Intel Equity Research (1) - WordPress.com

Transcript of Intel Equity Research (1) - WordPress.com

Published by CityU Research & Investment Club

Intel

Equity Research CityU Research & Investment Club

Authors

Gerald Akhmelvan Kenneth Hans Periatna Waleed Meraj Qureshi

Andreas Kusnadi Muhammad Saif Ullah

Published by CityU Research & Investment Club

The content and opinions in this report are written by university students from the CityU Student Research & Investment Club, and thus are for reference only. Investors are fully responsible for their investment decisions. CityU Student Research & Investment Club is not responsible for any direct or indirect loss resulting from investments referenced to this report. The opinions in this report constitute the opinion of the CityU Student Research & Investment Club and do not constitute the opinion of the City University of Hong Kong nor any governing or student body or department under the University.

Published by CityU Research & Investment Club

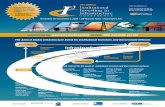

Intel Corporation (INTC) 11th Gen roadmap, commitment to change, and development in IOTG sets Intel for long-term growth We view that the market is overreacting and shifting most of its attention to Intel’s delay on their 7nm chips. Intel is currently undergoing a strategic transformation into a data-centric company. Client Computing Group (CCG) does comprise a majority of Intel’s revenue (2019: 51.8%, 2Q20: 48.2%), and the recent news of Intel’s delay on their 7nm chips may have investors losing confidence as AMD and NVIDIA have technological and manufacturing edge over Intel. However, we believe that investors are turning their heads away from long-term growth potential in their Data Center Group (DCG) and Internet of Things Group (IOTG), also combined with a solid upcoming 11th gen product pipeline. Intel’s architecture day highlights their commitment to continue delivering timely, high-quality products to clients, indicated by Intel’s statement that some of their GPUs will be made in external foundries (very likely TSMC). Their Tiger Lake processors represents a major improvement to their previous processors, offering superior single-core performance to AMD’s Ryzen 7 4800U series and [their IrisXe GPU] comparable performance with NVIDIA’s MX-350 GPU. Intel has also secured multiple partnerships with OEMs for their notebook CPUs, including major existing customers such as HP, Dell, and Lenovo, along with Acer and Asus, to name a few. We expect that the strong demand for their CPUs and GPUs can allow minimization of market share losses to AMD and NVIDIA. Intel has robust financials and fundamentals, shown by their consistent free cash flow generation ability, a healthy balance sheet, and quality capital allocation. This provides investors a cushion for downside risks and volatility nearing the election and amidst global uncertainty, in our view. It also allows Intel to continuously invest in the long-term development of segments such as IOTG, where we believe will experience double-digit growth post COVID-19 (base case: 1Q22), driven by increased demand of electric and autonomous vehicles, mainly in China. The rise in enterprise digital transformation, AI usage, users of digital banking and online wallets, and wearables also contributes to the increased demand for data storage, which serves as a positive future catalyst for Intel’s data center processors as more companies deem data center and cloud spending to be a necessity. We remain overweight on INTC, with a price target of $63.44.

13 October 2020 United States

Equity Research Rating: Overweight Current Share Price: $53.88 Price Target: $63.44 52-Week Range: $43.63–69.29 Market Cap: $229.17B Enterprise Value: $241.39B

Technology, Media & Telecommunications Gerald Akhmelvan – Lead Analyst [email protected] Kenneth Hans Periatna [email protected] Waleed Meraj [email protected] Andreas Kusnadi [email protected] Muhammad Saif Ullah [email protected]

40,00

50,00

60,00

70,00

Jan-20 Apr-20 Jul-20 Oct-20

INTC

Published by CityU Research & Investment Club

Table of Contents Revenue Breakdown (2019) ............................................................................................. 3

Largest Customers ................................................................................................................................................................................ 4 Competitors Revenue Breakdown and 5 Year Share Price Performance ........................................................................... 4

