interest rate market monitor 0113 - CME Group€¦ · where the S&P/Case-Shiller Housing Indexes...

Transcript of interest rate market monitor 0113 - CME Group€¦ · where the S&P/Case-Shiller Housing Indexes...

INTEREST RATES

Interest Rate Market Monitor 4th Quarter 2012

JANUARY 11, 2013

John W. Labuszewski Michael Kamradt

Managing Director Executive Director

Research & Product Development

312-466-7469

Interest Rate Products

312-466-7473

1 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

Fixed income market participants may trade based

upon performance expectations couched along

several dimensions including outright yield

movements, changes in the shape of the yield curve,

dynamic credit risks as well as volatility

considerations.

CME Group offers interest rate futures and options

that allow one to engage in trading activities driven

by any of these significant factors. Our offerings

includes Eurodollar, Treasury, Fed Funds, Swap and

other interest rate products covering the entire

spectrum of the yield curve, representing both public

and private credit risks. Further, our offerings

include options on the most popular of our interest

rate futures contracts.

This document represents a review of these factors

as they played out in the most recently completed

calendar quarter and the impact they have exerted

on CME Group interest rate products. We begin with

a review of fundamental economic conditions as a

backdrop of how this impacts upon outright yield

movements, the shape of the curve and credit

considerations.

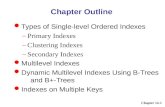

Fundamental Factors

Domestic interest rate market action during the 4th

quarter 2012 was largely colored by the state of the

U.S. economy. The Federal Reserve did a good job

in articulating the major economic issues during the

quarter, so we frame the following analysis

accordingly.

In September 2012, the Fed announced its

intentions to “increase policy accommodation by

purchasing additional agency mortgage-backed

securities at a pace of $40 billion per month … [it]

also will continue through the end of year its

program to extend the average maturity of its

holdings of securities … These actions, which

together will increase the Committee’s holdings of

longer-term securities by about $85 billion each

month … should put downward pressure on longer-

term interest rates … [and] … support mortgage

markets.” 1

1 Federal Reserve Press Release dated September 13,

2012.

These policies seem to have exerted some positive

impact as the Fed observed in December 2012 that

“economic activity and employment have continued

to expand at a moderate pace in recent months,

apart from weather-related disruptions. Although

the unemployment rate has declined somewhat

since the summer, it remains elevated. Household

spending has continued to advance, and the housing

sector has shown further signs of improvement, but

growth in business fixed investment has slowed.

Inflation has been running somewhat below the

Committee’s longer-run objective, apart from

temporary variations that largely reflect fluctuations

in energy prices. Longer-term inflation expectations

have remained stable.” 2

Reviewing the Fed’s findings, we see that 3rd quarter

2012 GDP was last reported in December at an

encouraging +3.1% and up from the 2nd quarter’s

anemic figure of +1.3%. The unemployment rate is

generally trending down but up-ticked to 7.8% in

December from November’s read of 7.7%.

While the unemployment rate generally appears to

be headed in the right direction, this optimism is

tarnished by the Bureau of Labor Statistic’s Labor

Force Participation Rate figure. This statistic

continues to slip and is most recently reported at

63.6% in December, down two notches from 63.8%

in October.

Real personal consumption expenditures (PCE) have

advanced remarkably since the height of the

2 Federal Reserve Press Release dated December 12,

2012.

4%

5%

6%

7%

8%

9%

10%

11%

-10%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

Q1 0

5

Q3 0

5

Q1 0

6

Q3 0

6

Q1 0

7

Q3 0

7

Q1 0

8

Q3 0

8

Q1 0

9

Q3 0

9

Q1 1

0

Q3 1

0

Q1 1

1

Q3 1

1

Q1 1

2

Q3 1

2

Unem

plo

ym

ent

Rate

Qtr

ly C

hange in G

DP

Growth and Employment

Seasonally Adj Real GDP Unemployment Rate

Source: Bureau of Economic Analysis (BEA)

& Bureau of Labor Statistics (BLS)

2 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

subprime crisis. In fact, the November 2012 PCE

report of $9,686.6 billion represents a new high

water mark for this statistic. But these expenditures

have come at the expense of generally declining

personal savings, reported at 3.6% in October 2012.

