India- What Can It Teach Us by Max Muller, k.m With Updated Font

JP Muller On India 2009

-

Upload

blba-new-delhi -

Category

Travel

-

view

820 -

download

0

description

Transcript of JP Muller On India 2009

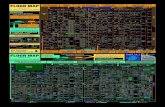

Update on the Indian economyUpdate on the Indian economy in the present global crisisin the present global crisis

andand overview of the overview of the BelgoBelgo--Indian Indian

economic relationseconomic relationsBy Jean-Pierre MullerTrade CommissionerAwex & Brussels Export OfficeNew Delhi

Brussels Export, June 12th 2009

I. II. INDIANDIA

a billion people country a billion people country with a trillion dollar with a trillion dollar

economyeconomy......

India : Nominal Gross Domestic ProductIndia : Nominal Gross Domestic Product and Real GDP Growthand Real GDP Growth

Fiscal years (beginning April 1st of the year indicated)

Source : The Economist Intelligence Unit

* forecasts

596.0

697.8

810.0

923.5

1,164.11,121.4

1,133.5

8.4% 8.3%

9.3%9.7%

5.0%

6.0%

9.1%

0.0

200.0

400.0

600.0

800.0

1,000.0

1,200.0

1,400.0

2003 2004 2005 2006 2007 2008 2009*

Bio

US$

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%Nominal GDP (BIO US$) % change from year ago

GDP GrowthGDP Growth Comparative data analysisComparative data analysis

Source : The Economist Intelligence Unit

* = forecasts

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

2005 2006 2007 2008 2009*

India

China

USA

EU 27

World

World World RankingsRankings List of countries by nominal GDP in 2008 (in Bio US$)List of countries by nominal GDP in 2008 (in Bio US$)

Source : CIA, The world factbook 2008

1 United States 14,330.0 16 South Korea 857.5

2 Japan 4,844.0 17 Turkey 798.9

3 China (PRC) 4,222.0 18 Poland 567.4

4 Germany 3,818.0 19 Belgium 530.6

5 France 2,978.0 20 Sweden 512.9

6 United Kingdom 2,787.0 21 Indonesia 510.8

7 Italy 2,399.0 22 Switzerland 492.6

8 Russia 1,757.0 23 Norway 481.1

9 Spain 1,683.0 24 Saudi Arabia 467.7

10 Brazil 1,665.0 25 Austria 432.4

11 Canada 1,564.0 26 Taiwan, R.O.C. 401.6

12 India 1,237.0 27 Iran 382.3

13 Mexico 1,143.0 28 Greece 373.5

14 Australia 1,069.0 29 Denmark 369.6

15 Netherlands 909.5 30 Argentina 338.7

World World RankingsRankings List of countries by nominal GDP in 2008 (in Bio US$)List of countries by nominal GDP in 2008 (in Bio US$)

Purchasing Power Parity (PPP) methodPurchasing Power Parity (PPP) method

Source : CIA, The world factbook 2008

1 United States 14,290.0 16 Turkey 906.5

2 China 7,800.0 17 Iran 842.0

3 Japan 4,348.0 18 Australia 800.5

4 India 3,267.0 19 Taiwan 738.8

5 Germany 2,863.0 20 Netherlands 670.2

6 United Kingdom 2,231.0 21 Poland 667.4

7 Russia 2,225.0 22 Saudi Arabia 582.8

8 France 2,097.0 23 Argentina 575.6

9 Brazil 1,990.0 24 Thailand 553.4

10 Italy 1,821.0 25 South Africa 489.7

11 Mexico 1,559.0 26 Pakistan 452.7

12 Spain 1,378.0 27 Egypt 442.6

13 Canada 1,307.0 28 Colombia 399.4

14 South Korea 1,278.0 29 Belgium 390.5

15 Indonesia 915.9 30 Malaysia 386.6

INDIA vs. CHINAINDIA vs. CHINA (Comparative data (Comparative data -- 2007)2007)

