Investor Presentation FY14 - pental.com.au Presentation FY14 ... A year of consolidation – On...

Transcript of Investor Presentation FY14 - pental.com.au Presentation FY14 ... A year of consolidation – On...

Investor Presentation FY14

Investor Presentation FY14

Charlie McLeish – Chief Executive Officer

Albert Zago – Chief Financial Officer

Strategic Achievements

A year of consolidation – On target with strategy

Relocation & upgrade of bleach plant (stages 1 & 2) completed

Cemented our position as No.1 supplier of liquid bleach

New packaging launched reinforcing “Australia Made and Owned”

Velvet soap successfully repositioned as a beauty bar

Invested in people and systems to deliver future growth

R&D on new high speed liquid line completed • Installation planned for end FY15 -> to drive future growth

Closure of Speciality Chemicals business completed

2

Financial Overview

NPAT increased by $3.4m to $5.3m

Early exercise of Loyalty Options raised $5.705m (net of costs & tax)

Net Debt reduce to effectively zero – from June 2012 of $61m

Strong Balance Sheet - no gearing - substantial capacity

New normalised and competitive banking arrangement

Reinstatement of interim and final dividend payments

– full year dividend of 0.12 cents per share (fully franked)

• record date of 12 September 2014 (i.e. after expiry of Loyalty Options)

• payable on 30 September 2014

– Approximately 40% of NPAT

3

Financial Headlines $’m FY14 FY13 (ii) Change %

Gross Sales 109.4 107.9 1.5 1.39%

Underlying EBITDA (i) 9.7 9.6 0.1 1.04%

Underlying EBITDA to gross sales (i)

8.9% 8.9% - -

Depreciation & Amortisation

(1.8) (1.1) (0.7)

Underlying EBIT (i) 7.9 8.5 (0.6) -7.06%

Underlying EBIT to gross sales (i)

7.2% 7.9%

Profits after Tax 5.3 1.9 3.4 +100%

Basic EPS (cents) 0.34 0.24 41.67%

Net Cash/ (Debt) 0.0 (8.2) (8.2) +100%

Key Points Focused on maintaining/growing margins rather

than participating in aggressive price reduction campaigns

Underlying EBITDA marginally above LY, after absorbing: • rental cost of $0.8m – Shepparton sale &

leaseback & relocated corporate office

• increased cost of raw materials not recoverable through price increases

• One off costs $0.5m: o bed down relocated/upgraded bleach plant o phasing in new private label bleach business

from Feb 14 o outsourced some of bleach production during

the relocation/upgrade EBIT down on LY due to additional depreciation

from new capital investment Finance costs down $4.7 million to $1.0 million

(incl. $0.15m to exit GE facility)

NPAT increased by $3.4m to $5.3m

(i) Before significant items (ii) Based on continuing operations – Consumers Products business

4

Improved Net Profit Before Tax (Continuing Operations)

One off income includes sale of Close-Up brand & Sunlight trademark (Pacific Islands only): Profit $0.4m