It is not entirely clear the extent to which the Fed’s

policy with respect to mortgage financing is

responsible, but the housing market has indeed

shown clear signs of improvement. This is

evidenced by an upturn in housing activity with

building permits, housing starts and housing

completions noticeably improving.

Building permits were reported at 899 thousand

units in November and up 75% from the May 2009

trough of 513 thousand units. Similarly, housing

starts and completions were reported at 861

thousand and 677 thousand units, respectively, and

up 80% and 33% from their lows recorded over the

past several years.

This impetus has further been felt in housing values

where the S&P/Case-Shiller Housing Indexes have

posted some nice gains over the past few months.

While the October 2012 read on the Composite

Index of 10 urban cities remains 29.8% below its

all-time peak observed in June 2006, it has

rebounded 7.0% from its low water mark recorded

in April 2012.

While news on the consumer front has been upbeat,

it is not clear that the business sector has kept pace

with the consumer sector as the Fed observed. The

Index of Industrial Production improved to 97.5090

in November from 96.4932 in October. Still, the

Index remains well below pre-crisis levels in excess

of 100.

Similarly, capacity utilization has rebounded but

remains below the pre-crisis peaks above 80.0%.

1%

2%

3%

4%

5%

6%

7%

8%

9%

$8,900

$9,000

$9,100

$9,200

$9,300

$9,400

$9,500

$9,600

$9,700

$9,800

Jan-0

7

Jul-

07

Jan-0

8

Jul-

08

Jan-0

9

Jul-

09

Jan-1

0

Jul-

10

Jan-1

1

Jul-

11

Jan-1

2

Jul-

12

Pers

onal Savin

gs R

ate

PCE (

Bil $

)

Personal Consumption & Savings

Personal Consumption ExpendituresPersonal Savings Rate

Source: St. Louis Federal Reserve FRED Database

0

500

1,000

1,500

2,000

2,500

Jan-0

4

Sep-0

4

May-0

5

Jan-0

6

Sep-0

6

May-0

7

Jan-0

8

Sep-0

8

May-0

9

Jan-1

0

Sep-1

0

May-1

1

Jan-1

2

Sep-1

2

000 U

nits

Housing Activity

Building Permits Housing Starts Completions

Source: Dept. of Housing & Urban Development (HUD)

80

120

160

200

240

280

320

Jan-0

0

Nov-0

0

Sep-0

1

Jul-

02

May-0

3

Mar-

04

Jan-0

5

Nov-0

5

Sep-0

6

Jul-

07

May-0

8

Mar-

09

Jan-1

0

Nov-1

0

Sep-1

1

Jul-

12

S&P/Case-Shiller Housing Indexes

Los Angeles San Diego San Francisco

Denver Washington DC Miami

Chicago Boston Las Vegas

New York Comp-10

Source: Standard & Poor's

66%

68%

70%

72%

74%

76%

78%

80%

82%

80

85

90

95

100

105

Jan-0

7

Jul-

07

Jan-0

8

Jul-

08

Jan-0

9

Jul-

09

Jan-1

0

Jul-

10

Jan-1

1

Jul-

11

Jan-1

2

Jul-

12

Capacity U

tilization

Industr

ial Pro

duction I

ndex

Industrial Activity

Index of Industrial Production Capacity Utilization

Source: St. Louis Federal Reserve FRED Database

3 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

The figure was most recently reported at 78.4% in

November and up from November’s 77.7%.

Corporate profitability improved 18.6% from the 2nd

to 3rd quarters 2012 to check in at $1,752.2 billion.

These business conditions seem to be contributing to

the controlled inflation the Fed describes in its

December report. November CPI fell to 1.8% on an

annualized basis, down from 2.2% in the previous

month. Much of this was driven by declining energy

prices. Still, CPI ex-food & energy fell to 1.9% from

2.0% on an annualized basis in November from

October.

