive production, Product mix when short term capacity constraints exist Rank products to maximise contribution per unit

of the limiting factor, Equipment replacement - long term decision (capital budgeting in week 17). Book value and depreciation of

old equipment are not relevant to the replace decision. Fair value of old equipment is relevant to its owncontinuation. Separate considerations - Keep, replace or discontinue operation).

Make or buy/outsource: Compare cost to buy to own production cost. Consider incremental revenue ofalternative uses if capacity is released.

Discontinuation options for product or part of operations: Consider relevant cost savings less present

contribution to committed fixed cost.

Relevant costs/revenues ultimately result in cash out- or inflows (not allocations) . Past/sunk costs (e.g. depreciation and allocated committed FC and VC without an alternative use/NRV (e.g.

raw material, temporary spare labour/machine capacity) are not incremental cash flows and irrelevant.

Future costs/revenues are relevant if they represent a present obligation/ commitment which will result infuture cash out or inflows.

Opportunity (sacrifices or saving of) costs/revenues have alternative use/NRV.

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

15/38

15

Qualitative factors: Important considerations are not always expressed in monetary terms (quantified) and shouldnot be ignored e.g. accuracy of data or a decline in product quality/customer satisfaction/support, local orexport market, entity reputation, supplier support and quality of supplies, staff morale/health and capacityutilisation.

Remember: When fixed costs will change in the long term as a result of a decision, they will become relevantcosts/savings. Variable costs which are identical for all alternatives are not relevant (can be ignored ).

THEORY OF CONSTRAINTS (TOC) AND THROUGHPUT ACCOUNTING (TA)

TOC is used to maximise operating profit by removing bottlenecks (limiting capacity/throughput) or maximise(i.e. ranking) throughput contribution per bottleneck hour/usage (TC pbh):

TC pbh = (SP pu RM pu)/Bottleneck hour pu (other costs are considered fixed in ST)

Throughput accounting (TA): Ranks products according to a Throughput AccountingRatio(TAR) :TAR = TC pbh/Factory OH cost ph

Factory OH cost ph = Factory OH cost / Total key resource hoursNote: TAC pu rankings = TAR ranking (both share a common denominator i.e cost per factory hour).

Example (9.34): Products A BSelling price R60 R70Product cost: Raw material 2 40

Variable prod. OH 28 4Contribution R30 R26Fixed production OH pu R10 R 6Total production hrs pu 0,25hrs 0,15hrsBottleneck dept. hrs pu (Avail. 3075 hrs) 0,02hrs 0,015hrsBudgeted production units 120 000 45 000

Required: Maximising profit

Traditional ranking:Contr. per constraint i.e. bottleneck hr pu R30/0,02 R26/0,015

= R1500 = R1733 maximise BTheory of Constraint (TOC):TC bph = (SPpu - Direct mat cost pu)/Hrs pu R58/0,2 R30/0,15

=R2900 maximise A R2000Throughput Accounting (TAR):Total factory cost per bottleneck hour: [(R38x120000)+(R10x45000)]/3075 hrs = R1629,27 ph

TARatio = TC pbh/Factory OH ph R2900/1629,27 R2000/1629,27=1,78 maximise A =1,225

Example: Relevant CostingExample: Relevant CostingExample: Relevant CostingExample: Relevant Costing ---- Intermediate S08Intermediate S08Intermediate S08Intermediate S08

The following cost estimate had been prepared for a once-off furniture order, in excess of normal budgeted production:

Direct materials:Wood

Metal fittingsDirect labour

Skilled

Unskilled

Overheads

Design

Administration overhead

10m2

at R50 m2

25 hours @ R80.00 per hour

10 hours @ R50.00 per hour

35 hours @ R100.00 per hour

15% of production cost

Note

1

2

3

4

5

6

7

R

500

200

2 000

500

3 500

1 000

7 700

1 155

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

16/38

16

Profit @ 20% of total cost

Selling price

8

8 855

1 771

10 26

1 The wood used for this order is in stock, cost R20per m2 (Market price is R50 per m2 and sale value is R40 per m2) and isnot regularly used.

