JLL 2014 Q1 Amsterdam Office Market Profile

description

Transcript of JLL 2014 Q1 Amsterdam Office Market Profile

* % Change for Prime Rent and Capital Values calculated using local currency

Office Market Overview

Demand was rather muted in Q1 2014, as tenants continue to downsize. A total of 25,740 sq m was taken-up in Q1, which was well below the levels achieved in the previous quarter and the year before. Tenants from the TMT sector, such as Booking.com and Amazon were the principal demand drivers in Q1. The reduction in office space per employee (from 25sq m/person to 12 – 15sq m/person) as an outcome of changing work place strategies continued to reduce corporate space requirement particularly from the banking and finance and insurance sectors. This ongoing trend is likely to impact take-up volumes going forward. Larger tenants are now upgrading to intelligent buildings that enable innovative workplace solutions, with growing demand from businesses to ‘increase productivity’ and ‘retain talent’. Overall office vacancy increased once again q-o-q, reaching 15.7%.This was due to second hand space released back on the market, a trend expected to continue in the near term. On the contrary, availability of prime space particularly in the sought-after Zuidas, continued to erode. New completions in Q1 totalled 32,890 sq m, none of which was speculative. The development pipeline for the remainder of the year totals 72,000 sq m, of which c. 10% is available. Prime rents held stable at € 335 / sq m pa, whilst rents in secondary office locations were €188 /sq m pa and remain supported by incentives. Incentives decreased in Zuidas owing to the shortage of prime space. Low availability of prime space thus creates for potential rental increase towards the end of the 2014 or early 2015. Incentives moved in slightly and include 6-12 months’ rent free on a 5+5 year lease contract in prime locations and 9-22 months’ rent free for the same lease length across the market as a whole. Commercial property worth €220 million changed hands in Q1 2014 of which €121 million was invested in offices. Prime yields compressed once again and now stand at 5.45%.

Figure 1: Take-up

Figure 2: Supply and Vacancy Rates

Figure 3: Prime Rents and Rental Growth

Figure 4: Prime Yields

Source all Charts: JLL

0100200300400500600

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Q1'14

000s sqm

Take Up 10yr Average

0

5

10

15

20

0200400600800

1,0001,2001,400

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Q1'14

000s sqm

Vacancy Total Vacancy Rate

Vacancy Rate %

00.20.40.60.811.21.41.61.8

300320340360380400

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Q1'14

Rental Growth Prime Rent

Prime Rent (psm pa) Annual Rental Growth*

4.50

5.00

5.50

6.00

6.50

Q4 98

Q4 99

Q4 00

Q4 01

Q4 02

Q4 03

Q4 04

Q4 05

Q4 06

Q4 07

Q4 08

Q4 09

Q4 10

Q4 11

Q4 12

Q1 14

Prime Yield 10 Yr Ave 20 Yr Ave

Prime Yield (%)

Amsterdam Office Market Profile - Q1 2014 EMEA Office Research

12 MonthSummary Statistics Q1 14 Q-o-Q Y-o-Y Outlook

Take-up (000s sqm) 26 -73.6 % -52.9 %

Vacancy Rate (% ) 15.7 80 bps 60 bps

Prime Rent (psm) €335 0 % 0 %

12 MonthQ1 14 Q-o-Q Y-o-Y Outlook

Capital Value (psm) €6147 0.9 % 2.8 %

Prime Yield % 5.45 -5 bps -15 bps

Change*

Change*

www.joneslanglasalle.eu COPYRIGHT © JONES LANG LASALLE IP, INC. 2014. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without prior written consent of Jones Lang LaSalle. It is based on material that we believe to be reliable. Whilst every effort has been made to ensure its accuracy, we cannot offer any warranty that it contains no factual errors. We would like to be told of any such errors in order to correct them.

JLL Contacts Martijn Smits Head of Office Agency Amsterdam +31 20 540 7898 [email protected]

Dré van Leeuwen Head of Capital Markets Amsterdam +31 20 540 7912 [email protected]

Sven Bertens Head of Research Amsterdam +31 20 540 7926 [email protected]

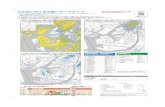

Office Market Map