Law and Executive Compensation: A Cross-Country Study

-

Upload

stephen-bryan -

Category

Documents

-

view

215 -

download

1

Transcript of Law and Executive Compensation: A Cross-Country Study

VOLUME 23 | NUMBER 1 | WiNtER 2011

APPLIED CORPORATE FINANCEJournal of

A M O R G A N S T A N L E Y P U B L I C A T I O N

In This Issue: Corporate Productivity and the Wealth of Nations

Growth and Renewal in the United States: Retooling America’s Economic Engine

8 James Manyika, David Hunt, Scott Nyquist, Jaana Remes,

Vikram Malhotra, Lenny Medonca, Byron Auguste, and

Samantha Test, McKinsey Global Institute

toward a Bottom-Up Approach to Assessing Sovereign Default Risk 20 Edward I. Altman, New York University Stern School of

Business, and Herbert A. Rijken, Vrije University Amsterdam

Current Accounts and Global Adjustment: the Long and Short of it 32 Manoj Pradhan and Alan M. Taylor, Morgan Stanley

the Dodd-Frank Wall Street Reform and Consumer Protection Act: Accomplishments and Limitations

43 Viral V. Acharya, Thomas Cooley, Matthew Richardson,

Richard Sylla, and Ingo Walter, New York University

China Adopts EVA: An Essential Step in the Great Leap Forward 57 Erik Stern, Stern Stewart and Co.

Corporate Portfolio Management: theory and Practice 63 Ulrich Pidun, Harald Rubner, Matthias Krühler, and

Robert Untiedt, The Boston Consulting Group,

and Michael Nippa, Freiberg University

Deleveraging Corporate America: Job and Business Recovery through tax-Deferred Debt Restructuring

77 Glenn Yago and Tong Li, Milken Institute

Law and Executive Compensation: A Cross-Country Study 84 Stephen Bryan, Fordham University, and Robert Nash and

Ajay Patel, Wake Forest University

What Drives CEOs to take on More Risk? Some Evidence from the Laboratory of REits

92 Roland Füss, Nico Rottke, and Joachim Zietz,

EBS Universität für Wirtschaft und Recht

Comply or Explain: investor Protection through the italian Corporate Governance Code

107 Marcello Bianchi, Angela Ciavarella, Valerio Novembre,

Rossella Signoretti, CONSOB

VOLUME 23 | NUMBER 1 | WiNtER 2011

APPLIED CORPORATE FINANCEJournal of

A M O R G A N S T A N L E Y P U B L I C A T I O N

In This Issue: Corporate Productivity and the Wealth of Nations

Growth and Renewal in the United States: Retooling America’s Economic Engine

8 James Manyika, David Hunt, Scott Nyquist, Jaana Remes,

Vikram Malhotra, Lenny Medonca, Byron Auguste, and

Samantha Test, McKinsey Global Institute

toward a Bottom-Up Approach to Assessing Sovereign Default Risk 20 Edward I. Altman, New York University Stern School of

Business, and Herbert A. Rijken, Vrije University Amsterdam

Current Accounts and Global Adjustment: the Long and Short of it 32 Manoj Pradhan and Alan M. Taylor, Morgan Stanley

the Dodd-Frank Wall Street Reform and Consumer Protection Act: Accomplishments and Limitations

43 Viral V. Acharya, Thomas Cooley, Matthew Richardson,

Richard Sylla, and Ingo Walter, New York University

China Adopts EVA: An Essential Step in the Great Leap Forward 57 Erik Stern, Stern Stewart and Co.

Corporate Portfolio Management: theory and Practice 63 Ulrich Pidun, Harald Rubner, Matthias Krühler, and

Robert Untiedt, The Boston Consulting Group,

and Michael Nippa, Freiberg University

Deleveraging Corporate America: Job and Business Recovery through tax-Deferred Debt Restructuring

77 Glenn Yago and Tong Li, Milken Institute

Law and Executive Compensation: A Cross-Country Study 84 Stephen Bryan, Fordham University, and Robert Nash and

Ajay Patel, Wake Forest University

What Drives CEOs to take on More Risk? Some Evidence from the Laboratory of REits

92 Roland Füss, Nico Rottke, and Joachim Zietz,

EBS Universität für Wirtschaft und Recht

Comply or Explain: investor Protection through the italian Corporate Governance Code

107 Marcello Bianchi, Angela Ciavarella, Valerio Novembre,

Rossella Signoretti, CONSOB

84 Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

Law and Executive Compensation: A Cross-Country Study

1. S. Bryan, R. Nash, and A. Patel, “How the Legal System Affects the Equity Mix in Executive Compensation,” Financial Management, Spring 2010, 393-418.

nvestigations of CEO compensation in the U.S. indicate that the average pay-performance sensi-tivity in S&P 1500 companies has increased substantially since 1992. A major factor contrib-

uting to the rise in pay-performance sensitivity has been the greater use of stock options and restricted stock grants in the compensation mix. And although the relative use of options and restricted stock in compensation structures has varied over time, the increased use of equity (options and restricted stock) in annual executive compensation contracts is consis-tent with the idea that executive compensation should be linked to performance that matters to shareholders.

