Investor Presentation Oct10

-

Upload

adithya-hiriyannaiah -

Category

Documents

-

view

218 -

download

0

Transcript of Investor Presentation Oct10

-

8/8/2019 Investor Presentation Oct10

1/29

Investor Presentation

Bharti Airtel LimitedOctober 2010

-

8/8/2019 Investor Presentation Oct10

2/29

-

8/8/2019 Investor Presentation Oct10

3/29

3

Mobile Services Telemedia Services Enterprise Services DTH

The Company...Bharti Airtel An Integrated Telco

Wireless Services

2G

3G Rural Market

Telemedia Services

Fixed Line Broadband

IPTV

Enterprise Services

Carriers

Corporates

Passive Infrastructure Services

Infratel

Indus

DTH

Pay per view / HD

Interactive Services including

Gaming

Fully integrated telecom player offering end to end solutions

and entering new geographies

-

8/8/2019 Investor Presentation Oct10

4/29

4

Mobile Services Telemedia Services Enterprise Services DTH

Bharti a growth journey

DELHI

1996 2001 2003 2004 2010

No. of circles Today

1 5 15 22 19 countries

-

8/8/2019 Investor Presentation Oct10

5/29

5

Mobile Services Telemedia Services Enterprise Services DTH

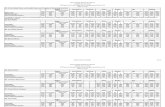

Growth trajectory reflected in the numbers

Continuing on our journey of Value Creation

Note: 1) 2010 financials are as per FY 2010 results. 2) Exchange rate: Financials as of 31stMar 10 : Rs 45.14

Single Circle Operator + telephone

instruments

Company Profile Largest integrated private telecom

operator

< 25k Customers ~ 137 mn

~ USD 17 mn Revenue ~ USD 9 bn

~ USD 2.5 mn EBITDA ~ USD 4 bn

~ USD 1.4 mn Cash Profit ~ USD 4 bn

~ USD 16 mn Market Capitalization ~ USD 26 bn

1996 2010

-

8/8/2019 Investor Presentation Oct10

6/29

6

Mobile Services Telemedia Services Enterprise Services DTH

3,3603,550

1,651

2,519

0

1,000

2,000

3,000

4,000

5,000

2007 2008 2009 2010

Years

1,8762,017

1,484

943

0

500

1,000

1,500

2,000

2,500

2007 2008 2009 2010

Years

3,103

3,679

2,467

1,619

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2007 2008 2009 2010

Years

8,1888,776

5,987

4,103

0

2,000

4,000

6,000

8,000

10,000

2007 2008 2009 2010

Years

Revenue & Profitability trends

Source: Financials for the year ended March 31, 2006, 2007, 2008, 2009 & 2010 are audited and as per USGAAP. The above numbers are in Mn USD re-stated at 31stMar 10exchange rate.Exchange rate as of 31st Mar 10 : Rs 45.14

EBITDATotal revenues

Cash profit from operationsNet profit

Bharti Airtel demonstrating robust performance

39%CAGR

42%CAGR

42%CAGR

36%CAGR

42%CAGR

-

8/8/2019 Investor Presentation Oct10

7/29

7

Mobile Services Telemedia Services Enterprise Services DTH

Financials & Positioning

Key financial metrics Positioning in the world & in India

3rd LARGEST wireless operator in the world (1)

LARGEST private INTEGRATED telecom

company in India

5th LARGEST INTEGRATED telecom operator

in the world

LARGEST operator in NLD, ILD and VSAT

business

LARGEST TELECOM company listed on Indian

Stock Exchanges

Note: FY10 numbers are as per IFRS as per June10 quarterly report. Exchange rate for Re to $ conversion: 45.14.

* EBITDA Margin before acquisition related costs of Rs 976 mn for the quarter & FY ended Mar 31, 2010.(1) 3rd largest wireless operator in the world refers to in-country (single country) operator based on the number of subscribers.

