Investment Outlook - Welcome to PCDA(O)€¢ Key Sector gainers: Information Technology, Realty,...

Transcript of Investment Outlook - Welcome to PCDA(O)€¢ Key Sector gainers: Information Technology, Realty,...

Document meant for Information purpose only and should not be construed as Investment Advice

Investment Outlook

August 2017

1

Research NotesIndia: Running on One Engine

2

Nimish ShahHead – Investments & Research, SBI Exclusif

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Monies continue to flood emerging markets. YTD CY’17, FIIs have pumped in over $150 Bn. Of this, India has attractedFII flows of nearly $17 Bn in fixed income and $8.7 Bn in equity. FDI flows have increased exponentially from $14 Bn oneyear ago to over $40 Bn in the first 6 months of 2017.

These flows are pushing up asset prices and hence the current valuations demand a judicious evaluation of growthprospects vis-à-vis price to justify investing. Growth prospects are in turn assessed by the macro economic situation andgovernment polices to support the growth factored in the current price of assets.

Majority of the growth in India is coming from consumption demand. Government led reforms are likely to support thesecond engine for growth - investments. Large impact reforms like De-monetisation, GST and Bankruptcy have beensuccessfully implemented. These initiatives along with others like Make in India, Digital India, FDI liberalisation, Powersector reforms, Renewable Energy focus, Railways and Defence capex and various Financial Inclusion schemes will surelypush growth. And, that in turn should trigger investment demand. Growth in investments is approximately 1.5% versusa 8% growth in consumption demand. India cannot run only on the engine of consumption demand. Effectiveimplementation of reforms will help kick start the investment engine. Lower interest rates will lend support to creditofftake and hence a revival in investment demand. Normal monsoon, stable commodity prices and structurally lowinflation is creating an environment conducive for RBI to look at reducing rates and possibly consider reverting to an‘Accommodative’ stance.

While the Investment demand is expected to revive over next few quarters, we would, in the mean time, err on the sideof caution. A gradual and specific approach can be adopted in these times versus a immediate and general approach toinvestments in equity markets.

21.0%21.7%

28.1%

24.8%

9.4%

4.1% 4.4% 4.5%

0%

5%

10%

15%

20%

25%

30%

Sensex Nifty 50 NiftyMid Cap

100

BSE 500 DowJones

FTSE 100 Nikkei225

ShanghaiSE Comp

YTD CY 2017 Equity Indices Returns

14.7% 15.4%

26.2%

19.4%

16.9%

10.8%

20.1%

7.6%

0%

5%

10%

15%

20%

25%

30%

Sensex Nifty 50 NiftyMid Cap

100

BSE 500 DowJones

FTSE 100 Nikkei225

ShanghaiSE Comp

One Year Equity Indices Returns

Market IndicatorsEquities

3

• Nifty 50 moved up by 4.6% in July’17 on back of continued inflows from domestic and FII investors. Global indices continued to trade in a range as no significant policy announcements were made

• Good progress of monsoon till date, expectations of rate cuts from RBI, earnings recovery and strong global liquidity have contributed to the positive domestic sentiments

• In August factors like RBI policy stance, corporate earnings, US Fed monetary stance, FII and Domestic flows and monsoon progress are likely to influence market movements

India Global India Global

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Market IndicatorsFixed Income, Commodity, Currency

4

• During July, 10 year G-Sec yield moved down by around 8 bps on back of expected lower inflation numbers and expectations of rate cut in upcoming RBI Monetary Policy Committee (MPC) meeting in August

• RBI announced multiple Open Market Operations (OMO) sales cumulatively amounting to ₹ 300 Bn across multiple tranches during July’17 with an intent to reduce excess liquidity out of the system

• FIIs remained buyers for Indian debt for sixth consecutive month with net purchases of $17.0 Bn on YTD basis

6.5

0

7.7

7

7.9

8

7.2

5

1.5

7

6.2

5

7.1

3

7.3

3

6.4

3

2.3

4

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

Repo Rate 5 yr AAACorp Bond

10 yr AAACorp Bond

10 yr G-SecYield

US 10 yr G-Sec Yield

%

Debt Market Indicators

Jul'16 Jul'17

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Global Economy UpdateModerate growth, low inflation – a Goldilocks scenario in the making?

