Investor Presentation - NMC · Investor Presentation September 2018. 2 Prasanth Manghat CEO Hani...

Transcript of Investor Presentation - NMC · Investor Presentation September 2018. 2 Prasanth Manghat CEO Hani...

Investor Presentation

September 2018

2

Prasanth Manghat

CEO

Hani Buttikhi

CIO

Senior management presenting

Prashanth Shenoy

CFO

2

Asjad Yahya

Investor Relations

3

Agenda

3

1

2

Overview of the business

Understanding the Saudi opportunity better

3 Transformational partnership with GOSI to form a new KSA healthcare champion

4 M&A: A vital part of the story

5 Financial outlook

6 A closer look at key assets

7 Appendix

4

NMC at a glance

4

Over 108,000

distribution SKUs

100+ owned and managed facilities

2017 Group revenues:

USD 1.6bn

Operations across

17 countries

Over 5.7 mnpatients in 2017

1,919licensed beds

2017 Group EBITDA:

USD 353mn

20%

2017 RoAE

FTSE 100 company

c. £7bn market cap

c. 2,000 doctors

c. 18,000 staff

5

Est. 1975

c.109,000 SKU’s

Five verticals built around centres of excellence

5

CENTRE OF

EXCELLENCE

Est. 1975

1,259 beds

Est. 2015

106 beds & c.20k Cycles

Est. 2015

554 beds

Est. 2012

Over 1,000 beds

Card

iolo

gyL

ong-te

rm

Care

6

Future growth driven by a well-defined strategy

6

2015 Strategy Update 2017 Strategy Update

Capacity Build Capabilities Focus Geographic Expansion

Accelerate the establishment of Centres of Excellence in

key specialties within existing hospitalsAddition of new verticals focused on highly

underserved segments in the UAE and wider GCC and

further development of Centres of Excellence

Establish a strategic presence outside the UAE with

leading global medical institutions to enhance and

expand technological know-how and medical expertise

Increase participation in the growing UAE medical

tourism industry and establish NMC as a destination of

choice

Grow NMC’s medical speciality offering and clinic

network within the UAE and maximising operational

synergies

Increase NMC’s footprint in Saudi Arabia and the

broader GCC via organic initiatives and acquisitions

NMC Health’s strategy is built on three key tenets

Expanding the healthcare business’ target market

from the GCC to wider emerging markets

Fertility to be developed as a global business taking

advantage of substantial growth opportunities

Rapid adoption and deployment of technological

innovation via both organic initiatives and acquisitions

1 2 3

77

An expansive footprint: 100+ facilities across 17 countries

Own and O & M

Key to facilities

Own

O & M

Colombia

Brazil

Spain

UK

Sweden

Kenya

YemenOmanUnited Arab Emirates

Italy

Latvia

Slovakia

Egypt

Denmark

Kuwait

Saudi Arabia

Jordan

8

Agenda

8

2

1

Understanding the Saudi opportunity better

Overview of the business

3 Transformational partnership with GOSI to form a new KSA healthcare champion

4 M&A: A vital part of the story

5 Financial outlook

6 A closer look at key assets

7 Appendix

9

Attractive demographics working in NMC’s favour

9

33m pop’n

▪ 2% growth rate p.a., twice the global growth rate

▪ NMC has c. 1,200 licensed beds in UAE with a population base of 9-10mn. This implies

potential for 3,000-4,000 beds in KSA on simple comparison

▪ KSA faces an estimated shortage of 30,000 beds, requiring substantial investment

▪ Median age of 29 years

▪ Healthy outlook for various

medical segments NMC focuses

on:

▪ Obstetrics and

Gynaecology; Paediatrics;

Fertility (IVF) and

Cosmetics

30% of the

pop’n <19 yrs

▪ Beds shortage in KSA estimated

at 15,000

▪ 30% of existing, overall beds in

the system blocked by LT care

patients

▪ Geriatrics continues to expand

at a rapid 7-8% CAGR

Considerable

demand for LT

care beds

▪ As with most GCC countries,

lifestyle disease is a major

problem in KSA

▪ Almost 70% of the population is

obese

▪ 30% of the population is

diabetic, or pre-diabetic

Prominence

of lifestyle

disease

10

Continued roll-out of insurance coverage a significant potential

catalyst

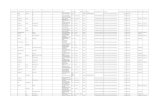

10

Public sector 56%Private sector 44%

Stats Gov Est. Q2 2018*

population

33.4 m

Saudis

20.7

Expats

12.7

Saudis

5.0

Expats

10.2

Private Insurance Mandate

(Addressable Market)

15.2 m

Expats

8.2

Saudis

2.7Under insured

expats

1.2

Saudis

2.2

Public Coverage

18.2 m

Dependent of

expats & illegal

residents

0.9

Insured end Q2 ‘18

10.9 m

Under/Uninsured

4.3 m

Gov.