While the Fed observes some improvement in

economic conditions, it nonetheless “remains

concerned that, without sufficient policy

accommodation, economic growth might not be

strong enough to generated sustained improvement

in labor market conditions. Furthermore, strains in

global financial markets continue to pose significant

downside risks to the economic outlook.” 3

Thus, the Fed intends to continue its mortgage

purchasing programs. The Fed further hones its

focus on labor markets, suggesting that if they do

not “improve substantially, the Committee will

continue its purchases of Treasury and agency

mortgage-backed securities, and employ its other

policy tools as appropriate, until such improvement

is achieved in a context of price stability.” 4

The Fed further intends to maintain target Fed Funds

at 0-25 basis points “at least as long as the

unemployment rate remains above 6-1/2 percent.” 5

This linkage of monetary policy with a stated target

for unemployment is quite significant.

The 2013 “fiscal cliff” provided further economic

apprehension in December 2012 as executive and

legislative branches of government struggled to

reach an accord on taxes and spending cuts. By

early January, an agreement had passed both House

and Senate consideration.

This bill includes higher taxes on individuals

reporting $400,000+ and married couples with

$450,000+ in income and increases the dividend tax

from 15% to 20% on those taxpayers.

Consideration of budget issues is, however,

postponed until March.

3 Ibid.

4 Ibid. 5 Ibid.

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

120%

Q1 0

4

Q4 0

4

Q3 0

5

Q2 0

6

Q1 0

7

Q4 0

7

Q3 0

8

Q2 0

9

Q1 1

0

Q4 1

0

Q3 1

1

Q2 1

2

Pre

-Tax P

rofits

(Billions)

Annualized C

hange

U.S. Corporate Profitability

Annual Change Corporate Profits (Bil)

Source: Department of Commerce

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

Jan-0

4

Aug-0

4

Mar-

05

Oct-

05

May-0

6

Dec-0

6

Jul-

07

Feb-0

8

Sep-0

8

Apr-

09

Nov-0

9

Jun-1

0

Jan-1

1

Aug-1

1

Mar-

12

Oct-

12

Year-

on-Y

ear

Change

Consumer Price Index (CPI-U SA)

CPI - All Urban Consumers SA CPI ex-Food & Energy SA

Source: Bureau of Labor Statistics (BLS)

50

55

60

65

70

75

80

85

90

95

100

$40

$45

$50

$55

$60

$65

$70Q

4 0

4

Q3 0

5

Q2 0

6

Q1 0

7

Q4 0

7

Q3 0

8

Q2 0

9

Q1 1

0

Q4 1

0

Q3 1

1

Q2 1

2

Consum

er

Confidence I

ndex

Household

Net

Wort

h (

Tri

llio

ns) Net Worth & Consumer Confidence

Household Net Worth Consumer Confidence Index

Source: U.S. Federal Reserve & FRED Database

4 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

The fiscal cliff weighed on consumer sentiment as

evidenced by the dramatic decline in the Thomson

Reuters/University of Michigan Index of Consumer

Sentiment. The figure plummeted from 82.7 to 74.5

between November and December 2012. This

decline came despite the fact that household net

worth has been climbing nicely over the past several

quarters. Fading consumer confidence is further

reflected in preliminary reports of disappointing

holiday sales.

Fiscal Policy

The Federal spending deficit appears to have

stabilized after increasing into the neighborhood of

$1.2-$1.4 trillion beginning in 2009. The 2012

deficit can be expected to fall within the same

general range. Future deficits will be a function of

both economic and political considerations.

The federal government is, of course, aware of the

magnitude of the fiscal situation and has attempted

to curb spending within the context of the so-called

“fiscal cliff” tax and spending negotiations. While

progress has been made to forestall the expiration of

the Bush administration tax cuts as of this writing,

the spending debate has been postponed until March

2013, as discussed above. Further drama may be

anticipated in the form of a renewed debate on the

debt ceiling in coming months as well.

Current & Capital Accounts

In addition to the troublesome fiscal deficit, the U.S.

faces a significant trade deficit as reflected in the

current account balance. While the trade deficit

diminished in the immediate wake of the subprime

crisis, it is growing once again although it has not

yet breached pre-crisis levels. Still, the deficit

strains upwards to 4.0% of GDP in 2011 and the

highest amongst all G10 nations.