5

• The International Monetary Fund (IMF) July ‘17 World Economic Outlook Update:• Pickup in global growth remains on track. Output projected to grow by 3.5% in 2017 & 3.6% in 2018• Growth projections for U.S. are lowered while it has been revised upwards in Japan, China and Euro Area• Monetary policy normalization could trigger a faster than anticipated tightening in global financial conditions

• While key Global economies have been exhibiting a sustained moderate growth, Inflation has not been picking up pace as expected despite easy monetary policy stance, leading to a “Goldilocks scenario”

• Central Banks’s policy updates:• ECB left its easy monetary policy stance unchanged and indicated more monetary easing if the outlook worsens• The Bank of Japan (BoJ) said it would continue with “quantitative and qualitative monetary easing” until the price

stability target (CPI) of 2% is achieved. • US Federal Reserve kept interest rates unchanged and announced a “relatively soon” unwinding of the QE program

• China’s Q2 CY ‘17 GDP grew 6.9% y-o-y supported by a pick up in industrial output, consumption and investments

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

Jul-

16

Au

g-1

6

Sep

-16

Oct

-16

No

v-1

6

De

c-1

6

Jan

-17

Feb

-17

Mar

-17

Ap

r-1

7

May

-17

Jun

-17

Inflation Trends - Major Economies

U.S. Eurozone China U.K. Japan

6.6%

6.7%

6.8%

6.9%

7.0%

1.0%

1.4%

1.8%

2.2%

2.6%

Mar-16 Jun-16 Sep-16 Dec-16 Mar-17

Ch

ina

GDP Trends - Major Economies

U.S. Eurozone U.K. Japan China

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

India Economy UpdateGrowth tail winds gathering mass

6

• Asian Development Bank (ADB) raised developing Asia’s growth outlook for 2017 from 5.7% to 5.9% citing strong export demand. India is expected to achieve 7.4% growth in 2017 & 7.6% in 2018,led by strong consumption

• Monsoon & sowing update: Cumulative rainfall during this year’s southwest monsoon season so far (1st June to 19th

July 2017) is 1% above the long period average. Sowing activity for the Kharif season stands at 563 lakh hectares as compared to 522 lakh hectares for same period last year

• Economic Data updates:• Exports grew by 4.4% to $23.6 Bn for the month of Jun’17. Imports increased by 19.0% to $36.5 Bn, mainly due to

increase in non-oil imports by 21.2%. Subsequently, trade deficit increased to $12.9 Bn• Wholesale Price Inflation (WPI) & Retail Inflation (CPI) fell to 0.90% & 1.54% respectively in Jun’17, led by decline in

prices of food articles. • Industrial output (IIP) in May ‘17 grew 1.7% y-o-y from a revised 2.8% in Apr’17 led by a slowdown in the

manufacturing sector (1.2% y-o-y) growth

Monthly High Frequency Indicators*

*Latest Data

-3.0%

2.0%

7.0%

12.0%

May

-15

Jul-

15

Sep

-15

No

v-1

5

Jan

-16

Mar

-16

May

-16

Jul-

16

Sep

-16

No

v-1

6

Jan

-17

Mar

-17

May

-17

IIP 3 Month Moving Average

IIP Mining Manufacturing Electricity

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

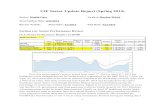

India Equities – July 2017Monthly Update

7

• India equities registered smart gains erasing previous month’s losses. Sensex was up 4.2%; Nifty 50 was up 4.7%. Both the benchmark Indices are up c21% CYTD respectively

• NSE Midcap & Smallcap Indices gained 3.7% & 6.7% respectively. For CYTD ‘17, the indices are up 28.1% & 35.0%• Key Sector gainers: Information Technology, Realty, Banks, Metals, Oil & Gas; Key Sector Loser: FMCG• Institutional flows sustain market momentum: FIIs net buyers worth $0.22Bn; DIIs net buyers worth $0.7Bn. For CYTD

‘17, FIIs are net buyers worth $8.42Bn while DIIs are net buyers worth $6.7Bn• Sentiment Triggers: Global liquidity supported by easy monetary policy stance by major Central Banks & Domestic

liquidity led by increasing financial savings, positive results from corporate India for Q1 FY 18, normal monsoon, softening Inflation triggering hopes of interest rate cuts, expectations of a steady economic and an earnings recovery

