KYC Initiative

-

Upload

jeff-plein -

Category

Documents

-

view

99 -

download

0

Transcript of KYC Initiative

36 GRC Professional • December 2016

FinAnciAL criMe

small firms can find the cost of setting up a compliance department prohibitively expensive.

Looking ahead, the trend is clear – the regulatory burden is only going to increase over time. This means that the resources (both human and financial) required to collect, verify and maintain KYC and AML records will continue to increase. Furthermore, the risk based approach (RBA) further complicates the landscape, because each financial institution interprets regulatory policy through their own organisational lens, leading to non-standardised KYC and AML procedures.

As regulators cast the net ever-wider, it will become increasingly complex to operate across jurisdictions. This is especially true for heavy-documentation markets trading derivatives, structured products and non-exchange over- X

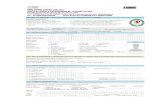

kYC and aml in the aPaC region: an innoVatiVe Solution to deeP-rooted ChallengeSJeff Plein, Chief Operating Officer of Fullerton Fund

Management, discusses the challenges that know your customer

(KYC) and anti-money laundering (AML) legislation have

introduced into the asset management industry, as well as

solutions on the horizon. “the industry as a whole is grappling withincreased KYc and AML requirements, although different firms face different challenges.”

KYC and AML regulations are becoming increasingly onerous for asset managers and our challenges are no different in that regard. We have seen our on-boarding and systems costs increase, and on-boarding times have also lengthened.

In addition to new customer on-boarding, we need to ensure that existing customer data is always up-to-date. For example in Singapore, fund managers are required to identify and screen mandated officials, the number of which can run into the thousands in some larger organisations. It is a major undertaking.

The industry as a whole is grappling with increased KYC and AML requirements, although different firms face different challenges. Global asset managers have to take cognisance of global regulations, while at the other end of the spectrum,

Jeff Plein, COO fullerton fund Management

37

FinAnciAL criMe

The challenges with existing KYC and AML client on-boarding processes do not end there.

The industry suffers from predominantly manual KYC and AML workflows, where audit trails are paper-based and not digitised. Manual workflows between teams may also result in inadvertent slippages of controls. Other areas of concerns include keeping track of the expiry of information, as well as managing voluminous anti-money laundering screenings.

It is also time consuming and not cost efficient for firms to search for information from independent public sources. In addition, un-harmonised global KYC and AML rules across multiple jurisdictions create tension with clients who are fatigued by multiple requests from various financial institutions.

So what is the solution? To help tackle these challenges, Fullerton recently selected Thomson Reuters Org ID, which will further help Fullerton follow best practices and remain up-to-date with KYC and AML regulations in Singapore, APAC and globally. From

the-counter (OTC) instruments, where marrying up the KYC and AML requirements with IMAs becomes more challenging by the day. One of the more immediate challenges relates to dated regulations, such as the pre-digitization requirement for hard copy, certified copies of documents.

From the client’s perspective, they also face a variety of challenges, including inconsistencies in data and documentation requests. These are a direct result of different interpretations of regulations. When coupled with disparate remediation cycles and additional ad-hoc requests, it can be frustrating for clients. If a client has multiple relationships, and each one interprets legislation differently, the administrative burden can become significant. The end result is longer on-boarding times, increased costs for both the client and the asset manager, and delays in launching mandates.

There is also growing concern about how sensitive client data is being consumed and stored. With identity theft on the rise, clients rightly want to know who is accessing their data and what is being done to protect it.

“there is also growing concern about how sensitive client data is being consumed and stored.”

X

38 GRC Professional • December 2016

FinAnciAL criMe

industry and our clients face: the ‘hassle tax’ involved in dealing with KYC and AML documentation-related requests. If we can remove this tax and save our clients time and money in responding to KYC requests, whilst ensuring that their private information is kept safe, then we will create an incentive for widespread adoption of this model.

Finally, there are two drivers for the successful adoption of a centralised solution:

• Regulatory support – the in• Industry needs the regulator(s) to publicly

support the use of a centralized model.• Community support – the community of banks

and asset managers should collectively agree to centralize their own data and encourage clients to do the same. With this momentum, the efficiencies of a centralized solution will become obvious in a very short time.

• The opportunity to materially change the way the industry conducts KYC and AML is real. There is no better time for the asset management industry to work together to drive positive change in a very meaningful and impactful way. •••

Biography Jeff Plein is the COO of Fullerton Fund Management. He is responsible for Fullerton’s Compliance, Finance, Investment and Fund Operations, Legal, Risk, and Technolog y globally. Prior to Fullerton, Jeff held senior business operations roles in Asia Pacific at PIMCO and BlackRock. Most recently Jeff was Managing Director, Head of Operations at BlackRock, and subsequently Head of Institutional Operations. Jeff has worked in Asia Pacific for 20 years and has 14 years of investment management experience.

an operational perspective, this selection improves efficiency for our staff, because Org ID collects, verifies, screens and continuously monitors entities and related parties, highlighting risks throughout the process. This allows our staff to concentrate on more value-add tasks (such as making risk-based decisions on PEPs, sanctions and adverse media) that inform our ultimate decision on whether or not to on-board a client.

Perhaps the biggest benefit of this solution is one that I envision will accrue to the industry as a whole – the concept of centralising the KYC and AML process. We work in an industry where there are multiple firms on-boarding the same client. Clearly, there has to be a significant benefit for the client, where the client record is created once and then maintained and shared between all the entities with whom the client works. The expected end result is reduced costs, shorter on-boarding times and less of a regulatory burden for individual asset managers. In turn, this will improve the customer experience: clients will only have to provide data and documents to a centralized service once.

Singapore benefits from a progressive and supportive regulator who actively encourages the market to look for solutions and improve market conduct. Certain Singapore banks are already looking at innovative solutions for the banking sector. Other financial service communities, including asset management, should also progress in this area – or risk being left behind. The adoption of a centralised KYC and AML model eliminates this risk.

I believe the starting point to centralisation may be developing a standardised policy across banks and asset managers. Standardisation will go a long way towards alleviating some of the pain around the interpretation of the policies driving data and documentation collection. Having a standardised operating model, underpinned by digitisation, will drive efficiencies and lower costs.

In the asset management community, there is a significant overlap of clients across firms. Instead of each firm performing KYC and AML on a single client many times, a centralised KYC and AML model will create a client record once and share that output amongst many asset managers and banks, leading to lower costs for both the client and the asset manager.

The main drivers of the adoption of a centralised model are cost, efficiency, regulatory compliance and data security. There is one additional driver that the

“i believe the starting point to centralisation may be developing a standardised policy across banks and asset managers. standardisation will go a long way towards alleviating some of the pain around the interpretation of the policies driving data and documentation collection.”