Jeffrey Walkenhorst Alt Energy 090209

-

Upload

jeff-walkenhorst -

Category

Business

-

view

941 -

download

1

description

Transcript of Jeffrey Walkenhorst Alt Energy 090209

[email protected]© 2009 Jeffrey Walkenhorst

Jeffrey [email protected]

September 2, 2009

Global Energy and Clean Tech Sector Overview – and –

Investment Approach and Select Ideas for Discussion

Please see Risk Factors and Disclosure at the back of this presentation.

[email protected]© 2009 Jeffrey Walkenhorst 2

Outline

• Macro Overview: Big Picture Global Trends

• Renewable Energy Consumption: U.S. and U.K.

• Wind Power: Status, Trends, and Challenges

• Solar: Status, Trends, and Challenges

• Water: Brief Look at Supply/Demand Imbalance

• Investment Analysis and Research Approach

• Searching for Ideas

• Potential Longs

• Potential Shorts

• Conclusion: Plenty of Opportunities to Assess

[email protected]© 2009 Jeffrey Walkenhorst 3

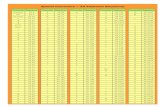

Macro: Global Energy Supply by Fuel and Region (IEA)

Source: IEA, 2008, http://www.iea.org/textbase/nppdf/free/2008/key_stats_2008.pdf .

[email protected]© 2009 Jeffrey Walkenhorst 4

Macro: Nuclear and Hydro Production (IEA)

Source: IEA, 2008, http://www.iea.org/textbase/nppdf/free/2008/key_stats_2008.pdf .

[email protected]© 2009 Jeffrey Walkenhorst 5

Macro: World Energy 2020/2030 Outlook (IEA and AES)

Source: IEA, 2008, http://www.iea.org/textbase/nppdf/free/2008/key_stats_2008.pdf .

Source: AES 6/09/08 investor presentation. Source: AES 5/27/09 investor presentation.

[email protected]© 2009 Jeffrey Walkenhorst 6

Macro: CO2 Emissions and Power Needs/Sources

Source: AES 5/27/09 investor presentation.

Source: IEA, 2008, http://www.iea.org/textbase/nppdf/free/2008/key_stats_2008.pdf .

[email protected]© 2009 Jeffrey Walkenhorst 7

Renewable: U.S. Energy Consumption (EIA)

• Renewable energy consumption increased 7% Y/Y in 2008 despite a 2% Y/Y decline in total energy consumption.

• Total renewable energy consumption increased by 487 trillion Btu to 7,301 trillion Btu, “the highest level attained based on EIA estimates of renewable energy back to 1949 … due to substantial increases in the use of biofuels, wind and solar energy”.

• Renewable energy’s share of total U.S. energy consumption was over 7% in 2008, up from 6% in 2004.

Source: Energy Information Administration, Renewable Energy Consumption and Electricity Preliminary Statistics 2008,July 2009, http://www.eia.doe.gov/cneaf/alternate/page/renew_energy_consump/rea_prereport.html .

[email protected]© 2009 Jeffrey Walkenhorst 8

Renewable: U.K. Energy Consumption (DECC)

• “In spring 2007 the [UK] Government helped secure EU agreement to an ambitious target to obtain 20% of the EU’s total energy consumption – a combination of electricity, heat and transport – from renewable sources by 2020.”

• However, DECC noted: “Our latest modeling also suggests that solar heat may deliver less than we had envisaged in our Renewable Energy Strategy consultation last year. This is due to a reduction in our estimates of average heat output from this technology.”

Source: UK, The Department of Energy and Climate Change (DECC), The Renewable Energy Strategy (RES), July 2009, http://www.decc.gov.uk/en/content/cms/what_we_do/uk_supply/energy_mix/renewable/res/res.aspx .

[email protected]© 2009 Jeffrey Walkenhorst 9

Wind Power: Global Capacity Snapshot (GWEC)

Source: Global Wind Energy Council, Global Wind 2008 Report, http://www.gwec.net/fileadmin/documents/Global%20Wind%202008%20Report.pdf .

• Installed global capacity of 120.8 GW at year-end 2008, with the U.S. at 21% of total capacity.

[email protected]© 2009 Jeffrey Walkenhorst 10

Wind Power: Global Forecast and Public Policy

Source: AES 5/27/09 investor presentation.

