July 2014 The Bakken magazine

-

Upload

bbi-international -

Category

Documents

-

view

220 -

download

0

description

Transcript of July 2014 The Bakken magazine

www.THEBAKKEN.comPrinted in USA

Locations in Minot and Watford CityOffice: 701-837-0800 | Cranes: 307-231-6766 | Trucks: 701-818-0013

www.RosscoCrane.com

COVERING THE ENTIRE BAKKEN AREA Full Drilling Rig Moves | Work-Over Rig Moves | CompletionsHeavy Equipment Hauling | 100% TERO Compliant

(701) 575-8242 www.mbienergyservices.com

North Dakota | Wyoming | Texas | Pennsylvania | Colorado

Well established, innova on in safety and excellent customer service is what truly makes MBI Energy Services

“The Oilfield Service Professionals.”

THEBAKKEN.COM 5

CONTENTS JULY 2014 VOLUME 2 ISSUE 7

Pg 20 LOGISTICS

The State of WaterThe North Dakota State Water Commission reveals

how hydraulic fracturing, new completion methods, water recycling and the water permitting

process impact water use. BY EMILY AASAND

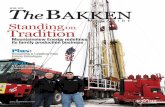

ON THE COVER: Finding drilling efficiencies isn't the only production advancement for Halcon Resources. The company has also utilized slickwater fracks to increase production. PHOTO: HALCON RESOURCES

Pg 28 EXPLORATION & PRODUCTION

The Slickwater StorySlickwater fracking increases production, lowers costs and has the Bakken buzzing. An operator, energy services provider, water supplier and engineer and a proppant supplier discuss the trend. BY LUKE GEIVER

DEPARTMENTSIN PLAY

46 Bakken Firm Joins Nine EnergyThe formation of a new energy services company gives a Bakken fi rm a chance to expand its off erings. BY EMILY AASAND

IN PLAY48 SD School of Mines Launches Energy Education Opportunities

Following the success of its Shale Research Initiative announced earlier this year, the South Dakota School of Mines is expanding its shale energy educational off erings. BY PATRICK C. MILLER

6 Editor’s NoteWhat To Know About Water In The BakkenBY LUKE GEIVER

8 ND Petroleum CouncilBakken Crude Characteristics and Crude by Rail: MYTH VS FACTBY TESSA SANDSTROM

10 Events Calendar

14 Bakken NewsBakken News and Trends

The BAKKEN MAGAZINE JULY 20146

How do you describe a process that happens 10,000 feet be-low ground? Numbers help, for starters. Add in some microseismic imagery interpreted by experts, combined with the general theories of those who commissioned the process, and the prospect of explaining becomes feasible. To explain the impact of slickwater fracking on the Williston Basin, we deployed all of those methods to produce a comprehensive look at the fracturing method that has operators touting impressive production increases. We included per-spective from several well-known Bakken entities, including an operator, energy services fi rm, engineer, water supplier and a proppant expert.

In “The Slickwater Story,” we’ve explained the basics of slickwater frack designs and the logistics required to make the process happen. We even included a less-technical analogy from an energy services provider in the piece to help describe what happens 10,000 feet below ground. Imagine breaking a pane of glass, he says, and all the little pieces of glass remain attached. That process creates an incredibly complex fracture network that allows for better hydrocarbon drainage.

In addition to the piece on slickwater, the July issue includes an examination of North Da-kota’s current state of water availability, the permitting process and overall usage. For her story, “The State of Water,” staff writer Emily Aasand spoke with Jon Patch of the North Dakota State Water Commission about the commission’s report, “Facts About North Dakota Fracking and Water Use,” which covers the current state of water availability, the permitting process and overall usage.

In 2012, fracking accounted for roughly 4 percent of North Dakota’s total water con-sumption. Although that number has most likely risen since 2012, other uses such as irrigation, municipal and power generation will still account for more of the state’s water consumption than fracking. But, that doesn’t mean fracking isn’t causing the Water Department to rethink the way it deals with water used for the process. As Aasand writes, the State Water Commission is vastly understaffed for keeping track of the water used and permitted for fracking. The other looming, and quite possibly biggest hot-button issue, regarding water and fracking in North Dakota is the Missouri River, an incredible resource that the State Water Commission can-not typically utilize. Just how incredible is the river? “One day of the average daily fl ow of the Missouri River at Bismarck (45,480 acre-feet) is enough water to frack 6,497 wells or 87 percent of all wells ever fracked in North Dakota,” the report said. Aasand’s piece explains why North Dakota cannot better utilize the resource.

In a nonwater-related vein, staff writer Patrick Miller reports on the investment the South Dakota School of Mines and Technology, in Rapid City, is making in the Bakken and other shale plays including the Rockies. The intentionality of the school’s investment shows in a statistic the school provided Miller: Engineering students from the program have a 100 percent placement in the oil industry and receive the highest starting salary of any other degree at the school.

What To Know About Water In The Bakken

Luke GeiverEditorThe Bakken [email protected]

EDITOR'S NOTE

For the Latest Industry News:www.TheBakken.comFollow us:

twitter.com/thebakkenmag facebook.com/TheBakkenMag

THEBAKKEN.COM 7

www.THEBAKKEN.com

VOLUME 2 ISSUE 7EDITORIAL

Editor Luke Geiver [email protected]

Senior Editor Sue [email protected]

Staff Writer Emily [email protected]

Staff Writer Patrick C. Miller [email protected]

Copy Editor Jan [email protected]

PUBLISHING & SALES

Chairman Mike Bryan [email protected]

CEO Joe Bryan [email protected]

President Tom Bryan [email protected]

Vice President of Operations Matthew Spoor [email protected]

Vice President of Content Tim Portz [email protected]

Business Development Manager Bob Brown [email protected]

Account Manager Tami [email protected]

Marketing Director John Nelson [email protected]

Circulation Manager Jessica Beaudry [email protected]

Traffi c & Marketing Coordinator Marla DeFoe [email protected]

ART

Art Director Jaci Satterlund [email protected]

Subscriptions Subscriptions to The Bakken magazine are free of charge to everyone with the exception of a shipping and handling charge of $49.95 for any country outside the United States. To subscribe, visit www.TheBakken.com or you can send your mailing address and payment (checks made out to BBI International) to: The Bakken magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Reprints and Back Issues Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or [email protected]. Advertising The Bakken magazine provides a specifi c topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To fi nd out more about The Bakken magazine advertising opportunities, please contact us at 866-746-8385 or [email protected]. Letters to the Editor We welcome letters to the editor. If you write us, please include your name, address and phone number. Letters may be edited for clarity and/or space. Send to The Bakken magazine/Letters, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203 or email to [email protected].

TM

Please recycle this magazine and remove inserts or samples before recycling

COPYRIGHT © 2014by BBI International

ADVERTISER INDEX

17 AE2S

22 AE2S Water Solutions

23 Appam Water Depot Inc.

39 ACS Construction Equipment USA, Inc.

4 Capital Lodge

38 Capps Van & Truck Rental

26-27 Energy Effi cient Group

36 Gamajet Cleaning Systems, Inc.

18 Gibson Environmental Services

43 Hotsy Water Blast Manufacturing LP

33 JANX

19 J-W Energy Company

3 MBI Energy Services

12-13 National Oilwell Varco

34 NCS Energy Services, Inc.

51 Peak Oilfi eld Service Company, LLC

24 Presto Geosystems

11 Quality Mat Company

2 Rossco Crane41 Serka Services, LLC50 2015 The Bakken | Three Forks Shale

Oil Innovation Conference & Expo

52 Tyco Fire Protection Products35 URTEC40 Watford City Homes Inc.16 Wells Concrete37 Westeel25 Wingate By Wyndham

The BAKKEN MAGAZINE JULY 20148

NORTH DAKOTA PETROLEUM COUNCIL THE MESSAGE

The transportation of crude oil by rail has been a top issue the last few months. In discussing this topic, one of the speculations was that Bakken crude may (please note: may) have been more volatile than other light sweet crudes, and therefore more dangerous to haul than many other hazardous materials that traverse the nation’s rails daily, including ethanol, gaso-line, diesel or other types of crude oil. That speculation was recently disproven by three sepa-rate independent studies, but still the misconceptions about Bakken crude continue to spread.

Myth: Bakken crude is more volatile than other crude oils

FACT: Three independent studies have shown that Bakken crude is similar to other North American light, sweet crude oils in gravity, vapor pressure, fl ash point and initial boiling point. Ac-cording to these studies, Bakken’s gravity, or density, is 41 degrees, which classifi es it as a light sweet

crude and is comparable to other light crudes, which are defi ned as having a gravity of 31.1 degrees or more.

