Introducing Alfa Romeo into Canada

description

Transcript of Introducing Alfa Romeo into Canada

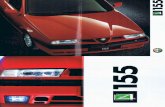

Introducing Alfa Romeo into Canada

Table of ContentsExecutive Summary2Company Background/History3Statement of Problems3Analysis5Brief History Overview5Industry Overview5SWOT6Porters 5 Forces7PEEST8VRIO10Competitor Overview12Alternatives12Decision Criteria14Implementation16Contingency19References21Exhibits22

Executive SummaryAlfa Romeo, a company steeped in automotive performance history is being evaluated for re-entry into the North American and specifically Canadian consumer market. The company was founded in 1910, and has been producing high performance vehicles to present day. To-date its sales focus has been focused on the European market, with over 90% of units sold in Europe. It was acquired by, then Fiat Group, in 1986 from this acquisition a partnership was brokered between Fiat and Chrysler Motor Company in 1988 for exclusive rights to sell Alfa Romeos through Chrysler dealerships from 1988 to 1995, at which time Alfa Romeo pulled out of the North American market. In 2015, due to the recent partnership between Fiat and Chrysler and the creation of Fiat Chrysler Automotive Group, Alfa Romeo is returning to North America.Three key problems have been identified that must be overcome for Alfa Romeo to be successful in the Canadian market place and North American market overall. The first is to develop strong brand recognition, the second is to achieve market share in the North American and Canadian market specifically, and finally the venture into Canada and North America must prove to be profitable.From the analysis, it is evident that as in Europe the North American and Canadian market is fierce with competition. There are currently many strong contenders in the market such as BMW, Mercedes-Benz, Audi and other Fiat Chrysler Group subsidiaries. But with the new partnership, the potential for profits is great. From the SWOT analysis, the weaknesses and threats point to a low market presence and strong competition, but the strengths and opportunities show that there is room for success with the launch of the brand with potential market share to be taken.Four alternatives are being proposed, with the overall analysis pointing to the initially opening two Alfa Romeo dealerships and sell through two non-Alfa Romeo dealerships. This will allow Fiat Chrysler Group to capitalize on existing customer base and to further grow and develop brand image through the Alfa Romeo dealers. An implementation plan outlining the short, medium and long term plans is described. A contingency plan is laid out to analyze any shortfalls and how to best mitigate them.Company Background/History

Originally, the company that would become the current Alfa Romeo Company was founded in 1906 in France and known as Societ Anonima Italiana Darracq (SAID). In 1910, it merged with an existing company from Milan, Italy Anonima Lombarda Fabbrica Automobili (A.L.F.A.). This partnership continued until 1986 when it was purchased and became part of the Fiat Group, now known as Fiat Chrysler Automobile Group.The Alfa Romeo brand has had a strong sales history in Europe to-date. But its success has been 90% based out of Europe. As such a strategy by the Fiat Chrysler Automobile Group (FCA) CEO, Sergio Marchionne has outline a strategy for the Alfa Romeo brand. He wants Alfa Romeo to become a competitive premium player in worldwide markets, much like Maserati, but then less expensive and less exclusive. His previous goal of 500.000 worldwide sales in 2014 has been revised twice, but it will be hard to even return to 100.000 sales with just two volume models and one limited edition sports car.From this strategy, one of the first steps is to enter the North American market, with Canadian market being entered at present. This is not the first venture that Alfa Romeo has had into North America. In 1988, Chrysler and Fiat, owner of Alfa Romeo, reached an agreement that named Chrysler to be the exclusive distributor for Alfa Romeo in North America and easily allow Chrysler dealers to sell Alfa products, which lasted until Alfa left the United States in 1995.The recent purchase of Chrysler by Fiat Group has enable the organization to globally diversify the product offerings, which will allow for a stronger company brand image and lead to a higher customer satisfaction.Statement of Problems

With the reintroduction of the Alfa Romeo brand to the North American market, several problems arise. These key problems are the key success factors that will be necessary for the brand to achieve success in the North American market and carve out a market segment for itself. By meeting these key success factors, Alfa Romeo will be able to grow and become successful in North America. The following are the identified key success factors identified for the Alfa Romeo brand looking to re-enter and develop in the North American market.The first identified success factor is to clearly and well develop the brand in the North American consumers eye. It is important to generate brad awareness for the regular consumer, outside of the automotive aficionado, to be considered as the next purchase. By developing our brand clearly and driving it into the consumers mind this will have the positive effect of driving sales and creating a profitable brand in North America. Brand awareness is one of the top success factors necessary for any product to become extremely successful, especially a sports luxury automobile. Where it is the brand image, coupled with unique product offerings that really differentiates itself from the competition.The second identified success factor is achieving sufficient market share to be a profitable venture. By driving and developing brand awareness, this in turn will drive and develop the market share held by Alfa Romeo in the North American sports luxury automobile market. Market share is what ultimately will drive profits by selling a profitable number of vehicles and will help drive product awareness and in turn brand awareness. This is a relatively challenging task as the North American market is a difficult one to enter because the North American consumer is relatively averse to foreign brands initially.The final identified success factor for the Alfa Romeo brand, is that this initial venture will need to be profitable. For Alfa Romeo to succeed as a brand and grow, it must show the sales numbers in a timely manner and as a result there must be profits. If this is not realized, the sign is that the market is not willing to accept a new product and as such will not be successful in a full scale venture into North America. Since there is a limited number of automobiles on sale in North America, the net profits will be large, but will give insight into how well the brand will perform.Therefore, from these three key success factors by achieving them, Alfa Romeo will be able to grow and succeed in the North American market.Analysis