Industry Trends ................................................................................................................... 5 Sales of Global Semiconductor Market .......................................................................................................................................... 5 Personal Computing Device Shipments ........................................................................................................................................ 6 IoT Spending ........................................................................................................................................................................................... 6 Semiconductor Sales Segments ....................................................................................................................................................... 6

Investment Catalysts and Risks ....................................................................................... 6

Catalysts .................................................................................................................................................... 6 Intel’s Tiger Lake (10nm) demonstrates enhancement in laptop CPUs and comparable performance to AMD’s 7nm processors. ..................................................................................................................................................................................... 7 Massive growth potential for IOTG segment driven by increased EV sales trend in 3 major regions. .................... 8 Intel’s actions show commitment and willingness to adapt. ................................................................................................. 9

Risks ........................................................................................................................................................... 9 Intel faces intense competition on the CCG segment and market share is continuously being eaten by AMD. .. 9 Other risk factors ................................................................................................................................................................................... 9

Valuation ........................................................................................................................... 10

Summary ................................................................................................................................................ 10

Discounted Cash Flow (85%) ............................................................................................................. 10

Comparables (10%) ............................................................................................................................. 12

Precedent Transactions Analysis (5%) ............................................................................................. 12

Summary of Financials .................................................................................................... 13

Published by CityU Research & Investment Club

Revenue Breakdown1

Client Computing Group (CCG): This segment includes platforms designed for end-user form factors and generates 51.8% of Intel’s revenue. Data Center Group (DCG): The DCG segment provides cloud services and makes up 32.8% of Intel’s revenue. Internet of Things Group (IOTG): The IOTG segment develops autonomous vehicles and produces high-technology products such as Intel’s VR Sports. This segment accounts 6.6% of Intel’s revenue and has shown constant high growth in the past five years. Non-Volatile Memory Solutions Group (NSG): The NSG segment manufactures products such as NAND technologies and covers 6.1% of Intel’s revenue. Programmable Solutions Group (PSG): Intel’s PSG segment constructs configuration devices, design software and power solution products. It books 2.8% of Intel revenue following a constant growth since 2015.

1 Pie chart may not equal to 100% due to rounding.

9000

13000

17000

21000

2015 2016 2017 2018 2019

Figure 1. Revenue by Regions (Millions USD)

China (Including Hong Kong)SingaporeUnited States

Source: Company Reports

13%

17%

11%

8%

10%

12%

14%

16%

18%

20%

2015 2016 2017 2018 2019

Figure 3. Intel's Three Largest Customers (% of Revenue)

Lenovo Group Limited Dell Inc. HP Inc.Source: Company Reports

32.8%

6.6%

6.1%2.8%

51.8%

Figure 4. Revenue by Product Segments (2019)

DCG IOTG NSG PSG CCGSource: Company Reports

0

20000

40000

60000

80000

2015 2016 2017 2018 2019 1Q20 2Q20

Figure 2. Revenue by Product Segments (Millions USD)

DCG IOTG NSG PSG CCGSource: Company Reports

Published by CityU Research & Investment Club

Largest Customers

For the past 5 years, Intel’s three largest customers, Dell Inc, Lenovo Group Limited, and HP Inc., accounted for an average of 41% of Intel’s net revenue. Revenue from these customers was from sale of platforms and various components mostly provided by the CCG and DCG operating segments. We expect CCG to experience low single-digit growth supported by upcoming 11th gen products, partially offset by a declining market and heavy competition from peers AMD and NVIDIA. We presume DCG will have mid-single-digit growth from increased demand of infrastructure expansion from hyperscalers, cloud computing and data centers, and cloud builders in the telecommunication and service provider companies. With the acquisition of Mobileye and partnership with Geely, we predict IOTG’s high growth will continue and will be set off by growing automotive sales post COVID-19. Due to the decreasing trend in NAND prices, slowing demand across communication and embedded segments, coupled with uncertainty arising from COVID-19, we believe that the growth in NSG and PSG may be limited or flat. Competitors Revenue Breakdown and 5 Year Share Price Performance