FY 10 (in Mn)

Customers 137.0

Revenue $ 9,271

EBITDA $ 3,714

Cash Profit $ 3,710

Net Income $ 1,989

EBITDA Margin (%) 40.3*

ROCE (%) 24.4

-

8/8/2019 Investor Presentation Oct10

8/29

8

Mobile Services Telemedia Services Enterprise Services DTH

Latest Results 1Q11

Key operating and financial metrics Continued Strong Performance

Wireless CMS 21.5%

Wireless RMS 31.2%

Total MOU carried in Qtr 206.2 bn

Balance sheet strength:

Assets $ 31 bn

Net debt $ 12.9 bn

Net debt to EBITDA 2.9 Times

(annualized)

Continues to be FCF positive on a standalonebasis

Includes 23 days of Airtel Africa Exchange rate as of 30 thJune 2010:

46.60

18.4%ROCE

36.9%EBITDA Margin

-32.0%$ 361 mnNet Income

-10.0%$ 857 mnCash Profit

3.0%$ 947 mnEBITDA

17.4%$ 2,625 mnRevenue

71.0%183.37 mnCustomers

Y-on-YQ1 FY 11*

-

8/8/2019 Investor Presentation Oct10

9/29

9

Mobile Services Telemedia Services Enterprise Services DTH

Performance dashboard - 3 line graph

Productivity Indicators = growing revenues + cost efficiencies + capital productivity

112,725

107,491

103,053103,785104,143

38.1% 38.4% 39.9%40.9% 40.6%

69%66%

63% 63% 65%

80,000

85,000

90,000

95,000

100,000

105,000

110,000

115,000

Q110 Q210 Q310 Q410 Q111

GrossRevenue(U

SD

Mn

10%

20%

30%

40%

50%

60%

70%

80%

Gross Revenue (USD Mn) (LHS)

Opex to Gross Rev (RHS)

Revenue (annualized) to Gross Cummulative Capex (RHS)

Note: (1) The graph shown above is based on Bharti Airtel (India & South Asia), excluding Bharti Airtel African Operations as it is for less than one month in this quarter

-

8/8/2019 Investor Presentation Oct10

10/29

10

Mobile Services Telemedia Services Enterprise Services DTH

Wireless Services

-

8/8/2019 Investor Presentation Oct10

11/29

11

Mobile Services Telemedia Services Enterprise Services DTH

Indian Market

Lot of opportunity ahead.

Population 1.2 billion

Relatively large youth population

Telecom penetration c.58%

(~688 mn telecom subs)

Sub number should go upto 1 Billion by 2015

Broadband penetration 0.83% (9.77 mn)

Govt. target to reach 20 mn. Broadband subs by2010

Wireless MarketOverall Telecom Market

Sub Base c.652 mn

Wireless Penetration c.55%

Operational metrics per month

Usage per user 480 min

ARPU ~ US$ 4.6

Rate per minute US$ 0.01

VAS ~ 11.6%

Note: (1) Subscriber numbers and wireless penetration numbers as on July 31, 2010 are as per TRAI release (2) Other indicators on the slide are based on GlobalWireless Matrix 2Q10 dated 9thJuly 10 by Merrill Lynch, and reflective of Industry numbers.

-

8/8/2019 Investor Presentation Oct10

12/29

12

Mobile Services Telemedia Services Enterprise Services DTH

Net Adds in Aug 18.2 Mngreater than overlast 3 months average run rate of 17.1 Mn

S-curve triggered

Rapidly Growing Indian Wireless Market

Note: (1) Actual Data as per Industry Association Releases and Industry Estimates in India.

