QMX 2 leaflet NEW Xpress_… · Title: QMX_2_leaflet_NEW Created Date: 5/9/2012 12:34:23 PM

Investor Presentations1.q4cdn.com/118255390/files/20180126-QMX-Corporate-Presentation… ·...

Transcript of Investor Presentations1.q4cdn.com/118255390/files/20180126-QMX-Corporate-Presentation… ·...

New Discoveries & Strong Pipeline in Val d’Or East Mining Camp, Quebec

January 2018 | TSXV: QMX

Investor Presentation

FORWARD-LOOKING INFORMATION:This presentation contains certain “forward-looking information” under applicable securities laws concerning the business, operations and financial performance andcondition of QMX Gold Corporation. Forward-looking information includes, but is not limited to, statements with respect to the benefits and the developmentpotential of the properties of QMX Gold Corporation; the future price of gold; the estimation of mineral reserves and resources; drilling and other explorationpotential; costs; liquidity issues; permitting; success of exploration activities; and currency exchange rate fluctuations. Forward-looking information may becharacterized by words such as “plan,” “expect,” “project,” “intend,” “believe,” “anticipate”, “estimate” and other similar words, or statements that certain eventsor conditions “may” or “will” occur. Forward-looking information is based on the opinions and estimates of management at the date the statements are made, andare based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differmaterially from those projected in the forward-looking information. Information and assumptions upon which such forward-looking information is based includesbut is not limited to; title to mineral properties; understanding of geological trends and influences in the region; financing requirements; and general economicconditions. Many of these assumptions are based on factors and events that are not within the control of QMX Gold and there is no assurance they will prove to becorrect. Factors that could cause actual results to vary materially from results anticipated by such forward-looking information includes changes in marketconditions, fluctuating metal prices and currency exchange rates, the possibility of project cost overruns or unanticipated costs and expenses, labour disputes andother risks of the mining industry, as well as those risk factors discussed or referred to in the Management’s Discussion and Analysis for QMX Gold Corporation filedwith the securities regulatory authorities in Canada and available at under the corporations profile on SEDAR at www.sedar.com. Although QMX Gold has attemptedto identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may beother factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information willprove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. QMX Gold undertakes no obligation toupdate forward-looking information if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. Thereader is cautioned not to place undue reliance on forward-looking information.Comparative market information is as of a date prior to the date of this presentation.

IMPORTANT NOTICE:This presentation does not constitute an offer to buy or an invitation to sell, any of the securities of QMX Gold Corporation. Such an offer may only be madepursuant to a registration statement and prospectus filed with the U.S. Securities and Exchange Commission and an offer to purchase and circular filed withCanadian securities regulatory authorities.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES:This presentation uses the terms “Measured, “Indicated” and “Inferred” Resources. U.S. investors are advised that while such terms are recognized and required byCanadian regulations, the Securities and Exchange Commission does not recognize them. “Inferred Resources” have a great amount of uncertainty as to theirexistence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred resource will ever be upgraded to ahigher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or other economic studies. U.S. investors are alsocautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

NATIONAL INSTRUMENT 43-101:David Rigg, P.Geo. the Senior VP of Exploration of the Company and a Qualified Person under NI 43-101, has supervised the preparation of and approved thescientific and technical information in this presentation.

TSXV: QMX 2

Cautionary Note Regarding

Forward Looking Statements

Capital Structure

Shares Outstanding: 164.1mln

Options: 10.7mln

Warrants: 6.1mln

Cash: ~C$5.5mln

Long-term Debt*: ~C$2.2mln

Market Cap: C$49mln

As at Jan 9, 2018

*Excluding ~C$3.8 million relating to deferred closure costs.

