Latin Trade (English Edition) - Jan/Feb 2013

-

Upload

latin-trade-group -

Category

Documents

-

view

229 -

download

4

description

Transcript of Latin Trade (English Edition) - Jan/Feb 2013

LA

TIN

TR

AD

E

BE

ST

OF

TR

AV

EL

ISS

UE

JA

NU

AR

Y /

FE

BR

UA

RY

20

13

YOUR BUSINESS SOURCE FOR LATIN AMERICA » WWW.LATINTRADE.COM JANUARY/FEBRUARY 2013

HOTELSAIRLINES

RENTAL CARSDESTINATIONS

ALSO INSIDE:

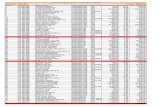

• DEALS OF THE YEAR

• WILL PANAMA GROW AFTER THE CANAL?

FORECAST: REVENUES OF TOP LATIN AMERICAN COMPANIES IN 2013

HOTELS & RESORTS IN LATIN AMERICA

Don’t just travel, treat yourselff

SHERATON SAO PAULO WTC HOTEL, BRAZIL

TAMBO DEL INKA, A LUXURY COLLECTION RESORT & SPA,

VALLE SAGRADO, PERU

Feel the energy of Latin America in your choice of more than 70 hotels, each refl ective of

one of nine brands that are part of Starwood Hotels & Resorts. A selection of 42 unique

destinations in 13 countries throughout the region. Each hotel provides the essential elements

for an unforgettable stay.

To learn more, visit STARWOODLATINAMERICA.COM

2013 Openings: The Westin Panama; Sheraton da Bahia Hotel, Salvador; Sheraton Tucuman

Hotel; Four Points by Sheraton Mirafl ores; Palacio del Inka Libertador, a Luxury Collection

Hotel, Cusco; Aloft Panama; Four Points by Sheraton Cancun and the just opened Le Meridien

Mexico City.

Best Business Hotel Chain in Latin America

by the readers of Business Traveler magazine

©2013 Starwood Hotels & Resorts Worldwide, Inc. All Rights Reserved.Preferred Guest, SPG, Aloft, Element, Four Points, Le Méridien, Sheraton,St. Regis, The Luxury Collection, W, Westin and their logos are the trademarks of Starwood Hotels & Resorts Worldwide, Inc., or its affi liates.

THE WESTIN PANAMA

ALOFT BOGOTA AIRPORT, COLOMBIA

Reducing energy consumption andenvironmental impact while improving quality. Sounds impossible? Not for McDonald ’s.

As the manager of McDonald’s restaurants throughout Latin America and the Caribbean, Arcos Dorados is planning for the future by making our restaurants more environmentally sustainable. Doing so has a positive impact on our business, the environment and the communities in which we operate. In January

was built with technologies that reduce the use of electricity, water and gas. It is also equipped to promote

www.arcosdorados.com

Council. It is the third McDonald’s restaurant in Latin America to receive this

made some important strides in making our restaurants environmentally sustainable, we know we have more work to do. Our vision is to serve meals that are appreciated by millions of Latin American families while encouraging sustainable practices in our restaurants and local communities.

4 LATIN TRADE JANUARY-FEBRUARY 2013

Features16 Cover

Best of Travel: Latin Trade weighs in on the best hotels, destinations, airports, and meeting venues in Latin America.

30 Industry Report Latin Trade’s Deals of the Year

36 Financial Strategies: Real Estate Shopping for the well-heeled

38 Corporate StrategiesAIG starts over

40 Special Report: LatAm 2013 For companies, 13 is a lucky number

46 Education: Educating for Success Homework for the authorities in Ecuador and Haiti: Make sure the children get to school.

50 Country Report: Panama The Challenges Ahead: How will mega projects

impact the country; a hub for the Americas, and the toruism boom.

60 Investments: China’s Slowdown Chinese Shadows: China’s economy is cooling. How will Latin America fare?

62 Investments: Venezuela Outlook Venezuela in its labyrinth

64 Investments: Spain in Latin America Spain reconquers Latin America

66 Investments: Brazil in AfricaUnder the African sun: Brazilian firms increase

their presence in Africa.

50

62

CONTENTS JANUARY/FEBRUARY 2013 VOL. 21 No.1

60

6 LATIN TRADE JANUARY-FEBRUARY 2013

Editor’s Note8 Business Revs Up for Growth in 2013

The Scene 12 Thumbs Up for LatAm

Opinion14 The Contrarian: Cash Credit is King

By John Price

Tech Trends70 E-Learning for the Twitter Generation

How technology is revolutionizing education

Events 72 CFO México, D.F.

74 CFO Miami

Spotlight: Colombia

76 The Only Risk is Wanting to Stay...

76

70

CONTENTS JANUARY/FEBRUARY 2013 VOL. 21 No.1

8

Cover: Best of Travel

WebFind us online at www.latintrade.com

Client commitment.

Global solutions.

Total connectivity.

Taking your opportunity further.

That’s return on relationship.

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., all of which are registered broker-dealers and members of FINRA and SIPC, and, in other jurisdictions, by locally registered entities. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured May Lose Value Are Not Bank Guaranteed. ©2012 Bank of America Corporation

8 LATIN TRADE JANUARY-FEBRUARY 2013

EDITOR’S LETTER

Santiago Gutiérrez,

Executive Editor

BUSINESS REVS UPFOR GROWTH IN 2013

This year will be a good one for Latin

America. In what is the fi rst issue of Latin

Trade for 2013, we want to show you what lies

behind our optimism from a variety of angles.

Maybe we’ve been donning our rosy-tinted

spectacles. After all, the region’s economic

growth came to a close on 3.1 percent last year,

down from 4.3 percent in 2011.

But estimates from Latin Business Chronicle,

the digital news and market intelligence of

Latin Trade Group, show that last year’s slow-

down was far from a disaster for the productive

sector. On the contrary, the region’s leading

non-fi nancial companies recorded a 10 percent

average sales growth in 2012, and a quarter of

them achieved increases of 20 percent or more

(see story on page 40). Th e biggest increases

were recorded by companies involved in com-

merce, consumer goods, transport and telecom-

munications. Th ey were able to shrug off the

problems of the international economy thanks

to a growth in demand from Latin America.

On top of that, leading economists, such as

those from the UN Economic Commission

for Latin America and the Caribbean, reckon

that domestic demand will remain strong this

year, as shown by labor indicators and growth

in bank credit. Both drivers will boost growth

of the middle class, which the World Bank has

shown is now running neck-and-neck in num-

bers with the poor. Between 2003 and 2009,

the region’s middle class grew from 103 million

to 152 million.

2013 will also have an additional advantage.

Th e prices of raw materials produced by Latin

America are not expected to slump due to

economic uncertainty in Europe and elsewhere

because Chinese purchases will provide an

additional support mechanism (see story on

page 60).

Yet another positive factor will be the re-

newed importance of tourism as a result of

growth in business, the movement of the Eu-

ropeans and help from governments (see story

on page 16).

Good results are also to be expected from

the multilatinas, whose internationalization

strategy has paid off in terms of a diversifi ca-

tion of the sources of growth. Th ey are opening

up new markets in the South, as are Chilean

companies in Peru and Colombia, Colombian

fi rms in the Caribbean and Brazilians in Africa

(see story on page 66). Investment fl ows will

also continue from the United States, Europe

(see story on page 64) and, to a lesser extent,

Asia, providing increased fi nancial returns from

the growth of Latin America.

For all of these reasons, as well as others, this

year is heading in the right direction from the

viewpoint of business activity in almost all the

region’s countries. For some of them, such as

Panama, 2013 will be yet another marvelous

year (see story on page 50). Of course, there

are challenges to the fi scal fragility of some

countries, especially those of the Caribbean,

and the need to increase investments so that

consumption is no longer the sole motor of

growth. Others, thanks to their relative well-

being, might fi nd room for technical changes

to boost social inclusion. But in general, except

for unforeseen events, the productive sector

will have a clean bill of health and will generate

economic prosperity. Are things looking good

for the year? No question.

Do you live an InterContinental life?

©2013 InterContinental Hotels Group. All rights reserved.

Shouldn’t each business trip or vacation you take be an unforgettable experience? At InterContinental, that is our mission. We use our local knowledge and insight to provide you with an authentic and captivating stay at the best destinations and cities in Latin America and the Caribbean…every time you travel!

More than 170 destinations including MIAM MED PA D SAN JUAN

And now earn 10 Priority Club points for every US$1 spent at InterContinental hotels in the Americas

Visit www.ihg.com/LACor www.priorityclub.com/ambassador

MIXING BUSINESS WITH PLEASURE?AUTHENTIC EXPERIENCES INCLUDED.

