JP Morgan Global Markets Outlook and Strategy 20110406

Transcript of JP Morgan Global Markets Outlook and Strategy 20110406

Global Markets Outlook and Strategy

Global Asset AllocationApril 6, 2011

www.morganmarkets.comThe certifying analyst is indicated by an AC. See page 35 for analyst certificationand important legal and regulatory disclosures.

Contents

Economic Outlook 2

Market Forecasts 6

Global Market Strategy 7

Top Assets to Own, and to Avoid 12

FX Strategy 15

Fixed Income Strategy 20

Credit Strategy 23

Equity Strategy 26

Commodity Strategy 29

Jan LoeysAC

(1-212) [email protected]

Bruce Kasman(1-212) [email protected]

John Normand(44-20) [email protected]

Nikolaos Panigirtzoglou(44-20) [email protected]

Grace Koo(44-20) [email protected]

Seamus Mac Gorain(44-20) [email protected]

Matthew Lehmann(44-20) [email protected]. Morgan Securities Ltd.

• The economyThe global economy disappoints bullish 1Q expectations in the face ofnumerous negative shocks, but despite 3/4%pt downward revision to 1Hglobal GDP growth, recovery to stay above trend and accelerate in 2H.

• Asset allocationMarkets are interpreting all weak economic data as part of a V-shapedmove down then up due to Japan. But higher oil and weaker US consum-ers are real threats. We stay medium-term long risk assets, but reduce theoverweight from aggressive to significant, taking instead more tacticalrisk from within-asset class positioning on relative value and growth.

• Top assets to own, and to avoidOW alternatives and UW govt bonds in a long-only portfolio with a targetvol of 12%, i.e. market portfolio vol. HFs, Private Equity and Real Estatehave low Marginal Contribution To Risk (MCTR), even after “de-smooth-ing” their historical return series. In a low 6% vol portfolio, we recom-mend high exposure to Hedge Funds, HG corp bonds and Real Estate.

• Fixed incomeHold shorts and flatteners in the UK and Euro area in anticipation ofpolicy tightening. Overweight US vs. Canada on monetary policy, andNew Zealand vs. Australia on carry. Position for wider swap spreads inGerman Bunds vs. US Treasuries.

• CreditReduce directional exposure by closing longs in CLOs, but maintain longsin HY corporates and top quality US CMBS. OW US Banks vs. Industrialsand open underweight in Asian versus US corporates in CDS indices asAsian corporates face stronger headwinds in the near term.

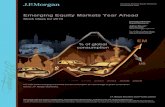

• EquitiesMove to an OW in EM vs. DM equities as both positions and the IPgrowth differential favour EM. UW Cyclical vs. Defensive sectors on aprospective slowing in the global PMI. Sector momentum favoursCommodity sectors and Telecoms. Stay long small vs. large caps.

• CurrenciesRelative growth, monetary policy and debt dynamics are our guides. Stayshort USD vs. CAD, EUR and EM. Short EUR and GBP vs. CHF, SEKand NOK.

• CommoditiesWe stay long commodities on a longer term view but focus on relativevalue for the near term.

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

2

Global Markets Outlook and StrategyApril 6, 2011

JPMorgan Chase BankDavid Hensley (1-212) [email protected]

Carlton Strong (1-212) [email protected]

Economic Research

Global Economic Outlook Summary

Source: J.P. Morgan

Note: For some emerging economies, 2010-2012 quarterly forecasts are not available and/or seasonally adjusted GDP data are estimated by J.P. Morgan.Bold denotes changes from last edition of Global Markets Outlook and Strategy, with arrows showing the direction of changes. Underline indicatesbeginning of J.P. Morgan forecasts.

2010 2011 2012 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 4Q10 2Q11 4Q11 2Q12

The Americas

United States 2.9 2.9 2.9 2.6 3.1 2.5 3.5 3.5 3.0 2.0 1.2 2.8 2.5 1.6

Canada 3.1 3.3 3.0 1.8 3.3 4.0 3.6 3.5 3.3 2.7 2.3 2.4 1.9 2.0

Latin America 6.1 4.4 3.8 2.5 4.5 3.7 5.5 4.0 4.1 3.3 6.7 7.0 7.5 7.6

Argentina 9.2 6.5 4.8 2.7 10.5 6.5 5.0 6.0 3.0 4.0 11.0 11.0 11.0 12.0

Brazil 7.5 4.0 3.8 1.6 3.0 3.9 4.8 4.9 4.6 4.0 5.6 6.0 6.1 6.2

Chile 5.2 6.0 4.5 8.7 3.8 4.5 5.0 5.0 5.0 4.5 2.5 4.0 5.5 5.0

Colombia 4.3 4.5 4.0 -1.9 7.9 6.0 3.8 3.7 4.2 4.5 2.7 3.6 4.0 3.4

Ecuador 3.6 3.5 3.0 8.4 11.0 3.0 2.5 2.5 2.0 3.5 3.4 3.5 3.8 3.6

Mexico 5.5 4.5 3.5 3.2 5.1 2.0 8.0 2.5 3.6 1.5 4.2 3.6 3.7 3.6

Peru 8.8 7.3 6.0 7.2 8.6 6.8 7.0 4.5 6.7 6.5 2.1 2.9 2.8 2.8

Venezuela -1.4 1.5 3.0 0.6 -1.8 2.5 1.5 2.0 2.5 3.0 27.3 29.0 33.8 34.6

Asia/Pacific

Japan 4.0 0.8 3.2 3.3 -1.3 0.5 -3.5 5.0 6.5 3.0 0.1 0.8 0.8 0.8

Australia 2.7 2.6 4.5 0.5 3.0 -0.3 4.8 4.1 5.2 5.1 2.7 3.4 3.6 3.2

New Zealand 1.5 0.6 4.4 -0.8 0.8 -1.9 1.2 4.4 3.4 5.7 4.0 5.8 3.9 3.1

Asia ex Japan 9.1 7.4 7.6 7.3 7.9 7.5 6.9 8.6 7.3 7.1 4.9 5.4 4.4 3.9

China 10.3 9.4 9.0 9.9 12.7 8.7 8.8 9.0 9.0 9.3 4.7 5.1 3.3 3.0

Hong Kong 6.8 4.7 4.7 3.6 6.1 4.1 4.2 4.8 5.0 4.8 2.8 4.3 4.6 3.6

India 8.5 8.0 8.7 13.5 0.9 7.9 8.4 13.2 5.8 5.0 9.2 8.5 8.5 8.0

Indonesia 6.1 6.0 6.7 6.7 7.5 6.0 5.0 4.5 5.0 7.0 6.3 7.2 6.3 5.5

Korea 6.2 4.2 4.7 2.6 2.0 5.0 3.4 6.5 5.8 4.0 3.6 4.7 3.5 2.8

Malaysia 7.2 4.7 4.8 -0.6 8.9 5.2 2.0 6.5 5.0 5.5 2.0 3.4 3.7 3.0

Philippines 7.3 5.0 5.1 -3.1 12.7 4.9 3.6 5.3 4.5 5.3 2.9 4.9 5.1 3.5

Singapore 14.5 4.1 5.7 -16.7 3.9 5.3 7.0 8.2 6.6 4.9 4.0 4.5 3.3 2.0

Taiwan 10.8 4.5 5.4 3.2 0.0 8.0 4.6 6.0 6.5 5.5 1.1 1.8 2.9 2.1

Thailand 7.8 3.6 4.8 -1.3 4.8 6.5 1.0 6.5 5.5 4.5 2.9 4.5 5.4 4.5

Africa/Middle East

Israel 4.6 4.5 4.0 4.6 7.7 4.5 4.5 4.5 4.5 4.5 2.5 4.9 3.8 3.5

South Africa 2.8 3.7 3.8 2.7 4.4 3.6 3.7 4.0 4.1 3.0 3.5 4.2 5.9 5.8

E

% over a year ago

Consumer prices

% over previous period, saar

Real GDP

% over a year ago

Real GDP

Europe

Euro area 1.7 2.2 2.2 1.4 1.1 3.0 2.0 2.0 2.5 2.3 2.0 2.5 2.4 1.8

Germany 3.5 3.3 2.2 2.8 1.5 4.5 2.5 2.5 2.5 2.0 1.6 2.3 2.3 1.8

France 1.5 2.3 2.4 1.0 1.4 3.5 2.0 2.5 3.0 2.3 1.9 2.1 2.2 1.8

Italy 1.2 1.4 2.1 1.3 0.5 1.5 1.5 2.0 2.5 2.5 2.0 2.5 2.5 2.2

Norway 2.2 2.9 2.9 4.4 1.3 3.3 3.3 3.0 3.0 3.0 2.2 1.1 0.9 0.9

Sweden 5.3 4.6 2.9 8.7 5.1 3.5 3.3 3.0 3.0 3.0 1.9 3.1 2.9 2.4

United Kingdom 1.3 1.8 2.7 2.9 -1.9 2.8 2.0 2.5 3.0 2.5 3.4 4.4 4.5 3.1

Emerging Europe 4.5 4.3 4.5 0.6 7.1 3.9 3.0 4.0 5.2 4.9 6.6 7.3 6.8 6.0

Bulgaria 0.1 3.5 4.0 … … … … … … … … … … …

Czech Republic 2.3 3.0 3.5 3.6 1.4 1.5 3.0 3.5 4.0 3.5 2.1 2.2 2.9 2.7

Hungary 1.2 2.8 3.5 2.2 0.8 2.5 3.0 3.5 3.5 3.5 4.4 4.3 4.2 3.7

Poland 3.8 4.0 4.2 4.9 3.2 4.5 3.5 4.0 4.0 4.2 2.9 4.0 3.7 3.0

Romania -1.3 2.0 4.0 … … … … … … … 7.9 7.3 4.8 5.0

Russia 4.0 4.5 5.0 -1.1 10.8 4.5 2.8 4.2 6.0 5.5 8.2 10.1 8.9 7.6

Turkey 8.9 5.6 4.3 … … … … … … … 7.4 6.3 6.8 6.5

Global 3.8 3.3 3.6 3.0 3.0 3.3 3.0 4.1 4.1 3.3 2.7 3.5 3.3 2.7

Developed markets 2.5 2.3 2.7 2.3 1.5 2.4 2.0 3.1 3.4 2.4 1.6 2.5 2.4 1.7

Emerging markets 7.3 6.0 6.0 4.9 6.9 5.9 5.9 6.6 6.1 5.7 5.6 6.1 5.6 5.2

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

3

Global Markets Outlook and StrategyApril 6, 2011

Economic Research

Economic Outlook

• Global economy disappoints bullish 1Q expectations inthe face of numerous negative shocks.