Some improvements in these figures seem to be

developing as the trade deficit decreased to $107.5

billion in the 3rd quarter from $133.6 billion in the

first quarter. The decrease in the current account

deficit may be attributed to a declining deficit on

goods and an increase in the surplus on income.

In addition to monitoring current account activity,

we may likewise study capital account flows. The

U.S. Treasury Department’s Treasury International

Capital (or “TIC”) database represents a ready

source of information. This database tracks flows

into and out of the U.S. The data is broken into

foreign stocks, foreign bonds, U.S. stocks, U.S.

-$1,600

-$1,400

-$1,200

-$1,000

-$800

-$600

-$400

-$200

$0

$200

$400

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Federal Surplus/Deficit(Billions USD)

-$250

-$200

-$150

-$100

-$50

$0

Q1 0

4

Q3 0

4

Q1 0

5

Q3 0

5

Q1 0

6

Q3 0

6

Q1 0

7

Q3 0

7

Q1 0

8

Q3 0

8

Q1 0

9

Q3 0

9

Q1 1

0

Q3 1

0

Q1 1

1

Q3 1

1

Q1 1

2

Q3 1

2

U.S. Current Account Deficit(Billions USD)

Source: Bureau of Economic Analysis (BEA)

-$800

-$300

$200

$700

$1,200

2003

2004

2005

2006

2007

2008

2009

2010

2011

Thru

10/1

2

Net US/Foreign Capital Flows (Billions USD)

US Treasuries US Gov't Agencies US Corporates

US Stocks Foreign Bonds Foreign Stocks

Source: U.S. Treasury TIC Database

5 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

corporate bonds, U.S. government agencies and

U.S. Treasuries.

Foreign investors acquired some $432.6 billion in

U.S. Treasuries, on a net basis during the first 10

months of 2012. Clearly U.S. Treasuries continue to

be regarded as a “safe haven” investment despite

the unusually low yields currently prevailing in the

marketplace. While the 2012 inflows are unlikely to

match the 2009 or 2010 investments of $538.4 and

$703.7 billion, respectively, the number is

substantial and supportive of the Treasury market.

Outright Yield Movements

Noting that interest rates now hover at extreme lows

in both nominal and real terms, many analysts

suggest that the only direction in which the next

major interest rate movement can occur is up. This,

of course, implies declining fixed income asset

values and represents a further source of global risk

as explained in more detail below.

We might measure the prospective risk of rising

rates by resorting to an analysis known as

“breakeven (B/E) rate analysis.” This technique

addresses the questions – how much do rates need

to advance, measured in basis points (bps), before

investors suffers a loss by holding a particular

security or portfolio?

In order to address this question in a current

context, we examined the characteristics of various

indexes as published by Barclays Capital including

the U.S. Treasury Index (inclusive of all maturities);

the Intermediate Treasury Index (1-10 year

maturities); the Long Treasury Index (10+ year

maturities); and the Aggregate Index (includes

mortgages and corporates).

Breakeven Rate Analysis (12/31/12)

Barcap

Index

2012

YTD

Return

Duration

(Years) Yield

B/E

Rate

Advance

U.S.

Treasury 1.99% 5.4 0.86% 16 bps

Intermediate

Treasury 1.71% 3.8 0.59% 16

Long

Treasury 3.56% 16.7 2.66% 16

Aggregate 4.22% 5.1 1.74% 34

This analysis is generally conducted over a twelve-

month time horizon and takes into account any

income generated by holding the security. One may

estimate the rate advance required to offset income

over a 12-month period by simply dividing the yield

on the index by its duration.

E.g., if rates advance just 16 basis points (bps) or

0.16% on all securities in the U.S. Treasury Index

over the course of the next 12 months, the returns

associated with the index will equate to zero, or the

breakeven point. This is calculated as the yield in

basis points divided by duration or 16 bps = (86 bps

÷ 5.4 years).

E.g., the breakeven rate advance for intermediate

Treasuries is 16 bps (=59 bps ÷ 3.8 years).

E.g., the breakeven rate advance for long-term

Treasuries is 16 bps (=266 bps ÷16.7 years).

