Investor Presentation - Alpha Ideas - Investment Blog...

-

Upload

nguyennguyet -

Category

Documents

-

view

217 -

download

2

Transcript of Investor Presentation - Alpha Ideas - Investment Blog...

Confidential Slide

Forward looking statements – Important Note

2

This presentation and the discussion that follows may contain “forward looking statements” by Reliance Infrastructure that are not historical in nature. These forward looking statements, which may include statements relating to future results of operation, financial condition, business prospects, plans and objectives, are based on the current beliefs, assumptions, expectations, estimates, and projections of the directors and management of Reliance Infrastructure about the business, industry and markets in which Reliance Infrastructureoperates. These statements are not guarantees of future performance, and are subject to known and unknown risks, uncertainties, and other factors, some of which are beyond Reliance Infrastructure control and difficult to predict, that could cause actual results, performance or achievements to differ materially from those in the forward looking statements. Such statements are not, and should not be construed, as a representation as to future performance or achievements of Reliance Infrastructure. In particular, such statements should not be regarded as a projection of future performance of Reliance Infrastructure. It should be noted that the actual performance or achievements of Reliance Infrastructure may vary significantly from such statements.

Confidential Slide 3

Roads

Metros

Cement

Airports

Power Sector

Distribution

Transmission

Trading

Generation

R Infra Presence

Infrastructure Sector

Business Overview

Confidential Slide 4

Pan India Presence

36 Projects I 16 States I 8 Sectors

Madhya Pradesh, Uttar Pradesh, Chattisgarh & Haryana : 3 projects

1 Ultra Mega Transmission Project1 Road Project , 1 Cement Plant

Andhra Pradesh & Orisaa : 3 projects1 Ultra Mega Transmission Project ,

1 Hyderabad Real Estate & 1 Power Generation Plant

Tamil Nadu : 6 projects6 Road Projects

Karnataka : 1 projectWind Farm Generation Plant

Goa : 1 projectPower Generation Plant

Maharashtra : 14 projects1 Road, 2 Metros,

5 Airports, 1 Real Estate,1 Cement plant , 1 Generation,

2 Transmission & 1 Distribution

Gujarat : 2 projects1 Road Project &

1 Transmission Project

Rajasthan : 1 projectRoad Project

Punjab & Himachal Pradesh : 1 project

Transmission Project

Kerala : 1 projectPower Generation Plant

Delhi : 3 projects1 Road Project, 1 Metro & 1 Distribution

Confidential Slide 6

Roads 11 ` 120 Bn

Metros 3 ` 170 Bn

Airports 5

Total 21 ~` 360 Bn

Cement 2 ` 66 Bn

Business No. of projects

Project Cost ` Bn

Infrastructure Portfolio

Amongst the largest infrastructure company in India

` 5 Bn

Confidential Slide 7

Road Business

11 Projects I 7 States I 970 kms I ` 120 Bn

Amongst the largest NHAI concessionaire

Urban centric roads ensuring high traffic growth

8 road projects are revenue operational

10 road projects will be revenue operational within FY13

First developer in the country to introduce:• Enterprise Toll Management System • Mobile Environment Monitoring system

Pune-Satara : First road project in India to be accredited with ‘ISO 27001’ certification for Robust Information Security practices

Won best project management award for online monitoring of project activities from CIOL and

Data Quest - First of its kind application

RInfra presence

Confidential Slide

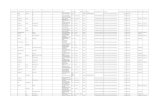

Road Project DetailsParticulars

Namakkal Karur(NK Toll Road)

DindigulSamyanallore(DS Toll Road)

TrichyDindigul

(TD Toll Road)

Salem Ulenderpet

(SU Toll Road)

HosurKrishnagiri

(HK Toll Road)*

Pune Satara(PS Toll Road)*

Length (kms) 44 53 88 136 60 140

Project Cost -` Bn ` 3.5 Bn ` 4.2 Bn ` 5.4 Bn ` 10.6 Bn ` 9.3 Bn ` 19.9 Bn

Debt - ` Bn ` 2.8 Bn ` 3.3 Bn ` 3.2 Bn ` 6.4 Bn ` 5.6 Bn ` 10.9 Bn

Equity - ` Bn ` 0.5 Bn ` 0.5 Bn ` 1.1 Bn ` 2.1 Bn ` 3.7 Bn ` 8.9 Bn

Grant/Premium - ` Bn ` 0.2 Bn ` 0.3 Bn ` 1.1 Bn ` 2.1 Bn ` 0.7 Bn (P) ` 0.9 Bn (P)