Employees

12.0

Retired

2.4Gov.

Employees

0.4Domestic

Helpers¹

2.1

Saudis

15.7 m

Expats

2.5 m

Unemployed

0.8

Others

0.5

Source: Stats.gov.sa, GOSI, Mol., CCHI, and Bupa Arabia estimates.

* Doesn’t include recent deportation of illegal expats

(1) Not under public coverage but also not under private insurance mandate

Saudis

15.7

Expats

2.5

11

Agenda

11

3

1

Transformational partnership with GOSI to form a new KSA healthcare champion

Overview of the business

2 Understanding the Saudi opportunity better

4 M&A: A vital part of the story

5 Financial outlook

6 A closer look at key assets

7 Appendix

12

NMC and GOSI have entered a strategic partnership to create a

new national healthcare champion in KSA

12

Formation of a new and unique

national champion

#2 private healthcare operator in KSA

by beds capacity

Strong platform with pan KSA

presence

Wide ranging yet well defined

investment mandate

Strong synergy potential to support

sustainable value creation

1

2

3

4

5

13

Formation of a new national champion

13

JV to be capitalized through:

▪ NMC to transfer its KSA assets

▪ GOSI/ Hassana to transfer their stake in CARE at

c.SAR70 per share

▪ NMC to fully consolidate the JV’s financials and retain

operational, Board and management control

▪ Transaction remains subject to regulatory approvals and

due-diligence

JV capitalization New structure

1

2

New JV

> 51% < 49%

38.9%majority

KSA Assets

New JV

38.9%

1

2At SAR70 /

share

KSA Assets

majority

14

Addition of CARE to the existing portfolio: substantial growth

opportunity

14

Significant milestones achieved since inception which now includes 2 flagship hospitals

1967

Year incorporated

USD46m

2017 EBITDA

+7%

2013-17 EBITDA

CAGR

2013

Year listed

+10%

2013-17 Rev.

CAGR

USD380m

Total assets

USD667m

Market cap.(1)

c. 3,000

Total staff

Note: company information, Facstet. SAR to USD exchange rate: 0.2666

(1) As of 7 June, 2018 (closing share price: SAR55.8)

USD228m

2017 Revenue

1967 1991 2015

20%

2017 EBITDA

margin

0.5x

Leverage (2017

Net Debt/EBITDA)

10%

2017 Net profit

margin

RCH 330, CNH

495

Number of beds

2

Hospitals

1

Polyclinic

1

Mobile unit

15

664

788

825

998

1,020

1,328

1,489

c.1,850

Newly formed JV platform will be the second largest Saudi operator

by bed capacity in KSA

15

Source: companies website, AlpenCapital GCC Healthcare industry report (March 2018)

Notes: Market cap as of 6 June 2018

(1) Best estimate for the number of beds from publicly available sources which include the under construction Al-Habib Medical City, Al-Khobar Hospital and two hospitals in Jeddah

(2) No of beds does not include announced Greenfield project in Al Khobar by NMC

(3) Includes the under construction Mouwasat Hospital Al Khobar (220 beds)

(4) Includes the expansion of Dallah Hospital Al-Nakheel by 150 beds and the development of Namar Hospital (400 beds)

KSA

KSA

(1)

(3)

(4)

A combination of NMC’s KSA assets and CARE would immediately create one of the largest private

healthcare providers by beds capacity

(2)

10(1)

7

3

6(2)

2(3)

5

5

2

# of beds capacity # of hospitals

Al Rashid

Hospital

Al Salam

Medical Group

Chronic Care

Al Qadhi

Specialty

As Salama

Hospital

National Care

Hospital

Riyadh Care

Hospital

Ha’il

Najran

JeddahRiyadh

Al Khobar

64 beds

330 beds

495 beds

140 beds

100 beds

140 beds

220 beds

NMC’s hospitals CARE’s hospitals

(2)

