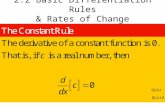

2.2 Basic Differentiation Rules & Rates of Change Quiz Quiz2.

KeyFIN2700 Quiz2!2!2012 Bangna.docx

-

Upload

pasinee1234 -

Category

Documents

-

view

84 -

download

3

description

Transcript of KeyFIN2700 Quiz2!2!2012 Bangna.docx

FIN 2700 Money, Banking and Financial Markets Quiz 2 (2/2012)Bangna

ASSUMPTION UNIVERSITYMARTIN DE TOURS SCHOOL OF MANAGEMENT

DEPARTMENT OF FINANCE AND BANKINGQUIZ 2(2/2011)

COURSE TITLE : FIN2700 Money, Banking and Financial MarketsLECTURER : Dr.Pathathai S., Dr.Teerasak N., Dr. Niruncha L., A. Rattana W.,

A.Peerawich C., A.Sirikarn J. and A. Saw N.DATE : February 3, 2013TIME : 9.00 – 10.00 hrs (1 Hour)

Instruction:● Calculators with notext files and financial calculators are allowed.● Answer all questions in the given booklet.● Answer without supporting calculation will not be graded.

Part I: Short Answers. ( 20 Marks)

Question 1 (5 marks)1.1 In which situations in the stock markets that called ‘bull markets’ and ‘bear market’? (2Marks)

Bull markets >> stock prices and volume of trading continuing raise (1)Bear markets >> stock prices and volume of trading continuing fall (1)

1.2 Explain why bull markets enable the companies to raise more revenue per share of stockissued? (1 Marks)

Lower cost of capital (1) or more paidin capital (1)1.3 If the market expected to have low inflation, what should be the impact to the stock prices? (1Marks) Explain (1 Marks)

Stock prices raise (1)Low expected inflation (0.5) >> low interest (0.5) >> stock prices increase

Question 2 (5 marks)2.1 What are the two critical components of aggregate expenditures are influenced by the stockprice? (2 Marks)

Consumption spending (1)Investment spending (1)

2.2 What situation that causes ‘wealth effect’? How? (2 Marks)Change in stock prices (1)Because it affect individuals’ net worth on their consumption and saving decision (1)

2.3 Give two examples of the events that eventually end a virtuous cycle? (1 Mark)A sharp increase in oil prices (0.5)Major political or military development (0.5)

Question 3 (5 marks)During the celebration of New Year 2013, Millions of tourists come shopping at the shops aroundCentral World, Siam Paragon and Siam Discovery.3.1 Would the events cause Thai baht to appreciate or depreciate against other foreigncurrencies? Explain in term of product preferences and draw graph to support your answer. (2.5marks)Appreciate (0.5)Thai can sell product � more foreign buyers (0.5) � higher demand for Thai baht (0.5)Draw graph: show the demand for Thai baht shift right (0.5) and Baht ↑ (0.5)

3.2 If the events result in higher inflation rate in Thailand compare to the inflation rate in Japan,would it cause Thai baht to appreciate or depreciate against Japanese Yen? Explain and drawgraph tosupport your answer. (2.5 marks)

Depreciate (0.5)

1This exam paper is ABAC’s property and cannot be distributed or duplicated without proper authorization.

FIN 2700 Money, Banking and Financial Markets Quiz 2 (2/2012)Bangna

Thailand has inflation � less foreign buyers (0.5) � less demand for baht (0.5)Draw graph: show the demand for baht shift left (0.5) and baht value ↓ (0.5)

Question 4 (5 marks)Suppose you are Thai Exporter exporting Sugar Crane to Hong Kong. You expect to receive the payment of HKS 5,500,000 in the next 60 days. The current spot rate is 4.02 Baht/HK$, but you expect Thai Baht will fluctuate against the Hong Kong dollar over the next 60 days so you decide to buy a forward contract with the forward rate of 4.19 Baht/HK$.4.1 What is your expectation of the HK$ by deciding to sign forward contract? (1 mark)

HK$ appreciate (1)4.2 If the future spot rate in 60 day is 4.12 Baht/HK$, how much is your actual return in Baht incase that you haven’t bought forward contract? (1 mark)

5.5m * 4.12 = 22.66m (1)4.3 How much is your actual return in Baht under forward contract? (1 mark)

5.5m * 4.19 = 23.045m (1)4.4 Does Thai exporter gain or loss by signing this forward contract? Explain (2 marks) Gain (1) b/c exporter receive more baht from baht depreciation or HKS appreciation (1)

PART II: Problems Solving. (10 MARKS)● Answers without supporting calculation will not be graded.

Use the provided information to answer the following question.

1. Apply crosssectional ratio analysis to analyze the Matthew Company’s liquidity withoutrelying on its inventories. (2.5 marks)

AnswerQuick ratio = (CAInventory)/CL (choose correct ratio 0.5)

= (35,4009000)/26,500 (0.25/0.5/0.25) = 1 (0.5)1 > 0.7 Better than Betty (0.5)

2. Apply crosssectional ratio analysis to analyze the Matthew Company’s fix asset utilization.(2.5 marks)

Answer FATO = Sales/FA (choose correct ratio 0.5) = 185,000/21,912.8 (0.5/0.5) = 8.44 (0.5) 8.44 > 0.9 Better than Betty (0.5)

3. If you are a long term investor who wants to receive dividend from the company rather thanthe capital gain, calculate the rate of return of Matthew share and use crosssectional ratio analysis toanalyze the attitude of investors toward Matthew share. Regarding the crosssectional analysis, is theshare cheap of expensive? (5 marks)AnswerDPS = Dividend to common shareholders/ # of shares outstanding (0.5) = 17,119.2/22,500 (0.5/0.5) = 0.76 baht per share (0.5)DY = DPS/Price (0.5) = 0.76/35*100 (0.5/0.5) = 2.17% (0.5)2.17% < 6% Worse than Betty (0.5)Matthew share is expensive (0.5)

2This exam paper is ABAC’s property and cannot be distributed or duplicated without proper authorization.

FIN 2700 Money, Banking and Financial Markets Quiz 2 (2/2012)Bangna

*** THE END ***

3This exam paper is ABAC’s property and cannot be distributed or duplicated without proper authorization.