10 LATIN TRADE JANUARY-FEBRUARY 2013

CEO

Rosemary Winters

EXECUTIVE DIRECTOR & PUBLISHER

María Lourdes Gallo

EXECUTIVE EDITOR

Santiago Gutiérrez

ART & PRODUCTION DIRECTOR

Manny Melo

GRAPHIC DESIGNER

Vincent Becchinelli

CONTRIBUTING EDITORS

Gabriela Calderón (research), Mark Ludwig

COLUMNIST

John Price

CORRESPONDENTS Argentina: David Haskel, Charles Newbery • Brazil: Taylor Barnes (Rio de Janeiro), Tereza Cruvinel

(Brasilia), Vincent Bevins, Thierry Ogier, (São Paulo) • Chile: Gideon Long • China: Ruth MorrisColombia: John Otis • Mexico: David Agren (Mexico D.F.), Nancy Ibarra (Monterrey) • Peru: Lisa K. Wing,

Ryan Dube • Spain: Sergio Manaut • US: Alejandra Labanca, Joseph Mann Jr. (Miami), Mark Chesnut, John T. Sullivan (NY), Ángela María Riaño (Washington D.C.),

Pablo Calvi, Isabel Piquer • Venezuela: Peter Wilson TRANSLATION: David Buchanan COPY EDITOR: Ronald Buchanan/Millie Acebal Rousseau

EVENTS & CONFERENCES

PROGRAM MANAGER

Victoria Kenny

EVENTS EXECUTIVE

Sandra Bicknell

EVENTS MARKETING EXECUTIVE

Suzana Fiat

SALES & CIRCULATION

Miami/Pan-regional sales: Silvia Clarke, Senior Account Manager/Team LeaderMercedes Fernández, Business Development Director

Andean region/Central America: María Cristina Restrepo, ManagerDubai: Stephen Dioneda

Special Projects Coordinator: Rebecca MillerSales and Marketing Coordinator: Silvia Morales

For advertising/sponsorship opportunities: [email protected] or [email protected]

LATIN BUSINESS CHRONICLE

Senior Marketing Associate: Rosemary Begg: [email protected] Associate: Blanca Charún: [email protected]

OFFICE MANAGER & CIRCULATION

Claudia Banegas

Latin Trade Group

CHAIRMAN

Richard Burns

CHIEF OPERATING OFFICER

Joanne Harras

ACCOUNTS MANAGER

Kathy Pollyea, [email protected]

Latin Trade Group is a division of Miami Media, LLC, an affiliate of Isis Venture Partners

Executive, Editorial, Circulation and Advertising offi ces are located at Brickell Bay Offi ce Tower,

1001 Brickell Bay Drive, Suite 2700, Miami, Florida 33131, USA.

CUSTOMER SERVICE AND SUBSCRIPTIONS: Please visit www.latintrade.com to order online or call +1 (305) 749-0880. Latin Trade (ISSN 1087-0857, USPS 016715) is published bimonthly, with editions in English and Spanish, by Miami Media, LLC. All rights reserved. Reproduction in whole or part of any text, photograph

or illustration without written permission of the publisher is strictly prohibited.

Visit Latin Trade online @ www.latintrade.com

Are you losing valuable time looking for data and analysis on Latin America and the Caribbean?

Turn to

www.latinbusiness

chronic

le.com

Page

69

12 LATIN TRADE JANUARY-FEBRUARY 2013

There is a general consensus among North American and

European investors that, despite signifi cant macroeconomic

headwinds in Europe and China, Latin America is a region with

steadfast domestic markets and attractively valued companies with

signifi cant growth potential. Also, the consumer goods and services

sectors are the most attractive to investors, while utilities, basic

materials, and commodities sectors are the least appealing, accord-

ing to a survery conducted by Ipreo in September 2012, on behalf

of J.P. Morgan’s Depositary Receipts Group. Respondents for the

survey were global institutional investors from the United States,

Canada, and European countries.

THE SCENE

Source: North American and European Investor Opinions of Latin American Companies, by JP Morgan’s Depositary Receipts Group

THUMBS UP FOR LATAMIT’S A GOOD TIME FOR REGIONAL COMPANIES TO PURSUE A PUBLIC EQUITY OFFERING.

In total, Ipreo obtained feedback from 40 participants who invest

in Latin America. As of June 30, 2012, these participants’ fi rms

managed a combined $807.6 billion in equity assets, $43.0 billion

of which represented holdings in Latin American companies. Of

these fi rms, 70 percent are traditional investment advisers/mutual

fund managers, while 30 percent are hedge funds. A high percent-

age of survey participants believe that now is a good time for a Lat-

in American company to pursue a public equity off ering. However,

investors have concerns about government intervention, as well as

company-specifi c shortcomings in fi nancial accounting standards,

investor communications, and corporate governance practices.

0% 5% 10% 15% 20% 25% 30% 35% 40%

38%

28%

25%

23%

23%

15%

15%

GovernmentIntervention

Liquidity

InvestorCommunications

PracticesCorporate

GovernancePracticies

MacroEnvironment

RealisticGuidance

Sustainability of Results

Main challenges to maintaining a fair market valuation *

0% 10% 20% 30% 40% 50% 60%

50%

38%

35%

35%

23%

23%

18%

Strong Senior Mgmt. Team

Track Record of Execution

Valuation

Corp. Governance Practices

Strong Business Model

Stability of Results

Market Sector/Industry

Most important factors for a successful IPO *

0% 10% 20% 30% 40% 50% 60% 70%

65%

60%

20%

15%

10%

Consumer Goods

Consumer Services

Infrastructure

Financials

Healthcare

Which sectors in Latin America do you favor?

0% 10% 20% 30%

25%

20%

18%

13%

10%

10%

Utilities

Basic Materials

Commodities

Energy

Gov-Regulated Industries

Technology

Which sectors in Latin America are you avoiding?

5%10%

30%55%

YesNoMixed OpinionNo Opinion

Does an ADR program help LatAm Issuers maintain a fair market valuation?

* Participants had the option of providing multiple responses. Only the responses with 6 or more mentions are displayed.

* Participants had the option of providing multiple responses. Only the responses with 7 or more mentions are displayed.

JANUARY-FEBRUARY 2013 LATIN TRADE 13

THE SCENE

FIGURES FOR TOURISM IN LATIN AMERICA

TURNING ONE BILLION TOURISTS INTO ONE BILLION OPPORTUNITIES

On December 13, 2012, Latin America received its symbolic

tourist number one billion, a Brazilian lady entering Argentina where

she was greeted by a special welcoming committee. Th at billion fi gure

means one out of seven people crossed the borders of their country in just

one year, 2012. Amazing! Also note, that in 1950, the registered fi gure

of international travelers was 25 million passengers.

of least developed countries

of world trade

$ in US1.2 trillion1/12 jobs

9% GDP

(Direct, indirect and induced) (Direct, indirect and induced)

in exports

6% 8% exports

14 LATIN TRADE JANUARY-FEBRUARY 2013

The expansion of credit has dramatically

altered the consumer landscape in Latin

America over the last decade. Going back a bit

further, in 1990, fewer than 3 percent of Latin

American households had a credit card. By

2020, that fi gure will grow to 25 percent. In

Brazil, where credit has grown even more radi-

cally, consumer loans expanded eight fold from

2002 to 2012.

Access to credit changes how consumers

shop. Credit enables people to buy larger ticket

items that would otherwise be out of reach.

When Mexico’s Telmex began off ering Acer

computer packages to its landline customers in

1998, it instantly became the largest computer

re-seller and doubled Mexican PC and laptop

demand from 1 million to 2 million units per

year. Most of Telmex’s customers could not ob-

tain a credit card at the time, so the opportunity

to pay for a computer through installments on

their monthly phone bill was irresistible, even

if the interest rate used to calculate the install-

ments was set at loan-shark levels. Th e Telmex

example illustrates how consumer credit, even

unconventional and costly sources of credit, can

unleash repressed demand for expensive but

vital goods.

Over the last decade, Brazilian software sales

CASH IS KINGBY JOHN PRICE

have jumped 671 percent, car sales have grown

by 561 percent, and appliance sales have leapt

521 percent, all faster than GDP or general

consumption growth.

In Latin America, credit card interest rates

are onerous, ranging from 30 percent to 230

percent per year. Th e banks defend the rates

based on the high costs associated with collect-

ing unsecured debt. High interest rates limit

the use of cards. Latin Americans generally do

not buy groceries, medicine, clothing and other

staples with a credit card. Plastic is reserved for

big ticket and extraordinary expenses. High

interest rates also provoke prudent balance

management. Default rates in Latin America

are about half the levels found in the United

States. Even while growing, consumer credit

in Latin America represents no more than 70

percent of total GDP, versus 230 percent in the

United States.

Consumer demand for credit in Latin

America is not fully satisfi ed by banks. Push-

ing credit beyond the top 15 to 20 percent of

households into the base of the pyramid has

proven too daunting a task for most of the

region’s banks, and their brick-and-mortar ap-

proach drives up the cost of customer acquisi-

tion beyond a sustainable level. In their place,

John Price is the managing

director of Americas Market

Intelligence and a 20-year

veteran of Latin American

competitive intelligence and

strategy consulting.

innovative alternative providers of credit have

stepped in. Th e largest credit card issuer in

Chile is Falabella, a leading supermarket chain.