Beds capacity and number of hospitals Strategic geographic positioning across KSA

16

NMC is now in a position to replicate full continuum of care across

Saudi Arabia

16

Tertiary

Highly

specialised

Primary Care

Multi-specialty

UAE

Establishing an integrated

network across the full

continuum of care

UAE KSA

17

Agenda

17

4

1

M&A: A vital part of the story

Overview of the business

2 Understanding the Saudi opportunity better

3 Transformational partnership with GOSI to form a new KSA healthcare champion

5 Financial outlook

6 A closer look at key assets

7 Appendix

18

10.2x

7.6x

9.6x

12.6x

11.1x

8.5x

12.9x 12.4x

17.4x

19.9x 19.9x

23.2x22.2x

21.0x

22.5x

33.9x

Feb-15 Apr-15 Apr-15 Jun-15 Nov-15 Aug-16 Dec-16 Jan-18

Snapshot of key acquisitions

18

57%

14%

4%

36%

16%

30%

14%

Price performance post-acquisition (+4 months)

Significant medium-term returns to NMC

shareholders from integration of acquisitions

Price m

ovem

ent

(fro

m p

re-a

nnouncem

ent clo

sin

g p

rice)

NMC undisturbed LTM EV/EBITDA (pre-acquisition)

LTM EV/EBITDA multiples paid: recent acquisitions (>USD25mn)

Demonstrated discipline in identifying and executing

immediately accretive acquisitions

Source: NMC, S&P Capital IQ

+24% on average

19

90+30

+26

+140+17

+220 +5+26

Case study: Leveraging the long-term care acquisition

19

Evolution of long-term care beds

Source: NMC, S&P Capital IQ

▪ Fully acquired ProVita in June 2015

for a total consideration of US$ 161m

▪ 90 beds at time of acquisition

▪ Added 35 beds organically

▪ Cross-asset pollination:

▪ Added 52 and 17 LT care

beds in NMC Royal and Al

Zahra, respectively

▪ Dual benefit of enhancing

service offering and

improving margin profile

▪ Entered the Saudi market by

targeting the highly under-served LT-

care segment

▪ This route would not have

been possible without the

ProVita license and expertise

▪ Increase in number of beds from 90

to 554 done at an incremental cost of

only c. US$ 40m

No. of long-term care beds added to NMC network

90 120 146 286 303 523 528 554

No. of LT care

beds at

acquisition

Organic

expansion

H2 2015 H1 2016 H2 2017

Royal Hospital

additions

As-Salama

additions

Al Zahra

additions

Chronic Care

H1 2017

Total

beds

Organic

expansion

Royal

Hospital

additions

20

Agenda

20

5

1

Financial outlook

Overview of the business

2 Understanding the Saudi opportunity better

3 Transformational partnership with GOSI to form a new KSA healthcare champion

4 M&A: A vital part of the story

6 A closer look at key assets

7 Appendix

21

NMC’s strategy has delivered consistent long-term revenue and

EBITDA growth

21

Revenue (US$m)

339 387 444 490 551 644

881

1,221

2009 2010 2011 2012 2013 2014 2015 2016 2017

CAGR FY09-17: 21.4%

Growth

EBITDA (US$m)

42 56 71 80 93 103

150

246

2009 2010 2011 2012 2013 2014 2015 2016 2017

Growth

Margin

CAGR FY09-17: 30.5%

14.0% 14.8% 10.5% 12.4% 16.9% 36.8%

34.3% 25.0% 12.9% 16.7% 10.3% 46.7% 63.7%

12.4% 14.6% 15.9% 16.2% 16.9% 15.9% 17.1%

38.6%

20.2%

31.3%

44%

22.0%

353

1,603

22

Solid growth momentum seen in 2017 to continue in 2018

Key figures2017 results overview

22

880.9 1,220.8 1,603.4

36.8%

38.6%

31.3%

0%

10%

20%

30%

40%

50%

0

300

600

900

1,200

1,500

1,800

2015 2016 2017

Revenue US$m and annual growth

Revenue Growth

150.3 246.1 353.4

17.1%

20.2%

22.0%

0%

5%

10%

15%

20%

25%

0

100

200

300

400

2015 2016 2017

EBITDA US$m and margin

EBITDA Margin

2018 outlook

▪ 2018E guidance:

▪ 22% YoY revenue growth

▪ EBITDA of around US$ 465m

▪ Strong cash conversion cycle sustained

▪ 79% of EBITDA converted into cash flow from

operations in 2017

▪ Net debt-to-EBITDA projected at 2.7x at end-2018

▪ FY 2017 revenue reached US$ 1.6bn, up 31.3% YoY

▪ Healthcare business accounted for 70% of Group revenues

and 87% of Group EBITDA for the year

▪ EBITDA increased by 43.6% to US$ 353.4m

▪ EBITDA margin reached 22.0%, increase of 180bps YoY

▪ Adjusted net profit reached US$ 236.6m, up 43.2% YoY

23

Strong growth built within the system

Capex already incurred for upcoming beds*

23

Earnings uptrend to continue

25% EBITDA margin sustainable over long termBreakup of operational beds (2018E)

*: additional 210 beds under construction in KSA

537

679

1,365

1,675

2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 E

Operational beds

Mature beds, 53%

Beds in ramp-up

phase, 47%

22%

25%

2 0 1 7 2 0 2 0 / 2 0 2 1

Group EBITDA margin

1,221

1,603

1,956

246 353

465

2 0 1 6 2 0 1 7 2 0 1 8 E

Revenues (US$mn) EBITDA (US$mn)

24

Agenda

24

6

1

A closer look at key assets

Overview of the business

2 Understanding the Saudi opportunity better

3 Transformational partnership with GOSI to form a new KSA healthcare champion

4 M&A: A vital part of the story

5 Financial outlook

7 Appendix

25

Multispecialty Vertical:

The foundation of the healthcare business

25

Abu Dhabi Specialty: The original healthcare facility

US$575m

▪ Established in 1975 as a small pharmacy, with a clinic added in 1976

▪ 127-bed facility in the heart of Abu Dhabi island

▪ One of the largest top and bottom line contributors for NMC:

▪ 2017 revenues of over US$ 130m, serving over 1m patients p.a.

▪ Consistent EBITDA margin

▪ Sustaining 7-9% YoY revenue growth, despite maturity of the asset

▪ Increase in top line driven by:

▪ Annual price revisions

▪ Capacity expansions

▪ Introduction of more sophisticated specialisms

Al Ain Specialty: Key driver of intermediate growth

▪ Established in 2008, the facility is designed to cater to the greater

concentration of Emiratis within Al Ain’s population

▪ 125 licensed beds, 115 currently operational

▪ Al Ain Specialty has sustained over 20% revenue CAGR since its opening in

2008

▪ Al Ain Specialty’s top line growth is anticipated to moderate in the coming

years, but the facility will remain one of the key drivers of NMC’s revenue

and EBITDA growth over the near to medium term

26

Multispecialty Vertical:

Dubai assets primed to capitalize on mandatory insurance rollout

26

Dubai Specialty: Leveraging off mandatory insurance in Dubai

US$575m

▪ 116-bed facility established in 2004

▪ Positive impact of introduction of mandatory insurance in Dubai already

visible in the form of improving patient footfall

▪ Witnessing double digit revenue and patient growth in past 3 years

▪ Given that the final phase of the mandatory insurance roll-out was

completed in March 2017, a material improvement in operations is

anticipated from 2018 onwards

▪ NMC owns the plot of land adjacent to Dubai Specialty Hospital, allowing for

doubling of capacity if sufficient patient demand is generated

DIP Hospital: Catering to “New Dubai”

▪ Located in Dubai Investment Park, the 86-bed facility is the only hospital

catering to a catchment of over 300,000 patients

▪ Only hospital in Southern Dubai with inpatient facilities

▪ Services offered include sophisticated specialisms such as:

▪ Cardiology

▪ Critical care medicine

▪ Neurology and

▪ Neonatology

▪ Similar to the case for Dubai Specialty, the DIP Hospital is anticipated to be

a key beneficiary of the roll-out of mandatory insurance in Dubai

27

Multispecialty Vertical:

Major growth drivers of the future

27

Al Zahra Hospital: Completing the ‘hub & spoke’ model in Sharjah

US$575m

▪ NMC announced the US$ 560m acquisition of Al Zahra Hospital in

December 2016

▪ Widely recognized as the highest quality private sector hospital in Sharjah,

with over 35 years of operational experience

▪ Licensed capacity of 154 beds

▪ 17 long-term care beds introduced at the hospital; to be managed by

ProVita

▪ Ability to increase total number of beds to 200 without significant

capex

▪ Serves as a hub for NMC’s existing network of outpatient facilities in Sharjah

that cater to 800,000 patients per annum

▪ Focus on under-utilized specialities, such as cardiology, expected to

substantially improve revenue generation and margin profile

NMC Royal Hospital: Transformational impact on the healthcare portfolio

▪ Only private tertiary care hospital in UAE

▪ Licensed for 316 beds, with the potential to increase capacity to 400 beds

▪ Completed in late 2015, operational ramp-up progressing ahead of

expectations

▪ EBITDA breakeven achieved in less than 18 months versus original

guidance of 24 months

▪ A key beneficiary of the recent relaxation of regulations for Thiqa

cardholders, with Emiratis constituting over 40% of the patient base

▪ Expected to be primary top and bottom line growth driver for NMC from 2019

onwards and likely to become largest contributor by 2022

28

Multispecialty Vertical:

Establishing a foothold in the lucrative Saudi market

28

Al Qadhi Specialty Hospital: Only private tertiary care facility in Najran

US$575m

▪ Only tertiary care facility in Najran, serving a population of over 500k

▪ The transaction was sourced and completed by NMC’s own team

▪ Strong business relationship with the original owner translated into

an attractive deal for NMC Health

▪ The facility recently signed a contract with the Saudi Arabian Society of

Metabolic and Bariatric Surgery for referral of patients

▪ Bariatric surgery represents addition of a value-add service to the

facility

▪ NMC’s team played an instrumental role in the introduction of this

service, reflecting rapid integration with the acquired entity

▪ Land and building owned by previous owner

▪ Long-term lease signed

▪ Owner also owns adjacent land, allowing further expansion

Al Rashid Hospital: First private hospital in Ha’il

▪ Established in 1991, Al Rashid was the first private hospital in Ha’il

▪ Serving a population of over 500k

▪ Benefits from a strong reputation and better geographic positioning

than competitors

▪ Ha’il remains underserved in terms of healthcare services

▪ Al Rashid currently offers primary and secondary care services

▪ New specialities to be added following the acquisition

▪ Transaction completed at one of the lowest multiples paid by NMC to date

▪ Land and building acquired as part of the transaction, with empty

adjacent land allowing further expansion

29

Multispecialty Vertical:

Greater focus on specialisms in larger cities in KSA

29

Al Salam Medical Group: Entry into the largest healthcare market in KSA

US$575m

▪ Established in 1985, Al Salam Medical Group owns a 100-bed hospital and

2 polyclinics in Riyadh

▪ Served over 900k patients in 2016

▪ Transaction completed at less than 7x 2018E EV/EBITDA multiple

▪ Hospital and clinics offer a range of specialties, including cardiology and

paediatrics

▪ NMC to add a number of specialized services after the acquisition, including

long-term care, cosmetics and IVF

▪ Availability of vacant land adjacent to existing facility offers opportunity for

further growth

30

Multispecialty Vertical:

Building a leading position in the Omani private healthcare space

30

Atlas Healthcare: The first extension of vertical outside UAE

US$575m

▪ Private healthcare sector still at a nascent stage in Oman

▪ With 102 beds, NMC’s facilities account for a 20% market share in

the private healthcare space

▪ Mandatory healthcare insurance to be rolled out in Oman from 2018

▪ Two facilities acquired from Atlas Healthcare, located in Ruwi and Ghubra,

respectively

▪ Both facilities have been upgraded and rebranded

▪ Focus on expansion of medical staff (particularly doctors) and introduction of

specialities to support improvement of operational performance

31

Multispecialty Vertical:

Reinforcing the cosmetics and aesthetics business

31

CosmeSurge: A leader in a high growth market segment

US$575m

▪ Largest group of cosmetic surgeons, dermatologists and dentists in the GCC

▪ Enhances NMC’s cosmetic services portfolio

▪ Cosmetic and aesthetic services added to invasive cosmetic

procedures and complex surgeries already offered by NMC

▪ Transaction completed at an attractive 2018E EV/EBITDA multiple of 10.6x

▪ NMC managing CosmeSurge since September 2017 under O&M contract,

providing considerable insight into the business pre-acquisition

▪ Wide number of revenue and cost synergies identified prior to the

transaction

▪ Key areas in this regard include: cross-referral of patients, reduced

capex requirement from leveraging NMC’s existing capacity and cost

sharing of support services related to HR, IT and procurement

▪ CosmeSurge associated with attractive 31% EBITDA margin, with potential

for up to 400bps improvement on back of identified synergies

32

Maternity & Fertility Vertical:

Second largest IVF player in the world

32

▪ NMC acquired 86.4% stake in Clinica Eugin for EUR 143mn in February

2015

▪ Ranked among top 3 fertility providers in Europe in terms of number of

cycles

▪ Clinica Eugin is a leading IVF centre of excellence, with world leading

technology and expertise

▪ Subsequent bolt-on acquisitions have expanded geographical and

knowledge base of the company

▪ Operating in Spain, Brazil, Columbia, Italy, Denmark, Sweden, Latvia

& Kenya

▪ Substantial knowledge transfer from Clinica Eugin to UAE, which is

transforming the IVF landscape in the country

Clinica Eugin: The start of the capability focused stage of growth strategy

US$575m

Fakih IVF: The undisputed market leader in UAE

▪ Solidified foothold in UAE fertility market by acquiring 51% stake in Fakih

IVF for US$ 189m in November 2015

▪ Outstanding 49% minority acquired in 2018, with Fakih IVF now a

wholly owned subsidiary of NMC

▪ Over 40% market share in UAE with more than 4,000 IVF cycles performed

each year

▪ Aggressive expansion underway:

▪ First IVF clinic established in Oman in 2018

▪ KSA represents a major growth market. Entry planned during 2018

33

Maternity & Fertility Vertical:

Targeting a highly underserved segment of the market

33

▪ First private mother and child hospital in Abu Dhabi

▪ The 106-bed facility opened in July 2014 with only outpatient services

▪ Inpatient services introduced in July 2015, starting with 60

operational beds

▪ Brightpoint has consistently exceeded internal expectations and achieved

EBITDA breakeven earlier than original guidance provided by management

▪ Ability to cater to some of the most pronounced maternity-related

complications

▪ Premature births at as early as 24 weeks have been successfully

managed at NMC’s facilities

Brightpoint Royal Women’s Hospital: A first for the private sector in UAE

US$575m

34

Long-Term & Home Care Vertical:

A vital component of NMC’s integrated healthcare offering

34

▪ NMC fully acquired ProVita in June 2015 for a total consideration of US$

161m

▪ Only two long-term care providers currently operating in the UAE

▪ A highly underserved market, with the UAE government spending

substantial amounts on Emirati patients in long-term care abroad

▪ 30 patients shifted from abroad to ProVita facilities already

▪ Number of beds increased from 90 at time of acquisition to 194

▪ 52 LT care beds added at NMC Royal Hospital

▪ 17 LT care beds added at Al Zahra

▪ 86% bed occupancy as at end-2017

ProVita: Pioneer in UAE long-term care market

US$575m

Chronic Care : Foray into the attractive Saudi market

▪ NMC entered the Saudi healthcare market in August 2016 through 1)

acquisition of a 70% stake in Al Salama Hospital in Al Khobar and 2)

investment in a start-up long-term care provider in Jeddah (Chronic Care)

▪ Chronic Care addresses the acute shortage of LT care beds in KSA

▪ Beds are made available to other healthcare operators on a “lease

plus” model to de-clog their ICU beds

▪ Retention payments made for usage of beds in the Jeddah facility

effectively remove receivables risk

35

Aspen Healthcare: Adding value across multiple verticals

35

▪ Acquired 100% of Aspen Healthcare in 2018 at an Enterprise Value of GBP

10m, translating into 2018E EV/EBITDA of less than 2x

▪ Founded in 1998, Aspen Healthcare operates 9 facilities across the UK,

including 4 in the Greater London region.