• Despite 3/4%pt downward revision to global GDPgrowth in 1H, recovery to stay above trend andaccelerate in 2H.

• MENA unrest and oil prices remain the key near-termrisk; consumer resilience in 2Q to be tested.

• Fed and BoJ continue easing as ECB joins EM centralbanks in heading for the exit.

Global recovery resilient amid shocksThe devastating earthquake and tsunami in Japan this monthadd to an unusual array of shocks already buffeting the globaleconomy in the first half of 2011. These include a spike in oilprices amid social unrest in the MENA region, an ongoingsurge in agriculture prices, severe winter weather in the USand Europe, Lunar New Year holiday disruptions in China,and simmering tensions surrounding the EMU fiscal crisis. Assome drags have persisted longer than expected and new oneshave come on the scene, they have both raised the level ofuncertainty about the outlook and tempered our baseline fornear-term growth. These near-term disappointments are all themore so given that our view of robust growth into the newyear was being amplified by what were risks to the upside. Asof now, the risks are skewed more to the downside.

The past month has brought a stream of downward revi-sions. Relative to the March GMOS, our forecast for globalGDP growth in the first half has been marked down by3/4%-point annualized. Revisions have centered on the USand Asia. In response to the oil price shock and somewhatweaker than expected consumer spending data, we now lookfor US GDP to post a 3% gain in 1H11, 3/4%-point weakerthan in the last GMOS. In Asia, the Tohoku earthquake willdo considerable damage to growth in Japan and leave anoticeable imprint on activity in the rest of region. GDPgrowth in Japan is now expected to contract 1.5% annual-ized in 1H11, a downward revision of nearly 4%-pointssince the last GMOS. First-half output growth in EM Asiahas been marked down roughly 3/4%-point over the sameperiod, but further revisions are likely as the full extent ofthe earthquake is assessed.

Despite the sizable downward revisions to our outlook and theshift in risk distribution to the downside, we maintain that theglobal recovery will be resilient this year. Indeed, as we assessthe likely impact of these supply and geopolitical shocks onnear-term growth, it is important to recognize that most, if not

JPMorgan Chase BankBruce Kasman (1-212) [email protected]

David Hensley (1-212) 834-5516 Joseph Lupton (1-212) [email protected] [email protected]

Source: J.P. Morgan

2.5

3.0

3.5

4.0

4.5

5.0

%q/q, saar

2005 2006 2007 2008 2009 2010 2011

Previous GMOS forecast

Trend growth

Chart 1: Real global GDP%q/q, saar

all of them, will prove to be temporary, and that they are occur-ring against a backdrop of very strong fundamental supportsfor growth. Although industrial production is set to deceleratethis quarter, this is from a robust pace in 1Q11, and the pur-chasing-power hit to consumption from higher oil prices is be-ing cushioned by improving labor markets, a 17% advance inglobal stock prices since September and the reduction in socialsecurity taxes in the US. Moreover, the soft spots in the globaleconomy, including the service sector, the Euro area outside ofGermany and Japan, are all showing signs of improvement.Even with the cuts we have made to the forecast so far, thenear-term outlook is still for global output to expand at anabove-trend pace of 3.2% annualized in the first half of 2011,with a 3.3% gain in 1Q11 followed by a 3% gain in the currentquarter. The latest global PMI reading confirms our view, bothof above-trend growth at the turn of the year as well as a mod-est deceleration into the current quarter. Put differently, theshocks to date would have to magnify considerably to pushglobal growth below this trendline.

Watching oil and the consumerOur biggest immediate concern remains the oil shock and po-litical turmoil in the Middle East and North Africa. Oil shockscan affect the economy through two channels: the hit tohousehold purchasing power and a loss of confidence and riskappetite that undermines asset prices. To date, this shock hasproved manageable because the hit to purchasing power,while significant, has not been big enough to stifle growth inreal income, and because it has not spilled over to confidenceand asset prices. However, this view will be tested in the com-ing weeks as oil prices have begun moving up further, withfront-month Brent trading above $120/bbl. Our energy strat-egy team anticipates that although there will be an unusualamount of volatility in global oil prices in coming weeks, thelevel of prices will be moving lower by midyear.

There is little doubt that the spike in energy prices is dampingspending behavior. According the latest readings, global retailsales volumes decelerated over the last quarter. Some of thiswas anticipated following the strong gains in 4Q10. Conse-quently, it remains to be seeing how households respond to the

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

4

Global Markets Outlook and StrategyApril 6, 2011

-16

-8

0

8

16

-9

-6

-3

0

3

6

9

2008 2009 2010 2011

IP

Retail sales

Economic ResearchJPMorgan Chase BankBruce Kasman (1-212) [email protected]

David Hensley (1-212) 834-5516 Joseph Lupton (1-212) [email protected] [email protected]

Chart 2: Global IP and retail sales (volume)%3m, saar

Source: J.P. Morgan

purchasing power hit from higher oil prices. We see growth inpersonal outlays easing further in March and April but thenpicking back up as the oil price shock fades and improvementsin labor markets and further gains in equity prices boost pur-chasing power.

However, we cannot rule out the possibility that the unrest inthe region will intensify and spread to additional suppliers,critically Saudi Arabia, delivering a fresh jolt to oil prices andgeopolitical uncertainty. At the same time, there isconsiderable near-term risk that OPEC, which has so far onlyfilled two thirds of the supply loss from Libya, fails to makeup the supply gap in a timely fashion ahead of the summerdriving season. Not only could that tighten an already tightmarket, but it could also resurrect concerns about “peak oil”and spare capacity that could manifest themselves in higherprices. Absent a more meaningful supply response fromOPEC, the risk is of a move above $130/bbl that would furtherdamp already diminished economic expectations.

Asia to get hit hard by earthquakeThe natural disasters that struck Japan took an enormous hu-man toll and will have major economic consequences. Eco-nomic activity is being disrupted by a supply shock as dam-aged infrastructure and losses in power supply lead to busi-ness shutdowns. The crisis also has crimped aggregate de-mand. The decline in Japanese output in March is likely to behuge, with the hit to March holding GDP in the entire firstquarter roughly unchanged from 4Q10, and pushing activitydown at an annualized pace of 3.5% in the current quarter.Industry will feel the brunt of the impact, with IP projected tocollapse 12% in March. The sharp fall in Japan 2Q11 GDPwill mask an underlying shift in momentum in real time. Byall appearances the Japanese economy is finding a bottom inlate March. This will be followed by a sustained rebound inactivity beginning in April as production comes back on lineand the reconstruction effort takes hold. In this regard, a sharpV-shaped recovery is expected, with the economy will growwell above trend during 2H11.

The near-term loss of crucial Japanese exports will leave asubstantial imprint on industrial activity elsewhere. In 1H11,we estimate that the growth of global GDP could be reduced

by anywhere from 0.4%-1.2%-pts. Thereafter, global output willaccelerate significantly as Japan rebounds. Global GDP growth in2H11 could be 0.6%-1.4%-pts higher than our pre-quake estimate.

Emerging Asia is most exposed to developments in Japan be-cause it is Japan’s biggest trading partner and has a high manu-facturing intensity. Our econometric analysis suggests that theASEAN region will see the largest impact, followed by Koreaand Taiwan. China is more insulated but is not immune. Asimilar pattern was seen following the Kobe earthquake. Theimpact of this event will dissipate the further we move awayfrom its source in Japan. Although global manufacturing willbe hit by the reverberations from Japan, the impact on serviceswill be much more muted. Given the much larger share of ser-vices in the global economy and the underlying cyclicalstrength of the expansion, the GDP impact will be limited.

Global monetary policy breaking ranksThe surge in commodity prices and the resulting jump in head-line inflation rates is causing a headache to central bankers inthe developed markets who are still concerned about generat-ing enough growth to close still-large output gaps. Inflationmoves are being amplified in Europe by increasing VATs and,in the UK and the US, by the influence of past declines in thecurrency. And yet, despite the similarity of the driving forces,central bank reactions are varied.

Commodity price moves are viewed as temporary by the Fedand their influence in damping growth — and thus underlyingcore inflation — is a bigger concern than the impact on head-line inflation. For this reason, we maintain that the Fed willcontinue easing through June via its QE2 program and that thepolicy rate will remain on hold near zero through this year atleast. In Japan, the BoJ is expected to also continue easing,with an expansion of its asset purchase program.

In sharp contrast to the Fed and BoJ, the ECB’s balance sheet isbeing geared towards fostering financial stability while interestrates will be raised to contain inflation pressure. The ECB willlikely begin normalizing policy rates this week with a 25bp hike.Such a move will not be beneficial to the periphery. But ECBcouncil members have been adamant that the central bank onlyhas one policy instrument and it thus has to respond to condi-tions in the region as a whole. The central bank is helping theperiphery via its bond purchases and the collateral requirements,as illustrated this week when the ECB suspended the ratingthreshold for debt instruments of the Irish government.

In the EM, policymakers in many countries are feeling increas-ingly behind the curve. Consequently, despite the twin growthshocks from commodity price increases and the fallout fromthe Japanese earthquake in Asia, central banks in EM Asia andLatin America are continuing down the tightening path thatstarted last year. In addition to food and energy inflation, coreinflation is also on the rise in the face of tightening resourceutilization in much of EM Asia and Latin America.