25

30

35

40

45

50

55

60

65

70

75

Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20

Figure 5. INTC 5 Year Price and Major Events

March 2020: Coronavirus Market Crash, INTC share price dropped by 34.8%

April 2019: INTClowered revenue guidance by $2.5 billion due to weak demand

July 2020: INTCannounced delays in their 7nm chips

July 2019: INTC sold their smartphonemodem business to AAPL

October 2017: Strong Q317 results, +6% in total revenue yoy, IOTG +23% yoyrevenue growth

June 2018: CEOBrian Krzanich resigned

July 2018: Beginning of US-China Trade War

Table 1. Competitors' Revenue Breakdown

Company Major Revenue Segments Regional (FY19) Product Mix (FY19) Major

Customers

AMD Ryzen Chips and Gaming Console custom chips in PS4 and Xbox

US (26.2%), APAC (57.8%), Europe (11.3%), Others

(4.7%)

Computing and Graphics (70%), EESC (30%)

Google, Amazon, Oracle

NVIDIA Data Center platforms and GeForce GPUs for gaming

US (8.1%), APAC (77.3%), Europe(9.1%), Others (5.5%)

Graphics (54%), Computer and Networking (46%)

Microsoft, Alphabet, Apple

IBM Power9 processor, Cloud-based

services, Cognitive Computing and Consulting

Americas (47%), APAC (21.3%), EMEA (31.7%),

Cloud and Cognitive Software (32%), Global Business and Technology Services (57%),

Systems (11%)

BNP Paribas, JP Morgan Chase,

Daimler AG

TSMC Manufacturing Apple’s new Arm-based processors and Nvidia GeForce GPUs

US (59.3%), APAC (32.7%), EMEA (6.3%), Others (1.7%) Wafer (86.7%), Others (13.3%)

Apple, AMD, NVIDIA

Source: Company Reports

Published by CityU Research & Investment Club

Industry Trends

Sales of Global Semiconductor Market

• Cylicality in memory market and pricing of memory products were the main driver in 12% global semiconductor sales decrease from 2018 to 2019.

• 2020 forecast of $426 billion is a revision of WSTS’ fall 2019 forecast of $436 Billion. This downgrade was attributed by disruptions in supply chain from the COVID-19 pandemic.

$412,2

$468,8

$412,3$426,0

$452,0

$350,0

$375,0

$400,0

$425,0

$450,0

$475,0

$500,0

2017 2018 2019 2020F 2021F

Figure 10. Total Sales of Global Semiconductor Market (Billions USD)

Source: The World Semiconductor Trade Statistics

$88,4

$166,0

$22,1

$114,7

$79,5

$171,0

$26,5

$95,6

$0,0

$30,0

$60,0

$90,0

$120,0

$150,0

$180,0

Desktop PC +Desktop

Workstation

Notebook +Mobile

Workstation

DetachableTablet

Slate Tablet

Figure 11. Personal Computing Device Shipment by Category (In Million USD)

2019

2023

Source: International Data Croporation

0

20

40

60

80

100

Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20

Figure 6. AMD

0

100

200

300

400

500

600

700

Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20

Figure 7. NVDA

80

100

120

140

160

180

200

Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20

Figure 8. IBM

0

20

40

60

80

100

Oct-15 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20

Figure 9. TSM

Published by CityU Research & Investment Club

• We assume and expect the pandemic to be over by 1Q22, and will help support global sales. We think that the growth will be mainly driven by, including but not limited to, IOT in health and data center segments.

Personal Computing Device Shipments

• Personal Computing Devices’ demand is expected to decline by 1.2% CAGR over the next 4 years due to decline of Slate Tablet and Desktop PC demand, partially offset by increased demand for Notebooks and Detachable Tablets.

• Rising demand for notebooks sector due to its portability and increasing performance. • The entrance of chrome-based detachable tablets that mainly focuses on educational purposes

potentially see an increase in demand for the same reason as the above.