2 Metal fittings are in stock at R200 and are regularly used in products. The replacement cost is R250.3 Skilled labour is paid R80 per hour and must work overtime at time and a half for the above order, unless the production of

another product, that requires 2 hours of skilled labour, sells at R800 and has variable costs of R500 per unit, is reduced.4 No further unskilled labour needs to be hired to complete the above order.5 Overheads include electricity for machines at R8 per hour. The above order requires 35 hours of machining. Other overheads

are not directly identifiable with this job.

6 Design time represents the normal working hours spent by full time employees to design the furniture for this order.7 20% is normally added to the production cost to cover normal administration costs.8 Products are normally priced at cost plus 20%.

REQUIRED:

Define relevant cost, opportunity cost and discretionary cost, and state the usefulness of these cost classifications tomanagement.

Prepare the lowest cost estimate for the above order. Give reasons for including/excluding all the given costs.

Should the order be accepted at a total sales value of R5000? ( discuss quantitative and qualitative factors).

Solution

Cost estimate: R

Wood 10 m2

@ R40m2

- Relevant as it is the opportunity cost. 400

- R20m2not relevant as it is a sunk cost.

- R50m2not relevant wood will not be replaced.

Metal fittings R250 relevant as it is the replacement cost and fittings are regularly used. 250

- R200 not relevant as stock will be replaced.

Skilled labour 25 hours @ R120 p\h relevant as work will be done in overtime. 3 00

- R80 is not relevant/normal time rate. Will work has overtime

- R150 opportunity cost is not relevant. It is cheaper to work overtime.

Unskilled 10 hours @ R0 relevant as there is spare capacity in this labour category. 0

- R50 p\h is not relevant and not an incremental cost.

Overhead 35 hours @ R8 is relevant/overhead directly identified with the job. 280

- R92 of the overhead rate of R100 p/h is not incremental cost.

Design The design cost is a sunk cost and is not relevant. 0

Admin costs Not relevant as these costs are already incurred/sunk. 0

Profit A lowest cost estimate excludes profit. 0

Lowest estimate 3 930

Chapter 10 Activity Based Costing (Assessed at level 3)ABC is an absorption costing system that provides more accurate product costs by allocating indirect costs (e.g.overheads) to products by means of a variety of cause-effect cost drivers.

Need for ABC: The % indirect cost is significant and increasing. Relevant costs are required to identifypotentially unprofitable products in highly complex environments and numerous product lines on a continuousbasis. Resources are shared by many products.

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

17/38

17

Benefits of ABC

ABC requires a better understanding of costs and cost drivers and can be expected to enhance costawareness and promote control over costs. The extent of cost savings and other benefits from improvedproduct costing resulting from ABC may not be measurable, but their existence cannot logically be denied.

Enterprises require more sophisticated and accurate full product/contract costs when selling prices/contracttenders are prepared on a cost plus basis or a high proportion of overheads are independent ofproduction volumes and a variety of products are produced.

ABC is flexible and can be extended to determine cost per customer and for management and producesreliable product costs which are not ideal for short term decisions, but, in the long term, is useful for strategicplanning.

An enterprises product range can be improved when new product costs are determined more accuratelyand less viable products (i.e. demand and profitability) are discontinued. Low-volume products arecorrectly allocated a higher proportion of costs (e.g. machine set-up and packing) while high volumeproducts are justifiably allocated a lower proportion of costs.

Traditionally indirect costs were assigned to production and service departments based on a few volumebased cost drivers (e.g. machine and/or direct labour hours) resulting in the under-costing of low volumeproducts.ABC allocates costs to a variety of cost pools (e.g. production scheduling, machine set-up, materials handling andmaterials purchases) and, using a wider variety of volume (e.g. hours, %, runs, batches and no. of orders) andnon-production volume (e.g. m

2, %, kilowatts, no. of employees and value of PPE) based cost drivers, to

individual products.

Designing ABC systems: Identify major activities (cost pools) at unit/batch/product/facility level (e.g. material ordering cost), Assign costs to each activity/pool on cause-effect relationships (e.g. telephone, wages, office, etc) Identify measurable activity/resource based cost driver (e.g. no. of orders) for each activity and Assign costs to individual products based on cost driver usage (e.g. ordering cost/no. of orders).

