Investor Presentation - · PDF fileAston Swift, Vice President Investor Relations Barcelona...

Transcript of Investor Presentation - · PDF fileAston Swift, Vice President Investor Relations Barcelona...

Investor Presentation

NOVEMBER 2017 ASTON SWIFT, IR

Contents

1 Applus introduction (3-12)2 Divisions description (13-17)3 Inversiones Finisterre and

Equity Raise (18-26)4 Equity Analysts (27)

2

CALENDAR AND FURTHER INFORMATION

2017 FY 27 February 2018

2018 Q1 10 May 2018

2018 H1 24 July 2018

2018 Q3 30 October 2018

Ticker: APPS-MC

Aston Swift, Vice President Investor Relations

Barcelona +34 935 533 111

www.applus.com

CALENDAR AND CONTACT

3

4

Applus+ at a Glance

Applus+ is one of the world's leading Testing, Inspection & Certification companies. It provides solutions for customers in all types of industries to ensure that their assets and products meet quality, health & safety, and environmental standards and regulations.

19,000employees in 2016

€ 1,587million total revenue in 2016

70countries across all continents

accreditedby major international organisations

US & Canada

Latin America

Spain

Rest ofEurope

AsiaPacífic2,100

20%

6,00018%

3,70028%

1,90013%

2,00012%

Employees%total revenue

in 2016

Employees%total revenue

in 2016 Employees%total revenue

in 2016

Employees%total revenue

in 2016

Employees%total revenue

in 2016

Employees%total revenue

in 2016

Middle East& Africa

3,3009%

· ALGERIA· ANDORRA· ANGOLA· ARGENTINA· AUSTRALIA· AZERBAIJAN· BAHRAIN· BELGIUM

· BOLIVIA· BRAZIL· BRUNEI· CAMEROON· CANADA· CHILE· CHINA· COLOMBIA

· COSTA RICA· CZECH REPUBLIC· DEMOCRATIC REPUBLIC OF CONGO· DENMARK· ECUADOR· EGYPT· EL SALVADOR

· EQUATORIAL GUINEA· FINLAND· FRANCE· GABON· GERMANY· GHANA· GUATEMALA· INDIA

· INDONESIA· IRAQ· IRELAND· ITALY· JAPAN· KAZAKHSTAN· KUWAIT· MADAGASCAR

· MALAYSIA· MEXICO· MOROCCO· MONGOLIA· MOZAMBIQUE· NETHERLANDS· NICARAGUA· NIGERIA

· NORWAY· OMAN· PAKISTAN· PANAMA· PAPUA NEW GUINEA· PERU· PHILIPPINES

· POLAND· PORTUGAL· QATAR· RUSSIA· SAUDI ARABIA· SINGAPORE· SLOVAKIA· SOUTH AFRICA

· SOUTH KOREA· SPAIN· TAIWAN· THAILAND· TURKEY· UKRAINE· UNITED ARAB EMIRATES· UGANDA

· UK· USA· UZBEKISTAN

5

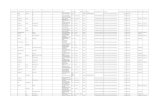

Financial Institutions andother shareholders

Milestones

1996 - 2003 2004 - 2007 2008 - 2013 2014 - 2015

100%

53%

25%

22%

70%

30% 1 0 %

Acquisition of VELOSI (est 1982)

Acquisition of 20 more businesses

Acquisition of RTD (est 1937)

Acquisition of Norcontrol (est 1981)

The IPO of

Automotive established

IDIADA contract awarded (est 1971)

Labs contract awarded (est 1907)

Free Float

Financial Institutions andother shareholders

7 5 %

Shareholding

Energy & Industry division formed

1 5 %

Period

Established over 20 years

Current equity ownership (>3%)

Source: CNMV disclosures as of 3 November 2017

2016

Rev €1.6bn

AOP €141m

FCF €129m

99% Free Float

6

7

Revenue for 2011 and 2012 are proforma for acquisitions within the relevant acquisition year

CAGR 2011-16: 6.1%

1,180

Reve

nue

(€ m

illio

n)

