Volume 5, Number 1 January 25, 2013 ISSN:1553-992X A c a d ...

January 2013 c

-

Upload

orlando-barrios -

Category

Documents

-

view

50 -

download

8

Transcript of January 2013 c

Vol. 157 No. 1 January 2013

Transforming the Grid

2013 Industry Forecast Russian Power Revolution Californias Future: Distributed Generation Hunting Black Swans

Your search for expertise ends with us. We build better boilers.Satised customers discover the power of our practical knowledge the ability to design and build boilers that operate efciently, safely and cleanly in a variety of industrial applications, including rening, petro-chemical and power generation. The know-how of our engineers and technicians combined with our expanded facilities and equipment, including a new membrane panel welding machine results in economic value and competitive advantage for you. Weve been designing and building boilers for people who know and care since 1996.

WWW.RENTECHBOILERS.COM

CIRCLE 1 ON READER SERVICE CARD

Established 1882 Vol. 157 No. 1

January 2013

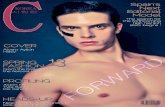

ON THE COVERThe Electric Power Research Institute, which contributed the cover story, titles our cover illustration Tomorrows Power System. It depicts the shift from almost exclusively central station generation and one-way power flows to a system in which power users are also sometimes generators, and in which both energy and information flow in two directions. Courtesy: EPRI 2012, All rights reserved

20

COVER STORY: RESEARCH AND DEVELOPMENT20 Emerging Technologies Enable No Regrets Energy StrategyThe Electric Power Research Institute (EPRI) anticipates unprecedented change in the electricity industry over the next 10 to 20 yearsmore than in the previous 100. To copelet alone thrivethe industry needs to continue innovating and adapting to the changing markets and consumer demands. Heres EPRIs rundown of collaborative research it is engaged in to develop a no-regrets portfolio of technologies that should allow utilities to maintain a reliable, environmentally sound, and reasonably priced electricity supply in the face of uncertainty and enormous upheaval.

30

SPECIAL REPORTS2013 INDUSTRY FORECAST

30 Slow Growth Aheadwith Unexpected Flares of ActivityThe power generation industry is a long-lead-time business with long-lifecycle infrastructure, so any diversion from familiar operating parameters (shale gas, were looking at you) can spell difficulties for generation owners, grid dispatchers, and end users. POWER editors and contributors look at the likely scenariosand surprises ahead for the U.S. and Europe.

40 Coal Battered Early, Later ReboundsShale gas development in the U.S. has changed the tune for power generators, leading to a game of musical chairs for coal- and gas-fired power dispatch. Gas may be leading the dance now, but dont count coal out.

44

42 Natural GasFired Plants Continue Rollercoaster RideWhen combined cycle peakers reach peak capacity factors of 80%, you know market fundamentals have changed. There may be more supply now than during the previous gas bubble, but there are still factors that could burst that bubble.

POWER IN RUSSIA

44 The Russian Power RevolutionRussia holds some of the largest fossil fuel reserves in the world and has become a major fuel exporter. Domestically, however, those resources have not guaranteed a reliable electricity infrastructure. We look at the history of the Russian power industry, previous reforms, and the latest plan to modernize a sector hobbled by Sovietera assets and operations. Will $615 billion be enough?

January 2013 POWER

|

www.powermag.com

1

FEATURESASSET MANAGEMENT

50 The Electric Grid: Civilizations Achilles Heel?Todays electric grid has become too essential to modern life and too vulnerable to human and natural threats. Thats the argument made by several industry experts. Although they may disagree about the most likely threats, and about how to defend against those threats, they agree that if a major grid failure were to occur, the effects would be unprecedented.

FUTURE POWER

53 Distributed Generation: Californias Future

50

Once again, California is serving as energy industry paradigm changer. This time the shift is from central-station generation to increasingly pervasive distributed generationin large part driven by the states renewable energy mandates. How California copes with the associated gear-grinding will be instructive for the rest of the U.S.

DEPARTMENTSSPEAKING OF POWER

6 My Top 10 Predictions for 2013GLOBAL MONITOR

8 World Energy Outlook Foresees Distinct Generation Shift 9 Floating Solaron Water 10 THE BIG PICTURE: The Coal Pile

9

FOCUS ON O&M

14 Safety a Main Theme at Asian Coal Users Meeting 16 Controlling Fugitive Combustible Coal DustLEGAL & REGULATORY

18 Calif. Cap-and-Trade: Bull or Bear Market?By Allison Davis and Kerry Shea, Davis Wright Tremaine

57 NEW PRODUCTS COMMENTARY

64 The Electric Power Industry: A Post-Election AssessmentBy H. Sterling Burnett, PhD, senior fellow, National Center for Policy Analysis

Get More POWER on the Web

16Connect with POWERIf you like POWER magazine, follow us online (POWERmagazine) for timely industry news and comments. Become our fan on Facebook Follow us on Twitter Join the LinkedIn POWER magazine Group2

The stories in this issue look ahead to the power industrys future. Online, associated with this issue (on our homepage, www.powermag.com, during the month of January or in our Archives any time), youll find these web exclusives that look back at how we got where we are today:

Navigant Announces Coal-Fired Generation Operational Excellence Awards Grading My 2012 Industry Projections (By Editor-in-Chief Bob Peltier) Too Dumb to Meter, Part 7 (The Atomic Earth-Blaster, Chariot Swings Down to Alaska, and Sedan Side Trip to Nevada chapters from Contributing Editor Kennedy Maize) Russias Power Profile (A detailed supplement to the special report in this issue, by Senior Writer Sonal Patel)

And remember to check our Whats New? segment on the homepage regularly for justposted news stories covering all fuels and technologies.www.powermag.com

POWER January 2013

|

CIRCLE 2 ON READER SERVICE CARD

EDITORIAL & PRODUCTIONEditor-in-Chief: Dr. Robert Peltier, PE 480-820-7855, [email protected] Managing Editor: Dr. Gail Reitenbach Executive Editor: David Wagman Gas Technology Editor: Thomas Overton, JD Senior Writer: Sonal Patel European Reporter: Charles Butcher Contributing Editors: Mark Axford; David Daniels; Steven F Greenwald; Jeffrey P Gray; . . Jim Hylko; Kennedy Maize; Dick Storm; Dr. Justin Zachary Graphic Designer: Joanne Moran Production Manager: Tony Campana, [email protected] Marketing Director: Jamie Reesby Marketing Manager: Jennifer Brady

Visit POWER on the web: www.powermag.com Subscribe online at: www.submag.com/sub/pw POWER (ISSN 0032-5929) is published monthly by Access Intelligence, LLC, 4 Choke Cherry Road, Second Floor, Rockville, MD 20850. Periodicals Postage Paid at Rockville, MD 20850-4024 and at additional mailing offices. POSTMASTER: Send address changes to POWER, P Box .O. 2182, Skokie, IL 60076. Email: [email protected]. Canadian Post 40612608. Return Undeliverable Canadian Addresses to: PitneyBowes, P BOX 25542, London, ON .O. N6C 6B2. Subscriptions: Available at no charge only for qualified executives and engineering and supervisory personnel in electric utilities, independent generating companies, consulting engineering firms, process industries, and other manufacturing industries. All others in the U.S. and U.S. possessions: $87 for one year, $131 for two years. In Canada: US$92 for one year, US$148 for two years. Outside U.S. and Canada: US$197 for one year, US$318 for two years (includes air mail delivery). Payment in full or credit card information is required to process your order. Subscription request must include subscriber name, title, and company name. For new or renewal orders, call 847-763-9509. Single copy price: $25. The publisher reserves the right to accept or reject any order. Allow four to twelve weeks for shipment of the first issue on subscriptions. Missing issues must be claimed within three months for the U.S. or within six months outside U.S. For customer service and address changes, call 847-7639509 or fax 832-242-1971 or e-mail powermag@halldata .com or write to POWER, P Box 2182, Skokie, IL 60076. .O. Please include account number, which appears above name on magazine mailing label or send entire label. Photocopy Permission: Where necessary, permission is granted by the copyright owner for those registered with the Copyright Clearance Center (CCC), 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, www.copyright.com, to photocopy any article herein, for commercial use for the flat fee of $2.50 per copy of each article, or for classroom use for the flat fee of $1.00 per copy of each article. Send payment to the CCC. Copying for other than personal or internal reference use without the express permission of TradeFair Group Publications is prohibited. Requests for special permission or bulk orders should be addressed to the publisher at 11000 Richmond Avenue, Suite 690, Houston, TX 77042. ISSN 0032-5929. Executive Offices of TradeFair Group Publications: 11000 Richmond Avenue, Suite 690, Houston, TX 77042. Copyright 2013 by TradeFair Group Publications. All rights reserved.