Source : The Economist Intelligence Unit

3,241.8

2,453.0

5,478.0

1,032.01,133.5

2,784.0

0.0

1,000.0

2,000.0

3,000.0

4,000.0

5,000.0

6,000.0

Nominal GDPin BIO US$

GDP / headin US$

GDP/ headin US$

(PPP Method)

India : Balance of India : Balance of tradetrade and and currentcurrent accountaccount balancebalance

Fiscal years (beginning April 1st of the year indicated)

Source : The Economist Intelligence Unit

75,537

105,975

149,430

185,041

231,571

305,487

-14,642 -28,036

-47,255 -62,078

-80,861

-129,130

60,89577,939

102,175122,963

150,710

176,357

-150,000

-100,000

-50,000

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

2003

2004

2005

2006

2007

2008

Mio

US$

Indian Imports (Mio $)

Indian Exports (Mio $)

Trade Balance (Mio $)

Current account balance (Mio $)

Top 30 Top 30 exportersexporters in the worldin the world List of countries by exports in 2008 (in Bio US$)List of countries by exports in 2008 (in Bio US$)

Source : CIA, The world factbook 2008

1 Germany 1,530.0 16 Spain 292.8

2 China 1,465.0 17 Taiwan 255.7

3 United States 1,377.0 18 Singapore 235.8

4 Japan 776.8 19 Un. Arab Emirates 207.7

5 France 761.0 20 Brazil 200.0

6 Italy 566.1 21 Malaysia 195.7

7 Netherlands 537.5 22 Poland 190.5

8 Russia 476.0 23 Sweden 185.1

9 United Kingdom 468.7 24 Australia 178.9

10 Canada 461.8 25 Thailand 178.4

11 South Korea 419.0 26 Norway 177.6

12 Belgium 372.9 27 India 175.7

13 Hong Kong 362.1 28 Switzerland 172.7

14 Saudi Arabia 311.1 29 Austria 163.3

15 Mexico 294.0 30 Czech Republic 145.8

Top 30 Top 30 importersimporters in the worldin the world List of countries by imports in 2008 (in Bio US$)List of countries by imports in 2008 (in Bio US$)

Source : CIA, The world factbook 2008

1 United States 2,190.0 16 India 287.5

2 Germany 1,202.0 17 Taiwan 236.0

3 China 1,156.0 18 Singapore 219.5

4 France 833.0 19 Poland 213.9

5 Japan 696.2 20 Switzerland 212.8

6 United Kingdom 645.7 21 Turkey 204.8

7 Italy 566.8 22 Australia 187.2

8 Netherlands 485.3 23 Austria 183.4

9 Spain 444.9 24 Thailand 179.0

10 Canada 436.7 25 Brazil 176.0

11 South Korea 435.0 26 Sweden 166.6

12 Hong Kong 387.9 27 Malaysia 156.2

13 Belgium 375.2 28 Czech Republic 141.4

14 Mexico 305.9 29 United Arab Emirate 141.1

15 Russia 302.0 30 Indonesia 128.8

Exchange rate of Exchange rate of IndianIndian RupeeRupee (Value (Value atat the end of the the end of the indicatedindicated periodperiod))

49.60 50.36

42.4943.52

46.6948.34

45.6043.73 44.12

39.43

42.85

47.86

42.8343.73

67.25

67.70

53.53

58.2558.08

43.99

57.26

59.66

48.04

45.19

30

40

50

60

70

80

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

Jun-09

1 $

or 1

€ =

INR

1 € = INR 1 $ = INR

India India -- ForeignForeign Direct Direct InvestementInvestement

Source : Ministry of Commerce & Industry, Department of Industrial Policy & Promotion

Total FDI : 83,6 Bio US$

FDI Inflows in India(accumulated from April 00 to December 08)

6,458.3

5,867.6

5,142.4

3,524.1

2,353.5

2,111.9

2,003.0

1,172.4

881.9

778.4

654.3

592.1

509.2

488.8

457.0

440.7

365.2

391.0

359.1

279.4

34,241.4

0.0 5,000.0 10,000.0 15,000.0 20,000.0 25,000.0 30,000.0 35,000.0 40,000.0

MAURITIUS

SINGAPORE

U.S.A.