Concession Period (years)# 20 20 30 25 24 24

Client NHAI NHAI NHAI NHAI NHAI NHAI

State Tamil Nadu Tamil Nadu Tamil Nadu Tamil Nadu Tamil Nadu Maharashtra

COD Operational since Aug’ 09

Operational since Sep’ 09

Operational since Jan, 12

Operational since June’12

Tolling started in June’ 11

Tolling started in

Oct’10

8

# Includes construction period P - Premium sharing * Six Laning projects

Confidential Slide

Road Project Details

9

* Six laning projects # Includes construction period P – Premium sharing @ GF Toll road – Upfront payment of ` 1.5 Bn paid to Haryana Govt

ParticularsGurgaon

Faridabad(GF Toll Road)

Delhi Agra(DA Toll Road)*

Trichy Karur(TK Toll Road)

JaipurReengus

(JR Toll Road)

KandlaMundra

(KM Toll Toad)

Length (kms) 66 180 80 52 71

Project Cost - ` Bn ` 7.8 Bn ` 29.5 Bn ` 7.3 Bn ` 5.6 Bn ` 11.3 Bn

Debt - ` Bn ` 5.8 Bn ` 19.1 Bn ` 4.4 Bn ` 3.9 Bn ` 7.9 Bn

Equity - ` Bn ` 2.0 Bn ` 8.5 Bn ` 1.5 Bn ` 0.6 Bn ` 3.4 Bn

Grant/Premium - ` Bn ` 1.5 Bn@ ` 1.8 Bn ` 1.5 Bn ` 1.0 Bn ` 0.4 Bn (P)

Concession Period (years)# 17 26 30 18 25

Client Haryana NHAI NHAI NHAI NHAI

State Haryana Uttar Pradesh Tamil Nadu Rajasthan Gujarat

COD /Revenue to start

Operational since July’12

Tolling startedsince Oct’12 Q4 FY13 Q4FY13 Q2FY14

Confidential Slide 10

Metro Rail Business

* Including construction period ^ Could be extended for further 10 years

3 Projects I 66 kms I ` 170 Bn

ProjectProject Cost

` BnDebt : Grant

: EquityLength (Kms)

No. of Stations COD Concession

Period*

Reliance Metro Airport Link - Delhi ` 28.9 Bn 70:0:30 23 6 Feb 2011 30 years

Reliance Metro Line I - Mumbai ` 25.0 Bn 51:27:22 11 12 2013 35 years

Reliance Metro Line II - Mumbai ` 115.0 Bn 64:21:15 32 27

Within 5 years from

start35 years^

Total ~` 170.0 Bn 66 45

Confidential Slide 11

Delhi Airport Metro Express Link – Project Details Metro airport express link connects New Delhi Railway

Station to Dwarka through IGI Airport

Connected with existing DMRC network at both ends i.e. New Delhi station and Dwarka station

Fare structureCategories Fare / Trip

Between New Delhi Station & IGI Airport ` 150

Between Dwarka Sector 21 & IGI Airport ` 30* Fares to be increased every 2 yr @ WPI

Real Estate area of 1,32,000 sqft at New Delhi Railway station and Shivaji Stadium stations

Fastest, comfortable and economical commute to the airport

Dwarka sector -21

IGI Airport

NH-8 Dhaula Kuan

Shivaji Stadium

New Delhi Railway Station

Commercial operations commenced in February 2011 – Completed in a record time of 27 months

Confidential Slide 12

Delhi Airport Metro Express Link – Status Update Commercial operations resumed on January 22, 2013,

post rectification of defects by DMRC and subsequent certification by CMRS

All repairs work cost borne by DMRC

Trains operating : 19 hours/day @ 100% system availability

Frequency of trains : 15 mins

No. of commuters : Over 12,000 within one month of operations

Advertisement : Partnered with leading advertising firm JC Decaux to manage advertisements

Commuter centric facilities like Trolley & Porter, Radio-cab, Wifi, Feeder Buses, Chota Pass, Monthly Pass etc started