Brief History OverviewCars were always a luxurious product in Canada, a product that is only owned by the rich for luxurious purposes, up until the 1950th when World War II ended, and economic growth started to take place in Canada making cars more affordable to more people. In the 1960th, as economic growth increased more, the automobile industry started offering cars with different sizes and started offering sports cars, and accordingly some cars were priced more than others, and some cars were more luxurious than others creating the luxury car industry. Industry OverviewThe luxury car industry products is divided into 3 categories: The small size/entry luxury cars The midsize luxury car The large luxury car The small size luxury car, including sport utility cars (SUVs) include brands such as BMW 3 series, Mercedes Benz C class, Audi A4, Lexus IS. The small size luxury car industry has increased by 4.6% from 2013 -2014. The highest percentage increase in sales was accounted to the Lexus IS brand, a luxury sport sedan, with a percentage increase of 278% (Appendix 1)The midsize luxury car industry include brands such as Acura RLX/RL, Lincoln MKZ, and Cadillac CTS. The midsize car industry sales has decreased by only 1.7% from 2013 2014. The Acura RLX/RL brands account for the highest percentage increase in sales, which is equal to 1170% (Appendix 2)The large size luxury cars include brands such as Audi A6, BMW 6 and 7 series, Mercedes-BenzS-Class & CL-Class, Jaguar KJ, Lexus LS and Porsche Panorama. Sales of large luxury cars have increased by 42.2% from 2013 -2014. Mercedes-BenzS-Class & CL-Class accounts for the highest percentage increase in sales, which is equal to 263% (Appendix 3)On overall, the luxury car industry in Canada is thriving with an increase in sales and in number of dealerships, and the top 3 selling brands are BMW, Mercedes-Benzes and Audi. (Appendices 4 and 5) Luxury cars are either sold directly to high end Canadian consumers through show rooms or through dealerships. The pricing structure varies depending on the brand, yet all luxury cars are priced at a minimum of $50,000. SWOTStrengths Unique style of vehicles Strong brand name

Weaknesses Low presence in world markets Low number of distribution and service centers

Opportunities Growing Canadian luxury sports vehicle market Competitive pricing No Alfa Romeo cars sold in Canada for past 20 yearsThreats Competitors have strong brand image Competing in well-established market Few buyers in that specific segment Shorter Canadian Winters may cause problem in sales

From a broader perspective, Fiat Chrysler Automotive, and more specifically Alfa Romeo, displays many strengths and a few weaknesses. The company ranks amongst the top car manufacturers in the world and is one of the few truly Italian engineered vehicles produced. Alfa Romeo upholds strong quality standards and is known for having the best craftsmanship in the industry. The company is focused on growth and to diversify and enter new markets. Furthermore, FCAs business goals are aligned with Canadian and worldwide market needs. Sales in the small luxury vehicle market have increased 4.6% in 2013 to 2014 and that trend continues in Canada. Alfa Romeos brand has become bigger and better over the years, even though they have not been the North American market for over 20 years. Proof of this is when Volkswagen, FCAs direct competitor, eyed to purchase Alfa Romeo in 2010. Other such potential acquisitions have been proposed but FCA refused to sell the Alfa Romeo brand.

As far as weaknesses, Alfa Romeo has just recently entered one of the worlds biggest markets, the U.S. Alfa Romeo is still not as active in many markets outside of Europe. Sales in the European market have been slow as well due to no new models coming out and changes in consumer preferences. With the new 4C and 4C spider, Alfa Romeo and analysts are predicting a turnaround for Alfa Romeo and FCA.The growing Canadian market for luxury vehicles is a perfect opportunity for Alfa Romeo to re-enter the Canadian market. Further, with the launch of Alfa Romeos new models, analysts are expecting a rise in sales for Alfa Romeo. FCA and Alfa Romeo will have to deal with the existing competitors in the Canadian market which include the Porsche Cayman and Jaguar F-Type, along with other indirect competitors such as the BMW M3 and Mercedes-Benz C63 coupe.Porters 5 ForcesThreat of New Entrants The luxury car industry is booming due to increase in generation X and the increase in disposable income. Thats encouraging the new entrants into the industry. Also, since other automotive companies usually have the economies of scale and the capabilities to do so, they are encouraged to diversify their product offerings and offer luxury cars to make use of the increasing trend. Accordingly, the threat of new entrants is high. Bargaining Power of BuyersBuyers are high end Canadian Consumers, and whether they buy directly from showrooms or from dealerships, they are not price sensitive. Also, when high end Canadian consumers purchase a car, they usually favor a certain brand due to its quality, reputation and brand awareness making the switching costs to other brands medium. Plus, the fact that the demand for luxury cars is increasing is creating a seller markets. Accordingly, this makes the bargaining power of buyers low.