Elektra, the Mexican domestic appliance re-

tailer focused on the vast working class segment,

provides credit to customers who can show they

receive regular remittances from family in the

United States. Elektra is also the largest agent

network for Western Union inside Mexico.

Th e next frontier in the expansion of credit

will be pursued on two fronts. Extending short-

term credit to Latin America’s 200 million

base-of-the-pyramid consumers remains an

unrealized ambition for a handful of banks

and a curious mix of non-traditional lenders,

including retailers, utilities providers, phone

companies and mono-line lenders who are not

burdened by the fi xed costs of banking.

Th e larger, still untapped prize is consumer

mortgages. Of Brazil’s 62 million households,

approximately 550,000 have mortgages (<1

percent) compared with over 50 percent in the

United States. Mortgages are growing rapidly

(by 58 percent in Brazil in 2010), but are both

expensive and diffi cult to obtain. In most juris-

dictions in Latin America, seizing property post-

foreclosure is a time consuming and legally costly

procedure. Th at gives banks pause before extend-

ing new mortgages. Tenancy laws, which in

many countries tend to favor tenants and squat-

ters over property owners, need to be reformed

before banks will be willing to extend mortgages

to those beyond its premium level customers.

So far, the benefi ts of credit expansion in

Latin America have outweighed the costs. To

get to the next level, however, both lenders and

legislators will need to be far more bold and

creative than they were during the last decade of

easy and rapid growth.

THE CONTRARIAN

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 0

100

200

300

400

500

600

700

800

900

Loan growth surpasses all other consumer categories(Brazilian Consumer Category Sales 2001-2015)

Source: Economist Intelligence Unit

Credit_

SAS and all other SAS Institute Inc. product or service names are registered trademarks or trademarks of SAS Institute Inc. in the USA and other countries. ® indicates USA registration. Other brand and product names are trademarks of their respective companies. © 2011 SAS Institute Inc. All rights reserved. S71303US.0411

ANALYTICSBuild on your future.

Scan the QR code* with your mobile device to view a video or visit sas.com/build for a free Harvard Business Review report.

SAS®

*Requires reader app to be installed on your mobile device

16 LATIN TRADE JANUARY-FEBRUARY 2013

PH

OT

O:

©IS

TO

CK

PH

OT

O.C

OM

/ @

DIE

GO

CE

RV

O

Along with religion and politics, travel is a topic that produces very strong opinions. Whether they’re raving about the best airplane seat or ranting about the worst hotel res-taurant, nearly every business trav-eler is well equipped to launch into a list of their best and worst travel experiences.

In Latin America — as in the rest of the world — the travel in-dustry is in a state of fl ux, as airlines merge, airports struggle to handle more passengers, and hoteliers and destinations react to economies that are booming in some places and struggling in others. No one knows this better than the readers of Latin Trade, who seem to cross national borders within the Americas the way that other people cross a street in their hometown.

To help harried business travel-ers navigate the region and point them in the direction of the best pos-sible experiences, we’ve assembled a group of well-traveled experts to rank and rate a variety of hotels, destinations, airports and meeting venues throughout the region. Our expert panel includes a crucial cross-section of savvy travelers and objec-tive industry experts — including frequent business travelers, travel agents and destination management companies, the organizations that make meetings happen around the globe. Th e results off er unique insight into the very best options for travel-ers in Latin America — and helpful guidelines for the months of travel that lie ahead.

BY MARK CHESNUT

BEST OF TRAVEL

Latin Trade’s

JANUARY-FEBRUARY 2013 LATIN TRADE 17

PH

OT

O:

CO

UR

TE

SY

OF

TH

E R

ITZ

-CA

RL

TO

N H

OT

EL

CO

MP

AN

Y,

L.L

.C.

BEST OF TRAVEL

Latin America is a closely watched region by the International Con-gress and Convention Association (Icca), a global organization that represents specialists in organiz-ing, transporting and accommo-dating international meetings and events, with more than 950 mem-ber companies and organizations in 88 countries around the world.

To host its 51st world congress, Icca chose the Caribbean island of Puerto Rico, a destination that saw its number of international meetings grow from 9 in 2010 to 30 in 2011 (Icca’s 2012 figures had not been released as of press time). The increase represents a

jump in Puerto Rico’s worldwide rankings (measured by num-ber of international association meetings per country) from 77th place in 2010 to 56th in 2011 and, in the regional North and Latin American rankings, from 18th to 12th position.

Latin America overall is becoming a more popular area for international meetings, accord-ing to Icca figures, with a steadily increasing market share over the past decade. And while the United States may lead the hemisphere in terms of number of internation-al meetings, other nations lead when broken down by city.

THE IMPORTANCE OF THE MEETINGS MARKET

BEST HOTELSTh e expansion of international hotel brands in Latin America is, in many

regions, continuing an impressive growth trajectory. In Brazil, mid-market

chains are growing especially quickly, largely in response to the growing

middle class and, in Rio de Janeiro, also to prepare for the large infl ux

of visitors expected to attend the 2014 World Cup and 2016 Olympics.

Bogota and Panama City also stand out as cities with substantial growth

in hotel investment and the debut of new international brands, while San

Juan, Puerto Rico, is aiming to recast itself as a destination for meetings

and conventions with new group-friendly upscale properties in the works.

Hotels serve such a diverse group of clientele that it’s necessary to break

them down into multiple categories in order to provide an accurate picture

of which properties are best. And even within each ranking category, there

may not be a black-and-white best answer — especially when it comes to

ranking things like value for the money, notes Vera Joppert, a member of

Latin Trade’s expert panel for this issue and the director of Turismo Clas-

sico, a destination management company in Rio de Janeiro. Th rough her

years of experience in the “Cidade Maravilhosa,” she knows well that what

you pay for a hotel one month may be very diff erent from the rate just a

couple months later. In other words, you might get more for your money at

one time of year than another, based on occupancy and peak travel trends.

“Th is will always depend on the particular situation of each property for

the requested date,” she says. “Th is applies to each and every city.”

Hotel lobby of The Ritz-Carlton in Santiago, Chile

According to the most recent Icca rankings, here are the western hemisphere’s most important countries and cities in the international meetings and convention segment:

Number of meetings by country:1. USA: 7592. Brazil: 3043. Canada: 2554. Argentina: 1865. Mexico: 1756. Colombia: 1137. Chile: 878. Peru: 559. Uruguay: 4610. Paraguay: 34

Number of meetings by city:1. Buenos Aires: 942. Rio de Janeiro: 693. São Paulo: 604. Vancouver: 555. (tie): México City: 51 Washington D.C.: 517. Montreal: 508. Santiago: 499. (tie) Bogota: 44 Boston: 44 Lima: 44 Toronto: 44Fuente: www.iccaworld.com

18 LATIN TRADE JANUARY-FEBRUARY 2013

THE WINNERS(Note: Hotels are presented in alphabetical order, not in order of votes)

BEST LOCATED HOTELS FOR BUSINESS ACTIVITIES

Asuncion: Sheraton Asunción Bogota: Charleston Casa Medina, JW Marriott Bogotá Brasilia: Brasil 21 Convention Suites, Meliá Brasil 21,

Royal Tulip Brasilia Alvorada Buenos Aires: Four Seasons Hotel Buenos Aires, Hilton Bue-

nos Aires, Palacio Duhau Park Hyatt Buenos Aires

Caracas: Eurobuilding Hotel & Suites, Gran Meliá Cara-cas, JW Marriott Caracas

Guadalajara: Fiesta Americana Grand GuadalajaraGuatemala City: Barceló Guatemala City, Real InterContinental

Guatemala, Westin Camino Real GuatemalaLima: JW Marriott Lima, Mirafl ores Park, Westin Lima

Hotel & Convention CenterManagua: InterContinental Real Metrocentro Medellin: InterContinental Medellín Mexico City: Four Seasons Hotel Mexico, D.F., JW Marriott

Mexico City Montevideo: Radisson Victoria Plaza, Sheraton Montevideo Panama City: Miramar Intercontinental, Panama Marriott,

Sheraton Panama Hotel & Convention CenterQuito: JW Marriott Quito, Sheraton Quito, Swissotel

QuitoRio de Janeiro: Copacabana Palace, Sofi tel Rio de Janeiro

Copacabana, Windsor AtlanticaSan Jose: Grano de Oro, InterContinental Real San José San Juan: Caribe Hilton, El San Juan Resort & Casino San Salvador: Courtyard by Marriott San Salvador

Santiago: Grand Hyatt Santiago, Ritz-Carlton, Santiago Santo Domingo: Hotel Frances Mgallery, Meliá Santo Domingo,

