June 2, 2017 • Volume 07, No. 06 OilfieldServiceS · Offshore drillers Ensco and Atwood Oceanics...

Transcript of June 2, 2017 • Volume 07, No. 06 OilfieldServiceS · Offshore drillers Ensco and Atwood Oceanics...

All Standard Disclaimers & Seller Rights Apply.

June 2, 2017 • Volume 07, No. 06

OilfieldServiceSServing the marketplace with news, analysis and business opportunities

OKLAHOMA STACK OPPORTUNITY17,407 NonOp Net Acres.KINGFISHER, CANADIAN, BLAINE, CUSTER & DEWEY CO.Play Marching West Northwest LForced Pooling Benefits NonOpsMeramec, Osage, Woodford, Hunton STACKMeramec 3 Benches, Osage 2 Benches75% Lease NRI To Rights Below ChesterOffsets >2,000 BOEDOFFERS DUE JUNE 19, 2017L 2065DV

LARAMIE CO., WY PROJECT 10,224 Net Acres on Trend.NORTHERN DJ BASIN LCODELL SAND OIL PLAYBase Case IP: 750 BOPDD&C: $4.5MM for 9,000’ Laterals DRILLNet Pay Thickness: 20-40 ft~70% OPERATED WI; 83.5% NRI LeaseCONTACT OPERATOR FOR DETAILSL 8793DV

DEALS FOR SALE

New Halliburton CEO says price hikes of 10-20% coming

Halliburton CEO Jeff Miller predicted that the company will raise prices by at least 10% this year—and possibly as much as 20%—and do it at a pace where producers would make money as well. Miller, who took over from Dave Lesar on June 1, also predicted that margins near 20% would return in 2018.

A Halliburton price increase would be welcomed by many in oilfield services, who have struggled to pass along rig-reactivation costs and rising expenses for labor and frac sand. With oil around $50/bbl, producers are watching all expenses.

Miller said that Halliburton margins were approaching 20% in 3Q14 after about three quarters into that recovery, so margins at that level in 2018

“feels about right.”

Saudi Aramco signs $50B in MOUs with Trump in townSaudi Aramco used President Trump’s visit to Saudi Arabia to promote $50 billion

in agreements with US businesses including deals involving oilfield service firms. The biggest development in terms of dollar value was a memorandum of understanding

that would lead to a $6.0 billion joint venture between Aramco and National Oilwell Varco to build a plant in Saudi Arabia to construct high-spec land rigs, drilling equipment and other

aftermarket services. Barclays estimates the deal could bring up to $200 million in gross annual revenue to NOV, which will enjoy contracted exclusivity as supplier to Saudi Arabia, the Gulf Cooperation Council (GCC) and the Middle East-North Africa (MENA) regions. First orders are expected next year with first revenue in 2020.

Generally, the announcements stemming from President Trump’s visit were a mix of new business, MOUs requiring more negotiation, previously announced projects or extensions of existing alliances. For Saudi Aramco, the deals are ways to turn oil cash into domestic jobs. Many of the announcements referred to how many jobs would be created for the In Kingdom Total Value Add (IKTVA) initiative, which aims to keep 70% of Saudi Aramco’s spending in the country.

Keane acquires fellow fracker RockPile for $284.5MMKeane Group agreed to acquire RockPile Energy Services on May 18 for

$284.5 million in cash, stock and capex, increasing its pressure-pumping fleet by 26% to 1.2 million fracking horsepower. The sale price is nearly five times what PE firm

White Deer Energy paid for RockPile in September. In addition to assuming $26.5 million committed for 30,000 hp to be delivered in

Q4, Keane will pay $135 million in cash and 8.7 million common shares, using term loans and cash on hand to pay out the cash portion of the consideration, plus $9.0 million for equipment. Keane’s NYSE-traded shares closed at $14.64 each the day of the announcement.

In buying RockPile, Keane adds 215,000 hp, eight wireline trucks, 12 workover rigs and 10 cement units. RockPile’s completion assets are currently 100% utilized, divided roughly 50:50 between the Permian Basin and the Bakken. Another 30,000 hp is to be delivered in Q4 for a Bakken customer.

Offshore drilling giant Ensco acquires Atwood for $839MMOffshore drillers Ensco and Atwood Oceanics have agreed to merge in an

all-stock deal valued at $839 million. Shareholders of Houston-based Atwood will receive 1.6 Ensco shares for each of their common shares for a total value of $10.72

per Atwood share, a 33% premium above the company’s NYSE closing price on May 26. Upon closing of the transaction, Atwood

shareholders will own about 31% of the outstanding shares of Ensco.

The merger is the second largest in the oilfield services sector to be announced this year, according to PLS’ M&A Database. Wood Group agreed to acquire Amec Foster Wheeler in a deal valued at $3.95 billion in stock and debt in March.

Ensco and Atwood have combined liquidity of $3.87 billion—including $1.62 billion in cash—with $1.6 billion in debt maturities until 2024. The estimated enterprise value based on combined pre-merger stock value is $6.9 billion. Revenue backlog is $3.7 billion.

PLS tracks thousands of deals for sale www.plsx.com/listings

Choosing freedom to negotiate prices over being tied to long-term contracts.

Ensco to add 6 UDW and 5 jackups upon closing, possible in Q3.

Continues On Pg 4

Keane to borrow $135MM to cover cash portion of acquisition.

Continues On Pg 6

Saudi Aramco seeks to keep 70% of oil money in its own country.

Cont'd On Pg 11

Continues On Pg 13

www.plsx.com To learn more about PLS, call 713-650-1212Find more on the oilfield sector at

OilfieldServiceS 2 June 2, 2017

■ Axalta Coating Systems, a liquid and powder coatings supplier, has agreed to acquire Spencer Coatings Group, a manufacturer of industrial coasting for heavy-duty equipment. Spencer, which was established in 1909, is the largest independent industrial coatings manufacturer in the UK. Philadelphia-based Axalta will acquire Spencer products including Acothane polyurethanes for internal and external pipeline coatings and three England-based manufacturing facilities. Financial terms were not disclosed.

■ Savanna Energy Services and Total Energy Services entered into an amalgamation agreement, another step as Total completes its takeover of Savanna. The agreement will allow Total to acquire the 14% interest in Savanna that it does not already own. Total will convert each Savanna common share into 0.13 of a Total common share and C$0.20, which was Total’s successful takeover offer, unless the Savanna shareholder exercises dissent rights.

■ Bergen Group has agreed to acquire AAK Energy Services, which specializes in advanced access technology related to maintenance and modification. The two companies signed a strategic alliance in February, and AAK moved its headquarters to vacant premises at Bergen Group locations at Straume in Norway. Bergen offers a variety of services to many types of vessels, oil and gas installations and equipment. Financial terms of the acquisition were not disclosed.

A&D

North American Rotary Rig Count as of May 26 Source: Baker Hughes

LocationCurrent

05/26/17Week Ago05/19/17

Month Ago4/28/17

Year Ago06/27/17

% Chg. YOY

US 908 901 870 404 125%

Canada 93 85 85 43 116%

US Breakout Info

Oil 722 720 697 316 128%

Gas 185 180 171 87 113%

Miscellaneous 1 1 2 1 0%

Major Basins

Barnett 7 7 6 2 250%

DJ-Niobrara 27 23 25 13 108%

Eagle Ford 86 85 83 29 197%

Fayetteville 1 1 1 0 -

Granite Wash 9 10 10 6 50%

Haynesville 40 40 38 15 167%

Marcellus 45 45 46 26 73%

Mississippian 9 9 8 3 200%

Permian 362 361 342 137 164%

Utica 25 25 23 11 127%

Williston 45 44 44 22 105%

Woodford 65 62 67 32 103%

Major Basins 721 712 693 296 144%

EU approves GE-Baker Hughes merger unconditionally The EU competition authority has unconditionally cleared GE Oil & Gas’

acquisition of Baker Hughes, the European Commission announced on May 31. The companies still need regulatory approval in the US but expect the $34 billion merger

to be complete by the middle of the year.

The authority found no competition concerns in the areas where the companies overlap. It investigated the areas of electrical submersible pumps, refining chemicals and sensors used in drilling and wireline applications.

In submersible pumps, the commission found that GE has only a limited role onshore and was inactive offshore because its technology cannot withstand North Sea

conditions. The commission said that GE and Baker Hughes’ offerings in refining chemicals were complementary and that

a number of competitors would remain. GE could harm competitors if it starts selling the sensors for drilling and wireline it manufactures to only Baker Hughes, but the Commission found that alternative suppliers were present.

The merged company, owned 62.5% by GE and 37.5% by Baker Hughes, will continue to operate under the Baker Hughes name. The combination will be the world’s second-largest oil and gas service company.

No competition concerns were found in any of the areas investigated.

Companies still expect $34B merger to be complete mid-year.

Transactions Metrics and Comparables

Providing critical valuation information on oil & gas deals.

www.plsx.com/ma

Access PLS’ archive for previous oilfield services newsFor general inquiries, email [email protected]

Volume 07, No. 06 3 ServiceSectOr

OilfieldServices

Secure to acquire fellow Canadian fluids disposal firmSecure Energy Solutions, a Calgary-based fluids and solids solutions provider,

will acquire Ceiba Energy Services in a cash-and-stock deal valued at C$37 million ($27 million), including the assumption of C$11 million in Ceiba debt.