0%

1%

2%

3%

4%

5%

6%

7%

Jan-0

1

Jan-0

2

Jan-0

3

Jan-0

4

Jan-0

5

Jan-0

6

Jan-0

7

Jan-0

8

Jan-0

9

Jan-1

0

Jan-1

1

Jan-1

2

Benchmark U.S. Rates

Target Fed Funds 2-Yr Treasury

5-Yr Treasury 10-Yr Treasury

30-Yr Treasury

0

50

100

150

200

250

U.S. Treas Inter Treas Long Treas Aggregate

Breakeven Rate Analysis(Basis Points)

Dec-99 Dec-07 Dec-12

6 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

E.g., the breakeven rate advance for the Barcap

U.S. Aggregate Bond Index is 34 bps (=174 bps ÷

5.1 years).

These breakeven rate advances are near the lowest

levels ever observed. This analysis underscores the

vulnerability associated with fixed income securities

and represents a significant source of concern,

particularly in light of the magnitude of planned

Treasury issuance.

Shape of Yield Curve

The Fed reacted quickly and decisively to the

subprime crisis by injecting massive liquidity into the

system. The target Fed Funds rate was reduced in

2008 from 5-¼% to the current level of zero to ¼%.

But after the Fed moved rates (essentially) to zero,

it had apparently expended its major monetary

policy bullet with little positive impact.

Thus, it followed up with more inventive methods,

notably its “Quantitative Easing” programs known as

“QE” and “QE2” – followed by the latest round

focusing on mortgage backed securities, as outlined

in the Fed’s September 13th press release and

described above.

The net effect of these monetary policies is that, in

addition to contributing to a very bloated Fed

balance sheet, we currently have very low nominal

interest rates across the entire maturity spectrum of

the yield curve, i.e., a reasonably flat yield curve.

Yield spreads are now quite compressed at any

level. (See Table 1 below.)

Noting that inflation rates generally exceed all but

the longest nominal interest rates, real or inflation-

adjusted interest rates are likewise observed at very

negative, and historically low, levels. By the

conclusion of the 4th quarter 2012, the rates

associated with 5- and 10-year Treasury Inflation

Protected Securities (TIPS) were hovering at -1.37%

and -0.67%, respectively.

Credit Risk

Credit risk essentially refers to the risk that of

default associated with a fixed income security, i.e.,

the risk that the issuer will fail to make timely

coupon and principle payments. This risk may be

monitored and traded by reference to spreads

between instruments bearing divergent credit

qualities.

E.g., one may compare the yields associated with

corporate bonds of varying credit quality to the

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

3-M

th6-M

th1-Y

r2-Y

r3-Y

r

5-Y

r

7-Y

r

10-Y

r

30-Y

r

Treasury Yield Curve

Dec-12 Sep-12 Jun-12 Mar-12

Dec-11 Sep-11 Jun-11 Mar-11

-1%

0%

1%

2%

3%

4%

5%

Jan-0

1

Jan-0

2

Jan-0

3

Jan-0

4

Jan-0

5

Jan-0

6

Jan-0

7

Jan-0

8

Jan-0

9

Jan-1

0

Jan-1

1

Jan-1

2

Treasury Yield Spreads

2-5 Yr Spread 2-10 Yr Spread 2-30 Yr Spread

5-10 Yr Spread 5-30 Yr Spread 10-30 Yr Spread

-2%

-1%

0%

1%

2%

3%

4%

5%

Jan-0

3

Jan-0

4

Jan-0

5

Jan-0

6

Jan-0

7

Jan-0

8

Jan-0

9

Jan-1

0

Jan-1

1

Jan-1

2

TIPS Yields

5-Yr TIPS 7-Yr TIPS 10-Yr TIPS

20-Yr TIPS 30-Yr TIPS

7 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

yields associated with comparable maturity Treasury

securities. This represents a classic comparison of

private vs. public credit risks. As a rule, of course,

the corporate securities should offer a more

attractive yield to compensate for the enhanced risk

of default.