Turner, Mason and Com-pany, one of the contractors commissioned to study Bakken crude characteristics, found that the average vapor pressure for the commodity was between 11.5 and 11.8 pounds per square inch (PSI), which is virtually the same as other light crudes.

In fact, U.S. Senators Jeff Merkley and Ron Wyden have acknowledged this and have rightly shifted focus on ensuring all hazardous materials, including ethanol, gasoline, diesel and crude oils, are transported safely.

Myth: Bakken crude is corrosive and damages tank cars.

FACT: Corrosivity is defi ned by the U.S. Department of Transportation as having the ability to corrode a tank car by a half a centimeter per year. Sulfur weight and acidity, measured by the total acid number (TAN)

are two contributors to corrosiv-ity. Bakken crude’s sulfur weight of .14 percent classifi es it as a sweet crude and well below the .5 percent threshold upon which it would be considered a sour crude. Comparatively, Bakken crude’s TAN is 0.1 to 0.2 milligrams of potassium hydroxide per gram (mg KOH/g) is low and compa-rable to West Texas Intermediate crude, a common benchmark crude. Crudes below 0.5 mg KOH/g is considered low TAN and rarely a concern. Crudes above 1.0 are considered high TAN, and require special refi nery processing techniques.

Myth: Bakken crude contains gases that make it more hazardous

FACT: The vapor pressure is a measure of a liquid’s ability to hold gases rather than releasing them into vapor. The Bakken’s average vapor pres-sure is an indicator

that the liquid portion continues to hold on to those gases despite seasonal temperatures. Ques-tions arose as to whether or not Bakken crude had a tendency to release vapors during transit. The Turner, Mason and Company study measured vapor pressure at the loading site in North Dakota and was measured again at the point of delivery 1,700 miles away in Louisiana. Results showed that the vapor pressure remained unchanged, showing that Bakken crude remains consistent even during transit.

Myth: Current DOT-111 tank cars are insufficient to haul Bakken crude

FACT: DOT-111 tank cars are designed to accept vapor pressures of up to 100 PSI, which means even the Bakken’s maximum vapor pressure of 14.4 is three times lower than the

Bakken Crude Characteristics and Crude by Rail: MYTH VS. FACTBy Tessa Sandstrom

THEBAKKEN.COM 9

NORTH DAKOTA PETROLEUM COUNCIL

accepted threshold. These same tank cars are used to haul ethanol, gasoline and diesel fuel, all of which also meet the criteria for these tank cars.

Myth: Bakken crude has been misclassified during shipping

FACT: Bakken crude has been properly classifi ed as a Packing Group I or II fl ammable liquid based on its fl ash point and initial boiling point. The study conducted by Turner, Mason and Company did identify fl aws in the classifi cation methodol-ogy, however. The limitations of the test required for measuring initial boiling point can result in the same sample of crude being assigned to Packing Group I (<95°F IBP) or Packing Group II (>95°F IBP). The American Petroleum Institute is currently working to determine improved, more precise classifi cation stan-dards for assigning fl ammable liquid packing groups to ensure maximum consistency and safety in the transportation of crude oils. Packing Group I or II ma-terials are still hauled in the same

type of railcar and elicit the same emergency response in the case of an accident.

Myth: Bakken crude needs to be stabilized or have light ends stripped before transit

FACT: Data from the stud-ies show that Bakken crude is not more volatile or fl ammable than other crudes. With a vapor pres-sure of 11.5-11.8 PSI, Bakken crude falls well below the safety margins built into railcars and well below the 43.5 PSI threshold between fl ammable liquids and fl ammable gases according to the DOT regulations.

Stripping of NGLs is used typically in the condensate win-dow where API gravity is above 50 degrees. At API gravities of 50-60 degrees, stabilization is required for pipeline trans-portation and required by EPA environmental standards. Bakken crude has an average API grav-ity of 41, which falls below the EPA tank vapor guidelines, so it doesn’t make sense for industry or regulators to explore strip-ping the NGLs from Bakken. In

most cases, “stabilization is used to fulfi ll market demand for light materials.” There is currently not a market demand for these lighter ends in North Dakota, however, and removing them from crude oil would require their transport by rail car to the Gulf Coast or East and West Coast where mar-kets currently exist.

The NDPC welcomes the establishment of these markets, however, to contribute to a grow-ing and diversifi ed North Dakota economy.

Despite these and other perpetuating myths, sound scien-tifi c data consistently show that Bakken crude is a high quality commodity that is safe to haul by rail. Regulators and leaders such as Merkley and Wyden have recognized this and have shifted focus to the root of incidences involving Bakken crude: the derailments themselves.

Safety always has and con-tinues to be a core value of the oil and gas industry and the goal is zero incidents. The NDPC and its members believe rail safety improvements must be developed

using a holistic, comprehensive, and systematic approach that examines prevention, mitigation, and response. Safety solutions must be data-driven and produce measurable improvements to safety without creating new risks or inadvertently shifting the risks to other businesses or operations. To achieve this, collaboration is needed among government, shippers, railroads, and tank car builders.

The NDPC met with the White House Offi ce of Man-agement and Budget on July 7 to discuss these characteristics and fi nd ways we can continue to work together to enhance safety in bringing this product to market and ensuring our state can continue to improve our energy security by providing a reliable energy resource for our nation.

Author: Tessa SandstromCommunications Manager,North Dakota Petroleum [email protected]

The BAKKEN MAGAZINE JULY 201410

EVENTS CALENDAR

The Bakken magazine will be distributed at the following events:

Bakken Artifi cial Lift & Production Optimization 2014July 16-17, 2014 Denver, ColoradoIssue: July 2014

The Bakken magazine

Unconventional Resources Technology Conference August 25-27, 2014Denver, ColoradoIssue: August 2014

The Bakken magazine

NDPC Annual MeetingSeptember 24-25, 2014Dickinson, North DakotaIssue: September 2014

The Bakken magazine

The Bakken | Three Forks Shale Oil Innovation Conference & Expo July 2015 Grand Forks, North Dakota

powerful ways to leverage the magazine’s targeted circulation:1. Print Advertising

The Bakken magazine (10,000 readers)

2. Online Advertising TheBakken.com (30,000+ monthly page views)

3. Weekly eNewsletter The Bakken Update (43,000+ targeted emails)

For more information, contact:[email protected] | 866-746-8385 | www.TheBakken.com

The Bakken magazine is one of the hottest forums where you can promote your products and services to a targeted circulation of decision makers looking for real solutions to the challenges they face every day in the Bakken play.

1 - 8 0 0 - 2 2 7 - 8 1 5 9 \ \ Q M AT. C O M

Quality Mat is the standard in the mat business. Manufacturing and installing mats worldwide for 40 years!

Don’t be a stick-in-the-mud.

World’s largest mat supplier. Over 60,000 mats in stock in Bismarck, Dickinson, Tioga and Killdeer locations.

Minimize: · Environmental Impact · Road Congestion · Reclamation Cost · Accidents · Rock Cost · Dust

Increase production while providing a safe working environment and accessing in all weather conditions 24/7 365 days a year.

ALL-WEATHER LOCATION 24/7

The BAKKEN MAGAZINE JULY 201412

EPA APPROVED

The IssueAre you in compliance with the new

EPA regulations effective April 2014?

EPA’S AIR RULES FOR THE OIL & NATURAL GAS INDUSTRY Storage tanks used in oil or natural gas production are subject to EPA’s 2012 New Source

Performance Standards (NSPS) for VOCs if they have the potential to emit six or more tons of VOCs a year. This legislation (40 CFR 60 Subpart 0000, “Quad 0”) also affects existing tank batteries built

from August 2011 to present. Tanks that come online after the most recent proposal is published in the Federal Register will require controls (a combustor or vapor recovery unit), to reduce VOC

emissions by 95 percent in place by April 15, 2014 or within 60 days after startup, whichever is later.

Get ready now and contact NOV today:Phone: 713 395 5000 | Email: [email protected]

© 2

013

Natio

nal O

ilwel

l Var

coAl

l rig

hts

rese

rved

D392

0055

89-M

KT-0

06 R

ev 0

1

THEBAKKEN.COM 13

The Solution

NOV’s full line of reliable enclosed combustors are designed to address the ever changing requirements of today’s regulation filled oil and gas industry. The EVC incorporates years of tank vapor experience with a highly effective combustor design— tested and EPA approved “99% plus” for destruction of vent emissions from oil and condensate tank batteries, loading operations and storage facilities. NOV’s stainless steel enclosed flare design is capable of meeting strict environmental industry regulations while also offering significant cost savings. Scalable to customer applications, this combustor is field-proven throughout the world.