Strategic Investors:

Osisko Gold Royalties 14.2%

Probe Metals 9.1%

Currently funded for multiple phases of drilling throughout 2018

TSXV: QMX 3

QMX Gold – Capital Structure (QMX-V)

Val d’Or East Camp – Highly Prolific Region of Canada

Frankfurt Exchange OU2A

TorontoVentureExchange

QMX

Research Coverage:

Mackie Research – Spec Buy

$0.60 price target

(C$) Millions

As atSep 30, 2017

As atSep 30, 2016

Cash 1.9* 0.1

Accounts Payable 0.8 13.5

Total Current Liabilities 1.2 19.4

Long Term Debenture 2.1 2.2

Deferred Closure Costs 3.8 3.8

Working Capital 1.5 (17.9)

$33

$43

$49

$63

$131

CartierResources

AlexandriaMinerals

QMX Gold

MonarquesGold

ProbeMetals

QMX vs Other Companies Active in Val d’Or: Market Cap (C$M)

* Excludes $6.4mln equity financing announced October 5, 2017

4

A Quebec focused Exploration Company with an extensive, underexplored and highly prospective land package on the Abitibi Greenstone Belt in the Val d’Or East Mining Camp

➢ Nearly 200km2 in Val d’Or East Mining Camp➢ Over $5 million on the balance sheet➢ Multiple drill rigs turning with significant pipeline of drill ready targets➢ Supportive corporate shareholders: Osisko Gold Royalties and Probe

Metals

QMX Gold (QMX: TSXV)

What is QMX Gold?

Strategy - Systematically evaluate ~200km² land package; - Prioritize and drill test near term targets based on

new geological interpretation of historical data;- Evaluate longer term potential.

• Abitibi – 3rd Largest Gold District in the World

• Many of Canada’s major mining companies originated in the Abitibi

• 8 Major Gold Mining Camps along belt

• QMX Gold is located in Val d’Or East Mining Camp on the Southeastern portion of the Abitibi Belt

• Multiple historical mining operations and new discoveries in Val d’Or region

TSXV: QMX 5

QMX Gold (QMX: TSXV)

Located on Highly Productive Abitibi Belt

TorontoMontreal

Canada QMX GOLD

Val d’Or East

High Priority: East Zone & Southwestern Zone

➢ East Zone – Three priority targets across a ~9km strike

• Bonnefond South - Data compilation - Completed- Phase I drilling - Completed- Phase II drill testing model reinterpretation - Underway

• Bevcon Intrusive - Data compilation - Completed- Drill testing multiple prospective gold showings - Underway

• New Louvre - Data compilation - Completed- Phase 1 drill testing multiple prospective gold showings – Underway

➢ Southwestern Zone - Phase I reconnaissance drilling - Completed- Sigma-Lamaque extension drilling – Underway

• Follow-Up on Recent Successes – Bonnefond South Target, Southwestern Zone and Beacon Target‒ Evaluating follow-up programs given new discoveries, surveys, orientation results and

new drill data

• Longer Term Focus – Systematically Test Prospective Zones

‒ Multiple prospective Gold and Base Metal targets with limited recent exploration (Central and Bourlamaque Zones)

‒ Evaluate potential custom milling contracts for Aurbel Gold Mill

QUEBEC

ONTARIO

Montreal

Toronto

QMX GOLDVal-d’Or, Qc.

➢ Strong Exploration Pipeline on Highly Prospective Land Package

Drilling Underway

Exploring Enviable Position in Val d’Or East

TSXV: QMX 6

QMX Gold – Catalysts

Upcoming Catalysts

➢ Bonnefond South Plug – Phase I results (New Release January 29, 2018)

➢ Bonnefond South Plug – Phase II drill program

➢ Bevcon Intrusive drill programs

➢ North Shear target

➢ Buffadisson South target

➢ West extension Buffadisson/ Bevcon Mine target

➢ New Louvre drill program

➢ Southwestern Zone drilling campaigns and expanding knowledge base

➢ Evaluate additional prospective gold and base metal zones within land package

➢ Strategic review of non-core exploration properties and assets

➢ Pursue custom milling contracts

TSXV: QMX 7

Taking a Systematic and Methodical Approach to its Large Land Package➢ Initial focus is on Val d’Or East targets and Southwestern Zone