Rivalry among Existing firms: Competing firms are all making use of the increase in demand and making fresh moves by adjusting their existing models or offering new brands to capture market share and improve business performance. However, since the demand is already increasing, this makes the rivalry among existing firms medium.Threat of substitutesSubstitute products for the luxury cars would be limousine services or private jets. Substitute products, such as limousine services or private jets, are more expensive than luxury cars and will not provide the same experience for high end Canadian Consumers. Plus, they may require additional learning or licenses making end users very uncomfortable using them. So this makes the switching costs to substitute products very high. Accordingly, the threat of substitutes would be very low. Bargaining Power of SuppliersSuppliers of the luxury cars are the raw material producers and the manufacturers of cars. Since most luxury cars companies are vertically integrated, or they already have economies of scales that allows them easy access to raw materials, the bargaining power of suppliers is low. Accordingly, this makes the luxury car industry a medium risk industry where players have good chances to be profitable.PEEST

The PEEST analysis is a useful tool for understanding the Canadians automobile market. It concentrates on the Political, Economic, Environmental, Social and Technological factor of macro environment. It points out the potential of the market, gives overviews of industry trends and helps find position for companies. Political FactorsA company should consider all the legal issues, laws and regulations in which the company survives. Canada is well known for its stability of governments and harsh requirements on the safety aspects. All imported cars must go through Canada Motor Vehicle Safety Standards.On the other hand, the tax policy is quite straightforward. Based on Canada Border Services Agency (CBSA)and transport Canada requirements, 5% of duty have to be paid and another 5% of GST afterwards.Environmental Canada has an uneven population distribution that south area has a high density while the north is rather low. Subarctic and arctic areas are mostly inhabitant due to extreme weather and ice-covered soil. Sports cars, designed for speed racing on F1 games will may suffer a lot from long Canadian winter. That is also the reason all-season sports cars such as Acura TL and Audi A3 are welcomed in the Canadian market. Therefore the main market for luxury sports car is tightened to the south and hard to extend.Economic FactorsCanada is one of the wealthiest countries in the world that the education is of high quality and the standards of living are pretty high as well. The Median total income, by family type is $74,540 in 2012.In general, Canada has a mature market of luxury cars and a stable increase annually. The luxury vehicle market set yet another sales record in 2014 with 187,786 units and for the first time accounted for 10 percent of the overall Canadian market. Under pressure of oil dependency and currency alternation, prices of luxury cars in Canadian market are increasing from the year 2014. Social factorsLuxury cars are booming in Canada thanks to the increasing number of high net-worth individuals. Those segments, consist of 3%-5% Upper Class and 2%-4% percent lower-uppers, are basically older people with high disposable income and young people with inherited savings. Since cars are considered as status symbol, features that will differentiate from other luxury car brands, especially technology and driving experience will help build up the brand.New immigrants play an important role in the luxury car market. Demographically, Quebec has good recognition of European luxury car brands. Immigrants in BC are better affordable to the luxury cars. The research stats that BC has the highest increase of sales at first quarter of accounts for 11.2%, while Quebec ranks the second with 9.3%.Technological ForcesR&D division of the auto manufactures is extreme crucial to fulfill the customers demands. It is viewed that companies are working hard to make better engines, handling, safety, and reliability to excel other luxury brands. Canadian car dealer attract consumer with safety and fuel-efficient driving engineers to put a lot effort on these areas to keep competitive. Besides, companies are introducing low pricing luxury car with the similar technologies and techniques into Canada to attract more customers. Many more models are designed to fulfill all need by all uses and all genders. VRIOValueDue to financial backing of Fiat Chrysler, Alfa Romeo has the resources and capabilities that enable the firm to respond to environmental threats and opportunities. With an approximate value of FCA of just under $20 Billion, FCA has the ability to fuel Alfa Romeos growth. Since finance is one of the biggest issues that companies like Alfa Romeo face, FCA can help make Alfa Romeo successful depending on how the financing is used and the strategic choices that Alfa Romeo management make.RarenessCompetitors have similar capabilities but Alfa Romeo is more rare and unique in the market. Many experts point to Alfa Romeos out of the box type designs for the reason why Alfa Romeo has trouble reaching sales targets and succeeding in the market. With Alfa Romeos new 4C, the company has decided use the latest technology and carbon fiber parts in order to compete with luxury vehicles in the same price range but also with much more expensive super cars.ImitabilityAlfa Romeo is one of the few truly Italian engineered vehicles in the market. Other Italian made vehicles include Fiat, Ferrari, Maserati, Lamborghini and Lancia. Only the last two that are not owned by FCA. Italian made cars are known for their high quality and craftsmanship, a trait that is hard to imitate among vehicle manufacturers.OrganizationFirm organization has potential to exploit its resources and capabilities in order to compete with competitors. Since FCA, one of the largest car manufacturers in the world, owns Alfa Romeo, Alfa Romeo has a good chance to succeed in its intended market. After analyzing all aspects of the VRIO model, we can see that Alfa Romeo has a clear competitive advantage and has the core competencies that will help FCA and Alfa Romeo succeed in a new market like Canada.ResourcesMarketingOperationsDevelopmentFinancialHuman ResourcesCorporate Reputation