For more information visit: www.nov.com/tb/mission

Enclosed Vapor Combustors: EVC

The BAKKEN MAGAZINE JULY 201414

BAKKEN NEWS BAKKEN NEWS & TRENDS

Traffi c Increases by the Numbers

North Dakota led the na-tion in diesel passenger vehicle (cars, SUVs, pickup trucks and vans) growth in 2013 with a 24.12 percent increase. Follow-ing were the District of Co-lumbia with 15.94 percent and Illinois with a 13.62 percent increase.

“Consumers have an ever-growing number of choices for more fuel-effi cient vehicles and this analysis shows that clean diesels are gaining in popular-ity all across the nation,” said Allen Schaeffer, executive

director of the Diesel Technol-ogy Forum.

Data that included the registration statistics of all pas-senger vehicles was compiled by R.L. Polk and Co.

According to the study, North Dakota tied for third with California in fastest growth in diesel cars and SUVs at 11.35 percent and came in fi fth in the nation for an in-crease in highest percentage of diesel passenger vehicles with a 6.4 increase from 2012-'13.

The increase in diesel

vehicles in the state solidifi es an increase in infrastructure to support the high volume of traffi c the Williston Basin has seen over the past couple of years.

Earlier this year, the North Dakota Department of Transportation released its State Freight Plan in an effort to promote safe, secure, sustainable and reliable freight mobility.

The plan outlines a stra-tegically developed transporta-tion system that is necessary

for North Dakota businesses to participate in the global economy. The primary em-phasis will be on highways fol-lowed by emphasis on railroad, pipeline transload and air cargo freight facilities.

The plan outlined the need for stronger communication af-ter the state saw an increase in train volume, in airline freight and a 22.4 percent increase in daily truck vehicle miles trav-eled from 2000-'12.

Implementation of the freight plan will consist of four

#1 NORTH DAKOTA+24.12%

#10 ARIZONA +7.68% #2 DISTRICT

OF COLUMBIA +15.94%

#3 ILLINOIS +13.62%

#4 DELAWARE +10.21%

#5 IDAHO+8.55%#6 NEW

JERSEY+8.54%

#7 OHIO+8.33%

#8 SOUTHDAKOTA+8.01%

#9 TEXAS+8.00%

Top 10 States of Diesel Drivers2013 Fastest Growth Diesel Cars, SUVS, Pickup Trucks and VansSOURCE: DIESEL TECHNOLOGY FORUM, MAY 2014

THEBAKKEN.COM 15

BAKKEN NEWS

components: infrastructure projects that eliminate freight bottlenecks and delays; new or modifi ed operational strate-gies; planning and feasibility studies; and, the application of innovative technologies to

improve the safe, secure, and effi cient movement of freight.

The plan will not only create more infrastructure to meet the transportation needs, but will also create more job opportunities within the state.

In January, Gov. Jack Dalrymple and the N.D. DOT Director Grant Levi appointed Dave Leftwich as a liaison to work with offi cials in Western North Dakota to help meet the transportation

needs in the state’s oil and gas region.

“With the increase in traffi c and transportation needs, it is imperative to work closely with local units of government,” said Levi.

National TruckNetworkSOURCE: NORTH DAKOTA DEPARTMENT OF TRANSPORTATION

– National Truck Network

Highway EnergyCorridorsSOURCE: NORTH DAKOTA DEPARTMENT OF TRANSPORTATION

Collection - Points

Rail Transload - Oil

Rail Loading - Sand

Western Area Water Supply Depot

Major Corridors

Feeder Corridors

The BAKKEN MAGAZINE JULY 201416

BAKKEN NEWS

Two new companies from across the map are fi nding prime business opportunities in the Bakken shale play. Companies from the East Coast as well as Europe are opening facilities in Western North Dakota to pro-vide quick and effi cient resources for oilfi eld operators.

Solvay, a Belgium-based chemical provider, opened a laboratory and production facility in Killdeer, N.D., that develops tailor-made, biobased formula-tions that help oilfi eld services operators manage and reduce water consumption, optimize stimulation operations and im-prove well yields.

“Most of our lab-to-well services are in Texas, but thanks to this new facility, we can now also seize growth opportunities with our oil and gas customers in North Dakota’s increasing shale gas activities,” said Chen Pu, Solvay Novecare executive vice president for oil and gas.

Solvay’s Global Business Unit Novecare is one of the fi rst specialty chemical players to serve companies in the Williston Basin. Each of their formulas is designed to fulfi ll distinct needs, depending on the unique geo-logical conditions of the shale for which the company is providing chemicals for.

“Our priority is to provide expert formulation and produc-tion services that quickly and accurately meet a specifi c applica-tion need, driving value for our customers,” said Jack Curr, direc-tor of Novecare unit Chemplex.

Along with Solvay, Praxair Inc., a company that produces, sells and distributes atmospheric, process and specialty gases, and high-performance surface coat-ings, is also catering to a demand in the Bakken.

Praxair has facilities in Wil-liston, Dickinson, and Minot and has opened its fourth gas fi ll plant in Bismarck, N.D., which will

signifi cantly increase the cylinder gases capacity in the Bakken play. The automatic facility has been designed to quickly and effi ciently fi ll packaged gases from single cylinders and packs to liquid ves-sels and tube trailers.

“The biggest benefi t is go-ing to be the increased capacity and the ability to turn products around quickly,” said Robert Crew, the general manager of the U.S. central region of Praxair. “We’re at approximately double the capacity that we had before and that’s just on the fi lling side. We built a plant that was designed to be loaded and unloaded quickly.”

Praxair’s new plant offers a variety of industrial and specialty gases as well as ultra-high purity gases and blends.

“This facility, together with our branch locations, help us more effectively serve the growing needs of regional busi-nesses,” said Crew.

The facility fi lls argon and argon carbon dioxide mixes that are used for welding applica-tions. Those welding applications are out in the fi eld for repair and maintenance on rigs, but they’re also used in construction products, pipelines, gas plant construction and for refi neries.

Specialty Chem Facilities Increase Oilpatch Services

FROM BELGIUM TO THE BAKKEN: Solvay is bringing its biobased chemical formula-tions to the Williston Basin. The company also operates in Texas. PHOTO: SOLVAY

THEBAKKEN.COM 17

The month of June saw sales of well-known companies in the Bakken. Oil production assets, retail business, and work-ing interest were all exchanged, which could have a signifi cant long-term impact on the Wil-liston Basin.

Marathon Oil Corp. sold its Norway oil production assets for $2.7 billion to Det norske oljese-laskap ASA in order to simplify and concentrate its business, according to the company.

“Since becoming an inde-pendent exploration and produc-tion company in 2011, Marathon Oil has executed $6.2 billion of strategic divestitures reposi-tioning the portfolio for future growth and profi tability,” said Lee Tillman, president and CEO of Marathon.

Before the sale of Marathon Oil Norge AS, the Norwegian as-set represented 17 percent of the company’s total global produc-tion. The Bakken, in both North

Dakota and Montana, represents 8 percent of Marathon’s global production.

Other companies doing business in the Bakken and fol-lowing that trend are Hess Corp. and WPX Energy, which both recently announced asset sales.

Hess Corp. sold its retail business to Marathon Petroleum Corp. for $2.6 billion. Marathon Oil and Marathon Petroleum are two separate companies. Accord-ing to Hess, proceeds from the sale will be used for additional share repurchases. John Hess, CEO, said the sale of the retail business marks the culmination of the company’s transformation into a strategic pure play explora-tion and production fi rm.

The sale includes 1,342 gas stations and convenience stores along the East Coast.

WPX Energy completed the sale of working interests in some of its historical Piceance Basin wells to Legacy Reserves LP for

$355 million. The agreement provides WPX with 10 percent ownership in a newly created class of incentive distribution rights with Legacy.

“We will use the proceeds from the sale to build on the successes we’re seeing in our growth basins, particularly our oil plays where we grew domestic volumes by 40 percent in the fi rst quarter versus a year ago,” said

Rick Muncrief, WPX president and CEO.

WPX had a near $1.5 billion capital budget this year and plans to gear that toward growing the company’s domestic oil proper-ties in the Williston and San Juan Basins, where WPX currently has seven rigs deployed.

Marathon, Hess Parlay Assets to Invest in Bakken

BAKKEN NEWS

SEA AND LAND SALES: Although neither company specifically stated it would use sale proceeds for Bakken investments, each alluded to the possibility. PHOTOS: MARATHON OIL CORP, WPX ENERGY

The BAKKEN MAGAZINE JULY 201418

BAKKEN NEWS

Development in the Bakken oil fi eld helped North Dakota lead all states in eco-nomic growth for the fourth consecutive year, according to statistics released by the U.S. Bureau of Economic Analysis (BEA).