Occidental El EmbajadorSao Paulo: Grand Hyatt Sao Paulo, Renaissance Sao

Paulo, Tivoli Sao Paulo MofarrejTegucigalpa: Tegucigalpa Marriott

BEST FOR NUMBER/QUALITY/

VARIETY OF CONVENTION ROOMS

Asuncion: Sheraton Asunción Bogota: JW Marriott Bogotá Brasilia: Brasil 21 Convention Suites, Naoum Plaza

Brasilia, Royal Tulip Brasilia AlvoradaBuenos Aires: Alvear Palace, Hilton Buenos Aires, Sheraton

Buenos Aires Hotel & Convention CenterCaracas: Gran Melia Caracas Guadalajara: Presidente InterContinental GuadalajaraGuatemala City: Westin Camino Real GuatemalaLima: Mirafl ores Park, Westin Lima Hotel & Conven-

tion CenterManagua: Crowne Plaza ManaguaMedellin: Dann Carlton Mexico City: Four Seasons Hotel Mexico, D.F., Sheraton

María Isabel Hotel & TowersMontevideo: Radisson Victoria Plaza, Sheraton Montevideo

Radisson Panama City: Miramar Intercontinental, Panama Marriott,

Sheraton Panama Hotel & Convention CenterQuito: JW Marriott Quito, Sheraton Quito, Swissotel

QuitoRio de Janeiro: Sofi tel Rio de Janeiro Copacabana, Windsor

Atlantica, Windsor Barra San Jose: Crowne Plaza Hotel San José Corobici, Inter-

Continental Real San José San Juan: Caribe HiltonSan Salvador: Sheraton Presidente San SalvadorSantiago: Grand Hyatt Santiago, Ritz-Carlton, Santiago,

Sheraton Santiago Hotel & Convention CenterSanto Domingo: Occidental El Embajador, Meliá Santo Do-

mingoSao Paulo: Grand Hyatt Sao Paulo, Renaissance Sao

Paulo, Tivoli Sao Paulo MofarrejTegucigalpa: InterContinental Real Tegucigalpa

BEST VALUE FOR THE PRICE FOR

BUSINESS TRAVELERS IN GENERAL

Asuncion: Sheraton Asunción Bogota: Charleston Casa Medina, JW Marriott BogotáBrasilia: Brasil 21 Convention Suites, Meliá Brasil 21Buenos Aires: Hilton Buenos Aires, Meliá Buenos Aires, Sofi -

tel Buenos Aires

BEST OF TRAVEL

Exterior view from a hotel room in the Real Metrocentro Managua

PH

OT

O:

CO

UR

TE

SY

OF

IH

G

20 LATIN TRADE JANUARY-FEBRUARY 2013

Caracas: Eurobuilding Hotel & Suites, Gran Meliá CaracasGuadalajara: Crowne Plaza Guadalajara Guatemala City: Westin Camino Real GuatemalaLima: Meliá Lima, Mirafl ores Park, Westin Lima Hotel

& Convention Center Managua: Hilton Princess ManaguaMedellin: Holiday Inn Express MedellínMexico City: Meliá México Reforma Montevideo: Radisson Victoria PlazaPanama City: Deville Hotel Panama, El Panamá, TRYP by

Wyndham Panama CentroQuito: Holiday Inn Express Quito, Hotel Quito, Shera-

ton QuitoRio de Janeiro: JW Marriott Rio de Janeiro, Rio Othon Palace,

Sheraton Rio Hotel & ResortSan Jose: Aloft San José, InterContinental Real San JoséSan Juan: Caribe Hilton, Conrad San Juan Condado Pla-

za, InterContinental San Juan Resort & CasinoSan Salvador: Hilton Princess San SalvadorSantiago: Grand Hyatt Santiago, Sheraton Santiago Ho-

tel & Convention CenterSanto Domingo: Occidental El Embajador, Meliá Santo Do-

mingo Sao Paulo: Grand Hyatt Sao Paulo, Renaissance Sao

Paulo, Tivoli Sao Paulo MofarrejTegucigalpa: Tegucigalpa Marriott

BEST OVERALL SERVICE

Asuncion: Sheraton AsunciónBogota: Charleston Casa Medina, JW Marriott BogotáBrasilia: Meliá Brasil 21, Royal Tulip Brasilia Alvorada Buenos Aires: Alvear Palace, Four Seasons Hotel Buenos Ai-

res, Palacio Duhau Park HyattCaracas: Gran Melia Caracas Guadalajara: Westin Guadalajara Guatemala City: Westin Camino Real GuatemalaLima: Country Club Lima, JW Marriott Lima, Westin

Lima Hotel & Convention CenterManagua: InterContinental Real Metrocentro Medellin: InterContinental Medellín Mexico City: Four Seasons Hotel Mexico, D.F., JW Marriott

Mexico CityMontevideo: Radisson Victoria Plaza, Sheraton MontevideoPanama City: Le Meridien Panama, Marriott Panama, Mira-

mar InterContinentalQuito: Hilton Colon Quito, JW Marriott Quito, Swis-

sotel QuitoRio de Janeiro: Copacabana Palace San Jose: InterContinental Real San JoséSan Juan: Caribe Hilton, Ritz-Carlton, San Juan San Salvador: Sheraton Presidente San SalvadorSantiago: Grand Hyatt Santiago, Ritz-Carlton, Santiago,

W Santiago

Santo Domingo: Hilton Santo Domingo, Hotel Frances Mgal-lery, Meliá Santo Domingo

Sao Paulo: Fasano Sao Paulo, Grand Hyatt Sao Paulo, Hotel Unique

Tegucigalpa: Tegucigalpa Marriott

BEST REWARDS/LOYALTY PROGRAM

Asuncion: Sheraton Asunción Bogota: JW Marriott BogotáBrasilia: Meliá Brasil 21, Royal Tulip Brasilia Alvorada Buenos Aires: Hilton Buenos Aires, Marriott Plaza Hotel Bue-

nos Aires, Palacio Duhau Park HyattCaracas: Gran Meliá Caracas, Renaissance Caracas La

Castellana, Tamanaco InterContinental Guadalajara: Crowne Plaza Guadalajara, Westin GuadalajaraGuatemala City: Real InterContinental GuatemalaLima: JW Marriott LimaManagua: InterContinental Real Metrocentro Medellin: Four Points by Sheraton Medellín Mexico City: JW Marriott Mexico City, Presidente InterCon-

tinental Mexico City, Sheraton María Isabel Hotel & Towers

Montevideo: Radisson Victoria Plaza Panama City: Le Meridien Panama, Panama MarriottQuito: JW Marriott QuitoRio de Janeiro: Copacabana Palace, Sheraton Rio Hotel &

Resort

BEST OF TRAVEL

W Santiago in Chile

PH

OT

O:

CO

UR

TE

SY

OF

ST

AR

WO

OD

HO

TE

LS

ALAMEDA SANTOS, 1437 | CERQUEIRA CÉSAR

SÃO PAULO | SP | BRASIL

T: 55 11 3146 5900F: +55 11 3146 5901E: [email protected]

THE MOST EXCLUSIVE PLACE TO START DISCOVERING SÃO PAULO.A privileged location in the heart of Jardins, the

best neighborhood of São Paulo. Tivoli São

Paulo – Mofarrej is a member of the The Leading

Hotels of The World. The hotel has 220

apartments, equipped with the most recent

technological devices combined with its elegant

decor. All fully inspired to satisfy well-being and

provide exclusive comfort to our guests.

Whether you are travelling for pleasure or

business and need to unwind, choose a relaxing

treatment from many new and soothing options

available at Elements Spa, part of the prestigious

Asian Bayan Tree chain. The treatments involve

traditional Asian techniques improved along the

years, passed by generation to generation.

Lovers of good food are also well looked after at

our two international restaurants.

The Spanish 2 stars Michelin chef Sergi Arola is

at the helm of our stylish 23rd floor restaurant

called Arola Vintetres. He is the first Michelin

award winning chef to lead a restaurant in all of

the Americas. And Bistrô Tivoli is a French bistro

with a Brazilian contemporary touch, offering a

casual atmosphere in an informal environment.

At Tivoli São Paulo – Mofarrej, life assumes an

indescribable level of refinement and

sophistication, dedicated to all of those who

want to experience it.

1

2

3

4

TIVOLI SÃO PAULO - MOFARREJ

1- Arola Vintetres restaurant; 2- Presidencial Suite Mofarrej;3- Outdoor climate controlled swimming pool; 4- Collection Suite.