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

5

Global Markets Outlook and StrategyApril 6, 2011

Economic Research

Central Bank Watch

JPMorgan Chase BankDavid Hensley (1-212) [email protected]

Michael Mulhall (1-212) [email protected]

Official Current Forecast

rate rate (%pa) 05-07 avg Peak1 Trough1next change Jun 11 Sep 11 Dec 11 Mar 12 Jun 12

Global 1.94 -239 -308 29 2.08 2.24 2.38 2.48 2.60

excluding US 2.65 0 0 38 2.85 3.07 3.26 3.40 3.56

Developed 0.62 -402 -464 9 0.74 0.87 1.00 1.11 1.23

Emerging 5.57 -430 -513 85 5.80 6.03 6.20 6.28 6.37

Latin America 7.85 -269 -350 174 8.35 8.46 8.67 8.67 8.67

CEEMEA 4.14 -365 -800 18 4.42 4.72 5.15 5.48 5.70

EM Asia 5.32 -342 -525 104 5.43 5.66 5.71 5.71 5.79

The Americas 1.38 -402 -464 32 1.47 1.53 1.58 1.59 1.61

United States Fed funds 0.125 -430 -513 0 6 Dec 08 (-87.5bp 27 Apr 11 On hold 0.125 0.125 0.125 0.125 0.125

Canada O/N rate 1.00 -269 -350 75 8 Sep 10 (+25bp) 12 Apr 11 31 May 11 (+25bp) 1.25 1.75 2.00 2.25 2.50

Brazil SELIC O/N 11.75 -365 -800 300 2 Mar 11 (+50bp) 20 Apr 11 20 Apr 11 (+50bp) 12.50 12.50 12.50 12.50 12.50

Mexico Repo rate 4.50 -342 -525 0 17 Jul 09 (-25bp) 15 Apr 11 4Q 11 4.50 4.50 5.00 5.00 5.00

Chile Disc rate 4.00 -62 -425 350 17 Mar 11 (+50bp) 12 Apr 11 12 Apr 11 (+25bp) 5.00 6.00 6.50 6.50 6.50

Colombia Repo rate 3.50 -374 -650 50 18 Mar 11 (+25bp) 29 Apr 11 29 Apr 11 (+25bp) 4.25 5.00 5.00 5.00 5.00

Peru Reference 3.75 -26 -275 250 10 Mar 11 (+25bp) 7 Apr 11 7 Apr 11 (+25bp) 4.50 4.50 4.50 4.50 4.50

Europe/Africa 1.50 -224 -354 4 1.75 2.01 2.30 2.57 2.81

Euro area Refi rate 1.00 -189 -325 0 7 May 09 (-25bp) 7 Apr 11 7 Apr 11 (+25bp) 1.25 1.50 1.75 2.00 2.25

United Kingdom Bank rate 0.50 -444 -525 0 5 Mar 09 (-50bp) 7 Apr 11 May 11 (+25bp) 0.75 1.00 1.25 1.50 1.75

Sweden Repo rate 1.50 -100 -325 125 15 Feb 11 (+25bp) 20 Apr 11 20 Apr 11 (+25bp) 1.75 2.25 2.75 3.00 3.25

Norway Dep rate 2.00 -106 -375 75 5 May 10 (+25bp) 12 May 11 12 May 11 (+25bp) 2.25 2.50 2.75 3.00 3.25

Czech Republic 2-wk repo 0.75 -160 -300 0 6 May 10 (-25bp) 5 May 11 23 Jun 11 (+25bp) 1.00 1.25 1.75 2.25 2.75

Hungary 2-wk dep 6.00 -119 -500 75 24 Jan 11 (+25bp) 18 Apr 11 4Q 11 (+25bp) 6.00 6.00 6.25 6.50 6.50

Israel Base rate 3.00 -124 -250 250 28 Mar 11 (+50bp) 24 Apr 11 24 Apr 11 (+25bp) 3.75 4.25 4.50 4.75 5.00

Poland 7-day interv 4.00 -56 -250 50 5 Apr 11 (+25bp) 11 May 11 Jun 11 (+25bp) 4.25 4.25 4.50 4.75 5.00

Romania Base 6.25 -225 -1106 0 4 May 10 (-25bp) 3 May 11 3Q 11 (+25bp) 6.25 6.50 6.75 7.00 7.00

Russia 1-wk dep 3.00 98 -425 25 24 Dec 10 (+25bp) Apr 11 2Q 11 (+25bp) 3.50 3.75 4.00 4.25 4.50

South Africa Repo rate 5.50 -265 -650 0 18 Nov 10 (-50bp) 12 May 11 Nov 11 (+50bp) 5.50 5.50 6.00 6.50 7.00

Turkey 1-wk repo 6.25 -964 -1125 0 20 Jan 11 (-25bp) 21 Apr 11 Jul 11 (+50bp) 6.25 7.00 8.00 8.50 8.50

Asia/Pacific 3.34 -76 -148 36 3.40 3.55 3.59 3.60 3.66

Australia Cash rate 4.75 -114 -250 175 2 Nov 10 (+25bp) 3 May 11 Aug 11 (+25bp) 4.75 5.00 5.25 5.25 5.50

New Zealand Cash rate 2.50 -482 -575 0 10 Mar 11 (-50bp) 28 Apr 11 2Q 12 (+25bp) 2.50 2.50 2.50 2.50 3.00

Japan O/N call rate 0.05 -15 -47 0 5 Oct 10 (-5bp) 7 Apr 11 On hold 0.05 0.05 0.05 0.05 0.05

Hong Kong Disc. wndw 0.50 -542 -625 0 17 Dec 08 (-100bp 28 Apr 11 On hold 0.50 0.50 0.50 0.50 0.50

China 1-yr working 6.31 23 -116 100 5 Apr 11 (+25bp) - 3Q 11 (+25bp) 6.31 6.56 6.56 6.56 6.56

Korea Base rate 3.00 -110 -225 100 10 Mar 11 (+25bp) 12 Apr 11 2Q 11 (+25bp) 3.25 3.50 3.50 3.50 3.75

Indonesia BI rate 6.75 -312 -600 25 4 Feb 11 (+25bp) 12 Apr 11 3Q 11 (+25bp) 6.75 7.00 7.00 7.00 7.00

India Repo rate 6.75 -11 -225 200 17 Mar 11 (+25bp) 3 May 11 3 May 11 (+25bp) 7.00 7.25 7.50 7.50 7.75

Malaysia O/N rate 2.75 -47 -75 75 8 Jul 10 (+25bp) 5 May 11 5 May 11 (+25bp) 3.00 3.00 3.00 3.00 3.00

Philippines Rev repo 4.25 -282 -325 25 24 Mar 11 (+25bp) 5 May 11 5 May 11 (+25bp) 4.75 4.75 4.75 4.75 4.75

Thailand 1-day repo 2.50 -125 -250 125 9 Mar 11 (+25bp) 20 Apr 11 20 Apr 11 (+25bp) 3.00 3.50 3.50 3.50 3.50

Taiwan Official disc. 1.750 -75 -188 50 1 Mar 11 (+12.5bp 3Q 11 3Q 11 (+12.5bp) 1.875 2.00 2.125 2.25 2.3751 'Peak' refers to highest rate between 2007-08, 'trough' refers to lowest from 2009-present

Bold denotes move since last GMOS and forecast changes. Aggregates are GDP-weighted averages.

Chg sinceNext meetingLast change

Forecast (%pa)

Source: J.P. Morgan

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

6

Global Markets Outlook and StrategyApril 6, 2011

Market Forecasts

Global Asset Allocation

Source: Bloomberg, Datastream, IBES, Standard & Poor’s Services, J.P. Morgan estimates

Interest rates Current Jun-11 Sep-11 Dec-11 Mar-12 YTD Return*

United States Fed funds rate 0.125 0.125 0.125 0.125 0.125

10-year yields 3.51 3.60 3.65 3.70 3.90 -0.3%

Euro area Refi rate 1.00 1.25 1.50 1.75 2.00

10-year yields 3.43 3.50 3.55 3.65 3.75 -2.6%

United Kingdom Repo rate 0.50 0.75 1.00 1.25 1.50

10-year yields 3.76 3.90 4.00 4.15 4.20 -1.2%

Japan Overnight call rate 0.10 0.05 0.05 0.05 0.05

10-year yields 1.30 1.15 1.30 1.35 1.40 -0.8%

GBI-EM hedged in $ Yield - Global Diversified 6.93 7.30 0.0%

Credit Markets Current Index YTD Return*

US high grade (bp over UST) 134 JPMorgan US Index (JULI) i-spread 0.7%

Euro high grade (bp over Euro gov) 151 iBoxx Euro Corporate Index -0.8%

USD high yield (bp vs. UST) 511 JPMorgan Global High Yield Index 4.5%

Euro high yield (bp over Euro gov) 493 iBoxx Euro HY Index 3.8%

EMBIG (bp vs. UST) 286 EMBI Global 1.5%

EM Corporates (bp vs. UST) 266 JPM EM Corporates (CEMBI) 2.0%

Quarterly Averages

Commodities Current 11Q2 11Q3 11Q4 12Q1 GSCI Index YTD Return*

Brent ($/bbl) 122.2 118.0 108.0 108.0 110.0 Energy 17.9%

Gold ($/oz) 1457 1450 1475 1500 1500 Precious Metals 2.0%

Copper ($/metric ton) 9370 9450 9750 10000 9750 Industrial Metals 1.1%

Corn ($/Bu) 7.60 7.00 6.75 6.10 6.20 Agriculture 7.8%

YTD Return*

Foreign Exchange Current Jun-11 Sep-11 Dec-11 Mar-12 in USD

EUR/USD 1.43 1.43 1.45 1.48 1.48 EUR 6.2%

USD/JPY 85.3 80 79 78 78 JPY -4.0%

GBP/USD 1.63 1.57 1.59 1.64 1.66 GBP 4.2%

USD/BRL 1.60 1.64 1.64 1.65 1.67 BRL 5.5%

USD/CNY 6.54 6.40 6.35 6.30 6.20 CNY 0.4%

USD/KRW 1087 1140 1090 1110 1120 KRW 4.7%

USD/TRY 1.51 1.60 1.60 1.55 1.55 TRY 1.8%

3m cash index

YTD Return 2011

Equities Current (local ccy) Forecast

S&P 1333 6.5% 1425

Nasdaq 2791 5.7%

Topix 840 -5.5%

FTSE 100 6041 3.4% 6600

MSCI Eurozone* 167 5.4% 181

MSCI Europe* 1204 3.8% 1310

MSCI EM $* 1195 4.2% 1300

Brazil Bovespa 69501 0.3%

Hang Seng 24285 5.7%

Shanghai SE 3001 6.9%

*Levels/returns as of Apr 05, 2011

Local currency except MSCI EM $

US Europe Japan EMSector Allocation * YTD YTD YTD YTD ($)

Energy 17.6% 9.0% 17.1% 14.6%

Materials 6.8% 0.8% -2.3% 5.3%

Industrials 9.4% 4.2% 2.3% -0.8%

Discretionary 6.1% -0.3% -5.1% 3.6%

Staples 3.5% -1.0% -5.1% 0.4%

Healthcare 6.3% 2.1% -0.9% -3.9%

Financials 3.8% 6.6% -10.7% 3.0%

Information Tech. 2.8% 7.3% -10.2% 0.1%

Telecommunications 4.4% 5.8% 7.3% 3.8%

Utilities 3.1% 4.2% -33.5% 4.2%

Overall 6.5% 3.8% -5.5% 4.2%

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

7

Global Markets Outlook and StrategyApril 6, 2011

J.P. Morgan Securities Ltd.Jan LoeysAC (1-212) [email protected]

Global Asset Allocation

Global Market Strategy

• Risk markets have rallied over the past month, per-forming better than we would have thought withhindsight given recent economic shocks.