North Dakota's gross domestic product (GDP), a measure of total economic production, increased 9.7 per-cent last year to top economic growth among all states. Min-ing—the extraction of min-eral resources, which includes oil, gas and coal—contributed 3.6 percent to North Dakota’s GDP growth.

According to the BEA, mining was one of the major contributors to earnings

growth in North Dakota, Oklahoma, and Texas in 2013. Earnings growth rates in these three states have outpaced the national average not only in 2013, but in each of the four years since the recession, the agency said.

North Dakota’s con-tinued economic growth is refl ected in many areas of commerce, including manu-facturing, agriculture, the energy industry, construction, transportation, wholesale trade, retail trade and the fi nance and insurance sectors, resulting in new jobs and ris-ing wages.

“It’s very encouraging that our continued economic growth stems from nearly

every business sector and that no single industry tells the whole story of the great progress we’re making,” Gov. Jack Dalrymple said. “Mov-ing forward, we will con-tinue to support economic growth through low taxes, a sensible and effective regula-tory environment and a state government that is responsive to the needs of its people and businesses.”

In 2013, North Dakota’s economy produced a record $49.8 billion. In the past four years, North Dakota’s economy has averaged an annual growth rate of about 12 percent compared to the national economy’s growth rate of 2 percent.

Other statistics that detail the state’s economic progress include:

• North Dakota has created 116,600 net jobs since 2000.

• North Dakota’s per-capita personal income of $57,084 represents the strongest income growth in the nation. In 2000, North Dakota’s per-capital personal income ranked 38th in the nation. Today, North Dakota’s personal income ranks second among all states.

• The state continues to have the nation’s lowest unemployment rate, at just 2.6 percent.

ND Economic Growth Leader 4 Straight Years

Production Waste • Drilling Waste

Crude Oil By-Products • Spill Waste

Our new Williston Basin full-service waste management facility will process production and drilling waste using innovative recycling technologies. In late spring 2014, we’ll debut a new state-of-the-art landfill. We are your complete resource for process, recovery and disposal of all E&P waste.It’s an exciting new day for WISCO – a name Williston Basin operators have trusted to provide safe, reliable production services for more than 50 years.

Find out more about our turnkeydrill cuttings capabilities:

visit: gibsons.com/esus

or call (701) 572-2135

The new WISCO is now:Gibson Environmental Services

Gibson Production [email protected]

The Any and All

Waste Management

Solution for

Williston Basin Operators

WISCO is now a part of Gibson Energy, a North American leader in environmentally

efficient waste management solutions.

THEBAKKEN.COM 19

BAKKEN NEWS

Summit Midstream Part-ners LLC in June announced four new oil, water or natural gas projects in North Da-kota requiring $300 million of investment, expanding the company’s footprint in Wil-liams and Divide counties.

Steve Newby, president and CEO of Summit, said he is pleased with the recent an-nouncements, particularly the Tioga Midstream development. The four new developments or project updates include:

Tioga Midstream—The new development will ser-vice a Bakken producer and help collect crude oil, water and associated natural gas in Williams County. The project

will require 240 miles of new pipeline. In total, the gathering system will offer 20,000 barrels per day capacity for crude oil, 25,000 bpd for water and 14 million cubic feet per day of capacity for moving associated gas. The project was formed with a 10-year, fee-based gath-ering agreement including an acreage dedication of 114,000 acres. The gathering system will help connect remote wells with the operator’s current natural gas processing plant.

Divide System Commer-cial—Through Meadowlark Midstream Co. LLC, a wholly owned subsidiary of Sum-mit, Samson Resources Co. will gain long-term crude oil

transportation. Meadowlark will continue its expansion of crude oil gathering lines in Divide County. The expanded infrastructure will be con-nected to Samson wells. The system should be running by the third quarter of this year.

Stampede Rail Con-nection—Meadowlark is also working on an oil transload facility for Global Partners LP. The crude oil unloading facility will include 55,000 barrels of crude storage capacity and a 47-mile pipeline to connect Global’s 270,000 barrel crude storage facility at Basin Trans-load’s Stampede rail terminal in Burke County, N.D. The rail portion of the project will help

connect other customers to both the East and West coasts, according to Meadowlark.

Kodiak Oil & Gas Corp—In Williams County, Meadowlark has agreed to expand its current gathering system known as the Polar System. The expansion will connect more than 60 pos-sible well pad sites for Kodiak over the next several years. The expansions will more than double the number of pad sites currently linked into the Polar System.

Four new North Dakota projects announced by Summit Midstream Partners

Serving the Industry since 1960 . . .

located to serve the

Bakken and

surrounding areas

energy solutions.

J-W POWER COMPANY Compression Services

J-W Power Company specializes in designing and fabricating compressors to our cus-tomer’s unique needs, providing a variety

services.

J-W WIRELINE COMPANY Cased-Hole Services

J-W Wireline Company excels in cased-hole logging and perforating, including multi-well pump-down plug and perforating opera-tions with radio frequency safe equipment capabilities.

Leasing I Sales I Service Logging I Perforating I TCP Natural Gas I Compression Slickline I Pipe Recovery

701-214-6955www.jwenergy.com

406-943-0116www.jwwireline.com

I

The BAKKEN MAGAZINE JULY 201420

LOGISTICS

This spring, the North Dakota State Water Com-mission issued a report, “Facts About North Dakota Fracking & Water Use,” which outlines several ele-ments of the fracking pro-cess used in the state and how those elements are impacted.

In 2012, records indicate that 12,629 acre-feet of sur-

face and ground water were used for fracking purposes, which was 4 percent of North Dakota's 2012 water consumption.

The report found that most of North Dakota’s wa-ter usage, about 56 percent, goes to irrigation, followed by municipal usage at 22 per-cent, power general usage at 9 percent, industrial (non-

fracking) usage at 6 percent, rural water usage at 3 percent and multi-use and bottling commercial and domestic us-age at less than 1 percent.

Hydraulic Fracturing Hydraulic fracturing––

water and other materials are injected under high pressure into a well bore to fracture the rock and release the oil––

is increasing in popularity. The wells in North Dakota generally require approxi-mately 7 acre-feet of fresh water for the drilling and hydraulic fracturing process, according to the report. That water is currently obtained from surface water and ground sources.

According to the report, where ground water has been

Hydraulic fracturing, permitting, recycling and new completion methods

are responsible for a new water eraBy Emily Aasand

THESTATE OF

WATER

THEBAKKEN.COM 21

LOGISTICS

used, it has generally come from freshwater aquifers within 2,000 feet of the sur-face, or from saline aquifers located between 5,000 and 6,000 feet below the surface. Regardless of the ground-water source, the use of this water for industrial purposes is managed and evaluated carefully by the Offi ce of the State Engineer. Tapping into

surface water to use at well sites is the preferred source, with the Missouri River fl ow-ing through the oil region. The Missouri River plays a valuable role in the hydrau-lic fracturing process both in terms of quality and quantity.

Although the river seems to be a viable option, many North Dakota oil rigs have been denied access within

reservoir boundaries by the U.S. Army Corps of Engi-neers, which forces rigs to seek water elsewhere.

The Corps has been re-stricting access to the Mis-souri River under its surplus water policy, in which the Corps contends it has author-ity through the Flood Control Act of 1944 to charge fees for the use of surplus stored

The BAKKEN MAGAZINE JULY 201422

LOGISTICS

water in the mainstream reser-voirs.

Concerns over suitable ac-cess points only leave 10 Mis-souri River miles accessible to industrial water users within the oil producing region of the state.

For water haulers, the limited number of water sup-ply locations translates to long transportation distances and ex-cessive amounts of time spent waiting in lines at water depots, resulting in high water acquisi-tion costs for Bakken oil pro-ducers, according to a report by the University of North Dako-ta’s Energy and Environmental Research Center.

With the increase in hy-draulic fracturing wells, as well as the increased need for water, the North Dakota State Water Commission has seen a back-log of water permit application reviews throughout the entire state.

According to statements

from the North Dakota State Water Commission, careful consideration to new appropria-tions must be given to ensure that rights of prior appropria-tors are not unduly affected, the public interest is protected and that the pumping from the re-source will be sustainable.