22 LATIN TRADE JANUARY-FEBRUARY 2013

San Jose: InterContinental Real San JoséSan Juan: Caribe Hilton, InterContinental San Juan Re-

sort & CasinoSan Salvador: Sheraton Presidente San SalvadorSantiago: Grand Hyatt Santiago, Ritz-Carlton, Santiago Santo Domingo: Hilton Santo Domingo Sao Paulo: Grand Hyatt Sao Paulo, Renaissance Sao

Paulo, Sheraton Sao Paulo WTCTegucigalpa: InterContinental Real Tegucigalpa

BEST CHECK IN-CHECK OUT SERVICE

Asuncion: Granados Park, Sheraton Asunción Bogota: B.O.G. Hotel, Charleston Casa Medina,

JW Marriott BogotáBrasilia: Royal Tulip Brasilia AlvoradaBuenos Aires: Four Seasons Hotel Buenos Aires,

Hilton Buenos Aires, Palacio Duhau Park HyattCaracas: Eurobuilding Hotel & Suites, Gran Melia

Caracas, InterContinental Tamanaco Guadalajara: Westin Guadalajara Guatemala City: Westin Camino Real GuatemalaLima: JW Marriott Lima, Meliá LimaManagua: InterContinental Real Metrocentro Medellin: InterContinental Medellín Mexico City: Four Seasons Hotel Mexico, D.F.,

JW Marriott Mexico City Montevideo: Radisson Victoria Plaza Panama City: Le Meridien Panama, Panama MarriottQuito: Swissotel QuitoRio de Janeiro: Copacabana PalaceSan Jose: InterContinental Real San JoséSan Juan: Caribe Hilton, El San Juan Resort & CasinoSan Salvador: Hilton Princess San Salvador Santiago: Ritz-Carlton, Santiago, W Santiago Santo Domingo: Hotel Frances Mgallery, Meliá Santo Domingo Sao Paulo: Grand Hyatt Sao Paulo,

Renaissance Sao Paulo, Tivoli Sao Paulo MofarrejTegucigalpa: Clarion Hotel Real Tegucigalpa

BEST OF TRAVEL

AIRLINES/RENTAL CARS

THE BEST AIRLINES FLYING IN LATIN AMERICA

Any list of the best — or worst — airlines fl ying in Latin America

today is noticeably shorter than it would have been a few years ago,

thanks to the continuing consolidation of the industry. LAN and

TAM have come together, although still fl ying as separate brands,

while the TACA name will disappear in 2013 as its parent, Avian-

caTaca Holding S.A., rebrands its various divisions under the Avianca

banner. Still, clear favorites appear in our expert panel opinions.

THE WINNERS1. Best food and beverage (in order) LAN, TAM/Copa (tie), Avianca, Emirates

2. Most comfortable cabins overall (in order) LAN, Avianca, TAM, Aeromexico, Copa, Emirates

3. Best business-class service (in order) LAN, American/Copa/TAM (tie for second), United

4. Best in-fl ight technology and entertainment (in order) LAN, American/TAM (tie for second), Delta, TACA

6. Best VIP lounges (in order) LAN, TAM, Aeromexico, American

7. Best on-the-ground service (in order) LAN, Copa, TAM, United, American

8. Best partnerships and alliances with other carriers Delta, LAN, Avianca, United

9. Best frequent fl yer program in terms of rewards (in order) American, LAN, Delta

10. Best overall route network for travelers in Latin America Copa, LAN, Avianca, TAM

11. Best luggage handling (in order) LAN, Copa, Avianca, TAM

12. Best with on-time arrivals/departure (in order) LAN, Copa, Avianca

LAN DreamLiner/Boeing 787-8

PH

OT

O:

CO

UR

TE

SY

OF

LA

N A

IRL

INE

S

© 2

01

2 C

HA

D S

LA

TT

ER

Y

24 LATIN TRADE JANUARY-FEBRUARY 2013

RENTAL CARS

BEST PAN-LATIN PRESENCE: AVIS BUDGET GROUP

Th e Avis brand maintains a presence at 337 locations around Latin

America, including 68 offi ces in Argentina, 4 in Bolivia, 85 in Brazil, 24

in Chile, 6 in Colombia, 75 in Mexico, 8 in Uruguay and 67 in Venezuela.

In Latin America, licensees operate every location of the Avis and Bud-

get brands except in Argentina, which is a corporate operation. “We are

seeing increases in travel to and from South America, and our intent is

to ensure that the trusted Avis brand is conveniently located to meet the

needs of both commercial and leisure travelers here,” says Patric Siniscal-

chi, president for Latin America/Asia Pacifi c at Avis Budget Group. Th e

company recently announced its intention to acquire Zipcar Inc., a com-

pany that specializes in car sharing, although no plans have been made

public about introducing that brand into Latin America.

ONE TO WATCH: DOLLAR THRIFTY AUTOMOTIVE GROUP

Hertz recently completed its acquisition of Dollar Th rifty, potentially

increasing this dual-brand company’s exposure in Latin America. Ac-

cording to Dollar Th rifty, Brazil holds a lot of potential for the division.

“We are experiencing robust growth in Brazil, where Th rifty Car Rental

has expanded operations to 32 cities across the country,” says Fernando

Intriago, executive director for Caribbean & Latin America operations at

Dollar Th rifty Automotive Group. Th e Caribbean and Latin America fi g-

ure heavily in the international operations of the company’s Dollar Rent

A Car brand, and Panama was cited as a major focus in Latin America

for both brands.

BEST NEW PARTNERSHIPS: ENTERPRISE HOLDINGS

In 2012, Enterprise announced two new franchising agreements: One to

bring the Alamo and National brands to three locations in Uruguay, and

another with Brazil-based rental car company Unidas to introduce both

Alamo and National in Brazil, starting with the fi ve largest international

airports. Enterprise maintains a franchise network for its National Car

Rental and Alamo Rent A Car divisions at more than 350 locations in 23

countries in Latin America and the Caribbean.

BEST NEW LUXURY OPTION: HERTZ CORPORATION

Travelers seeking a bit of luxury on the road in Mexico might want to

consider Hertz, which recently introduced its Prestige Collection there,

featuring vehicles like the BMW 325i. Hertz also provides Hertz Gold

Service in Mexico, and plans to expand to other Latin American coun-

tries in 2013. Hertz has more than 24,000 vehicles in Latin America and

the Caribbean, with franchises in Mexico, the Caribbean and Central and

South America; Hertz Puerto Rico and St. Th omas are the only corporate

operations in the region. Th e company recently signed up a new franchise

operator for Bolivia, leaving Guyana as the only South American nation

where the brand is not represented.

BIGGEST SOUTH AMERICA PRESENCE: LOCALIZA

In 2012, Localiza opened 29 new offi ces in Brazil, for a total of 464 of-

fi ces in that country alone, with a total fl eet of 107,312 vehicles. Th is

Brazil-based company operates 513 offi ces in 352 cities, with a presence

in Argentina, Bolivia, Colombia, Ecuador, Paraguay and Uruguay.

BEST DESTINATIONS

People look for diff erent things in diff erent cities, depending on the pur-

pose of their visit. Individual business travelers might be most concerned

with a decent airport experience, a good hotel and perhaps a pleasant

restaurant or two. Th ose involved with meetings, conventions and other

business-minded events need all those things too, as well as group-friend-

ly venues where they can spread out and get down to business.

In the following ratings, Latin Trade’s Expert Panel weighs in on all of

these aspects of Latin America’s top business destinations. In some cases,

ratings can vary widely — especially with airports, several of which are

in the midst of expansion and upgrades. In addition, new meeting and

convention spaces that are about to debut are already attracting business

as well as positive reviews even before their opening date, since meeting

planners work months or years ahead of time.

BEST OF TRAVEL

PH

OT

O:

©IS

TO

CK

PH

OT

O.C

OM

/BL

AC

KR

ED

26 LATIN TRADE JANUARY-FEBRUARY 2013

THE WINNERSAIRPORT RANKINGS

(“1” is bad, “5” is excellent) based on infrastructure, services, amenities

BEST NON-HOTEL MEETING SPACE

Asuncion: Yacht y Golf Club ParaguayoBogota: Club El NogalBrasilia: Centro de Convenções Ulysses Guimarães,

CICB — Centro Internacional de Convenções do Brasil (to open in 2013)

Buenos Aires: Centro Costa Salguero, La Rural, Faena Arts Center

Caracas: World Trade Center ValenciaGuadalajara: Expo GuadalajaraGuatemala City: Domo Polideportivo de la CDAG (Domo de la

Zona 13), COPEREX (Comité Permanente de Exposiciones)

Lima: Larcomar Managua: Centro Cultural de España en Nicaragua

Medellin: Centro de Convenciones Plaza Mayor Mexico City: La Hacienda de los Morales, Expo Bancomer

Santa FeMontevideo: IMM Centro de Convenciones, Torre de las

ComunicacionesPanama City: Centro de Convenciones Atlapa, Club de Golf

de Panamá Quito: Centro de Convenciones San FranciscoRio de Janeiro: RioCentro, Centro de Convenções SulAmérica San Jose: Teatro Nacional de Costa Rica San Juan: Puerto Rico Convention CenterSan Salvador: Centro de Ferias y Convenciones-CIFCO Santiago: Espacio Riesco, CasaPiedraSanto Domingo: Terminal Sansouci Sao Paulo: Ahhembi Parque, Centro de Convenções Re-

bouças, Expo Center NorteTegucigalpa: Centro de Convenciones Plaza Juan Carlos

EASE OF ORGANIZING A MAJOR CONVENTION

(“1” is very diffi cult; “5” is very easy)

Asuncion: 2Bogota: 3; “general security issues”Brasilia: 3.3Buenos Aires: 4; “Buenos Aires has lots of good hotels, is at-

tractive as a city, and has a good price/value relation.”