Ceiba provides water-disposal and oil-treating facilities to the Canadian energy sector. The acquisition gives Secure 10

new locations to its 39 facilities in the Western Canadian Sedimentary Basin. Secure predicts that the merger will add $7.0-8.0 million a year to its adjusted EBITDA.

Secure will offer C$0.205 or 0.02115 of a Secure share for each Ceiba share up to 1.3 million Secure shares. The cash exchange rate represents a 64% premium to the value of Ceiba shares shortly before

the acquisition was announced. Both companies’ boards have

approved the acquisition, and owners of 40% of the outstanding shares are already on board. The agreement needs support of two-thirds of shareholders. The transaction is expected to close in Q3.

In addition to gaining more facilities in one of Canada’s top plays, Secure acquires $1.0 million of net working capital excluding debt and $30 million of fixed assets such as tanks, pumps, pipelines, treaters, disposal wells and various other equipment. Ceiba assets will become part of Secure’s Processing, Recovery and Disposal segment.

Ceiba’s past losses can also benefit Secure. The acquired company has $49 million in total tax pools including $27 million in non-capital losses, which Secure expects to be able to deduct from its taxes.

A&D Analysts wonder if offshore merger will launch trend

A merger of offshore drillers wrapped up May with Ensco adding Atwood Oceanics in the second-largest oilfield services combination announced

in 2017 (PG. 1). Analysts largely supported a move to consolidation in the

ailing offshore segment and immediately wondered if this could be the start of a wave of offshore mergers.

Oilfield service companies have been some of the industry's hardest hit. Seadrill warned yet again that it was likely to file bankruptcy (PG. 7), and Paragon Offshore stepped closer to getting its reorganization plan passed (PG. 8). Tidewater, the owner of the world’s largest fleet of support vessels, filed a reorg plan and is looking to eliminate $1.6 billion of its $2.0 billion debt (PG. 7).

Saudi Aramco used President Trump’s visit to the kingdom to pass out $50 billion in MOUs or deals to oilfield services companies including Schlumberger, Halliburton, Weatherford, National Oilwell Varco, Nabors Industries and Rowan Companies (PG. 1). Baker Hughes was left out but got good news from the EU on its merger with GE Oil & Gas (PG. 2).

Helmerich & Payne rarely ventures into the M&A market, but it decided to add Motive Drilling Technologies, which develops of cognitive computing for directional drilling (PG. 3).

Mammoth Energy Service closed on Chieftain Sand and Proppant, which Mammoth got in a bankruptcy auction (PG 5).

Keane Group acquired RockPile Energy Services, in Keane’s first acquisition since netting $475 million in its IPO (PG. 1). Five oilfield services companies have gone through with IPOs in 2017, a faster rate than E&P companies (PG. 7). The latest IPO was Solaris Oilfield Infrastructure, which designs and builds proppant management systems (PG. 6).

H&P buys drilling tech creator in rare acquisitionHelmerich & Payne announced that it would purchase Motive Drilling Technologies

for $75-100 million. The Tulsa, OK, contract driller will pay $75 million to acquire Motive when the deal closes sometime this month and another $25 million that would be paid out conditionally over a period based on the achievement of performance targets.

The acquisition represents a notable shift in strategy for H&P, which is the US land drilling leader with 19% of the market. While the company has stressed technological innovation to investors amid increased demand

for directional drilling, the addition of a technical service that will be offered to other contract drillers is unique for H&P.

H&P called Motive the industry leader in the use of cognitive computing in directional drilling. Motive’s propriety Bit Guidance System uses algorithms to consider the total economic consequences of directional drilling decisions, resulting in lower drilling costs, smoother wellbores and more accurate well placement. The Bit system will continue to be offered to all E&P operators and directional drilling providers, said John Lindsay, H&P president and CEO.

Hours after the acquisition was announced, Goldman Sachs analyst Waqar Syed downgraded H&P from Neutral to Sell. The analyst did not cite the merger, but an expectation that the US land rig count will flatten over the coming months and dayrates will peak at around $20,000.

Motive, which will remain headquartered in Dallas, was launched by Hunt Energy Enterprises with financial and development support of venture capital companies Formation 8 and GE Ventures. Simmons & Co. International, Energy Specialist of Piper Jaffray & Co., served as financial advisor to H&P.

IN THIS ISSUE

$75MM to be paid at closing, $25MM more possible later.

The deal is expected to add at least C$7.0MM/year to Secure’s EBITDA.

Secure anticipates using Ceiba’s $49MM in total tax pools.

All Standard Disclaimers & Seller Rights Apply.

CanadianaCquirerServing the marketplace with news, analysis and business opportunities

EAST ALBERTA PROPERTY10-Wells. 2,048-Gross/Net Acres.WAINWRIGHT FIELD. T45.EDGERTON VILLAGE PPHeavy Oil Prospect With ----- Shallow Gas Production. ~35100% OPERATED WI AVAILABLE BOEDMonthly Cash Flow: ~$17,000/MonthCONTACT SELLER FOR MORE INFOPP 11478

SASKATCHEWAN PROPERTIES9-Oil Producers; 1-SWD; >10-PUDMANOR AREA. IMMEDIATE UPSIDE PPManor Tilston Oil Pool.Frobisher & Midale Oil Wells.100% OPERATED WI FOR SALE ~502Expected Future Production: 600 BOPD BOPDManor Proved Reserves: 445 MBOEManor Net Proved PV10: $23,443,000CONTACT AGENT FOR STATUSPP 13109DV

FEATURED DEALS

Canadian upstream M&A activity quadruples in 2014

Repsol’s $15.2 billion Talisman buy caps a busy 2014 in the Canadian oilpatch with $46.0 billion in upstream deals—roughly quadrupling 2013’s $11.8 billion. Of the previous six years, only 2012 had a higher tally at $54.7 billion and that included CNOOC’s $18.1 billion acquisition of Nexen. By deal count, activity declined 15% YOY to 269 transactions in 2014 from 319 in

2013 although deals with disclosed values actually rose slightly to 213 from 191.

This Canadian M&A analysis includes Repsol/Talisman because Talisman is a flagship Calgary company with a large domestic asset base, despite the fact that it operates globally and produces more oil and gas from the US and Indonesia than it does at home. However, even excluding this transaction Canada racked up $30.9 billion in 2014 deals, up more than 160% YOY.

Veresen & KKR nab Montney midstream for $600 millionEncana and Mitsubishi are selling Montney midstream assets in the Dawson area

of northeast British Columbia for $600 million to a new 50:50 partnership formed by Veresen Inc. and private equity giant KKR. Encana will receive $412 million for interests owned both directly and through its 60% stake in Cutbank Ridge Partnership (CRP),

its JV with Mitsubishi.Veresen Inc.-KKR

venture Veresen Midstream LP will acquire 500 km of gas gathering pipelines and 675 MMcfd of compression capacity. The deal also includes the Saturn compression station currently under construction, which will add 200 MMcfd of compression capacity when completed. The infrastructure gathers gas production from Encana and CRP and delivers it to various processing plants including the nearby Hythe/Steeprock facilities, which Veresen Inc. is contributing to Veresen Midstream.

Encana will continue to operate the assets on a contract basis, while Veresen Midstream will provide gathering and compression services to Encana and CRP under a 30-year fee-for-service arrangement in a 240,000-acre AMI.

Woodside enters shale patch with Kitimat buy from ApacheExecuting on a promise made to investors back in July, Apache agreed to sell

its interests in the Kitimat gas venture in British Columbia and Wheatstone project off Australia to Woodside Petroleum for $4.34 billion (US$3.75 billion). While the Australian project is a natural fit for Woodside’s offshore and LNG operational expertise, Kitimat is uncharted territory—its first

venture into onshore shale gas.Woodside is getting 50%

WI in the proposed ~1.3 Bcfd Kitimat LNG plant (10 million tonnes per annum), 460-km Pacific Trail Pipeline and 322,000 net acres (644,000 gross) of shale gas assets in British Columbia’s Liard and Horn River Basins. The acreage will provide an estimated 15 Tcf of net 2C resources. The entire project is owned in a JV with Chevron, which will operate the pipeline and LNG plant while Woodside takes over the shale acreage from Apache.

Talisman to be acquired by Spain’s Repsol for $15 billionMarking the first multi-billion-dollar foreign acquisition of a Canadian oil and gas

company since 2012, Spain’s Repsol agreed to buy Talisman Energy for $15.2 billion (US$13.0 billion). The price consists of $9.33/share in cash plus Talisman’s $5.4 billion

debt. The companies were able to strike the deal after months of on-again, off-again negotiations largely because falling oil prices cut the value of Talisman’s stock in half in less than five months. Nonetheless this is the largest deal seen

in Canada since China’s CNOOC paid $18.1 billion for Nexen in 2012.

