KPMG @ PDAC 2014

-

Upload

kpmg-canada -

Category

Business

-

view

1.009 -

download

3

description

Transcript of KPMG @ PDAC 2014

2014 PDAC Seminar Show me the money! Lee Hodgkinson National Industry Leader, Mining Canada March 4, 2014

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

KPMG – 14 Mining Centers of Excellence Around the Globe

14/03/2014 2 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

KPMG – Industry tailored solutions through all stages of a mine

14/03/2014 3 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated 14/03/2014 4 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

SHOW ME THE MONEY!

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

• Our objective when managing capital is to provide value for shareholders by maintaining an optimal short-term and long-term capital structure in order to reduce the overall cost of capital while preserving our ability to continue as a going concern.

• Our capital management objectives are to safeguard our ability to support our operating requirements on an ongoing basis, continue the development and exploration of our mineral properties and support any expansion plans.

• Our objectives are also to ensure that we maintain a strong balance sheet and optimize the use of debt and equity to support our business and provide financial flexibility in order to maximize shareholder value.

14/03/2014 5 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

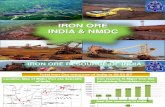

Global Mining Equity Raised

14/03/2014 Source (ThomsonOne) 6

$63

$52

$36

$28 $22

697 1,008

973

771

482

200

400

600

800

1,000

1,200

1,400

1,600

1,800

$

$10

$20

$30

$40

$50

$60

$70

2009 2010 2011 2012 2013

Volum

e V

alue

($ b

illio

ns)

Value Volume

© 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

The State of the Mining Industry

817 companies with less than $200,000 left

14/03/2014 7

500 companies have a market cap of less than $1 million

There are around 500 companies with negative working capital totaling $1.6 billion

© 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Panel

14/03/2014 8

David S. Bryson Senior Vice President & Chief Financial Officer HudBay Minerals Inc.

Carol Banducci Executive Vice President & Chief Financial Officer IAMGOLD Corporation

Mark Brennan Chief Executive Officer & President Largo Resources Ltd.

© 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

TSX: IMG NYSE: IAG

Carol Banducci EVP and CFO KPMG’s PDAC Seminar – March 4, 2014

Case Study: High-Yield Debt

YATELA SADIOLA

Boto Siribaya

Introduction to IAMGOLD

10 Mid-Tier Gold Producer Operating on Three Continents

GOLD Mines Development Project Advanced Exploration

Exploration Office

ESSAKANE Senegal

Burkina Faso

Mali

WESTWOOD

MOUSKA

NIOBEC Val d’Or

Côté Gold ROSEBEL

Brazil

Suriname Colombia

Peru Niobium Mine

Founded 1990

6 gold mines

835,000 oz. in 2013

Niobium mine among world`s top 3

NORTH AMERICA

WEST AFRICA

SOUTH AMERICA

11

IAMGOLD’s Inaugural High-Yield Bond Offering

$650M Senior Unsecured Notes

6.75% coupon

8-year term due 2020

Subordinated to Credit Facilities

Private Placement (144A /Reg S)

Primarily U.S. and Canadian institutional investors

12

Why High Yield Debt?

Low interest rates driving demand for yield

Balances capital structure

No bank debt and $750M credit facilities

Strong financial base and cash flow

Ability to service debt

13

Key Steps

Selection of lead banking partner(s) & ratings advisor

Selection of credit rating agencies (Moody’s/S&P)

Lengthy and intensive discussion to obtain ratings

Offering memorandum and other legal due diligence

5-day roadshow targeting U.S./Canadian institutional investors

Issuance amount established on last day of roadshow

Announcement – key terms, structure, pricing, credit rating

14

Credit Rating Process

Objective was to achieve strong, but sustainable ratings

Lead bank ratings advisory service valuable to understanding rating agency methodologies and concerns

Early introductory meetings with rating agency analysts

Agency view of sector limited; lack of similar-sized comparable companies problematic and challenging

Focus on enhancing rating agency knowledge and understanding of IAMGOLD

Final rating committee meetings

Three months turned into six months

15

Expected a Focus on:

Business model and overall strategy

Current and future cash flow volatility

Financial stability and conservatism

Financial and credit metrics

Geographic diversification

Sovereign risks

Risk levels and ability to mitigate risk

16

Risk Management became Primary Focus

Lack of familiarity with geographic regions

Lack of sovereign/country credit ratings for Mali and Burkina Faso, compounded by coup in Mali

Resource nationalism perceived to be predominant risk

Cross-functional team with Corporate Affairs and Internal Audit playing a critical role

In-depth review of Enterprise Risk Management Identification and management of

geopolitical risk Global Corporate Affairs Program Significant economic contribution to

host countries

Perception Gaps Intense Risk Management Review Required

17

Lessons Learned

Executive level commitment

Start months in advance of funding

Use lead bank advisory services

Tailor message to bond investors

Anticipate hot buttons

Perceptions can be reality

Don’t underestimate need to address both qualitative and quantitative elements of the business

Maintain ongoing relationships with bondholders

TSX: IMG NYSE: IAG

Investor Relations [email protected]

Bob Tait VP, Investor Relations T: 416-360-4743

Laura Young Director, Investor Relations T: 416-933-4952

Penelope Talbot-Kelly Analyst, Investor Relations T: 416-933-4738

KPMG’s PDAC Seminar March 4th, 2014

March 4, 2014

HBM

KPMG Financing Seminar

About Hudbay

KPMG FINANCING SEMINAR l 20

Integrated base and precious metals mining company that became publicly traded in 2004

Operating mines, development projects and processing facilities located in the Americas

Long track record of operating success in Flin Flon Greenstone Belt

Nearly 90 year history where we have developed and operated 28 mines

Disciplined and clear growth strategy focused on enhancing per share metrics

Focused on value creation through exploration, mine development and efficient operations

TSX, NYSE, BVL Symbol HBM

Market Capitalization1 $1.7 billion

Shares Outstanding 193 million

Available Liquidity $1.4 billion

Long-Term Debt (2020) $750 million

1.Based on Hudbay’s TSX closing share price on February 20, 2014

Precious Metal Stream Overview

US$885 million in upfront deposit payments from Silver Wheaton for delivery of:

100% of payable gold and silver from 777 mine until the end of 2016; and 50% of payable gold and 100% of payable silver thereafter for the remainder of life of mine 100% of payable silver and 50% of payable gold from Constancia project Along with upfront payments, Hudbay will receive US$400 per ounce for gold and US$5.90 per ounce of silver1

Provided $885 million of approximately $1.8 billion in non-dilutive external financing arranged for Lalor and Constancia projects

1Subject to 1% annual escalation starting 2015

KPMG FINANCING SEMINAR l 21

Stream Financing – Funding Objective

Overall objective: Minimize cost of capital, while maintaining access to capital and strategic flexibility Stream characteristics:

Aspects of both debt and equity (but more equity-like) Best thought of as the sale of an asset that produces (or is expected to produce) cash flow

• Limited repayment obligations • No dilution to shareholders

Selling a stream limits future debt capacity of the encumbered asset

Most appropriate for assets that are non-core and receive a higher valuation in the stream than embedded in the core business

e.g. Precious metal production from a base metal asset

KPMG FINANCING SEMINAR l 22

Comparison of Funding Options

Capital Type Strategic Flexibility

Capital Source Approximate After-Tax Cost of

Capital

Debt

Low Bank Debt 5.1%1

Unsecured Bonds 6.9%2

Gold/Silver Stream <8.0%3

Equity

High Common Equity >10.0%4

KPMG FINANCING SEMINAR l 23

1 Assumes long-term LIBOR rate of 2.5% and LIBOR margin of 4.5%, income tax rate of 27%. 2 Based on interest rate of 9.5% and income tax rate of 27% 3 Source: CIBC World Markets, “Streaming to Fund Constancia”, August 9, 2012 4 Hudbay estimate

Conclusions

Streaming has evolved to become a mainstream tool in mining finance Attractive cost of capital relative to equity More flexible than other non-equity funding options Most attractive for deposits with byproduct credits with the potential to unlock value

Critical to ensure that the consequences of a stream are fully understood Typically a life-of-mine transaction – mistakes can be costly In mine development financing, need to understand how the stream affects other necessary sources of capital Accounting and tax considerations are complex

KPMG FINANCING SEMINAR l 24

For more information contact:

David Bryson, Senior Vice President and Chief Financial Officer

Tel: 416.362.4759 Email: [email protected]

The Northern Lights at 777 Mine

TSXV: LGO

Best Mining Deal

www.largoresources.com

Near Term VANADIUM Producer

PDAC March 2014

CORPORATE PRESENTATION

Metals and Mining Deal of the Year

TSXV: LGO

Forward Looking Statements

The information presented contains “forward-looking statements,” within the meaning of the United States Private Securities Litigation Reform Act of 1995, and “forward-looking information” under similar Canadian legislation, concerning the business, operations and financial performance and condition of the Company. Forward-looking statements and forward-looking information include, but are not limited to, statements with respect to the estimation of mineral reserves and mineral resources; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; metal prices and demand for materials; capital expenditures; success of exploration and development activities; permitting time lines and permitting, mining or processing issues; government regulation of mining operations; environmental risks; and title disputes or claims. Generally, forward-looking statements and forward-looking information can be identified by the use of forward-looking terminology such as “plans,” “expects” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates” or “does not anticipate,” or “believes,”, “projects” or variations of such words and phrases or state that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,” “occur” or “be achieved.” Forward-looking statements and forward-looking information are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including, but not limited to, unexpected events during operations; variations in ore grade; risks inherent in the mining industry; delay or failure to receive board approvals; timing and availability of external financing on acceptable terms; risks relating to international operations; actual results of exploration activities; conclusions of economic valuations; changes in project parameters as plans continue to be refined; and fluctuating metal prices and currency exchange rates. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except in accordance with applicable securities laws.

Investors are advised that National Instrument 43-101 of the Canadian Securities Administrators requires that each category of mineral reserves and mineral resources be reported separately. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated or Inferred Resources The information presented uses the terms “measured,” “indicated” and “inferred” mineral resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally mineable.

27

TSXV: LGO 28

Production in sight.

As at October 10, 2013

Project as at February 20, 2013

TSXV: LGO

Maracas Vanadium Project

Vanadium Project in Brazil Highest grade, quality; lowest cost project Funded and in construction Commissioning in Q1, 2014 Glencore Off-take: 100% Take-or-Pay

29

Metals and Mining Deal of the Year

Best Mining Deal

Recent Construction Milestones Electrical power line commissioned Oct/13 Crushing commissioned Oct/13 Milling & beneficiation commissioned Feb/14

TSXV: LGO

Vanadium – Few Substitutes

30

2lbsV 1 Tonne of Steel 2X

Strength

Highest strength to weight ratio of any alloy

Source: vanitec.org

TSXV: LGO

Uses of Vanadium

31 Source: Roskill, 2013

91%

4.5% 3.5% 1%

Steel Alloy Titanium Alloy Chemical Catalyst Other

48%

35%

14% 3%

High Strength Low Alloy Full Alloy Carbon Steel Other

Uses of Vanadium

Vanadium in Steel High Strength Low Alloy Steels are the leading market for vanadium in the steel industry

Steel is the largest end-use for vanadium

TSXV: LGO 32

Rebar for construction

Buildings, bridges, tunnels

Automotive parts

Pipelines

Aviation and aerospace

Power lines and power pylons

Chemical plants, oil refineries, offshore-platforms

Various tools and dies

High strength steel structures

Construction machinery and equipment

Cast iron used for rolls in steel mills

Vanadium is Everywhere

Source: Vanitec

TSXV: LGO

Maracas – Ideal Location

33

Mining friendly jurisdiction

Government and local support Arid climate, ideal topography Management with regional experience Strong tax incentives Local familiarity with mining

Metals and Mining Deal of the Year

Best Mining Deal

TSXV: LGO

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

South African Australian Maracas

Cost Advantage

*Average grade comparisons compiled by Les Ford, presentation March 8, 2011 34

Highest Grade/Quality Vanadium Deposit in the World

Ore V2O5% Concentrate SiO2% Concentrate V2O5%

Higher head-grade and

higher iron content Concentrate has much

higher V2O5

Concentrate has fewer contaminants

like silica

= LOWEST

COST PRODUCTION

Higher Recoveries

Less Energy Required

Lower reagent costs

Results in

TSXV: LGO

Maracas Project Economics*

35 *As outlined in 2013 Preliminary Economic Assessment **including iron ore byproduct credit – OPEX without credit is $3.18 (still lowest cost producer) ***Average years 1-15