Commercial operation restarted on January 22, 2013

Confidential Slide 13

Elevated metro rail connecting Versova – Andheri – Ghatkopar

Reduction in travel time from 90 mins to 20 mins

Traffic forecast: 0.6 Mn per day

Fare Structure:Categories Fares at Base (in FY13)*

Traffic < 3 km ` 9

8 km <Traffic>3 km ` 11

Traffic > 8 km ` 13

* Fares to be increased @11% every 4th year

Real Estate of 1,000 sqmtrs at each station

Mumbai Metro Line I – Project Details

Fastest East to West connectivity

Confidential Slide 14

Mumbai Metro Line I – Status Update ~99% of civil work completed

• Cable stayed bridge on Western Express Highway completed• All spans on Andheri Bridge completed• Mithi River Special Bridge completed• Train simulation system successfully installed

Final testing of major equipment commenced

10 out of 16 rolling stock received

Obtained Viability Gap Funding of ` 5.5 Bn from MMRDA

Project to be commissioned in 2013

Confidential Slide

Mumbai Metro Line II – Project Details 32 km elevated track along the Charkop-Bandra-Mankhurd

Will provide North-South & East-West connectivity

Estimated project cost of ` 115 Bn

Viability Gap Funding of ` 23 Bn

15

Direct connectivity to all suburban lines i.e Western, Central & Harbour

Mumbai Metro Line I Status Update

Complete readiness to take-up the project• Achieved Financial closure• Pre-construction work related activities completed

Govt. of Maharashtra yet to fulfill few Condition Precedent (CP)• Only 50% Right of Way provided • Environmental clearance for depot land awaited

Confidential Slide

Airport Business

16

Developing & Operating 5 brownfield regional airports in Maharashtra i.e. Nanded, Latur, Yavatmal, Baramati & Osmanabad

Lease period : 95 years

Land area : 1,487 acres

Nanded airport : 6 commercial flights operating/week

Osmanabad airport : Hangar facilities and flight training academy already set-up

Charter flights operations are increasing in all 5 airports due to increased economic and social activities

Innovative non-aero revenue streams such as automobile testing, film / TV commercials, shooting, etc. being undertaken

Aims to increase footprints across the aviation industry

Confidential Slide

Cement Business

17

Developing two cement plants of 5 Mn tons each in Madhya Pradesh & Maharashtra

Grinding and Blending unit of 0.6 mtpa• First cement bag launched in the Vidarbha market under

brand name ‘Reliance Cement’

• Cement bags being produced from Butibori, Maharashtra

Maihar (MP) plant of 5 mtpa• All regulatory clearances received

• Major plant & machinery ordered

• Expected to be commissioned by Q3FY14

2 Projects I 10 Mn tons I ` 66 Bn

Confidential Slide

EPC Business

19

Order Book of ` 121 Bn as on Dec 31, 2012

• RPower & Internal Power projectso 3,960 MW Sasan UMPPo 600 MW Butibori TPP*o 2,400 MW Samalkot power project o Western Region Strengthening project

• External Power projectso 1,200 MW Raghunathpur TPP*o 1,200 MW Rajiv Gandhi TPP* at Hisaro 500 MW Parichha TPP* BOP package

• Road projects o Jaipur Reengus Toll Roado Pune Satara Toll Roado Kandla Mundra Toll Roado Hosur Krishnagiri Toll Roado Delhi Agra Toll Road

* Thermal Power Project

Well equipped for fast track execution of projects…

0

20

40

60

80

100

120

FY09 FY10 FY11 FY12 9MFY13

2535 36

117

56

Revenue (` Bn)

EBIT Margin (%) 8% 9% 10% 13% 10%

Confidential Slide

Power Generation

21

Dahanu Power Station is “ISO 50001:2011” certified for Energy Management System – Only plant in the world to receive this certification

Dahanu Power Plant running at PLF of ~100% from last 7 years

Outperformance of norms leading to high ROEs

Power Plant

Capacity(MW)

Type Off-take Arrangements

Dahanu 500 Thermal Mumbai Discom

Samalkot 220 Combined Cycle Andhra Pradesh Grid

Goa 48 Combined Cycle Goa Grid

Kerala 165 Naptha Kerala State Electricity Board

Wind Farm, Karnataka 8 Wind Karnataka Power

Transmission Corp. Ltd

Total 941

Confidential Slide 22

Future Power Generation through Reliance Power

2222

Largest integrated private sector power generation portfolio in India

RInfra owns 36.5% of RPower

RPower to develop all future power generation assets in India and overseas

1,840 MW of operational capacity

Coal production commenced in September 2012

Sasan UMPP 1st unit to be commissioned in March 2013

Confidential Slide 23

Reliance Power Portfolio

Well diversified portfolio by fuel type, offtake and location

Power – Operation

Project No. Capacity (MW)

Coal based 1 1,800

Solar 1 40

Power – DevelopmentProject No. Capacity (MW)