Small market share outside Europe

Strong supplier relationsLarge scale facilitiesBacked by a $17 billion dollar car manufacturerPositive relations with unions and staff associatesFCA has a longstanding, reputable history with suppliers and buyers

Growing Canadian marketPlants shared by FerrariPipeline projects include SUV and small sized sedan

Reputation for high quality vehiclesTechnological partnership with Microsoft

Company performance over 3-5 years Alfa Romeo has been suffering the past few years as indicated by the 100 vehicles sold worldwide in 2012. Whereas in the late 1980s and early 1990s, Alfa Romeo sold on average 144 vehicles in Italy alone. These low sales volumes are due to poor range of vehicles and a bad European economic market. Experts agree that these figures should change with the launch of the new 4C edition vehicle and with new vehicles such as the SUV and smaller sedan, Alfa Romeo is set to increase its sales and performance numbers over the past few years.On the other hand, FCA has been steadily increasing their net revenues year over year. This result can be attributed to increasing demand in European markets for Fiat vehicles and a turnaround by the CEO of FCA, Sergio Marchionne. Competitor OverviewAlfa Romeo 4C has two major direct competitors that are Porsche Cayman from Volkswagen Group, and Jaguar F-Type from Tata Motors Limited. Further details about the specific models that are considered direct competitors can be found in appendix 6.Alternatives

For the re-entry into the North American market for Alfa Romeo, four alternatives have been developed that need to be evaluated for success and best fit for FCA Group. These three alternatives examine broad approaches that could be taken by FCA that would best suit the re-entry into the Canadian market. The fourth alternative to be considered is the do nothing alternative, that is do not enter the Canadian market.The first alternative to be considered is the option to sell the new Alfa Romeo through two already established independent dealerships and to open two exclusive Alfa Romeo dealerships in key market locations. This approach would create a strong and positive brand image through the use of the Alfa Romeo dealerships by providing an exclusively Alfa Romeo experience for the customer. Additionally, the use of the independent dealerships would allow FCA to maximize on the existing customer base. The issues faced with this approach are that there is a risk of customer brand awareness confusion and possibility of brand value dilution by selling through independent dealerships. Also, the existing independent dealership staff would require additional training before the product launches, both in customer service and vehicle service. This alternative is a relatively low risk approach.The second alternative is to solely sell the Alfa Romeo through independent dealerships and not open any exclusive Alfa Romeo dealerships. The advantages to this approach are that there are already established dealerships with a customer base, this approach would allow FCA to maximize on this and sell the target number of units. The drawbacks to this approach are that the sole use of the independent dealerships, the risk of brand dilution is quite high. As mentioned above, the staff would have to undergo training in terms of customer service and servicing of the vehicles. Finally these dealerships are already established and in fixed locations, FCA would not be able to optimally position them for the Alfa Romeo target market. This alternative is a medium-low risk approach.The third alternative to be considered is to open four exclusive Alfa Romeo dealerships in key areas. This approach will enable FCA to best develop and grow brand awareness through these dealerships. Additionally, through these exclusive dealerships a unique customer experience can be provided and unique and exclusive products could additionally be offered to the customer. Also, this alternative offers the flexibility to be able to choose the locations that best suit the target market to have the dealerships open. The drawbacks to this alternative is, that currently there is minimal brand awareness which these new dealerships would be required to develop along with marketing strategy. There is no customer base to rely on, since there has not been a large number of Alfa Romeos in Canada since 1995. This alternative is a medium-high risk approach.The fourth alternative is the do nothing approach and not enter the Canadian market with the Alfa Romeo brand. This approach would allow FCA to focus and further develop its current product offerings. But, this approach will not further diversify the product offerings by FCA in Canada and not allow FCA to gain greater market share and therefore grow the FCA brand. This approach is a low risk approach as it requires that FCA keep operating as is, but it is also a relatively low gain approach.Decision Criteria

Alfa Romeos corporate goals and structure should be considered when analyzing which strategy is best for Alfa Romeo and Fiat Chrysler. The metrics in the following decision matrix include Competitors Rivalry, Profitability, Consumer Preference and Time to Implement. The scores are ratings as to how well each dimension contributes to Alfa Romeos potential success in the Canadian market. Our scoring is based on the following: a score of 5 is the best option where as a score of 1 of is the worst option for Alfa Romeo.