IoT Spending

• $742 billion forecast for spending on IoT in 2020 is a downward revision compared to the previous forecast of 14.9% in 2019 as COVID-19 dampens economic activities.

• Wearable technology has garnered popularity during the pandemic as consumers start to become more health conscious, and we expect this trend to continue in the future. This could potentially bring more revenue for semiconductor companies as infrastructure of wearable technologies are heavily supported by semiconductor components.

• Increase in wearables will provide more data for wearable technology companies, which in turn will increase demand for data center products as firms collect data on consumer behavior.

Semiconductor Sales Segments

• The share of global semiconductor sales by categories mostly remain constant from 2018. • Communication still holds the largest share of the sales. We deem smartphones as a necessity

currently and this sector will most likely keep growing in the future from the development of 5G. • Computer section still holds a lot of potential as the demand for cloud computing is on the rise, as

we believe that firms will need to incorporate cloud computing inside their businesses.

Investment Catalysts and Risks Catalysts

$646,0 $681,2$742,0

$825,8$919,2

$1.023,0

$1.138,6

$0,0

$250,0

$500,0

$750,0

$1.000,0

$1.250,0

2018 2019 2020F 2021F 2022F 2023F 2024F

Figure 12. Spending on IoT (In Billions USD)

Source: International Data Corporation

33,0%

28,5%

13,3%

12,2%

11,9%1,3%

Figure 13. Global Semiconductor Sales by Categories (2019)

Communication

Computer

Consumer

Automotive

Industrial

Government

Source: Semiconductor Industry Association

Published by CityU Research & Investment Club

Intel’s Tiger Lake (10nm) demonstrates enhancement in laptop CPUs and comparable performance to AMD’s 7nm processors. The major discriminant between the new Intel processors and its competitors’ is their ability to tackle a prevalent problem in laptops, which is the inconsistency in performance when laptops are plugged in to an AC2 adapter compared to when they are unplugged or run on the device’s battery (DC). In Figure 143 we can see that the performance spread between AC and DC’s performance is smaller (2% on single core and 0.6% on multi core) in Tiger Lake compared to AMD’s Ryzen 4800 U (68% difference on single core and 33.7% on multi core), and to Tiger Lake’s predecessor, Intel Ice Lake (9.26% difference on single core and 44.35% on multi core performance).

Intel’s new integrated GPU, IrisXe, looks promising as it outperformed NVIDIA’s discrete GPU MX350 and AMD’s Ryzen 4800U, while its medium-end i5 outperformed AMD’s Ryzen 7 4800U. This surprised us because integrated GPUs would face more constraints on performance compared to discrete GPUs like NVIDIA’s MX 3504. Despite releasing a 10nm processor, Intel achieved comparable or even better performance than competitors who have implemented 7nm chips inside their processors. This portrays a bold statement from Intel, signaling that they cannot be counted out yet from the race.

2 AC = Alternating Current, DC = Direct Current 3 Geekbench is a platforms to test both angles of CPU performance, from the perspectives of single core and multi core performance. Geekbench Open CL tests GPU performance. 4 Integrated GPUs have to share their RAM with their CPUs while discrete GPUs have their own RAM.

1549

675

1145

6034

4834

2726

1588

1140

1251

6075

6461

3935

0 1000 2000 3000 4000 5000 6000 7000

Intel Core i7-1185G7

AMD Ryzen 7 4800U

Intel Core i7-1065G7

Figure 14. Performance Using AC Current vs DC Current Tested Using Geekbench 5.2*

Multi Core (AC) Single Core (AC) Multi Core (DC) Single Core (DC)

*The higher the better

(Ice Lake)

(Tiger Lake)