ADVERTISING SALESSales Manager: Matthew Grant Southern & Eastern U.S./Eastern Canada/ Latin America: Matthew Grant, 713-343-1882, [email protected] Central & Western U.S./Western Canada: Dan Gentile, 512-918-8075, [email protected] UK/Benelux/Scandinavia/Germany/ Switzerland/Austria/Eastern Europe: Petra Trautes, +49 69 5860 4760, [email protected] Italy/France/Spain/Portugal: Ferruccio Silvera, +39 (0) 2 284 6716, [email protected] Japan: Katsuhiro Ishii, +81 3 5691 3335, [email protected] India: Faredoon B. Kuka, 91 22 5570 3081/82, [email protected] South Korea: Peter Kwon, +82 2 416 2876, +82 2 2202 9351, [email protected] Thailand: Nartnittha Jirarayapong, +66 (0) 2 237-9471, +66 (0) 2 237 9478 Malaysia: Tony Tan, +60 3 706 4176, +60 3 706 4177 [email protected] , Classified Advertising Diane Hammes, 713-343-1885, [email protected] POWER Buyers Guide Sales Diane Hammes, 713-343-1885, [email protected]

AUDIENCE DEVELOPMENTAudience Development Director: Sarah Garwood Fulfillment Manager: George Severine

CUSTOMER SERVICEFor subscriber service: Electronic and Paper Reprints: List Sales: All Other Customer Service: [email protected], 800-542-2823 or 847-763-9509 Wrights Media, [email protected], 877-652-5295 Statlistics, Jen Felling, [email protected], 203-778-8700 713-343-1887

BUSINESS OFFICETradeFair Group Publications, 11000 Richmond Avenue, Suite 690, Houston, TX 77042 Vice President and Publisher: Brian K. Nessen, 713-343-1887 [email protected] , Vice President, Energy and Engineering Events: David McKinnon

ACCESS INTELLIGENCE, LLC4 Choke Cherry Road, 2nd Floor, Rockville, MD 20850 301-354-2000 www.accessintel.com Chief Executive Officer: Donald A. Pazour Exec. Vice President & Chief Financial Officer: Ed Pinedo Exec. Vice President, Human Resources & Administration: Macy L. Fecto Divisional President, Business Information Group: Heather Farley Senior Vice President, Corporate Audience Development: Sylvia Sierra Senior Vice President & Chief Information Officer: Robert Paciorek Vice President, Production & Manufacturing: Michael Kraus Vice President, Financial Planning & Internal Audit: Steve Barber Vice President/Corporate Controller: Gerald Stasko

4

www.powermag.com

POWER January 2013

|

WHERE WATER and POWER MEETC U S T O M I Z E D WAT E R S O L U T I O N S T H AT F I T YO U R P O W E R P L A N T

Achieving Zero Liquid DischargeWhen a public utility client needed upgrades to the FGD efuent system at a coal plant, Tisha Scroggin and Don Schilling took a long, hard look at how it could be done. Applying recent experience, the pair helped the utility install a zero liquid discharge (ZLD) system in less than 20 months. With a nal cost approximately $45 million per 100 gpm treated, the ZLD system eliminated a discharge point and was completed on a schedule that deed industry norms. In the long run, the installation gave the utility cost and regulatory certainty by removing future needs for additional equipment.

As a nationwide technical leader in ZLD system development, Don has 40 years of experience consulting with utilities on the water requirements for coal and other power plants. Tisha has led the installation of ZLD systems for clients facing regulatory challenges to their power plant water systems. They are two of our experienced professionals who can help you identify the water alternative that ts: Zero liquid discharge Customized wastewater treatment and water management Constructed wetlands Landll and pond management Bottom ash handling

9400 Ward Parkway Kansas City, MO 64114

www.burnsmcd.com/water-team

Engineering, Architecture, Construction, Environmental and Consulting SolutionsCIRCLE 3 ON READER SERVICE CARD

SPEAKING OF POWER

My Top 10 Predictions for 2013year ago in this column, I predicted that 2012 would be pivotal for the power generation industry, and it was. Coal-fired generation dropped precipitously and gas-fired generation accelerated much faster than industry predictions. Early in 2012 the unthinkable occurred: coal- and gas-fired generation crossed paths at about 32% for a short period of time, although coal subsequently began a slow recovery for the remainder of the year. Our 2013 Industry Forecast (p. 30) discusses the likely price and usage trends to expect this year, which are reflected in many of my 2013 predictions. Looking back over the past years predictions, I graded myself a strong B, slightly down from the past two years (a detailed discussion of my individual scores is available as an online supplement to this issue). Like coal, Im expecting a comeback in 2013.

A

10. Kyoto 2 is DOA. The Kyoto Protocol expired on Dec. 31, 2012, and an extension (Kyoto 2) was formulated in late 2011 as an interim measure until a new treaty was negotiated, slated for 2015. COP18, which ended on Dec. 7, made no tangible progress. Few nations have backed Kyoto 2, and Russia, Japan, and Canada have rejected the measure unless China and India also accept binding targets. In 2013, China and India wont engage, and the European Union (EU) will stay at arms length until there is agreement for carryover of unused emissions allowances, which the many small member countries disagree with. 9. Coal Combustion Residuals, and Cooling Water Intake Structures Rules Go Live. Why would the administration go into low gear with these two regulations in 2012 and delay post-election into 2013 unless the rules were onerous? Expect coal ash to be reclassified as a special waste and new plants (plus some existing ones) to be forced to begin the move from once-through cooling to cooling towers. 8. Natural Gas Prices Rise. Expect the6

average price of natural gas used for power generation to rise 20% and the amount of electricity produced by natural gas to drop by at least 10% in 2013, below 2012 levels. 7. Coal Use Rises, But No New Plants Are Built. As gas prices rise, the use of coal for power generation will follow suit, but at a lower rate. Expect coal-fired generation to rise 7% to 8% in 2013, over 2012 levels. Unfortunately, no new coal plants will begin construction in the U.S. in 2013. 6. The EU Embraces Coal. EU member countries will begin construction of several new supercritical coal-fired plants in 2013 in preference to gas-fired combined cycle plants. The price of natural gas imported from Russia into the EU is pegged to the price of oil, making indigenous coal a very attractive fuel, particularly when carbon allowance are at historic lows, and the EU has already reached its 2020 carbon dioxide reduction goals. 5. The EPA Fracks Gas. On the same day the Environmental Protection Agency (EPA) released New Source Performance Standards (NSPS) for the oil and natural gas industry (Aug. 16, 2012), a group of associations petitioned the EPA administrator for reconsideration of certain provisions (now pending). Also, the petitions of eight industry groups challenging the NSPS were combined and filed with the D.C. Circuit Court of Appeals on Oct. 15, 2012. The first hearing is set for Dec. 21, 2012. I predict that the EPA will make small adjustments in the rule to correct the most egregious errors, but the Court of Appeals will strike down the rule for many of the same reasons it did the Cross-State Air Pollution Rule. 4. Demand Stays Flat. The Energy Information Administrations (EIAs) Annual Energy Outlook 2013 Early Release Overview (AEO2013 Overview) predicts that demand for electricity will rise at a rate of 0.9% for 2013. In my opinion, the prospects for an economic stall in early 2013 are very high, thereby quenching the hope of an increase inwww.powermag.com

the GDP growth rate. Electricity demand will grow at the more pedestrian rate of 0.7%. 3. Electricity Costs Rise. The average domestic cost of electricity will reach a new milestone of 12 cents/kWh in 2013, an increase of about 2%, according to the EIA. 2. LNG Stays Home. The EIAs December 2012 release of its AEO2013 Overview predicts that a surplus of natural gas will be available for liquefied natural gas (LNG) export by 2016, and the volumes are double those predicted in last years report. With legislators calling on President Obama to declare a moratorium on gas exports and only a single new export terminal approved (Cheniere Energys facility in Sabine Pass, La.) to date, the infrastructure is unlikely to be in place by 2016 to export any significant additional quantities. Other than Cheniere Energy, dont expect approvals for additional export terminals in 2013, which will make the EIA predictions moot. 1. The Carbon Tax Dies. Perhaps the most disturbing concept under discussion by our congressional representatives on both sides of the aisle is the political viability of a carbon tax. Spurring on that discussion was the September 2012 study by the Congressional Research Service that suggested the U.S. budget deficit could be reduced 50% in 10 years if a $20 per metric ton carbon tax were enacted. The tax is represented by some as a way to fight climate change, although many legislators are more interested in the tax as a new revenue source, and others wish to use the revenues to stem the flow of federal budget red ink. Expect plenty of talk but little action, because a tax by any other name is still a tax. I dont expect everyone to agree with each of my predictions. If you have strong feelings, aye or nay, let me know at editor@ powermag.com. Dr. Robert Peltier, PE is POWERs editor-in-chief.POWER January 2013

|

TODAYS CHALLENGES CREATE TOMORROWS INNOVATIONShaw serves the fossil and nuclear industries from start to nish. We offer a full spectrum of services, including engineering, procurement, construction, maintenance, modications, turnaround, uprate, outage, and decommissioning. We are also the leading provider of nuclear maintenance and modications in the U.S.