Sample activities and cost drivers:Activity cost pool Cost driver

Production set-up cost number of production runsGoods received cost number of goods received transactionsQuality control cost number of quality inspectionsRaw material sourcing cost number of requests for raw materialSales salary cost number of salesmen

Sales delivery cost number of sales ordersFactory depreciation number of machine hours/value of assetsProduct design number of design hoursRates, Insurance, Electricity and Overheads number of machine hours/floor space

Cost driver/denominator: Budgeted (problem: hides unused capacity and low demand will increase cost and SPwhen a lower SP would stimulate higher sales volume) orpreferredPractical capacity (does not fluctuate annually- more consistent costing/SP). (Also unlikely theoretical capacity and IASs normal production level under AC/VC)

Cost driver/denominator: Budgeted capacity focuses on resource usage, hiding unused capacity. Also note thatlow demand will increase cost and SP when a lower SP would stimulate higher sales volume. Practical capacity ispreferred (does not fluctuate annually - more consistent costing/SP). (Theoretical capacity is unlikely)(IASsrequires higher of normal or actual production level)

Resource consumption cost-models:ABC focuses on resources consumed/ used, excluding unused/available resources.ABC can be used to measure the cost of unused capacity (practical capacity [supplied] minus actual capacityx recovery rate[FC]). The recovery rate = expected fixed costs/ practical capacity for the year. This indicates thepotential saving of excess resources/capacity.

Unused capacityarises withcommitted/inflexible resourcesacquired in discrete (constant) amounts in advance.

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

18/38

18

Resource supplycannot be adjusted continually/in ST to match resource usage.

Managementdecisions can change activityusage (e.g. discontinuation decisions reduce resourceusage/increase unused capacity).

Resource consumption models Example 10.2Resources supplied: 10 staff at R30 000 per year = R300 000 annual activity costQuantity of cost driver supplied pa: 1 500 orders per employee x 10= 15 000 ordersCost driver = Number of orders processed Cost per order (R300 000/15000) = R20Resources used: Actual annual number of orders (used) = 13 000Cost of resources used to parts/materials = R260 000 (13 000*R20)Cost of unused capacity = Resources supplied (15000) - Resources used (13000) orders = 2 000 ordersCost of unused orders at R20 per order = R40 000 (2 000*R20)

ABC profitability analysis: ABC product costs are not directly suitable for decision making, but more readilyreveal potential unprofitable products. For product mix and discontinuation decisions three contribution levelsshould be analysed:

unit level contribution for each product (i.e. sales minus cost of unit level activities), batch level contribution (i.e. unit level contribution minus batch related costs), product sustaining contribution (i.e. batch level contribution minus product sustaining costs).

Two more contribution levels (after Brand sustaining expenses and product-line sustaining expenses) may beused.

See review problem 10.26 on page 400 to compare traditional and ABC cost allocations.

Chapter 11 Pricing Decisions (Assessed at level 3, except target based pricing [level 2]) and Profitability

Analysis [level 3])

Price setters/takers:Price setters produce highly customised products and need accurate product costinformation to set selling prices. Price takers produce standard/commoditised products (i.e. not unique ordifferent e.g. maize meal. milk, gold, oil and petrol) and accept/take pricesset by the market and need accurateproduct cost information for product profitability and product mix decisions.

The decision time horizon (short and long-term) determines the cost information that is relevant for productpricing or output mix decisions.

For short term decisions many costs are likely to be fixed and irrelevant and only incremental costs of acceptingan order must be recovered in the selling price provided:

spare capacity is available for all the resources used to fulfil the order Opportunity costs, the order is once-off (not likely to be repeated/minimised effect on normal operations) and spare capacity will be released by the time that more profitable opportunities become available.

In the long-run virtually all costs are variable in nature and pricing decisions must be based on accurate full costinformation (i.e. ABC).

A price taker firm facing short- and long-run productmix decisions: Periodic and ABC hierarchical profitabilityanalysis should be carried out to determine which products to sell.