Source: Tom's Hardware

59845

51741

46620

59828

0 10000 20000 30000 40000 50000 60000 70000

Intel Core i7-1165G7

Intel Core i5-1135G7

AMD Ryzen 7 4800U

Nvidia MX-350

Figure 15. GPU Performance Tested Using Geekbench 4 Open CL*

Source: wccftech

*The higher the better

Published by CityU Research & Investment Club

Massive growth potential for IOTG segment driven by increased EV sales trend in 3 major regions. According to Deloitte, the Advanced Driver-Assistance Systems (ADAS) is expected to be an 11 billion USD business in 2022. By the same year, they also expect that the cost of semiconductor content to reach USD600 per car, up from around USD400 in 2019. With Mobileye, Intel is tapping into a relatively uncharted market which Deloitte believes to have a 5-year CAGR growth of 23.6%. Furthermore, Intel is collaborating with Geely in their Zero Concept model (produced by Lynk & Co., a joint venture between Geely and Volvo), which features Mobileye’s SuperVision™ ADAS technology. Intel also announced that they have secured a long-term and high-volume agreement with Geely Auto for ADAS, which means that more Geely vehicles will be using Mobileye’s technology. China is one of the fastest growing electric vehicle (EV) market, with McKinsey predicting the units sold to reach a range of 2.4 million to 3.5 million units by 2022. We believe that the demand for EV5 will pick up once the pandemic recedes and subside (base case scenario: 1Q22).

5 BEV = Battery Electric Vehicle, PHEV = Plug-in Hybrid Electric Vehicle

220

339

574

1062

2015 2016 2017 2018

Figure 18. Light EV Sales (Thousand Units)

China

BEV PHEVSource: McKinsey

115 158200

361

2015 2016 2017 2018

Figure 20. Light EV Sales (Thousand Units)

United States

BEV PHEVSource: McKinsey

154 169232

320

2015 2016 2017 2018

Figure 19. Light EV Sales (Thousand Units)

European Union

BEV PHEVSource: McKinsey

151

254

146

0

50

100

150

200

250

300

1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20

Figure 16. Mobileye Revenue (Millions USD)

Source: Company Reports

+68.2% growth

150

300

475

60018%

27%

40%

45%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

0

100

200

300

400

500

600

700

2000 2010 2020 2030

Figure 17. Price of Semiconductor Components in a Car and Proportion of Electronics Cost to Total Car Cost (USD)

Semiconductor Price (per car)Proportion of Total Car Cost

Source: Deloitte, IHS

Published by CityU Research & Investment Club

Intel’s actions show commitment and willingness to adapt. After the drop in their share price, Intel carried out a $10 million share buyback which rewarded their shareholders. Apart from that, Intel also got into an agreement with TSMC, which gives TSMC the right to begin mass production of Intel’s CPUs and GPUs next year, reducing Intel’s 7nm delay by around 6 months. By outsourcing to TSMC in their production, Intel can focus on their future 5nm chips by intensifying their research and development activities in the near future. Intel has also appointed Safroadu Yeboah-Amankwah as their chief strategy officer, who previously served McKinsey as a senior partner and global head of the transformation practice of TMT. We believe that this management change points Intel to the right direction.

Risks

Intel faces intense competition on the CCG and DCG segment and market share is continuously being eaten by AMD and NVIDIA. Intel lost significant CPU market share of around 9% in the period 2Q19 to 3Q19 when they first delayed their 7nm chips to 2021. AMD has pressured Intel’s market position by consistently offering products that were better in terms of price-to-performance; AMD’s Ryzen series are cheaper than Intel’s processors but still provided comparable performance. Intel’s delay announced in 2Q20 allows AMD to potentially be able to supply customers with 3nm chips by 2022. Should AMD maintain its technological advantage over Intel, we may see Intel’s market share dropping to 50-55%, a further 10-15% decrease. Moreover, the recent acquisition of Arm by NVIDIA provides the Intel competitor considerable synergies and potential enhancement for their data center products. However, the impact of this acquisition may be limited in the next few years as it is hindered by regulatory and bureaucratic processes, in our view. AMD has also been rumoured to be in talks to buy Xilinx in a $30 billion deal. We view that, should the deal go through, AMD may have to finance it using debt and may reduce future margins. Therefore, we need to continue to keep an eye out on these acquisition deals. Other risk factors that could negatively impact the share price include: (1) material, negative events affecting HP, Dell, or Lenovo (2) COVID-19’s negative effects on the global economy, lockdown measures, and consumption are longer than expected (3) mis-execution of their 11th gen roadmap (4) weaker-than-expected demand in CCG, IOTG, and DCG segments (5) worsening of the trade tension