NUCLEAR GAS COAL RENEWABLES AIR QUALITY CONTROL SYSTEMS GENERATION SERVICES MAINTENANCE & MODIFICATIONS

POWERENVIRONMENTAL & INFRASTRUCTURE FABRICATION & MANUFACTURING

www.shawgrp.comCIRCLE 4 ON READER SERVICE CARD

Photo Courtesy of Southern Company

59M112012D

World Energy Outlook Foresees Distinct Generation ShiftGlobal generating capacity is poised to soar by more than 72%, to 9,340 GW, by 2035 from 5,429 GW in 2011, despite retirement of about 1,980 GW, the International Energy Agency (IEA) forecasts in its World Energy Outlook 2012, released in November. Nearly half of this new capacity growth will be propelled by new natural gas plants and wind farms; new coal and hydro facilities are expected to add about 15% each. An estimated $9.7 trillion will be needed to float new capacity additions, with another $7.2 trillion for new transmission and distribution lines, roughly 40% of which will be needed to replace aging infrastructure. Demand for electricity is set to grow faster than for any other final form of energy worldwide through 2035, ballooning at an average rate of growth of 2.2% per yearat least 38% of which will be driven by China and 13% by Indiabased on the IEAs central New Policies Scenario (which takes into account existing policy commitments and assumes that those recently announced are implemented). By 2030, just 12% of the worlds population will still lack access to power, compared with 19% in 2010. Government Policies to Determine a Future Fuel Mix Gross electricity generation worldwide will, meanwhile, increase by more than 70% from 21,408 TWh in 2010 to almost 36,640 TWh in 2035, the report says. Fossil fuels will continue to dominate the generation fuel mix, led by coal, even though coal generation will see a significant decline in its share of total generation (Figure 1). Shares of natural gas and non-hydro renewables are slated to increase, denoting a broader trend toward more diversity in the fuel mix both in Organisation for Economic Co-operation and Development (OECD) and non-OECD countries. According to the IEA, the projected shift in the types of power generation fuels and technologies will be influenced by several factors, foremost of which will be government policies, which can affect investment in new generating capacity and how existing plants are operated, specifically in the nuclear and renewable sectors. Policies on

nuclear vary considerably across countries: some continue to encourage public and private investment in new capacity, while others ban the use of nuclear energy or have introduced programmes to phase it out, the IEA says. But capital costs will also play an enormous role, as will carbon prices, and water scarcity, which can pose reliability risks for coal-fired and nuclear plants while also influencing the generation mix and generating costs. The Flight of Wind and Solar PV In 2035, the report forecasts, almost two-thirds of the capacity in operation today will still be generating power. Gas- and coalfired plants will make up the bulk of gross capacity additions, but wind capacity will also make its mark. About half of the projected 1,250 GW of gross wind capacity additions will be installed in OECD countries. The fledgling solar photovoltaic (PV) sector will also take off with a global capacity increase that is almost as big as that of hydropower and 2.5 times as large as the net increase in nuclear capacity, the IEA says (Figure 2). It notes, however, that power generated from new solar capacity will be considerably less than the increase in nuclear power generation, reflecting the much lower average availability (capacity factor) of these plants and the variable nature of their output. Some Regions to See Marked Change Certain recent events will distinctly shape future power plans for some countries. In the U.S., for example, the recent shale gas boom and environmental regulations geared toward coal and oil plants have put the nation on track to see a sharp increase in gas-fired generation to replace nearly 110 GW of retired coal capacity by 2035, the report estimates. Japan is still experiencing energy-related aftershocks from the March 2011 Fukushima Daiichi incident, and a September-

2. When one door shuts.

1. Changing states. According to the International Energy Agencys(IEAs) newly released World Energy Outlook 2012, the share of electricity generation by source and region in the New Policies Scenario shows a marked shift away from coal to natural gasfired generation. Courtesy: World Energy Outlook 2012 OECD/IEA 2012, figure 6.2, page 183 Coal Gas Oil Nuclear Solar PV Other renewables Bioenergy Hydro Wind

About a third of new capacity additions through 2035 will replace retired generating facilities. More than 50% of new capacity additions will be from new gas plants and wind farms, and about 30% will come from coal and hydropower, the International Energy Agency forecasts. Courtesy: World Energy Outlook 2012 OECD/IEA 2012, figure 6.2, page 183 Retirements: 20122025 20262035 Capacity additions: 20122025 20262035 Net capacity changeCoal Gas

OECD

2010 2035

10,850 TWh 13,300 TWh

Oil Nuclear Bioenergy

Non-OECD

2010 2035

10,560 TWh 23,340 TWh

Hydro Wind Solar PV

World

2010 2035 0% 20% 40% 60% 80%

21,140 TWh 36,640TWh 100% Other 600 300 0 300 GW 600 900 1,200 1,500

8

www.powermag.com

POWER January 2013

|

released Innovative Strategy for Energy and Environment aims to reduce reliance on nuclear power, which had in 2010 provided a quarter of all electricity generated in Japan. But even if no new nuclear plants are built through 2035 beyond the two reactors at Shimane-3 and Ohma that are already at an advanced stage of construction, and existing plants are subjected to shorter lifetimes, nuclear generation could recover a 20% share by 2020 (but could be slashed to 15% by 2035, its share picked up by renewables), the current Outlook suggests. The European Union (EU), which pioneered and continues to be at the forefront of renewable deployment, in 2011 drew away from gas-fired generation (which fell by 17%) and moved toward coal-fired generation (which increased by 11%), driven by higher gas prices and lowered carbon prices in the systemwide Emissions Trading System. The IEA forecasts that trend will continue in the short term even if carbon prices increase over the 20132020 period. The share of coal-fired generation will drop dramatically from 26% in 2010 to just 9% in 2035, the report says, citing higher carbon prices and a greater penetration of renewables. Gas-fired generation will also regain market share in the longer term as the share of nuclear power will decline (from 28% in 2010 to 22% in 2035) as more capacity is retired. One notable trend emerging globally concerns increased urgency to reform competitive electricity markets to buttress against increased price volatility associated with the surge of renewables and ensure that the risks of investing in other capacitysuch as flexible peaking plants, storage, interconnection or demand responseare correctly priced, the report says. With more interconnections being established between neighboring markets 1 3202 MetFab 4c ad:Layout 1 1/19/10 3:28 PM Page

to uphold system adequacy, electricity markets are becoming increasingly integrated.

Floating Solaron WaterThe recent explosive growth of massive solar plants in some of the worlds most remote deserts has stolen some of the spotlight from smaller solar installations that float on water. But in November, a concept proposed by researchers at Norwegian foundation DNV (Det Norske Veritas) for a dynamic floating offshore solar field concept stirred up myriad possibilities, particularly for congested urban regions such as coastal megacities. The so-called SUNdy concept essentially involves a floating hexagonal array that can be grouped together for a power capacity of as much as 2 MW (Figure 3). Multiple islands connected together make up a solar field of 50 MW, DNV said. SUNdy uses thin-film 560-W photovoltaic (PV) solar panels that are flexible and lighter than the traditional rigid glass-based modules, allowing them to undulate with the oceans surface, as Sanjay Kuttan, managing director of the DNV Clean Technology Centre in Singapore, explained. The key to creating an ocean-based structure of this size is the use of a tension-only design. Rather like a spiders web, this dynamic, compliant structure yields to the waves, yet is capable of withstanding considerable external loads acting upon it. According to Dr. Kuttan, separating the solar arrays into prefabricated sections allows for large-scale manufacturing and streamlined assembly offshore. The cable grid provides for maintenance access in the form of floating gangways. Below the surface, the shape of the island is maintained by the tensile forces

Looking to Improve Boiler Availability and Lower Maintenance Cost?Metalfab Provides Quick Turnaround with Less Outage Time to Deliver Real $avings!For more than 20 years, Metalfab has been working with the Power Industry to manufacture a diverse range of quality equipment that has resulted in a large, multimillion dollar installed customer base.