That year saw two other Canadian producers bought up by foreign firms: Progress Energy Resources by Malaysia’s state-owned Petronas for $6.0 billion and Celtic Exploration by ExxonMobil for $3.1 billion. Following the CNOOC deal, Ottawa enacted new limits on oil sands ownership by overseas state-owned companies. These rules have had a chilling effect on foreign investment over the past two years but do not affect Talisman, whose assets in Canada target conventional oil and gas or shale rather than oil sands.

Biggest deal in Canada since CNOOCbought Nexen for $18 billion in 2012.

Continues On Pg 12

Acquires 320,000 net acres with 15 Tcfof 2C gas in Horn River & Liard Basins.

Encana takes in $412 million fromsale with Mitsubishi getting the rest.

Driven by dividend-plus-growth firms, return of foreign buyers & royalty appetite.

US$3.75 billion deal also includesWheatstone in Australia.

InternationalDeals Dec. 18

Continues On Pg 4

Cont'd On Pg 11

Continues On Pg 6

KMI scraps Trans Mountain JV, plans $1.8B IPO instead.

CanadianAcquirer May 16

Support vehicle operator Gulfmark enters bankruptcy (PG. 8).

www.plsx.com To learn more about PLS, call 713-650-1212Find more on the oilfield sector at

OilfieldServiceS 4 June 2, 2017

Key weathers the storm to reduce net loss YOY

In its first quarter out of bankruptcy, Key Energy Services cut its Q1 net loss by 43% YOY to $46.9 million even as revenue fell by 8.7% YOY to $101.5 million. Lower US operating costs helped offset negative revenue impacts from deferred activity.

CEO Robert Drummond predicted that Q2 revenue would rise 10%. Activity

is picking up, and customers are looking to lock in pricing for 2H17.

"We are also seeing an increase in inquiries regarding equipment and crew availability for well maintenance and repair activity," Drummond said. "We view these two dynamics as positive indicators of future demand."

In Q1, the company's largest segment, US Rig Services, declined 2.4% sequentially to $60.3 million because of heavy rain in California and an unplanned activity deferral by a large customer. Without those two factors, the segment’s

revenue would have risen 8.0% from Q4. Even with those developments, Q1 revenue rose 2.2% YOY.

The Fluid Management Services segment took a $900,000 hit when a lightning strike at a saltwater disposal well triggered an explosion.

Key posted Q4 net income of $163.2 million because of a $245.6 million benefit from restructuring. The company, which is the largest onshore, rig-based well-servicing contractor based on the number of rigs owned, left bankruptcy protection on Dec. 15.

Earnings A&D

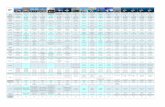

The combined company, which will have operations and drilling contracts on six continents, will have 63 rigs, building upon London-based Ensco’s claim to the title of the world’s largest offshore drilling fleet. The combined fleet—including rigs under construction—will have 26 floating rigs including 21 ultra-deepwater drilling rigs with an average age of five years—the youngest in the industry. The jackup fleet of 37 rigs

will include 27 premium units.Ensco will add six ultra-deepwater floaters, including four

advanced drillships, plus five high-specification jackups. “This acquisition significantly enhances our high-specification floater and jackup fleets, adding technologically advanced drillships and semisubmersibles and refreshing our premium jackup fleet to best position ourselves for the market recovery,” Ensco CEO Carl Trowell said.

The company predicted that it would save $65 million a year through reduced expenses in 2019 and beyond and $45 million in 2018. The savings will come from consolidating offices and standardizing systems. Ensco’s executive management will

remain in charge.Two members from Atwood’s current

board will join the board of directors at closing, which could come as soon as Q3. Senior executive officers will be located in London and Houston with headquarters in the UK. Analysts' initial reactions were generally positive with Clarksons Platou upgrading Ensco to buy from neutral on optimism about the shallow-water market. However, Barclays questioned the timing and value of the deal because Ensco has 19 rigs cold-stacked or idle. RBC’s Kurt Hallead added to his “positive” assessment a prediction of more mergers to come. He labeled Transocean, Diamond Offshore Drilling and Noble as potential buyers and Ocean Rig UDW, Pacific Drilling and Rowan as potential targets.

Morgan Stanley served as lead financial advisor to Ensco. DNB Markets also advised Ensco. The financial advisor for Atwood was Goldman Sachs.

Offshore giant Ensco acquires Atwood Continued From Pg 1

World’s Largest Offshore Drilling Fleet Gets Bigger

26

20

50

23

4

14

23

8

12

6

7

37

32

21

25

14

1

15

5

0 10 20 30 40 50 60 70

ESV/ATW

ESV

RIG

SDRL

RDC

NE

DO

Maersk

ORIG

ATW

PACD

Floaters Jackups

(# of rigs)

ESV/ATW

ESV

ü Balanced exposure to deep- & shallow-water marketsü Largest jackup fleet, including 27 premium jackupsü Second largest floater fleet with one of the largest UDW presence

ESV/ATW

ESV

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

ATW

Peer 8

Peer 7

Source: Ensco May 30 Presentation via PLS docFinder www.plsx.com/finder

Combined company will have 37 jackups, the most in the world.

Ensco execs to keep posts; headquarters will be in UK.

Heavy rains in CA, lightning strike affect Key’s bottom line.

Customers looking to lock in pricing for H2, CEO says.

All Standard Disclaimers & Seller Rights Apply.

Serving the US upstream industry with information, analysis & prospects for sale Volume 26, No. 08

Petro ScoutMay 21, 2015

e&Pwww.plsx.com

REEVES CO., TX PROSPECT ~4,600-Net Acres.DELAWARE BASINObjectives: Wolfcamp (A,B,C)All Depths. All Rights. L80-Acre Down Spacing Pilots Underway.Subsurface Geology Data Available100% OPERATED WI; 75% NRI WOLFCAMPWolfcamp A Approx. IP: ~1,091 BOEDWolfcamp B/C Approx. IP: ~1,190 BOEDWolfcamp EUR’s: 300-450 MBO/WellPKG UPDATED WITH NEW ACREAGEL 5187DV

COLORADO DRILLING PROJECT~43,700 Net Acres.LINCOLN & KIT CARSON COUNTIES MISSISSIPPIAN / PENN TARGETSMiss-Spergen & Penn-Cherokee. <7,500’. LMultipay Objectives. Shallow Depths.Defined By Extensive 3-D Seismic-- MULTIPAY-- Geology & Geophysics Data.100% OPERATED WI; ~80% NRI221 Active Offset Wells, 150 Offset Permits.L 4489DV

FEATURED DEALS

Hess’s Bakken costs falling, targeting $6.0-6.5MM/well

Hess’s lean manufacturing approach in the Bakken is leading to higher production and cheaper wells. Q1 volumes averaged 108,000 boe/d, up 70% YOY and 6% sequentially. A total of 70 wells were brought online in the play during the quarter, down from 96 in Q4. Well costs fell to $6.8 million from $7.1 million in Q4 and

$7.5 million in 1Q14. Hess expects costs to fall further, with 2015 wells averaging $6.0-6.5 million.

During Q1 Hess reduced its Bakken rig count to 12 from 17 at the end of 2014. The company is running currently eight rigs in the play and will continue with that number for the remainder of the year. D&C plans call for 178 wells drilled, 214 completed and 213 turned to sales compared to 261, 230 and 238 last year, respectively.

Noble’s DJ Basin spud-to-rig release days fall to seven In the DJ Basin, Noble Energy has driven spud to rig release times for 4,500-ft

laterals down to just seven days as of Q1, a 23% reduction YOY. Notably, the company drilled a 9,280-ft lateral in just seven days.

“We’re now averaging seven days from spud-to-rig release for a standard lateral length well, almost as fast as we used to drill vertical wells,” said chairman, president

and CEO David L. Stover during a conference call.The company is drilling

wells so quickly that it will end up drilling more wells than anticipated in 2015 and has taken funds from the Marcellus and reallocated them to the DJ. Currently Noble is drilling 70% of the footage of 2014 with 40% of the rigs. The company ended Q1 running four rigs and one completion crew in the DJ. In H2, an additional completion crew will be added as needed.

Reduced drilling times and equipment optimization has led to a 5-15% reduction in costs vs. 2014. Noble foresees further savings via lower service costs and possible use of slickwater, which could save $2.0 million per well.

Parsley’s rookie hz drilling season delivers peer-leading resultsParsley Energy’s well performance has continuously improved since it began

drilling horizontal wells a year and a half ago. The company has drilled 30 Wolfcamp A or B wells thus far and, based on the 30-day data, recently introduced a type curve with

estimated recoveries of 1 MMboe. In the Wolfcamp B during Q1, the 30-day peak IP per 1,000 ft of lateral improved 30% YOY to 231

boe/d. According to COO Matt Gallagher, the improved performance is owed to higher stage density, more slickwater stages, increased proppant per stage and optimal placement of the lateral within the zone.

Parsley’s improved wells are outperforming many of its peers in the Midland Basin. In Upton County, the company’s Wolfcamp B 24-hr IPs are 75% higher than the average when adjusted for lateral length. The Ratliff-28-1 H Wolfcamp B well is credited with flowing the highest reported oil rate of all horizontals in Upton, according to IHS. In Reagan County, data suggests Parlsey’s 24-hr IPs for Wolfcamp B wells are 55% higher than the county average when adjusted for lateral length.