0,00%

10,00%

20,00%

30,00%

40,00%

50,00%

60,00%

70,00%

80,00%

90,00%

Q12015

Q22015

Q32015

Q42015

Q12016

Q22016

Q32016

Q42016

Q12017

Q22017

Q32017

Q42017

Q12018

Q22018

Q32018

Q42018

Q12019

Q22019

Q32019

Q42019

Q12020

Q22020

Figure 21. x86 CPU Market Share of AMD and Intel Over The Last 5 Years

Intel AMDSource: Statista

Published by CityU Research & Investment Club

situation between the US and China that may substantially affect Intel (6) significant loss of market share in CCG and DCG through increased competition from AMD and NVIDIA.

Valuation Summary Our target price of $63.44 or a 17.7% upside from the current share price of $53.88 (12/10/20) is derived from a weighted average of 3 valuation models, namely a Discounted Cash Flow (DCF) model, a Comparables, and Precedent Transaction Analysis. We get a fair value share price of $58.28 from our DCF model, $87.08 from Comparables, and $103.97 from our Precedent Transaction Analysis. DCF valuation was given the highest weighting with 85%, while Comparables, and Precedent Transaction Analysis were given 10%, and 5% respectively. Our valuation is supported by our belief of growth potential in their data-centric businesses, strong fundamentals amidst global uncertainty, and strategic transformation of the company.

Discounted Cash Flow (85%) Our fair value share price of $58.28 reflects our base-case scenario of low single-digit revenue growth in the next 2 years, a $4.43 EPS in FY20, and a $4.91 EPS in FY21. We expect a flat 2% revenue growth in 2021 (vs estimates of -2%) and modest mid to high-single-digit growth in 2022 forward, mainly driven by top-line growth in IOTG, CCG, and DCG segments, reflecting economic recovery post COVID-19 (base case: 1Q22), narrowing gaps in technology and manufacturing advantage, and increased digitalization of global industries. Assumptions are made while also considering severe pressure from competitors, including NVIDIA’s enhanced data center chips through its acquisition with Arm, AMD’s future Ryzen releases and their potential acquisition of Xilinx. We view that NVIDIA’s acquisition with ARM may have an effect 2022/2023 onwards, taking into account the lengthy bureaucratic process and regulatory compliances.

20 70 120 170 220 270

52 Week Trading Range

Current Analyst Forecasts

Comparables Valuation

Precedents Valuation

DCF Valuation

Share Price ($)

Figure 22. Football Field Valuation Summary

Sources: Internal Valuation Model and Yahoo Finance

Current share price (12/10/20): $53.88

$66.14$51.97

$87.03 $227.9

$87.08 $170.9

$42

$43.63

$82

$69.29

Published by CityU Research & Investment Club

Table 2. Valuation Summary US10Y Treasury (12/10/20) 0,78%

Cost of Equity 8,26% Tax Rate 14,5% After Tax Cost of Debt 2,71% WACC 7,15% Terminal Growth Rate 1,90% Equity Value (Millions USD) 248275

Shares Outstanding (Millions USD) 4260

Current Share Price 58,28

Table 3.