TSXV: QMX 8

Val d’Or East Mining Camp Property

Enviable Land Position - Multiple Prospective Targets

TSXV: QMX 9

QMX Gold – Near Term Opportunities; Multiple Targets within East Zone

East Zone – Unexplored area over 9 km Strike▪ Large 28km2 target zone encompassing the Bonnefond South and Bevcon Intrusion with multiple targets

across >9km strike length

▪ Very limited recent exploration - last drill program on the Bevcon Intrusive was in 1992 and Bonnefond South was in 1999

▪ Bevcon mine produced 438,000 oz from 1940 to 1960. The gold-bearing Quartz Tourmaline vein systems were mined over a strike of >1,000m and to a depth of 680m (deposit open at depth)

▪ Historical mining/exploration focused within a narrow corridor, limited UG drilling and shallow surface drilling. A review of historical drilling highlighted prospective targets including:

• The northern part of the Bevcon Intrusion on trend of a potential eastern extension of Bonnefond South. The geological context similar to the Bonnefond South and Lamaque Project (previously Integra) with gold-bearing shear zones and plug/sill style intrusion hosted gold mineralization including – New Louvre, North Shear and 3D Mag Inversion anomalies

• Multiple areas to the south and along strike of the Bevcon/Buffadison mines – historical drilling intersected similar veining over 3km using shallow drilling – West Extension and Buffadison South

• Additional gold showings within and along the margin of the Bevcon Intrusion -re-evaluated in relation to the geometry of the gold mineralization from recent discoveries.

TSXV: QMX 10

QMX Gold – Near Term Opportunities; Multiple Targets within East Zone

East Zone – Unexplored Highly Prospective Area

AUR Resources discovered a plug-like, tonalitic intrusion 2km east of the Louvicourtmine

Mineralized veins in shear zones and within a tonaliteplug - similar to plugs on Eldorado’s Lamaque Property

The current geological interpretation indicates that the gold system remains open on strike and at depth

Result from Phase 1 drilling confirm a misinterpretation of the shear & vein orientations

TSXV: QMX 11

QMX Gold – Near Term Opportunities; Multiple Targets within East Zone

Bonnefond South Target – Re-evaluating ModelPhase I Drilling Results

Testing reinterpretation of the historical geological model

Phase I program consisted of 9 holes for 4,331m to test vein, fault and shear orientations and confirm gold distribution within the Tonalitic Plug. Results show previous drilling did not test all vein systems adequately

Phase II program will evaluate the Tonalitic Plug with an infill drilling and test the eastern extensions of this gold system

QMX Gold – Near Term Opportunities; Multiple Targets within East Zone

Bonnefond South Target – 2017 Result Phase I

TSXV: QMX 12

TSXV: QMX 13

QMX Gold – Near Term Opportunity; Targets on Trend of Triangle Deposit and Sigma/Lamaque Mines

Southwestern Zone – On Trend of Lamaque Property

Early 2017 QMX made a new discovery on Southwestern Zone- Testing along trend of Triangle Zone and Sigma/Lamaque (former producers)

Limited deep exploration in this area

Encouraging gold intersections on trend from Sigma/Lamaque mines

Magnetic anomaly and shear zone continuity trending eastward from Lamaque Property (Eldorado)

3D Mag Inversion anomalies untested

Corporate Headquarters

800-65 Queen St. W.

Toronto, Ontario

M5H 2M5 Canada

Thank you.

QMX Gold – Experienced Team

Management Team & Board of DirectorsManagement

Brad Humphrey | President, Chief Executive Officer & Director

+20 years of international mining experience, predominantly as a precious metals analyst. Prior to joining QMX Gold, Mr. Humphrey worked for Morgan Stanley as an Executive Director and North American Precious Metals Analyst, where he was responsible for growing Morgan Stanley’s North American Gold research coverage. Mr. Humphrey was also a Managing Director and Head of Mining Research at Raymond James and covered precious metal equities at CIBC World Markets and Merrill Lynch. Before starting his capital markets career, Mr Humphrey held a variety of mining industry roles from Corporate Development to contract underground miner.