U.K.

NETHERLANDS

JAPAN

GERMANY

CYPRUS

FRANCE

U.A.E.

SWITZERLAND

CAYMAN ISLAND

ITALY

SWEDEN

BERMUDA

SOUTH KOREA

SPAIN

RUSSIA

BRITISH VIRGINIA

HONGKONG

BELGIUM

(in Mio US$)

India : Destination of FDI by locationIndia : Destination of FDI by location

Source : Ministry of Commerce & Industry, Department of Industrial Policy & Promotion

FDI stocks accumulated from April 00 to Dec. 08

33.8%

16.1%

7.0% 6.8%5.6% 4.3%

1.6%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

MUMBAINEW D

ELHI

BANGALORE

AHMEDABAD

CHENNAIHYDERABAD

KOLKATA

Top 30 recipients of FDI in the worldTop 30 recipients of FDI in the world List of countries by FDI stock in 2007 (in Bio US$)List of countries by FDI stock in 2007 (in Bio US$)

Source : CIA, The world factbook 2008

1 United States 2,093.0 16 Brazil 248.9

2 United Kingdom 1,288.0 17 Austria 222.9

3 Hong Kong 1,185.0 18 Sweden 216.6

4 France 942.3 19 Singapore 214.5

5 Germany 855.8 20 Ireland 191.4

6 China 758.9 21 Denmark 149.7

7 Belgium 678.2 22 Poland 143.0

8 Netherlands 673.4 23 South Korea 119.6

9 Spain 568.8 24 Japan 110.8

10 Canada 527.4 25 Hungary 108.6

11 Italy 364.8 26 Turkey 106.4

12 Australia 315.0 27 India 95.9

13 Switzerland 306.4 28 South Africa 93.5

14 Russia 271.6 29 Taiwan 92.8

15 Mexico 260.9 30 Chile 91.5

Stock Stock marketmarket IndexesIndexes (Values (Values atat the end of the the end of the periodperiod))

9181

1149710787

10021

8342

13264

3055

5006

39723263 3377

58396603

1378714650

20287

9647

15411

1078310454

8739

8776

11345

10718 1246313409

9398

13461

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007/1

2007/2

2008/1

2008/2

2009/1

Dow Jones Industrial Average (NY)

BSE Sensex (Mumbai)

•5.8% quarterly GDP growth in March 2009 (higher than expected and better than the previous term)

•Low inflation : less than 1% in March 2009, on a year earlier, vs. 10% in March 2008 (wholesale prices)

• Tumbling exports : in March, they were 33% down on a year earlier (but India is less reliant on trade than most emerging markets)

•Fiscal deficit well above 5.5% of the GDP(actually more than 12% if we include State Governments deficits +

extra budget spending)

Latest update on Indian economyLatest update on Indian economy

II. II. BilateralBilateral relations relations

Bilateral trade BelgiumBilateral trade Belgium--IndiaIndia

Source : Belgian National Bank

4,225

5,126

4,522

5,202

4,782

1,867 1,9982,358

3,128

2,260

2,9582,493

2,262

1,824

2,709

0

1,000

2,000

3,000

4,000

5,000

6,000

2004 2005 2006 2007 2008

Mio

€

Belgian exports to India (Mio €) Belgian imports from India (Mio €) Balance

Bilateral trade (II)Bilateral trade (II)

Composition of Belgian imports (2008)

Minerals, 9.8%

Metals, 8.9%

Textiles, 7.6%

Chemicals, 7.1%

Transportationequipment, 4.1%

Diamonds, 50.3%

Machinery, 3.5%

Belgian Importsminus diamonds

= 1,450 Mio €

Belgian exportsminus diamonds

= 1,000 Mio €

Source : Belgian National Bank

Composition of Belgian Exports (2008)Plastics, 2.2%

Diamonds, 78.8%

Machinery, 6.4%

Metals, 5.5%

Chemicals, 3.9%

•India is Belgium’s 9th customer and 13th

supplier.