India - Fastest Growing Market in the World

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019

-

100

200

300

400

500

600

700

800

-

2

4

6

8

10

12

14

16

18

20

22

Closing Subscribers Net Adds

-

8/8/2019 Investor Presentation Oct10

13/29

13

Mobile Services Telemedia Services Enterprise Services DTH

Wireless Market Structure in India

Airtel continuously consolidating its market leadership position despite intense competition

Airtel current monthly net adds at 2.0 million vs. 2.8 million a year ago Airtel ranks 1& 2 in 17 circles in terms of number of subscribers

Over 62% of net adds coming from B&C circles (rural India)

Airtel Continues to lead on Revenue Market Share

Subscriber Trends Customer Market Share CMS (%)

Note: Based on subscriber data for India as on August 31 2010 as per TRAI press release.

141

115 114

8173 77 69

108

84 81

62

5043

2933 31 33

19 23

3440

-

20

40

60

80

100

120

140

160

Aug-10 Aug-09 Net adds during the year

21.1%

17.2%

12.1%11.5%

10.3%10.8%

17.0%

23.6%

18.4%17.7%

13.6%

11.0%

9.4%

6.3%

5%

7%

9%

11%

13%

15%

17%

19%

21%

23%

25%

Airtel

Reliance

Vodafone

BSNL+MT

NL

Id

ea

T

ata

Others

CMS(Aug'10) CMS(Aug'09)

-

8/8/2019 Investor Presentation Oct10

14/29

14

Mobile Services Telemedia Services Enterprise Services DTH

AirtelPerformance Indicators (Operational)

Customers & Market Share Prepaid/Postpaid

MoU/Sub/Month & MONARPU & RPM

0.450.480.600.58 0.53

215220230

252278

-

0.2

0.4

0.6

0.8

Q110 Q210 Q310 Q410 Q111

0

100

200

300

RPM (Rs.) ARPU ( INR)

480468446450478

195,197172,797

153,241143,680

140,713

420440

460

480

500

Q110 Q210 Q310 Q410 Q111

0

100,000

200,000

300,000

MoU/Sub (Min) Total minutes on Network (Mn Min)

96.0%95.8%95.3%95.2%94.7%94.2%

93.5%92.9%

92.3%

99.2%101.7%97.5%100 .4%

101.1%

100 .8%97.9%

98.4%

99.6%

85%

90 %

95%

100 %

105%

Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 1Q11

Prepaid Subs Prepaid Net Adds

110.5102.4 118.9 127.6136.6

21.8%

22.7%

23.5%24.0%

21.5%

0

40

80

120

160

Q110 Q210 Q310 Q410 Q111

20 %

21%

23 %

24 %

26 %

Customers (mn) CMS (%)

-

8/8/2019 Investor Presentation Oct10

15/29

15

Mobile Services Telemedia Services Enterprise Services DTH

Current positioning and way forward

Brand

Distribution

Churn lower than industry

Spectrum Mix (900/1800 MHz)

Improving cost efficiencies

Lowest cost GSM network

Revenue size

(>$ 9 Bn)

Revenue Market

Share

Increasing the usage through U&R drive

Wallet share

Driven by rural strategy

Changing face of

growth through M-Com,

M-entertainment & 3G

Leadership Positioning Growth strategy and plans

Revenue

Non financialvitals

Cost

New RevenueStreams

Net Adds

Maximizingusage

-

8/8/2019 Investor Presentation Oct10

16/29

16

Mobile Services Telemedia Services Enterprise Services DTH

Telemedia Services

-

8/8/2019 Investor Presentation Oct10

17/29

17

Mobile Services Telemedia Services Enterprise Services DTH

A snapshot

Largest private operator having presence in the voice , broadband , IPTV and data.