-2.5

%

1.1

%

2.8

%

3.4

%

3.7

%

3.8

%

3.9

%

4.2

%

4.2

%

4.6

%

4.7

% 5.6

% 6.2

%

6.3

%

6.4

%

6.7

%

8.1

%

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Sector Indices Performance – July’17

9400

9500

9600

9700

9800

9900

10000

-1500

-1000

-500

0

500

1000

1500

Nif

ty

Nifty 50 Index Vs. Institutional Flows

FII Equity (Rs.Crs) DII Equity (Rs.Crs) NIFTY Index

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

India Equities – OutlookMomentum depends on a sustained Economic & Earnings recovery

8

• India equities out-performed global benchmarks CYTD ‘17 on the back of expectations that many of the reforms being carried out by the Government across the sectors would stabilize the economy and trigger an earnings recovery

• The Government has also been focusing on resolving key issues like Banking sector NPAs and Private sector CapexValuations are trading at a c12% premium to 10-year average. Nifty 1-year forward P/E at 18.0x Vs. 10-year avg. of 16x

• CYTD ’17, Nifty one year forward P/E re-rated by c10% while consensus FY ‘18 & ‘19 earnings projections have seen revisions of (7.5%) & 0.0% respectively. Sustainability of the market momentum now depends on a sustained economic recovery and earnings upgrades

• Possibility of US Fed to “normalize” monetary policy could cause short term market volatility. Any such disruption is a good long-term buying opportunity given India’s strong structural growth

Investment Trends: Stock specific approach on companies with earnings visibility and high return on capital. Bias towards investments in Large Cap stocks & Mutual Funds vs. Mid cap & Small cap stocks due to valuation concerns

4500

5500

6500

7500

8500

9500

10500

11500

12500

Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17

Nifty 1yr Forward P/E Chart

Price 14x 17.5x 21x

500

550

600

650

700

7850

8350

8850

9350

9850

Ap

r-1

6

May

-16

Jun

-16

Jul-

16

Au

g-1

6

Sep

-16

Oct

-16

No

v-1

6

De

c-1

6

Jan

-17

Feb

-17

Mar

-17

Ap

r-1

7

May

-17

Jun

-17

Earn

ings

Est

imat

es

Nif

ty

Nifty 50 Index - Earnings Estimates Vs. Index Movement

Nifty Index FY 18EPSe FY 19EPSe

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

India Fixed Income - OutlookDifficult for RBI to not cut rates in August Monetary Policy Committee (MPC)

• 10 year G-Sec yield has been moving in range of 6.40% to 6.51%, awaiting rate cut in August MPC• Both Jun’17 CPI and WPI numbers came in soft on back of decline in food prices and minerals, however IIP too

remained weak as manufacturing output grew at slower place coupled with contraction in mining and quarrying• These weak economic prints have led to debt markets expecting and pricing in 25 bps rate cut. The differential

between Repo rate and 10 year G-Sec yield is also pricing in a rate cut (18 bps currently vs average of 50 bps)• SBI Economists expect CPI to be sub-2% for Jul, sub-3% for Aug-Sep and sub-4% for Oct-Nov’17 and 4-4.5% between

Dec and Mar’18. For FY18, CPI inflation average could thus be below 3.5% with a downward bias

Key Risks: RBI MPC Stance, Monsoon trends and spread, FII flows and US Fed rate increases

Investment Trends:• Investments continue in accrual funds with a 3 year horizon, as corporate bond spreads remain attractive and short

term yields could move lower on back of rate cuts and normal monsoon• Investors with high risk appetite looking for short term tactical play have been investing in Gilt Funds

9

(0.50)

-

0.50

1.00

1.50

2.00

Term Premium Spread (10 yr G-Sec vs Repo)

Avg: 0.50

18 bps

Data as on 25th Jul 2017

6.33 6.346.45

6.536.43

6.77

6.997.06

7.13

7.33

6.00

6.20

6.40

6.60

6.80

7.00

7.20

7.40

1Y 2Y 3Y 5Y 10Y

% G-Sec yield curve

G-Secs Yield AAA Corporate Bonds Yield

0.440.65

0.610.60 0.90

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Investment Trends – Mutual Funds IndustryAuM nears ₹ 20 trillion, retail participation remains strong