1,4601,581 1,619

1,7021,587

Revenue History

8

• A “TIC” company benefiting from Quality, Safety & Environmental structural growth drivers:• Regulations, Risk, Outsourcing, Product Variety, Complexity, Ageing

• Leading market positions in key markets

• Good balance of developed (2/3) and emerging market (1/3) exposure

• High entry barriers: accreditations, reputation, relationships, network, innovation

• Resilient earnings profile due to critical nature of work, differentiated offerings, blue-chip customer relationships, diversified revenue streams and flexible cost base

• Longer term margin potential

• Management experience of TIC industry and managing challenging markets

• Strong cash flow with low capital intensity that can comfortably manage higher gearing levels

• Fragmented industry

With 42% O&G exposed end markets, Applus+ is demonstrating its resilience in the current environment and recover when energy capex spending resumes

Investment Case

9

Growth Drivers and Key Risks

Energy & IndustryIDIADA

(Automotive Engineering & Testing)

Automotive(Statutory

Vehicle Inspections)

Infrastructure investment

Maintenance of ageing assets (eg Pipes, Refineries, buildings)

Growth in Emerging Market infrastructure

Increase in regulations

Economic growth in Spain

Key risks: decline in capex and opex spend in Oil & Gas

Resilience to economic downturn

Developing countries adopting statutory inspection programmes

Incease in car volume

Increase in regulations

Key risks: contract renewals

Regulations of vehicle safety and emissions

Increased number of vehicle models / shorter product life cycle

Increased outsourcing in developed markets

OEMs in Emerging Markets need to import technical know-how

Key risks: reduced R&D spend and model variants in Auto OEM and contract renewal

See Annual Financial Statements for all risks and further detail

Structural Growth Drivers

Fernando Basabe

CEO

ENERGY & INDUSTRY DIVISION

LABORATORIES DIVISION

IDIADA DIVISION

AUTOMOTIVE DIVISION

Joan AmigóCFO

José Delfín PérezHuman Resources

M. Teresa SanfeliuHSQE

Jorge LluchCorporate Development &

Communications

Eva ArgilésLegal

Anna DíazCompliance

Pablo San Juan

Latin America

Phillip Morrison

North America

Nothern Europe

Sytze Voulon

Mediterranean

Ramón Fernandez

Armas

Jordi Brufau

Carles Grasas

Aitor Retes

Ramón Fernandez Armas

Africa

Guillermo Andres

Middle East Oceania Southeast Asia

Brian Dawes

Cameron Waters

Derek Burr

10

Group management

11

• No. 1 in Non Destructive Testing (NDT) for the Oil & Gas industry

• No. 2 Operator of Statutory Vehicle Inspections

• Leading independent Auto Proving Ground

Leadership in chosen markets and technology

• c. 19,000 employees

• > 70 countries

• Over 48,000 customers

• Organised through 4 divisions

Global platform with local presence

• Revenue of €1,587 million, down 6.8% on 2015

• Adj. Op. Profit of €141 million, 8.9% margin

• Adj. Net Profit €83.7 million, down 14.5%

2016 results

End markets (2016)

Oil & Gas42%

Statutory Vehicle Inspection

19%

Auto OEM11%

Power9%

Other13%

Diversified geographic footprint (2016)

Rest of Europe

28%

North America

20%

Latin America

9%

Asia Pacific13%

Middle East, Africa

12%Spain18%

Construction3%

Aero 3%

Today: Global Leader in Testing, Inspection and Certification

12

LABORATORIES DIVISION

Statutory vehicle inspection services for safety and emissions.

Industrial and environmental inspection, technical assistance, non-destructive testing (NDT) and technical staffing.

Product testing and system certification services from multidisciplinary laboratories.