Economic theory: Economic theory assumes rational enterprises prefer selling prices that maximise profits(most return with least risk/soonest) and that prices/profits can be estimated at each potential demand level

enablingprofit maximisation decisions (where marginal revenue equals marginal cost [see economistsrevenue/cost graph]) when the optimum output is sold at the optimum price. Some difficulties include:

enterprises have multiple products and different demand curves,

various factors, apart from pricing, affect demand e.g. quality, packaging, advertising and credit terms, marginal cost curves for individual products are complicated by joint/indirect costs.

Selling prices should be maximised when demand isinelastic (vary little at varying prices).

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

19/38

19

Facility sustaining costs are incurred to support the organisation as a whole and may either:

be excluded from individual products costs or

included in product costs to be recovered in revenue/SP in the long term (cost-plus pricing), but notreported as production costs.

Pricing non-customized products: Market leaders use estimated sales volume/ demand to set productionvolumes/costs and add a profit (cost plus) to determine selling prices. As selling prices affect demand it isnecessary to set selling prices for a range of potential demands.

Cost-plus pricing: Cost normally includes direct variable costs, total direct and indirect costs (overheads) andapportioned organisational costs. A higher CV% is required to cover costs excluded from the cost base.Disadvantages:

price-demand relationship is ignored, production volume/budget is dependent on sales demand (problem: When demand/volume is low

costs/prices increase when lower selling prices would stimulate demand/volumes), if actual demand falls below estimated demand a loss may result even though selling prices were set on

full costs.Cost plus pricing is useful:

when a wide variety of products is sold and demand curves are costly/ time consuming for unimportantproducts.

to predict the prices when industry/competitorcost structures are similar and may encourage pricestability

Cost plus selling prices are not ideal, and ignores market prices.

QE 2009 P2Q3: Identify and discuss any areas for improvement in the companys existing pricing procedure ofgenerally marking up the estimated absorption manufacturing cost by 30% to determine the selling price.Pricing procedure

Relevant cost (hedged replacement cost of imports) should be considered for engines rather than the irrelevanthistoric cost per unit of R16 500. A standard cost could be developed from budgeted cost of R15 375 or actualcost of R17 000. Could also use the disposal value or opportunity cost if no information is available.

Detailed supplier quotes for material components appear adequate.

Variable costs appear to be an estimate based on the 2009 annual budget [R580 per unit]. No supportingcalculation/proper allocation was given.

Recovery of direct labour & other fixed overheads: The recovery of 27% of material cost is conservativecompared to budget (21,9%), while the actual costs for 2009 was 20,4% of material cost. Increasing recoveriesdue to increases in material costs may not be appropriate as fixed costs do not increase with changes inproduction volume and material price increases. Recoveries should be based on normal production volumes andcapacity and an appropriate cost driver (activity based costing) used.

Pricing policy

Cost plus mark up policy appears to work in the companys case, due to its actual GP% in 2009 of 24,5%, higherthan theoretical GP% of 23,1%.

The company should investigate the use of target costing.

Competitors selling prices for similar products should be considered as well as the impact of increasing prices oncustomer orders. Is the company strategy differentiator(price setter) or a price taker. Elasticity of demand shouldbe considered (price sensitivity).

Target costingis the inverse of the cost plus pricing and may be used to price non-customized products. Therequired profit is deducted from the maximum market selling price to arrive at a target cost (limit). Unlike cost-plus pricing it fully considers marketing factors.

Pricing policies: Management may choose a: price-skimming - highestSP in inelastic market or high demand earlier in product life cycle/few substitutes)

price penetration policy - low initial prices to gain market share when close substitutes exist or when marketis easy to enter.

Business goals:Short term: Breakeven and earn some NP;Medium term : Maximise NP (SP&Units; VC&FC&Tax) Long term: Maximise ROI (NP; Investment)

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

20/38

20

Customer profitability analysis: ABC uses a hierarchical structure similar to product profitability analysis to identifyimportant customers and the price to charge for customer services based on the resources they consumed.