Decision CriteriaWeightAlternative 1 (Two owned dealers and sell through two dealers)Alternative 2 (Sell through dealers)Alternative 3 (4 showrooms in Canada)

Competitors Rivalry0.2341

Profitability0.3332

Consumer Preference0.4314

Time to Implement0.1351

Total1.032.62.5

As evident in the matrix above, the benefit of Alfa Romeo opening two dealerships of its own and selling through dealers at two other locations is higher than compared to focusing solely on one method of entering the Canadian market. The following information outlines the reasoning and assumptions behind each criteria in the decision matrix:Competitors Rivalry: The degree of competition varies depending on the method of entering the Canadian market. By building your own dealerships and selling Alfa Romeo exclusively, you may be competing against other brands that have been well established in the Canadian market such as BMW and Audi. These companies have a well-developed supply chain and have experience operating within Canadian laws and regulations. Selling Alfa Romeo vehicles through established dealerships that sell exotic cars will help Alfa Romeo enter the Canadian market without having to deal with the troubles of establishing themselves in the market. Combining these two options and choosing alternative 1, Alfa Romeo can have the benefits of getting experience in owning their whole supply chain in Canada along with benefiting from selling through dealerships in the other two locations.Profitability: By having their own dealership in Canada, Alfa Romeo can have more control over their operations in Canada. Low control over operations can lead to human errors that can cost the company millions of dollars in lawsuits in the future. By choosing Alternative 1, Alfa Romeo can have control over their operations in two locations and therefore control profitability but also has a the risk of costs being higher than expected. By selling through other dealers in two other locations, Alfa Romeo may be able to benefit from their advanced supply chain processes and therefore increase profitability.Consumer Preferences: A showroom is proved to be not only an effective way to boost the sales in automobile industry, but also a demonstration of the luxury image for costumers. Although it is a good way to differentiate Alfa Romeo from other brands and take up the market share, it will cost a lot time and money. However, Alternative 1 has a balance of both cost control and brand pitching. Two owned dealers can put advertisement to target consumers and avoid the potential customer churn made by middle dealers.Time to implement: Setting up their own dealership in Canada will be time consuming as there will be more aspects that go into making a dealership. By selling vehicles through other dealerships, Alfa Romeo can save time but may need to pay more premiums to dealerships to sell their vehicles. In Alternative 1, the dealerships that Alfa Romeo sets up will take a longer time to make but entry into Canada will be much quicker with the two locations that they will sell through other dealerships.ImplementationShort-term plan: year 2016 ~ year 2017Open two branded dealerships and award two independent dealerships to carry Alfa Romeo 4C in Canada in 2016. (Appendix 7)CityOakville, ONVancouver, BCMontreal, QCCalgary, AB

DealershipsAwarded:Maserati Store, Oakville, ONAwarded:FIAT of Vancouver, BCBranded Branded

New NameMaserati-Alfa Romeo, ON Alfa Romeo of Vancouver, BCLaSalle Alfa RomeoAlfa Romeo Of Alberta

ServedRegionGreater Toronto AreaVancouver Island & surrounding areaGreater Montreal areaCalgary & surrounding area

TimeSummer 2016

Summer 2016

Summer 2016Before Grand PrixSummer 2016

StaffMaintain current sales and technical staff.Recruit experienced sales and technical staff from local luxury car dealers, including sister brands, Ferrari and Maserati, and competitors brands, i.e. BMW and Porsche. Recruit experienced sales and technical staff from local luxury car dealers, including sister brands, Ferrari and Maserati, and competitors brands, i.e. BMW and Porsche. Recruit experienced sales and technical staff from local luxury car dealers, including sister brands, Ferrari and Maserati, and competitors brands, i.e. BMW and Porsche.

TrainingStart With:An intensive one-week training for all sales and technical staff.Lead by a dedicated staff assigned by the parent company.Aim to ensure the high quality service for Alfa Romeos clientele.Continue to:Further training once every month Target to teach employees what problems appeared in the previous month, how to deal with them, and how to avoid the same problems in future.

Cars(Appendix 2)24 Alfa Romeo 4C Launch Edition coupes will be delivered by the four dealerships with a Canadian MSRP of $ 78,495.24 Standard Alfa Romeo 4C will be distributed by the four dealerships starting fall 2016 with a Canadian MSRP of $ 64,495.

Target ClienteleHousehold annual income: $100,000+Gender: primarily MaleAge: 25 to 54, focus on Millennials

Ads TimeStarting March 2016

AdvertisementChannelTraditional: TV, newspaper, and business magazines to attract Generation X (age 35-54), i.e. CBC, Global and Mail, and Canadian Business Digital: Internet, Mobile Apps, Social Media to attract Millennials(Age 25 - 35): Website, Youtube, Facebook, Twitter, and Pinterest

AdvertisementContents

Emphasize the power of technology.Slogan: Without Heart We Would Be Mere Machines.