“To ensure compliance with water laws and rules, in-creased monitoring and en-forcement activities are required by the water appropriation di-

vision,” says Jon Patch of the Water Appropriations Division. “Monitoring of water sales for industrial use has resulted in a real-time monitoring initiative, monthly meter reporting and spot meter inspections. These added regulatory duties and re-sponsibilities directly related to the recent oil boom have sub-stantially increased the work-load for our staff.”

Recycling WaterOperator's interest in us-

ing recycled water at well sites is increasing due to the restric-tions on available water use and the cost savings possible from reusing fl owback and produced water.

“Once water has been per-mitted for a particular use, the state engineer does not require re-permitting of that water if it is contained within the control of the process and not released

LOADED UP: Trucks are continuously hauling fresh water to hydraulic fracturing well pads with no end in sight.PHOTO: NORTH DAKOTA STATE WATER COMMISSION

AE2S Water Solutions Freshwater Delivery Pipeline System Conveys Water to Temporary Storage

Reservoirs at Pad Sites Southeast of Watford City

W A T E RS O L U T I O N SS

www.ae2swatersolutions.com

Project Development and MarketingLand Services/GIS/MappingWater Sourcing Fresh Water Delivery Systems Water Reservoirs/Storage

Water Treatment/Recycling/Reuse Produce Water Collection Systems Salt Water Disposal Controls/Programming Operations

MARKETING DESIGN/BUILD OWN OPERATE

THEBAKKEN.COM 23

into and recaptured from the managed water courses,” says Patch.

According to research done in 2013 by the EERC, there are three potential options for treatment, reuse, and recycling of nontraditional water supply sources for use in the Bakken. They are treatment and reuse of the water used for hydraulic fracturing after it returns to the surface (fl owback), treatment and use of wastewater from

other nontraditional sources, such as saline groundwater and municipal wastewater, and use of hydraulic fracturing fl uid sys-tems that work with saline water rather than high-quality water.

These approaches aren’t without challenges though.

“Bakken fl owback tends to be very salty and only a por-tion of it returns to the surface. Treatment of other nontradi-tional water sources may be easier, but transportation costs

may be too high. The use of salt-tolerant fracturing fl uids may hold promise, but these formulations are just begin-ning to be developed,” says the EERC report.

Development of new tech-nologies to recycle or other-wise utilize fl owback, produced water, or saline groundwater would provide multiple ben-efi ts to the state and industry and improve the quality of life for residents impacted by truck

traffi c and associated dust and road maintenance issues.

Some of those benefi ts would be decreased demand on freshwater resources, decreased wastewater disposal costs and associated costs for industry, fewer issues associated with the heavy volume of truck traffi c in the region, increased versatility in water supply options, result-ing in decreased production costs and decreased environ-mental footprint for Bakken development.

Permit BasicsAccording to the Water

Commission, in North Dakota, all water that fl ows in the natu-ral watercourses and all ground-water is considered to be waters of the state and are available for appropriation for benefi cial use. The state engineer has been given the regulatory authority to appropriate the waters of the state through a permitting system.

WAITING IT OUT: The North Dakota State Water Commission has seen a backlog of water permit application reviews throughout the entire state. PHOTO: NORTH DAKOTA STATE WATER COMMISSION

got [clean] water?

QUALITY FRESH WATER

CHLORINATED

CONTRACTS AVAILABLE

FILTERED

HOT WATER BY APPOINTMENT

AUTOMATED KEYPAD

701.528.5900701.570.7516

Just 2 miles E. of Hwy. 85 on Hwy. 50 in Williams County

GPS 48.570585, -103.581011

www.AppamWaterDepot.com

The BAKKEN MAGAZINE JULY 201424

LOGISTICS

Water permits are required for all industrial use no matter how much water is used. Two types of permits are available, conditional and temporary, ac-cording to the study.

Conditional permits begin the establishment of a water right, which will last in perpetu-ity provided the water is contin-ued to be put to benefi cial use.

“These permits establish a fundamental property right and can be diffi cult to obtain in ar-eas of high competition,” says Patch.

Three principles must be met in order to apply for a conditional permit: no undue impacts to prior water rights, the water right is in the public

interest, and the use from the resources will be sustainable.

Temporary water permits are easier to obtain provided that excess water is available. “By law, temporary permits last up to one year maximum and no water right accrues,” says Patch. “Because of the complexities of the systems, temporary permits are not typically issued from groundwater sources.”

Slickwater Fracks on the Rise

With an increase in slick-water fracks, there will be an increase in the volume of water used.

Water quality isn’t much of a concern with this type of FILL IT UP: An average hydraulic well uses 7 acre-feet of fresh water.

PHOTO: NORTH DAKOTA STATE WATER COMMISSION

800-548-3424 or 1-920-738-1328 www.prestogeo.comAP-7497

GEOWEB®

SOIL STABIL IZ ATION

GEOWEB®-confi ned granular fi lls require up to 50% less infi ll to bridge organic or soft soils.

Aggregate or sand infi ll is ready for traffi c immediately, and virtually maintenance-free.

Build over frozen ground; reduce rutting at thaw.

Create fast-to-deploy access roads and laydown areas.

Please direct all inquiries to distribute/represent GEOSYSTEMS®

products to our Business Director at 1-920-738-1237.

GEOWEB®— Creating stable roads and pads for over 30 years. PRESTO

Instant Roads Over Soft Soils

THEBAKKEN.COM 25

LOGISTICS

drilling, however, and alternative sources may become much more viable allowing the reuse of produced and fl owback wa-ter and brine water sources like the Da-kota aquifer, according to Patch.

“The ongoing need and increase in maintenance water may account for a substantial portion of the ongoing water need into the future,” says Patch. “Esti-mates indicate as many as 2,000 wells per year over the next 20 years, each possibly requiring 10 to 15 barrels of fresh water

added to them each day, may result in a doubling of the current use into the fu-ture.”

Author: Emily AasandStaff Writer, The Bakken [email protected]

IRRIGATION195,581 AF (56%)

MUNICIPAL75,683 AF (22%)

POWER GENERAL33,207 AF (9%)

INDUSTRIAL (NON-FRACKING)21,830 AF (6%)

INDUSTRIAL (FRACKING)12,629 AF (4%)

RURAL WATER11,932 AF (3%)

MULTI-USE, BOTTLING COMMERCIAL & DOMESTIC1,230 AF (<1%)

2012 Consumptive Water Use in North DakotaAF = Acre-FeetSOURCE: NORTH DAKOTA STATE WATER COMMISSION

WINGATEBISMARCK.COM

BISMARCK, ND

• Expanded Hot Breakfast Buffet with Made-To-Order Omelets

• Cocktail Lounge

• High-Speed Wired and Wireless Internet Access

• 24-hour Business Center with Copy, Fax, and Print

• 24-hour State of the Art Fitness Center

• Heated Indoor Pool and Whirlpool

• Refrigerator and Microwave in every room

• Meeting Space Available

• Corporate Rates and Group Rates

• And Much More!

All this and more included at NO EXTRA COST:

Wingate by Wyndham® Bismarck, ND1421 Skyline Blvd.Bismarck, ND 58503Phone 701.751.2373Fax 701.751.2336www.wingatebismarck.com

For Volume Based Negotiated Rates, Please Contact the Sales Department

The BAKKEN MAGAZINE JULY 201426

THEBAKKEN.COM 27

The BAKKEN MAGAZINE JULY 201428

THE SLICKWATERSTORY

EXPLORATION & PRODUCTION

The timeless adage, “What’s old is new again,” now applies to the Bakken, thanks to the oil industry’s adoption of slickwater fracking. The fracture method that relies on high volumes of water and minimal chemical ad-ditives has been the recent buzz-word during investor calls and in-dustry events this year. Slickwater fracks were used before gels and high viscosity fluids became the in-dustry norm for conventional and unconventional fracking designs, but the simple design of a slickwa-

ter frack has proven to produce a more complex fracture network in the middle Bakken formation.