The Moody’s Corporate Bond Indexes cover

investment grade securities with credit qualities

ranging from Baa to Aaa. Moody’s targets bonds

with remaining maturities as close to 30 years as

possible. Securities are deleted from the indexes if

their remaining maturity falls below 20 years, if the

security is susceptible to redemption or if the rating

should be amended.

By the conclusion of the 4th quarter 2012, Aaa and

Baa corporate bond yields, as measured by the

Moody’s Indexes, were at 3.67% and 4.63%,

respectively. These figures might be compared to

the yields of 1.758% and 2.950% associated with

on-the-run (OTR) 10- and 30-year Treasuries.

Fixed income portfolio managers must, of course,

decide whether to allocate assets to Treasury or

corporate securities. One critical central question

becomes – how many basis points must the spread

between corporates and Treasuries widen before

corporates actually underperform Treasuries?

To provide some insight into this question, we may

create a simple corporate spread breakeven (B/E)

analysis for the Finance sector, as reported by

Bloomberg.. This process is analogous to our

breakeven rate analysis as explained above.

Specifically, we divide the finance spread, or the

premium in corporate bond rates vs. comparable

maturity Treasury rates, by the duration associated

with those corporates. The result provides an

indication of the degree to which the spread must

widen before corporates underperform Treasuries.

5-Year Corporate “Finance” Spread B/E

Analysis (12/31/12)

Corporate

Quality

Duration

(Years)

Finance

Spread

vs. Treas

B/E

Spread

Advance

AA 4.9 0.81% 17 bps

A 4.9 0.96% 20

BBB 4.9 2.08% 42

BB 4.9 2.14% 44

Source: Bloomberg

E.g., if the spread for AA corporate bonds should

increase by 17 basis points (bps) over the course of

the next 12 months, the returns associated with

corporates will underperform comparable maturity

Treasuries. This is calculated as the finance spread

in basis points divided by duration or 17 bps = (81

bps ÷ 4.9 years).

E.g., the breakeven spread advance for A-rated

corporates is 20 bps (=96 bps ÷ 4.9 years).

E.g., the breakeven spread advance for BBB

corporates is 42 bps (=208 bps ÷ 4.9 years).

E.g., the breakeven spread advance for BB

corporates is 44 bps (=214 bps ÷ 4.9 years).

3%

4%

5%

6%

7%

8%

9%

10%

Jan-0

1

Jan-0

2

Jan-0

3

Jan-0

4

Jan-0

5

Jan-0

6

Jan-0

7

Jan-0

8

Jan-0

9

Jan-1

0

Jan-1

1

Jan-1

2

Moody's Corporate Bond Indexes

Moody's Aaa Corp Moody's Aa Corp

Moody's A Corp Moody's Baa Corp

0

50

100

150

200

250

AA A BBB BB

Corporate Spread B/E Analysis(Basis Points)

Dec-08 Dec-10 Dec-12

Source: Bloomberg

8 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

Note that the current B/E spread advance figures

are at the lowest levels observed for some years

now. In other words, corporate investors may be

more vulnerable to the prospect of widening credit

spreads today than ever before.

Other Credit Spreads

Two additional and interesting credit quality spreads

that bear watching include (1) swap spreads; and,

(2) the OIS-LIBOR spread.

A swap spread is a reference to a spread between

interest rate swaps (IRS) and Treasury securities.

Consider this a form of credit spread insofar as it

represents a direct comparison between the private

credit risks represented in IRS markets vs. public

credit risks represented in Treasury markets.

Our graphic depicts various swap spreads

constructed from data gleaned from the U.S.

Treasury Department’s daily H15 report. Thus, we

compare 2-, 5-, 10- and 30-year LIBOR-based

interest rate swap instruments to “Constant Maturity

Treasury” (CMT) yields.

These spreads tend to advance and decline as a

function of credit conditions and the general level of

macroeconomic concerns. Normally, one would

expect that the IRS instruments would carry a

higher yield than comparable maturity Treasuries.

But expected relationships do not always hold.

Note that the 30-year swap spread has fallen into

negative territory, flying in the face of the historical

presumption that private credit risks and yields must

exceed public risks and yields. Some would suggest

acting upon this apparent mispricing by pursuing an

arbitrage transaction by buying long-term Treasuries

and paying fixed rate on 30-year interest rate swap

instruments.