Devon surges past guidance on Eagle Ford performanceCompletion mods push positive results across multiple plays

Fueled by the Eagle Ford, Devon’s oil production exceeded guidance by 12,000 bo/d during Q1 at 272,000 bo/d. Based on the results, the company has increased its oil growth target from 20-25% to 25-30% (270,000 bo/d) for the full year. Q1 overall

volumes also overshot guidance, averaging 685,000 boe/d (60% liquids), up 3% vs. Q4 and 22% YOY. Devon expects volumes to grow 5-10%

this year to an average of 667,000 boe/d. Capex was reduced by $250 million to $3.9-4.1 billion on an improved LOE outlook and accretive midstream transactions.

Since it took control of the Eagle Ford position it acquired from GeoSouthern in March 2014, Devon has grown production in the play 140% to 122,000 boe/d (62% oil). In the last quarter alone volumes jumped 24,000 boe/d, exceeding expectations and creating a bottleneck that will prevent growth in Q2.

Devon’s Eagle Ford drilling is concentrated in the Lower Eagle Ford where the company added 79 new wells to production in Q1.

Eagle Ford output has risen 140% since it took over the assets in March 2014.

Continues On Pg 4

Continues On Pg 21

Continues On Pg 6

Bakken well costs stood at $7.1MM at YE14, already down to $6.5MM in '15.

Continues On Pg 22

Noble nearly drilling horizontals in the time it used to take it to drill a vertical.

Wolfcamp B rates are 75% higher than peers in Upton County.

See PLS’ upcoming PetroScout for story on rising service costs.

PetroScout June 7

Analyst predicts more offshore mergers could be in the offing.

Access PLS’ archive for previous oilfield services newsFor general inquiries, email [email protected]

Volume 07, No. 06 5 ServiceSectOr

OilfieldServices

Mammoth completes acquisition of bankrupt Chieftain Sand Mammoth Energy Service closed the acquisition of Chieftain Sand and Proppant

for $36 million. The assets include wet and dry plants on 600 acres in New Auburn, WI, and an estimated 38 million tons of usable frac sand on Chieftain parcels.

CEO Arty Straehla said, “The acquisition of the Chieftain assets was strategic for Mammoth as we now have access to

the Union Pacific railway with unit train capabilities, which provides a low-cost solution to move sand into the Midcontinent.” The rail connection will make it easier to move the sand to Texas markets, where the high-quality sand is in demand, the CEO said.

Mammoth won the Chieftain assets at a bankruptcy auction March 27. The company expects to have the 1.5 mtpa dry plant running as soon as staff can be hired. The wet plants should start in two months after upgrades.

Also in March, Mammoth announced it would add three more companies to its collection of small oilfield services companies, acquiring the parent company of Taylor Frac, Stingray Energy Services and Stingray Cementing for $133 million in stock. Those transactions are expected to be completed in Q2.

Flotek sells production tech segment as part of strategyFlotek Industries sold its production technologies segment for $2.9 million to an

undisclosed buyer. The company’s move is part of a strategic shift to focus on energy chemistry and consumer and industrial chemistry. Flotek shut down its production and

drilling technologies segments on Dec. 31 and began looking for a buyer.The Houston-based chemical applications company also has closed

the $17.0 million sale of drilling technologies to National Oilwell Varco in May. At the time, the company said it was looking to focus on specialty chemicals for frackers and energy data.

After the sales, Flotek’s debt is $27 million, reduced from $50 million at the end of Q1. The company has been under a yearlong strategic review. Chairman, President and CEO John Chisholm said that because of the debt reduction, overhead cost-cutting efforts and “our positioning as a returns-focused and streamlined, chemistry-technology company, I am confident that we have never been in as strong a position as we are today.”

A&D

Select cuts net loss in half aswell completion rate rises

Select Energy Services halved its net loss YOY to $12.3 million in Q1 while increasing revenue 15% to $99.9 million.

The water services provider benefited from increased drilling and completions.

CEO John Schmitz also said Select saw a “growing trend by our customers to increase well completion intensity, which drives an increase in revenue per well.”

Gainesville, TX-based Select said 78% of revenue came from its water solutions segment. All three of Select’s segments—the others being accommodations and rentals and wellsite completion and construction services—posted revenue 15-30% above their cost of sales, but a $21.2 million depreciation charge tipped Select to a net loss.

In March, Select acquired Gregory Rockhouse Ranch, a provider of water and water-related services to E&P companies in the Delaware Basin, for $56.5 million in cash and stock. Select also raised $121.8 million in an IPO in April, which it will use to repay borrowings and fund its 2017 capex.

Earnings

Philadelphia Stock Exchange’s Oil Service Sector Index Vs. S&P 500

-6.00%

-4.00%

-2.00%

0.00%

2.00%

4.00%

6.00%

S&P 500

PHLX

05/01/17 05/05/17 05/09/17 05/13/17 05/17/17 05/21/17 05/25/17 05/29/17

Source: PLS Research Using Google Finance

ADTransacTionsServing the marketplace with news, analysis and business opportunities

March 3, 2017 • Volume 28, No. 03

All Standard Disclaimers & Seller Rights Apply.

DEALS

Conoco moves forward with $5-8B divestment effort

Marketing processes have begun for multiple parts of ConocoPhillips’ US upstream portfolio as it progresses toward a $5.0-8.0 billion divestment target for 2017-2018. Having put the San Juan Basin up for sale late last year, Conoco is also actively seeking buyers for its entire Barnett position and mostly gas-weighted assets in the Williston and Anadarko basins, the Texas and Oklahoma panhandles, the Permian and Western Canada.

Conoco hired Wells Fargo to sell the San Juan assets, which cover 900,000 net acres primarily in northwest New Mexico with 2016 net production of 746 MMcfe/d (22% liquids) from more than 12,600 active wells. Bids were due Feb. 16. After meeting with management, Barclays analysts wrote in a March 1 note that the company expects to announce a sale by midyear.

Kimbell Royalty poised for multi-basin M&A post-IPOA group of major Texas investors that have been quietly buying mineral and

royalty interests in the Permian and other US onshore basins plans to dramatically increase acquisitions through their new upstream MLP vehicle Kimbell Royalty Partners. The investor group is led by KRP CEO Bob Ravnaas and Fort Worth’s Kimbell Art Foundation. KRP raised $103.5 million in a Feb. 8 IPO and will distribute net proceeds of $96 million to its sponsors, which contributed assets to and retain a

64.8% LP stake in the MLP.President and CFO Davis

Ravnaas (Bob’s son) told PLS that KRP’s sponsors made $200 million in acquisitions from 1998 to 2012 and then ramped up to ~$100 million annually from 2013 through 2016 as the expansion of horizontal development plays brought new assets to the market. Even so, he said,

“we’ve missed out on deals in the last few years because we didn’t have enough capital,” so the access to public capital provided by the MLP “will give us the opportunity to make more acquisitions.”

KRP is currently considering 15 acquisition opportunities and expects “robust deal flow going forward,” Ravnaas said.

Linn Energy spins off Berry, prepares asset salesThe largest E&P firm to fall into bankruptcy during the downturn has re-emerged as

two separate companies and is marketing non-core assets to further reduce debt. After taking on heavy debt at the height of the market to buy Berry Petroleum for $4.9 billion

in 2013, Houston-based Linn Energy filed for Chapter 11 protection in mid-2016 and has now exited the process with debt reduced by more than $5.0 billion to ~$1.0 billion. As part of the reorganization, Linn is spinning out

Berry as a private standalone company.Berry will once again be

headquartered in its historic home of Bakersfield, Calif. Led by veteran oil and gas exec and consultant Trem Smith as CEO, it will have assets in California’s San Joaquin Basin, Utah’s Uinta Basin and Colorado’s Piceance Basin—three of its pre-merger operating areas—as well as Kansas’ Hugoton field. Notably absent is Berry’s pre-merger Permian position, which Linn mostly sold to ExxonMobil and others in 2014 and 2015.

EQT’s $527MM bid beats Tug Hill for Stone’s Marcellus/UticaStone Energy sold its entire Appalachian position to EQT Corp., which won

a bankruptcy auction for the assets with a $527 million cash bid. The sale included 86,000 net acres with net production of 80 MMcf/d mostly in northern West Virginia. It was approved by the bankruptcy court Feb. 10 and closed Feb. 27. Combined with a restructuring completed the next day, the sale repositions Stone as a pure Gulf of Mexico

and Gulf Coast operator.Stone struck a deal

last October as it was heading into Chapter 11 to sell the Appalachian assets to Tug Hill for $350 million. But it opened the sale to bidding from EQT and another suitor following court orders in January, with Tug Hill’s offer as the stalking horse bid. Stone used part of the proceeds from EQT to pay Tug Hill a $10.8 million break fee and a $1.85 million reimbursement for expenses.

“With the successful conclusion of the auction, we are now poised to move forward with our pre-packaged plan, with Stone, its noteholders and the bank group all in agreement on a plan of action,” Stone CEO David Welch said.