Caracas: 4; “general security issues”Guadalajara: 4; “easy access via plane from major gateways

in the US and Central America via Mexico City”

Guatemala City: 5 Lima: 3.75; “needs to improve communication access

and transportation”

Asuncion: 1Bogota: 4Brasilia: 3.3Buenos Aires EZE: 3 Buenos Aires AEP: 3 Caracas: 2.2Guadalajara: 3 Guatemala City: 4Lima: 3.5Managua: 2 Medellin: 3 Mexico City: 3 Montevideo: 3.3

Panama City: 4.3Quito: 3 Rio de Janeiro GIG: 2.5Rio de Janeiro SDU: 3.5San Jose, Costa Rica: 3 San Juan: 2San Salvador: 5 Santiago de Chile: 4.2Santo Domingo: 3 Sao Paulo GRU: 3.2Sao Paulo CGH: 2.8Tegucigalpa: 3

BEST OF TRAVEL

General view of Comalapa International Airport in El Salvador

PH

OT

O:

RO

BE

RT

O E

SC

OB

AR

/EP

A/N

EW

SC

OM

28 LATIN TRADE JANUARY-FEBRUARY 2013

Expert PanelEzequiel Barrenechea, director for Latin America & Caribbean, Corporación América, Buenos Aires; Luciana Belfort, manager, Ovation Rio/Ovation Global DMC, Rio de Janeiro;

Sandra Borello, president, Borello Travel, New York City and Buenos Aires; Francisco Cerezo, chair, Foley & Lardner LLP’s Latin America practice group and co-chair of the fi rm’s

international practice, Miami; Bryan D. Foat, senior sales executive, Bloomberg LP, Buenos Aires (Foat’s input refl ects his own personal opinions and not an endorsement on the part of

Bloomberg LP); Doris Dornheim, managing director, Condor Verde Travel, Caracas; Benedicto Grijalva, marketing director, Martsam Travel, Antigua Guatemala, Guatemala, www.

martsam.com; Gaelle Jacques, Mice director, Surtrek, Quito; Vera Joppert, director, Turismo Classico, Rio de Janeiro; Mariann Lentz, market manager of the Americas, Sportstour, San-

tiago de Chile; Aaron Paiva Leyton, general manager, Peru Magia y Misterio, Lima; Brian Pearson, founder and CEO, Santiago Adventures Ltda, Santiago de Chile; David Preciado,

director of sales and marketing, Latin America & Caribbean region, Th e Hertz Corporation, Miami; João H. Rodrigues, senior account director, Turner PR, New York City; Alonso

Roggero, country manager, Metropolitan Touring Peru, Lima; Ana Royo, CEO, Experience Panama DMC, Panama City; Emanuel Schreibmaier, president, Global Travel Leaders,

Doral, Florida, USA; Alejandro Verzoub, president, AV Business & Communication, Buenos Aires; Anonymous panel member, frequent business traveler, Miami, Florida.

Managua: 3Medellin: 3Mexico City: 4; “lots of convention hotels, easy access from

all of the Americas”Montevideo: 2.5Panama City: 5; “lots of convention hotels, easy access from

all of the Americas”Quito: 4 Rio de Janeiro: 4.3San Jose : 4; “limited hotel inventory in fi ve-star category”San Juan: 4.5; “easy access from all major gateways in the

US”San Salvador: 3 Santiago: 4.25; “lots of convention hotels, easy access from

all of the Americas”Santo Domingo: 3.5; “limited hotel inventory in fi ve-star category”Sao Paulo: 4.2; “lots of convention hotels, easy access from

all over the world”Tegucigalpa: 3

BEST OF TRAVEL

COST OF ORGANIZING A CONVENTION OR GROUP EVENT

Asuncion: Reasonable to inexpensive Bogota: Reasonable to expensiveBrasilia: Reasonable to expensive, “depending on time of the year” Buenos Aires: Reasonable to inexpensive Caracas: Reasonable to expensiveGuadalajara: Reasonable Guatemala City: Reasonable Lima: Reasonable to inexpensive Managua: Inexpensive Medellin: ReasonableMexico City: Reasonable to expensiveMontevideo: Reasonable to inxpensivePanama City: Reasonable to inxpensiveQuito: ReasonableRio de Janeiro: Reasonable to expensive, “depending on time of the year” San Jose: Reasonable San Juan: Reasonable to expensiveSan Salvador: Reasonable Santiago de Chile: Reasonable to expensiveSanto Domingo: Reasonable to inexpensiveSao Paulo: Reasonable to expensive, “depending on time of the year” Tegucigalpa: Reasonable

Colorful stage production with monitor displays

PH

OT

O:

©IS

TO

CK

PH

OT

O.C

OM

/ S

UR

PA

SS

PR

O

30 LATIN TRADE JANUARY-FEBRUARY 2013

BY PETER WILSON

INDUSTRY REPORT

When BNP Paribas began to put together

a $390 million loan for a Colombian

consortium to operate, manage and expand

the airport in the capital, Bogotá, many com-

mercial banks balked at participating.

Th e Opain consortium, made up of fi ve lo-

cal construction and infrastructure companies,

needed the funds to complete the terms of the

20-year, $1.2 billion concession contract they

won in 2007.

BNP Paribas, and its partner, Bancolombia,

met their customers’ needs by thinking out-

side the box. “Many commercial banks were

reluctant to take on 14-year debt at a time of

US dollar liquidity issues,’’ said Jean-Valery

Patin, managing director and head of BNP

Paribas Latin America.

“Th at is what made us think about seek-

ing help from multilateral lenders such as

the Inter-American Development Bank

(IDB) and the Development Bank of Latin

America.”

But in an added twist, BNP Paribas and

Bancolombia approached the China Develop-

ment Bank (CDB) even though it had mini-

mal experience in Colombia. Nonetheless, the

CDB put up $175 million for the loan, taking

the lion’s share of the credit facility. Th e IDB

approved $165 million and CAF $50 million.

“Th e idea to seek capital from China was

due to that country’s decision to join the IDB

as a non-borrowing member country,” said

Patin. “Th is was the fi rst time that the CDB

had participated in a transportation project in

Latin America.”

Innovation and creativity were necessary

ingredients last year in Latin America as

bankers faced the lingering eff ects of the US

fi nancial meltdown, as well as the crisis in the

Eurozone. Many fi nancial institutions were

still reluctant to lend. Others tightened re-

quirements. But deals did get done, and often

with unexpected benefi ts for clients.

Opain was a case in point. Th e inclusion of

multilateral lenders resulted in lower borrow-

ing costs and the certainty that the deal would

be made, said Philippe Birebent, a director at

BNP Paribas, who worked on the transaction.

“Our client wanted to be certain that they

would receive the funds, given the deadlines

for expansion works in the concession agree-

ment. Th at was paramount,” he said.

Th e involvement of the development banks

did come at a cost. More work was involved

because the loan concession not only had to

meet the requirements of Opain’s fi ve share-

holders, but also of the participating multilat-

eral lenders.

Slower execution is not uncommon in the

region. “In Latin America in general, deals

take a longer time to complete,” said Hernan

Rissola, head of advisory for Latin America

at HSBC Securities (USA) Inc. “Many of the

deals completed, and in the works, have a long

history.”

Many of the deals consummated in 2012

were years in the making, discussions starting

before the US meltdown and then concluding

as conditions improved. Regional diff erences

also played a part.

ALL IN THE FAMILY

Global players sometimes take a long time

to learn that building client relationships is

crucial in Latin America, especially as many

companies are family owned. Close ties and

long-term partnerships are key to deal making

in the region. In 2012, there were some inter-

esting examples.

HSBC helped broker a deal between

American paint company Sherwin-Williams

and Mexico’s biggest paint company Cons-

orcio Comex. Sherwin-Williams agreed to

acquire privately held Comex for $2.34 bil-

lion, the largest coatings transaction ever in

Latin America. Th e acquisition was also the

largest investment bank-driven sale in Mexico

in 2012.

HSBC was the sole fi nancial advisor to

Comex, a family-owned company, during the

sale. Long ties to the company meant every-

thing, said Rissola.

Bank of America Merrill Lynch parlayed

DealsYear

Lati

n Tr

ade’

s

of theFrom complex loan arrangements

to large-scale initial public off erings,

innovation was a hallmark of several

deals in 2012. Th ese are some of the

most interesting of the year.

JANUARY-FEBRUARY 2013 LATIN TRADE 31

PH

OT

O:

ER

IKA

SA

NT

EL

ICE

S/A

FP

/GE

TT

Y I

MA

GE

S/N

EW

SC

OM

INDUSTRY REPORT

Financial instruments and struc-tures in Latin America tend to follow trends and developments in Europe and North America. Accord-ing to bankers surveyed, there are reasons why Latin America lags in innovation and creativity.