• We fear long positions, mild complacency and stickershock at bad IP data are creating downside risk ...

• ... even as we retain a medium-term bullish view onrisk based on value.

• We thus reduce our aggressive overweight in equitiesto a still significant long ....

• ... using the freed up VaR for relative positioningwithin asset classes aimed at reducing overall risk beta.

March brought massive volatility in the wake of thedisastrous earthquake in Japan, but little net change in assetprices over the full month, followed by a strong rally duringthe first week of April. Our model portfolio, which was longrisky assets, had a significant drawdown, but ended theperiod significantly in the black. The seeming impervious-ness of world risk markets to major catastrophes shouldmake one more comfortable being long over the remainderof this year. But it also raises the question of whethermarkets have become complacent.

Asset prices of corporate securities are barely changed overthe month, likely because market participants areinterpreting the impact of the earthquake in Japan and theuprising in the Middle East as temporary factors that do notchange the medium-term outlook for the world economy andcompany earnings. We similarly see the earthquake pushingJapanese activity and world manufacturing downdramatically in Q2, only to rise by year-end virtually to thesame level we had expected before disaster struck. We arenot so confident about the impact of the Arab uprising andresulting rise in oil prices (see Economic Outlook, pp. 3-4).

Over the next two months, two major forces will be battlingeach other. On one side is the zero-sum theme, or what goesdown will come up again. This view states that however badthe impact of the Japanese earthquake is on Japanese andglobal industrial activity data, this impact is just temporary andwill be offset by an equal if not stronger V-shaped rebound sothat by year-end, the world and Japanese economy will beoperating at the level that we expected a month ago. With mostasset prices unchanged over the month, this view is likelyshared by the majority of market participants.

The issue is, though, whether investors will keep the samesanguine view when they see “bad” PMIs and industrial data

The GMOS strategy and model portfolio

GMOS focuses on cross market, tactical asset allocation acrossbonds, currencies, emerging markets, credit, equities andcommodities. Recommendations are presented in the form of amodel portfolio. Strategies focus on a medium-term investmenthorizon, and deal with asset classes rather than relative valueacross securities, which are presented by our many sisterpublications. Any intra-month updates to our strategies arepublished in the weekly The J.P. Morgan View. We endeavourconsistency with our economists and sector strategists, but mayhave gaps due to differences in timing, investment horizons andhedging. We express trades only in three sizes: small, medium andlarge, and denote these with one, two and three stars (, and ). For performance measurement, they constitute,$5 million, $10 million and $20 million in value-at-risk.

Chart 1: 2011 global GDP growth forecasts: JPMorgan and Consensus%

Source: J.P. Morgan, Consensus Economics. Consensus Economics forecasts are for regions andcountries that we averaged using the same 5-year rolling USD GDP weights that we use for our ownglobal growth forecast.

2.8

3.0

3.2

3.4

3.6

3.8

4.0

Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11

JPM

Consensus

coming through over the next one to two months. We callthis the sticker-shock problem. Will the market still thinkconfidently that the fall is just temporary and will be madeup, or will doubt start creeping in that something else moreominous is at work? We would have felt better talking downthis risk if risky assets had been down over the month,suggesting that investors have indeed reduced some of theirgrowth and earnings expectations. The fact that our hedgefund position indicators are showing that hedge funds havegone significantly long equities after the Japanese tsunamiadds to our worry (see charts in Equity Strategy section).

We retain a bullish six- to nine-month month view on globalequities, based on value and an intact global economy. Thedrivers of this positive view are the still very high equityrisk premium relative to low real yields on cash andgovernment debt and the observation, based onoutstandings, that equity holdings of global end-investorsremain near historic averages.

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

8

Global Markets Outlook and StrategyApril 6, 2011

Global Asset AllocationJ.P. Morgan Securities Ltd.Jan LoeysAC (1-212) [email protected]

In addition, we have an overarching macro view thatinvestors are focusing on quality balance sheets, whichmeans non-financial corporates and EM, versus publicsector issuers. In other words, the world as a whole isgrowing at only a moderate pace, and one that is not enoughto fix the many balance sheet problems of the householdand the public sectors in developed markets soon. Butaround this disappointing pace of growth, there are hotspots and weak spots. The hots spots are corporates andEM. Private sector companies are seeing searing profitmargins while the public sector is in a multi-year deleveringmode. EM has suffered much less from the financial crisisand its growth gap with DM has widened in recent years.The message is clear: put your money in winning sectorsand regions — securities issued by companies andemerging markets.

One picture that highlights the divergence between themediocre performance of the overall economy and muchbetter corporate performance is the cumulative change ineconomists’ forecasts for US GDP growth and profits.Chart 2 shows how the consensus has raised its current andnext year GDP forecasts by a cumulative 2% since the endof the recession, but has raised its US profits by acumulative 35% since then.

Our medium-term bullish view on risky assets implies thatwe should not want to focus exclusively on the near-termrisk of sticker shock in PMIs, even as our nervousness hasclearly increased. Hence, we reduce the risk-beta of ourmodel portfolio, while keeping it significantly over-weight equities and credit to bonds and by using thefreed up tactical risk-capital to try and exploit relativereturn opportunities.

Our within-asset class allocation opportunities are based ona combination of discretionary macro signals and the rule-based strategies that we have published since 2000 in ourInvestment Strategies series (IS numbers 1-65). The objec-tive is to earn excess returns that are not too correlated withbeing long equities and credit. And to safeguard diversifica-tion, there is no overarching theme across these positions.

In equities, we moved to overweight EM vs. DM lastweek, retain our ill-timed overweight of Japan initiated amonth ago, and switch to underweight cyclicals on thecoming slowdown in IP and PMIs, while stayingoverweight small caps.

• Our EM equity tactical allocation versus DM is based oneconomic, price and flow momentum. It has little to dowith value as we have found relative multiples to havehad no historic timing value in choosing between EM and

Chart 2: US corporate profit vs. real GDP forecast revisionsForecast revisions are the average of the change in the current year and nextyear’s consensus forecast based on monthly observations from the Blue ChipEconomics survey.

-15

-10

-5

0

5

10

15

86 91 95 99 03 07

-30

-20

-10

0

10

20

30

Corp profits

Real GDP

US Recessions

Source: J.P. Morgan, Blue Chip.

DM equities. During Jan and Feb, we were underweightEM as investors were upgrading DM growth more thanEM, and fears of an overheating China followed by hardlanding induced investors into DM equities. Early lastmonth we went neutral in our weekly JPMorgan View, asthe drivers of our position were weakening. Last week,we moved to overweight EM on reduced Chinese hardlanding fears, faster downgrading of DM growth, andrenewed flows into EM equity funds (IS no. 56).

• We retain an overweight of small caps on their higherbeta (medium-term force), their lower liquidity (whichmeans that they would not be sold first if equities were tofall modestly in coming months) and on the expectedsurge in M&A, which should target small caps.

• Our ill-timed move to overweight Japan a month agocost us badly. By now, we find strong interest outsideJapan to position for the ultimate rebuilding of thecountry, and thus stay overweight.

• Our OW/UW Cyclicals signal in equities consistslargely of the change in the orders to inventory ratio inJ.P. Morgan’s Global PMI series. This ratio fell this pastmonth, and thus signals an underweight of Cyclicals(IS no. 58).

In fixed income, we focus on three cross market exposures.One is to be long US 5y vs. Canada on better economicmomentum in Canada. A second is be long 10y NewZealand vs. Australia, on relative monetary policy and thefact that they are on opposite ends in terms of carry (IS no.15). We also have a US Treasury relative 10y swap spreadstightener versus Bunds on the coming end to QE2 and thestart of ECB rate tightening.

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

9

Global Markets Outlook and StrategyApril 6, 2011

Global Asset AllocationJ.P. Morgan Securities Ltd.Jan LoeysAC (1-212) [email protected]

In credit, our positions are largely based on earning carrythat is not challenged by higher risk. This includesoverweighting Financials versus Industrials in HG, long USversus European high-yield, and long Build America Bondsversus US HG corporates (IS nos. 36, 21). We also includean underweight of Asian corporates against US ones in CDSon an assumed underestimated impact of the Japanesetsunami and mean reversion to a more normal higher yieldspread on Asian companies.

In commodities, we are now long grains vs. base metals assupply in grains is super tight, there are upside risks ondemand and there is no relief on inventories until the nextharvest. Base metals, in contrast, should have downsiderisks from weaker global IP growth and tighter creditconditions in China.

In currencies, we focus on relative growth, monetary policyand debt dynamics. This means being long SEK, NOK,CHF in Europe against EUR and GBP, and CAD versusUSD. Across regions, we remain long EUR vs. USD, andare long CAD vs. NZD. Within EM, this implies buyingRUB vs. PLN, MXN vs. CLP and SGD vs. MYR (see StuartSclater-Booth, GBI EM Model Portfolio, EM FX — “Allin” again, April 5). We retain a long-standing long in EMFX overall against USD.

