JSE up 4% YTD – wide discrepancy in stock returns · 2013/06/14 1 JSE up 4% YTD – wide...

Transcript of JSE up 4% YTD – wide discrepancy in stock returns · 2013/06/14 1 JSE up 4% YTD – wide...

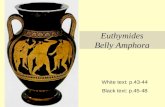

2013/06/14

1

JSE up 4% YTD – wide discrepancy in stock returns

ZARSA 10 Yr Bond

Outperformers YTD

Richemont

Naspers

SABMiller

BATS

Sasol

+30%

+31%

+36%

+28%

+23%

Rand tumbles to a 4 year low reflecting jitters over ongoing labour unrest

Laggards YTD

Harmony

Gold Fields

Implats

Anglogold

Angloplats

-44%

-41%

-40%

-35%

-29%

The worst month in a year for emerging market currencies will prove to be more

than a momentary bout of weakness

2013/06/14

2

S&P500 vs MSCI Emerging Markets Index

Developed Markets

Emerging Markets

“Investors looking for emerging market-like

growth rates should look to the US”

Meredith Whitney

Breakdown of the JSE

The top 12 companies make up 70% of the JSE (12 month return)

0 200 000 400 000 600 000 800 000 1 000 000 1 200 000

(FIRSTRAND)

(KUMBA IRON ORE)

(VODACOM)

(STANBANK)

(SASOL)

(NASPERS -N)

(ANGLO)

(MTN GROUP)

(RICHEMONT)

(BHPBILL)

(SAB)

(BRITISH AM TOBACCO) +41%

-17%

+62%

+24%

+99%

+27%

+63%

+22%

-7%

+15%

-12%

+3%

R1,135bn

R856bn

R612bn

R447bn

R324bn

R316bn

R301bn

R289bn

R175bn

R167bn

R155bn

R152bn

Market Cap

Telkom 8bn

PSG 12bn

Clicks 15bn

Pick ‘n Pay 18bn

Market cap

2013/06/14

3

Flow out of safe haven assets

Gold

1) Easing inflation fears, appeal of equities sparks move out of safe haven assets

2) Soros and other hedge fund managers cut exposure to gold ETFs

3) Biggest gold sell-off in 30 years

Mining – “Commodities Conundrum” Stan Druckenmiller, May 2013

6

“Too many investors made the big mistakeof betting Chinese demand would continue

to accelerate...”

Stan Druckenmiller, US hedge fund manager

1988-2000 Stan managed money for George Sorosas the lead portfolio manager for Quantum Fund

“It’s the end of the commodity super-cycle”

Price recovers on China re-stocking & improving outlook for global growth

Excess supply

could push price lower

2013/06/14

4

Mining industry

A phase of consolidation

� CEOs of major mining corporations have stepped down

� Management had been over ambitious during the commodity boom

� New management likely to relook at existing projects

� Demand remains robust – China

� Commodity prices likely to track sideways

� Efficiencies seen through operational gearing

Impairments:

Rio Tinto $ 14bnAnglos $ 5bnBHP Billiton $ 3bnBarrick $ 3bnKinross $ 3bn

South Africa

8

� No long-term growth vision

� Declining manufacturing & mining output

� Labour strikes an on-going issue

� Mining sector tarnishes investor perceptions of South Africa; more troubleson the horizon

� Power supply under threat

� Rising inflation, electricity, fuel and other input costs

� Slowdown in household spending

� Continued shift in fiscal policy to social spending from infrastructure

� Corruption, poor skills, inefficiency

2013/06/14

5

Three speed economy:

Growth projections 2014 (%) – IMF April 2013

9

Size of the Economy

US 21.6%

China 10.4%

European Union 26%

Japan 8.4%

Brazil 3.6%

UK 3.5%

Russia 2.6%

Estimated Growth

China 8.2%

India 6.2%

Russia 3.8%

Brazil 4%

US 3%

Australia 3%

UK 1.5%

Europe 1.1%

Growth: World Economy 4.00%

Growth: Emerging Regions 5.70%

Growth: Advanced Economies 2.20%

Size of the economy

“Borrowing levels are high in China and it’s now taking greaterunits of credit to generate a unit of growth – much like the restof the developed world.”