10

• MF Industry AuM has seen six fold increase in last 10 years (Mar’07 - ₹ 3.26 trillion AuM)

• AuM has doubled since May 2014 when it had crossed milestone of ₹ 10 trillion for the first time

• Number of folios too increased to 5.82 crores with equity folios at 4.70 crores where maximum investment is from retail segment

• Equity funds (including balanced funds & ETFs) have seen good inflows, resulting in an increase share from 31% to 35% in last one year

• SIP flows continue to remain strong ~ ₹ 4,744 crores in Jun’17. Around 7.75 lacs SIP accounts have been added on an average each month in first quarter of FY’18

13.5514.90

16.51 17.0618.58

19.92

0

5

10

15

20

25

Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

MF Industry AuM in ₹ Trillion

43% 44% 47% 42% 41%

2% 2% 2% 3% 3%

31% 32% 31% 33% 35%

24% 22% 21% 23% 21%

0%

20%

40%

60%

80%

100%

Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

MF Industry AuM Breakup

Debt Oriented Schemes ETFs & FoFs

Equity Oriented Schemes Liquid / Money Market

Data as on 30th Jun 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

4.13 3.95 3.95 4.17 4.44

4.77 5.06

5.54 5.82

-

1.00

2.00

3.00

4.00

5.00

6.00

7.00

Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 Sep-16 Mar-17 Jun-17

No. of Investor Folios in Crs

Investment Trends – Mutual FundsEquity and Balanced Funds see huge flows, Top 10 AMCs grow further

11

• In last 1 year, the industry has seen good increase with individual investors AuM showing an increase of 39% vs Institutional investors increase of 29%

• Industry AuM has increased by 35% while top 10 AMCs have seen higher growth at 38%. Amongst top 10, four AMCs (DSP Blackrock, Kotak, Axis and SBI) have seen still higher than industry growth

• Equity funds including balanced funds and ETFs (CPSE, Nifty based) have seen strong inflows. ETFs of SBI, UTI and Reliance AMC have seen increased traction

• Accrual funds have been seeing large inflows while gilt and gold ETFs have been witnessing outflows

9.48 10.44

6.80 8.10

-

2.00

4.00

6.00

8.00

10.00

12.00

Individuals Institutions*

AuM (₹ Trillion): Individual vs Institutional

Jun-17 Jun-16

29%

*Institutions include domestic and foreign institutions and banks

Top 10 AMC AuM Y-o-Y Change

Category wise AuM Y-o-Y Change

Data as on 30th Jun 2017

₹ Trillion

₹ Trillion

39%

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Mutual Funds PerformanceFocus Funds – Equity (1)

12

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Mutual Funds PerformanceFocus Funds – Equity (2)

13

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Mutual Funds PerformanceFocus Funds – Debt (1)

14

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Mutual Funds PerformanceFocus Funds – Debt (2)

15

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Mutual FundInvestment Options – Focus List

16

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

15%

30%

50% 50%10%

10%

15%25%

50%

20%

10%

30%

25%20%

15%25%

20%

15%

5% 5%5%

5%5%

5%15%

20%

VeryConservative

Conservative Moderate Aggressive VeryAggressive

Strategic Asset AllocationClient Risk Profile & Asset Classes

17

Benchmark Returns

Note: We have used BSE 500 as the benchmark for Alternates as it is the most appropriate benchmark reflecting returns of listed equities across market caps

Data as on 25th Jul 2017

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

Back Tested Performance Benchmark & MF Investment Options as on 25th Jul 2017

18#Returns Computed are pre-tax

Returns for below 1 year are absolute, others are annualized returnsFor Benchmark Portfolio• Computation done based on respective asset class benchmarkFor MF Investment Options Portfolio• Regular plan – Growth option of all funds have been considered• Equal allocation have been taken for respective focus / approved

funds in each categories as on 25th Jul 2017• For Gold – MCX INR Gold Spot Price and for Alternates asset class