▪ 7th largest player in the UK independent hospital market, accounting

for c. 2% market share

▪ With 223 beds, Aspen treats c. 350,000 patients per year

▪ Aspen offers strong expertise in Orthopaedics & Oncology, two of the most

underserved medical segments in the GCC

▪ Orthopaedics & Oncology account for c. 50% of Aspen’s revenues

▪ Aspen’s team has won several awards for deployment of innovative

medical treatments that can easily be adopted in the UAE

▪ Ideally positioned locations for introducing IVF services

▪ Significant opportunity for transferring knowledge across medical

procedures and diagnostics to UAE in particular and GCC in general

▪ Acquisition of Aspen will also allow NMC to capture outbound medical

tourists from the GCC, particularly for cases where adequate medical

procedures are not available in the region

▪ NMC can offer significant cost savings for governments and

individuals by offering pre and post care within its regional facilities

A key driver of NMC’s International Patient Centre

US$575m

3636

▪ Over 40 years of experience has helped transform NMC Trading into one of

the top 3 distribution companies in the UAE

▪ Around 109,000 SKUs across several segments

▪ Exclusive wholesaler of mainly globally established and branded

healthcare products and equipment

▪ Additional distribution agreements, addition of agencies, customer tie-ups

and cost efficient operations contribute to driving performance

▪ Slower growth in the Distribution division, relative to the Healthcare business

resulting in declining contribution to top and bottom line

▪ High single digit revenue growth expected to sustain

▪ EBITDA margin stable around 9-10% mark

A high RoE business

US$575m

Distribution:

Exclusive tie-ups drive growth

Segment contribution (2017)

Scientific 11.1%

Homecare0.2%

Pharma 34.2%

Education4.6%

Veterinary0.4%

FMCG 35.3%

Food14.2%

37

A snapshot of the business segments

1. Healthcare – Reported 2017 revenues up 41%, EBITDA up 31% to US$ 355.4m

2. Distribution – 2017 Revenues up 13%, SKU’s at 108.9k and EBITDA margin at 10.6%

3. Consolidated 2017 EBITDA at US$ 353.4m (+43.6% YoY), Net profit at US$ 209.2m (+38.2% YoY)1

37

880.9 1220.8 1,603.40

36.8%

38.6%31.3%

0%

10%

20%

30%

40%

50%

0

300

600

900

1,200

1,500

1,800

2015 2016 2017

Revenue Growth

Revenue US$m and annual growth

Source: NMC 2017 results presentation

1. 2015-2017 EBITDA corresponds to Profit from Operations before Depreciation, Amortisation, Impairment and Transaction Costs in the NMC annual reports

517.1 823.3 1,161.6

55.7%59.2%

41.1%

0%

20%

40%

60%

80%

0

500

1,000

1,500

2015 2016 2017

Revenue Growth

Healthcare revenue US$m and YoY growth

150.3

246.1

353.4

85.8

151.4

209.2

0

100

200

300

400

2015 2016 2017

EBITDA Net profit

EBITDA & Net profit US$m

393.4 431.9 486.8

16.1%

9.8%

12.7%

0%

5%

10%

15%

20%

0

200

400

600

2015 2016 2017

Revenue Growth

Distribution revenue US$m and YoY growth

43.5 47.1 51.5

11.1%10.9%

10.6%

8%

9%

10%

11%

0

10

20

30

40

50

60

2015 2016 2017

EBITDA EBITDA margin

Distribution EBITDA US$m and margin

3,211 4,320 5,767

34.3%34.5%

33.5%

33%

34%

35%

0

2,000

4,000

6,000

8,000

2015 2016 2017

Total patients Growth

Patients (‘000) and YoY Growth

137.0 241.1 355.4

26.5%29.3%

30.6%

0%

10%

20%

30%

40%

0

100

200

300

400

2015 2016 2017

EBITDA EBITDA margin

Healthcare EBITDA US$m and margin

33.3% 29.5% 30.6%

20%

25%

30%

35%

2015 2016 2017

Net working capital as % of sales

Scientific 11.1%

Homecare0.2%

Pharma 34.2%

Education4.6%

Veterinary0.4%

FMCG 35.3%

Food14.2%

Segment contribution 2017

38

Key healthcare segment statistics

38

1,919 licensed beds

Healthcare verticals dominate revenue stream

Revenue/patient rising as complexity increasesSharp increase in operating beds capacity

Healthcare verticals continue to grow faster than Distribution (2017)