See Tutorial 11.21 AC versus VC pricingPrice elasticity of demand (reaction to price changes) is a major consideration Cost structures at varying output levels help to maximise profits with optimum price (i.e. Marginal

revenue=marginal cost), AC results in SP being a function of overhead apportionment/ recovery appropriate at one level of output

(i.e. ignoring the effects of changes in output on total costs/SP), See disadvantages of cost-plus pricing above, Advantage of AC: All production costs are included and recovered in SP Relevant (incremental) costing is preferred to AC e.g. The use of production facilities entails an

opportunity cost from the alternative use of those facilities

Chapter 12Chapter 12Chapter 12Chapter 12 - Risk and Uncertainty (assessed at level 1)

Ignore maximin, maximax and regret criteria (pages 463 to 464) and Appendix 12.1 CVP analysis and uncertainty(pages 470 to 474).

A decision- making model (p 452)A structured approach to problem solving under conditions of uncertainty (see figure 2.1 on p453):

1. identify the objective, for example, maximise profits.2. search for alternative courses of action which will enable the objective to be achieved.3. identify uncontrollable factors that may occur for each alternative, also known as events or states of nature.4. list and measure possible different outcomes for the various combinations of actions and events.5. select a course of action.

A decision tree (see below) is an illustrative diagram of the elements of the decision making model.

Buying perfect and imperfect information (p 463)When faced with uncertain information one considers the costs/benefits of acquiring further information toeliminate the uncertainty, i.e. perfect information. The maximum amount worth paying for perfect informationequals the expected value with perfect information less the expected value without that information. (See Q12.19(d))

A probability (objective=statistical with decimal >0

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

21/38

21

Continuous distribution

0

10

20

30

40

1 3 5 7 9 11 13 15 17

Number/Value

Probability

10

1 Std Deviation = 68% of deviations (2 Std Dev = 95%)

Expected value/mean ( ) of a distribution = (Rn x Pn) if action is repeated many times.

Measure of uncertainty = Variance (2) = [R- ]2P) is the dispersion of possible outcomes on both sides of themean.

Example: Calculate the Variance (2) and Standard Deviation () of the following sales unit distribution:20% prob. salesR 25; 60%sales R30 and 2o% sales will be R35

Solution:Sales Probability Probable Mean Variation Variation Probability Variance

25 0,2 5 30 -5 25 0,2 530 0,6 18 30 0 0 0,6 -35 0,2 7 30 5 25 0,2 5

Expected sales/Mean 30 ( ) Variance 2 = 10Standard deviation() 10 = 3,1623

Risk takers prefer maximum Risk and Return. Risk neutral/indifferent investors are not as aggressive as risktakers and will accept reasonable degrees of risk. Risk averse investors prefer the lower return of lower riskinvestments.

Example: Choose between alternative investments (A and B) with the following possible outcomes (Each

economic state has a 1/3rd chance of occurring): A BRecession 240 0Normal 300 300Boom 360 600

Solution: Expected return( ) A BRecession (,333) 80 0Normal (,333) 100 100Boom (,334) 120 200

Expected value ( ) 300 300Note: A & B have the same mean outcome but different levels of risk.

- A risk-seeker/taker will prefer B (higher risk and possible return)- A risk-averter will prefer A.- A risk-neutral/indifferent individual will be indifferent between A and B.

Do not use a single expected/mean sales value/volume to calculate a probable overall profit. Use all probablesales or Si x to fist calculate a separate probable net profit (Q12.17 [c]) then apply each profit/loss own probability orPi to determine the overall/mean outcome (profit/loss) ([Sn xPn])(see decision tree example below).

. .Measurement of risk: Risk is expressed as or 2 (i.e. dispersion of possible outcomes = [R- ]2P and thecoefficient of variation(CV) (/R,risk per rand of return) allows the comparison of the relative risk of differentprojects.

Mean

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

22/38

22

Z-value [z = (X- )/]: Z-value calculates the number of standard deviations of a value (X) from the mean ( )and indicates the chance (% probability) that a variable (i.e. sales or profit) will statistically occur or that thevariable will fall within a specified range (between two different points). According to the table a z-value of 1 (one from the mean) covers 0,3413 or 34,13% of the area on one side of the mean, thus 68,26% of the total area(both sides). Two s from the mean covers some 98% of the total area.