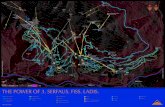

While executive compensation contracts of U.S. compa-nies have been studied extensively, we know much less about the role of equity in executive compensation contracts for companies outside the U.S. Figure 1 shows that, for each year during the period 1996 to 2008, our sample of non-U.S. companies used substantially less equity in their compensation mix than U.S. firms. But despite this consistent “cross-sectional” difference between U.S. and other companies, the pattern of changes in the equity pay of U.S. companies over time (as can also be seen in Figure 1) appear to be mirrored by changes in the pay of companies in other countries.

As shown in the figure, equity-based pay as a percent-age of total compensation for U.S. companies increased from about 35% in 1996 to around 50% in 2001. Then it dropped to about 42% in 2003, remaining approximately at that level through 2005, before declining to 35% in 2006. By 2008, however, it had climbed back to around 48%.

For non-U.S. firms, by comparison, equity represented less than 5% of the compensation mix in 1996, but climbed to just over 20% in 2001 before declining to approximately 12% in 2002. Equity compensation then stayed at around 12% through 2004 before declining again to around 10% from 2005-2007. By 2008, it had settled at 8%.

So how do we explain both these cross-sectional differ-ences between the pay practices of U.S. and non-U.S. companies, and how these practices have changed, if at all, over time? In a recently published study,1 we attempted to explain the cross-sectional differences in compensation struc-

tures by relying on the growing stream of research linking corporate financial decisions to institutional settings. This body of work has identified a number of legal and other institutional characteristics that appear to influence many corporate financial policies.

In our recent work, we attempted to extend this research by investigating how the institutional environment, partic-ularly the legal system, affects the design of compensation contracts. Our main hypothesis was that differences in legal systems have effects, direct or otherwise, on the structure of corporate compensation plans. We tested this hypothesis by focusing on the equity mix (i.e., relative amount of equity-based compensation) used by companies representing all major legal systems.

As discussed in detail below, our study produced strong evidence that certain features of a nation’s legal environment can help explain major differences in compensation struc-ture across countries. As a general rule, companies based in countries that provide greater protection of shareholder rights use larger amounts of equity-based compensation. And the equity mix is higher in countries where the legal system ensures strict enforcement of the laws that are on the books.

But having said that, the fact that the equity mix has varied considerably over time within the same legal environ-ment—and that specific measures of legal systems remain relatively fixed—makes it clear that factors other than the legal environment affect compensation structure. With that in mind, we also attempted to extend earlier academic studies of the determinants of compensation structure for U.S. companies by explaining the time-series variation within each legal environment in our sample. More specifically, previous studies of U.S. companies have focused on the role of compensation contracts in limiting potential conflicts of interest between managers and their shareholders and the “agency costs” that stem from such conflicts. In studying our sample of non-U.S. companies, we find that, after controlling for legal factors, company-specific variables that proxy for agency costs affect the compensation mix in fairly predictable ways that we discuss below.

I

by Stephen Bryan, Fordham University, and Robert Nash and Ajay Patel, Wake Forest University

85Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

2. See Bryan, Nash, and Patel (2010) for a summary of the cross-country differences in the use of equity-based compensation from 1996-2000. While the data used in the current study cover the much longer 1996 to 2008 period, the patterns are similar to those of the 1996-2000 study.

3. For a more detailed discussion of legal environments, see R. David and J. Brierley, 1985, Major Legal Systems in the World Today, London, U.K., Stevens and Sons, R. LaPorta, F. López-de-Silanes, A. Shleifer, and R. Vishny, 1997, “Legal Determinants of External Finance,” Journal of Finance 52, 1,131-1,150, and R. LaPorta, F. López-de-

Silanes, A. Shleifer, and R.Vishny, 1998, “Law and Finance,” Journal of Political Econ-omy 106, 1,113-1,150.

4. This work is based on the path-breaking studies of the intersection of law and fi-nance by LaPorta et al. (1997, 1998).

5. See S. Djankov, R. LaPorta, F. Lopez-de-Silanes, and A. Shleifer, 2008, “The Law and Economics of Self-Dealing,” Journal of Financial Economics 88, 430-465, and S. Johnson, R. LaPorta, F. Lopez-de-Silanes, and A. Shleifer, 2000, “Tunneling,” American Economic Review 90, 22-27.

tion they afford to stockholders and shareholder rights.4 We primarily use the anti-self-dealing index (developed by Djankov et al. (2008)) to measure the degree of legal protec-tion for shareholders. The anti-self-dealing index focuses on shareholder protection against expropriation by insiders. The index explicitly considers such control mechanisms as legally mandated disclosure and approval processes, as well as procedural remedies and penalties if minority sharehold-ers are wronged. As described by Djankov et al. (2008) and Johnson, LaPorta, Lopez-de-Silanes, and Shleifer (2000)5, insider self-dealing (i.e., expropriation by majority owners or “tunneling”) is a major concern to minority share-holders. By directly targeting the level of legal protection against this risk, the anti-self-dealing index appears to be an especially relevant measure of shareholder rights and is being used extensively in recent studies of the intersection of law and finance.