Focus on SMB segment & Broadband at Homes

Key Performance Indicators

1. Voice (wire-line) and Data (DSL) Presence in 88 top cities of India.

2. Target Segment : Retail and Small and Medium Enterprises.

3. Customer base: 3.2 million (end August2010)

4. Broadband (DSL with speeds>256 kbps) penetration at 42.6% of customer base.

5. Average ARPU for Quarter ended Jun10 $ 20.6 per month.

6. Segment contributing to 7% of overall revenues of the company.

7. EBITDA margin of over 44.0%.

Broadband revolution to follow wireless revolution in India

SMB opportunity across ICT stream

-

8/8/2019 Investor Presentation Oct10

18/29

18

Mobile Services Telemedia Services Enterprise Services DTH

Enterprise Services

-

8/8/2019 Investor Presentation Oct10

19/29

19

Mobile Services Telemedia Services Enterprise Services DTH

A snapshot

Enterprise Services provides a broad portfolio of services to large Enterprise and Carrier customers

Corporates: Single point of contact for all telecommunication needs for Top 2500 corporate

customers, providing full suite of voice, data, and managed communications solutions

Carriers: Wholesale voice and data services to over 130 domestic and 450 internationaltelecommunications carriers, as well as ILD and NLD carriage for Airtels own customers

Extensive national and international infrastructure

Pan-India network with 129,244 Route kms of optical fiber, over 4,150 MPLS and SDH POPs

Access network (terrestrial) in 88 cities, Wimax network in 143 cities, and over 1,500 local POIs

International network with 225,000 Route Kms, connecting over 50 countries and 5 Continents.

Key Performance Indicators (Q1 11)

NLD Minutes Carried:17.3Billion ; ILD Minutes Carried:3.0Billion

Revenue: Rs.10,186 Million (8 %Segment Contribution Share)

EBITDA: Rs. 2,497 Million (24.5%EBITA Margin)

-

8/8/2019 Investor Presentation Oct10

20/29

20

Mobile Services Telemedia Services Enterprise Services DTH

Emerging Growth Engines

Passive Infra

Africaiiiiiiiiii

-

8/8/2019 Investor Presentation Oct10

21/29

21

Mobile Services Telemedia Services Enterprise Services DTH

FinancialPerformance Passive Infra

EBITDARevenue

Revenue (in INR Mn)

15,93717,049

18,40719,459

20,412

10,000

14,000

18,000

22,000

26,000

30,000

Q110 Q210 Q310 Q410 Q111

EBITDA (INR Mn)

5,201

5,8316,267

7,224 7,240

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

Q110 Q210 Q310 Q410 Q111

32.6 34.2 34.0 37.1 35.5

Focus on tenancy enhancementdriving Revenue & Profitability

-

8/8/2019 Investor Presentation Oct10

22/29

22

Mobile Services Telemedia Services Enterprise Services DTH

Operational Performance Passive Infra

Towers (nos) & Sharing Factor

29,806

31,196

30,568

29,112

28,078

1.651.62

1.57

1.491.43

26,000

27,000

28,000

29,000

30,000

31,000

32,000

Q1 10 Q2 10 Q3 10 Q410 Q111

1.40

1.50

1.60

1.70

No of towers Shar ing Factor

Sharing Revenue per Sharing Operator perMonth (Rs)

38,107

36,420 36,696 36,87836,290

25,000

29,000

33,000

37,000

41,000

Q1 10 Q2 10 Q3 10 Q410 Q111

Sharing Revenue per Sharing Operator per month

Sharing Revenue per Sharing Operator perMonth (Rs)

Towers (nos) & Sharing Factor

102,696

104,901

102,938

100,728

97,925

1.75

1.71

1.66

1.61

1.55

93,000

95,000

97,000

99,000

101,000

103,000

105,000

Q110 Q210 Q310 Q410 Q111

1.40

1.50

1.60

1.70

1.80

No o f t ower s Shar ing F ac to r

30,37929,674

25,91728,915 28,333

15,000

20,000

25,000

30,000

35,000

40,000

Q110 Q210 Q310 Q410 Q111

Sharing Revenue per Sharing Operator per month

Aims to enhance the tenancy ratio & be the preferred choice of vendor for allexisting and new operators