returns, the BSE 500 benchmark returns have been taken

2.8

4%

7.3

4%

8.6

8%

8.6

0%

3.1

7%

7.2

2%

8.3

4%

8.2

4%

Very Conservative MF Investment Options Benchmark Portfolio

6.2

6% 10

.67

%

11

.89

%

12

.95

%

6.9

7% 10

.74

%

9.8

7%

10

.48

%

Conservative MF Investment Options Benchmark Portfolio

8.9

9%

12

.61

%

12

.97

%

14

.96

%

9.8

6%

12

.38

%

9.9

5%

11

.67

%

6M 1 Yr 3 Yrs 5 Yrs

ModerateMF Investment Options Benchmark Portfolio

13

.84

%

16

.09

%

15

.15

%

18

.83

%

15

.02

%

15

.76

%

10

.63

%

14

.05

%

AggressiveMF Investment Options Benchmark Portfolio

16

.21

%

17

.56

%

16

.37

%

21

.12

%

17

.42

%

17

.75

%

11

.51

%

15

.47

%

6M 1 Yr 3 Yrs 5 Yrs

Very Aggressive MF Investment Options Benchmark Portfolio

Sources: SBI Wealth Management Research, SBI Economics Research Department (ERD), SBICAP Securities, CRISIL Research, RBI, Bloomberg, CMIE, Reuters, International Monetary Fund

SBI Exclusif offer

A dedicated Relationship Manager as the single point of contact for a personalized and prioritized service experience; available either at the ‘e-wealth center’ or the ‘Exclusif enabled branches’

Digital banking and a first-of-its-kind ‘e-wealth centre’ which lets you access your RM and conduct all transactions through calls or video chats

Full suite of products and services including enhanced features on your wealth savings account, lifestyle benefits, investment products, and other services

Holistic financial guidance services by experts across all asset classes, specifically customized to your individual financial needs and goals

Single point of contact

Your SBI Exclusif team includes:

▪A dedicated RM as your sole point of contact with the bank and to provide you with any sort of financial and business assistance at any time

▪This RM will be available to you at the ‘Exclusif enabled branch’ or on call/chat at the ‘e-wealth centre’, as you choose

▪The RM is backed by a team of experts that includes financial planning and investment counsellors with specialized and extensive experience in various investment products

▪The program also lets you access best-in-class firms for online will drafting and other services, such as legacy and taxation planning

▪Should you find it difficult to reach us at our branch, our executives will be available for hassle-free pickup and delivery of documents for your convenience

Dedicated Relationship model

21

We have designed two distinct channels to serve Wealthmanagement customers

Remote relationship modelTraditional relationship model (dedicated or hub branches)

Sales and relationship model

• Traditional RMs

• Investment experts

Research / Investment expertise

• Investment research

• Transactions / service requests in person

Services

• In person through customer visiting RM or RM visiting customer

Mode of communication

• Traditional self employed

• Retirees

Typical customer segments

• Dedicated remote wealth RM for each customer

• Investment experts for RM support

Research / Investment expertise

• Investment research as well as all transactions / service requests (except cash, lockers, DD) remotely

• Services from 8:00 am - 10:00 pm through 2 shifts

Services

• Digital channel through voice, video and text

Mode of communication

• Traditional self employed

• Retirees

Typical customer segments

Keeping our core digital strategy in mind we have created wealth portals across multiple platforms …

Internet Banking

1 2 3

1st ever‘e-Wealth’

Center

Android / iOS Mobile Apps

Digital Banking

… enabling delivery of a complete suite of investment services at the customer’s finger-tips

1

2

3

4

Access to research and full-range of transactions at extended hours through e-Wealth Centre

Internet & mobile banking applications for customer to manage his investments on the go

Dedicated research set –up

Technology enabled middle office to prevent mis-selling

Digital Banking

Based on competitor benchmarking, we have defined a productsuite differentiated for wealth customers vis-à-vis other customers of the bank

Products

• Open platform for mutual funds – all fund houses including SBI MF

• Equities through SBI Cap Securities trading platform

• PMS referral through Motilal Oswal and ASK Securities

• Insurance products via SBI Life/SBI General insurance; open platform post change in regulations

• Alternate investment funds/structured products (currently not available)

Investment products

• Legacy planning through SBI CTCL

• Taxation planning through tie-up with few CA firms – Luthra & Luthra

Other products / services

• Visa signature debit card with lifestyle benefits such as airport lounge access, entertainment, travel and dining benefits along with accelerated loyalty program