Some Qualifications. But to complicate matters, although the English common law system provides significantly stron-ger protection overall, a much cited study (LaPorta et al. (1997)) concluded that the degree of protection of shareholder rights can vary significantly within the same family of legal systems. What’s more, in addition to the strength of the laws on the books, the quality of each nation’s law enforcement may also affect contracting decisions. In other words, the legal rights of investors will be undermined if a country has ineffec-tive enforcement of well-designed laws. And to measure the effectiveness of law enforcement in each country, our study used the Rule of Law index from LaPorta et al. (1997), which takes on a higher value for nations with a stronger tradition of law and order.

To sum up, then, in our empirical analysis, we start by trying to assess how legal systems differ with respect to both the strength of laws to protect minority shareholders and the effectiveness with which those laws are enforced.

How Legal System May Affect Contract DesignBut to return to our main hypothesis, our study was designed to explore the possibility that differences in national legal system can lead to differences in compensation structure. The following section outlines some potential ways that legal envi-ronment may impact compensation structure.

The Legal System Affects How Much Stockholders MatterIn studies of U.S. companies, it is typically argued that equity is included in compensation contracts to provide

The Connection Between Legal Environment and Compensation StructureAs the data summarized in Figure 1 make clear, the structure of executive compensation in U.S. companies is substantially different from that of most companies outside the U.S.2 To explain some of this international variation in contract design, let’s start by looking at differences in legal environ-ments. There are two key questions we begin by addressing: How do legal systems vary across nations? And how could such differences in legal systems contribute to differences in compensation structure?

The Different Legal SystemsMost commercial law derives from one of two broad tradi-tions: common law or civil law.3 Common law is determined primarily by judges in legal systems where laws are formulated through precedent and then later incorporated into the legis-lature. Common law is based on English tradition and, like the other systems, has been spread across the world mostly through occupation and colonization. Civil law, on the other hand, relies on statutes and comprehensive codes that have been formulated and articulated primarily by legal scholars and governmental authorities. Civil systems, which are all based on the principles of Roman law, can in turn be arrayed into three main families: French, German, and Scandinavian. The socialist legal tradition, based on the law of the former Soviet Union, is closely related to the civil law systems.

For purposes of our study, perhaps the most important area of difference among legal systems is the level of protec-

Figure 1 Mean Percent Equity Compensation for U.S. and Non-U.S. Firms

60%

50%

40%

30%

20%

10%

0

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

U.S.Non-U.S.

86 Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

6. See R. Morck, B. Yeung, and W. Yu, 2000, “The Information Content of Stock Markets: Why Do Emerging Markets Have Synchronous Stock Price Movements?” Jour-nal of Financial Economics 58, 215-260, J. Dow, and G. Gorton, 1997, “Stock Market Efficiency and Economic Efficiency: Is There a Connection?” Journal of Finance 52, 1,087-1,129.

7. See A. Ali, and L. Hwang, 2000, “Country-Specific Factors Related to Financial Reporting and the Value Relevance of Accounting Data,” Journal of Accounting Re-search 38, 1-21, and R. Ball, S.P. Kothari, and A. Robin, 2000, “The Effect of Interna-tional Institutional Factors on Properties of Accounting Earnings,” Journal of Accounting and Economics 29, 1-51.

from potential conflicts between the interests of managers and their shareholders.

Most studies of compensation structure have focused on U.S. public companies and emphasized how compensation design affects agency conflicts within those companies, such as the natural tendency of managers of large organizations to emphasize growth over profitability, and to retain assets and cash flow rather than distributing them to investors. But because of the lack of shareholder protection in other legal systems, the severity of these conflicts of interest are likely to be more pronounced in other countries—so pronounced as to prevent the development of deep and liquid public markets for minority shares. Consistent with this argument, studies of the interdependence of law and finance show that minority shareholders provide large amounts of capital only in nations where the legal system ensures a high degree of protection of shareholder rights. Accordingly, we expect significantly lower use of equity-based compensation in companies based in nations with limited shareholder rights.

The Legal System Influences the Effectiveness of Stock in Motivating and Rewarding ManagersEquity-based compensation is likely to be most effective in motivating managers to increase efficiency and value in markets where stock prices are more informationally effi-cient. To provide the right motivation, stock prices must do a reasonably good job of reflecting not just current earnings, but the expected payoffs from the company’s capital invest-ments and its prospects for future performance. But if the stock market is not efficient in this sense, stock prices have less ability to link pay to performance. As a result, in econo-mies where the current stock price is a less accurate gauge of managerial performance, we would expect to see less use of equity-based compensation.