GMOS performanceInvestors who held our recommended positions gained16bp since last GMOS, on 108bp of ex ante annualized risk.After a volatile month, our long equities vs. bonds tradeproduced a strong 7bp as risky markets rallied followingthe sharp correction after the disaster in Japan. The fixedincome portfolio benefited from being long inflationbreakevens as near term inflation expectations rose on theback of higher energy prices. The disaster in Japan andtighter credit conditions in China hurt our long in copperbut this was more than offset by the gains made in gold andcorn. Gains in convertible bonds, EM and commodityequities helped the equity portfolio finish with a decent 4bpgain while further spread comprssion in US HY bonds andlonas helped the credit portfolio.

Performance (cumulative return, basis points)

Since last GMOS (2 Mar) YTD

Total 16 67Equities 4 22Bonds 5 6Credit 2 18Currency -2 -7Commodity 1 11Cross-asset 7 16

* The GMOS performance reported is calculated as of closing on the date of the GMOS publication. Anynecessary adjustment for market movements today will be made in the following GMOS, reflected in the YTDGMOS performance. Source: J.P. Morgan

J.P. Morgan model portfolio performancequarterly performance*, bp, not annualized

-100

-50

0

50

100

150

200

250

300

95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

10

Global Markets Outlook and StrategyApril 6, 2011

-20

0

20

40

60

80

100

Total

Equitie

s

Fixed I

ncom

eCred

it FX

Commod

ity

Cross-a

sset

Global Asset Allocation

Trades and overall risk allocationOverall risk allocation$mn risk capital on y-axis, directional risk contributions to the portfolio in light grey bars

Equity Strategy$mn risk capital on x-axis

Cross Asset Positions$mn risk capital on x-axis

The GMOS model portfolio

The overall risk, or value at risk, is the annualised standarddeviation of the set of trades in each asset class, in $mn.The directional risk, or beta to the market, in each asset class isthis total VaR times the correlation of these trades with the marketportfolio. The latter means MSCI World in equities, GBI, MBSand Pfandbriefe in Fixed Income, Barcap Multiverse minus the FIbenchmark in credit, GSCI in commodities, and DXY in FX.

Source: J.P. Morgan

FX Strategy$mn risk capital on x-axis

Country / regional trades

Sector / style trades

Source: J.P. Morgan

Source: J.P. Morgan

Directional trades

0 5 10 15 20

MSCI AC World vsGBI

Long ELMI vs. USD

$mn

0 5 10 15 20

CHF vs EUR

EUR vs GBP

EUR vs USD

EUR vs JPY

CAD vs NZD

CAD vs USD

NOK vs GBP

SEK vs EUR

RUB vs PLN

MXN vs CLP

SGD vs MYR

$mn

- 5 10 15 20

OW MSCI EM vs. MSCI World

OW Japan

OW US vs. European Real Estate

OW US vs. European Utilities

$mn

- 5 10 15 20

Long ConvertibleBonds

Long MSCI ACWorld

$mn

- 5 10 15 20

UW Cyclicals vsDefensives

Long RelativeSector Momentum

OW Small vs.Large caps

$mn

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

11

Global Markets Outlook and StrategyApril 6, 2011

0 5 10 15 20

Long NZD vs AUD 10yr bonds

Long 5yr Canada vs US

Long Bunds vs Treasuries swapspreads

Short France vs. Germany

Long South Africa vs Russia

OW 1yr Greece vs Germany

Long Spain vs. Germany

Global Asset Allocation

Fixed Income Strategy$mn risk capital on x-axis

Credit Strategy$mn risk capital on x-axis

Directional trades Directional trades

0 5 10 15 20

Long Grains vs.Base Metals

Long the GSCI

Long Gold

Long Copper

Long Wheat

Long Corn

$mn

Source: J.P. Morgan

Source: J.P. Morgan

Commodity Strategy$mn risk capital on x-axis

Source: J.P. Morgan

Spread tradesCurve trades

Cross tradesCountry trades

0 5 10 15 20

Long German Bunds/ UK Gilts

Long short end Euro area inflation

$mn

0 5 10 15 20

UK 10s30sflattener

Euro area 2s7sflattener

$mn 0 5 10 15 20

OW US Banks vs. Industrials

OW taxable US Municipal bonds vs USHG

$mn

0 5 10 15 20

OW US CMBS

Overweight US HYCorporates

$mn

0 5 10 15 20

OW BB-rated US HY vs. Eur HY

UW Asian vs. US corporates inCDS

$mn

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

12

Global Markets Outlook and StrategyApril 6, 2011

Global Asset Allocation

• OW alternatives and UW government bonds in along-only portfolio with a target volatility of 12%, i.e.market portfolio vol.

• We project 0%-1% for the government-related bonduniverse over the next year. This justifies a large 8%underweight relative to market weights.

• We use this large underweight in government-relatedbonds to fund a 14% overweight in alternatives, i.e.Hedge Funds, Private Equity and Real Estate.

• The main driver of our portfolio optimization resultsis that these alternative asset classes have lowMarginal Contribution To Risk (MCTR), even afterde-smoothing their historical return series.

• The highest Sharpe ratios, i.e. the ratio of expected12-month return to MCTR, are found in HedgeFunds, Private Equity and Real Estate (>1). Thelowest Sharpe ratio, 0.1, is found in governmentbonds. Equities, Corporate bonds and Commoditieshave an expected Sharpe ratio of 0.6.

• In a low 6% volatility portfolio, we recommendhigh exposure to Hedge Funds, HG Corporates andReal Estate.

Assets to own in a market volatility (12%)portfolio• Underweight government-related bonds: Our total

return projection of 0%-1% for this universe justifies alarge underweight, even after taking into account the lowmarginal contribution to risk that this sector has within aglobal portfolio. In our optimized portfolio we recom-mend an allocation to government bonds that is 8%below market weights (chart 1).

• Overweight Alternatives: The main counterpart to theunderweight in government bonds is a large overweightin Alternatives. Our optimal portfolio has a total over-weight of 14% in Alternatives driven by HFs, PrivateEquity and Real Estate. The weight of HFs in particular,at 10%, is almost 8% above their market weight.Themain driver of our portfolio optimization results stemsfrom the fact that these alternative asset classes, espe-cially Hedge Funds, have low Marginal Contribution ToRisk (MCTR). Chart 2 shows that the MCTR of HedgeFunds is only 6%, only modestly above the 4% MCTR ofgovernment bonds. And this is after using more volatileinvestable HF indices (i.e. HFRX indices) in ouroptimization process.

J.P. Morgan Securities Ltd.Nikolaos PanigirtzoglouAC (44-20) [email protected]

Grace KooAC (44-20) 7325-1362 Seamus Mac GorainAC (44-20) [email protected] [email protected]

Top Assets to Own, and to Avoid

Chart 1: Optimised weights vs. market weightsWeights based on Black-Litterman optimisation as explained in the blue box minusmarket weights.

Source: J.P. Morgan-15% -10% -5% 0% 5% 10%

Govt. Bonds/Agencies

DM equities:

EM equities:

HG corp bonds/securitized:

HY corp bonds/loans:

Commodities (GSCI):

Real Estate

Private Equity:

Hedge Funds:

In this section we construct a long-only portfolio ofmajor asset classes by incorporating our long-term(12-month) return forecasts across asset classes, as well asthe volatilities and correlations. This is different fromthe other GMOS sections where the focus is on long-shorttrade ideas, many of which are not accessible to long-onlyinvestors. In addition, the sizes of these long-short tradesare mostly a reflection of our confidence and do not takeinto account the correlations between the different assetclasses. The investment horizon for this portfolio is alsolonger than other GMOS trades, which have a horizon ofone month.

Our long-only portfolio includes govt bonds, corporatebonds, mortgage-backed bonds, agency and localauthority bonds, EM and DM equities, and alternativeasset classes, i.e. commercial real estate, private equity,commodities and hedge funds. Table 1 shows the differentasset classes used in the portfolio, along with their marketcapitalization weights. These market weights are thestarting point of our asset allocation process. The marketportfolio is a natural benchmark to a global investor thatinvests across a broad range of traditional and alternativeasset classes. The fixed income universe currently has amarket capitalization of $43tr versus $45tr for equitiesand $8.7tr for alternatives.

After constructing the market portfolio, the next step inour asset allocation process is to incorporate our returnprojections over the next 12 months into the portfoliooptimization process. This is done using the Black-Litterman (BL) framework, where our return forecastsrepresent “subjective” expected returns. The uncertaintiesof these subjective returns are assumed to be independent

(Continued in shaded box on next page.)

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

13

Global Markets Outlook and StrategyApril 6, 2011

Global Asset AllocationJ.P. Morgan Securities Ltd.Nikolaos PanigirtzoglouAC (44-20) [email protected]

Grace KooAC (44-20) 7325-1362 Seamus Mac GorainAC (44-20) [email protected] [email protected]

• Close to neutral allocation to equities: While we projectdouble-digit returns for equities, we do not recommend anoverweight. As chart 2 shows public equities have thehighest MCTR to a global portfolio among all asset classes,making their expected Sharpe Ratio (0.6=12.5% return/20% MCTR) the lowest after government-related bonds,and similar to that of Corporate bonds and Commodities.

Assets to own in a low volatility (6%)portfolio• Focus allocation to Hedge Funds (37%), HG corporaate

bonds (29%), govt-related bonds (19%) and Real Estate(10%): By using a volatility target of half that of themarket, i.e. 6%, we find that the optimisation results in

and normally distributed and are specified by thehistorical standard deviation of each asset class.

These return projections along with the risk and theoptimized weights of each asset class are shown in Table1. The optimized portfolio is constructed so that it hasthe same annualized volatility as the market portfolio,i.e. 12%. We also construct a portfolio with half thevolatility of the market portfolio for investors with alower risk tolerance.

For traditional asset classes we use Datastream Equity andBarcap Multiverse fixed income indices. For private equityand real estate we use IPD/NCREIF and CambridgeAssociates indices respectively. These indices suffer fromsmoothing bias, which makes them less volatile and lesscorrelated with public equities than they are in reality. We“de-smooth” these indices by regressing their returns ontheir own past returns and the returns of their publiclyquoted counterparts i.e. the LPX50 index for private equityand REITs for real estate. The result is higher vol andhigher correlation with public equities, resulting in higherMarginal Contribution To Risk (MCTR).