The level of fi nancial sophistica-tion varies greatly throughout the region, often mirroring the state and health of the countries’ capital markets and the size of their middle class. Brazil, Chile and Mexico are regarded as the most developed markets; laggards include Venezu-ela and Ecuador.

Secondly, many businesses in Latin America remain in the hands of their founding families or govern-ments. For such businesses, fi nan-cial records – essential to putting deals together – are often lacking as the owners have minimal ac-countability. That makes it diffi cult to assess the veracity of any results they might care to share. Accoun-tants can be pressured to overlook fi nancial twists and turns, leading to unintended or blatant misrepre-sentation of facts, they say.

Government-owned businesses carry their own set of baggage. Governments can reverse their poli-cies, and seize previously privatized companies. Venezuela, for example, has resumed control over previously sold telephone, steel, and electricity companies with mixed results for the former owners.

And thirdly, banking and fi nancial instruments remain out of touch for many fi rms in the region due to their lack of projects. Given that, fi nancial institutions have little rea-son to think outside the box.

INNOVATION IN LATIN AMERICA

a good working relationship with the family

that owned the Dominican Republic’s larg-

est brewer, Cervecería Nacional Dominicana

(CND) into a deal that might serve as a

model for other mergers with family-owned

companies in the region.

“We had been advising the family that

owned Cerveceria for several years on various

matters and projects,” said Martin Sánchez,

who heads Bank of America’s mergers and

acquisitions unit in Latin America. “Many

families are very reluctant to engage in

straight sales of businesses. Personal relation-

ships are therefore very important in putting

deals together. You build trust with time. We

approached them with this idea.”

Bank of America proposed that the family

look into merging CMD with Ambev, the

Brazilian unit of Anheuser-Busch InBev, the

world’s largest brewer. Under terms of the

accord, that took two years to hammer out,

Ambev paid $1.23 billion for a controlling

interest in the resulting company.

Th e agreement brought together Ambev’s

exceptional operating capabilities and CND’s

strong footprint in the Caribbean, said San-

chez. “It’s a win-win deal for both parties,”

Sánchez said. “It creates value for each party.

It’s a strategic alliance. We think the resulting

deal that emerged (a joint venture instead of

a straight buyout) between Ambev and Cer-

veceria can be a model throughout the region

for family-owned companies.”

GOVERNMENT INTERESTS

Bank of America also successfully put to-

gether the merger of Colombia Telecomuni-

caciones, the country’s third-largest fi xed line

operator, and Movistar, which was the second-

largest mobile operator. Th e agreement also

included a restructuring of the payments to

the Colombian government’s pension fund.

“Th e biggest challenge to the deal was

arriving at the relative valuations of the com-

panies,” said Sánchez. “When Telefónica in-

vested in 50 percent of the fi xed line company

in 2006, who would have imagined that the

wired line businesses around the world would

suff er in a relatively short period of time ver-

sus wireless/integrated operations.”

“Making the agreement trickier was the

need to talk to the government to reduce its

participation in the new company, as well as

reshaping the government pension fund.” Th e

fund was in charge of administrating pension

payments to former Colombia Telecomunica-

ciones employees. Th e fund received payments

from the company as defi ned in the original

concession agreement.

As a result of the agreement, the govern-

ment took a 30 percent stake in the new com-

pany, with Telefónica retaining the remainder.

The president of Dominican brewer CND, Franklin Leon; the chairman of the board of directors of ELJ, Abel Wachsmann; and the vice-president of Ambev, Alexandre da Medicis Silveira. Brazilian Ambev acquired 51 percent of CND, making it the leading company of the sector in the Caribbean.

32 LATIN TRADE JANUARY-FEBRUARY 2013

INDUSTRY REPORT

Th e government also agreed to take the new

company’s payments to the fund.

Bank of America advised Telefónica, which

owned 50 percent of the fi xed-line operator,

and 100 percent of the mobile operator, on

all aspects of the agreement. “Th is was a very

complex deal as it involved two parties with

diff erent participations in two assets, the gov-

ernment and the restructuring of the pension

plan,’’ said Sánchez. “For the government, an

important consideration was to restructure its

participation in the context of creating a lead-

ing integrated player in the country.”

THE HOTTEST DEAL OF THE YEAR

Deutsche Bank, acting as one of four global

coordinators, successfully priced Grupo

Santander’s Mexican unit initial public of-

fering, which sold a 24.9 percent stake of the

company for $4.3 billion. Th e sale was the

largest Mexican IPO ever, the largest in Latin

America since 2009, and the ninth largest

bank IPO in the world in the last decade.

Key to its success was strong coordination

among the four leaders, said Deutsche Bank.

Th e quartet led a syndicate of 22 banks, and

11 international bookrunners. “Deutsche

Bank compiled a team of experienced bankers

to closely advise the issuer on every aspect of

the transaction,” the bank said in a statement.

Deutsche said key to the IPO’s success and

its oversubscription by fi ve times was a truly

global marketing eff ort, both before and dur-

ing the roadshow. Deutsche bankers visited

more than 500 clients and investors before

the sale.

Th e sale, although it took place during a

period of market volatility coming as it did on

the heels of concerns about Greek and Span-

ish fi nancial stability, was successful as the

bank stressed Santander Mexico’s dominant

position in retail banking and the opportuni-

ties for increased lending in the country. Th e

Mexican operation was very important for the

bank as it accounts for approximately 10 per-

cent of its global profi ts, which is very close to

the amount they receive in Spain.

Interestingly, Santander had sold a 24.9

percent share of the company in 2006 to Bank

of America, and bought it back in 2009. “So,

in eff ect, all they’re really doing is putting

the same 24.9 percent back into play,” said

Wharton lecturer Adrian Tschoegl in a recent

interview for knowledge@wharton.

On the same direction of tapping local

markets, another IPO attracting attention and

investor interest was Cemex LatAm Holdings’

$1.2 billion off er. Th e IPO was the second

largest ever off ered and executed in Colombia,

and was led by a quartet of global coordina-

tors: Bank of America, Santander, Banco Bil-

bao Vizcaya (BBVA) and Citibank.

Th e sale had a local public off ering in Co-

lombia and an international off ering as well.

Th e off er was oversubscribed by three times

with strong demand from international funds

leading the way.

Unique to the Colombian portion of the

sale was the IPO´s bookbuilding mechanism,

the fi rst time it was used in the country. ¨Citi

was the only global securities fi rm that could

structure, market and close this landmark

transaction, because of its integrated Colom-

bia-US banking and European capital mar-

kets and local brokerage capabilities, Citibank

said in a statement.

TOP NAMES

“In Brazil, Banco Pactual and Banco Itau are

the leaders without a doubt,’’ said one banker

who didn’t want to be identifi ed. “Th roughout

Government and corporate offi cials from Grupo Financiero Santander at the company´s IPO on the Mexican Stock Exchange.

PH

OT

O:

AG

EN

CIA

EL

UN

IVE

RS

AL

/EL

UN

IVE

RS

AL

DE

ME

XIC

O/N

EW

SC

OM

34 LATIN TRADE JANUARY-FEBRUARY 2013

INDUSTRY REPORT

the rest of the region, J.P. Morgan is the most

aggressive bank in going after new busi-

ness. Whenever we hear of an opportunity,

J.P. Morgan is usually already there. Th ey’re

tough.”

J.P. Morgan’s big deal of the year was its

handling of Chile’s Cencosud’s purchase of

Carrefour’s Colombian unit. “J.P. Morgan

provided Cencosud a unique competitive

advantage by delivering single-handedly an

integrated $2.5 billion debt commitment and

disbursement in a very short time frame, and

without having to tap other banks,” said the

bank’s former CEO for Latin America Nico-

las Aguzin, by email. Aguzin has since moved

to head the bank’s Asian Pacifi c unit.

Cencosud is Latin America’s third-largest

retailer. Th e company is expanding aggres-

sively throughout Latin America, where it has

bought several small to medium-sized retail

chains in Brazil over the last fi ve years.

Colombia’s growing economy, which was

forecast to grow by 5 percent in 2012, led

Cencosud to consider the deal. “To minimize

the risk of interlopers, J.P. Morgan committed

the full amount and only after the announce-

ment reached out to other institutions,”

Aguzin said. “We saw this as a key competi-

tive advantage for Cencosud.”

J.P. Morgan’s strategy also meant that

Cencosud could close the deal 60 days earlier

than competitors, and went a long way to-

wards convincing Carrefour that the Chilean

company was a credible buyer, Aguzin said.

Completion of the transaction made Cenco-

sud Latin America’s largest independent food

retailer.

Appetite for longer-term debt was also

more pronounced last year, as witnessed by

BNP Paribas’ management of a $527 million

debt placement for the Parque Rimac proj-

ect. Th e bond placement was for 25 years, a

record tenor, said Paribas. Th e overall project,

which carries a price tag of $983 million, is

for a brownfi eld urban toll road expansion in

Lima, Peru. Once completed, it will comprise

15 miles of highways. Lamsac (the conces-

sionaire) will operate the concession for 30

years under a contract with the Metropolitan

Municipality of Lima.