Hydroelectric 12 5,292

Coal based 1 ~5,000

ResourcesAsset No. Resources

Coal blocks-India 3 ~ 2 bn tonnes

Coal mine-Indonesia 3 ~2 bn tonnes

CBM blocks 4 193.92 BCM# Operating Projects; ̂ Projects Under Construction; * Projects Under Development

Power – ImplementationProject No. Capacity (MW)

Coal based 5 15,840

Gas based 1 2,400

Solar 1 100

Wind 1 45

Butibori#(600 MW)

Rosa #

(1,200 MW)

Tilaiya^

(3,960 MW)

Krishnapatnam^

(3,960 MW)

Chitrangi^(3,960 MW)

Sasan^

(3,960 MW)

Samalkot^(2,400 MW)

Sohagpur

Kothagudem

Barmer 4

Barmer 5

Coal Gas Coal Mines CBM blocks

Solar CSP ^

(100 MW)

Solar PV #

(40 MW)

Wind^

(45 MW)

Renewable

Hydro Projects *(672 MW)

Hydro Project *

(400 MW)Hydro Projects *

(4,220 MW)

Hydro

Confidential Slide 24

Power Transmission Portfolio

5 Projects I 10 States I ~` 66 Bn

* Tariff Based Project # Regulated Return Project

1

1

2

33

5

5

4

4

4

4

S.No Name of the project Project Cost ` Bn

1 WRSS* ` 13.8 Bn

2 Mumbai Transmission# ` 18.0 Bn

3 Parbati Koldam# ` 10.7 Bn

4 North Karanpura* ` 15.5 Bn

5 Talcher II* ` 8.2 Bn

Total ` 66.2 Bn

Confidential Slide 25

First 100% privately owned transmission line commissioned in India 6 out of 9 transmission lines commissioned in Maharashtra & Gujarat ~98% of tower foundation and ~88% of stringing work completed Project to be commissioned in 2013

Signed financing agreement with PFC & REC for debt of ` 7.7 Bn Stringing commenced in February 2012 Both the lines to be commissioned in 2013

Western Region Strengthening Scheme

(WRSS)1

Parbati Koldam3

North Karanpura4

Talcher II5

Largest private player in transmission sector

Acquisition process completed Applied for force majeure - Application is being heard by CERC

Acquisition process completed Applied for force majeure - Application is being heard by CERC

Power Transmission – Project Status

Mumbai Transmission2

8 EHV stations charged till Q3FY13 - Enabling additional flow of 250 MW to load centres in Mumbai

5 multi storied compact EHV sub-stations recently charged provides connectivity to the State Transmission Grid

Registered all time high availability of 99.8% v/s regulatory target of 98%

Confidential Slide 26

Power Distribution

Serves 2 out of 3 homes in Mumbai & Delhi

Serves over 6.0 million customers

Distributes over 5,000 MW of power

Distributes uninterrupted and reliable 24x7 power

Largest private sector distributor of power

Confidential Slide 27

Mumbai Distribution Distributing power to over 2.9 million customers

• Added ~54,000 consumers in 9MFY13

Among the lowest AT&C loss levels in the country• AT&C losses of ~10%• Reliability of 99.98%

Continuous upgradation and modernization undertaken• Yearly investment of ` 4 Bn

Created ring main system upto last mile

Unique web enabled new connection services

International standard customer care centers based on ‘Single Window' concept

Awarded “India Power Award 2012” for energy efficiency and conservation

Confidential Slide 28

Mumbai Distribution – Recent Developments

License renewed for 25 years i.e till 2036

Migration to Tata Power banned for consumers consuming >300 units/month for one year

ATE* recognized & rejected Tata Power appeal challenging MERC order on cherry picking of high end consumers by Tata Power

ATE upheld MERC order of levying CSS on changed over customers relieving RInfra consumers from tariff shock

Earned Cross Subsidy Surcharge and Wheeling Income from migrated consumers

• Cross Subsidy Surcharge - ` 0.8 Bn in 9MFY13• Wheeling Income - ` 2.0 Bn in 9MFY13

* ATE – Appellate Tribunal on Electricity

Confidential Slide

Delhi Distribution

29

Owns 49% in two Discoms since privatization in 2002

Distributing power to over 3.2 million customers• Added 123,600 customers in 9MFY13• 3,255 MW of peak demand