$527 million sale is up 46% from Tug Hill's $350 million stalking horse bid.

Mineral/royalty MLP follows in Viper’s footsteps, but ventures beyond Permian.

Continues On Pg 15

Continues On Pg 16

Berry, founded in 1908 & purchased by Linn in 2013, returns home to Bakersfield.

San Juan deal expected by midyear, Barnett & Canada a few months later.

Continues On Pg 13

Continues On Pg 11

SOUTH TEXAS NONOPERATED 18-Active Wells.FRIO & ZAVALA COUNTIESBRISCOE RANCH PP5-10 PUD Wells Scheduled Near Term.10%-20% NonOperated WI; 74.5% NRI NONOPNet Production: 200 BOPD & 66 MCFDNet Cash Flow: ~$170,000/Mn (6-Mn Avg)Estimated PUD AFE: ~$4,300,000/WellPP 5953DV

NORTH TEXAS ASSETS FOR SALE17-SWD Wells. ~80,000-Net Acres.JACK, PALO PINTO & CLAY COUNTIES PPTargets: Marble Falls, Barnett, Strawn,Conglomerate & Caddo Formations. ~2,600~100% OPERATED WI; ~75% NRI BOEDTotal 2P Reserves: 82,160 MBOEAGENT WANTS OFFERS MAR 9, 2017PP 2550DV

DEALS FOR SALE

PLS tracks thousands of deals for sale www.plsx.com/listings

Devon Energy pulling trigger on $1.0B non-core sales.

A&D Transactions May 23

Added wet and dry plants and 38MM tons of frac sand.

Save time sourcing critical data

Over 1.5 million slides at your fingertips in seconds.PLS provides buyers, sellers, capital providers and their advisers critical information, marketing resources and advisory services. Take a test drive and find out how docFinder can save thousands of man hours.

www.plsx.com/docFinder

www.plsx.com To learn more about PLS, call 713-650-1212Find more on the oilfield sector at

OilfieldServiceS 6 June 2, 2017

Tidewater seeks to shed $1.6B in debt in bankruptcy

Tidewater has filed for Chapter 11 as part of a prepackaged reorganization plan. The owner of the world’s largest fleet of offshore service vessels said the plan would allow it to eliminate $1.6 billion of its $2.0 billion debt.

The plan has the support of the lenders of 60% of the outstanding principal of loans and holders of 99% of the aggregate outstanding principal of senior notes. Tidewater predicts it will leave bankruptcy protection by July.

The debt holders will divide $224 million, 95% of the common stock and $350 million in new 8% secured notes due in 2022. Current Tidewater shareholders will receive the remaining 5% of common stock and Series A and B Warrants, each to purchase 7.5% of equity in the reorganized company.

Tidewater will also use Chapter 11 to reject sale-leaseback agreements for leased vessels so it can limit the resulting rejection damages to $131 million. However, Tidewater said this matter will ultimately be resolved by litigation.

“We decided that commencing the Chapter 11 cases was necessary to create financial stability, which would allow Tidewater to remain a formidable competitor given this unprecedented industry downturn. Throughout the Chapter 11 process, we anticipate meeting ongoing obligations to our employees, customers, vendors, suppliers, and others,” said President and CEO Jeffrey Platt.

The company paid a price when the declining price of oil caused offshore oil production to be slashed. A glut of new vessels also drove down dayrates.

Company financial results have fallen from an operating income of $201 million on $1.44 billion in revenue in YE14 to an operating loss of $70 million on $979 million in revenue in YE16. Tidewater has needed to receive limited waiver extensions from its principal lenders and noteholders since September.

The acquisition is expected to close by July 31.The acquisition is Keane’s first since netting $475.39 million in a January IPO. Keane used its IPO proceeds to repay its term loan facility and $50 million of its senior notes. In February, the company secured a new $150 million revolving credit facility to replace a $100 million revolver. The new facility allows the company to ask for commitment increases of up to $75 million more.

In 1Q16, Keane acquired Trican Well Service’s US pressure-pumping business for $247 million in cash and stock, increasing Keane from 300,000 hp to 950,000 hp.

White Deer Energy paid Triangle Petroleum $58 million for RockPile. Triangle let RockPile go with a debt-free balance sheet. A week later, RockPile acquired workover company American Well Service.

The RockPile acquisition is the outcome of Keane's focus on growth through industry consolidation in a tightening service market. "The combination allows Keane to further capitalize on the shifting industry fundamentals, where customers are increasingly focused on efficiency...at a time when we have line of sight into full utilization of our completion assets by the end of the year," Keane CFO Greg Powell said.

Finance

Proppant manager Solaris raises $111MM in downsized IPOSolaris Oilfield Infrastructure launched a downsized IPO, raising net proceeds

of $110.8 million. The Houston-based manufacturer of patented mobile proppant management systems sold 10.1 million shares at $12.00 per share after seeking $15.00-$18.00 per share for 10.6 million shares when it filed earlier in May.

If the underwriters exercise their 30-day greenshoe of 1,515,000 shares, the IPO will bring Solaris $127.9 million. Solaris will use all of its proceeds to fund a subsidiary, Solaris Oilfield Infrastructure, LLC,

in exchange for limited liability company units in Solaris LLC. From there, Solaris LLC will use the net proceeds to repay borrowings incurred

under its credit facility, to pay cash bonuses to certain employees and consultants, to make a cash distribution to the existing owners of Solaris LLC, and to fund Solaris’ 2017 capex, which was budgeted at $40-55 million.

The company is most active in the Permian Basin, the Eagle Ford and the SCOOP/STACK. Solaris manufactures its equipment in Early, TX, between the Permian and the Eagle Ford. The standard Solaris system holds 2.5 million lb of proppant in six silos that take up the space of two flatbed trailers—three times the proppant in half the space of a competitor’s system, Solaris says.

Credit Suisse and Goldman Sachs acted as bookrunners for the offering. Solaris is trading on the NYSE under “SOI.”

A&D

Keane acquires fellow fracker RockPile Continued From Pg 1Tidewater expects bankruptcy

proceedings to last 45 days.

Access PLS’ archive for previous oilfield services newsFor general inquiries, email [email protected]

Volume 07, No. 06 7 ServiceSectOr

OilfieldServices

Oilfield services taking the lead in IPO activityOilfield services have played a larger-than-usual role in the US energy IPO market

in 2017, keeping pace with upstream IPOs. However, the OFS offerings have been mixed, with some downsized, delayed or trading below the initial price.

Five oilfield services companies in the US have gone through with IPOs in 2017, according to PLS’ Capitalize, the latest being Solaris Oilfield Infrastructure, which builds mobile proppant management systems (PG. 6). Six upstream companies have done so this year. Four of the six are blank-check companies, leaving Jagged Peak Energy and Kimbell Royalty Partners as the only true E&P companies to hold IPOs this year. Upstream companies had six IPOs in 2015 and 2016 combined compared with only two in

oilfield services.Rising rig counts have led to rising

revenue for oilfield services, which should attract investors. Companies are also using increased activity as a time to seek more capital to expand such as Source Energy Services’ IPO to buy a frac sand mine or Liberty Oilfield Services’ plan to use proceeds to buy 120,000 hhp in new frac fleets.

However, the downsizes and delays suggest that investors remain unconvinced of the recovery in the services sector. Companies seeking IPOs are “going to have to tell the story and differentiate themselves,” Rob Thummel, a portfolio manager at Tortoise Capital Advisors, told Bloomberg.

The services IPO market came to a halt in October 2014 when sand industry leader FairmountSantrol went public. The IPO was originally priced as the largest in US oilfield services history, with anticipated proceeds of over $1.0 billion. Instead, the IPO was downsized resulting in net proceeds of $379 million. The company’s stock is now trading at a third of its $16/share offering price. That was the last oilfield services IPO for two years.

The next oilfield services IPOs should be Denver-based fracker Liberty Oilfield Services and Houston-based production and completion services provider Nine Energy Service, which have filed paperwork with the SEC for their own IPOs. Liberty said it intends to seek up to $400 million, while analysts have predicted Nine will aim for around $300 million.

Finance

Seadrill again warns of bankruptcy amid debt talks

Warnings that Seadrill’s debt restructuring talks have reached an “advanced” stage overshadowed a growing order backlog in the deepwater driller’s Q1 earnings report.

Debt restructuring negotiations have been extended until

July 31, and a restructuring deal would probably include a Chapter 11 filing, in which shareholders would have

“minimal recovery.” For Q1, Seadrill reported total net interest-bearing debt of $8.2 billion.

The Q1 update also referred to involvement of “certain third-party and related-party investors” in discussions of a “comprehensive recapitalization.” Some analysts have interpreted that as a suggestion that Norwegian billionaire and Seadrill founder John Fredriksen will have a role.

Seadrill Group’s contract backlog increased by $700 million from Q4 to $7.1 billion in Q1. SeaMex, a Seadrill 50% WI JV, got a 29-month extension of five jackups contracted with Pemex. While SeaMex agreed to give a discount on contracted rates for 22 months starting last November, the net result was a $580 million increase to Seadrill’s backlog. On top of the SeaMex contract, Seadrill subsidiary NADL received 10-year contracts for two jackups with ConocoPhillips for the Greater Ekofisk area, which will add $1.4 billion to the contract backlog.