Last year’s strong momentum is expected

to carry through 2013, especially as the US

fi scal crisis seems to have been averted for

now, and worries about Europe subside. “We

look for increased activity in 2013,” said Ge-

rardo Mato, chief executive offi cer at HSBC

Global Banking Americas. “Th ere is more

and more interest in emerging markets and

in Latin America. “Mexico and Brazil will

always be the chief areas of interest, but we

are also seeing interest in Colombia and Peru.

Investors view companies in Chile as more

expensive and with lower growth potential

than in the rest of the region, but with more

stable cash fl ows.”

Bigger, more innovative deals: Th at is a

trend that was consolidated in 2012 and

which will surely continue this year as a liquid

world looks for investment opportunities.

Latin Trade wanted to recognize some of the

most important members of this sophisti-

cated fi nancial legion that in 2012 devised

interesting ways to place capital in productive

projects.

Peter Wilson reported from Miami.

Chilean retailer Cencosud offered its stock on the New York Stock Exchange

in 2012. Horst Paulmann, founder of the fi rm, at the helm.

PH

OT

O:

LA

SE

GU

ND

A/E

L M

ER

CU

RIO

DE

CH

ILE

/NE

WS

CO

M

Completion of the transaction made Cencosud Latin America’s largest independent food retailer.

36 LATIN TRADE JANUARY-FEBRUARY 2013

PH

OT

O:

©C

EC

IFO

TO

.CO

M

BY DAVID RAMÍREZ

SHOPPING FOR THE WELL-HEELED

Growth of the purchasing power of the region’s middle classes has

spurred commerce and an increase in opportunities for new com-

mercial projects in construction. Consumers prefer to shop in a single

area in order to save time from one to another. As a consequence, shop-

ping centers have arisen under the leadership of major chains of super-

markets and department stores that act as poles of attraction for the in-

dependent shops that surround them. Th e population’s increasing income

in real terms, meanwhile, has drawn the opening of luxury boutiques that

off er products from high fashion and jewelry to high-end automobiles.

Brazil appears to be the main magnet for luxury boutiques. Last

year, 28 new malls were opened, bringing the total to 458, with a

likely increase this year of 48, according to Abrasce, the association of

Brazilian boutiques. Th e proportion of unoccupied spaces is a mere

2 to 3 percent. Th e rental prices of top-class spaces are the highest in

the region. Real estate consultants Cushman & Wakefi eld reckoned

that the rental per square foot in Sao Paulo for such locations stood

at $309 toward the middle of last year, the most recent estimate avail-

able. By comparison, the rentals per square foot in the Chilean capital,

Santiago, were $97, in Lima $94, and in Mexico City $97. Bogota was

much closer to Sao Paulo at $250 per square foot.

FINANCIAL STRATEGIES: REAL ESTATE

The expansion of retail chains, the appearance of exclusive boutiques and consumers’ shopping habits are boosting commercial construction this year in Latin America. Investors in real estate are looking at double-digit returns.

Clients come to us.... for their contract

logistics and transportation

needs.

We deliver to them…

world class services and value added solutions…

with the people, processes and technology…

to make it all

happen.

JANUARY-FEBRUARY 2013 LATIN TRADE 37

FINANCIAL STRATEGIES: REAL ESTATE

Meet some of the thousands

of contract logistics and

distribution professionals at

UTi who can integrate our

value-added warehousing and

distribution solutions to your

business. Our single-source

solutions enable you to deliver to

your customers while we deliver

savings to your bottom line.

To fi nd out more about which

UTi CL&D solution best suits your

needs and view our team videos,

visit go2uti.com/videos.

Not a weak link in the chain

Exceeding their expectations…

time and

time again. Because what’s important to them… Is important

to us.

In Bogota, intense competition for land has soared, pushing up the

costs of rentals and real estate purchases in general, as it has in other Lat-

in American capitals. A similar phenomenon has persuaded boutiques in

Mexico City to opt to set up in already-established luxury malls. In the

Colombian capital, they have sought to seek out new constructions in

areas where land prices are highest.

On the other hand, developers of commercial projects that target

middle-class consumers have opted to tackle the shortage of land prices

by building in provincial cities or on the outskirts and marginal areas,

as well as underused locations of major population centers. One such

expansion has been in downtwn Bogota where the development of com-

mercial, housing and offi ce space has been backed by the local govern-

ment. Rental costs in the new development zones are about $6-$8 per

square foot, according to the estimates of Carlos Rico of the Century 21

real estate agency. Th is level, way below that of the luxury areas, can pro-

vide annual rental profi ts of 10-12 percent for the owners of the proper-

ties, and are thus attracting the interest of investors. Th e association of

Colombian malls, Acecolombia, forecasts that between last year and

2015, more than 45 malls will be opened and another 15 updated, for a

total investment of more than $2.2 billion.

Meanwhile, as Abrasce expects 48 malls to be opened in 2013 to bring

the total to 500, the Peruvian association of shopping centers, Accep,

forecasts 13 this year, up from the existing 35. As in other Latin Ameri-

can major cities, expansion of the leading retailers — most of them

Chilean — is boosting the construction of new commercial areas. As

Juan Agüero, of Coldwell Banker Perú, points out, Lima has enormous

potential for new centers, given that the penetration of inhabitants is 1.5

million per mall compared with the overall proportion in Latin America

of 2.5 million. Agüero adds that the new commercial developments

that aim for middle-class consumers off er average rental costs of $12

per square foot, providing investors with gross annual profi ts of some 15

percent.

In parallel with the surge in growth of major shopping centers in

Lima and other cities of the region, there has been a growing tendency

of construction of strip malls that are attracting investors, shops and con-

sumers. Álvaro Antadillas of the real estate brokers Colliers International

Panamá, says that the average profi tability of investors in Panama City’s

strip malls amounts to a gross 12 percent a year, per shop. Meanwhile,

this year, two major new shopping centers are to be built on the outskirts

of the capital that are expected to have a similar success to the new com-

plex opened in 2012 around the Tocumen International Airport.

Within the concept of strip malls along major streets and shop-

ping centers in residential and offi ce areas, real estate investors and

funds in the Costa Rican capital of San José are looking at annual

profi tability of 11 to 12 percent a year, according to the estimates

of Danny Quirós of Colliers International Costa Rica. People who

live in San José feel that new commercial areas where they live and

work are key to avoiding the growing traffi c that aff ects them and

other cities in the region. Th is year, the dynamics are expected to

be similar to those of 2012, when eight new shopping centers were

opened in the Costa Rican capital.

David Ramírez reported from Miami.

38 LATIN TRADE JANUARY-FEBRUARY 2013

PH

OT

O: C

OU

RT

ES

Y O

F A

IG

Back in 1919, when Cornelius Vander Starr founded AIG in Shang-

hai, he could scarcely have imagined that the fi rm that began in two

little offi ces in China would one day become one of the world’s top 10

insurance companies, only to face the setback of the 2008 crisis, over-

come it, and stage a vigorous recovery in 2012. He would probably have

imagined he had been dreaming if he were to see the major expansion

plans the company has for Latin America this year.

Th e 2008 crisis was no minor bump in the road. AIG had to bor-

row from the US Federal Reserve and Treasury in order to overcome

the setback. It even had to change its name to Chartis, sold part of its

assets – including some of its Latin American operations – staged a

recovery, and once again kept its competitors awake at night in order

to follow its progress.

BY SANTIAGO GUTIÉRREZ

CORPORATE STRATEGIES: AIG

STARTING OVER

With the problems of the 2008 crisis behind it and its former name restored, the insurer AIG is embarking on an expansion in Latin America.

“Latin America is very important to us,” said Ed Mena, AIG’s lead-

ing executive for Latin America and the Caribbean. Th e numbers prove

his point. AIG’s Latin American operation is growing at a rate of 20

percent, boosted by greater access to credit and growth of a middle class

whose younger members are now joining the labor market.

But Latin America is a very profi table place to be. Insurers are receiv-

ing a return on their assets that Franklin Santarelli of Moody’s reckons

to be 2.5 percent. Th e return in Brazil is slightly over 2 percent, but in

Central America it is more than 5 percent.

In addition, Mena says, the future holds a rich bounty of growth

thanks to the continuance of controls on infl ation combined with multi-

million investments in infrastructure. And there is plenty of room to

grow in the insurance industry; cover in the region is very scarce. On

average, Moody’s estimates that premiums in Latin America amount to

2 percent of GDP. Th e proportion rises to 3 percent in countries such as

Chile, but it falls well short of the 10 percent of GDP in Spain.

With its former name restored, AIG aims to make the most of its

opportunities by concentrating eff orts on Brazil, Mexico and Colom-

bia — three of the 29 countries where it has businesses in the region.