Burners, Fuel Firing Parts, Air Registers, Windboxes,Tips, and Pulverizer Components

Boiler Lime or PAC Handling Systems Hoppers, Feeders, Piping, and Ductwork Wear Resistant Plate and Weld Overlay Wear Protection Fully Engineered and Shop Assembled Fan andPipe Skids For more information and a FREE 4/c brochure visit www.metalfabinc.com, e-mail: [email protected], call 800-764-2999, in NJ 973-764-2000, or Fax: 973-764-0272.P.O. Box 9, Prices Switch Road Vernon, NJ 07462

PowerGen Equipment, Assemblies & Parts Made Better by DesignCIRCLE 5 ON READER SERVICE CARD January 2013 POWER

|

www.powermag.com

9

THE BIG PICTURE: The Coal PileAbout 1,199 new coal-fired facilities (as defined by the World Research Institute)a total installed capacity of 1,401 GWwere being proposed globally as of July 2012, spread across 59 countries. China and India account for about 76% of the proposed coal power capacities, and Chinese and Indian companies lead the pack of 483 firms proposing to build the new plants. These are the 10 countries leading the global coal power boom. Sources: World Research Institute, International Energy Agency Copy and artwork by Sonal Patel, Senior Writer

10. GERMANY12,060 MW (10 plants) #4: 251.15 TWh

10.

9. POLAND 8. UKRAINE12,086 MW (13 plants) #10: 133.42 TWh

9. 8. 7. 6. 5.

7. U.S.20,236 MW (36 plants) #2: 1,890.06 TWh

14,000 MW (14 plants) #15: 60.46 TWh

6. S. AFRICA22,633 MW (8 plants) #6: 232.20 TWh

5. VIETNAM34,725 MW (30 plants) #34: 14.98 TWh

4. TURKEY36,719 MW (49 plants) #17: 54.23 TWh

4.

3. RUSSIA3.48,000 MW (48 plants) #9: 156.76 TWh

2. INDIA2.Key developers: state-owned NTPC (47 plants), state-owned Maharashtra State Power Generation Co. (14 plants), JSW Group (12 plants), Andhra Pradesh Power Generation Corp. (11 plants), Essar Energy (11 plants)

519,396 MW (455 plants) #3: 2,615.46 TWh

1. CHINA557,938 MW (363 plants) #1: 2,891.66 TWh

1.Key developers: state-owned Huaneng (66 plants), state-owned Guodian (55 plants), state-owned Datang (43 plants), state-owned Huadian (37 plants), stateowned China Power Investment (31 plants)

KEY Proposed coal plant capacity Global rank of total coal generation in 2009

10

www.powermag.com

POWER January 2013

|

Dust Monitoring: Compliance Now and in theVisit SICK at EUEC Conference Booth #415

Does Your Plume Make You Blue? MCS03

First IR process photometer for continuous SO3 measurement in ppm ranges Elevated SO3 / H2SO4 concentrations in lue gas cause concerns from both an environmental and corrosion standpoint. Uncontrolled injection of control reagents wastes money. With the MCS03, real time control of your acid problem is a reality. Thanks to specially adapted IR spectral ranges and the hot/extractive system, effective control can be achieved.

SICK Process Automation Division United States - Houston | Minneapolis | 281-436-5100 Canada - Calgary | Toronto | 855-742-5583 www.sicknorthamerica.com | [email protected] 6 ON READER SERVICE CARD

3. Rocking solar.

A concept proposed by Norwegian foundation DNV calls for a hexagonal solar panel array that floats on the seas surface. DNV says a collection of these arrays, totaling 4,200 solar panels, could form a solar island the size of a large soccer stadium and be capable of generating 2 MW. Courtesy: DNV

from the lengthy spread mooring. DNV said that the island has also been optimized for solar capability and cabling efficiency. The solar arrays are divided into electrical zones feeding electricity produced into two main switches collecting the power for voltage step up at a central transformer (2 MVA 480/34.5 kV). From the offshore solar farms central island, 30-kV electrical transmission lines connect, tying other islands in

series to form a closed loop and continue to the electrical substation onshore for grid connection, said Kevin Smith, global segment director for DNV KEMAs Renewable Energy Services. The concept of a floating solar array is not new, though only a handful of developers seem to be involved so far. Israeli startup Solaris Synergy in February 2011, for example, installed a modular floating concentrating PV system at the Arava Institute for Environmental Studies Center for Renewable Energy and Energy Conservation north of the Israeli resort town of Eilat that connects to the Israel Electric Corp. grid. Solaris Synergy has also so far signed strategic partnership agreements with Mekorot (the Israeli national water company) and French power company EDF for deployment of their first operational pilot plants of 12 to 15 kW each. The company says it is focusing future efforts on water bodies associated with hydroelectric dams, pumped storage installations, and cooling ponds of electric power plantslocations that typically have existing power grid connections. The company claims that a massive market potential exists for the technology using these industrial water surfaces aloneenough to produce a total of 90 GW of solar power. Other players include French company Sky Earth, which has operated a pilot project in the south of France since February 2011 and is now developing 12-MW and 4-MW projects in that region. Associated drawbacks of floating solar plants have also already been established. Aside from cumbersome maintenance and repair, concerns have been voiced about solar energy concentration levels on a rocking platform. Then there are ecological and cost concerns. Sonal Patel is POWERs senior writer.

Need directions to EPA compliance?

Let Nol-Tec help you ind the right path.

Sorb-N-JectDry Sorbent Injection Solutions Mitigation of Hg SO2 SO3 HCI HF Customized innovation based on proven technology Flexible design to meet your precise needs Reliable, automated operation and control Scalable installation to cover scope of any system On-site, self-contained testing systems Call 651-780-8600 today to begin an analysis of your mitigation needs.

www.nol-tec.comNol-Tec Systems, Inc. 425 Apollo Drive Lino Lakes, MN 55014 651.780.8600 [email protected]

CIRCLE 7 ON READER SERVICE CARD 12 www.powermag.com

POWER January 2013

|

SERVICES: CLIENTELE: DetailedDesignEPCCM UtilitiesIPPsIndustry StudiesOwner&Bank UniversitiesOEMs Engineering Banks/Investors PROJECTS (New, Retrot & Modications): BiomassSolar(Thermal&PV)Simple&CombinedCycle WindFluidizedBed/PC/StokerBoilersBiofuelsMSW GasiicationLandillGasPyrolysisPlantImprovements AirPollutionControlCHP/CogenerationEnergySavings Engine-GeneratorsFacilities/Buildings&Systems

Powerplant Engineering DESIGN & EPC CONSTRUCTION

A Few Examples of Our Recent Experience FiveBiomassPowerplantsNowinDetailedDesign OwnersEngineerNowfora900MWCombined CycleRepoweringProject PrelimDesignNowfora1.2MGPDIndustrial WastewaterDesalinationPlant CompletedDesignandStartupofa300MW CombinedCycleRepoweringProject CompletedDesignandStartupofaConcentrating SolarThermalPowerTowerProject OwnersEngineerNowfora4xLM6000Simple CyclePowerPlant VariousPowerPlantServiceProjects

Some of Our Management Team

Chairman/CEO

Bob Bibb

President/COO

Lou Gonzales

VPEngineering

Dave Wiker

Mgr.Civil/Structural

Matt Helwig

Doug Franks Mgr.Electrical

Mgr.Bus.Develop.

Chris Bramhall

Phil Peterson Sr.ProjectMgr.

Rich Carvajal Sr.ProjectMgr.

Nick FrancovigliaChiefMech.Eng.