When Halcon Resources re-ported a record initial production rate for a well in the Fort Berthold Indian Reservation in a June pre-sentation, slickwater fracks were recognized as the reason for the record. Oasis Petroleum has al-ready said that in the second half of 2014, 60 percent of all new Oasis wells will be completed using slickwater fracks after test results revealed a production in-crease of nearly 25 percent over

wells completed with other meth-ods. Triangle Petroleum Corp. said it has increased production by as much as 40 percent with the combination of cemented liners and slickwater fracks and reduced well-completion costs by $400,000 per well thanks to slickwater. Lib-erty Resources II, the exploration and production fi rm considered a leading-edge completion design-er, has gone almost exclusively to slickwater fracks. And Lynn Helms, director of the North Da-kota Department of Mineral Re-sources, said earlier this year that

The reemergence of a simple frack design is increasing production, lowering well costs and impacting water usage in the BakkenBy Luke Geiver

THE SECRETS OF SLICKWATER

Mike Stemp is familiar with the tug-of-war nature of unconventional oil production. After 20-plus years spent in the oil industry working in locations around the world, he knows that com-pleting a well requires the right balance of pro-

duction effi ciency, proven science and economics. Today, Stemp is the corporate engineering advisor for fracturing at Sanjel Corp., the Calgary-based oil services fi rm that entered North Dakota in 1998. Sanjel’s Williston Basin operations now in-

|Article continued on page 36

EXPLORATION & PRODUCTION

An industry staple reveals the merits, challenges of slickwater fracksBy Luke Geiver

THEBAKKEN.COM 29

DRILLING DAYS: Halcon Resources has drilled a Bakken well in as few as 12 days. PHOTO: HALCON RESOURCES

The BAKKEN MAGAZINE JULY 201430

EXPLORATION & PRODUCTION

SLICKWATER REQUIREMENTS: Sanjel Corp. uses 18 to 20 pressure pumping trucks for slickwater jobs. Non-slickwater jobs require as few as five to ten pumping trucks. PHOTO: SANJEL CORP.

THEBAKKEN.COM 31

EXPLORATION & PRODUCTION

clude fi ve fracturing fl eets con-sisting of over 60 frack pumps, 8 blenders, 4 coiled tubing fl eets and other services including ce-menting. The Williston Basin is one of Sanjel’s largest opera-tions, Stemp says, an operation he describes as experiencing massive growth. Because of that massive growth, his team has be-come in-tune with the complexi-ties of slickwater fracks.

Although slickwater fracks have become one of the most popular completion methods in the play today, Stemp offers a friendly disclaimer to all current or prospective clients. “I have to remind everyone that slickwater fracks are not a one-size fi ts all approach. Each geological area may call for a different tech-nique,” he says. But, for the wells that match up with the selection criteria for a slickwater treat-ment, the production results are undeniable and economics can make sense when Sanjel’s team of fracturing and reservoir ex-perts examine all the data paying particular attention to the qual-ity of the reservoir.

The Meaning of the NameTraditional hydraulic frac-

turing techniques are often com-pared to interconnected chan-nels. A conventional fracture method utilizes a viscous fl uid to carry proppant into a horizontal lateral. The fl uid-proppant mix-ture is pumped downhole to wedge the rock open, creating long, wide channels for trapped hydrocarbons to fl ow through.

These bilateral fractures can ex-tend between 500 and 1,000 feet outwards from the wellbore. The fl uid mixture is typically pumped into the well at 20 to 40 barrels per minute. The maxi-mum proppant concentrations in the fl uid range from 4 to 12 pounds per gallon. The permea-bility of the rock to be fractured dramatically affects the type of treatment required. The tighter the rock, the more fracture com-plexity required. Conventional hydraulic fracturing methods typically do not create this com-plexity.

A slickwater frack offers a peculiar outcome. The technique is simple by design, but it can create a larger, more complex fracture network. The method creates a fracture network that is closely related to a broken pane of safety glass with all the tiny fragments attached. “If you have ever seen a piece of safety glass and it has shattered into a thousand little pieces but they all stay connected,” Stemp says, “that is more or less what we are trying to do with slickwater fracks but in a three dimensional network.”

By simplifying the fl uid used to fracture the rock and carry the proppant, slickwater can create a more complex fracture network. The idea, according to Stemp, is to take advantage of the situa-tion below ground. The low permeability rock can be frac-tured into a complex network of multiple channels when a thin-ner fl uid is pumped at higher

The BAKKEN MAGAZINE JULY 201432

than traditional rates. Because the water is non-viscous it does not create a single wedge or frack wing but rather multiple fracks which form a dendritic-like or branching fracture network. “We found that the small stimulated reservoir volume (SRV) created by conventional fracturing was leaving a lot of the reservoir untreat-ed,” Stemp says. “By lowering the fl uid viscosity and changing the proppant type, we can essentially improve production by increasing the total fracture network. We call them slickwater because the fl uid used is non-viscous and slick.”

Deploying Slickwater FracksBecause a slickwater fl uid does not

include gels or other viscosity enhanc-ers, more fl uid is required to move the amount of proppant necessary to effec-tively prop open the stimulated reservoir. “We pump at a very high rate,” Stemp says. A conventional frack job would be pumped at 20 to 40 barrels per minute. A slickwater job is pumped at 60 barrels of fl uid per minute or more. The main addi-tive to the fl uid is a friction reducer, an el-ement of the fl uid necessary to allow for the high pumping rate. For every gallon of fl uid pumped, a completions crew will add from 0.25 to a maximum 2 pounds of proppant.

To effectively pump the fl uid mixture at the desired rate, Sanjel's teams typically use 15 to 20 pumping trucks, a large in-

crease from the 5 to 10 trucks used on a well site in the past. Although Sanjel works with operators who complete their wells in various stages or with differing designs, Stemp says most are running three perforation clusters per discrete fracture zone and each well is completed with 25 to 40 zones. For each discrete fracture zone, Sanjel's team will pump slickwater fi rst to initiate the fracture, followed by ramps of low proppant con-centration, then a PAD or a sweep stage to create additional fractures, followed by additional stages of 0.25, 0.5, 0.75 and 1.5 pound per gal of proppant. In some instances that process would be repeated three to four times per zone. In the end, the results are massive. On a per zone ba-sis, a well could use 150,000 pounds of proppant and 250,000 to 300,000 gallons of water. The end result could push the well totals for proppant and water to 4.5 million pounds or greater, and 8 million gallons or greater. “In many cases, the vast quantity of fl uid and proppant can make or destroy the economics of the treatment,” he says.

Some operators are using slickwater-based fracks that include a process known as a tail-in. To perform the process, the completion team will use slickwater and a smaller sized proppant combo for the initial stages of the job, followed by larger size proppant and conventional frack fl u-ids towards the end of an individual treat-

ment on a zone. “This is called a hybrid system,” he says. The slickwater mixture is used to create the complex network away from the well bore and then the conven-tional system to tie all these branches to-gether. The conventional frack fl uids used near the end of a slickwater treatment on a single zone creates a wide fl ow path which connects all the small channels cre-ated by the slickwater stages.

For Sanjel and the entire industry, designing a fracture network based on the abilities of slickwater was not as dif-fi cult as learning the most effi cient way to physically align the elements needed to perform the frack job. “It has been a massive learning curve for the region,” he says. “The logistics for all of the prop-pant required the trucks to move the fl uid and everything else involved was diffi cult. But now, the industry is comfortable do-ing this. We are comfortable, and success-ful in doing this,” he says.

The advent of slickwater frack de-signs has required Sanjel to increase the number of pumps in the region. The company has also had to work through the logistics aspect of the practice, in-cluding water tank storage and supply.

Although the process is proven to increase production, Stemp does say each operator needs to understand the reservoir they have and whether or not the costs of added water, proppant and proppant quality/type will be outweighed by the reservoir’s potential production increase. For many operators, the allure of greater production has tugged them towards slickwater, he says. Sanjel is con-tinuing to develop and apply evolving technologies to keep pace with the indus-try’s demands for effi ciencies and contin-uous improvements” adds Stemp.

Author: Luke GeiverManaging Editor, The Bakken [email protected]

EXPLORATION & PRODUCTION

'The logistics for all of the proppant required the trucks to move the fl uid and everything else involved was diffi cult. But now, the industry is comfortable doing this. We are comfortable, and successful in doing this'Mike Stemp, corporate engineering advisor, Sanjel Corp.

Leave nothing behind.

ncsfrac.com+1 281.453.2222

©2014, NCS Energy Services, LLC. All rights reserved. Multistage Unlimited and “Leave nothing behind.” are trademarks of NCS Energy Services, LLC. Patents pending.

The moment of truth:

Where do your fracs (and your well investment) go?

Plug-and-perf simply cannot deliver predictable frac results, and neither can open-hole packers

right where you plan them and proppant volume in every frac is exactly what you want. Cemented,

PLANNED

PLANNED

PLANNED

REAL WORLD (unpredictable)

REAL WORLD (unpredictable)

REAL WORLD (predictable)

www.URTeC.org

Sponsorship and exhibit opportunities are selling fast!

Book yours today.

Register Now The integrated event for unconventional resource teams

The BAKKEN MAGAZINE JULY 201436

EXPLORATION & PRODUCTION

one of the major trends his offi ce is see-ing is the use of more water (slickwater) in frack jobs performed in the state.