But the Fed essentially backstopped the banking

industry during the subprime crisis while S&P

downgraded the credit rating of U.S. long-term

sovereign debt in August 2011, thereby causing the

implicit credit risks to converge to a degree.

Further, the structure of IRS instruments may imply

reduced risk relative to long-term Treasuries as

swaps do not contemplate an original exchange of

principal values and may be marked-to-market.

Thus, some suggest that the spread belongs in

negative territory, representing a proverbial “black

swan” in practice.

Further explanation for this apparent pricing

anomaly may be found in the movement towards

liability-driven investment (LDI) strategies. Many

pension fund managers have increasingly turned to

long-term IRS, as an alternative to 30-year Treasury

investment, to match the maturities of their assets

with liabilities.

CME Group now offers 2-, 5-, 10- and 30-year

deliverable swap futures contracts (DSFs) as well as

Treasury futures contracts covering the 2-, 5-, 10-

and 30-year sectors of the curve. Thus, one may

construct a weighted spread to take advantage of

risk-on, risk-off conditions.

Credit Quality

Increasing ����

Buy DSF / Treasury futures spreads

Credit Quality Decreasing

���� Sell DSF / Treasury

futures spreads

If you believed that economic tensions are

dissipating and wanted to adopt an aggressive “risk-

on” posture, some suggest buying DSF/Treasury

spreads. If you believed that economic tensions

might flare up, then one might adopt a conservative

“risk-off” position by selling DSF/Treasury spreads.

On the short-end of the yield curve, one may

monitor the spread between 3-month LIBOR and

Overnight Interest Swap (OIS) rates.

LIBOR is an acronym for London Interbank Offered

Rate and represents the rate paid by commercial

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

Jan-0

1

Jan-0

2

Jan-0

3

Jan-0

4

Jan-0

5

Jan-0

6

Jan-0

7

Jan-0

8

Jan-0

9

Jan-1

0

Jan-1

1

Jan-1

2

Swap over Treasury Spreads

2-Yr Spread 5-Yr Spread

10-Yr Spread 30-Yr Spread

9 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

banks (in London) on U.S. dollar denomianted

deposits. OIS represents the rate paid on overnight

deposits by a central bank such as the U.S. Federal

Reserve to its member banks, i.e., the Fed Funds

rate, as observed and compounded over a period of

time such as three months.

To the extent that this spread gauges the difference

between commercial bank and central bank deposit

rates, it reflects the risk of default on the part of

commercial banks.

This spread has historically been observed around

10 basis points. But it rocketed to 3.5% at the

height of the subprime mortgage crisis. While the

European sovereign debt crisis does not hit quite so

close to home, the spread nonetheless spiked in mid

2010 and is moved up again in 2011 and in reaction

the European sovereign debt situation.

CME Group offers 3-month Eurodollar futures based

on the British Bankers Association (BBA) 3-month

Eurodollar time deposit rate; and futures based on

30-day Federal Funds rate. Thus, a properly

weighted spread between Eurodollar and Fed Funds

futures may represent a nice proxy for the 3-month

LIBOR vs. OIS spread.

Credit Quality

Increasing ����

Buy Eurodollar / Fed Funds futures spreads

Credit Quality Decreasing

���� Sell Eurodollar / Fed Funds

futures spreads

If you believed that economic tensions were likely to

dissipate and wanted to adopt an aggressive risk-on

position, some suggest buying buy Eurodollar/Fed

Fund spreads. If you believed that economic

tensions might flare up, then one might adopt a

conservative risk-off position by selling

Eurodollar/Fed Funds spreads.

Conclusion

CME Group offers a broad array of interest rate

futures and option contracts running the gamut from

short-term to long-term contracts and reflecting

both public to private credit risks.

These products provide facile and liquid vehicles

with which one may express a view on prospective

market movements. Or, to manage the risks

associated with fixed income holdings during

turbulent times.