Source: National Renewable Energy Laboratory / Wind Powering America, “Wind Energy Update”, August 2009, http://www.windpoweringamerica.gov/pdfs/wpa/wpa_update.pdf .

Source: Global Wind Energy Council, Global Wind 2008 Report.

[email protected]© 2009 Jeffrey Walkenhorst 11

Wind Power: U.S. Trends for FPL’s NextEra

Source: FPL 5/27/09 investor presentation.

[email protected]© 2009 Jeffrey Walkenhorst 12

Wind Power: Not Without Current Challenges• FPL expressed caution about reaching the company’s wind forecast – summarized by 7/30/09

WSJ article “Wind Power: Best of Times, or Worst of Times?”http://blogs.wsj.com/environmentalcapital/2009/07/30/wind-power-best-of-times-or-worst-of-times/?mod=wsjcrmain

• … “Getting to the low end of our previously announced 2008 to 2012 new wind range of 7,000 to 9,000 megawatts may be overly optimistic given the current economic environment,” chief financial officer Armando Pimentel Jr. said on a conference call….

• FPL said that utilities, which are seeing less demand for electricity, are less eager than in the past to sign up for long-term agreements to purchase the electricity generated by wind farms. Without those long-term agreements, it is tough to secure financing for new wind farms.

• On 8/18/09, Vestas maintained its 2009 outlook for revenue Y/Y growth of 20% with an EBIT margin of 11-13% but noted the following:

• “Since the autumn of 2008, the credit crisis has impacted the wind power industry, causing limited order intake during the past nine months and keeping it well short of the level of the same period in 2007/2008. Many customers have been unable to finance scheduled projects either due to increasing funding costs or an actual lack of funding. Moreover, some of the banks that were previously key players in the wind turbine market are no longer active.”

• Zoltek, a maker of carbon fiber, talked of a “perfect storm” in its 8/10/09 F3Q09 report, pointing to delays related to uncertainty over government spending, frozen credit markets, and price decreases.

[email protected]© 2009 Jeffrey Walkenhorst 13

Solar: Global Deployment (EPIA) – Europe Dominates

• At year-end 2008, cumulative global capacity increased by 5.6 GW to ~15 GW with Europe at more than 9 GW (65% of worldwide capacity), Japan at 2.1 GW (15%) and the US at 1.2 GW (8%).

• The Spanish market almost quintupled in 2008 to more than 2,511 MW (45% of WW capacity).

• Approximately 1.5 GW was installed in Germany, 342 MW in the US, 230 MW in Japan, 274 MW in South Korea,258 MW in Italy, 105 MW in France, 51MW in the Czech Republic, 50MW in Portugal, and 48 MW in Belgium.

Source: The European Photovoltaic Industry Association (EPIA), Global Market Outlook For Photovoltaics Until 2013,http://www.epia.org/index.php?id=18 .

[email protected]© 2009 Jeffrey Walkenhorst 14

Solar: Public Policies and Two Large Utility Players

• xxxxx– xxxxxx

• xxxxxx– Xxxx

[email protected]© 2009 Jeffrey Walkenhorst 15

Solar: Transition Phase and Two Scenario Forecast

Source: The European Photovoltaic Industry Association (EPIA), Global Market Outlook For Photovoltaics Until 2013, http://www.epia.org/index.php?id=18 . Source: First Solar Analyst Day presentation, 6/24/09.

[email protected]© 2009 Jeffrey Walkenhorst 16

Solar: Which Solution is Best? Depends Who You Ask

Source: recent corporate management presentations.

First Solar (FSLR): Energy Conversion Devices (ENER):

Suntech (STP): Sunpower (SPWRA):

[email protected]© 2009 Jeffrey Walkenhorst 17

Solar: Challenges Highlighted by ENER and FSLR

• From Energy Conversion Devices 8/27/09 report: "Demand for solar products in our target markets weakened further from the third quarter into the fourth quarter as commercial construction declined, building owners deferred reroofing projects, and project financing constraints continued.”