Net Present Value $554 million After tax IRR 26.3% Discount rate 8% Exchange rate (BRL:USD) 2:1 Average Production 11,400 t V2O5 equiv Mine life 29 Years Initial CAPEX 235 million OPEX $2.10** V2O5 price – 3 year avg $6.37 Average annual cashflow $89 million***

Includes taxes, royalties, and sustaining capex

TSXV: LGO

Low Cost Environment

Open pit mining At surface deposit Highly magnetic ore Few contaminants Water leaching process

36

Ore provides better recoveries and reduces input costs

*including iron ore byproduct credit - OPEX without credit is $3.18 (still lowest cost producer)

TSXV: LGO

Production Profile

37

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

$0

$20

$40

$60

$80

$100

$120

$140

2014 2015 2016 2017 2018

Pro

duct

ion

Cas

h-flo

w (M

ILLI

ON

S)

Free Cashflow ($M) Operating Cashflow ($M) Tonnes V2O5 Equiv.

Phase 1 (10,000 Tonnes Capacity)

Initial Ramp Up, Implementing

Expansion & FeV Plant

Phase 2 (15,000 Tonnes Capacity)

Expanded Production rates & FeV

*As outlined in 2013 Preliminary Economic Assessment **Does not include debt repayment

TSXV: LGO

Maracas Environment

38

Gulcari “A” Open Pit

Main Access Road

Admin Facilities

Roasting (kiln)

Crushing

1 km

Milling Leaching

Desilication Precipitation

Final Product

Project as at December 11, 2013

Tailings

Tailings

TSXV: LGO

Maracas Deposit Outcrop

39

25 meters of ore at surface

150 meters

Magnetite (ore)

Gabbro (waste)

◦ Dips at 65

TSXV: LGO

Maracas Construction

40

Project as at February 20, 2013

TSXV: LGO

Corporate Structure

41

Stock symbol: LGO – TSX-V

Share price (Jan 24, 2013): $0.28

Shares issued (Basic): 982 million

Market Cap C$275 million

52-week High/Low: $0.305 / $0.155

Management & Institutions: 75%

Warrants & Options (Basic): 253 million

Cash: $38.5 million

Debt: $159 million

Institutional Shareholders

Arias Resource Capital - 25.9%

Mackenzie Investments - 14.3%

Eton Park Capital Management - 11.1%

Ashmore Investment Management - 11.4%

Shareholders & Project Partners

Project Finance Deal of the Year Awards - March 2013

Project Partners

Glencore International 100% 6 yr take-or-pay off-take for Maracas

Business Development Bank of Brazil

Bank Itau, Votorantim, Bradesco

*Cash based on last reported financial statement – September 30, 2013

Questions & Answers

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

14/03/2014 43 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

How important is an effective

communication strategy with your shareholders and other stakeholders when executing a financing, and what does that look like?

14/03/2014 44 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

There has been lots of discussion around Private Equity in the mining space, and about new funds being created.

There is also a view that these funds will

need to deploy some of the capital raised sooner rather than later, do you think we will need significant activity in 2014, and what may that look like?

14/03/2014 45 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

We have discussed streaming at Hudbay. Streaming seems to bring out passions in the industry unlike other forms of financing. Some love it, others do not! When is the right time for streaming?

14/03/2014 46 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

How do you factor in capital allocation in terms of your financing strategy, does the ability to raise money drive what you can spend, or does what you want to spend money on drive your financing?

14/03/2014 47 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

How do you get noticed in the marketplace? The Canadian landscape is very crowded with companies, and projects and any investors who want to invest in the industry have a plethora of choices, how do you get your story out there?

14/03/2014 48 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

Q&A

14/03/2014 49 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

© 2010 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated

“There is nothing so disastrous as a rational investment policy in an irrational world”

John Maynard Keynes

14/03/2014 50 © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

Thank You

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. Any trademarks represented in this communication are the property of their respective owner(s). © 2014 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. The KPMG name, logo and “cutting through complexity” are registered trademarks or trademarks of KPMG International.