5

Source: Aztec data - market share in the major grocery channel

MANUAL TOILET CLEANER FIRELIGHTERS

Maintaining Solid Market Share BLEACH WOOL WASH BAR SOAPS

White King Bleach

79%

Coles Smart Buy Bleach

10%

Homebrand Bleach

11%

Dollars Share

Martha Gardener Woolmix

20%

Softly Wool Wash 36% Australian

Pure Wool Wash

8%

Earth Choice

Wool Wash 27%

Coles Smart Buy Wool

Wash 7%

Homebrand Wool Wash

2%

Dollars Share Pental Products P/L

17%

Colgate Palmolive

20%

Johnson & Johnson

2% Pz Cussons

8%

Reckitt Benckiser

4%

Unilever 34%

Other Mfrs 9%

Private Label 6%

Dollars Share

White King 23%

Duck 18%

Harpic 41%

Earth Choice 7%

Domestos 1%

Ecostore 1%

Coles 5%

Coles Smart Buy 1%

Homebrand 1% Woolworths

Select 2%

Dollars Share Total Jiffy

Cubes 25%

Total Little Lucifier Cubes 14%

Total Coles Cubes 10%

Total Homebrand

Cubes 14%

Total Redheads

Cubes 37%

Dollars Share

Sunlight 21%

Morning Fresh 21%

Palmolive 46%

Down To Earth

6%

Ecostore 6%

DISHWASH - NZ

6

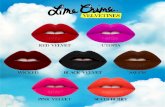

New Product Launches 2014

7

White King - New Look

8

9

Building Growth via Robust Innovation Process

Marketing Strategy

10

3 Year innovation

pipeline focused

on delivering

brand growth

• Targeting younger

consumers

• Tailoring products for

new channels

• Improving and adding

value on current best

sellers

Investing in

marketing

communication

on our key

brands

Building

category

strategy to

deliver growth

on the fabric

care portfolio

Supported by “Australian Made & Owned” credentials

Investing in Key Brands - 2015

White King Brand TV Commercial to run from October-December 2014

White King Community partnership with Western Bulldogs

Velvet PR Campaign, Print Ad & Consumer promotion – Win $10,000 or $100 Swarovski voucher every day with Velvet from

27th October to 21st December 2014

Pental is the official sponsor of the Prostate Cancer Foundation Australia Big Aussie Barbie event - to be communicated on our

Little Lucifer packs and included in all the Big Aussie Barbie launch events and PR releases as well as their website and all

participants’ sponsorship pages. 11

12

Sales Strategy

Re-aligned sales structure

Strong business plans with key

customers

Best practise planning system

Industry Best Practice Sales structure to build Brands and Private Label growth opportunities

Private label growth plans with Coles & Aldi

New Pharmacy Sales Partner with aggressive growth targets

Brand focused business plans in Metcash with all Banners Groups

New sales/trade spend planning/forecast system implemented late June 2014 streamline processes improving return on investment of

promotional spend

Manufacturing Strategy

13

Bleach Plant relocation &

upgrade completed in FY14

Improve speed and capacity of Bleach Line B – completed

August 14

Foundations completed with growth & cost

reductions forecast in FY15

R&D on new High Speed Liquid Line

completed

Installation by late FY15

Allows for growth in new product

categories & reduce costs in FY16

Soap plant evaluation underway

Modernisation and consolidation of

soap lines

Reduces cost to produce, grow Private label &

reduces operational risks

Safety comes first Lean Manufacturing Program – Reduce

Waste

Working with industry experts to deliver the

right solutions

Supply Chain Strategy

14

Lowest Cost & Mitigation of

Supply Risk

Bench- marking in Australia

and globally

Working with

suppliers to ensure

minimal or no cost

increase

Ensure processes &

costs are continually evaluated

Flexibility in raw materials & to achieve

customer needs

Example: Soap

produced from

either tallow or

sustainable palm

raw materials

Interstate & New

Zealand freight

review being

targeted to deliver

savings

Outlook Solid pipeline of innovative new products to drive growth

Evolving our key brands into new categories and channels

Growth expected through increasing demands of private label

Investing in manufacturing capability for future growth:

• High speed liquid line

o Installed during FY15 -> drive future growth

• Modernisation & consolidation soap manufacturing plant

o Reduce costs & maintain niche position of being Australia’s largest soap

manufacturer

Conversion of options and strong cash flows will fund CAPEX

investment

15

Outlook

Increased marketing planned for FY15 to grow our key brands

Trading conditions expected to remain consistent with the past year

Pursuing all avenues of growth that will improve shareholder

returns

• including value-creating acquisitions or distributorship opportunities

Plan to reinstate a position of paying regular interim & final

dividends

• subject to performance and outlook of the business

Share consolidation - Subject to shareholder approval at AGM

16

Appendix • Financial Performance for the year (52 weeks) ended 29 June

2014 • Summary of Loyalty and Piggy back Options

17

Profit and Loss Key Points Sales up 1.38%

• focused on maintaining/growing margins rather than participating in aggressive price reduction campaigns

Gross margin improved on last year by 0.26% to 34.1%

Prior year initiatives from consolidation of distribution arrangements embedded in the business

Employee costs increased as a result of enhancement to leadership team - R&D, procurement/supply chain and private label management

Depreciation up on LY mainly from relocation/upgrade of bleach plant

$’m FY 14 FY 13 % Change

Gross Sales 109.4 107.9 1.38%

Trade rebates and discounts (28.7) (28.8) 0.61%

Gross margin (incl. trade rebates)

37.6 36.8 2.17%

Freight expenses (8.8) (9.1) 3.04%

Employee expenses (11.6) (10.9) -6.37%

Marketing expenses (3.2) (2.9) -7.36%

Other expenses & other revenue

(4.3) (4.2) -2.13%

Underlying(1) EBITDA 9.7 9.6 0.74%

Depreciation & amortisation (1.8) (1.1) -67.63%

Underlying (1) EBIT 7.9 8.55 -7.62%

% to Gross Sales:

Sales rebates and discounts 26.20% 26.72%

Gross Margin (incl. trade rebates)

34.34% 34.08%

Freight and distribution costs 8.04% 8.41%

Marketing costs 2.89% 2.73% (1) Underlying result excludes significant one-off items - in FY14 this

was the profit ($0.4m) on sale of Close Up brand

18

Balance Sheet

Key Points

Successful equity raising of net $5.7m (net of

cost) via options schemes

Net debt reduced to nil – Cash of $0.025m

Borrowings:

• Repayment of fixed terms debt

• Changed to a multi-option facility of $16m

• Facility expires 28 February 2017

• Interest rate of 3.82% plus 0.9% line fee

• GE receivable finance facility discontinued

Reduction in working capital of $0.6m due to improved working capital management.

$’m FY 14 FY 13

Net Assets 73.0 62.1

Net Debt - 8.2

Working Capital 18.6 19.2

Property, Plant and Equipment 13.7 10.7

Goodwill 25.1 25.1

Other Intangibles: Brand Names & Software

15.2 15.2

Net Debt / Equity 0.0% 13.2%

19

Cash Flow Key Points

Capital expenditure included:

• Relocation/upgrade of the bleach plant

• Upgrade of ERP system and new promotional planning/forecasting system

• Packaging equipment for individually wrapped firelighters

• Bottle sleeve equipment for bleach line

Sale of Close-Up brand & Sunlight trademark (Pacific Islands only) $0.6m

LY’s net cash position in the “Statement of Cash Flows” does not included $12.6m of debt

(1) Consumers Products and Specialty Chemicals businesses

$’m FY 14 FY 13(1)

Cash in/(out) flow from operating activities 7.0 (2.9)

Capital expenditure (5.0) (2.4)

Proceeds from sale of brand name & property, plant

and equipment 0.6 30.0

Net Proceeds from issue of shares 5.7 18.0

Net Repayment of borrowings (12.6) (42.1)

Net increase/(decrease) in Cash (4.3) 0.6

Net cash position at end of year - 4.3

20

Loyalty Options

Loyalty Options expire on 11 September 2014

Options traded on ASX as PTLO (traded at $0.013 on 21 August 2014)

Exercise price $0.02

Early exercise of the Loyalty Options raised $5.7m (net of costs and tax)

Options exercised between 29 June 2014 and 29 August 2014 - $0.5m

Options in the money, but not exercised at 29 August 2014 amount to $1.2m

21

Piggy Back Options

• Exercise period: 6 December 2013 – 6 June 2015 (expiry date)

• Exercise price $0.03

• Options traded on ASX as PTLOA (traded at $0.005 on 21 August 2014)

• As at 29 June 2014 - 287million piggy back options on issue – valued at $8.6m

22

Disclaimer The material in this presentation is a summary of the results of Pental Limited (Pental) for the year (52 weeks) ended 29 June 2014 and an update on Pental’s activities and is current at the date of preparation, 29 August 2014. Further details are provided in the Company’s full year accounts and results announcement released on 22 August 2014.

No representation, express or implied, is made as to the fairness, accuracy, completeness or correctness of information contained in this presentation, including the accuracy, likelihood of achievement or reasonableness of any forecasts, prospects, returns or statements in relation to future matters contained in the presentation (“forward-looking statements”). Such forward looking statements are by their nature subject to significant uncertainties and contingencies and are based on a number of estimates and assumptions that are subject to change (and in many cases are outside the control of Pental and its Directors) which may cause the actual results or performance of Pental to be materially different from any future results or performance expressed or implied by such forward-looking statements.

This presentation provides information in summary form only and is not intended to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor.

Due care and consideration should be undertaken when considering and analysing Pental’s financial performance. All references to dollars are to Australian Dollars unless otherwise stated.

To the maximum extent permitted by law, neither Pental nor its related corporations, Directors, employees or agents, nor any other person, accepts any liability, including, without limitation, any liability arising from fault or negligence, for any loss arising from the use of this presentation or its contents or otherwise arising in connection with it.

This presentation should be read in conjunction with other publicly available material. Further information including historical results and a description of the activities of Pental is available on our website, www.pental.com.au

23