Stan Druckenmiller, May 2013

China is at crossroads

10

• Home to 20% of the world’s population

• Household consumption accounts for 38% of GDP (US ~70%)

• World’s largest car market, 19.3m cars sold in 2012

• Largest internet market in the world

• Reduced the per-watt cost of solar power from over $3 (2008) to under $1 (2011)

� New regime acting more carefully, balancing growth,shifting from a production oriented economy to onecentred around household consumption

� Demand slowly recovering, expect growth around 7.5%

� Structural reforms designed to improve the supply sideof the economy

� Reforms would help sustain the growth of productivecapacity, improving the allocation of capital and labour

� Cutting red tape and other regulatory barriers to entrywould help private firms invest in industries nowdominated by state-owned enterprises

2013/06/14

6

Three snapshots of China’s next chapter

11

1) China’s new middle class

Fuelling the engine of growth

12

2) China’s urbanisation

2013/06/14

7

Rapid growth reshapes an industry

13

3) China’s e-tail revolution

What the Frack ?

2013/06/14

8

US: Energy boom & manufacturing revival

“North America has set off a supply shock that is sending ripples throughout the world” IEA Exec Director, Maria van der Hoeven

15

� Manufacturing revival led by Apple, Caterpillar, Ford Motor, General Electric & Whirlpool

� Key drivers include cheap energy, weak dollar, stagnant wages, tech advances (3D printing)

� Rising costs & industrial land costs in Asia making manufacturing in US more attractive

� Energy boom: US is the world’s biggest producer of natural gas

� Costs per m thermal unit: US $3.55, Europe $12.00, Japan $16.00

Crude Oil net Imports Crude Oil net Exports

� US oil production topped 7m barrels per day, analysts expect 10mby 2020 - Saudi Arabia produces 9m barrels a day

� Infrastructure, know-how, abundance of water in place

� Biggest beneficiaries will be energy-guzzling firms like chemicalproducers and steelmakers

BNSF carry 650k barrels

a day, soon to increase to

750k barrels a day, will

eventually reach over 1m

barrels a day

Hydraulic Fracturing

16

2013/06/14

9

Opportunities still abound in the US economyWarren Buffet, May 2013

Recovery Drivers

� Multiples not excessive14x 2013 profits

� Investors light on exposure

� Disasters in Europe avoided

� Worries over bank defaults lifted

� Growing trust in policy makers: Bernanke, Kuroda, Draghi

� US private debt levels falling as %GDP

� Increasing M&A activity

� US budget deficit shrinking and trade balance improving

� Ultra low interest rates

� Improving jobs numbers

� Housing inventory lowest in 30 years

“The US is a huge market. There

are plenty of acquisitions to make.”

“The US economy hasn’t come

roaring back but the overhang in

housing has almost disappeared.”

Warren Buffett, May 2013

S&P500 reaching new highs

PE 25.6x PE 15.2xPE 16x

+106%

+101%

+111%

PE 14.1x

PE 10.3x

PE 16x

“The loss of cash’s purchasing power has been brutal. With

interest rates so low, equities are cheap. I feel sorry for people who

have clung to cash. For most of my life it has made dramatic sense

to hold equities.”

Warren Buffett, May 2013

2013/06/14

10

Japan: The next sugar rush

After 2 lost decades, Japan’s nominal GDP is the same as in 1991

Target to push up inflationrate to 2% through

introduction of bondpurchase programme

If Kuroda pushes inflation up to 2% then interest rates

should rise to 4%. That would blow Japan out of the water”

- Kyle Bass, May 2013

Japan CPI

2013/06/14

11

“Abenomics” a mix designed to jolt the economy

Abenomics:

1) Reflation

2) Government spending

3) Growth strategy

A mix designed to jolt the economy out of thesuspended animation that has gripped it for morethan two decades

Geopolitical rebranding and constitutional changethat is meant to return Japan to its rightful place asa world power