Earlier studies have found that nations providing stronger protection of shareholder rights have stock markets that are more informationally efficient.6 For example, Ball, Kothari, and Robin (2000) and Ali and Hwang (2000) show that legal institutions significantly affect the value relevance of accounting information.7 Specifically, these studies find that, in countries with common law legal systems (such as the U.S. and the U.K.), accounting information is more timely, followed more closely by analysts, and does a better job in explaining security returns. This stronger connection between accounting information and firm value in common law countries improves informational efficiency, facilitates monitoring, and provides a more direct link between the stock price and firm performance.

economic incentives for managers to “think like stock-holders” and take actions that add to shareholder wealth. This argument ref lects the “Anglo-American” premise that the main objective of public companies is to maxi-mize shareholder value. In much of the rest of the world, however, shareholders tend to be viewed as only one of a number of corporate constituencies whose interests must be “balanced”—and in many countries, the interests of share-holders are routinely and systematically subordinated to policy goals such as full employment.

One explanation for this subordination of sharehold-ers that suggests itself is the relative scarcity of minority shareholders, particularly in companies based in continental Europe and Asia. But this begs the question: why do such companies make so little use of public equity? A number of studies, starting with La Porta et al. (1997), have shown the important role of a nation’s legal environment in encourag-ing (or discouraging) investment by minority shareholders. As a general rule, countries with legal systems that provide for stronger shareholder rights are home to significantly more public companies, and with significantly higher market capitalizations, than countries with limited legal protection. In countries with stronger shareholder protection, a larger proportion of the population generally holds stock and an “equity culture” is more prevalent. Conversely, in places where the legal system does not protect minority shareholders, equity ownership is much less common, and the maximiza-tion of shareholder wealth is less of a focus for top managers. As a result, the goals of the firm are likely to differ across countries, and in significant part because of differences in the legal system.

In countries with shareholder-friendly legal systems, then, boards of directors are more likely to be focused on increasing share values, and we expect greater relative use of equity-based compensation to encourage managers to focus on this goal. But in countries with legal systems that effectively discourage minority share ownership, even the boards of companies with public shareholders will place less emphasis on shareholder wealth maximization as a corporate goal. And as a direct consequence, such companies will make less use of equity-based compensation.

The Legal System Affects the Conflicts of Interest within the FirmFinancial economists view the incentives provided by compensation contracts as a way of focusing managers on achieving the company’s goals. In the language of Jensen and Meckling, such contracts reduce the “agency costs” that stem

87Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

8. For example, see S. Bryan, L. Hwang, and S. Lilien, 2000, “CEO Stock-Based Compensation: An Empirical Analysis of Incentive-Intensity, Relative Mix, and Economic Determinants,” Journal of Business 73, 661-693.

9. This ratio is equal to the book value of total debt plus the market value of equity divided by the book value of total assets.

10. D. Yermack, 1995, “Do Corporations Award CEO Stock Options Effectively?” Journal of Financial Economics 39, 237-269.

11. K. Lehn, and A. Poulsen, 1989, “Free Cash Flow and Stockholder Gains in Going Private Transactions,” Journal of Finance 44, 771-787.

practice of using the ratio of the market value to the book value of the firm’s assets (Market-to-Book).9 Ratios well above 1.0 are assumed to indicate companies with substan-tial growth options.

Managerial discretion and agency costs also tend to increase with firm size, since a larger span of operations allows for greater managerial opportunism and contributes to less effective external monitoring. We measure a firm’s size by the natural logarithm of the firm’s total assets. The higher poten-tial agency costs of equity at larger firms should contribute to a greater relative use of equity-based compensation.

Prior research by Yermack (1995) and Bryan et. al. (2000) has shown that excess cash is negatively related to equity-based pay.10 We measure the firm’s cash flow by using Lehn and Poulsen’s (1989) cash flow statistic:11 operating income before depreciation less income tax less interest minus dividends paid. This measure of free cash flow divided by the firm’s market value of equity provides an indication of cash availability.

Finally, prior research has also shown a negative relation between a firm’s use of debt in the capital structure and the use of equity in the compensation mix (see Yermack (1995)). We investigate this issue by examining whether the ratio of a firm’s book value of total debt to total assets is related to the use of equity in the compensation mix.

In sum, while our study emphasizes the effect of the legal environment, our empirical analysis includes variables to test whether the same firm-level agency problems that influence the structure of U.S. compensation contracts also appear to affect the compensation design of non-U.S. firms.

Data Required for Tests of the HypothesesIn the past, the ability of researchers to examine cross-coun-try differences in compensation policy had been limited by a lack of readily available, detailed, and consistently presented compensation data for a broad array of countries. The key to our ability to conduct our study was the information required and made available by the SEC’s Form 20-F. Filing the Form 20-F is a reporting requirement for foreign firms whose equity trades in the U.S. market through American Deposi-tory Receipts (ADRs). Sponsored ADRs (those managed by a depository bank) are classified as Level 1, Level 2, Level 3, or Rule 144A. Level 1 ADRs are traded over-the-counter, while Rule 144A ADRs are private placements. Both are exempt from a majority of U.S. reporting requirements (such as filing the Form 20-F). Level 2 ADRs are listed on an exchange, or quoted on NASDAQ. Level 3 ADRs are for new equity offer-ings. Level 2 and Level 3 ADR-issuers must file the Form

Such findings lead us to expect equity-based compensa-tion to be more effective, and hence more widely used, in countries whose legal systems provide strong protection for shareholders.

