Lecture 3 globalisation

-

Upload

dmytro-zubytskyi -

Category

Business

-

view

155 -

download

0

Transcript of Lecture 3 globalisation

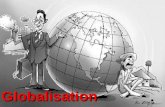

Significant and recent

Internationalisation? Global integration? Universalism? Americanisation? Shrinking world?

Industrial specialisation

Global economic exchange

Foreign direct investment (FDI)

Migration and travel

Technology• Transport – containers, jet aircraft • ICTs – satellites, fibre-optic cables, www,

smartphones

Government • Standardisation• International law• Exchange controls• Trade agreements

INTERNATIONAL MIGRATION

214 million - approximate 16 million refugees Up from 81.5 million in 1970 3.1% of all people 75% of all migrants live in 28 countries 20% + are in the USA 30%+ are in the EU

INTERNATIONAL MIGRATIONIndonesia, Vietnam & China: 0.1%India: 0.4%Romania: 0.6%Turkey: 1.9%Poland: 2.2%

UK & France: 10.5%Germany: 13.1%Spain: 14.1%USA: 16%

INTERNATIONAL MIGRATIONAustralia: 23%Switzerland: 23%Saudi Arabia: 28%Luxembourg 33%

Kuwait: 63%UAE: 70%Qatar: 87%

UAE: 90% of the workforce

Trans-nationals / multi-nationals

FDI: 1980: $700 billion 1990: $2.1 trillion 2000: $7.4 trillion 2010: $20.4 trillion2013: $22.8 trillion

Subsidiary-based expansion Acquisition-based expansion

MULTI NATIONALS1) ICBC China Banking2) China Construction Bank China Banking3) JP Morgan Cgase USA Banking4) General Electric USA

Manufacturing5) Exxon Mobil USA Oil 6) HSBC UK Banking7) Royal Dutch Shell UK / Holland Oil8) Agricultural Bank of China China Banking9) Berkshire Hathaway USA Various 10) Petrochina China Oil11) Bank of China China Banking12) Wells Fargo USA Finance13) Chevron USA Oil14) Volkswagon Group Germany Cars15) Wal-Mart USA Retail16) Apple USA Technology17) Gazprom Russia Energy18) BP UK Oil19) Citigroup USA Banking20) Samsung S Korea Electronics

Objectives:

• Wealth generation / new markets• Cost reduction• Risk reduction• Response to competition• Tariff avoidance

THE IMPACT OF GLOBALISATION

Industrial restructuring Competitive intensity Volatility Expatriate workers

Financial services Business services Creative & cultural industries Higher education Research / science Tourism Hi-tech manufacturing Sports and leisure Retailing Restaurants / bars IT Construction / engineering

Death of old jobs

Rise of new jobs

Upskilling

Labour market tightening and loosening

Greater inequality

It is notoriously difficult to measure competitive intensity in an objective way

Anecdotal evidence shows it has increased and is increasing very substantially

Use of proxy measures

Reduction in the length of time firms dominate markets

Increases in ‘industry churn’ Increases in financial instability Increased length of episodes of financial

instability Increases in growth rates of small organisations Increased incidence of price discounting Decreased ability to increase prices.

Efficiency / keeping a lid on costs

Additional pressure to recruit, retain and to engage good people

Sophisticated, emotionally intelligent people management – with fewer resources

Instability / inability to plan for the long-term

Regular restructuring & cultural change

Opportunism and agility

Flexible working

Change • Tends to disappoint in practice• Conflict• Politics

Flexibility• Temporal flexibility• Functional flexibility• Financial flexibility

EXPATRIATES Traditional model of expatriate work

• Migrant workers• Global careerists• Self-initiates• International commuters• Short-term assignees• Frequent flyers• Virtual internationalists