Mgr.Mechanical

Rob Schmitt

Roger PetersenBus.Dev.LA

Diane Jones KatholBus. Dev. Denver

For career opportunities e-mail a resume in conidence to: [email protected] 8 ON READER SERVICE CARD

Safety a Main Theme at Asian Coal Users MeetingPower plant operators, managers, and other professionals from across Southeast Asia met in Hong Kong in early November for the second annual Asian Sub-Bituminous Coal Users Group meeting, created to share information and best practices related to safety, handling, combustion, characteristics, and risk management of the fuel. This years co-hosts were CLP Power and HK Electric. The event was organized by the Powder River Basin Coal Users Group and TradeFair Group, which publishes POWER. Presentations during the two-and-a-half-day event focused on boiler management and coal-handling best practices. Danny S. Lau, engineer I (materials handling), with Hong Kong Electric Co., said a number of benefits come with the use of low calorific value (LCV) coal, which includes subbituminous varieties. He struck a conference theme by saying subbituminous coal also presents a number of problems to users such as increased fire risk, coal spillage and fugitive dust, and generation unit derates. These problems must be mitigated to prevent any catastrophic failure of coal-handling and combustion equipment, he said. At the Lamma Power Station near Hong Kong, where he works, coal yard operations were reengineered and coal-burning equipment was modified to accommodate increased use of LCV coal. Lau said the high moisture content of LCV coal adversely affects both pulverizer performance and the combustion process. As a result, mill inlet temperatures at the power plant were restricted to below 200C to minimize the risk of a mill fire when handling LCV coals. The mill outlet temperature also had to be lowered from 75C to around 60C to 65C. At the Lamma station, in-mill drying is the accepted method of preparing coal for pulverized fuel burning, and Lau reiterated industry standards of achieving a proper dryness in the coal by manipulating primary airflow and temperature. These standards were achieved at the Lamma plant in part by modifying the mills. These modifications included installing a dynamic classifier, which helped improve the fineness of the pulverized fuel; installing a dynamic vane wheel to improve mill airflow; changing the separators to deflectors to minimize the accumulation of residual coal; and installing a mill inerting system to admit steam into the system in case of a fire.

In addition, the mill and the boiler were retuned to handle LCV coals in an effort to obtain optimal operation and system performance. The tuning involved adjusting the mill outlet temperature in accordance with a coal fuel ranking system. Under the system, bituminous coal with a calorific value between 7,800 and 6,380 kcal/kg was classified as A, highcaloric value subbituminous coal of between 6,380 and 5,800 kcal/kg was classified as B, lowcaloric value subbituminous coal of between 5,800 and 4,600 kcal/kg was classified as C, and lowercaloric value subbituminous coal of less than 4,600 kcal/kg was classified as D. (Note that 1 kcal = 3.97 Btu and 1 kg = 2.2 pounds.) Boiler control parameters were adjusted, depending on the classification of the coal being burned. For example, existing boiler control function curves had been set for highcaloric value coal (6,300 kcal/kg), but that practice resulted in an oversupply of combustion air when LCV coal was used. This had the dual effects of reducing boiler efficiency and increasing the coal flow. Lau said that Lamma station operators learned that, based on the tuning results, excess O2 could be trimmed 1% at full load and 0.5% at half load. This adjustment enhanced boiler efficiency and alleviated unit derating when LCV coal was burned. Lau reported several improvements to plant operations as a result of the modifications. First, plant output increased when two types of LCV coal labeled A and B were burned. Following new settings that placed the mill outlet temperature at 70C, excess O2 at 3.2%, and the induced draft fan blade opening at 83%/77%, electrical output using coal A rose some 28.3 MW from a base of 322.4 MW to 350.7 MW. Auxiliary power consumption dropped by 0.31%, and boiler efficiency rose 0.79%. New settings applied to coal B combustion resulted in an increase of 17.3 MW from a base of 348.6 MW, to 365.9 MW. Auxiliary power consumption dropped by 0.74% and boiler efficiency rose 0.53%. The improvement in boiler efficiency was attributed to reduc-

2. Korean coal connection. Sung-Won Ha (right), senior manager with Korea South-East Power Co., answered questions following his presentation at the second annual Asian Sub-Bituminous Coal Users Group conference, which was held in Hong Kong in early November. Source: POWER, David Wagman

1. Asian coal users confab. Delegates to the second annual Asian Sub-Bituminous Coal Users Group meeting in Hong Kong mingle prior to the start of a conference session. The meeting drew power generators from across Asia and North America to discuss the safe, efficient, and economic use of sub-bituminous coal by generating companies. Source: POWER, David Wagman

14

www.powermag.com

POWER January 2013

|

tion in excess air as well as uplifting of mill inlet temperature, Lau said. The latter would increase the hot primary airflow, thus lowering the flue gas temperature and dry flue gas loss. Sung-Won Ha, senior manager with Korea South-East Power Co. (KOSEP) at its 3,340-MW Yeongheung power plant, said that as the use of subbituminous coal has increased, boiler combustion environments have grown worse. It is very important that power plant companies develop a coal management program for operation and maintenance cost reduction and increased efficiency. He said that for economical coal purchases, three cost factors should be considered: fuel cost, the operational cost for coal supply and flue gas draft systems, and maintenance costs for equipment malfunctions and replacement. Economical coal management means coal selection and mixing to satisfy these three factors, he said. He said that around 40 coals arrived at the Yeongheung station during 2011 from sources that included the United States, Canada, Colombia, Russia, Indonesia, and Australia. A maximum of four different coals may be burned each day with caloric values that range from 3,760 to 6,600 kcal/kg, moisture content that ranges from 6% to 41% and sulfur content that varies between 0.1% and 1.2%. Use of the fuel led to several problems, including pulverized coal deposition on the coal pipe due to condensation, coal feeder outlet clogs also due to moisture, and excessive soot production. Broadly speaking, the plant faced challenges due to the variety of coals, their diverse characteristics, the frequency with which they were changed, and the possibility of receiving coal whose properties violated design parameters. To help mitigate the problems, manage the coal diversity, and help the plant achieve steadily tightening environmental restrictions, an

E-Coal Operation Management System (E-COMS) was devised. E-COMS focuses on coal sampling, coal unloading, coal handling, managing short-term and long-term coal stockpile trends, and coal yard inventory control. The approach considers at least 10 variablessuch as coal rank, coal blending, boiler efficiency, maintenance costs, and auxiliary loadand seeks a balance among optimized coal blending, predictive combustion, and economic value. In order to improve the accuracy for the program, we made use of operation data in real time, Ha said. With this predictive data, coal blending can be made economical and eco-friendly. He said E-COMS will be upgraded continuously so that it becomes even more of a more reliable and user-friendly program as it interfaces with other programs. Richard P. Storm, president of Innovative Combustion Technologies Inc., said the pulverizer mills in a coal-fired power plant condition coal for proper combustion and deliver all of the fuel to the boiler. Because of this, the pulverizers are among the most important group of auxiliary equipment that affect unit reliability, performance, and capacity, as well as the ability to generate power economically. The pulverizers also present a constant risk to safety, which is especially true when firing highmoisture content and highly reactive subbituminous coals. He said these coals are more prone to mill fires and puffs, largely due to the high heat required to dry subbituminous coal prior to combustion. The heat that is required is a product of the temperature and quantity of airflow at the mill inlet. Because subbituminous coal is 15% to 30% moisture, very hot mill inlet temperatures are required to dry the coal and achieve mill outlet temperature. In particular, temperatures can be hot under the yoke, but are quickly reduced once mixed with the coal moisture after passing through the

CIRCLE 9 ON READER SERVICE CARD January 2013 POWER

|

www.powermag.com

15

throat. The temperature below the yoke is close to many subbituminous coals auto-ignition temperatures, Storm said. As a result, coal spillage into the wind belt under the yoke is a common cause of mill fires. Rejected coal quickly dries and ignites in the high-temperature, oxygen-rich environment. Coal feed interruptions also are a potential source of fires, Storm said. In this case, raw coal supply is interrupted due to imprecise feeder control and stoppages above and below the feeder. With no supply of moist coal, the higher temperatures and airto-fuel ratios present under the yoke migrate upwards into the grinding zone. This is also a risk in the case of mill trips or shutdown. Accumulations of debris or coal anywhere in the pulverizer also will increase the chance of a mill fire because accumulation and settling in the pulverizer components allow coal to dry and may lead to spontaneous ignition. Storm said excessive airflow to the pulverizer provides an abundant source of air to combust ignition sources, including smoldering coal in the classifier, pulverizer, or raw coal under the yoke. Smoldering coal from the bunker reaches a point of deflagration as it travels through the feeder and moves into the mill. Smoldering coal, which has no access to oxygen in the tightly packed bunker, will suddenly be exposed to oxygen as it breaks apart in transit. That, coupled with a decrease in particle size, can compound the danger of a fire. Storm said fundamental precautionary methods to reduce the chance of a pulverizer puff include the following: Ensuring that pulverizer airflow is adequate to facilitate stable transport of coal without settling in the burner but not excessively high to provide an abundant source of air for combustion in the presence of an ignition source. Taking all measures to prevent coal from accumulating or settling in any of the pulverizer components. Ensuring that raw coal to the pulverizer remains uninterrupted and controllable. This can be done through precise feeder control and minimizing stoppages above and below the feeder. Ensuring that no hot smoldering or burning raw fuel is anywhere in the pulverizer system. It is imperative that raw coal spillage into the under bowl area be prevented.