Seadrill reported Q1 net income of $57 million compared with net income of $127 million in Q4 and $88 million YOY. Q1 revenue of $569 million was down 15% from Q4 and 36% YOY.

Ch. 11 filing likely to be part of any restructuring plan.

Q1 net income declined 55% from Q4, 35% from 1Q16.

OFS companies netted $1.18B in ’17 IPOs, E&Ps only $532MM.

Oilfield services went 2 years in between IPOs.

Oilfield Services And Upstream IPOs In 2017

Date Company SectorDeal

Amount ($MM)

Net Proceeds

($MM)

05/15/17 Solaris Oilfield Infrastructure Services $121.20 $113.93

05/05/17 TPG Pace Energy Holdings Upstream $600 $567

05/01/17 NCS Multistage Holdings Services $161.50 $151.41

04/24/17 Select Energy Services Services $121.80 $114.19

04/12/17 Vantage Energy Acquisition Upstream $480 $453.60

03/30/17 Kayne Anderson Acquisition Upstream $350 $330.75

03/24/17 Silver Run Acquisition Corp.II Upstream $900 $850.50

03/20/17 ProPetro Holding Services $350 $329.53

02/06/17 Kimbell Royalty Partners Upstream $90 $84.38

01/30/17 Jagged Peak Energy Upstream $473.99 $447.92

01/20/17 Keane Group Services $508.44 $475.39

Source: PLS Research

Canada's Step Energy Services and Source Energy Solutions also held IPOs.

PLS brings transparency to oil & gas capitalization www.plsx.com/capitalize

www.plsx.com To learn more about PLS, call 713-650-1212Find more on the oilfield sector at

OilfieldServiceS 8 June 2, 2017

■ Nine Energy Service, a completion and production services provider, has added several bookrunners to its proposed IPO. BofA Merrill Lynch, Credit Suisse, Raymond James, Simmons & Co. International, Tudor Pickering Holt & Co, HSBC, Scotia Howard Weil and UBS Investment Bank have been added to a list that already included JP Morgan, Goldman Sachs and Wells Fargo. The original filing with the SEC lists sought proceeds at $100 million, but analyst Renaissance Capital predicted that the company would probably seek $300 million.

■ In its first quarter of commercial production, Select Sands Corp. posted a Q1 loss from sand operations of C$428,862 ($323,963). However, the operations started turning a profit in March, with a gross margin of C$125,110 that month. Select Sands sold 29,227 tons of sand in Q1, and the company predicted that Q2 volumes will increase 40-60% from Q1.

Paragon reorg continues with English administrators hiredAn English court has appointed two administrators to oversee Paragon Offshore

as part of the driller’s bankruptcy plan. Paragon filed for bankruptcy in February 2016, but announced in May that court-ordered mediation with lenders had resulted in a new

reorganization plan.Two partners at Deloitte

were appointed as part of the UK’s Insolvency Act of 1986. Paragon will also appear in US Bankruptcy Court in Delaware on June 7 for a confirmation hearing. If the plan is confirmed, Paragon expects to be out of bankruptcy in early July.

Under the plan, the holders of $2.4 billion of Paragon debt will receive $515 million in cash and common equity. Equity will be wiped out. Noble Corp. spun off Paragon in 2014. The reorganization plan includes money for possible litigation against Noble, which denies undercapitalizing Paragon.

Support vehicle operator Gulfmark Offshore files for Ch. 11Gulfmark Offshore has joined others in the sector in filing for bankruptcy

protection. The company has begun Chapter 11 proceedings as part of a negotiated debt restructuring plan that has been approved by holders of 47% of Gulfmark’s unsecured

6.375% senior notes due 2022.Under the plan, Gulfmark

will convert the senior notes into 35.65% of equity in a reorganized company. Gulfmark will also offer the note holders a $125 million rights offering for another 60% of the equity. Existing shareholders will receive 0.75% of the new Gulfmark’s equity plus a warrant for an additional 7.5%. The plan would eliminate $430 million in outstanding debt.

Gulfmark runs a fleet of support ships for the energy industry in the North Sea, Southeast Asia and the Americas. The bankruptcy proceedings only involve Gulfmark Offshore and not its 33 subsidiaries.

Finance

Oilfield Services Stock Movers—Last 30 Days Source: CapIQ

Company Ticker$/Share

05/30/17$/Share

04/28/17%

Change

% Change

YOY

Top

5

Atwood Oceanics ATW $10.04 $7.83 28% -6%

CARBO Ceramics CRR $7.53 $6.87 10% -39%

RPC RES $18.95 $18.17 4% 28%

Exterran EXTN $27.87 $27.37 2% 122%

Halliburton HAL $45.15 $45.88 -2% 7%

Bot

tom

5

Bristow Group BRS $6.80 $13.37 -49% -49%

CSI Compressco CCLP $5.60 $8.10 -31% -39%

Matrix Service MTRX $8.20 $11.75 -30% -51%

Pioneer Energy PES $2.35 $3.05 -23% -34%

Diamond Offshore DO $11.57 $14.42 -20% -55%

Note: Data includes public, US & Canadian-listed companies operating in the oilfield service space, limited to companies >$1.00/share and market cap >$100 million.

Texan told to pay $21.3MM over sale of Yellowjacket

A judge has ordered a Texas multimillionaire to pay $21.3 million over a dispute of the sale of Yellowjacket Oilfield Services. A jury decided that Denison businessman Lacy Harber owes $18.4 million to Gerardus “Jerry” Smith, a former owner of Yellowjacket, and Grayson County District Judge Jim Fallon added prejudgment interest and attorneys’ fees, including amounts for any future appeals to the award.

Smith initially sold a major share of Yellowjacket, a Midland-based wireline and completion services company to Tommy Robertson in exchange for payments over three years. Harber, through his company LDJH, LLC, later purchased Robertson’s stake, agreeing to assume the future payments due to Smith.

Harber and LDJH sought a declaratory judgment, asking the court to determine how much LDJH owed Smith. Seeking the $18.4 million owed to him, Smith countersued Harber and LDJH.

Restructuring would eliminate $430 million in debt.

Plan wipes out current common stock and $2.4B in debt.

All Standard Disclaimers & Seller Rights Apply.

January 13, 2015 • Volume 08, No. 02

CapitalMarketsServing the marketplace with news, analysis and business opportunities

NORTH TEXAS SALE PACKAGE 18-Wells. ~4,000-Gross Acres.PARKER, JACK & ERATH COUNTIESBig Saline, Marble Falls, Atoka Sand, PP-- & Conglomerate Reservoirs.Behind-Pipe Potential In Each WellAdditional Barnett Shale PotentialAll Acreage HBP. 18 Leases. 19275-100% Operated WI; 80% Lease NRI MCFDGross Production: 271 MCFD & 33 NGLsNet Production: 192 MCFD & 23 NGLPP 3426DV

KERN CO., CA PROPERTY ~18,000-Contiguous Net Acres.BEER NOSE FIELDBloemer Tight Sandstone Objective. PPEstimated Depth: 10,000-15,000 Ft.Also Monterey, Belridge, Gibson, Oceanic,Santos, Tumey & Kreyenhagen Potential. TIGHT100% OPERATED WI; ~77% NRI SANDGross Production: 36 BOPD & 57 MCFDNet Production:27 BOPD & 44 MCFD6-Mn Avg. Net Cash Flow: ~$28,800/MnPP 5217DV

FEATURED DEALS

Rice Midstream IPO raises $474MM in tough market

After a fairly banner 2014 for energy IPOs on the whole but a significant dry spell for all segments other than midstream through the last few months of the year, Rice Energy put a nice bow on 2014 with its buzzer beater Rice Midstream Partners IPO. Rice sold 28.75 million units at $16.50, for total gross proceeds of $474.4 million, and $441.6 million net. Units priced 17.5% below the midpoint of the

targeted price range of $19-$21/unit, probably reflecting the challenges the energy sector has seen of late in terms of obtaining financing. However, in an interesting turn for an underpriced IPO, subsequent demand was strong enough to merit full exercise of a 3.75 million unit option (included in the above gross proceed total) which boosted proceeds by $61.9 million.

Upstream MLPs under fire as distributions cut Upstream MLPs have been the subject of much discussion of late as a particularly

at-risk segment of the energy patch, and these concerns have in fact been realized for at least some partnerships with distribution and capex cuts. MLPs in general have been favored for their bond-like, high-yield distributions, stemming from preferential tax treatment for reinvesting a high percentage of profits back into the business. However, they also generally rely heavily on debt to fuel growth. And unlike their midstream brethren which are better positioned to weather recent commodity volatility with long-term, fixed-price contracts, upstream MLPs face full exposure to the recent oil and gas price declines, except to the degree they make use of hedges. However, hedges will largely peel off over the course of the year, and many of these partnerships will soon face the difficult decision of using cash to cover interest requirements and maintaining what may have become unsustainable payouts, or slashing the distributions which drew investors to them in the first place so they can make debt levels more reflective of current economics.