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

Jan-0

1

Jan-0

2

Jan-0

3

Jan-0

4

Jan-0

5

Jan-0

6

Jan-0

7

Jan-0

8

Jan-0

9

Jan-1

0

Jan-1

1

Jan-1

23-Mth LIBOR - OIS Spread

10 | Interest Rate Market Monitor 4th Quarter 2012 | January 11, 2013 | © CME GROUP

Table 1: Treasury On-the-Runs (OTRs) (As of 12/31/12)

Coupon Maturity Price Yield Duration (Years)

BPV (per Mil)

Yield (Sep-12)

Yield (Jun-12)

Yield (Mar-12)

Yield (Dec-11)

Yield (Sep-11)

4-Wk Bill 01/24/13 0.018% 0.060 $7.28

13-Wk Bill 03/28/13 0.043% 0.233 $24.81 0.073% 0.083% 0.08% 0.01% 0.01%

26-Wk Bill 06/27/13 0.114% 0.482 $51.08 0.133% 0.153% 0.14% 0.05% 0.04%

52-Wk Bill 12/12/13 0.140% 0.942 $97.81 0.155% 0.206% 0.19% 0.12% 0.10%

2-Yr Note 1/8% 12/31/14 99-24 1/8 0.248% 1.996 $199 0.232% 0.303% 0.34% 0.26% 0.21%

3-Yr Note 1/4% 12/15/15 99-22 3/8 0.353% 2.942 $293 0.307% 0.395% 0.51% 0.39% 0.35%

5-Yr Note 3/4% 12/31/17 100-04 1/8 0.724% 4.899 $491 0.626% 0.719% 1.02% 0.89% 0.90%

7-Yr Note 1-1/8% 12/31/19 99-20 1/4 1.180% 6.711 $669 1.050% 1.106% 1.56% 1.43% 1.42%

10-Yr Note 1-5/8% 11/15/22 98-25+ 1.758% 9.058 $897 1.634% 1.646% 2.17% 1.98% 1.98%

30-Yr Bond 2-3/4% 11/15/42 96-01 1/4 2.950% 19.978 $1,926 2.824% 2.754% 3.28% 2.98% 3.18%

Table 2: Treasury OTR Yield Spreads (As of 12/31/12)

Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 Sep-11 Jun-11

Yield Spreads

2-5 Yr 0.476% 0.394% 0.416% 0.68% 0.62% 0.69% 1.17%

2-10 Yr 1.510% 1.402% 1.343% 1.83% 1.66% 1.77% 2.59%

2-30 Yr 2.702% 2.592% 2.451% 2.94% 2.66% 2.97% 3.82%

5-10 Yr 1.034% 1.008% 0.927% 1.15% 1.04% 1.08% 1.42%

5-30 Yr 2.226% 2.198% 2.035% 2.26% 2.04% 2.28% 2.65%

10-30 Yr 1.192% 1.190% 1.108% 1.11% 1.00% 1.20% 1.23%

Butterflies

2-5-10 Yr 0.558% 0.614% 0.511% 0.47% 0.42% 0.39% 0.25%

2-5-30 Yr 1.750% 1.804% 1.619% 1.58% 1.42% 1.59% 1.48%

Copyright 2013 CME Group All Rights Reserved. Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is

required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a

portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade. All examples in this brochure are hypothetical situations, used for explanation purposes only, and should not

be considered investment advice or the results of actual market experience.”

Swaps trading is not suitable for all investors, involves the risk of loss and should only be undertaken by investors who are ECPs within the meaning of section 1(a)18 of the Commodity Exchange Act. Swaps are a

leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a swaps position. Therefore, traders should only use funds

that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to profit on every trade.

CME Group is a trademark of CME Group Inc. The Globe logo, E-mini, Globex, CME and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. Chicago Board of Trade is a trademark of the Board

of Trade of the City of Chicago, Inc. NYMEX is a trademark of the New York Mercantile Exchange, Inc.

The information within this document has been compiled by CME Group for general purposes only and has not taken into account the specific situations of any recipients of the information. CME Group assumes no

responsibility for any errors or omissions. Additionally, all examples contained herein are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual

market experience. All matters pertaining to rules and specifications herein are made subject to and are superseded by official CME, NYMEX and CBOT rules. Current CME/CBOT/NYMEX rules should be consulted in all cases

before taking any action.