on other concealed surfaces, producing more dust clouds and creating a domino effect that causes further explosions. Preventing Explosions by Using Appropriate Vacuum Cleaners Bill Bobbitt of Bobbitt Associates Environmental Systems, whos been working in the safety field for more than 25 years, said, I always tell my clients, it not a matter of if, but when. Conditions have to be perfect and that when can be 30 years from now, or it could be next week. But if you eliminate the fugitive dust, it cannot create a secondary dust explosion. The National Electrical Code (NEC) defines hazardous locations as those areas where fire or explosion hazards may exist due to flammable gases or vapors, flammable liquids, combustible dust, or ignitable fibers or flyings. Hazardous locations are classified in three ways by the NEC: type, condition, and nature. Class II locations are those areas made hazardous by the presence of combustible dust. Finely pulverized material, suspended in the atmosphere, can cause powerful explosions. The NEC also specifies that hazardous material may exist in several different kinds of conditions, which, for simplicity, can be described as normal conditions (Division 1) and abnormal conditions (Division 2). In the normal condition, the hazard would be expected to be present in everyday production operations or during frequent repair and maintenance activity. When the hazardous material is expected to be confined within closed containers or closed systems and will be present only through accidental rupture, breakage, or unusual faulty operation, the situation would be called abnormal. As the first line of defense in housekeeping routines to prevent catastrophic explosions caused by combustible dust and comply with regulatory agencies, plant personnel need to employ industrial vacuum cleaners that are built from the bottom up to be used in a variety of Class II, Division 2 areas (Figure 4). Redundantly grounded indus-

3. Explosive situation. Primary dust explosions occur when combustible dust such as coal dust is present, forms a dust cloud (in sufficient amounts) in an enclosed environment with an ignition source and oxygen. If any one of these elements is missing, there can be no explosion. Source: National Fire Protection AssociationIgnition

For more information on the Asian Sub-bituminous Coal Users Group, visit www.asiansbcusers.org. More information on the Powder River Basin Coal Users Group may be found at www.prbcoals.com. David Wagman is executive editor of POWER.

Dispersion of dust particles

Confinement of dust cloud

Controlling Fugitive Combustible Coal DustRegardless of how much prevention is employed to mitigate combustible dust in coal-fired power plants, fugitive coal dust is pervasive and can be dangerous. In coal-fired power plants, mechanical transfer points are leading sources for airborne fugitive dust. However, because coal dust travels quickly over large areas with minimal airflow, fugitive combustible dust settles in many areas. Primary dust explosions occur when combustible dust is present, forms a dust cloud (in sufficient amounts) in an enclosed environment with an ignition source and oxygen (Figure 3). If one were to put a flame to a layer of combustible dust on a desk, the dust would burn, but not explode. Fanning the dust with a piece of paper to make the dust particles airborne, however, would create a dust cloud that could blow up. Catastrophic secondary explosions occur when the force from the primary explosion dislodges fugitive dust that has been allowed to accumulate on walls, floors, and other horizontal surfaces such as equipment ledges, above suspended ceilings, and16

Combustible dust

Oxygen in air

4. Housekeeping helper. Cleaning up the abundant dust aroundthe boot seals in this cement plant is more effective with the VACU-MAX air-operated industrial vacuum cleaner than with shovels and wheel barrows. Courtesy: VAC-U-MAX

www.powermag.com

POWER January 2013

|

trial vacuum cleaners are designed to shield workers and property from catastrophic secondary coal dust explosions. Perils of Standard Shop-Type Vacuums Any time there is powder flowing in one direction through a plastic vacuum-cleaning hose, it can create a significant static electric charge. In addition, there may be static electricity buildup on individual dust particles. If a charged, ungrounded hose used to vacuum combustible dust were to contact an object that was grounded, the static electricity could then arc and trigger a violent explosion. This is why the U.S. Occupational Safety and Health Administration (OSHA) has issued numerous citations for plant personnel using standard vacuum cleaners where Class II, Division 2 equipment is required under the law. Bobbitt sees a number of standard shoptype vacuums in plants. There are so many problems with them. They themselves are hazards in an industrial environment, he said. First and foremost, they are not grounded or classified for Class II, Division 2 areas. In addition, they can shock workers and

5. Intrinsically safe systems. The VACU-MAX compressed airpowered vacuums meet regulatory requirements for grounding and bonding. Employing this type of industrial vacuum cleaner that is redundantly grounded eliminates the possibility of any kind of explosion from the vacuum. Courtesy: VAC-U-MAX

they clog easily. Not surprisingly, the workers dont want to use them, and if workers dont use them, fugitive dust continues to accumulate in the plant. Recently, Bobbitt discussed challenges with using Class II, Division 2 electric vacuums at a meeting of the Kansas City Power & Light (KCP&L) Coal Handling Group, where safety professionals from each of the KCP&L power stations came together to discuss proactive solutions to safety challenges. He described a recent incident in which he was shown five different expensive Class II, Division 2 electric vacuums sitting in a warehouse at a power plant not being used. Plant personnel told him that they did not want to utilize the equipment because after 20 minutes of use, the filters would bind. In addition, they were reluctant to use them because they continually had to lift the head from the vacuum cleaners and tap the cake off before they could achieve the appropriate suction levels. This same power plant, and its five sister facilities, now use a Class II, Division 2 air-powered VAC-U-MAX model with a pulse-cleaning system on the filters, that with the push of a button releases the dust from the filter and allows the user to resume cleaning, Bobbitt said. The VAC-U-MAX company developed the first air-operated industrial vacuum in 1954 and has been the pioneer in solving vacuum-related challenges in a wide range of manufacturing and industrial settings (Figures 5 and 6).

6. Modularity maximizes usage.Like the VAC-U-MAX central vacuum system shown in Figure 5 that has an explosion vent, most vacuums are modular in nature. Standard equipment with additional capabilities can be added to the vacuums for specific applications. Courtesy: VAC-U-MAX

Advantages of Redundantly Grounded Industrial Vacuum Cleaners Employing an industrial vacuum cleaner that is redundantly grounded in five different ways eliminates the possibility of any kind of explosion from the vacuum, Bobbitt explained. Although VAC-U-MAX does produce electric vacuums designed for Class II, Division 2 environments, the most economical solution for cleaning combustible fugitive coal dust is the companys air-operated vacuums. This type of vacuum is safer in terms of grounding, and it also works more efficiently in the industrial environment. Beyond the fact that VAC-U-MAX air-operated vacuums use no electricity and have no moving parts, the first of the five ways that these vacuums are grounded begins with the air line that supplies compressed air to the units. Because most plants have compressed air lines made from iron that conduct electricity, the companys air-operated vacuums use static conductive high-pressure compressed air lines. In addition to the static conductive air lines, static conductive hoses, filters, and casters are employed to further reduce risk. Furthermore, a grounding lug and strap that travels from the vacuum head down to the 55-gallon drum is used to eliminate the potential for arcing. Bobbitt added that when you are dealing with explosive dust, you may need a Class II, Division 2 vacuum cleaner in a non-Class II, Division 2 area. You might have small quantities of explosive dust, and it might take a very hot and prolonged source of ignition, but with OSHAs Combustible Dust National Emphasis Program (NEP), facilities need to be very careful that they comply because there are a lot of questions as to what compliance means, he said. Housekeeping violations ranked second in citations under the NEP with respect to combustible dust related hazards, according to recent OSHA statistics. In addition, the agency issued citations for General Duty Clause violations involving the practice of blowing dust with an air compressor and not using electrical equipment that was designed for hazardous (classified) locations. In fact, in the Electric Services Industry Group from October 2010 through September 2011, the General Duty Clause violation category was one of the top 10 violation categories most frequently cited by OSHA. Although the regulations for combustible dust arent real clear, I find that a lot of companies are trying to get better at general housecleaning, Bobbitt said. Contributed by Doan Pendleton (info@ vac-u-max.com), vice president of marketing and sales at VAC-U-MAX.17