Intel FCFF Projections

In millions of USD 2019 2020E 2021E 2022E 2023E 2024E

Revenue: 71965 74124 75606 79387 86532 95185 (-) Cost of Revenues, MG&A, R&D and Others -49930 -52665 -52671 -54297 -58917 -64762

Operating Income (EBIT): 22035 21459 22935 25090 27614 30422

Operating Margin: 30,6% 28,9% 30,3% 31,6% 31,9% 32,0%

(-) Income Taxes (EBIT*Tax Rate) -2754 -3111 -3326 -3638 -4004 -4411

(+) Depreciation and Amortization 10826 10121 10496 10941 11782 12800

Net Change in Working Capital 3058 -2677 1385 -640 870 161

(-) Capital Expenditures -16213 -15195 -16633 -18259 -20768 -22844

Free Cash Flows to the Firm (FCFF) 16952 10596 14857 13493 15494 16128

Discount Period: 0,5 1,5 2,5 3,5 4,5

Discount Rate (WACC): 7,15% 7,15% 7,15% 7,15% 7,15%

Cumulative Discount Factor: 0,97 0,90 0,84 0,79 0,73

PV of FCFF 10237 13396 11355 12169 11822

Table 4. Sensitivity Analysis of WACC and Terminal Growth Rate changes on share price

Terminal Growth Rate

58,28 1,60% 1,7% 1,80% 1,90% 2,00% 2,10% 2,20%

WA

CC

6,85% 58,76 59,88 61,03 62,23 63,48 64,78 66,14

6,95% 57,52 58,59 59,70 60,85 62,04 63,29 64,59

7,05% 56,33 57,35 58,42 59,52 60,67 61,86 63,10 7,15% 55,22 56,20 57,22 58,28 59,38 60,53 61,72

7,25% 54,07 55,02 56,00 57,01 58,07 59,16 60,30

7,35% 53,00 53,91 54,86 55,83 56,84 57,90 58,99

7,45% 51,97 52,85 53,75 54,69 55,67 56,68 57,72

Published by CityU Research & Investment Club

Comparables (10%) Our price of $87.08 assumes a normalized group forward P/E multiple of 17.7x attached to forecasted FY21 EPS of $4.92 for INTC.

Precedent Transactions Analysis (5%)

We obtain a share price of $103.97 for Intel from our Precedent Transactions Analysis model. We assign a weightage of 5% as we view this methodology to be less relevant for valuing Intel. Nevertheless, the selected set is shown below:

Published by CityU Research & Investment Club

Summary of Financials Intel Corporation In Millions USD except per share data and percentages Income Statement FY18A FY19A FY20E FY21E FY22E FY23E