• From First Solar’s 7/30/09 report:– xxxxxx

• xxxxxx– Xxxx

[email protected]© 2009 Jeffrey Walkenhorst 18

Solar: Need to Watch Supply / Demand Imbalance

• BusinessWeek, “Solar Update: More Volatility On The Cards”, 8/25/09http://www.businessweek.com/investing/green_business/archives/2009/08/solar_update_mo.html

• Highlights directly from article:

• … According to Credit Suisse: “Stable, but much lower [polysilicon] pricing from [the second quarter of 2010] will pull in the mythical grid parity in several global markets to [the second half of next year], triggering demand elasticity.”

• … that means tumbling polysilicon prices next year, coupled with an oversupply of other solar materials, could bring prices roughly inline with conventional energy sources, such as coal and natural gas.

• Yet … researcher iSuppli reckons the massive oversupply of solar materials, particularly panels, won’t be corrected until 2012. An Aug. 10 report says:

• “Total solar panel production in 2009 will grow by 14.3% to 7.5 Gigawatts (GW), up from 6.5GW in 2008. However, only 3.9 GW-worth of installations will take place this year. That means almost one out of every two panels produced in 2009 will not be installed but stored in inventory.”

• And according to iSuppli’s Henning Wicht: “This inventory glut will have a long-term impact on the solar business, with panels set to remain in a state of oversupply until 2012.”

[email protected]© 2009 Jeffrey Walkenhorst 19

Water: Different Type of Supply/Demand Imbalance

Source: Pico Holdings May 2009 investor presentation.

Source: Energy Recovery August 2009 investor presentation.

Source: GE 12/4/08 investor presentation.

[email protected]© 2009 Jeffrey Walkenhorst 20

Investment Approach: Focus on Business Model

• The Clean Tech universe offers wide variety of companies in which to invest and trade: high quality businesses that will likely be bigger, better, stronger in several years (long candidates) and low quality businesses that may not survive (short candidates)

• Long side: invest in growing, high quality business models with sustainable competitive advantages that support high or improving returns on invested capital over time

• Preference for high margins, limited leverage, current year growth, and low valuation multiples

• Seek improving fundamentals and identifiable positive catalysts within next six to 12 months not appreciated by the Street

• Margin of safety should be supported by replacement cost and/or difficult-to-replicate assets/franchise

• Short side: target the opposite – low quality business models with identifiable weaknesses or challenges that are destroying shareholder capital as illustrated by low/negative returns on invested capital

• Weaknesses might include poor quality of earnings and declining/low margins, as well as high leverage and negative free cash flow

• Seek deteriorating fundamentals and identifiable negative catalysts within next six to 12 months not appreciated by the Street

• No margin of safety and no difficult-to-replicate assets/franchise

[email protected]© 2009 Jeffrey Walkenhorst 21

Searching for Ideas – Two Minute Drill

• Quick analysis of income statement, balance sheet, and cash flow trends, as well as valuation, recent results, forward expectations, insider ownership, insider buying/selling, and institutional ownership (could establish quantitative screen)

• Interesting as potential Longs:

• Calgon Carbon Corporation (CCC) – water and air purification through manufacture and sale of activated carbon and other treatment systems

• Casella Waste Systems (CWST) – integrated solid waste and recycling services; focused on “resource transformation” with five landfill gas-to-energy facilities and 37 recycling facilities

• Energy Recovery (ERII) – devices for sea water reverse osmosis (SWRO) desalination

• Interesting as potential Shorts:

• First Solar (FSLR) – thin film solar modules made from cadmium telluride

• Ener1, Inc. (HEV) - rechargeable lithium-ion batteries and battery systems

• Universal Display Corp. (PANL) – R&D into and commercialization of organic light emitting diode (OLED) technologies and materials

[email protected]© 2009 Jeffrey Walkenhorst 22

Potential Longs – Summary Analysis

• Calgon Carbon Corporation (CCC) – stable business (2Q09 revenue down only 5% Y/Y and, on FX neutral basis, was up slightly Y/Y) serving diverse end-markets with pricing power (somewhat offsetting lower volumes), healthy margins (11% TTM OM), and favorable secular trends; at 28x TTM earnings and 18x NTM forecast earnings, CCC doesn’t appear inexpensive, yet all remaining holders of $75M in convertible notes (issued August 2006) recently converted notes into common shares (company now almost debt free) and two insiders made recent sizable purchases; potential positive catalysts include additional contract awards for flue gas mercury removal and UV drinking water disinfection, as well as increased activated carbon use in Asia