Sales and profitsAppendix 8

Mid-term plan: Five-yearDealership: Open 10 more awarded independent dealerships in Canadian Market. We will extend the awarded dealerships to Burnaby, BC, Edmonton, AB, Regina, SK, Winnipeg, MB, Vaughan, ON, Ottawa, ON, Quebec City, QC, Halifax NS, St. John, NB, and Charlottetown, PEI (Appendix 9).Models: Alfa Romeo plans to develop new rear-wheel-drive and four-wheel-drive vehicles. Eight new Alfa Romeo models will be introduced through all 14 dealerships. The new models will include sedan to compete with BMW 3-series and SUV to compete with Audi Q5 and BMW X3 in the mid-sized luxury car market.Sales units: Increase the sales to 670 units in the Canadian market (Appendix 10). We expect the majority of sales to realize in the British Columbia, Ontario, and Quebec with a steady increase of sales in Saskatchewan, Manitoba, Nova Scotia, New Brunswick, and Prince Edward Island. Target market: Males will remain the primary market; and females will become the potential market. Besides, more Millennials will grow into working ages and might become new rich because of their success of eBusiness. The desire to compensate themselves for hard working and early success might drive sales in this younger generation. Thus, the importance of Millennials will increase. To better serve the Millennials and the female clients, we will recruit Millennials sales that share the same values and hire female sales that better understand females concerns about cars to boost sales and client satisfaction. Commercials: Female clientele can be roughly divided into mother clients and single professional clients. To increase the interest of mothers, commercials of Sedan and SUV will stress how safe and stable the cars are when moms have kids in them. For example, the kids will continue playing happily without realizing that they are driving on a bumpy road. Slogan: Alfa Romeo, for you and your beloved ones. To draw attention of young, single, and successful professional women, focus on how the cars can extend their feelings of being in control of their lives and enhance their experiences of enjoying the adventures. Slogan: Alfa Romeo, the best lover on the road.Public relations: Attend Grand Prix in Montreal every year to maintain exposure to the public. Tourists go to Montreal for Grand Prix from all over Canada every year. The quality of attention that Alfa Romeo could generate during that week would be much higher than commercials as potential clients could physically experience the excellent design and technology of the car. In addition, sponsor MBA Games and Case Competitions in business school across Canada. MBA graduates have a tendency to work in venture capital and consulting firms and have a potential to become new rich. They might appreciate the support offered by Alfa Romeo when it is in need and would prefer Alfa Romeo to its competitors when they desire a luxury car indeed. Data collection and analysis: Children born after year 2000 will start to turn into 20s since 2020. They could become a totally new generation from Millennials. Alfa Romeo should start to collect and analyze data of this age group to project their preference of luxury cars. This age group could become a major client or influencer in another five to ten years. Understanding and meeting their needs will ensure Alfa Romeos first mover advantage of attracting and maintaining the youth market and enable Alfa Romeo to start building brand loyalty in the younger generations.

Long-term plan: Ten-yearEstablish more branded dealerships in Canada while remaining harmonized relationships with independent dealerships. FCA could have more direct control over the import and distribution channels, have the sales data on a daily basis, and be able to react to market requirements more promptly. Launch commercials and activities to attract the generation born after 2000. For example, Alfa Romeo could offer its old car models to science museums in selected cities so that the youth who are truly interested in cars will get a chance to learn the science behind the speed and the power. If Alfa Romeos technology leaves the youth a great first impression, there might be a high chance that the youth would become impressed and loyal for a lifetime.Keep track of the immigration trend. Vancouver and Toronto have been the most attractive settlement places for immigrants for decades. If the immigrants choices start to change because of the crowdedness of these two cities, Alfa Romeo should adjust its attention to the new cities accordingly as the market of previous target cities would start to saturate. If Alfa Romeo could detect the new trend and follow it closely, the brand would have a better chance to beat its competitors. ContingencyIf the sales of the first four dealerships did not meet the target after one year, then research will be conducted to assess the reasons why the sales target was not met. If the reason was due to a decrease in demand for Alfa Romeo luxury cars, a decision will be taken accordingly. If the decrease in demand is a slight decrease, then the 2 dealerships producing the least sales will be closed, and only 2 dealerships will be kept. If the decrease in demand was a medium decrease, then only the most profitable dealership will be kept, and the other three will be closed. If the decrease in demand was a sharp decrease, then Alfa Romeo will close its 4 dealerships in Canada and leave the Canadian Market. If the reason was due to fierce competition with other brands, then the reasons why other brands are performing better will be studied. If the reason is a better dealer-customer relations, then dealers and staff of Alfa Romeo will be re-trained how to improve and exceed competitors customer service. Training will be repeated, modified, and its results will be evaluated on monthly basis. If the reason was a better communication strategy, then Alfa Romeo should do research on the best way to communicate and reach its customers, take in consideration what competing firms are doing, and develop a fierce and competitive communication plan accordingly. If the reason was the quality and performance of Alfa Romeo compared to its competitors, then more developments should be made to Alfa Romeo cars to improve their quality, performance, satisfy their customers, and outperform the competing cars. If competition was still very fierce after one year, then Alfa Romeo should close one or two of its dealerships depending on the decrease in sales or leave the Canadian market at all.