Proving ground, design, engineering, testing and homologation services.

employees12,500€1,053M

(66%) employees800€61M

(4%) employees3,500€293M

(19%) employees2,200€180M

(11%)

ENERGY & INDUSTRY DIVISION AUTOMOTIVE DIVISION IDIADA DIVISION

Divisions

2016 Revenueand employees

Main Activities

Margin

2016 Adj Operating

Profit(% Group)

€80m(48%)

€6m(4%)

€57m(35%)

€22m(13%)

7.6% 10.0% 19.6% 12.4%

13

Revenue by End Market (2016)Overview

Revenue by Geography (2016)

Asia Pacific14%

North America26%

Europe32%

Latin America10%

Africa & Middle East18%

• The former divisions of RTD, Velosi and Norcontrol. Integrated into one in 2017

• Assesses the quality, safety, environmental and efficiency of design, construction and operation of industrial and civil infrastructure

• Non Destructive Testing, Inspection, Certification, Quality Assurance and Control, Site Supervision, Project Management, Vendor Surveillance, Technical Staffing

• 60 countries with 12,500 employees

• Top Customer < 6%. Top 10 = 27%

Oil & Gas63%

Mining4%

Construction5%

Power14%

Telecom2%

Aerospace3%

Other9%

Energy & Industry Division

• Overall Oil & Gas revenue down by 18% in 2016. Most of this mainly capex/upstream in Africa, LatAm and North America

Oil & Gas Exposure

14

ROW2%

LatAm3%

USA9%

Revenue by Geography (2016)

Spain50%

Rest ofEurope

25%

Overview

• Product testing and certification services

• Multi-technology state-of-the-art laboratories serving the Aerospace, Auto, Construction, Energy, IT industries

• Presence in Europe, Latin America, North America, Asia and Saudi Arabia with 800 employees

Asia10%

Laboratories Division

15

16

Revenue by Geography (2016)Overview

Revenue by Service (2016)

Body & Passive Safety34%

Homologation15%

Asia Pacific25%

Rest of Europe50%

Spain21%

Rest of World3%

• Founded in 1971. HQ in Tarragona, Spain

• Owned 80% by Applus+ and 20% local government and since 1999 Applus+ operates the assets owned by the local government under a long term contract1

• Engineering, testing, homologation and R&D services provider to the leading vehicle manufacturers (OEMs)

• Specialised facilities, people and proving ground with knowledge of global technical requirements

• Global network in 23 countries across Europe, Asia and Latin America with 1,980 employees

Proving Ground19%

Chassis & Powertrain

32%

IDIADA Division

17

Revenue by Geography (2016)Overview

Revenue by Regulatory Regime (2016)

Concession/authorisation

based (regulated)80%

Liberalised20%

North America13%

• Established in Spain in 1996

• 2nd largest statutory vehicle inspection operator globally1 with leading market positions in Europe and Americas: 11 million inspections pa and programme manage another 5 million by 3rd parties

• Vehicle safety and emissions inspection

• Active in both regulated and deregulated markets

• Europe and Americas with 3,500 employees

1. Based on number of inspections carried out

Scandinavia16%

Spain29%

Latin America15%

Ireland27%

Automotive Division

18

1. Acquisition of Inversiones Finisterre

• Reinforces our global leadership position in Auto Inspection

• Highly visible and stable cash flows

• Accretive for margin and earnings per share

• Funded by an equity accelerated book build

• Leverage will reduce

• Well positioned to make further attractive acquisitions

18

• Private company with 30 years of experience managing vehicle inspection concessions in Spain, Costa Rica and Argentina

• Argentina will transfer to a third party• Well known to Applus+• The current owners will retain 20%

2. Inversiones Finisterre

Applus+ Minority Partners (Spain)

Inversiones Finisterre

Supervisión y Control (Galicia)*

Minority Partner (Costa Rica)

Riteve (Costa Rica)*

80% 20%

100%

55% 45%

* Operating Companies

19

20

• Unique opportunity to acquire two highly attractive businesses• Vehicle inspection concessions in Galicia (Spain) and Costa Rica• Revenue of c. €74 million in FY 2017• Four million annual vehicle inspections growing between low and mid single digits • Price agreed of c. €89 million for 80% ownership with an agreement to, subject to

certain events, acquire the remaining 20% after July 2022• Expected to close in 2017• Low integration risk