Revenue 70848 71965 74124 75606 79387 86532

Cost of Sales -27111 -29825 -30761 -30243 -30770 -33315

Gross Profit 43737 42140 43363 45364 48616 53217

R&D -13543 -13362 -15195 -15499 -16274 -17739

MG&A -6750 -6150 -6338 -6464 -6788 -7398

Adj. EBIT 23444 22628 21830 23400 25555 28079

Net Interest -30 -6 -129 -122 -103 -67

Tax -2264 -3010 -3199 -3415 -3730 -4101

Adj. Net Income 21150 19612 18501 19864 21722 23911

Reported EPS 4,48 4,71 4,43 4,92 5,37 5,91

Adj. EPS 4,50 4,39 4,34 4,85 5,31 5,84

Payout Ratio 26% 26% 29% 29% 29% 29%

Balance Sheet & Cash Flow Statement FY18A FY19A FY20E FY21E FY22E FY23E

Cash and Cash Equivalents 11650 13123 25701 34265 41194 50912

Accounts Receivable 6722 7659 7783 7534 8336 9086

Inventories 7253 8744 7709 7863 8256 8999

Other Current Assets 3162 1713 1705 1739 1826 1990

Current Assets 28787 31239 42898 51400 59612 70988

PP&E 48976 55386 62586 70722 79916 90305

Long-Term Investments 9430 7243 6785 6785 6785 6163

Other Non-Current Assets 40770 42656 44573 45779 45135 44334

Total Assets 127963 136524 156843 174686 191448 211790

Short-Term Debt 1261 3693 2254 2254 2254 2254

Accounts Payables 3824 4128 4153 4083 4154 4497

Other Current Liabilities 11541 14489 12766 15172 15385 16657

Current Liabilities 16626 22310 19173 21509 21793 23409

Long-Term Debt 25098 25308 36093 36093 36093 36093

Other Non-Current Liabilities 11676 11402 10946 11006 11869 13426

Total Liabilities 53400 59020 66211 68608 69755 72928

Shareholders' Equity 74563 77504 90631 106078 121693 138862

Total Liabilities and Equity 127963 136524 156843 174686 191448 211790

Net Debt

Cash Flow from Operating Activities 29432 33145 28930 31958 33621 37521

Incl. D&A 9085 10826 10121 10496 10941 11782

Incl. Change in Working Capital -1910 1148 -1529 -144 -784 86

Published by CityU Research & Investment Club

Cash Flow from Investing Activities -11239 -14405 -16990 -15568 -17194 -19703

Incl. Capital Expenditures -15181 -16213 -15195 -16633 -18259 -20768

Cash Flow from Financing Activities -18607 -17565 -7511 -7827 -9498 -8101

Incl. Dividend Payments -5541 -5576 -5700 -5839 -6378 -7013

Net Change in Cash -414 1175 4428 8563 6930 9718

Adj. FCFF 13144 15373 11898 13583 13620 15011

Ratio Analysis FY18A FY19A FY20E FY21E FY22E FY23E

Gross Margin (%) 61,7% 58,6% 58,5% 60,0% 61,2% 61,5%

Adj. EBIT Margin (%) 33,1% 31,4% 29,5% 31,0% 32,2% 32,5%

Adj. EBITDA Margin (%) 45,9% 46,5% 43,1% 44,8% 46,0% 46,1%

Adj. Net Income Margin (%) 29,9% 27,3% 25,0% 26,3% 27,4% 27,6%

Dividend Yield (%) 2,32% 2,28% 2,47% 2,76% 3,02% 3,32%

ROCE(%) 21,2% 19,1% 14,6% 14,0% 13,8% 13,7%

ROE (%) 28,4% 25,3% 20,4% 18,7% 17,8% 17,2%

ROA (%) 16,5% 14,4% 11,8% 11,4% 11,3% 11,3%

Asset Turnover Ratio (%) 55,4% 52,7% 47,3% 43,3% 41,5% 40,9%

Adj. EBIT / Interest (x) 50,1 46,3 43,7 46,8 51,1 56,2

Debt / EBITDA (x) 1,64 1,76 2,07 2,02 1,91 1,83

Debt / Equity (x) 0,72 0,76 0,73 0,65 0,57 0,53

Net Debt / Equity (x) 0,56 0,59 0,45 0,32 0,23 0,16

Net Debt / EBITDA (x) 1,28 1,37 1,27 1,01 0,78 0,55

Current Ratio 1,73 1,40 2,24 2,39 2,74 3,03

Quick Ratio 1,30 1,01 1,84 2,02 2,36 2,65

Cash Ratio 0,70 0,59 1,34 1,59 1,89 2,17

P/E (x) 10,44 12,66 11,52 10,37 9,49 8,63

P/BV (x) 1,63 2,05 2,31 1,97 1,72 1,51

EV/EBITDA (x) 5,15 7,01 6,94 6,54 6,07 5,56

Source: Company Reports and CURIC estimates

Notes:

Cash and Cash equivalents includes cash, short-term investments, and liquid trading assets.

Long-Term Investment includes equity investments and other long-term investments

Other Non-Current Assets include goodwill, intangible assets, and other long-term assets

Other Non-Current Liabilities include contract liabilities, income taxes payable, deferred income taxes, and other long-term liabilities

Incl. = including or of which, e.g. 7.52 billion of depreciation is included in FY18 Cash Flow from Operating Activities of 29.4 billion.