The Legal System Affects How Managers Are Monitored In addition to being managed by well-designed compen-sation plans, the problem of agency costs can also be managed through the monitoring of managers by boards, equity analysts, buy-side investors, credit rating agencies, and auditing firms. In legal environments that encourage the development and effective operation of such monitor-ing institutions, compensation contracts (especially those involving equity-based compensation) are likely to be more effective in managing value-reducing conflicts of inter-est. But in legal environments that fail to encourage the development of such institutions, other ways of overseeing corporate management are likely to evolve—in particular, monitoring by the banks that provide much of the capi-tal in such economies. And with banks exercising such a control function, and companies more intent on repaying loans than on taking risks and creating shareholder value, there is no obvious corporate constituency pushing for more equity-based pay. (By contrast, during the 1990s, U.S. insti-tutional investors reportedly exerted significant pressure on the management teams of U.S. companies to increase their equity holdings.)

The Effect of Agency Costs: Firm-Specific Determinants of Compensation StructureAs noted earlier, previous studies of management compensa-tion (primarily in the U.S.) emphasize the role of corporate agency costs and conclude that U.S. companies develop compensation contracts designed to motivate managers to maximize shareholder wealth.8 With the idea of detecting the role of the effect of agency costs in driving the use of equity pay, we examined a number of corporate character-istics that are generally thought to be associated with more severe agency conflicts within a firm.

For example, companies with larger amounts of growth options typically confer more discretion on top management, and hence leave more room for opportunistic behavior. To encourage managers to make the best possible use of their greater discretion, such companies generally make extensive use of equity-based compensation. At the other extreme are companies like public utilities whose value comes mainly from fixed, or tangible, “assets in place.” When measuring the prevalence of growth options, we follow the standard

88 Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

12. For years up to and including 2006, non-U.S. companies were required to file a detailed reconciliation of foreign GAAP to U.S. GAAP. For fiscal years after 2006, non-U.S. firms that are fully compliant with International Financial Reporting Standards (IFRS) as promulgated by the International Accounting Standards Board (IASB) no longer have to provide such reconciliation. However, the Financial Accounting Standards Board (FASB) and IASB have continued to work to eliminate major outstanding differences to achieve convergence. We do not believe the remaining differences contribute in any meaningful way to measurement error in our results but do acknowledge that potential. Moreover, any discrepancy in accounting measurement and reporting would affect only the final two years of our sample period (2007 and 2008).

13. The grant date value of stock options is computed using the Black-Scholes (1973) option-pricing model. See Bryan, Nash, and Patel (2010) for details on inputs needed and computation methodology.

14. In our 2010 study recently published in Financial Management, we additionally decomposed the value of equity-based compensation into respective proportions of op-tion and restricted stock compensation (relative to total compensation). Stock option compensation is the dominant form of equity-based compensation in our sample. Re-stricted stock, while becoming increasingly popular in U.S. compensation, is used infre-quently in other countries. The results in our Financial Management paper indicate that the general findings are unchanged when we use these alternative measures of compen-sation structure.

15. See Bryan, Nash, and Patel (2010) for details regarding the composition of the non-U.S. sample.

To examine more thoroughly the relation between the compensation structures of U.S. and non-U.S. companies, we complemented our ADR sample with data for U.S. firms. For the U.S. sample, we obtained information on all components of CEO compensation, as defined above, from the Standard & Poor’s (S&P) ExecuComp database. ExecuComp provides detailed data for companies included in the S&P 500, S&P 400 MidCap, and S&P 600 SmallCap indexes.

We used Compustat data to form the firm-level explana-tory variables in our empirical models for both U.S. firms and our ADR sample. Our final sample covers the period 1996-2008 and consists of 2,528 firm-year observations from 44 non-U.S. countries and 22,383 firm-year observations for U.S. firms. These nations represent all of the major legal systems and provide widely varying degrees of legal protection for shareholders.15

Institutional Environment and Compensation Structure: The EvidenceThe major focus of this study was to determine whether institu-tional factors explain cross-sectional differences in compensation structure. As developed in our hypotheses, we expected compen-sation structure to be related to legal origin, the strength of shareholder rights as measured by the anti-self-dealing index, and the enforcement of laws as measured by the Rule of Law

20-F and thus provide the detailed compensation data that we use in our analysis.12

In compiling our sample, we first searched the Compustat database for a listing of all foreign companies with Level 2 and Level 3 ADR programs during 1996-2008. Next, we accessed the Securities and Exchange Commission’s EDGAR database and hand-collected information from the Form 20-F filings. To analyze cross-country differences in the design of the firm’s executive compensation structure, we collected information needed to measure the value of stock options, restricted stock, and cash-based compensation received by each executive. We also gathered information about any other forms of managerial compensation (such as payout from long-term incentive plans or pay in the form of benefits and perquisites) and included all of these components in our analysis of compensation structure.