January 2013 POWER

|

www.powermag.com

Allison Davis

Kerry Shea

Calif. Cap-and-Trade: Bull or Bear Market?By Allison Davis and Kerry SheaGHG emission allowances to business at no cost, and companies exceeding their allowance should be able to purchase GHG emission allowances from other companies. The Chamber concluded that this interpretation of AB 32 would fulfill the states goal of reducing emissions while keeping GHG compliance costs low for businesses and consumers. The Chambers complaint characterizes CARBs allowance auction as both an unconstitutional tax and a violation of AB 32. The complaint alleges that AB 32 only authorized CARB to impose a minor administrative fee but did not authorize CARB to raise revenue by selling GHG emission allowances. Because a two-thirds majority of the California legislature is needed to increase taxes, the Chamber contends that requiring businesses to purchase GHG emission allowances sold by CARB imposes an unconstitutional tax. The Chamber did not seek to enjoin this first auction, but its suit threatens future auctions. CARB must respond to the Chambers allegations prior to the next auction in February 2013. In addition to the Chambers lawsuit, other pending litigation may potentially delay or restrict Californias climate change initiatives:

he California Air Resources Board (CARB) recently kicked off a new era in its cap-and-trade program designed to reduce greenhouse gases (GHG) when it held its first GHG emissions allowance auction on November 14. While CARB pronounced the auction a success, the low price and lukewarm demand for allowances evidences market reticence to fully embrace the program. As a procedural matter, the auction was a success. It had no electronic glitches, and there was no evidence of tampering or interfering with the market. A brief analysis of the results, however, shows that the auction did not generate the enthusiasm that CARB expected.

T

Wide Participation But at a Low Price As a key part of Californias Global Warming Act, or AB 32, the cap-and-trade program relies on allowances as permission for entities to emit CO2 and other GHGs. The program sets a cap on total emissions that reduces yearly. Emitters must surrender one allowance per metric ton of CO2 (or CO2 equivalent). The program anticipates a secondary market in which emitters and others can buy and sell extra allowances. Those looking to trade in this secondary market will closely watch the allowance price from this and future quarterly auctions. The first auctions results indicate its success may be less than suggested by CARBs press release. First, the sale price for allowances was not as high as anticipated. While all of the available 2013 allowances (23,126,110) were sold, the sales price was $10.09, barely above the $10 minimum reserve price. Many expected the allowances to sell for $12 to $13 each. Second, the auction also included 2015 vintage allowances, of which only about 15% sold at the minimum reserve price of $10. These results indicate that market participants are taking seriously the obligation to obtain allowances but are uncertain of the programs future. The low prices and the minimal number of 2015 allowances purchased may indicate wariness. In essence, participants seem to be dipping their toes in the water, but they are not ready to take the plunge by purchasing large quantities of allowances. Challenges to the Cap-and-Trade Program Market participants cautious responses may be motivated by ongoing uncertainties caused by various court challenges to the cap-and-trade program. Todays prices for 2015 allowances may be inexpensive, but if the courts delay, narrow, or totally reject CARBs cap-and-trade program, todays bargain price could be tomorrows regulatory lemon. Most recently, the California Chamber of Commerce filed suit in state court to enjoin CARB from allocating to itself GHG allowances and then selling them through an auction process to raise revenue. This auction earned the state over $230 million. CARB has reserved for sale approximately 10% of GHG emission allowances. The Chamber asserted that CARB should allocate all18

Environmental groups filed a state suit in 2012 challenging the use of offsets (GHG emissions reductions in certain areas that can be used as allowances) for compliance under the capand-trade program. Environmental groups also filed a complaint last year at the Environmental Protection Agency, asserting that CARBs AB 32 regulatory program violates the federal Civil Rights Act of 1964 by not focusing on emissions reduction from specific local emission sources to the detriment of disadvantaged communities. An appeal is pending before the Ninth Circuit of an injunction issued against CARBs enforcement of the Low Carbon Fuel Standard (LCFS) regulations. So far, the LCFS litigation is the only challenge based on the Interstate Commerce Clause in the U.S. Constitution. The Ninth Circuit has suspended the injunction pending its decision. So although CARBs claimed success of its first auction can be construed as a positive first step in Californias GHG regulation through cap and trade, the auction results suggest reluctance by market participants, who remain unconvinced of its regulatory future. California must battle the lawsuits challenging the use of the auction proceeds, the application of offsets, and the viability of the program as a whole. The participation levels and prices associated with the next auction scheduled for February 2013 will provide more evidence as to market participants confidence that California will proceed with a robust cap-and-trade GHG regulation. Allison Davis ([email protected]) and Kerry Shea ([email protected]) are partners in Davis Wright Tremaines Energy Practice Group.POWER January 2013

www.powermag.com

|

TWO GREAT COMPANIES. ONE BRIGHT FUTURE.How do you create a global company built for the future? By combining two powerful histories in pursuit of a bold visionto help companies around the world contribute to healthier, safer environments.Building on the achievements of Pentair and Tycos Flow Control businesses, comprised of Valves & Controls, Thermal Controls and Water & Environmental Systems, the new Pentair delivers exceptional depth and expertise in filtration and processing, flow management, equipment protection and thermal management. From water to power From energy to construction From food service to residential Were 30,000 employees strong, combining inventive thinking with disciplined execution to deploy solutions that help better manage and utilize precious resources and ensure operational success for our customers worldwide. Pentair stands ready to solve a full range of residential, commercial, municipal and industrial needs.

PENTAIR.COMCIRCLE 10 ON READER SERVICE CARD

RESEARCH & DEVELOPMENT

Emerging Technologies Enable No Regrets Energy StrategyAchieving a balance between affordable and sustainable electricity while improving reliability is a challenge unlike any the electricity sector has faced since its inception. Technology innovations in key areas such as energy efficiency, smart grid, renewable energy resources, hardened transmission systems, and long-term operation of the existing nuclear and fossil fleets are essential to shaping the future of electricity supplies.By Arshad Mansoor, EPRI

N

othing in human history has been more transformative than electricity. Thomas Edison patented the lightbulb in 1879. Just a half-century later, President Franklin Roosevelt declared electricity a necessity, not a luxury. And in 2012, the National Academy of Engineering named electrification the greatest engineering achievement of the 20th century. Since its inception, the electricity sector has developed many innovative technologies to improve affordability, reliability, safety, and environmental sustainability. Over the last six decades, even as the power grid has grown dramatically in size and complexity, the price of electricity has remained relatively flat. The average cost of electricity is roughly the same today as it was in the late 1960s, when adjusted for inflation. And the industry has reduced its overall emissions while increasing fossil generation by more than 160% since 1970. But the industry cannot rest on its laurels today in the face of so much uncertainty and so many challenges. It needs to continue to innovate, to adapt to the changing markets and demands of consumers. At the Electric Power Research Institute (EPRI), we foresee unprecedented change in the industry over the next 10 to 20 yearsmore change than in the previous 100 years. The drivers are familiar to industry observers:

the aggregate fossil fuel share of U.S. total energy use will fall from 83% in 2010 to 77% in 2035, while over the same period generation from renewable sources will grow by 77%, raising their share of total generation from 10% in 2010 to 15% in 2035. Technology challenges to reducing carbon dioxide, mercury, and other emissions. A recent EPRI summary report, Prism 2.0: The Value of Innovation in Environmental Controls, projects the U.S. electricity industry will spend $140 billion to $220 billion for emissions control retrofits, new capacity, and fuel plus operation and maintenance between 2010 and 2035, with more than half of the expenditures occurring by 2020.

focused on a no-regrets portfolio of technologies that would allow utilities to maintain a reliable, environmentally sound, and reasonably priced electricity supply even under the uncertainty of fluctuating natural gas prices, unpredictable electricity supply from grid resources, and potentially increasing environmental regulations (Figure 1). Today, these no regrets technologies fall into three broad categories:

EPRI is collaborating with its members, national labs, universities, and other stakeholders to address all of these challenges and continue to provide the power quality and affordability consumers expect. But the projected costs are high. Thats why EPRI is

Flexible resources and operations. This category includes the ability to cycle potentially all generation assets, including coal, fossil, nuclear, and renewable generation technologies. It also includes energy storage, demand response, and other technologies located on consumer premises. Employing flexible investment strategies for securing all assets, including an array of alternative supply and demand resources, is another piece of this vision. Fuel flexibility is another component, including the ability to mix fuels for some technologies (for example, biomass cofir-

1. Balance dispatchable generation with forecastable demand-side resources. The supply side of todays power system consists of baseload generation plus loadfollowing generation, plus or minus bulk energy storage (left side). All those sources must be continuously balanced to meet customer demand minus interruptible load demand response (right side). The cover photo illustrates a vision of a fully integrated electricity system, where supply and demand are not exclusively on opposite ends of the grid. Source: EPRI