To describe the impact of slickwa-ter frack usage in the Williston Basin, we spoke with personnel in the main sectors of the play affected by the Bakken’s latest trend: an operator, a water provider and an energy services fi rm.

In 2010, several industry veterans co-authored a Society of Petroleum Engineers paper on slickwater fracks titled, “Slickwater Fracturing—Food for Thought.” The authors, Terry Palisch, global engineering advisor for Carbo Ce-ramics, Mike Vincent, founder of Insight Consulting, and Pat Handren, well integ-rity manager for Denbury Resources, de-scribed the motivation, benefi ts and con-cerns surrounding slickwater fracks. Their

fi ndings, according to Palisch, still apply today.

Slickwater fracking designs are typi-cally deployed for three reasons, the au-thors wrote. First, some operators are looking for cost-cutting measures due to low commodity prices The water-based design of slickwater frack doesn’t require the use of many additives. Second, the res-ervoirs being fractured might be depleted or feature lower permeability. In such cas-es, nonslickwater methods are not able to clean up or wash out the gels used in the fracturing process from the tiny rock fi s-sures. Third, completion teams recognize that fractures created using conventional methods may not always perform as well as expected and that slickwater fracks can provide the same production result at a lower cost.

|Article continued from page 28

MORE FRACKS MEANS MORE WATER: The availability of water in the Williston Basin has made slickwater frack designs feasible. In Texas, the use of such completion design has to account for the availability of water. PHOTO: HALCON RESOURCES

THEBAKKEN.COM 37

Although the authors did not mention a fourth reason, many operators and industry members believe the true merits of the slickwa-ter frack is its ability to create a complex frac-ture network not possible without the use of the highly-pressured water. The main goal of a slick-water frack, regardless of cost considerations in accordance to other fracture treatment options, is to create an adequate fracture geometry in low-permeability, large net-pay reservoirs, according to the 2010 paper. Adequate, in the Bakken’s case, translates to better, most operators and slickwater-backers believe.

The basics of the method involve water combined with a polyacrylamide friction reducer. The slickening agents reduce the friction of the water in the pipe and the viscosity of the fl uid. Because the fl uid is less viscous and the water is lighter, more volume is needed to carry the same amount of proppant to effectively prop open the

The BAKKEN MAGAZINE JULY 201438

fracture networks responsible for draining the reservoir. Higher rates of pressure are also required to move the water. Pumping rates of 100 barrels per minute are com-mon—a much higher rate than other un-conventional fracturing pumping method requirements. The high pressure needed to perform a slickwater frack also helps to stimulate more rock and create more frac-tures. The absence of gel also allows for a quicker and easier placement of proppant into the fractures allowing the hydrocar-bons to fl ow back quicker.

Of all the concerns about slickwater treatments, the greatest is the water volume required. Because the Williston Basin is sit-uated in a geographic region with an abun-dant water supply, operators are able to deploy the method without incurring high water costs. The amount of water needed to perform a slickwater frack job typically exceeds 4 to 8 million gallons. In some cas-es, the quantity of pumping trucks used to

EXPLORATION & PRODUCTION

-500

0

500

1000

1500

2000

2500

3000

-500 0 500 1000 1500 2000 2500

Easting (ft)

Nor

thin

g (ft

)

-1000

-500

0

500

1000

1500

2000

2500

3000

-1000 -500 0 500 1000 1500 2000 2500

West-East (ft)

Sout

h-N

orth

(ft)

Waterfrack(slickwater)

XL Gel Frack

Frack Complexity Comparison

Observation Well 1

Observation Well 2

Perforations Observation Well 1

Observation Well 2

Perforations

Comparison of microseismic traces in the same well between a XLGW Frack and a Waterfrack.SOURCE: SPE INTERNATIONAL

SOLID PERFORMANCE MADE SIMPLE.

Introducing SDLG wheel loaders — where simplicity, reliability, and industry leading pricing come standard. They’re easy to operate, easy to maintain, and a perfect fit for your day-to-day jobs.

Stop in and get an up-close look, and find out how SDLG uses design simplicity to improve reliability, lower costs, and pass the savings on to you. For more information on SDLG and our network of dealers, visit sdlgna.com/BM.

* Prices are subject to change without notice. Visit sdlgna.com for details.

LG938L

2.4 yd 3 Loader$99,500*

LG948L

3.0 yd 3 Loader$116,500*

LG958L

4.0 yd 3 Loader$134,500*

LG959

4.0 yd 3 Loader$144,500*

r*

4$

er*

3$

r*

4.$

LG938L

2.4 yd 3 Loader3 er

LG948L

3.0 yd 3 Loader3 r3

LG958L

4.0 yd 3 Loader34 r

LG959

4.0 yd 3 Loaderder34.

3739 38 St. S., Ste. EFargo, ND 58104

701.271.2360

4100 Highway 52 S.Minot, ND 58701

701.250.4882

750 Yegen Rd.Bismarck, ND 58504

701.250.4882

The BAKKEN MAGAZINE JULY 201440

EXPLORATION & PRODUCTION

4 BEDROOM 5 BEDROOM

4 & 5 BEDROOMSAVAILABLE

TOLL FREE: (877)-839-3949WWW.WATFORDCITY HOMES.INFO1504 4TH AVENUE N.E., WATFORD CITY, ND 58854

EMPLOYEE HOUSING NEEDS

Housing SalesMan Camp Property Management Housing LogisticsProject ManagementRepairs, Parts and Service

$46,900Delivered

inject the pressurized water into the wellbore needs to be doubled. Because the fl uid treat-ment doesn’t rely on additives, slickwater fracks are more conducive for produce and fl owback water recycling efforts, the authors also wrote.

Success With SlickwaterSince Halcón Resources fi rst entered the

Bakken oil play in 2012, the exploration and production company’s story has been char-acterized by two phrases, says Kelly Weber, director of corporate communications. “Our story is of rapid growth and production suc-

cess.” In the past two years, Halcón has grown its Bakken oil production num-bers from zero barrels of oil per day to 43,000. The company’s Denver offi ce fo-cuses exclusively on the Williston Basin. Two years ago, the offi ces were staffed by fewer than 10 but today’s count is more than 60.

The company’s rapid growth is linked to an entrepreneurial spirit cham-pioned by Floyd Wilson, chairman and CEO, says Charles Cusack, Halcón’s chief operating offi cer. “We have a lot of people that think outside of the box and fi nd ways to get things done,” he says. Wilson started Halcón Resources only a year removed from the sale of his previous exploration and production company, Petrohawk, to BHP Billiton. Cusack was also a part of the Petrohawk team. “It was a challenge in the beginning of Halcón until we got the right people in place,” Cusack says of Halcón’s early days. “From a technical standpoint, it is always a challenge to fi gure out which completion recipe works in each area.”

After purchasing acreage from an-other exploration and production com-pany operating in the Williston Basin, Cu-sack and company have not only proven how to successfully execute an entrance in the Bakken, they have has also found a way to make positive headlines. To turn its good wells into great wells in the com-pany’s Williams County, N.D., and Fort Berthold Indian Reservation acreage, Cu-sack and his team have joined the grow-ing list of operators who have turned to slickwater fracturing completions to get things done. The completion recipe has Cusack and the team confi dent that it has solved at least some of the challenges of the Middle Bakken.

In June, Halcón reported that its new slickwater completions deployed in the Fort Berthold Indian Reservation had outperformed all other wells com-pleted in the area using other methods. The results of the slickwater fracked

'With the increased amount of water used, you are basically tripling or even quadrupling [assuming approximately 60,000 to 80,000 bbls needed for the frack job] the amount of truck trips needed to deliver the freshwater to the well pad.'Grant Slick, principal engineer, AE2S Water Solutions

THEBAKKEN.COM 41

The Brooks Hotel (Behind Fuddrucker’s)

5515 Highway 85Williston, ND 58801

P: 701.609.5490 F: 701.609.5496www.TheBrooksHotels.com

Williston

Experience The Brooks Difference

Full Service Bar

The BAKKEN MAGAZINE JULY 201442

wells yielded a new initial production of 4,224 barrels of oil equivalent per day. “It has been a game changer, more of us moving to slickwater fracks,” Cusack says.

Halcón fi rst used slickwater fracks in Williams County. The completion methods used prior to slickwater were only economically average, he says, but the change to slickwater made the wells in Williams County more than economi-cal. “After we tried it in Fort Berthold, we saw a step change result. We turned great wells into world-class wells,” he says.