For Hedge Funds, we use the HFRX investable hedgefund index, which suffers by a lot less from smoothing orsurvivorship bias. HFRX includes mostly funds thatreport their performance on a daily basis and HFRexhausts all efforts to receive a fund’s performance untilthe point of final liquidation.

The marginal contribution to risk (MCTR) can bethought of as the amount of risk that the position is

Source: J.P. Morgan

Table 1: Projected asset returns and portfolio optimization weights

12-month MCTR Sharpe Ratio= optimal portfolio market cap Weight market cap

returns 12m return/MCTR weights weights difference $tr

DM equities: 12.5% 19.8% 0.63 33.4% 36.4% -3.0% 36.2

EM equities: 15.0% 25.6% 0.59 8.5% 8.9% -0.5% 8.9

Treas/Agenc/Supra/Local Auth: 0.5% 4.1% 0.12 18.7% 28.5% -9.8% 28.3

HG corp bonds/securitized: 3.0% 4.5% 0.66 13.0% 12.9% 0.2% 12.8

HY corp bonds/loans: 7.0% 11.9% 0.59 2.2% 2.0% 0.2% 2.0

Commodities (GSCI): 10.0% 17.0% 0.59 0.7% 0.4% 0.3% 0.4

Private Equity: 14.8% 11.2% 1.32 6.1% 1.7% 4.3% 1.7

Commerc Real Estate: 7.5% 7.9% 0.95 5.9% 4.7% 1.2% 4.7

Hedge Funds: 9.5% 5.9% 1.63 9.1% 1.9% 7.2% 1.9

Cash: 0.5% 0.0% 2.5% 2.5% 0.0%

We assume a normal weight of 2.5% for cash Total 96.8

MCTR denotes Marginal Contribution to Risk

Tracking error of optimal vs market portfolio = 0.95%

Volatility of both the market and optimal portfolio = 12.53%

Chart 2: Marginal Contribution To Risk of different asset classesMCTR is defined as the change in the total portfolio volatility for a small change inthe weight of a particular asset.

Source: J.P. Morgan

0% 5% 10% 15% 20% 25% 30%

Govt. Bonds/Agencies

HG corp bonds/securitized:

Hedge Funds:

Real Estate

Private Equity:

HY corp bonds/loans:

Commodities (GSCI):

DM equities:

EM equities:

(Continued in shaded box on next page.)

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

14

Global Markets Outlook and StrategyApril 6, 2011

very different allocations to the market-vol weightsdiscussed above. The highest allocation is to HedgeFunds (37%) due to their low historical volatility (7%)and MCTR (6%). HG corporate bonds is the next biggestallocation at 29% vs. 13% market weight. Government-related bonds have the third highest allocation at 19%,but this is below the market weight of 29%. Real Estatehas a high allocation at 10%, vs. a 5% market weight.Equities are absent from the optimal 6% volatilityportfolio, reflecting their high historical volatility andMCTR (>20%).

Global Asset AllocationJ.P. Morgan Securities Ltd.Nikolaos PanigirtzoglouAC (44-20) [email protected]

Grace KooAC (44-20) 7325-1362 Seamus Mac GorainAC (44-20) [email protected] [email protected]

Chart 3: Allocations with different volatility targetsWeights based on Black-Litterman optimisation for a portfolio with a vol targetequal to the market (12.5%) vs. weights for a portfolio with a vol target of 6%.

Source: J.P. Morgan

0% 5% 10% 15% 20% 25% 30% 35% 40%

EM equities:

HY corp bonds/loans:

Commodities (GSCI):

DM equities:

Private Equity:

Real Estate

Govt. Bonds/Agencies

HG corp bonds/securitized:

Hedge Funds:

Mkt vol 12.5% target 6% vol target

adding to the portfolio. It takes into account both thevolatility of the position relative to the market portfolioand the correlation to the other assets in the portfolio.Chart 3 shows the MCTR for each asset in themarket-vol portfolio. The final weight of each assetin the optimized portfolio is a function of the MCTRand the expected return.

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

15

Global Markets Outlook and StrategyApril 6, 2011

J.P. Morgan Securities Ltd.John NormandAC (44-20) [email protected]

Paul MeggyesiAC (44-20) [email protected]

Global FX Strategy

FX Strategy

• The global bear market in government bonds isclearly under way as the world’s second-mostimportant central bank (ECB) prepares to tightenThursday and the most important one (Fed) soundscollectively less dovish.

• Because this bear market is global, the Treasurysell-off has been a non-issue for 90% of currencies.

• At best, higher US rates start to correct the dollar’smonthlong undershoot which had been driven by thefiscal showdown. Trend strength in the dollar ispremature, even for USD/JPY.

• Strategy: Stay diversified around regional themes.

• In cash, sell NZD/CAD. In options, take profits onshort JPY/KRW put spread, long AUD vs. BRL volswap and short USD/JPY put.

The global bear market in government bonds is clearly un-der way as the world’s second-most important central bank(ECB) prepares to tighten tomorrow, and the most impor-tant one (Fed) sounds collectively less dovish. Althoughthis bond sell-off has been tame by historical standards —global rates have moved up only 20bp this quarter com-pared to +50bp moves when the ECB and/or Fed is tighten-ing (chart 1) — the trend for the rest of the year is clear.The path for currencies is more debatable. As always occurswhen the US bond market has sold off during this decade-long bear market in the dollar, hopes (or fears) of a trendchange emerge. The rates fixation is legitimate, but it stilllooks premature. Even though the US money market is thefourth most dovishly priced in the world, US activity dataare softening and the Fed remains a few quarters from hik-ing. And since actual rate spreads matter as much for deficitcountries like the US as shift in rate expectations, the dollaris very far from turning. At best last week’s payrolls cancorrect some of the dollar’s recent, excessive weaknesswhich the US fiscal disarray has been driving. Forecasts arestill bearish, and trades split across several regional themes.

Narrow USD move for major UST sell-off

Given that markets are obsessed with the next big trend, itis clear why the idea of a Fed-driven dollar rally appeals.The slope of the US money market curve is one of the flat-test in the world (chart 2), after Hungary (13bp), Japan(31bp) and Australia (40bp). Flat curve, decent growth,rising inflation implies that rates can only head north. Noargument with the obvious, but what matters for currenciesis whether that repricing will outpace that in other markets

Chart 1: Q1 sell-off in global rates has been tameChange (basis points) in global bond yields as measured by J.P. Morgan GlobalGovernment Bond Index yield over rolling 3-mo periods.

Source: J.P. Morgan

0

-50

-100

50

-150

-250

150

100

200

-200

20111987 1993 1999 2005

and when the central bank will validate expectations bylifting actual rates. (The carry trade relies on actual ratedifferentials, not expected ones.) During the Treasury sell-off of the past two weeks, spreads have moved only 10bpin the US’s favor, a rather feeble shift in an environmentwhere the most important central bank in the world alleg-edly will initiate its exit sequence.

The dollar should have rallied in this environment yet ithasn’t: the currency is flat trade-weighted and up pair-wise only versus JPY, CHF, GBP, ARS and PEN. Thereare several reasons for this pattern. First, the Fed looks afew quarters from lifting the cash rate even if this week’sFed comments signaled a shift in the consensus. The Fedwould need to end its current asset purchase program,drop the extended period language, drain reservesthrough repos then lift the cash rate. All possible inshort order, but nonetheless drastic steps when the USeconomy is untested when operating with floating interestrates (Fed purchases have suppressed rates during aperiod of record deficits). Second, the dollar still seems tocarry a risk premium for the debt ceiling debate. To besure, this fiscal premium isn’t provable — we simplyattach the label ex post given the dollar’s undershoot ofwhere traditional models suggest it should trade (chart 4)and the record amount of official selling of US assetsfrom monthly TIC reports (see Officially, the dollar hasfew friends, March 15).

At best this Treasury sell-off starts to correct the dollar’sroughly 3% mispricing (chart 4), as some shock alwaysdoes. Driving a trend requires much more strength fromthe US economy and weakness from the rest of the world,neither of which look likely this spring. Forecasts aretherefore unchanged, since they are partly anchored bythe view that cash rate spreads will widen over the course

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

16

Global Markets Outlook and StrategyApril 6, 2011

Global FX StrategyJ.P. Morgan Securities Ltd.John NormandAC (44-20) [email protected]

Paul MeggyesiAC (44-20) [email protected]

of the year for all countries but Japan, and that yen weak-ness will be reversed as lifers’ hedge ratios rise andJapan’s trade surplus revives by this summer. In extend-ing the forecast horizon through March 2012, we flat-linethe majors to show dollar stability once the Fed initiatesthe exit sequence. By then the US rate deficit — andprobably its current account deficit — will be larger, soconsolidation looks more likely than a dollar turn earlynext year. See FX forecast risk biases, scenarios andtrigger events.

Strategy: stay diversified acrossregional themesOn trades, exploit the yen collapse to take profits on ashort JPY/KRW put spread opened in the 2011 Outlook(November 23, 2010) and a short 1m USD/JPY putopened after BoJ intervention on March 18. Also takeprofits on a short AUD vs. BRL vol swap now thatUSD/BRL is beginning to slip. Sell NZD/CAD to increaseexposure to oil currencies and position for a possiblebumper Canadian employment report later this week, andstay short sterling within Europe (vs. EUR and NOK).There is no running theme amongst these trades, but rarelythis year have regional dynamics been so diverse.

Trades• Take profits on short yen call on USD/JPY; hold in

EUR/JPYWe sold these yen calls on the basis that the post-earth-quake risk premium for yen appreciation was too high —the market underappreciated G-7’s commitment and ca-pacity to absorb any post-disaster repatriation flow backinto Japan. The repricing of Fed policy, while unantici-pated, has proved a fortuitous bonus for the trades. Holdin EUR/JPY but take profits on the USD/JPY put, giventhat it is now virtually worthless.

— Take profits on a 1m 0.78 USD put/JPY call.Sold March 18 for 0.455%. Worth 0.01%.

— Hold a 1m 112 EUR put/JPY call.Sold for 0.62% on March 25. Worth 0.12%.