•But, without inclusion of the diamond trade, India is actually Belgium’s 33d

customer and 28th supplier.

Bilateral trade (III)Bilateral trade (III)

Source : Banque Nationale de Belgique

• Mission Marcourt (Awex) – September 2008

• State Visit to India by King Albert II and Queen Paola – October 2008

• 11th Joint bilateral commission (Brussels, May 2009)

• “India calling” mission in Brussels – October 2009 (Indian Merchants’ Chambers)

• Crown Prince Philippe mission to India – March 2010

Recent events in the bilateral relationsRecent events in the bilateral relations

•Agreement on Economic, Industrial, Scientific and Technological Cooperation between BLEU and India in March 1990•Agreement on Avoidance of Double Taxation signed on 26 April 1993, and came into effect on 5 August 1997 •Agreement on Bilateral Investment Protection signed by India and BLEU (Belgium Luxembourg Economic Union) in November 1997.•Agreement on Air transportation in March 2003• Social security agreement signed in New Delhi in November 2006 (will come into effect in Sept. 2009).

Bilateral AgreementsBilateral Agreements

•Market access challengesHigh level of tariff barriers (among the highest of the

emerging economies)Taxation on imported wine & spirit (incl. beers)Steel : BIS mandatory certifications + imposition of

antidumping duties.

•6th round of Free Trade Agreement (FTA) negotiations in March 2009

major issues : agriculture, service sector

Major bilateral and multilateral issuesMajor bilateral and multilateral issues

• Indian investments in Belgium exceed 1 Bio €, mainly through mergers & acquisitions

• Major M&A operations : • Crompton Greaves took over Pauwels Trafo in February 2005;• Suzlon Energy took over Hansen Transmissions in March, 2006;• Ranbaxy acquired Ethimed in March 2006;• Matrix laboratories Ltd (part of Mylan Pharma, US) acquired Docpharma in June 2005;• Jubilant Organosys, New Delhi took over PSI, Ghent in March 2005;• Raymond formed a joint venture with UCO Belgium in August 2006;• All Cargo, Mumbai bought substantial stake in Eculines, Antwerp in June 2005.• Satyam Computer Services took over S&V,Ghent in April 2008 • ORG Informatics acquired BSS (Belgium Satellite services) from Belgacom.

• Other important players : Indian BPO companies like Tata Consultancy Services (TCS) , HCL, NIIT, …

• Jet Airways

Indian investments in BelgiumIndian investments in Belgium

•Belgium invested 280 Mio $ in India from 2000 to 2008 (0.37% of total FDI, 21st most important investor) •Major sectors / investors :

Pharmaceuticals : UCB, Solvay, AFGA Healthcare, GSK, Omega pharma.Engineering and Equipments : CMI, Tractebel, Barco, Magotteaux, Hamon, Machines Boucherie, Ateliers FrançoisDiamonds : Rosy Blue, Munic Gems, Antwerp Diamond Bank (financing) and Bettonville (diamond cutting machines).Steel and Metals : Bekaert (steel cords), Umicore (Zinc powder unit + automotive catalysts)IT : Research centre of Alcatel Lucent in Chennai + Several IT centres of Belgian companies (KBC, Colruyt, …)Logistics / Marine : Ports (Antwerp and Zeebrugge), logistics companies (Ahlers and Conti-lines) and dredging companies (DEME, De Nul).Emerging & New Markets : biotechnology (Imec, Viziphar), environmental services (Waterleau) and sustainable energy (Vincke).Food : Puratos and Inbev

Belgian investments in IndiaBelgian investments in India

Thank youThank youfor your attention!for your attention!