References1950. In Search of the Canadian Car. Web. Google. May 20, 2015 http://www.canadiancar.technomuses.ca/eng/frise_chronologique-timeline/1950/1960. In search of the Canadian Car. Web Google, May 20, 2015 http://www.canadiancar.technomuses.ca/eng/frise_chronologique-timeline/1960/Cain, Timothy. Small and Midsize Luxury Car Sales in Canada - February 2014 YTD. Good Car Bad Car. Web. Google. May 20, 2015 http://www.goodcarbadcar.net/2014/03/canada-luxury-car-sales-figures-february-2014-ytd.htmlCain, Timothy. Large Luxury Car Sales in Canada - February 2014 YTD. Good Car Bad Car. Web Google, May 20, 2015 http://www.goodcarbadcar.net/2014/03/canada-large-luxury-car-sales-figures-february-2014-ytd.htmlCain, Timothy. Top 15 Best-Selling Luxury Vehicles In Canada - 2014 Year End. Good Car Bad Car. Web Google, May 20, 2015 http://www.goodcarbadcar.net/2015/01/canada-best-selling-luxury-autos-2014-sales-figures.htmlKeenan Greg. Porsche leads rise of Canadas luxury auto sector. The Globe and Mail. 18 February 2015. Web Google, May 20, 2015 http://www.theglobeandmail.com/report-on-business/international-business/european-business/porsche-leads-rise-of-canadas-luxury-auto-sector/article23062675/http://fiatgroupworld.com/2013/05/04/alfa-romeo-sales-2012-full-year-analysis/http://left-lane.com/european-car-sales-data/alfa-romeo/http://www.reuters.com/article/2010/08/23/retire-us-volkswagen-alfa-idUSTRE67M26E20100823http://business.financialpost.com/news/transportation/fiat-chrysler-automobiles-nvs-stock-surges-49-since-nyse-debut-but-analysts-arent-impressedhttp://seekingalpha.com/article/3078086-alfa-romeo-is-the-final-piece-in-the-jigsaw-for-fiat-chryslers-brand-strategyhttp://www.thestar.com/autos/toronto_auto_show/2015/02/18/toronto-autoshow-alfa-romeo-is-back-in-canada.htmlImporting a Vehicle Into Canada, Canada Boarder Service Agency, http://www.cbsa-asfc.gc.ca/publications/pub/bsf5048-eng.html#s5Statistics Canada, Government of Canada, http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil108a-eng.htmLuxury Vehicle Review for 2014, Dennis DesRosiers, www.desrosiers.ca/pdf_2012_update/sample_observations_DAR.pdfThe Canadian Automotive Market, Andrew King, http://www.desrosiers.ca/pdfs/economics.pdfZoeller, S. (2014, December 5) Target Market Segment Strategy: Porsche. Retrieved from http://www.stephenzoeller.com/targetmarket- segment-strategy-porsche/) https://porschecentre.cahttp://www.porsche.com/canada/en/models/cayman/cayman/Porsche. (2015, February 3). Farooq N. (2014, June 18). 2015 Alfa Romeo 4C priced from $61,995 in Canada. Autogo. Retrived from http://www.autogo.ca/en/news/industry-news/2015-alfa-romeo-4c-priced-from-61-995-in-canadaJones S. (2014, August 4). Porsche uses mobile ad to amplify social campaign. Luxury Daily. Retrieved from http://www.luxurydaily.com/porsche-uses-mobile-ad-to-amplify-social-campaign/.2012 Special Report: Luxury Automotive Outlook. (2012, March). Forbes Insights.http://www.jaguar.com/jaguar-range/f-type/pricing-specs/dimensions-weight.htmlCarr T. (2013, May 15). Jaguar sharpens F-Type push to reach men ages 25-54. Luxury Daily. Retrieved from http://www.luxurydaily.com/jaguar-sharpens-f-type-push-to-25-54-year-old-males/MAHWAH, N.J., (2014, Feb. 3). First Ever Jaguar Super Bowl Commercial Launches F-TYPE Coupe and Drives Record Consumer Engagement. PR Newswire. Retrieved from http://www.prnewswire.com/news-releases/first-ever-jaguar-super-bowl-commercial-launches-f-type-coupe-and-drives-record-consumer-engagement-243279201.html.http://www.jaguar.ca/en/dealer-locator.html?country=CA&fallback=trueAlfa Romeo Franchieses Awarded to 86 Dealers in U.S. and Canada. (2014, June 10). Fiat Chrysler Automobile. Retrieved from http://media.chrysler.com/newsrelease.do;jsessionid=68EDCE839515B20E819ACDF0EB5FD989?&id=15705&mid=1The Formula Publications Team. (2014, June 12). Four Canadian Dealers Awarded Alfa Romeo Franchises. Canadian Auto World. Retrieved from http://www.canadianautoworld.ca/article/101460/ Chrysler Canada - The Attainable Supercar: All-new 2015 Alfa Romeo 4C Coupe Delivers Groundbreaking Italian Design, Advanced Technological Solutions and Supercar-level Performance. (2014, June 17). Fiat Chrysler Automobile. Retrieved from http://media.chrysler.com/newsrelease.do;jsessionid=1012E03166E5584943261B11CC948B8C?&id=15731&mid=193Fiat targets doubling profit by 2018 on upscale models. (2014, May7). Automotive News Europe. Retrieved from http://europe.autonews.com/article/20140507/ANE/305079993/fiat-targets-doubling-profit-by-2018-on-upscale-modelsMonzasports. Alfa Romeo 4C TV Advert. (2011, September 2). Youtube. Retrieved from https://www.youtube.com/watch?v=z9Wdh2_HK50Fiat Chrysler Automobiles. (2015, April 7). Canada 2015 ALFA ROMEO 4C CUSTOMER PREFERRED CODE GUIDE.Fiat Chrysler Automobiles 2014 Annual Report. Retrieved from http://www.fcagroup.com/en-US/investor_relations/financial_information_reports/annual_reports/Pages/default.aspxhttp://en.wikipedia.org/wiki/Millennials