• Take profits on a bearish JPY/KRW seagullThe renewed interest in the yen carry trade is unlikelyto persist on a multi-month view (even a hawkish Fedwon’t generate sufficient carry on USD/JPY), while it istoo early to dismiss the prospect of heavier repatriationflow into Japan from domestic investors de-riskingtheir portfolios. We would also note that the slump inJapanese manufacturing will leave quite a mark on Korea

80

78

201120092007

98

82

88

84

86

9092

96

94ModelUSD nominal trade -wtd index

-500

-400

-300

-200

-100

0

100

200

300

400

USD JP

Y

EUR

GBP CHF

SEK

NOK

AUD

CAD

NZD

HUF

PLN

ILS

KRW

Max since 2000 Min since 2000 Current

80

84

-150

-140

Jun 11

78

838281

-130

-70

-80

86

89

-160

87

85

88

-110

-90

Dec 10

79

-120

-100

Jun 10

US - ROW weighted spread, bpUSD nomina l trade-wtd index

Chart 2: US money market is 4th most dovishly priced in the worldCurrent slope of money market curve (1-mo rates 12-mos forward minus 1-morates) indicated by dot. Highest value over past decade represented by diamondand lowest value by square.

Source: J.P. Morgan

Chart 3: Since mid March, US rates have moved up only 10bp inspread terms versus rest of the worldTrade-weighted USD versus weighted-average rate spread between US and therest of the world. Rate spreads based on 1-mo rates 12-mos forward.

Source: J.P. Morgan

Chart 4: UST sell-off starts to correct monthlong undershoot in USDActual versus predicted value of trade-weighted USD when regressed on weightedaverage rate spreads and equity volatility (VIX).

Source: J.P. Morgan

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

17

Global Markets Outlook and StrategyApril 6, 2011

Global FX StrategyJ.P. Morgan Securities Ltd.John NormandAC (44-20) [email protected]

Paul MeggyesiAC (44-20) [email protected]

as a close trading partner — in a worse-case scenario wecould see Korean manufacturing falling by 12-15%annualized in Q1 and Q2.

— Take profits on a 12m bearish JPY/KRW seagull,comprising long a 13.00/12.00 JPY put/KRW callspread and short a 16.25 JPY call/KRW put. BoughtNovember 23 for 0.52%. Worth 1.95%.

• Buy CAD vs. NZD; hold CAD vs. USD in optionsThe encouraging signals on US employment shoulddirectly benefit CAD as the largest trade partner of theUS. We have long regarded CAD as a high-beta playon US growth and do not regard it as counterintuitivethat USD/CAD should weaken in this environment.As for politics, the latest polls show little changein voting intentions, suggesting another minority Con-servative government could well be elected on May 2.Despite the weakness in NZ growth pre-earthquake,the RBNZ rate cut and loose policy outlook through2012, NZD has benefited from a substantial positionsqueeze over the past week or two. This leaves NZDlooking expensive to rate differentials against a rangeof currencies. Our preference is to sell NZD versusCAD, not least as the 2y NZD-CAD rate differential isnow at a 10-year low.

— Sell NZD/CAD at 0.7359 with a stop at 0.7650.

— Hold a 12m at-expiry-digital USD put/CAD call,strike 0.94. Bought Nov 23 for 21%. Valued 30.7%.

• Stay short GBP vs. EUR and NOKFor a currency where bearish fundamentals are in ouropinion so clear cut (the weakest growth, the highestinflation and the lowest real yields in G-10, a recordtrade deficit, net outflows of equity and FDI capital), itis a little puzzling why spec positions still appear to beon the long side. Puzzling perhaps but at least thismeans that short GBP is not a crowded trade as theQ1/Q2 data start to register the full force of a vigorousinflation squeeze on consumers and the onset of mean-ingful fiscal consolidation. Meanwhile, as chart 7shows, ECB policy is not aggressively priced relativeto the BoE outlook, meaning there is scope for a furtherdeterioration in GBP’s interest rate support, anchoringGBP’s status as a funding currency.

— Stay short GBP/NOK. Sold March 25 at 8.9810.Worth 1.2%.

— Stay long EUR/GBP. Bought at 0.8520 Feb 24,marked at 3.0%. Raise stop to 0.8710.

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

Apr-96 Apr-99 Apr-02 Apr-05 Apr-08

-10,000-5,000

05,000

10,00015,00020,00025,00030,00035,00040,000

2006 2007 2008 2009 2010

0

1

2

3

4

5

6

Mar-01 Mar-03 Mar-05 Mar-07 Mar-09 Mar-11

0.6

0.65

0.7

0.75

0.8

0.85

0.9

0.952Y NZD-CAD, rhs NZD/CAD

Chart 5: NZD-CAD rate differentials are the tightest in 10 years

Source: J.P. Morgan

Chart 6: CAD is likely to be a key recipient of the hefty, $25-50bn perquarter that central banks are now investing in non-G-4 FXChange in global FX reserves denominated in non-G-4 currencies, $mn

Source: JIMF COFER

Chart 7: ECB policy is not aggressively priced relative to BoE policywhen seen from a long-term historic perspectiveSteepness of EUR money market curve relative to the GBP money market curve.EUR 1Mx1Y forward swap minus GBP 1Mx1Y forward swap.

Source: J.P. Morgan

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

18

Global Markets Outlook and StrategyApril 6, 2011

Global FX StrategyJ.P. Morgan Securities Ltd.John NormandAC (44-20) [email protected]

Paul MeggyesiAC (44-20) [email protected]

• Stay long EUR/USDPayrolls was certainly encouraging, albeit in reality notmuch better than expected. In addition, it needs to beread in conjunction with the broader set of US data,which has been disappointing in recent weeks (our EASIindex of data surprises is at a six-month low (chart 9).The upshot is that we do not believe front-end yields inthe US are about to break out. Fed rhetoric is the firstline of defence against higher inflation but in our viewECB action next week will trump FOMC rhetoric.

— Hold long EUR/USD. Bought March 18 at 1.4130.Marked at -0.3%.

• Stay short EUR/SEK in cash and optionsSEK continues to drift, lacking a decisive catalyst foranother step re-rating of SEK rate expectations. Nonethe-less, we believe there is ample scope for the Riksbank toaccelerate the pace of tightening in coming months, toSEK’s benefit.

— Stay short EUR/SEK. Sold March 18 at 8.9200;marked at -0.5%.

— Hold a 12m at-expiry digital EUR put/SEK callstruck at 8.80. Bought November 23 for 18.5% ofpayout. Worth 35.36%.

• Hold long CHF vs. EUROn the basis that the Swiss economy is leading not lag-ging the growth rebound in the Western world, it is hardto make a case for the SNB lagging the G-10 rate cycleto the point that there is any carry in the Swiss carrytrade. Weather the P&L hit — stay focused on robustSwiss fundamentals. As an aside, why would anyone re-gard a currency with a current account surplus of 14% ofGDP as a suitable funding currency?

— Hold a 1y 1.250 at-expiry digital in EUR/CHF.Bought on June 8 for 13%. Currently 14.2%.

— Hold a bearish EUR/CHF seagull. Buy a 12m 1.30/1.20 EUR put/CHF call spread, sell a 1.4250 EURcall/CHF put. Bought November 23 for 0.37%.Marked at 1.84%.

• Open long SGD vs. MYR, MXN vs. CLP andRUB vs. PLNSee GBI_EM Model Portfolio, Stuart Sclater-Booth.

-8%

-6%

-4%

-2%

0%

2%

4%

1955 1965 1975 1985 1995 2005

Chart 8: UK posts its largest ever trade deficit in Q4—GBP is notexactly functionally cheapUK visible trade balance, % of GDP

Source: UK ONS

Chart 9: Notwithstanding payrolls, US data surprises are at a6-month low, which should put a ceiling on front-end yields2y yields versus J.P. Morgan’s EASI index of US economic data surprises. Balanceof positive vs. negative surprises.

Source: J.P. Morgan

-50

-40

-30

-20

-10

0

10

20

30

40

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11

-0.4

-0.3

-0.2

-0.1

0

0.1

0.2

0.3

0.4US EASI

2Y swap, change over 1m, bp, rhs

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

19

Global Markets Outlook and StrategyApril 6, 2011

Exchange rates vs. U.S dollar

Current

Majors Apr 5 Jun 11 Sep 11 Dec 11 Mar 12 forward rate Consensus** Past 1mo YTD Past 12mos

