Kiedy warto podnosić wiek emerytalny?

-

Upload

grape -

Category

Data & Analytics

-

view

212 -

download

0

Transcript of Kiedy warto podnosić wiek emerytalny?

Old vs young. Aging under different pension schemes.

Old vs young. Aging under different pension schemes.

(with Marcin Bielecki, Jan Hagemejer and Joanna Tyrowicz)

Karolina GorausPhD Candidate

Faculty of EconomicsUniversity of Warsaw

31 March 2013

Old vs young. Aging under different pension schemes.

Table of contents

1 Motivation and insights from literature

2 Model setup

3 Baseline and reform scenarios

4 ResultsBasic scenarioRobustness checks

Old vs young. Aging under different pension schemes.

Motivation and insights from literature

Motivation

Current problems with pension systems:

increasing old-age dependency ratio

majority of pension systems fails to assure actuarial fairness

in most countries people tend to retire as early as legally allowed

Typical reform proposals

switching to individual accounts’ systems

raising the social security contributions per worker

introducing general fiscal contraction

increasing the retirement age!

Old vs young. Aging under different pension schemes.

Motivation and insights from literature

Literature review

Two streams of literature:

1 Answering the question about optimal retirement age

2 Comparing different pensions system reforms: increasing retirement agevs. cut in benefits/privatization of the system/...

Fehr(2000)

Macroeconomic effects of retirement age increase may depend on the existingrelation between contributions and benefits!

Remaining gaps in the literature

We increase retirement age...

how the macroeconomic effects differ between various pension systems?

what happens to the welfare of different generations?

Old vs young. Aging under different pension schemes.

Motivation and insights from literature

Goals and expectations

Goal

Analyse macroeconomic and welfare implications of retirement age increaseunder DB (defined benefit), NDC (notional defined contribution), and FDC(funded defined contribution) systems

Tool

OLG models with first steady states calibrated to result in the samereplacement rate

Expectations

under DB: leisure ↓, taxes ↓, welfare?

under NDC: leisure ↓, pensions ↑, welfare?

under FDC: leisure ↓, pensions ↑, welfare?

What else makes the results less predictable? → Labor supply adjustments,general equilibrium effects...

Old vs young. Aging under different pension schemes.

Model setup

Model structure - consumer I

is ”born” at age J = 20 and lives up to J = 100

optimizes lifetime utility derived from leisure and consumption:

U0 =J∑

j=1

δj−1πj,t−1+juj(cj,t−1+j , lj,t−1+j) (1)

where δ is the time discounting factor and πj,t denotes the unconditionalprobability of a household of having survived from birth to age j at timeperiod t (accidental bequests are spreaded equally to all cohorts).

The instantaneous utility function takes the theGreenwood-Hercowitz-Huffman (GHH) form:

u (cj,t , lj,t) =1

1− θ

(cj,t − ψt

l1+ξj,t

1 + ξ

)1−θ

− 1

, (2)

Old vs young. Aging under different pension schemes.

Model setup

Model structure - consumer II

is paid a market clearing wage for labour supplied and receives marketclearing interest on private savings

is free to choose how much to work, but only until retirement age J̄(forced to retire)

The budget constraint of agent j in period t is given by:

(1 + τc,t)cj,t + sj,t + Υt = (1− τ ιj,t − τl,t)wj,t lj,t ← labor income (3)

+ (1 + rt(1− τk,t))sj,t−1 ← capital income

+ (1− τl,t)pj,t + bj,t ← pensions and bequests

Old vs young. Aging under different pension schemes.

Model setup

Model structure - producer

Firms solve the following problem:

max(Yt ,Kt ,Lt )

Yt − wtLt − (r kt + d)Kt (4)

s.t. Yt = Kαt (ztLt)

1−α

Standard firm optimization implies:

the average market wage wt = (1− α)Kαt (ztLt)

−α (there might beheterogeneity between cohorts if age-specific productivity is assumed)

interest rate r kt = αKα−1t (ztLt)

1−α − d , where d stands for depreciation

Old vs young. Aging under different pension schemes.