Although Halcón is pumping the same approximate amount of proppant into the slickwater wells, it is pumping much more water. The result provides the desired outcome pursued by every other Bakken operator that has transi-tioned to slickwater fracks. “It creates a

HALCON'S GROWTH: After entering the Bakken shale play in 2012, the exploration and production company has grown production from zero barrels of oil per day to more than 43,000. Slickwater fracks has the company excited for its future. PHOTO: HALCON RESOURCES

EXPLORATION & PRODUCTION

THEBAKKEN.COM 43

more complex, intricate frack network,” Cusack says.

Every Halcón well planned for the middle Bakken will use slickwater, Cu-sack says, and although the team is not yet convinced the approach is optimum for the Three Forks, the company is try-ing some slickwater completions in that formation as well. The industry’s expla-nation of why slickwater fracks are more productive varies, according to Cusack. From his perspective, the lower viscos-ity allows the lighter water fl uid to move more quickly through the rock to be frac-tured, while also letting the proppant set-tle more easily and quickly than if a gel-based fl uid were used. “Everybody just theorizes on how it works exactly, but the bottom line is that there is defi nitely a step change in our improvement.”

Halcón has certainly joined the slick-water believers, but it has also supplanted itself as a major Bakken player by taking action to evade certain challenges other operators have found to be unavoidable, particularly the harsh operating condi-tions present during a Bakken winter. During the winter of 2013-’14, Halcón’s Bakken team wasn’t as affected by snow, wind and extremely cold temperatures. When the company acquired its proper-ties in 2012, the local team immediately performed weatherization measures on its properties and equipment. According to Cusack, the company did not show any ill effects of winter weather because it also was able to offset producing or planned wells that were slowed by weath-er based on its higher than usual IP wells brought online in the winter. The wells were completed using slickwater. Even if slickwater may be linked to several facets of Halcón’s recent success, Cusack says his team isn’t done experimenting with better alternatives for completions, drill-ing techniques or any other element of the company’s overall operations.

“We will never sit on the status quo.

The BAKKEN MAGAZINE JULY 201444

We will never think we have all of the an-swers. I hope that when I talk to someone now versus a year from now that I can tell them about new records we’ve set and that we are doing more for less.”

Changes To SupplyThe continued implementation of

slickwater frack designs will increase the amount of oil retrieved. It will also alter the way water providers and infrastructure

design and construction teams operate. AE2S Water Solutions currently designs water supply and takeaway systems for several operators in North Dakota. Grant Slick, principal engineer for the water and engineering fi rm, believes slickwater fracking will impact how his team designs and operates infrastructure. “In order to handle the amount of water needed to complete a slickwater frack, which is often in the range of 250,000-plus bbls there has to be greater focus on hydraulic modeling of the entire [infrastructure] system.” The enhanced modeling needs to include pipe size information, pumps and storage con-tainers, all of which have to be part of the overall water supply infrastructure. The design of the entire system is necessary, Slick says, because when a well is fracked

EXPLORATION & PRODUCTION

THEBAKKEN.COM 45

ACCEPTING THE TREND: In addition to slickwater fracks, Halcon had used walking rigs for drilling and retrofitted equipment to handle the harsh weather of North Dakota. PHOTO: HALCON RESOURCES

with a slickwater design, a high volume of water will be needed at the well site, but over time, the volume of water needed is drastically reduced.

Slick and his team are proponents of the pipeline system for fracking and well maintenance. “With the increased amount of water used, you are basically tripling or even quadrupling [assuming approximately 60,000 to 80,000 bbls needed for the frack job] the amount of truck trips needed to deliver the freshwater to the well pad,” Slick says. “The economics for putting in a pipeline certainly are more favorable with the increased water use, but there are also other variables at play such as geography from source to end use, topography, quan-tity of wells served and other parameters.”

Slickwater fracking requires Slick and

his team to rethink the quality and quan-tity of the components it considers when designing a water supply or takeaway sys-tem, he says. The team does have systems currently operating south of Watford City that supply water for traditional fracture designs as well as slickwater. The system also gathers produced water.

The rise of slickwater fracking meth-ods may be the hot topic now, but for Slick it won’t always be the most important. “Maintenance water over the lifetime of the well can actually add up cumulatively to quite a bit of water,” he says. Some areas of the Bakken may not need fresh water for well maintenance fl ushing, while others could require as much as 100 bbls per day per well. According to Slick, if an operator installs both produced gathering pipelines

and freshwater pipelines, the system could operate on a closed loop cycle. Recycled water taken and treated from the gathering line could be reinjected into the freshwater pipeline. “Although recycle is in its infancy, proactive infrastructure planning can re-duce the investment later.”

Author: Luke GeiverManaging Editor, The Bakken [email protected]

701-738-4944

EXPLORATION & PRODUCTION

The BAKKEN MAGAZINE JULY 201446

Nine EnergyCreated From4-Firm Merger

IN PLAY

Nine Energy Service, a conventional and un-conventional completions and wireline services firm, has entered the oil and gas industry as a new oil-field services company.

The company is a merger of four smaller oilfield services com-panies: Northern States Comple-tions, Tripoint LLC, CDK Perfo-rating and Integrated Production Services Canada.

The company’s name reflects the entrepreneurial characteristics of the organization.

“Nine is a very strong num-ber and it’s the last number in a counting cycle,” says Paul Butero, Nine Energy president and CEO. “Perfection in the oilfield is im-possible, but nine out of 10 is as close as you’re going to get. We strive for perfection and that’s our commitment in maintaining the entrepreneurial characteristics of being fast, nimble and innova-tive.”

The four companies bring oilfield service experience from the different North American oil basins to Nine Energy.

Northern States Comple-tions, which was formed in the Bakken in 2007, was known for developing unconventional com-pletion tool solutions. According to Butero, NSC has a variety of completion methodologies that are highly recognized by opera-

tions in the Bakken. Merging to form Nine Energy will give NSC the opportunity to pull through other product lines and to expand their resources and technologies across North America.

"Instead of being trapped in our Bakken world, we're now able to expand the technologies within other companies in Nine Energy and expand on them," said Rick-ey Green, vice president of the Rocky Mountain Region and one of the founders of NSC. "It also helps us reach the vision we've always had of seeing Northern States tools run across the coun-try and across North America."

Tripoint was also a conven-tional completion tool company out of the Gulf of Mexico that focused on the niche market for gravel pack installations. CDK be-gan as a perforating services pro-vider in the Barnett Shale, and ex-panded to offer wireline services for nearly all of the oil producing states. IPS delivered innovative production enhancement solu-tions for oil and gas producers via discreet services and custom-ized solutions throughout all of Canada.

Nine recently made a some small acquisitions, including one in the Permian Basin, which is a rental surface equipment pro-vider, and the other is Dak-Tana Wireline, which specializes in log-ging services.

“If you think about Nine En-

SAME FACES, NEW NAME: Four smaller oilfield services companies merge to form Nine Energy, which will impact operation services in the Bakken. PHOTO: NINE ENERGY SERVICES

By Emily Aasand

THEBAKKEN.COM 47

IN PLAY

ergy and who we are today, we basically have three divisions,” says Butero. “We have a wireline division, a completion tools divi-sion, and we’re building a surface rental equipment division.”

“I think what’s unique about Nine is we have a group of entrepreneurs who have built their businesses on their abilities to develop customized solutions and to be very fast and nimble in making their decisions,” says Butero. “These guys wake up every day and perform at excep-tional levels at the well site, but more importantly are looking for new ways to drive operational efficiency and lower operator’s overall lifting costs.”

Moving forward as one large, merged company doesn’t come without challenges though.

“My challenge as we go forward is to professionalize the company and put structure into place to support our opera-

tions but not to the level that I choke the individual companies off,” says Butero. “We have to be supportive, we have to profes-sionalize, but at the same time I don’t want to create so much bu-reaucracy that it limits our abil-ity to move fast and to develop solutions quickly.”

A good example of this is one of Nine Energy’s newest developments: the Regu-lator Toe Valve. Rickey Green, vice president of the Rocky Mountain Region and one of the founders of NSC, had an idea for a valve back in December and six months later that valve is a reality and is ready to be field tested.

“I think what’s unique about this product is that as national regulations kick in, this tool will give the customer an opportu-nity to pressure up and test the well to make sure there are no leaks in the well and if there are

leaks, they can remediate those prior to opening up the valve,” says Butero.

“It’s revolutionary to the market,” says Green. “There’s nothing that we know of out there that functions this way.”

For Butero and Green, this Regulator Toe Valve is just the beginning of their growth in the industry.

“It’s great to see the growth that’s happening out there,” says Green. “With the new leadership that we have in Paul, we’re going to go in and focus on quality programs. It’s just going to give

us the basis to be a bigger and better company.”