NMC Royal largest hospital by bed capacity

137 176 190

20%

28%

8%

0%

5%

10%

15%

20%

25%

30%

0

50

100

150

200

2015 2016 2017

Rev per pat Growth

537 679 1,365

87%

26%

101%

0%

20%

40%

60%

80%

100%

120%

-

200

400

600

800

1,000

1,200

1,400

1,600

2015 2016 2017

Operational beds Growth

31

6

22

0

15

6

14

0

14

0

12

7

12

5

12

5

11

6

10

6

10

2

10

0

86

60

833.6 486.8 205.8 113.8 8.4

50.6%

29.5%

12.5%

6.9%0.5%

0%

10%

20%

30%

40%

50%

60%

0

200

400

600

800

1,000

Multispecialty Distribution Maternity &Fertility

LT &Homecare

O&M

Vertical revenues (US$mn) Share of revenues

39

Agenda

39

7

1

Appendix

Overview of the business

2 Understanding the Saudi opportunity better

3 Transformational partnership with GOSI to form a new KSA healthcare champion

4 M&A: A vital part of the story

5 Financial outlook

6 A closer look at key assets

40

0

1

2

3

4

5

6

7

0 10 20 30 40 50 60

4.2%

3.5%

2.4%

1.5% 1.0%

0.8% 0.3%

UAE GCC Africa Oceania Asia Americas Europe

50%

95%

2006 - Pre 2014 - Post

Attractive dynamics in the UAE healthcare market

40

1. Strong Macro Indicators – ratings agencies estimate UAE GDP growth in 2017e of ~2.3%

High historic population growth1 High GDP per Capita2 (US$ ‘000)

2. Growing demand, spending and lagging capacity

3. Mandatory healthcare insurance: Abu Dhabi in 2007, Dubai started in 2014 and Sharjah is expected to be next

Abu Dhabi Est. % of population covered AD insurance categories7

Healthcare expenditure per capita4 (US$) Beds/GDP per capita5 ('000)

Source: (1) IHS Connect data, 2008-15 population growth CAGR. (2) As at 2016, Oxford Economics, GDP per capital, real US$, constant prices (3) Latest statistics based on Dubai Statistics Center Dubai Statistics Center, Dubai Courts

Department, Dubai Health Authority and Global Media Insight

Source: (4) WHO, BMI as at 2016. (5) As at 2015, GDP per capita sourced from government offices of statistics or central banks; (6) Latest statistics from WHO, BMI HAAD

Source: EIU, Booz & Co, IMF, HAAD, DHA, MOH, UAE Stats; (7) Abu Dhabi insurance categories based on 2016 HAAD payer members split

Medical staff/1,000 population6

66

52 46 42 41

36

21 17

Qatar US UK UAE Kuwait KSA OmanGermany

World Average: 1.2%

10,203

4,722

3,312

1,956 1,737 1,388 1,066

US UK Qatar UAE Kuwait KSAGermany

France Germany

USUK

UAE

Kuwait

BahrainKSA

Oman

Lebanon

Egypt

UAE est. population by Emirate3 (‘m)

4.10 3.33

1.53 0.95

0.67 0.38 0.19

AD Dubai Sharjah RAK Ajman Fujairah UAQ

NMC focus

UAE population

4.1m3.3m

2.5m

Abu Dhabi Dubai NorthernEmirates

Mostly

insured

Mostly

insuredMostly

uninsured

3.3

1.5 1.9

1.4 0.9

8.9

3.0 3.6

2.9 2.3

OECD UAE Dubai AD NE

Physicians Nurses

OECD Avg.

45%

36%

19%Basic

Enhanced

Thiqa

41

Life-style diseases a major problem in UAE

▪ Non-communicable diseases responsible for largest

number of deaths among individuals below the age of 70

years in UAE

▪ Key concerns include cardiovascular, diabetes,

cancer and obesity

▪ WHO estimates 20% of UAE population has diabetes and

another 18% is at risk

▪ High genetic disorder incidence in UAE due to interfamily

marriages

▪ WHO estimates that, in 2012, average neo-natal

mortality rate was 5, while average mortality rate of

babies under 5 years of age was 8

High incidence of life-style related diseases

41

Over 70% deaths due to non-communicable disease*

Source: WHO

*: for population under 70 years of age

High prevalence of physical inactivity*

Source: WHO

*: for population under 70 years of age

42

UAE has a weight problem

42

Over 60% of UAE male population is overweight

Over 20% of UAE male population is obese… … while over 30% of female population is obese

… as is the case for female population

Source: WHO