Interrelationship between risk and return:Progressively determine the best investment proposition below, reviewing your opinion as new information isadded:

Project A Project BRisk ()(Deviation of returns) R1 000 R2 000

Opinion: In isolation, B seems more risky than B.Expected/mean return ( ) R10 000 R100 000

Opinion: In isolation B earns the most.Coefficient of Variation (CV) 10% (R1/10) 2% (R2/100)

Opinion: B has a better CV (Risk per R1 return) and seems the best option.Investment made R50 000 R1millionROI 20% (R10/50) 10% (R100/1000)

Correct decision: A is 5 times (10%/2%) more risky than B, yet it offers a return twice (20%/10%) that of B.Investors risk attitudes will select the preferred investment. A risk taker will invest in A while a risk averse investorwould probably prefer to invest in B.

Decision tree: The most beneficial outcome of different distributions ( each = 1) are chosen by backward

induction (rolled back). Study the comprehensive decision tree example on pages 466 to 468.

Decision trees/diagrams use cumulative probabilities and ensures that all outcomes are considered in proportion of its probability,

the time value of money can be incorporated in the form of NPV outcomes, risk attitudes can be compared with the cumulative probability of each alternative.

Tip: When unstructured/chaotic data is presented in the question, first structure/ organise the data percategory/logical sequence/patterns to highlight different options and outcomes as in Q12.22.

Note the weaknesses of decision trees.

Example: Management can develop and market a new product or continue as is. Development costs will be abou

R180 000 and the chance of success is 75%. If successful the outcome, after development cost, may be a profit ashigh as R540 000 (40% chance) or as low as R100 000 (30% chance) and, if a failure, a loss of R400 000 (30%chance). Draw a decision tree for the above.

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

23/38

23

Illustrative example Decision tree Question 10 - 1

An investors wants to start either a small plant (if demand is low - 25% chance) or large plant (if demand is high 75% chance).

Small plant (1or 2) Large plantIf demand is low (m=million) and one plant only R+3m profit R-3m (loss)If demand is high and one plant only R+4m profit R+7m profitChance of competing plant if demand high 60% 0%High demand & 2 small plants30% chance 2 plant result R+8m profitHigh demand 70% chance 2

ndsmall plant result R-2m loss

No competition 55% chance two plants result R+8m profitNo competition & one expanded/new plant 55% result R+6,5m profitNo competition & 2

ndor new plant fail expected result R+2,5m profit

Required: Draw a decision tree and determine the highest expected profit. Also determine the course that arisk averse investor would prefer.

Suggested solution Q10 1 Part A

Conclusion: Choose Large plant as this choice has a value of R4,5 Million which is 0,3 Million higher than theSmall plant.

Buying perfect and imperfect information:Costs of eliminating the uncertainty versus the benefits. Thus maximum cost = Increase in

Portfolio analysis:Diversificationspreads/reduces risk if investments/projects are not perfectly positivelycorrelated (respond differently to same circumstances) and overall variability of cash flows is reduced. One mustconsider the extent to which each investment/project affects the overall risk of the entity.

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

24/38

24

Example: Negatively correlated productsSeason Coat Ice-cream Combined

Sales Sales activitiesR R R

Summer 40 000 +60 000 +20 000

Winter +60 000 40 000 +20 000Each activity is risky/loss on its own, but combinedrisk is reduced/eliminated.

ChapterChapterChapterChapter 15151515 - BUDGETING PROCESS Intermediate only

Advanced - Activity-based budgeting (ABB)Conventional budgeting: Unfit for activities that consume resources not per output volume of products, produce incremental budgets, merely authorizes spending levels and views non-unit level activity cost as fixed,

ABB aims to authorize only resources essential to meet budgeted production and sales volumes.ABB reverses the ABC process: Essential cost driver/activity (e.g. Process 5000 sales orders) and resourceneeds (e.g. 0,5 hr per order = 2500 labour hours /1500 hrs per person pa = 2 persons). Thus cost pool (i.e.budget) includes salary of 2 persons.