Our primary measure of compensation design focuses on the relative use of equity-based awards. Equity-based compensation is the sum of the grant date value of both stock options and restricted stock.13 We defined the relative use of equity-based compensation (Percent Equity) as the value of equity-based compensation divided by total compensation, where total compensation is the sum of equity-based compen-sation, long-term incentive plans, other compensation, and cash compensation.14

Figure 2 Mean Percent Equity Compensation for English and Non-English Legal Systems

60%

50%

40%

30%

20%

10%

0

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Non-English Legal SystemEnglish Legal System

Figure 3 Mean Percent Equity Compensation by Legal System

50%

40%

30%

20%

10%

0

Engli

sh

Frenc

h

German

Scan

dinav

ian

Socia

list

89Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

16. While there is some time-series variation within the four non-English legal sys-tems across the 1996 to 2008 period, there does not appear to be any predictable pattern in the data.

17. For example, see S. Bryan, R. Nash, and A. Patel, 2006, “Can the Agency Costs of Debt and Equity Explain the Changes in Executive Compensation During the 1990s?,” Journal of Corporate Finance 12, 516-535.

U.S. companies in our sample. To be sure, the U.S. companies clearly use more equity-based compensation than non-U.S. firms within the English legal system. Nevertheless, there continues to be a significant difference in equity usage between that of companies from the non-English legal systems and that for non-U.S. firms within the English legal system.

Overall, the findings summarized in Figures 2 through 4 provide strong support for our hypothesis that the institu-tional environment impacts the use of equity in compensation structure. We also conducted regression analysis to support our conclusions from these exhibits to bolster our contention that differences in the institutional environment were the most significant factors in explaining the use of equity-based compensation. See Table 1 for these regression results.

Specifically, in Model 1 of our regressions, we use the anti-self-dealing index to measure how the legal protection of shareholders affects compensation structure. In Model 2, we use the Rule of Law variable to measure how the enforcement of the nation’s laws affects compensation structure. The results in Models 1 and 2 indicate that, when considered separately, each measure of legal environment is a highly significant determinant of compensation structure. More important, in regressions that include both variables, anti-self-dealing index and the Rule of Law (Model 3), both coefficients are highly significant. The regression results suggest that both variables capture distinctly different aspects of the institu-tional environment and that each independently affects the design of compensation contracts.

Our data provide examples of countries with non-English legal systems but a strong rule of law where a relatively large amount of equity-based compensation is used. As we noted in our figures, countries with non-English legal systems typically use much less equity-based compensation. Of the non-English system countries, the two providing the greatest amount of equity-based compensation are the Netherlands (22%) and Switzerland (18%). Despite hailing from the legal family generally providing the weakest protection of shareholder rights (French civil law), both countries earn the highest score regarding the strength of rule of law.

Agency Costs and Compensation StructureWhile we hypothesized that institutional factors would contribute to cross-sectional differences in compensation structure, we also speculated that the time-series variation might be related to differences in agency costs. We based this speculation on earlier work that has documented time-series variation in factors that proxy for agency conflicts.17 As explained earlier, we expected equity-based compensation to be positively related to a company’s growth opportunities

index. We also expected stronger protection of minority share-holders and more stringent enforcement of laws to be associated with greater use of equity in the compensation contract.

We began by comparing the use of equity-based compen-sation by companies operating in English legal systems with that of companies operating in other legal systems. As can be seen in Figure 2, there was a significant difference in the use of equity-based compensation by these two groups of compa-nies. Equity-based compensation varied between 35% and 50% for companies within the English legal system, while it was at or below 10% in all years except 2001 for firms within the non-English legal systems.

Our next step was to partition the data further to ensure that our results were not being driven by a subset of the data. We first examined whether there were significant differences in equity usage across the four different non-English legal systems: French, German, Scandinavian, and socialist. As summarized in Figure 3, the average equity-based compensation for the companies representing these four non-English legal systems between 1996 and 2008 showed very little variation over the full time period (ranging for the most part between 4% and 8%).16 At the same time, there were substantial differences in equity usage between the companies in the English legal system (average of over 40%) and those in the other four systems.

Moreover, to ensure that our findings for the English legal system were not driven by the use of equity-based compen-sation by U.S. companies, we partitioned the data from English legal system companies into two groups: U.S. and non-U.S. firms. As indicated by Figure 4, the differences in the time-series use of equity-based compensation by English and non-English legal system firms were not driven by the

Figure 4 Percent Equity Compensation by Country and Legal System

60%

50%

40%

30%

20%

10%

0

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Non-U.S.Firms—English Legal System

Non-U.S.Firms—Non-English Legal System

U.S. Firms

90 Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

Implications of Our FindingsThe important story from this study is that compensation structures can and do vary widely across different institu-tional and, more specifically, legal environments. Companies in countries that provide strong protection of shareholder rights and more effective enforcement of laws make greater use of equity-based compensation. And they do so for reasons that are closely related to their decision to raise public equity in the first place. When first making the decision to go public, a company’s founders (or private owners) are effectively relying on the country’s legal protection and enforcement to attract outside investors willing to pay a high enough price for the firm’s shares to motivate the private owners to sell at least part of their shares. But having made that decision to go public, providing the management team with equity compensation in turn provides another way—together with contractual legal protection—of assuring outside shareholders that the inter-ests of managers are consistent with their own.

and its size, and to be negatively related to a firm’s leverage and free cash flow.