Concho dials capex back $1.0 billion in second look In a rather noteworthy example of what many companies which announced 2015

spending plans early are dealing with these days, Concho Resources revised its capex for this year to more accurately reflect current market conditions. In early November

when WTI was still trading above $78/bbl, Concho had announced a $3.0 billion 2015 budget targeting ~30% production growth, but warned that it would ease spending if oil prices didn’t firm up over the next few months.

With oil now near $45, that clearly hasn’t happened, and Concho has proceeded accordingly with a new $2.0 billion plan which is 33% lower than prior guidance and down 23% YOY vs. 2014’s $2.6 billion.

The new plan contemplates $1.8 billion in D&C spend (down 33% from the prior $2.7 billion), with ~$1.3 billion or 72% of spend targeting the Delaware Basin (down 25% vs. prior budget, up from 64% of total spend), $300 million or 17% targeting the Midland Basin (down 49% vs. prior budget and 22% of total) and the remaining $200 million or 11% targeting the New Mexico Shelf (down 47% from prior budget and 14% of total).

Southwestern plans multibillion equity raise to fund buys The implications of Southwestern Energy’s $4.98 billion acquisition of West

Virginia and southwest Pennsylvania assets from Chesapeake Energy (plus another $394 million in add-ons in the region from Statoil) are beginning to become apparent for the company, with impacts on both Southwestern’s capital structure and capex.

The company is finally providing a clearer picture of how it plans to permanently fund the Chesapeake deal. The acquisition was funded

at closure with a $4.5 billion bridge loan and a two-year $500 million unsecured term loan, but significant sums of longer-term debt and equity were clearly needed.

In line with its previously announced intentions, Southwestern announced a proposed equity sale which should raise $1.8- $2.1 billion, depending on whether options are exercised. Specifically, the company plans to sell 20.26 million shares of common with a 3.04 million share option, and 26 million depositary shares (each amounting to a 1/20th interest in Series B mandatory preferred shares) with 3.9 million shares in possible options.

Should raise $1.8-$2.1 billion in equity depending on whether options go.

Boosting focus on Delaware Basin from 64% of prior budget to 72%.

Upstream MLPs are choosing between debt loads & distributions.

Units priced 17.5% below midpoint at $16.50 but option fully exercised.

Continues On Pg 4

Continues On Pg 6

Continues On Pg 8

Continues On Pg 14

$41B in securities offerings during Q1, says Capitalize.

CapitalMarkets May 10

Access PLS’ archive for previous oilfield services newsFor general inquiries, email [email protected]

Volume 07, No. 06 9 ServiceSectOr

OilfieldServices

Date Location AbstractAfrica

May 25 Angola- Block 15 NRC Angola, working in partnership with Angolan o&g service company Tradinter, has been awarded its first contract involving supply of a customized external caisson cleaning system on an FPSO in the block.

Europe

May 30 Norway- Valhall Allseas has a call-off for removal of the field QP topsides and QP/DP bridge in 2019, followed by disposal of both facilities. There are further options for removal and disposal of the QP and 2/4G jackets at a later date.

May 26 UK-Chevoit

Alpha Petroleum has selected GE Oil & Gas as subsea engineering and equipment supplier for the Cheviot development. GE O&G will supply early engineering, project management, and procurement activities for Cheviot under an agreement that is expected to lead to the supply of subsea trees, a full control system, three manifolds, flexible jumpers, flowlines, risers and umbilicals. GE will also provide subsea construction and installation services and support commissioning.

May 19 Norway-PL667Plexus will supply Aker BP surface wellhead equipment for the upcoming Hyrokkin and Nordfjellet wells, both to be drilled during Q3. The equipment includes Plexus' proprietary Pos-Speed connector system and cost ~$900,000.

May 19 UK- Tolmount Costain has been awarded the onshore FEED contract for the Tolmount development, with Land & Marine winning the beach crossing FEED.

May 19 Norway- Multiple Statoil extended completions specialist Tendeka’s work scope at its fields offshore Norway.

May 24 GOM- Julia Maersk Drilling has been awarded a $22.5MM contract extension for the ultra-deepwater drillship Maersk Viking by ExxonMobil.

May 19 Canada- Terra Nova

Subsea 7 will carry out a subsea work program at Terra Nova starting in August. Work will cover instal-lation of a water injection riser and water injection tree and converting related subsea equipment to handle water instead of gas.

Asia

May 31 Mongolia- Block V Petro Matad has awarded an LOI to Sinopec for the drilling of up to two wells in 2017.

May 30 UK-Tern & Otter Bibby Offshore has been awarded a contract with Taqa for subsea construction work in the field.

May 22 Russia- Sakhalin-2

Sakhalin Energy has awarded a five-year technical support services contract to Wood Group for the Sakhalin-2 project, with options to extend by up to two years. The deal adds brownfield drilling upgrade services to those already provided by Wood Group, and involves a number of assets, includ-ing: The Piltun- Astokhskoye-A and Piltun-Astokhskoye-B and Lunskoye-A offshore platforms; onshore processing facilities; the LNG plant; the oil export terminal and the tanker loading unit.

May 19 Russia- Taimyrsky

Halliburton started drilling operations in the Zhuravlinaya area of the Vostochno-Taimyrsky license block for Lukoil in early April. The project involves Halliburton constructing a 5,500m exploration well, in addition to delivering an integrated service package which includes directional drilling, drill bits, drill-ing fluids, well cementing and other services.

Australia & Oceania

May 9 Australia- PEP 11

Advent has appointed SLR Consulting to conduct an independent assessment of marine noise gener-ated by the planned 2D seismic survey to consider potential impacts on marine fauna in the area of the 2D seismic survey. It is anticipated that this will demonstrate a very low impact of the planned opera-tions on the marine environment.

Middle East & North Africa

May 29Egypt- West Mediterranean Deep

Add Energy has been awarded an £1MM contract with BP to carry out the development of a full asset maintenance build on the WND project. Development is due for completion in March 2018.

May 18 Qatar- Al-Shahen

Ramboll has been appointed by the North Oil Company to carry out a pre-FEED study for three new WHPs for the field.

May 18 Qatar- Al RayyanIn May 2017, Teekay Offshore finished a five-year contract extension, plus extension options for the FSO starting June 2017. The Falcon Spirit has been operating on the Al Rayyan field, offshore Qatar since 2009.

See more at wire.petrowire.com Email [email protected] to begin your trial!

Database Drilling, Contstruction & Service Contracts wire.plsx.com

www.plsx.com To learn more about PLS, call 713-650-1212Find more on the oilfield sector at

OilfieldServiceS 10 June 2, 2017

■ Wood Group will provide topsides conceptual and pre-FEED for two semisubmersible platforms in the Gulf of Mexico, the first work orders under a 10-year master services agreement with Chevron. Under the agreement, Wood Group will deliver conceptual engineering, pre-FEED detailed design and procurement services at multiple Chevron sites. The first assignments are on the Tigris and Anchor developments, where the platforms will operate in 4,000-5,000 ft of water. Financial terms were not released.

■ A JV of FairfieldNodal and Schlumberger is seeking permits for an imaging of 1,100 sq mi in the southern Delaware Basin. The Coyanosa Survey’s first phase will be a 3D seismic survey of 306 sq mi in Ward, Reeves and Pecos Cos., TX. Field operations at the area of mutual interest are expected to begin shortly. FairfieldNodal and WesternGeco, a Schlumberger company, will jointly license the data. Dawson Geophysical will handle field acquisition and TRNCO Petroleum will provide project management.

Finance

PE firm Pelican invests in Johnson Specialty Tools

Pelican Energy Partners has invested “significant growth equity” into Johnson Specialty Tools, the latest in a run of activity for the Houston PE firm. Earlier this year, Pelican made a similar investment in Canadian-based Quinn Artificial Lift Services and arranged a merger of two companies it backs, Houston-based Performance Wellhead & Frac Components with Slingshot Supply of Odessa, TX.

JST provides complete fluid management systems for drilling rigs including specialized pumps. The Houston-based company has locations in Pleasanton, TX, and Midland, TX.

Craig and Brett Johnson, third- and fourth-generation oilfield service entrepreneurs, founded JST in December 2014. Craig Johnson is the founder and former CEO of Stallion Oilfield Services.

Contracts

Precision anticipates adding 30 rigs to Western CanadaPrecision Drilling plans to have 60-70 active rigs in Western Canada this summer,

nearly double what it had a year before, CEO Kevin Neveu said. This means, 30 rigs and 750 people will be put back to work.

Most of the hires will be recalled workers Precision laid off in the downturn, the CEO said, but there will be a “wedge” of new hires. “We always want that wedge because we don’t want to get caught out with a workforce

getting older,” Neveu told reporters after Precision’s annual meeting in Calgary.However, $50/bbl crude has producers pinching pennies, and Neven warned

that dayrates will need to rise $2,000-$4,000 a day to stabilize the Western Canadian drilling industry. “There’s no question that lower costs are helping our customers… but I can tell you that dayrates right now are generally still unsustainably low, and need to be a little higher for this industry to be fully healthy long-term,” he said.