Periodically actual results are compared with an adjusted (flexible) budget.ExampleBudgeted activity for processing orders = 2,800 ordersOrders processed per person = 600Resources required 2800/600 = 4,67 personsResources supplied (practical capacity for 3000 orders)= 5 personsEmployment costs (R25,000 per person pa x 5) = R125,000Cost driver rate (R125,000/3,000 orders) = R41,67Actual orders processed for the period = 2,500 ordersPerformance report:Flexed budget (2,500 R41,67 ) = R104,175Budgeted unused capacity (3,000 2,800) R41,67 = 8,334Unplanned unused capacity (2,800 2,500) R41,67 = 12,491

R125,000

ChapterChapterChapterChapterssss 11118 & 198 & 198 & 198 & 19 - STANDARD COSTING

Sales and cost variances: There are two basic variances for sales, materials, labour and variable/fixed overheads:

Price/rate/expenditure variance determined by one standard and two actuals, as follows:(Standard Actual Price/ rate/expenditure) x Actual Volume sold/quantity purchased/hours used

Average annual

standard deviat ion (% )

Number of sharesin portfolio

Nondiversif iablerisk

1 10 20 30 40 1000

Diversif iable risk

/Unsystematic

/Systematic

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

25/38

25

Volume/quantity/usage or efficiency variance determined by one actual and two standards as follows:(Standard cost for actual production volume Actual Volume/quantity/usage) x Standard Price/rate/expenditure

Two exceptions (Budgeted replaces Standard) :

The Sales volume variance is: (Budgeted less Actual sales volume) x Budgeted contr. (VC) or Contr.pu FOAR (AC)

Fixed overhead variances: Expenditure variance = Budgeted fixed cost less Actual fixed cost: Volume variance(Rate per unit) = (Budgeted prod. units Actual prod. units)FOAR per unit: Volume variance(Rate per Hour) = (Budgeted hrs Std hrs for actual prod)FOAR per hour

A variable standard costing system has only one fixed overhead variance, namely the fixed overhead expenditure variance.

Fixed overheads variances: FOARper unit(only one product) produced:Budgeted FC R120000 (Actual R116000) Budgeted production 10 000 units (Actual 9 000 units) FOAR 120000/10000 = R12 pu

Fixed production overhead control account (R000)

Actual cost incurred 116 Absorbed (or std) cost 108

(actual Prod units x FOAR

(9 000 units x R12)

Under-absorbed cost 8116 116

Expenditure variance: Budgeted cost Actual cost = R120 000 116 000 = R 4 000 F

Volume variance: (Budgeted production actual production)FOAR = (10 000 9 000)12 = R12 000 A

Total variance R 8 000 A

Fixed overheads variances: FOARper std production hour: Budgeted hrs 30 000 for 10000 unitsNew FOAR: R120000/30000 = R4 per hour

Fixed production overhead control account (R000)

Actual cost incurred 116 Absorbed (or std) cost 108

(Std hrs for Actual Prod. Actual hrs)FOAR

(9 000 units x 3 hours x R4)Under-absorbed cost 8

116 116

Expenditure variance as above R 4 000 F

Volume variance = (budgeted hrs Std hrs for actual prod.)FOAR =[30000 (9 000x3)]4= R12 000 A

Fixed overhead capacity/efficiency variances: Fixed costs are sunk costs that do not change with production volumes or

efficiency of production. As a result separate fixed overhead capacity and efficiency variances are not consideredmeaningful and are seldom calculated in practice. These variances are more meaningfully combined into a single volume

variance.Fixed overhead capacity variance: [Budgeted machine hours Actual machine hours] x FOARphFixed overhead efficiency variance: [Std machine hrs of actual output Actual machine hours] x FOAR

FOH volume variance: [Budgeted hrs Std hrs for Act. Output) x FOAR

Detailed volume/quantity/usage variances: When more than one product is sold as substitutes or more than one raw material

is used and material is interchangeable, the volume/quantity/usage variance may be split into separate mix and yield variances

as follows (from example 19.2, p783):

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

26/38

26

Budgeted Sales/Mix Standard Mix(Actual sales)