David Rigg | Senior Vice President, ExplorationDavid has +30 years of experience in the mining industry, including work on exploration and mine development programs in Ontario and Quebec. Most recently, he was President and CEO of the former Alexis Minerals Corporation and was the President and CEO of Liberty Mines. He has worked for Agnico Eagle Mines in Val d’Or, Quebec in various capacities including Exploration Manager Agnico Eagle Mines and has gained international experience in Africa and Sweden. He contributed to the discovery of the Musselwhite Mine and was a member of the Laronde Mine discovery team awarded Prospector of the Year award by the QPA in 1995. Mr. Rigg obtained a B.A. and M.A. from King’s College, Cambridge University, England in 1978 and a M.Sc. at Queens University in 1980.

Jules Riopel | Director of ExplorationMr. Riopel is a seasoned exploration professional with more than 2 decades of experience at all stages of exploration from grassroots through to production. Prior to joining QMX Gold, Mr. Riopel was Vice-President Exploration and Acquisition for Adventure Gold where he was directly involved with the Pascalis-Colombiere discovery adjacent to the QMX Gold land package. Mr. Riopel has spent the majority of his career in the Abitibi with several major mining companies including Richmont, Noranda and Cambior.

Deb Battiston | Chief Financial Officer

+15 yrs of accounting, tax and corporate finance experience in Canada and Europe. From 2007-2010, she was the CFO of CD Capital Partners, a private real estate firm focused on developing mixed use retail and office real estate in Russia, Ukraine and Romania. From 2001-2008, she was the CFO of MAVA Investment Ltd., a private equity firm based in Budapest, Hungary.

Board of Directors

Michael Timmins | Executive Chairman Mr. Timmins is a mining executive with over 20 years of technical and corporate development experience at Agnico Eagle Mines Limited and Placer Dome Inc. Prior to joining QMX, Michael worked for AgnicoEagle as Vice-President, Corporate Development. During his tenure at Agnico, Mr. Timmins participated in the construction and commissioning of the Kittila Mine in Finland and led several key acquisitions and strategic investments into junior gold companies. Prior to working at Agnico Eagle, Mr. Timmins worked in various operational capacities in the Red Lake camp for Placer Dome. Michael is a graduate of Queens University (MBA), the University of British Columbia(M.Sc.) and Bishops University (B.Sc.).

Brad Humphrey | President, Chief Executive Officer & Director

Stéphane Amireault | DirectorStéphane Amireault to its Board of Directors. Mr. Amireault, MScA, P.Eng., has over 25 years of experience in mineral exploration, and is currently Vice President Exploration for Belo Sun Mining. Prior to joining Belo Sun, Mr. Amireault was the Vice President Exploration for Sulliden Gold Corporation until its acquisition by Rio Alto Mining in 2014. Mr. Amireault holds a master’s degree in Applied Sciences from École Polytechnique of the University of Montréal and is a member in good standing of the Ordre des Ingénieurs du Québec.

Ralph Lean | DirectorMr. Lean is a highly regarded business lawyer in the Toronto office of GowlingWLG. Mr Lean brings a broad base of expertise from startups to global corporations, in the private and public sectors as well as nationally and internationally. Mr. Lean was named one of the National Post’s “most influential” business people in Canada.