IndusInfratel

-

8/8/2019 Investor Presentation Oct10

23/29

23

Mobile Services Telemedia Services Enterprise Services DTH

Manageable

Deal Size

Clean /

certainty

of transaction

Shareholding and

Management

Control

Brand Airtel

Diversification of

India Risk

Avoid Greenfield

100% Cash Transaction

Focus on Core

Middle East

Operators

Speed in

Transaction

Repayment of

Debt

Significant

Synergies

Global

Stature

Emerging Market

Characteristics

Strong Platform

for Future

Expansion

Low Competitive

Intensity

Transaction Rationale

The proposed transaction meets the objectives of Airtel with long termstrategic benefits and creates tremendous shareholder value

-

8/8/2019 Investor Presentation Oct10

24/29

24Mobile Services Telemedia Services Enterprise Services DTH

Source: Global Insight, annual / quarterly reports.1. Data pertaining to the 15 African countries where Zain Africa has operations.

Mobile Penetration

Business Model

Minutes of Usage

ARPU (US$)

ARPM (US cents )

Africa(1)

Low usage, high pricing model

~100

~$7

7

32%

India

High usage, low pricing model

~480

~$5

1

55%

Average Number ofCompetitors

3-510-12

Differences between the two markets

And therefore huge opportunity space

-

8/8/2019 Investor Presentation Oct10

25/29

25Mobile Services Telemedia Services Enterprise Services DTH

Airtel Africa

450mnTotal Africa:1,025mn

Population, 2009 (mn)

Source: Zain Filings, WCIS.

32.0%

50.9%

Penetration, 2009

Airtel Africa Coverage Addressable Market Opportunity

Africa Strong Platform

Telecom Operators by Subs in Africa

Leading African Operators

3922 19 15

42

77

Subscribers, 2009 (mn)

(1)

Large addressable population with low tele-

density

Leading telecom operations acquiredthrough Zain Africa

Strong competitive positioning

450575

Airtel Africa Footprint Other African Countries

Population, 2009 (mn)

-

8/8/2019 Investor Presentation Oct10

26/29

26Mobile Services Telemedia Services Enterprise Services DTH

Customer Base :36.36 Mn

Performace Indicators (CY 2009):

Revenue:$ 3,667 Mn

EBITDA:$ 1,160 Mn

Prepaid Base:99.3%

one of the highest in theworld

Usage per sub per month:103 Minutesone of the lowest

ARPU: ~ US$ 7.4

Rate per minute: ~ US7.2

one of the highest

VAS: ~ 7.9%

One of the lowest

Another Growth Engine - Africa

-

8/8/2019 Investor Presentation Oct10

27/29

27Mobile Services Telemedia Services Enterprise Services DTH

Recent Honours

-

8/8/2019 Investor Presentation Oct10

28/29

28Mobile Services Telemedia Services Enterprise Services DTH

BhartiAirtel Leadership in business Recent Honours

NDTV Profit Business Leadership Awards 2010 Top Telecom Company

Sunil Bharti Mittal - Business Innovator of the Year

Indias Most Innovative company - Wall Street Journal

Most Preferred Cellular Service Provider - 2010 CNBC Awaaz Consumer Awards

Tele.net Telecom Operator award

Won in 6 out of total 14 categories. Few among them being

Powerful Brand - Economic Times (the only corporate brand to be awarded the AAA rating)

Bharti Airtel rated as Indias Best Enterprise Connectivity Provider- Users choice award

Instituted by PC Quest

Sunil Bharti Mittal Global Telecom Leader - Voice & Data magazine

Philanthropist of the Year at Asian Awards 2010

Akhil Gupta, Deputy Group CEO and MD - Asia Corporate Dealmaker Award 2010

Manoj Kohli, CEO( International) & Joint MD - Telecom Man of the year - Tele.net

Business world FICCI SEDF Corporate Social Responsibility Awards 2009-10

Most Admired company

Best National Mobile operator

Best Internet and Broadband operator

Best Enterprise services

-

8/8/2019 Investor Presentation Oct10

29/29

![HES UserGuide Oct10[1]](https://static.fdocuments.in/doc/165x107/55cf981d550346d03395a8eb/hes-userguide-oct101.jpg)