ExhibitsAppendix 1Small/EntryLuxury CarFebruary 2014February2013%Change2014YTD2013YTD% Change

Volvo C30 --- 42-100%---50-100%

Audi A3 --- 65-100%---110-100%

BMW 1-Series--- 250-100%1344-99.7%

Acura TSX 50 89-43.8%86167-48.5%

Acura ILX119 179-33.5%226369-38.8%

BMW 3-Series 593 626-5.3%9671302-25.7%

Lexus CT200h77 4860.4%107127-15.7%

Infiniti G/Q6034 37-8.1%5260-13.3%

BMW 4-Series113 ------224------

Mercedes-Benz CLA-Class 153 ------374------

Volvo V60 33 ------70------

Mercedes-Benz C-Class 372 534-30.3%9289270.1%

Mercedes-Benz B-Class201 17812.9%3923793.4%

Audi A5113 136-16.9%2212133.8%

Audi A4 419 35717.4%7206894.5%

Volvo S60 73 78-6.4%20618610.8%

Cadillac ATS 202 16423.2%33527024.1%

Infiniti Q50 231 11797.4%45122996.9%

Lexus IS254 62310%43111427.8%

---------------------

Total303729622.5%579155364.6%

Appendix 2Midsize Luxury CarFebruary2014February2013%Change2014YTD2013YTD%Change

Mercedes-Benz R-Class ---23-100%---54-100%

Infiniti Q70/M 8 26-69.2%2052-61.5%

Cadillac XTS 34 52-34.6%67112-40.2%

Lexus GS 23 37-37.8%5483-34.9%

Lexus ES 111 176-36.9%253346-26.9%

Acura TL 96 125-23.2%175236-25.8%

Volvo XC7044 3815.8%7790-14.4%

BMW 5-Series 111 140-20.7%298331-10.0%

Lincoln MKS 7 47-85.1%7071-1.4%

Hyundai Equus 2 20.0%660.0%

Audi A6 53 55-3.6%1111037.8%

Cadillac CTS 58 3661.1%1059312.9%

Mercedes-Benz E-Class & CLS-Class181 183-1.1%37930026.3%

Volvo S80 1 2-50.0%7540.0%

Audi A754 4131.7%1247957.0%

Jaguar XF 58 4528.9%935569.1%

Lincoln MKZ 5825132%13854156%

Acura RLX/RL 51 5920%6351160%

---------------------

Total8921058-15.7%20402075-1.7%

Appendix 3Large Luxury CarFebruary2014February2013%Change2014YTD2013YTD%Change

Jaguar XJ 1429-51.7%2564-60.9%

Audi A8 1218-33.3%2333-30.3%

Lexus LS 912-25.0%2123-8.7%

Porsche Panamera 19185.6%38372.7%

BMW 6-Series332532.0%604339.5%

BMW 7-Series 167129%392462.5%

Mercedes-BenzS-Class & CL-Class6725168%18551263%

---------------------

Total17013426.9%39127542.2%

Appendix 4

Appendix 5

Appendix 6Direct Competition ModelsPorsche CaymanJaguar F-Type

Parent CompanyVolkswagen GroupTata Motors Limited

OriginGermanyBritish

Target Market: AgeTypical: 40 years+New: Younger between25-54 years oldYounger:25-54 years old

Current Market: Income LevelHousehold with a college graduate: $100,000+With high level of disposable income

Target Market: GenderPrimarily MalePrimarily Male

CampaignRebels, Race on.Its Good To Be Bad

Highlighted Traits-Fuel economy City - 11.5 L/100 kmHwy 7.9 L /100 km- Drivetrain Rear-Wheel-Drive-Transmission Options6-speed manual7-speed dual-clutch auto-Weight1,655 kg to 1,685 kg- Fuel EconomyCity - 10.4 L/100 km Hwy - 7.1 L/100 km- Drivetrain:Rear-Wheel-Drive- Transmission Options8-speed auto-Weight1,567kg to 1,594kg

# Of dealerships1624

Price$59,900 - $96,500$77,500 - $117,500

Ads ChannelTraditional:Radio, Television, Magazine

Digital:BlogSocial MediaMobile AppsInternetTraditional: Article, Magazine, Newspaper, Radio, Broadcast TV, Cable TV

Digital:BlogSocial MediaMobile AppsInternet

Appendix 7The Locations of Four Dealerships from 2016 to 2017

Appendix 8Estimated Income Statement

Alfa Romeo Brand

For the year ended December 31st, 2017

Revenue$3,413,760

Costs of goods sold (86.5%) $2,952,902

Gross Profit$460,858

Expenses

Selling (7.4%) $252,618

R&D (1.5%) $51,206

Other (2.6%) $88,758 $392,582

Net income before tax $68,275

Net profit margin (before taxes)2%

Appendix 9The Locations of 14 Dealerships

Appendix 10Sales Target in Five-Year Plan15,000 vehicles x (4 Canadian dealerships / 86 dealerships in North America) =670 Vehicles.