Actual Mix &Sales

X: 8 000 (40%) 8 800 (40%) 6 000Dif@SM

Y: 7 000 (35%) 7 700 (35%) 7 000

Z: 5 000 (25%) 5 500 (25%) 9 000

25 000 22 000 22 000

Material Mix and YieldMix variance: (Standard mix for total actual sales/quantity/usage - Actual mix)Standard sale price per unit

o Using the data from example 19.1 (page 779), the material mix variance is calculated as follows:Standard Mix Actual Mix Variance Std Pce Variance

X: 50% x 100 000 = 50 000 53 000 3 000 A R7 21 000 A

Y: 30% x 100 000 = 30 000 28 000 2 000 F R5 10 000 F

Z: 20% x 100 000 = 20 000 19 000 1 000 F R2 2 000 FTotal Actual usage 100 000 100 000 Nil 9 000 A

Yield/Usage variance: Material: (Standard mix and usage for actual prod. - Standard mix for Actual usage) x Std price pu

Budgeted usage (std mix) Actual usage (std mix) VarianceX: 50% x 103 000 = 51 500 50% x 100 000 = 50 000 1500F x R7= R10 500

Y: 30% x 103 000 = 30 900 30% x 100 000 = 30 000 900F x R5= 4 500

Z: 20% x 103 000 = 20 600 20% x 100 000 = 20 000 600F x R2= 1 200

Total 103 000 100 000 as before R16 200F

Materials variances summary:Price variance (calculated as normal) R12 200 A

Mix variance R 9 000 A

Yield variance R16 200 F R 7 200 F Usage varianceTotal variance R 5 000 A

When more than one type of labour (skilled, semi-skilled and unskilled) is used, separate labour mix and efficiencyvariances can be calculated as demonstrated above.

Sales Mix and Qty variances

Budgeted Sales/Mix1 Standard Mix2

(Actual sales)

Actual Mix &

Sales

X: 8 000 (40%) 8800 (40%) 6 000

Y: 7 000 (35%) 7 700 (35%) 7 000

Z: 5 000 (25%) 5 500 (25%) 9 000

25 000 22 000 22 000

Quantity

Variance

Volume

Variance

Mix

Variance

Quantity

Variance

Volume

Variance

Mix

Variance

-

8/9/2019 Lecture Notes AMAF MAN Acc 09

27/38

27

1Budgeted mix = standard mix for budgeted volume

2Standard mix = standard mix for actual volume

Sales quantity variance split into two further variances (if industry sales volumes are available).

Market size variance Keep the firms market share constant (say 10%). If the total market grows by 75 000 units, thefirms sales would increase by 10% (i.e. 7 500 units at a contribution of R14,45pu = R108 375).

Market share variance Keep the industry market size constant (say 275 000 units). If the firms market share falls by2%, its sales decrease by 2% of the market size of 275 000 units (i.e. 5 500 units at R14,45 = R79 475).

Thus, the sales quantity variance comprises: Units ContributionMarket size variance 7 500 F 108 375 F

Market share variance 5 500 A 79 475 ASales quantity variance 2 000 F 28 900 F

Criticisms of sales volume/margin variances

Sales price and volume are mostly interdependent, so it serves no purpose to differentiate these effects, though onecould use the variance information sensibly, aware of the interrelationships,

Different sales weighting methods (i.e. by units or by revenue) result in different sales mixes resulting in different mixand quantity variances. It is better to use the firms target sales mix,

Though firms sell a range of different products with different margins , the products themselves are independent oone another (i.e. no planned sales mix) and there is no point in calculating a mix and quantity variance (i.e. rather use asingle volume variance by product).

Recording standard costs in the accountsStandard values inventory standard cost (i.e. FIFO, LIFO or WA now irrelevant). IAS allows standard cost stock values if i

approximates actual cost. Drury suggests that all variances be eliminated before transactions are recorded in the work-in

progress control account (i.e. all entries in WIP account at standard). Thus, individual cost control accounts (i.e. materiallabour, etc) are credited at standard costs and resulting variances from actual costs (debits) are either written off as period

variances in the income statement or allocated between stock values and cost of goods sold per p794):

R R