We investigated this issue using regressions that included both institutional factors (reflecting the legal environment) and firm-specific variables (representing the potential severity of agency costs). Table 1 presents our findings. Our proxy for growth opportunities (Market-to-Book) is significantly positively related to the use of equity in the compensation mix. Additionally, the use of equity-based compensation by non-U.S. firms is negatively related to both leverage and the firm’s free cash flow. These findings are consistent with prior studies of U.S. firms and provide evidence that non-U.S. firms also consider agency problems when designing compensation contracts. In general, the results suggest that agency problems and the contracting solutions to mitigate them transcend national boundaries. Nevertheless, our data indicate that institutional factors are the most significant determinants of the compensation structures of non-U.S. firms.

Table 1 Regression Results Explaining Equity Compensation as a Percent of Total Compensation – 1996-2008 This table presents the regression results from Tobit models. The dependent variable is the ratio of total equity-

based compensation (stock option compensation plus restricted stock compensation) to total compensation (Percent Equity). Total compensation is the sum of cash compensation, stock option compensation, restricted stock, and long-term incentive compensation. The independent variables are: SELFDEAL (the anti-self-dealing index is a measure of shareholder rights protection (from Djankov et al., 2008), where higher values indicate stronger protection of shareholder rights); RULELAW (“rule of law,” an additional measure of the legal environment that captures the quality of law enforcement, with higher measures indicating stricter enforcement); FCF (“free cash flow,” the ratio of operating income before depreciation less the sum of income tax, interest, and dividends paid to the firm’s market value); MVBV (the book value of total debt plus the market value of equity divided by the book value of total assets); SIZE (the natural logarithm of the firm’s total assets); and LEV (the ratio of the firm’s total debt to total assets). We also include industry and year controls but do not report coefficient values. Standard errors robust to serial correlation and heteroscedasticity are in parentheses. Dependent Variable: Total Equity-Based Compensation to Total Compensation (Percent Equity)

Non-U.S. – 1996-2008 N=2,528 Noncensored=472 Non-U.S. & U.S. – 1996-2008 N=24,911 Noncensored=18,349

Model 1 Model 2 Model 3 Model 1 Model 2 Model 3

SELFDEAL 0.6871***

(0.1034)0.8169***

(0.1059)1.1077***

(0.0432)0.8581***

(0.0505)

RULELAW 0.1627***

(0.0285)0.1991***

(0.0296)0.3711***

(0.0092)0.3633***

(0.0100)

FCF -0.8386** (0.2962)

-0.4190**

(0.2100)-0.4313(0.2933)

-0.0450 (0.0277)

-0.0626**

(0.0264)-0.0599**

(0.0266)

MVBV 0.0744** (0.0239)

0.0613**

(0.0238)0.0409*

(0.0240)0.0405***

(0.0028)0.0368***

(0.0027)0.0358***

(0.0027)

SIZE 0.0169(0.0129)

-0.0023(0.0127)

-0.0020 (0.0127)

0.0457***

(0.0020)0.0506***

(0.0019)0.0524***

(0.0019)

LEV -0.5528**

(0.1741)-0.5678** (0.1771)

-0.5140** (0.1727)

-0.1087***

(0.0195)-0.1345***

(0.0190)-0.1407*** (0.0189)

*** denotes significance at the 1 percent level** denotes significance at the 5 percent level* denotes significance at the 10 percent level

91Journal of Applied Corporate Finance • Volume 23 Number 1 A Morgan Stanley Publication • Winter 2011

appears to be partly conditioned by the nation’s institutional environment.

stephen bryan is a Professor of Accounting in the Graduate School

of Business and the College of Business Administration at Fordham

University.

robert nash is a Professor of Finance in the Schools of Business at

Wake Forest University.

ajay patel is a Professor and GMAC Chair in Finance in the Schools of

Business at Wake Forest University.

All this is especially true of “growth” companies whose value can be seen as consisting more of “real options” than tangible assets. In the case of such “growth” companies, management is likely to play an especially large role in creat-ing (or destroying) value for shareholders. And in such cases, significant equity stakes for management can function as another kind of protection for shareholders.