• Casella Waste Systems (CWST) – share price is up 5x from March lows, yet well below a 52-week high of $14.49 last September; levered 4.8x TTM EBITDA, but multi-year investment cycle to expand landfill capacity (now ~30 years) and modernize treatment (gas-to-energy and sorting) are complete; management pulling levers to improve free cash flow and reduce debt (e.g. higher pricing, cost controls) despite challenged fundamentals; potential positive catalysts include bottom-line improvement from pricing initiatives and value recognition of North Eastern landfill assets; CWST trades at an EV/EBITDA of 5.4x and P/S of 0.12x compared to RSG at 9.6x and 1.6x, respectively – company reports results 9/2/09

• Energy Recovery (ERII) – current short favorite (11% of float) on reduced near-term demand for SWRO product and some insider selling (mostly in $7-8 range, insiders still own ~47% of company); however, company is a market leader in category (~70% share per management) with favorable secular trends, IPR protection (5 U.S. patents, 9 international), $500M in announced projects (versus 2009E revenue of $50-55M), a strong financial position ($1.60 cash per share, virtually no debt), and solid operating metrics (21% TTM OM, 26% TTM ROE excluding cash); potential positive catalysts include incremental project wins and better-than-expected 4Q09 seasonality related to year-end budget flushes

Stock graphs and data from Yahoo! Finance as of 9/1/09 market close.

[email protected]© 2009 Jeffrey Walkenhorst 23

Potential Shorts – Summary Analysis

• First Solar (FSLR) – share price down sharply in recent weeks as investors focus on supply/demand imbalance (see rising inventory levels), quality of earnings, related party agreements, and changing economics (much lower polysilicon prices that arguably eliminate First Solar’s prior cost advantage); high historic margins and ROIC mitigate some risk, yet more downside probable as near-term challenges impact business model and expectations likely adjust downward

• Ener1, Inc. (HEV) – market enthusiastic about recent program wins and DOE grants, yet enterprise value of 15x NTM revenue appears egregious for capital intensive, competitive business with no history of profitability, still substantial operating losses, and potentially optimistic forward expectations

• Universal Display Corp. (PANL) – innovative leader in OLED technology with 942 patents issued/pending (at 12/31/08), yet similar story to Ener1: even with strong IPR portfolio, sales growth has NOT materialized as the company as not yet monetized IPR; EV of 19x NTM seems rich for a company with no history of profitability and still substantial operating losses (cash burn)

• Caveat: the business models of both Ener1 and Universal Display are not necessarily broken and the Market is awarding rich valuations based on seemingly gigantic future potential – specific negative catalysts other than potential earnings disappointments are unclear – requires more research and industry scuttlebutt

Stock graphs and data from Yahoo! Finance as of 9/1/09 market close.

[email protected]© 2009 Jeffrey Walkenhorst 24

Conclusion – Plenty of L/S Opportunities to Assess

• “Clean Tech” universe is large, diverse, and dynamic

• More research necessary – analysis herein is only tip of iceberg

• Strive to develop deep fundamental understanding of all potential investment ideas, with emphasis on business models –

• Review annual reports and other SEC filings, conference calls, company and industry news releases

• Analyze historical financials, key drivers (macro and micro), and forward expectations

• Develop financial model and derive scenario-based intrinsic value estimates

• Meet with and/or speak with management

• Establish industry contacts to understand scuttlebutt and better frame potential positive/negative catalysts

• Leverage knowledge to manage risk, preserve capital, and generate alpha on both long/short side

[email protected]© 2009 Jeffrey Walkenhorst 25

Thank You + Contact + Risk Factors and Disclosure

• Risk Factors and Disclosure• The content and/or views contained herein represent only the personal opinions of Mr. Walkenhorst based on his own research

and analysis.

• All data, information, and opinions expressed, are subject to change without notice. Mr. Walkenhorst currently has no positions in companies mentioned herein.

• Under no circumstances is this message an offer to sell or a solicitation to buy securities suggested herein.

• Invest at your own risk – all equity investments are subject to risk and an investor can lose some or all of his/her money.

• Any investment decisions you make should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Jeffrey WalkenhorstQuestions or Feedback?

http://commonstocksense.blogspot.com/

http://twitter.com/jeffwalkenhorst