• Visa signature credit card (through SBI Cards)

Lifestyle benefits

• Savings Wealth account with enhanced features and limits

Transactional benefits

SOURCE: Team Analysis

We have defined an end-to-end financial planning and investment suitability process

Central Research Team Investment committee Onground ICs and RMs

Central research team create SBI House view across asset classes

Central research team to also create product recommendation for the month

1

2

Investment committee comprising of Research head, ERD head etc. to

review and approve the House view and product recommendation

IE/ RM to do risk profiling and financial suitability analysis for the customers…

… with sharp insights

Insights

House view

Mutual Fund Recommendation for the Month

Large Cap fund : XXXXXXX

Mid Cap Fund : XXXXXX

8/7/2017

8/7/20178/7/2017

Moderate

Investment research

Key activities in customer’s lifecycle of investment management

Risk profiling of the customer

A

Financial Planning of the customer

B

Portfolio construction

C

Reports to the customerHouse viewDaily Update

D

Portfolio review & after sales

E

Investment research

Who is eligible currently?

Category 1: Total relationship value (TRV) - deposits and investments

Category 2: High potential customers

Proposed criterion for new acquisition

▪TRV of more than `30 lakh across (50 lakh in case of family)

–Total deposits–Investment products including mutual funds and demat

▪Salary credits > `2 lakh / month

▪Home loans > `1 cr

▪Initial deposit of approximately ` 10 lakh; to reach an overall relationship value of ` 30 lakh in 12 months

SBI Exclusif is a gateway to a vast range of personal banking facilities and lifestyle privileges

A differentiated wealth savings account, with enhanced limits and waiver of charges

Choice of a range of investment products including mutual funds, equity, debt, insurance, real estate, gold, PMS and other structured products besides all bank deposits

Access to online will drafting and other services, such as legacy and taxation planning with the help of experts

Furthermore, you are provided with lifestyle benefits such as access to airport lounges and golf clubs, discounts on entertainment, dining, travel, shopping, etc.; through VISA Signature Debit card

Convenience of digital banking and the e-wealth center

▪SBI Exclusif provides you with the first-of-its-kind ‘e-wealth center’, that is fully equipped to handle all your transactions – enquiries, transfers, recommendations for investments, and investment trades – through a quick call! Alternately, you can also Video chat with your RM

▪Moreover, you can also avail of Doorstep banking for document pickup and delivery

▪Add to that the convenience of internet and mobile banking to access all your information and conduct transactions from a single platform

▪Apart from this, we have the ‘Exclusif enabled branch’, not more than 4-5 km away from your home branch; but with an exclusive service area to offer you the priority service you deserve

While internet and mobile banking is available to all, you will be required to make a choice between using the

‘e-wealth center’ or the ‘Exclusif enabled branch’

What is unique about SBI Exclusif?

There are certain elements of this offering that are unique to SBI and reflect the needs that are currently unfulfilled for customers -

The absolute convenience offered by the e-Wealth Center, that enables you to conduct all your transactions seamlessly from the comfort of your home

Creating a culture of customer-centricity and thus maintaining the value of trust that comes along with the SBI brand

End-to-end assistance on investments through best-in-class providers for each asset class

A simple and intuitive self-service platform that takes care not only of your banking needs but also complete financial planning and investment Services

Requirements for sign up

The Exclusif program is available by signing a few documents and maintaining a TRV of Rs. 30 lakhs across deposits and investments, or a crore worth of loan through the SBI group (For family onboarding the TRV requirement is 50 lakh)

Documents required:

▪Consent formFor upgrading your regular savings account to a wealth savings account and for conducting transactions through any of our alternate channels

▪KYC documentsAny one document towards proof of identity and proof of address

▪Investment Services Account formIf you wish to invest in mutual funds and other services▪Demat/Trading Account Application formIf you wish to invest in equities and debt instruments▪Credit Card Application formIf you wish to apply for any of our credit card offerings

Sr. No Location Name & Designation E-Mail ID Mobile No.