EUR 1.42 1.43 1.45 1.48 1.48 4.9% 8.8% 3.1% 6.3% 5.5%

JPY 84.6 80 79 78 78 8.2% 10.9% -3.4% -4.2% 11.5%

GBP 1.63 1.57 1.59 1.64 1.66 1.6% 1.1% 0.2% 4.3% 6.5%

AUD 1.03 1.01 1.03 1.04 1.05 4.0% 8.0% 1.5% 1.1% 12.2%

CAD 0.96 0.98 0.97 0.96 0.94 1.2% 2.9% 0.8% 3.5% 4.0%

NZD 0.77 0.73 0.74 0.75 0.78 -0.9% 0.9% 2.3% -1.3% 9.5%

JPM USD index 79.0 79.5 78.6 77.6 76.5 -0.5% -2.9% -5.9%

DXY 75.9 75.3 74.3 72.9 72.6 -0.7% -4.0% -6.4%

Europe, Middle East & Africa

CHF 0.92 0.90 0.88 0.86 0.86 7.5% 14.2% 0.5% 1.1% 14.9%

ILS 3.47 3.75 5.75 3.50 3.45 0.2% 6.6% 4.6% 1.7% 6.6%

SEK 6.32 6.08 6.00 5.95 5.95 8.1% 8.2% 0.1% 6.2% 13.6%

NOK 5.47 5.38 5.31 5.27 5.27 5.6% 7.7% 2.3% 6.5% 8.7%

CZK 17.11 17.48 17.24 16.22 16.22 6.2% 8.8% 3.1% 9.3% 9.9%

PLN 2.81 2.73 2.69 2.60 2.60 10.9% 5.7% 2.0% 5.4% 1.5%

HUF 185 185 183 179 179 7.2% 11.5% 5.9% 12.3% 5.9%

RUB 28.27 26.34 26.12 26.21 26.21 10.8% 10.8% 2.1% 8.0% 3.3%

TRY 1.53 1.60 1.60 1.55 1.55 3.7% -1.5% 4.5% 0.9% -1.4%

ZAR 6.70 7.30 7.50 7.70 7.90 -8.9% -4.5% 4.0% -1.1% 7.9%

Americas ARS 4.05 4.10 4.15 4.35 4.45 -0.3% -1.7% -0.5% -1.7% -4.2%

BRL 1.61 1.64 1.64 1.65 1.67 3.4% 4.4% 2.9% 3.4% 9.6%

CLP 473 470 470 465 460 4.9% 5.8% 0.6% -1.1% 9.7%

COP 1837 1850 1850 1825 1845 0.6% 1.3% 3.8% 3.8% 4.0%

MXN 12.10 11.60 11.80 12.00 12.15 1.4% 2.1% 2.3% 4.3% 3.5%

PEN 2.81 2.77 2.75 2.72 2.75 4.4% 1.1% -1.1% -0.1% 1.1%

VEF 4.29 4.30 4.30 4.30 4.30 -0.1% 7.1% 0.1% 0.1% 0.1%

LACI 118.0 118.0 117.2 116.1 114.9 1.5% 2.5% 5.2%

Asia CNY 6.54 6.40 6.35 6.30 6.20 2.3% -0.2% 0.5% 1.0% 4.4%

HKD 7.77 7.76 7.76 7.76 7.76 -0.1% 0.2% 0.2% 0.0% -0.1%

IDR 8660 8700 8700 8650 9 3.2% 1.5% 1.9% 3.9% 4.6%

INR 44.3 44.8 45.5 44.7 44.0 3.7% -1.0% 1.6% 0.9% 0.3%

KRW 1087 1140 1090 1110 1120 -0.6% -4.5% 3.9% 3.6% 3.4%

MYR 3.03 3.00 2.96 2.93 2.91 4.3% 0.4% 0.9% 1.3% 6.8%

PHP 43.29 42.25 41.75 40.75 40.50 6.6% 2.7% 0.3% 1.2% 3.9%

SGD 1.26 1.24 1.23 1.21 1.20 4.1% 2.2% 0.9% 1.8% 10.9%

TWD 29.32 28.90 28.50 28.00 28.00 0.8% 2.5% 1.4% -0.1% 8.2%

THB 30.17 29.75 29.25 28.75 28.50 5.9% 1.1% 1.4% -0.4% 7.3%

ADXY 117.8 116.7 118.3 119.7 120.5 1.0% 1.1% 4.8%

EMCI 106.3 106.4 106.2 106.7 106.8 1.5% 2.6% 5.4%

Exchange rates vs Euro

JPY 120 114 115 115 115 3.2% 1.9% -6.3% -9.9% 5.7%

GBP 0.87 0.91 0.91 0.90 0.89 -3.1% -7.1% -2.8% -1.8% 0.9%

CHF 1.32 1.29 1.27 1.27 1.27 2.5% 5.0% -2.6% -5.0% 8.8%

SEK 9.00 8.70 8.70 8.80 8.80 3.1% -0.6% -2.9% -0.1% 7.6%

NOK 7.78 7.70 7.70 7.80 7.80 0.7% -1.1% -0.7% 0.1% 3.0%

CZK 24.34 25.00 25.00 24.00 24.00 1.2% 0.0% 0.1% 2.8% 4.2%

PLN 4.00 3.90 3.90 3.85 3.85 5.7% -2.9% -1.0% -0.8% -3.8%

HUF 264 265 265 265 265 2.2% 2.5% 2.7% 5.6% 0.3%

RON 4.11 4.15 4.15 4.00 4.00 5.7% 6.0% 2.3% 4.2% -0.1%

TRY 2.17 2.29 2.32 2.29 2.29 -1.1% -9.5% 1.5% -4.9% -6.4%

RUB 40.23 37.67 37.87 38.79 38.79 5.6% 1.8% -1.0% 1.5% -2.1%

indicates revision resulting in stronger local FX , indicates revision resulting in weaker local FX

* Negative indicates JPM more bullish on USD than consensus,** Consensus Economics Publication: Foreign Exchange Consensus Forecasts March 2011

Source: J.P.Morgan

JPM forecast gain/loss vs Dec-11* Actual change in local FX vs USD

Actual change in local FX vs EUR

Global FX StrategyJ.P. Morgan Securities Ltd.John NormandAC (44-20) [email protected]

Paul MeggyesiAC (44-20) [email protected]

J.P. Morgan FX forecasts vs. forwards & consensusExchange rates vs. US dollar

Source: J.P. Morgan

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

20

Global Markets Outlook and StrategyApril 6, 2011

Global Asset Allocation

Fixed Income Strategy

• We hold small shorts and flatteners in the UK andEuro area, in anticipation of policy tightening, butotherwise focus on relative value.

• Position for wider swap spreads in German Bunds vs.US Treasuries, on ECB tightening and the looming endof QE2.

• Underweight Canada vs. the US, as strong activitydata push the Bank of Canada towards tightening.

• Overweight New Zealand vs. Australia on carry, cheapNZ swap spreads and monetary policy.

• Within the Euro area, hold overweights in Spain (onfurther short covering), and 1y Greece (on carry),counterbalanced with an underweight in France.

Bonds fell slightly on the month, despite a mid-March flightto safety after the tragic earthquake in Japan. The principalcatalyst was the ECB’s announcement that it was set to hikeat its April meeting (tomorrow). Rising energy prices andupside inflation surprises also played their part (chart 1).Indeed, inflation breakevens have risen to their highestlevels since mid-2008, led by the front end.

The bear case for bonds still comes from historically lowyields, inflation risks and impending tightening fromEuropean central banks. The counterpoints are that yieldsare at the top of their recent range, and especially that theJapanese earthquake seems sure to precipitate a slowing inmanufacturing activity. Though we expect a bounceback inactivity later in the year, bad manufacturing data are a near-term upside risk for bonds.

Those opposing factors cause us to temper directionalrisk this month, and to focus more on relative valueopportunities.

• Small duration short and curve flatteners in UK andEuro area ()We keep bearish positions in the UK and Euro area,looking for a small further sell-off, primarily on monetarypolicy grounds. The Euro money market curve now pricesthree 25bp rate increases by year-end, in line with ourforecast, but we still see risks that the market will movetowards pricing four hikes this year. Much will dependon how President Trichet characterises theoutlook formonetary policy in Thursday’s press conference.

Monetary policy is harder to call in the UK, whichremains in a quagmire of weakish growth, high

J.P. Morgan Securities Ltd.Seamus Mac GorainAC (44-20) [email protected]

As discussed on p. 7, GMOS focuses on global tacticalasset allocation. In this section, we focus on medium-termasset allocation across G-10 and EM rates markets. Moreshort-term and detailed recommendations are presented inour sister publications, US Fixed Income Weekly, GlobalFixed Income Markets Weekly, Emerging MarketsOutlook and Strategy, and EM Top Trade Ideas.

Chart 1: Cumulative inflation surprises since December 2009Per cent. Difference between inflation outturn and economists’ consensus.Flash inflation for Euro area.

Source: Bloomberg, J.P. Morgan

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11

UK

US

Euro area

inflation and conflicting data. On balance, we stillexpect a May hike (now around two thirds priced). Focusflatteners on the long end in the UK, and on 2y to 4y/7yin the Euro area (for carry efficiency).

• Intra-EMU spreads: Overweight 10y Spain and 1yGreece, underweight 10y France, all vs. Germany ()March was a month of decoupling for Euro areagovernment bonds. The high-yielders (Greece, Ireland,Portugal) underperformed heavily on a slew of badheadlines, notably the resignation of Portugal’s PrimeMinister, and the upward revision of that country’s 2010deficit. Even so, the semi-peripherals (Spain, Italy)strongly outperformed German Bunds.

There are two main factors at play here: first, Spain hasbeen delivering on its fiscal targets, whereas the high-yielders have not; second, covering of widespread realmoney short positions (chart 2, next page) has benefitedSpain and Italy, but not the high-yielders. Instead, bondmanagers seem prepared to hold structural underweightsin the smaller peripherals, partly because ratingsdowngrades could see these countries exit governmentbond indices in time (e.g. Portugal is now rated one notchabove investment grade by S&P and Fitch).

This document is being provided for the exclusive use of JENSEN CHANG at SINOPAC FUTURES

21

Global Markets Outlook and StrategyApril 6, 2011

-2.0

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

09Q3 09Q4 10Q1 10Q2 10Q3 10Q4 11Q1

Germany

US

Larger deficit

Smaller deficit

Global Asset AllocationJ.P. Morgan Securities Ltd.Seamus Mac GorainAC (44-20) [email protected]

Our strategy is threefold. We position for further short-covering by overweighting Spain vs. Germany. Weunderweight France vs. Germany as a cheap hedgeagainst an (improbable) escalation of the crisis; likemoney market spread wideners, this trade is only likely toperform if the crisis is once again perceived to have asystemic dimension. And we continue to overweight 1yGreece vs. Germany. This position recorded a smallprofit last month. One reason was Ireland’s decision notto haircut senior bank debt after its stress tests; thathighlights the value argument for short-dated high-yielders (i.e. those maturing before the advent of the ESMin 2013). See GFIMS Euro Cash for details.

• Overweight New Zealand vs. Australia in 10ygovernment bonds ()We have discussed in our Investment Strategies serieshow overweighting high carry bond markets againstlow carry bond markets has typically been aprofitable strategy.1 Chart 3 shows the carry-to-risk ratiofor major developed swap markets i.e. 3-month carrydivided by 3-month realised volatility. Relative to risk,carry is lowest in Australia and Sweden, and highest inSwitzerland and New Zealand. Of these Australia vs.New Zealand is arguably the most natural pair.

Over and above the carry on the swap curve, NewZealand government bonds yield far (e.g. up to around40bp) above swaps while Australian government bondsyield some 50bp below swaps. The cheapness of NZgovernment bonds seems anomalous for a country withclose to zero net government debt, and likely reflects themarket’s difficulty in absorbing the post-crisis increase ingovernment bond issuance thus far.

The trade also has a monetary policy impetus: we expectthe RBA to outhike the forwards over the next year, butnot the RBNZ. See Sally Auld, The Antipodean Strategist,for an extended discussion.