The Economist

Yen

Electrifying a nation that had lost faith in its political class

Nikkei

From the time Mr Abe was elected, the stock market has risen 55%

The Nikkei , even after the recent surge, is a third off its peak

The growth-enhancement strategy should drive householdconsumption, exports & corp activity

Weaker Yen creating wealth effects through asset price rallies

2013/06/14

12

Local Investment Ideas

23

1) Companies expanding offshore into high growth regions

Naspers, Aspen, Bidvest, BHP Billiton, Sasol

2) Emerging market consumption growth

SABMiller, British American Tobacco, Richemont

3) Superior retail business models continue to hold

Woolworths, Famous Brands

4) Expansion into Africa

Imperial, Omnia, MTN, Shoprite, Mr Price, Vodacom

5) Expanding middle class exploring medicare options

Life Healthcare, MediClinic, Discovery

JSE is more of a convenience store than a supermarket

24

JSE Global Markets

2013/06/14

13

Create a champions league portfolio

25

Offshore Investment Ideas

26

1) America: The next emerging market

General Electric, Dow Chemical, Chevron, Berkshire Hathaway, Wal-Mart

2) Mobile revolution and consolidation

Akamai, TW Telecom, Level 3

3) Escalating prosperity in developing nations

LVMH, Swatch, Prada, Daimler, BMW

4) Frack Attack, Shale Gas, Shale Oil

Halliburton, Apache, Noble Energy

5) Competitive companies focusing on the consumer

Colgate, Unilever, P&G, Johnson & Johnson, Wholefoods

6) High yield in a low yielding environment

Vodafone, BAE, Allianz, Deutsche Post, Royal Dutch Shell, Glaxosmithkline

7) Global super brands expanding into high growth regions

Nestle, Coca Cola, LVMH, BMW, Altria, McDonalds

2013/06/14

14

Quotes

27

Howard Marks on investments…

“In investment, there has to be human involvement, nothing can be solved by an algorithm”

Howard Marks on the volatility of markets…

“Markets are like swinging pendulum, swinging from optimism to pessimism, it never stops,

driven by greed & fear, the happy medium is never seen”

Howard Marks on high conviction investments…

“The more you bet when you win, the more you win when you bet”

Howard Marks on investment odds…

“Investing consists of dealing with the future, even if you’re happy with the probability. Things

can happen, like the 6ft man who drowned in the river that on average was 5ft deep”

Quotes

28

Warren Buffett on macro forecasts…

“To ignore what you know (about companies) for predictions (about the economy) you don’t

know is silly”

Warren Buffett on the airline industry…

“They should have shot down the Wright Brothers’ Kitty Hawk. It would have saved investors

millions of dollars”

Warren Buffett on Fed policy…

“Monitoring the Fed is like watching a good movie where you don't know the end - no one

knows how it will play out”

Mitchell R Julis on macro…

“Overactive central bankers at present were like fools in a shower…constantly tampering with

all the dials not knowing how to regulate the temperature and flow of the water”

2013/06/14

15

Quotes

29

Warren Buffett on Harley-Davidson…

“Any business that gets customers to tattoo adverts on their chest can’t be a bad company”

Warren Buffett on parenting…

“More kids are ruined by the behaviour of their parents than by the amount they inherit.

Children learn from their parent’s actions”

Mitchell R Julis on macro…

“If you don’t do macro, macro will do you”

Barnett C Helzberg on parenting…

“It’s not a big deal getting your children into a fancy college; it’s getting them out”

Quotes

30

Howard Marks on the market timing…

“A lot of people get famous for being right, once in a row”

Howard Marks on theory & practice…

“In theory there is no difference between theory and practice, in practice there is”

Howard Marks on risk premiums…

“When people don’t demand risk premiums, they won’t exist”

Howard Marks on investing…

“What a wise man does in the beginning the fool does in the end”

2013/06/14

16

Thank You

31

David ShapiroDeputy Chairman / [email protected]

Kavita PatelPortfolio [email protected]

Craig DieselPortfolio [email protected]

Carmen SolomonsPortfolio [email protected]