Model setup

Model structure - government

collects social security contributions and pays out pensions of DB andNDC system

subsidyt = τt · wtLt −J∑

j=J̄

pj,tπj,tNt−j (5)

collects taxes on earnings, interest and consumption + spends GDP fixed amountof money on unproductive (but necessary) stuff + servicing debt

Tt = τl,t

(wtLt +

J∑j=J̄

pj,tπj,tNt−j

)+(τc,tct + τk,t rtsj,t−1

) J∑j=1

πj,tNt−j (6)

Γt = Gt + (1 + rgt )Dt−1 − Dt + subsidyt (7)

wants to maintain long run debt/GDP ratio fixed

Old vs young. Aging under different pension schemes.

Baseline and reform scenarios

Pension systems

Defined Benefit → constructed by imposing a mandatory exogenouscontribution rate τ and an exogenous replacement rate ρ

pDBj,t =

{ρtwj−1,t−1, for j = J̄t

κDBt · pDB

j−1,t−1, for j > J̄t(8)

Defined Contribution → constructed by imposing a mandatory exogenouscontribution rate τ and actuarially fair individual accounts

Notional

pNDCj,t =

∑J̄t−1

i=1

[Πis=1(1+r It−i+s−1)

]τNDCJ̄t−i,t−i

wJ̄t−i,t−i lJ̄t−i,t−i∏Js=J̄t

πs,t, for j = J̄t

(1 + r It )pNDCj−1,t−1, for j > J̄t

(9)Funded

pFDCj,t =

∑J̄t−1

i=1

[Πis=1(1+rt−i+s−1)

]τFDCJ̄t−i,t−i

wJ̄t−i,t−i lJ̄t−i,t−i∏Js=J̄t

πs,t, for j = J̄t

(1 + rt)pFDCj−1,t−1, for j > J̄t

(10)

Old vs young. Aging under different pension schemes.

Baseline and reform scenarios

Reform of the systems

Three experiments:

1 DB with flat retirement age → DB with increasing retirement age

2 NDC with flat retirement age → NDC with increasing retirement age

3 FDC with flat retirement age → FDC with increasing retirement age

What is flat and what is increasing retirement age?

flat: 60 years old increasing:

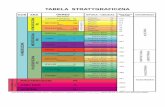

Old vs young. Aging under different pension schemes.

Baseline and reform scenarios

Welfare analysis - like Nishiyama & Smetters (2007)

What happens within each experiment?

1 Run the no policy change scenario ⇒ baseline

2 Run the policy change scenario ⇒ reform

3 For each cohort compare utility, compensate the losers from the winners

4 If net effect positive ⇒ reform efficient

Basic scenario

demographic profile includes both decreasing mortality and fertility rates

flat age-productivity profile

Robustness checks

alternative demographic projection

alternative age-productivity pattern

Old vs young. Aging under different pension schemes.

Results

Basic scenario

Baseline levels

Capital Aggregate labour supply Benefits

Subsidy as % of GDP Interest rate Labour tax

Old vs young. Aging under different pension schemes.

Results

Basic scenario

Effects of retirement age increase (relative to the baseline)

Capital Aggregate labour supply Benefits(ratio) (ratio) (ratio)

Subsidy as % of GDP Interest rate Labour tax(p.p. difference) (p.p. difference) (p.p. difference)

Old vs young. Aging under different pension schemes.

Results

Basic scenario

Welfare effects

Welfare effects: Consumption equivalent Table: Individual labor supply effects

Baseline ReformDB 58.1% 58.0%NDC 58.7% 58.2%FDC 59.8% 58.8%

Old vs young. Aging under different pension schemes.

Results

Robustness checks

Alternative scenarios

Table: Consumption equivalents as % of permanent consumption

Productivity Demographics DB NDC FDCFlat Baseline 20.5% 18.3% 26.8%Flat Stable fertility 20.7% 18.8% 27.3%

Deaton Baseline 35.0% 29.5% 42.1%Deaton Stable fertility 35.1% 29.9% 42.6%

Old vs young. Aging under different pension schemes.

Results

Robustness checks

Conclusions

extending the retirement age is universally welfare improving

this effect is strongly enhanced if productivity is increasing in age

agents adjust downwards the average labor supply, but theaggregated supply increases

lower savings imply decrease in per capita capital and output

Old vs young. Aging under different pension schemes.

Results

Robustness checks

Questions or suggestions?

Thank you!