1 Bangalore MADHUSUDAN NAYAK, AGM [email protected] 9480810234

2 Delhi SATISHAN, AGM [email protected] 9599250079

3 Mumbai S.B.MOON, AGM [email protected] 9820976668

4 Chennai K.RAMANATHAN, AGM [email protected] 9445865795

5 Hyderabad Radhyeshyam B, AGM [email protected] 8790246688

6 Ahmedabad PANKAJ SINHA, AGM [email protected] 7600035925

7 Bhopal SANDEEP AGRAWAL, AGM [email protected] 9425109098

8 Trivendrum SURESH K.KOMATH, AGM agmwch,[email protected] 9447000323

9 Kolkata BINOD KUMAR SINHA, AGM [email protected] 9674710389

Sr. No Location Name & Designation E-Mail ID Mobile No.

1 Delhi Amit Paliwal, RM [email protected] 8017877810

2 Bhopal Nitin Gupta,RM [email protected] 9575734704

3 Mumbai/Pune Ashish Kumar, RM [email protected] 7875558288

4 Chennai Gowrish Ambedkar, ARM [email protected] 7823995051

5 Hyderabad T Murali Krishna, ARM [email protected] 7995018066

6 Ahmedabad Naresh Vairagibawa, ARM [email protected] 7600039707

7 Bangalore Chinmay Mishra, RM [email protected] 9480880104

8 Trivendrum Archana Narendran, CRE [email protected] 9400664237

Contacts- SBI Exclusif

Disclaimers

Disclaimer: The report and information contained herein is of confidential nature and meant only for the selected recipient and should not be altered in anyway, transmitted to, copied or distributed, in any manner and form, to any other person or to the media or reproduced in any form, without prior writtenapproval of State Bank of India. The material in this document/report is based on facts, figures and information that are obtained from publicly available mediaor other sources believed to be reliable and hence considered true, correct, reliable and accurate but State Bank of India does not guarantee or represent(expressly or impliedly) that the same are true, correct, reliable and accurate, not misleading or as to its genuineness, fitness for the purpose intended and itshould not be relied upon as such. State Bank of India does not in any way through this material solicit any offer for purchase, sale or entering into any financialtransaction/commodities/products of any financial instrument dealt in this material. All recipients of this material should before dealing and or transacting inany of the products referred to in this material make their own investigation, and seek appropriate professional adviceProspective investors and others are cautioned and should be alert that any forward-looking statements are not predictions and may be subject to changewithout providing any notice. Actual results may differ materially from those suggested by the forward looking statements due to risks or uncertaintiesassociated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and othercountries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipatedturbulence in interest rates, foreign exchange rates, equity prices or other rates or prices, the performance of the financial markets in India and globally, changesin domestic and foreign laws, regulations and taxes and changes in competition in the industry. By their nature, certain market risk disclosures are onlyestimates and could be materially different from what actually occurs in the future. As a result, actual future gains or losses could materially differ from thosethat have been estimated.State Bank of India (including its subsidiaries) and any of its officers directors, personnel and employees, shall not liable for any loss, damage of any nature,including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this materialin any manner and any action on decision taking to buy, sale, invest, subscribe or entering into any contract for any financial product or services.The recipient alone shall be fully responsible/ are liable for any decision taken on the basis of this material. The investments discussed in this material may notbe suitable for all investors. Any person subscribing to or investing in any product/financial instruments should do so on the basis of and after verifying the termsattached to such product/financial instrument. Financial products and instruments, are subject to market risks and yields may fluctuate depending on variousfactors affecting capital/debt markets. Please note that past performance of the financial products and instruments does not necessarily indicate the futureprospects and performance thereof. Such past performance may or may not be sustained in future. State Bank of India (including its subsidiaries) or its officers,directors, personnel and employees, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or shortpositions in, and buy or sell the securities mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or othercompensation in the financial instruments/products/commodities discussed herein or act as advisor or lender / borrower in respect of such securities/financialinstruments/products/commodities or have other potential conflict of interest with respect to any recommendation and related information and opinions. Thesaid persons may have acted upon and/or in a manner which is in conflict with the information contained here. Purchase of any Insurance product by a Bank'sCustomer, is purely voluntary in nature and is not linked to any other facility from the Bank. Mutual Fund and all Financial investments are subject to marketrisks. Please read the offer document and scheme related information carefully before investing.

For Queries, Please Contact Your Relationship Manager Or Write us at [email protected]