Bruce Humphrey , P.Eng. | DirectorMr. Humphrey is a mining engineer with over 35 years' experience. He served as the President and Chief Executive Officer of Desert Sun Mining Corp. from October 2004 to April 2006. From May 1998 to May 2004, Mr. Humphrey served as Senior Vice President and Chief Operating Officer of Goldcorp Inc. He is a member of the Professional Engineers of Ontario. He also serves as a director of several public companies in the resource sector. TSXV: QMX 15

• Hole 25: 1.5g/t over 118.9m; incl. 2.5g/t over 44.1m

• Hole 26 : 1.9 g/t over 83.8m, well distribution gold value

• Confirm presence of sheared mafic dykes hosting quartz-tourmaline veins

• Mineralization is associated with multiple sets of quartz-tourmaline veins, one sub-parallel to the previous hole direction – not adequately tested

• Multiple shear zones were intersected within footwall volcanic rocks in footwall

Assays provided innext slide

TSXV: QMX 16

QMX Gold – East Zone: Bonnefond South Target

Bonnefond South Target – Geological Sections

QMX Gold - East Zone: Bonnefond South Target

Bonnefond South Target – 2017 Phase 1 Result

•Reported length are measured along the hole.** Au uncut. TSXV: QMX 17

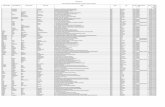

Drill HoleFrom

(m)To (m) Length (m)* Grade (g/t Au)** Geology

17315-17-25 61.7 180.6 118.9 1.5 Tonalite

Incl. 78.6 122.7 44.1 2.5

with 79.5 86.0 6.5 4.2 Shear Maf ic Dyke

and 111.1 116.7 5.6 4.5 Shear Maf ic Dyke

17315-17-26 71.8 155.6 83.8 1.9 Tonalite

Incl. 95.8 106.0 10.2 4.9 Shear Maf ic Dyke

17315-17-27

204.1 297.8 93.7 1.4 Tonalite

449.8 454.4 3.8 1.8 Shear Zone

17315-17-28

86.8 157.3 70.5 0.4 Tonalite

200.5 204.0 3.5 3.0 Shear Zone

375.0 382.7 7.7 1.0 Shear Zone

17315-17-29

63.0 151.9 88.9 1.2 Tonalite

201.0 204.3 3.3 4.2 Shear Zone

356.1 364.9 8.8 13.2 Shear Zone

17315-17-30

110.8 149.5 38.7 1.1 Tonalite

Incl. 113.3 117.2 3.9 3.3 Mafic Dyke

221.4 225.1 3.7 1.9 Shear Zone

17315-17-31 243.8 252.8 9.0 0.6 Tonalite

17315-17-32

122.3 123.3 1.0 15.2 Shear Zone

452.6 461.6 9.0 1.7 Shear Zone

Incl. 456.4 459.6 3.2 2.8

17315-17-33

271.3 339.5 68.2 1.9 Tonalite

Incl. 271.3 311.0 39.7 2.5

Incl. 331.6 339.5 7.9 3.4

QMX Gold – Recent Discoveries

Select Results from Southwestern and Beacon DrillingSouthwestern Zone – Reconnaissance Drilling

Hole From (m) To (m) Length (m)* Au Grade (g/t)

17307-16-002 93.1 93.8 0.7 14.0

17307-16-003 132.7 135.0 2.3 1.2

181.8 135.0 1.0 2.3

17307-17-007 35.8 36.9 1.1 1.0

96.3 97.3 1.0 1.4

108.3 118.5 10.5 2.0

incl. 113.2 116.4 3.2 4.9

124.6 125.8 1.2 2.0

135.3 136.5 1.2 2.1

Bourlamaque Zone - Beacon Target

Hole From (m) To (m) Length (m)* Au Grade (g/t)

17319-17-005 36.4 41.8 5.4 6.1

incl. 40.8 41.8 1.0 32.6

72.0 75.0 3.0 7.6

incl. 72.0 74.0 2.0 11.1

17319-17-007 12.0 17.1 5.1 2.4

26.1 27.2 1.1 1.1

17319-17-008 4.2 5.3 1.1 1.1

16.3 17.7 1.4 4.5

45.5 46.6 1.1 4.5

TSXV: QMX 18* Reported length are measured along the hole.Au uncut.