3. Transaction Highlights

20

4. Galicia

• Supervisión y Control S.A.• Established in 1987• Concession currently runs to Dec 2023 and can be extended in four year

periods up to 2037• Revenue in 2017 of c. €47 million with a margin above Auto division average• Provides services on an exclusive basis in Galicia through 25 stations and 10

mobile inspection centres and over 500 people• Gives Applus+ a presence in 9 Autonomous Regions in Spain• Benefit from back office efficiencies and increased scale• Number of inspections 2014-2017E CAGR at 3.7%

21

5. Costa Rica

22

• Best in class operation in Central America• Contract started in 2002 for ten years, has been extended ten years to 2022 and

can be further extended• Revenue in 2017 of c. €27 million with a margin above Auto division average• Provides services on an exclusive basis in the country through 13 stations and 4

mobile inspection centres and over 400 people• With a presence in 5 countries, Applus+ will now be the leader in Latin America

and in the best position to win further opportunities in the region• Number of inspections 2014-2017E CAGR at 6.1%

22

6. Strong Track Record in New and Renewed Programmes

• In last 10 years:• 15 new programmes• 10 programmes extended or won re-tender• 1 contract lost and re-won in 2016 (Massachusetts)

2323

7. A Broadly Diversified Auto Division

• Portfolio of 25 programmes in 2016 becomes 27 with this acquisition and 30 after the new programmes in Massachusetts, Uruguay and Ecuador commence

• Auto division proforma 2016 revenue is 22% of Group versus 19% previously

24

25

• Applus+ raised 13 million shares, 10% of current capital at €10.55

• Proceeds to be used to fund the acquisition and reduce debt

• Leverage will reduce:• End 2017 by 40-60 bps (proforma)• End 2018 by further 40 bps

• Increasing financial flexibility

8. Equity Raise

25

9. Summary of Acquisition and Equity Raise

26

• Adds €74 million of highly visible, stable revenue and cash flow

• Strengthens global leadership position in Vehicle Inspection

• Applus+ becomes the leader in Latin America where there are further opportunities

• Accretive for Group margin and EPS

• Combined with the equity raise, reduces leverage and positions Group for further attractive acquisitions

26

CALENDAR AND FURTHER INFORMATION

London: Madrid, Porto, Paris, Zurich:

Barclays, Paul Sullivan Santander, Robert Jackson

Morgan Stanley, Toby Reeks Sabadell, Andres Bolumburu

UBS, Denis Moreau Fidentiis, Alberto Sanchez

Citigroup, Ed Steele Alantra Equities, Alvaro Lenze

Berenberg, Josh Puddle Ahorro, Javier Díaz

Exane, George Gregory Caixa BPI, Filipe Leite

JPMorgan Cazenove, Robert Plant Oddo, Emira Sagaama

Credit Suisse, Andy Grobler Mainfirst, Mourad Lahmidi

Jefferies, Will Kirkness Kepler Cheuvreux, Aymeric Poulain

EQUITY ANALYSTS

27

This document may contain statements that constitute forward looking statements about Applus Services, SA (“Applus+” or “the Company”). These statements are based on financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations, which refer to estimates regarding, among others, future growth in the different business lines and the global business, market share, financial results and other aspects of the activity and situation relating to the Company.

Such forward looking statements, by its nature, are not guarantees of future performance and involve risks and uncertainties, and other important factors that could cause actual developments or results to differ from those expressed in these forward looking statements.

These risks and uncertainties include those discussed or identified in fuller disclosure documents filed by Applus+ with the relevant Securities Markets Regulators, and in particular, with the Spanish Market Regulator.

Applus+ does not undertake to publicly update or revise these forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be realised.

This document may contain summarized information or information that has not been audited. In this sense, this information is subject to, and must be read in conjunction with, all other publicly available information, including if it is necessary, any fuller disclosure document published by Applus+.

Nothing in this presentation should be construed as a profit forecast.

Disclaimer

28