Maersk Viking’s dayrate at Julia field slashed in extensionThe contract for the Maersk Viking in the Gulf of Mexico has been extended

for 150 days by ExxonMobil although at a much cheaper dayrate. Maersk Drilling estimated the value of the contract extension as $22.5 million, which comes out to a

dayrate of $150,000. The drillship has

been operating at Julia field since it was delivered from the shipyard in 2014. The original contract paid dayrates up to $557,000 and was scheduled to end in July.

“We are now looking at a dayrate much lower than the original contract, reflecting the current market situation. However, Maersk Drilling has significantly lowered cost levels across the fleet in the past years, enabling us to operate just as efficiently in this new environment,” said Michael Reimer Mortensen, VP and head of global sales in Maersk Drilling.

Contracts

Oceaneering signs ROV deal for Canada work into 2026 Oceaneering International has reached an agreement lasting into 2026 to

provide two remotely operated vehicle systems for projects offshore Newfoundland and Labrador. The Houston-based company only identified the customer as a “major

international oil and gas company.” The ROV systems will be onboard a multi-function platform

support vessel. Oceaneering will help the customer with subsea construction, inspection, maintenance and repair services on existing and future infrastructure. The company has a fleet of 282 ROVs.

Oceaneering also announced in May that Shell Offshore has awarded it a contract to support the design, fabrication and installation of ancillary flowline hardware for the Appomattox development in the Mississippi Canyon area of the US Gulf of Mexico. The new Ocean Evolution, scheduled for delivery in H2, is expected to be used to perform the offshore installation until sometime in 2019.

The assignment will include procuring and installing pre-lay and post-lay crossing mattresses, fabricating and installing flowline jumpers and manifolds. Oceaneering will also design, procure, fabricate and install subsea buoyancy for flowline thermal expansion.

In addition, Oceaneering’s Asset Integrity business segment has received a three-year operational inspection frame agreement extension with Statoil Petroleum. Oceaneering will develop and implement inspection and maintenance programs at 14 Norwegian onshore and offshore facilities. The programs include the assessment and reporting of integrity status and corrective measures.

Financial terms were not disclosed with any of the announcements.

Dayrate of drillship’s extension about a quarter of contract’s high.

Also inks agreement with Shell for Appomattox development in GOM.

Access PLS’ archive for previous oilfield services newsFor general inquiries, email [email protected]

Volume 07, No. 06 11 ServiceSectOr

OilfieldServices

■ Saipem has won an engineering, procurement, construction and installation (EPCI) contract with an

affiliate of ExxonMobil to work on Liza field 120 miles offshore Guyana. The Italian drilling

services company will handle the EPCI of the risers, flow lines and associated structures and jumpers needed for the development. Saipem will use its flagship vessels FDS2 and the Normand Maximus to execute the work, starting in 2019.

■ Iran has agreed to buy more than €550 million ($617 million) of corrosion resistant alloy (CRA) pipes for its oil industry from Tubacex. The Spanish company signed the deal with Foolad Isfahan. The Iranian company will take over production of the pipes within three years.

■ Jacobs Engineering has received a multi-year contract for engineering and procurement services for Nexen Energy’s operations in Western Canada. Financial terms were not disclosed.

■ MiX Telematics announced that fracker C&J Energy Services has selected MiX Fleet Manager for its more than 3,500 light- and heavy-duty vehicles for performance, design and technical specifications. MiX Fleet Manager is ELD-ready and supports the FMCSA's current requirements.

■ Hess extended the contract for Noble Paul Romano, a semisubmersible in the Gulf of Mexico, from late June to early August. That was the only change to Noble Corp.’s monthly fleet status report in May. Noble has 21 rigs under contract, five cold stacked and three warm stacked.

Contracts Investments from state-owned Saudi Aramco are seen as critical for the company

to stay competitive. "Who best to bring the technology and know-how to become even more competitive than the big American oil names?" Brian Youngberg, senior energy analyst at Edward Jones, told CNN.

Oilfield Services to vastly benefit from planned new spending—NOV, which will own 70% of the JV, currently builds rigs for MENA at Jebal

Ali, Dubai, which can produce 12 rigs a year. Because of increased demand, NOV was taking over the yard next door to expand to 16 rigs a year. This expansion could be off as

NOV focuses on the Saudi facility, which will include training Saudis to maintain and operate the facility. While the JV will be free to sell to other customers, initial demand is expected to come from a JV between Saudi Aramco and Nabors Industries that was announced in October.

The Saudi Aramco-Nabors JV will purchase 50 onshore drilling rigs over 10 years. The Nabors-Saudi Aramco JV was also extended during Trump’s visit to include additional well services and rig-movement studies. The JV will own, manage and operate onshore drilling rigs and begin operations in July. In all, this

JV is expected to see $9.0 billion of investment over 10 years, while creating 4,000-5,000 Saudi jobs.

On the offshore side, the 50:50 JV between Rowan Companies and Saudi Aramco announced it would begin the design and selection process for offshore drilling rigs, part of a $7.0 billion investment to own and operate the rigs. The JV, which was announced in November, has been named Aro Drilling—for Aramco Rowan Offshore.

Aramco reached an MOU with GE to perform a digital transformation of its operations to generate $4.0 billion in annual productivity improvements. The companies also signed an MOU for a broader Oil & Gas Investment Feasibility Study. GE agreed to provide a private cloud computing system and help establish a STEM educational curriculum for high schools and universities. Under the MOUs, Saudi Aramco and GE agreed to support the Saudis’ IKTVA program by helping create a local supply chain.

Saudi Aramco also announced MOUs with Schlumberger, Weatherford and Halliburton all to help Saudi Arabia localize oilfield goods and services. While financial terms were not announced, the Schlumberger deal was said to create 2,600 jobs and the Halliburton deal would create over 750. A Weatherford deal reportedly

involving $2.0 billion worth of projects will create more than 900 jobs.

A $3.6 billion Honeywell MOU was touted as helping Saudi Arabia further develop and diversify Saudi Arabia’s oil and gas sector and accelerate the Industrial Internet of Things for Saudi Aramco. Honeywell also signed an MOU to support IKTVA by developing engineering capabilities at industrial centers in the kingdom. McDermott International also agreed to support IKTVA through developing full-scale fabrication and marine facilities and moving regional operations to Saudi Arabia. The engineering, construction, procurement and instillation (EPCI) company estimated the value of the MOU at $2.8 billion.

Jacobs and Saudi Aramco agreed to create a JV to provide professional program and construction management services for social infrastructure projects, such as schools, hospitals and public housing, a deal valued at $250 million.

Saudi Aramco signs $50B in MOUs Continued From Pg 1

JV involving National Oilwell Varco to be worth $6B.

Nabors JV to purchase 50 onshore drilling rigs over 10 years.

Local supply chain part of MOU with Schlumberger, Halliburton, GE.

Honeywell to offer Internet of Things to Saudi Aramco.

Complete transaction services for sellersHelping clients market non-core assets since 1987.

www.plsx.com/advisory

713-650-1212

www.plsx.com To learn more about PLS, call 713-650-1212Find more on the oilfield sector at

OilfieldServiceS 12 June 2, 2017

■ Anton Dibowitz will take over as CEO of Seadrill Ltd. on July 1, replacing Per Wulff, who will remain a director with the company. Dibowitz joined Seadrill in 2007. He was appointed EVP and chief commercial officer in June 2016, when he assumed day-to-day business administration for the company as part of the company’s succession plan. Before joining Seadrill, Dibowitz worked for Transocean and Ernst & Young.

■ Tom Pajonas, COO of Flowserve and interim president of the Industrial Products Division, has told the company he will retire on Dec. 31. Flowserve, a provider of fluid motion and control products and services, has decided that will immediately take the position of president of IPD. The other division presidents will report to Flowserve President and CEO Scott Rowe. Flowserve also announced the election of its board of directors. In addition to Rowe, the board consists of: Leif Darner, Gayla Delly, Roger Fix, John Friedery, Joe Harlan, Rick Mills, David Roberts and Ruby Chandy.

■ Lyle Whitmarsh has been appointed president of Savanna Energy Services. Whitmarsh currently serves on the board of directors and will assume the duties of president effective June 1. He has more than 33 years of experience in the oil and gas industry.

■ The global fracking chemicals market will be a $57.59 billion market by 2025, according to a report. The global demand in 2016 for fracking chemicals was 2.2 million tons, and Grand View Research said it expects that to rise 9.1% a year to 2025. The Asia Pacific will have particularly rapid growth of 13.8% expected to 2025.

■ Epic Lift Systems has opened a new facility in Midland, TX, its latest expansion for Permian Basin customers. The Fort Worth-based company offers artificial lift solutions to E&P companies, including plunger lift, gas lift, and wellhead compression. Epic also has operations in Oklahoma, New Mexico, Louisiana, Colorado, Utah, Wyoming, Pennsylvania, Ohio and West Virginia.

Developments & Trends

Newpark Resources signs $70MM in international contractsNewpark Resources will provide drilling fluids and related services as part