The availability of natural gas and its increasing role in power generation. For some months in 2012, gas for the first time matched or exceeded coal for U.S. power generation. And according to the U.S. Energy Information Administration (EIA) Annual Energy Outlook 2012, natural gasfired plants will account for 60% of U.S. capacity additions between 2011 and 2035. The expanding role of renewable generation. The EIA Outlook projects that20 www.powermag.com

POWER January 2013

|

CIRCLE 11 ON READER SERVICE CARD

RESEARCH & DEVELOPMENTing with coal) or combine technologies, such as solar and coal. Long-term operations. In the U.S. alone, the industry has an estimated $1.2 trillion invested in assets. As these assets age, significant investment will be required to maintain or replace them and sustain high levels of reliability. The challenge, as it is in the everyday operation and maintenance of assets, is to do the right repair/ upgrade/replacement at the right time. That requires a wealth of data provided and analyzed using new technologies. An interconnected and flexible delivery system. The first energy management system (EMS) was used to balance generation and demand in 1882, when the first of the Pearl Street Station generators was placed in service in New Yorks lower Manhattan. Later, the first Supervisory Control and Data Acquisition (SCADA) systems were deployed in the 1950s and evolved into todays power system, which delivers 3,900 TWh of electricity, generated from approximately 1,000,000 MW of capacity. This electricity is delivered over 2.4 million miles (equivalent to circling Earth 650 times), which includes 200,000 miles of transmission and 2.2 million miles of distribution. Now EPRI is developing what we call Energy Management System 3.0a highly interconnected, complex, and interactive network of power systems, telecommunications, the Internet, and electronic commerce applications that can seamlessly and efficiently accommodate variable generation, demand response, electric vehicles, smart meters, distributed generation from thousands or even millions of nodes, phasor measurement units, and electronic communications. It includes:

Consumer-focused technologies. We are seeing unprecedented changes in the ways consumers access and use information. Smart devices and the new controls they provide to consumers will profoundly impact industry and require fundamental changes in the way we provide services and interact with end users.

Flexible Resources and OperationsNew tools now under development are expected to lead to better integration of variable generation. Power system flexibilitythe ability of the system to respond to changes in demand or variable generationis crucial to better integrating significant amounts of variable generation. The system will need to manage increased variability and uncertainty over multiple time scales, from seconds and minutes to hours and days. New resources such as battery storage, compressed air energy storage, or demand response enabled by smart grid technologies will also be important sources of flexibility in regions with high variable generation penetration. Additionally, improved variable generation forecasting, new probabilistic operational planning tools, transmission technologies such as high-voltage direct current (HVDC) and flexible alternating current transmission systems (FACTS), and greater coordination among balancing areas can enable smoother

integration of variable generation by allowing the system to manage variability and uncertainty more efficiently and reliably. EPRI is developing processes, with a focus on tools and long-term algorithms, for considering flexibility in resource expansion. Tools will be provided that allow system planners to consider the flexibility needs of the system with high variable generation. They are being designed to enable better planning decisions to maximize the value of flexible resources on the grid. For example, this could lead to metrics to determine the flexibility needs and resources in a system, considering new and existing resources as well as the transmission network in a system. Changes in demand and increased deployment of renewable generation are forcing coal and combined cycle plants to provide system load-balancing service. Specific operational changes expected for coal and gas plants include two-shifting, high ramp rates, high unit turndown, and reserve shutdown (Figure 2). Guidelines for flexible operations that detail best practices for limiting damage from cycling are under development. Owners and operators of fossil power plants need to consider a range of strategies for managing the increasing need for flexible operation. The biggest challenge to mitigating the impacts of power plant cycling is the lack of available data on the impact

2. Equipment life extension. Cycling the typical combined cycle plant accelerates damage mechanisms such as creep fatigue, thermal fatigue, and corrosion, thereby increasing the rate of component life consumption. This wear and tear increases the overall costs of generation, including direct costs such as fuel, water treatment, and maintenance. EPRI is studying component and operational changes that will reduce the impact of cycling. Source: EPRI

Reduce NOx/CO emissions at low load, install inlet dampers, and isolation/ venting of fuel headers

Smart energy. Smart energy is more than just the smart gridan intelligent distribution system, connected at the consumer level in a way that enables seamless integration of resources. Smart energy also includes big data, sophisticated analytics to interpret and maximize the value of the tremendous volumes of new data. And it includes beneficial electrification, exploring better end uses of energy to improve efficiency beyond kilowatthours saved. Grid resilience. As Superstorm Sandy demonstrated last November, we have to be prepared for the unexpected. Improved resilience includes not only power generation resource and grid hardening but also new/improved recovery and consumer survival technologies.

Accommodate winding thermal growth

Improved drains and attemperator sprays, new alloys for thinner walled headers, improved tubeto-header connections, and better-sealing stack damper

Improved drains and steam bypass systems

Automated startups and improved operator displays and alarm management

Improved casing design to reduce distortion and improved thermal insulation

22

www.powermag.com

POWER January 2013

|

RESEARCH & DEVELOPMENTof flexible operations on plant equipment, damage mechanisms, costs, and mitigation strategies. An EPRI project is using existing research results of component-level cycling impacts and mitigation, combined with collaborative sharing of lessons learned and strategies used by organizations worldwide, to develop a comprehensive knowledge resource that can guide a successful transition to flexible operation. These Guidelines for Managing Flexible Operations (EPRI document 1023539) are scheduled to be released in DVD format in March and will contain 80-plus EPRI reports plus non-EPRI cycling-related reports. EPRI also is conducting ongoing flexible operations research and development (R&D) focused on:

tions deserve recognition: one for concrete, one for underwater component inspection, and one for transmission line inspection (Figure 3).Concrete Crawler Allows Real-Time Asset Condition Monitoring. Long-term

Pulverized coal boiler impacts. Improved plant layup practices. Selective catalytic reduction and flue gas desulfurization cycling impacts and mitigation. Designs for increased flexibility in advanced coal plants. Instrumentation and controls to address cycling and turndown. Preventive maintenance for combined cycle plants. Improving power plant operator situational awareness.

An upcoming EPRI report, Plant Operational Flexibility: Emerging Industry Needs and Research Priorities, will document key cycling challenges and R&D needs for the industry.

Long-Term OperationsThe use of robotics to improve asset management is a key technology development area for EPRI. Three autonomous robotic applica-

operation of steam-electric power plants and hydropower facilities requires demonstration of the safety and reliability of concrete cooling, containment, and impoundment structures. Manual inspection is costly and time-consuming, and it exposes personnel to potentially hazardous working conditions. Inspection depth and accuracy are constrained by the capabilities of todays portable nondestructive evaluation (NDE) systems. Robots with the ability to climb and navigate irregular, vertical, and curved surfaces of large concrete structures are commercially available. In 2011, EPRI conceptualized a novel application of this technology: as a platform for automated inspection and advanced NDE of major concrete structures at power plants. This concrete crawler employs a commercially available robotic platform to climb the surface of large power industry structures. It applies on-board systems including simultaneous localization and mapping (SLAM) technology and advanced NDE instrumentation developed for concrete applicationsto conduct automated, highprecision inspections and to capture computer-encoded data and images for maintenance decision-making. The concrete crawler will support longterm operation of generating assets by enabling fast, safe, and in-depth inspection of structures such as cooling towers, hydroelectric dams, and nuclear reactor containments. It will obviate the need to use scaffolding or rappelling for routine structural evaluations, eliminating the associated setup challenges, time requirements, costs, and safety hazards.

Its payload of advanced NDE instrumentation will provide unprecedented abilities to examine the interior of concrete structures and locate and characterize voids, rebar corrosion, and other internal defects. Proof-of-concept testing of a concrete crawler with SLAM capabilities is planned for 2012/2013 at a host site. Follow-on enhancements to the navigation system are anticipated, and the crawlers desired NDE functionalities and requisite power supply, data collection and processing, communications, and other capabilities will be defined. A fully functional first-generation prototype will be constructed and evaluated in diverse industry settings during 2014, with further refinements and field tests leading to the development of specifications for a commercial inspection robot.Submersible Mini-Robot Targets Inspection of Nuclear Reactor Internals.

3. Robotic assistants. The concrete crawler (left) can climb structures and perform nondestructive tests, avoiding the need for a human to be present in a hazardous location or the necessity of erecting costly support structures. The submersible robotic vehicle (right) is being developed to inspect reactor vessels and spent fuel ponds. Courtesy: Climbing Machines; MIT