AT&C loss reduction of ~35% since takeover

Continuous upgradation and modernization undertaken• Yearly investment of ` 5 Bn

Implemented tariff hike of ~21% wef July 1, 2012

Additional surcharge of 8% imposed on the approved tariff to recover Regulatory Asset

ARR filed with DERC for additional tariff increase

Discoms have filed for Power Purchase Adjustment Charge price variation recovery

BYPL won “India Power Award 2012” for Turn Around Discom

31.326.7

23.520.2

17.0

15.0

29.9 27.3

20.5 18.916.6

17.8

0

6

12

18

24

30

36

FY07 FY08 FY09 FY10 FY11 FY12

AT&

C L

osse

s (%

)

BSES Rajdhani Power Limited (BRPL)

Target Achieved

39.9

30.024.0 22.9 19.9 17.8

40.034.8

30.526.3

22.018.0

0

10

20

30

40

50

FY07 FY08 FY09 FY10 FY11 FY12

AT&

C L

osse

s (%

)

BSES Yamuna Power Limited (BYPL)

Target Achieved

Recent Developments

Confidential Slide 30

Innovation and Technology Leadership - Distribution

India’s first utility to implement –“Network Intelligence and Fault Location Intelligence”

* RAPDRP - Restructured Accelerated Power Development & Reforms Programme

Mumbai Distribution

• Implemented GIS based Outage Management System

• Empanelled as IT Consultant, IT Implementer & SCADA/DMS Consultant under RAPDRP*. Key projects include:

o IT Consultancy to SEB’s of Karnataka

o SCADA/DMS Consulting to SEB’s of Haryana, Chattisgarh, Maharashtra, Bihar and Chandigarh

o IT Implementation projects for SEB of Chhattisgarh

Delhi Distribution

• Rockson Engineering, a leading Nigerian company awarded international consulting

• Launched solar power Renewable Energy Assisted Pump (REAP) project in association with IIT-Delhi

Confidential Slide

Financials Performance

32

Standalone

Amount In ` Bn

Consolidated

Particulars FY10 FY11 FY12 9MFY13

Operating Income 100.3 95.6 179.1 104.0

EBITDA 19.1 17.0 33.3 22.5

PBT 13.0 11.4 25.0 17.7

PAT 11.5 10.8 20.0 14.0

Cash Profit 14.4 13.4 26.2 17.6

EPS (US$/share) 50.3 40.5 75.7 53.3

Particulars FY10 FY11 FY12 9MFY13

Operating Income 148.7 152.2 242.3 161.9

EBITDA 23.5 24.9 35.4 29.1

PBT 13.5 13.6 18.4 17.2

PAT 15.2 15.5 15.9 15.2

Cash Profit 19.4 19.8 23.4 19.8

EPS (US$/share) 66.4 58.2 60.1 57.9

Bottomline growth of ~34% CAGR in last 3 years Topline growth of ~28% CAGR in last 3 years

Confidential Slide

Sound Financial Status Balance Sheet Strength

As on December 31, 2012

Conservatively financed with Debt:Equity of 0.72x on consolidated basis

All projects are financially closed

33

Strongest balance sheet in the industry…..

ParticularsStandalone

` Bn Consolidated

` Bn

Networth ` 204 Bn ` 262 Bn

Book Value/share (US$/share) ` 776 ` 995

Debt ` 96 Bn ` 188 Bn

Confidential Slide

Shareholding Pattern

34

CategoryNo. of Shares

(In Mn)% of total

shareholding

Promoters 128.3 49

Insurance Co 46.6 18

FII 45.3 17

Mutual Funds / Banks & FI 7.2 3

Bodies Corporate 6.6 2

Public 29.0 11

Total 263.0 100As on December 31, 2012

Largest shareowner family in the sector : 1.3 Mn shareholders

Confidential Slide 36

Expanding footprint in high growth INFRASTRUCTURE sectorsRoads 11 projects ` 120 BnMetro 3 projects ` 170 BnCement 2 projects ` 66 Bn Airports 5 projects ` 5 Bn

Healthy EPC order book of ` 121 BnPower 6 projects 9,900 MWRoads 5 projects 500 KmsTransmission 1 project 1,500 Kms

Largest private sector player in the POWER sectorGeneration 941 MW & Owns 36.5% of RPowerDistribution Licensee in Mumbai & DelhiTransmission 5 projects worth ` 66 BnTrading Amongst the top 5 trading licensee in the country

Healthy BALANCE SHEET to capitalize on growth opportunitiesNetworth : ` 262 Bn Debt:Equity : 0.72xBook Value : ` 995/share