A major implication of this finding is that even though we may have a global market for organizational talent, compen-sation structures across countries may not converge unless the underlying legal protections afforded shareholders converge. And while agency issues must clearly play a role in compensa-tion design for non-U.S. firms, the importance of that role

Journal of Applied Corporate Finance (ISSN 1078-1196 [print], ISSN 1745-6622 [online]) is published quarterly, on behalf of Morgan Stanley by Wiley Subscription Services, Inc., a Wiley Company, 111 River St., Hoboken, NJ 07030-5774. Postmaster: Send all address changes to JOURNAL OF APPLIED CORPORATE FINANCE Journal Customer Services, John Wiley & Sons Inc., 350 Main St., Malden, MA 02148-5020.

information for Subscribers Journal of Applied Corporate Finance is pub-lished in four issues per year. Institutional subscription prices for 2011 are: Print & Online: US$441 (US), US$529 (Rest of World), €343 (Europe), £271 (UK). Commercial subscription prices for 2010 are: Print & Online: US$590 (US), US$703 (Rest of World), €455 (Europe), £359 (UK). Individual subscription prices for 2010 are: Print & Online: US$105 (US), £59 (Rest of World), €88 (Europe), £59 (UK). Student subscription pric-es for 2011 are: Print & Online: US$37 (US), £21 (Rest of World), €32 (Europe), £21 (UK).

Prices are exclusive of tax. Australian GST, Canadian GST and European VAT will be applied at the appropriate rates. For more information on cur-rent tax rates, please go to www.wileyonlinelibrary.com/tax-vat. The institu-tional price includes online access to the current and all online back files to January 1st 2007, where available. For other pricing options, including access information and terms and conditions, please visit www.wileyonlineli-brary.com/access

Journal Customer Services: For ordering information, claims and any inquiry concerning your journal subscription please go to www.wileycustomerhelp.com/ask or contact your nearest office.Americas: Email: [email protected]; Tel: +1 781 388 8598 or +1 800 835 6770 (toll free in the USA & Canada).Europe, Middle East and Africa: Email: [email protected]; Tel: +44 (0) 1865 778315.Asia Pacific: Email: [email protected]; Tel: +65 6511 8000.Japan: For Japanese speaking support, Email: [email protected]; Tel: +65 6511 8010 or Tel (toll-free): 005 316 50 480.Visit our Online Customer Get-Help available in 6 languages at www.wileycustomerhelp.com

Production Editor: Joshua Gannon (email:[email protected]). Delivery terms and Legal title Where the subscription price includes print issues and delivery is to the recipient’s address, delivery terms are Delivered Duty Unpaid (DDU); the recipient is responsible for paying any import duty or taxes. Title to all issues transfers FOB our shipping point, freight prepaid. We will endeavour to fulfil claims for missing or damaged copies within six months of publication, within our reasonable discretion and subject to availability.

Back issues Single issues from current and recent volumes are available at the current single issue price from [email protected]. Earlier issues may be obtained from Periodicals Service Company, 11 Main Street, German-town, NY 12526, USA. Tel: +1 518 537 4700, Fax: +1 518 537 5899, Email: [email protected]

This journal is available online at Wiley Online Library. Visit www.wileyon-linelibrary.com to search the articles and register for table of contents e-mail alerts.

Access to this journal is available free online within institutions in the devel-oping world through the AGORA initiative with the FAO, the HINARI initiative with the WHO and the OARE initiative with UNEP. For information, visit www.aginternetwork.org, www.healthinternetwork.org, www.healthinternet-work.org, www.oarescience.org, www.oarescience.org

Wiley’s Corporate Citizenship initiative seeks to address the environmental, social, economic, and ethical challenges faced in our business and which are important to our diverse stakeholder groups. We have made a long-term com-mitment to standardize and improve our efforts around the world to reduce our carbon footprint. Follow our progress at www.wiley.com/go/citizenship

Abstracting and indexing ServicesThe Journal is indexed by Accounting and Tax Index, Emerald Management Reviews (Online Edition), Environmental Science and Pollution Management, Risk Abstracts (Online Edition), and Banking Information Index.

Disclaimer The Publisher, Morgan Stanley, its affiliates, and the Editor cannot be held responsible for errors or any consequences arising from the use of information contained in this journal. The views and opinions expressed in this journal do not necessarily represent those of the Publisher, Morgan Stanley, its affiliates, and Editor, neither does the pub-lication of advertisements constitute any endorsement by the Publisher, Morgan Stanley, its affiliates, and Editor of the products advertised. No person should purchase or sell any security or asset in reliance on any information in this journal.

Morgan Stanley is a full-service financial services company active in the securities, investment management, and credit services businesses. Morgan Stanley may have and may seek to have business relationships with any person or company named in this journal.

Copyright © 2011 Morgan Stanley. All rights reserved. No part of this publi-cation may be reproduced, stored or transmitted in any form or by any means without the prior permission in writing from the copyright holder. Authoriza-tion to photocopy items for internal and personal use is granted by the copy-right holder for libraries and other users registered with their local Reproduc-tion Rights Organization (RRO), e.g. Copyright Clearance Center (CCC), 222 Rosewood Drive, Danvers, MA 01923, USA (www.copyright.com), provided the appropriate fee is paid directly to the RRO. This consent does not extend to other kinds of copying such as copying for general distribution, for advertis-ing or promotional purposes, for creating new collective works or for resale. Special requests should be addressed to: [email protected].

This journal is printed on acid-free paper.