Institute of Export & International Trade Newsletter

Transcript of Institute of Export & International Trade Newsletter

Institute of Export & International Trade Newsletter

December 2019

In this issue

Foreword

Editorial

- What to expect from Brexit in 2020

IOE&IT News

- 4 new appointments to the Board of Trustee Directors

International Trade News - New report reveals UK exporting wind and marine energy to 37 countries - Financial & political uncertainty takes its toll on global trade

- Experts encourage greener shipping - International investment took a hit in 2018, but global trade remained steady

- ‘Europe’s man on the moon moment’ - European Green Deal - Trade groups in the US try to revert export restrictions

Foreword

Heading into a new decade, it feels like a fresh start is well overdue. We are at a place of political uncertainty, financial losses and gains in the stock markets amongst other factors. Whilst we are all waiting for decisions to be made by the powers that be, this inbetween stage needn't be wasted time. With the Government's help on offering grants for businesses to learn to export alongside Brexit, make sure that you are using this time to learn, reflect on your processes and optimise your international relationships. Let this be an insightful time, where business come back stronger and more knowledgeable. Here at the Institute, we are all too aware of the risks that lack of knowledge and communication can have on businesses and ultimately on our economy, our job is to make sure no business will trade unsupported or without the relevant information and training they need. From learning the basics on exporting to operational courses on customs procedures and documentation to bachelor’s degrees in international trade and world customs compliance, we offer education for all. This would include whether you are a small business looking to trade outside of the UK for the first time to a global corporation looking to refresh their practices and bring all their staff up to date with current legislations. With so much set to happen in 2020 it's impossible not to feel excited with what the future has in store. Even if politicians don't always please us all, we have so much planned for the year, we have our first World Trade Summit in 2020 hosted in Manchester to look forward to, where industry experts come together to offer their insight into the past and future of exports, share experiences, knowledge and overall a great place to network and most importantly, ask questions! If Manchester is too out of the way for you, we will also be hosting it in London towards the latter part of 2020. Please enquire with the Institute for more information. I hope this newsletter helps you to understand how the future of exports are being shaped. You'll find some high and some lows. How trade wars are still impacting global economic development. How advancements in environmentally friendly methods of transport are set to cause a change in logistics and dividing opinions along the way. But lastly, the team here at the Institute would like to wish you a happy Christmas with a very successful 2020 ahead of you. Speak soon,

2020 training dates now available

Our training calendar for 2020 is now live and available to book via our website.

The Institute offers a range of one-day training courses, designed to give you the skills and expertise you need to gain a competitive advantage in the challenging and complex world of export, import and international trade.

View all courses

What to Expect from Brexit from

2020 The size of the Conservative majority earned in Boris Johnson’s general election win is extremely significant for UK politics, but what will it mean for Brexit and the UK’s future relationship with the EU? The winter election of 2019 will undoubtedly be looked back on as a turning point in terms of the UK’s trading relations with the EU and the rest of the world and businesses now really do need to properly prepare for Brexit – it’s going to happen.

The UK is now going to leave the EU on January 31st, initiating a transition period in which the terms of the future trade relationship are to be negotiated. However, uncertainty does remain as to the nature of the UK’s future relationship and the length of the upcoming transition period. Here are some key moments for us all to either look forward to or brace ourselves for over the coming year…

January 2020: Passing the Withdrawal Agreement Bill A much-changed Parliament returns on December 17th, with all of the 365 sitting Conservatives having pledged to vote through Johnson’s Withdrawal Agreement Bill. They will first vote through the Prime Minister’s Queen's Speech, setting out the agenda of the Conservative

Government, and will likely vote through the Withdrawal Agreement Bill in early January. The country will then enter a transition period with the EU, in which all existing EU rules remain in place, until the end of December 2020. During this transition period the UK will be negotiating its future trade relationship with the EU. Businesses should also note the January 31st deadline to apply for grant funding towards training that gives you the Customs skills you will need in a post-Brexit Britain. An extension to this deadline is not out of the realms of possibility and we will update our members on any updates to this, but we do advise you to apply now for this funding, as whether it is extended or not, it is now almost certain that you’ll need this training to ensure a smooth continuation of trade into the EU for the years ahead.

Spring 2020: Initial Negotiations The UK and EU will then finally begin to negotiate the terms of its future trading relationship. Given the tensions and gridlock caused by the negotiations for the UK’s withdrawal from the EU, you should probably brace yourself for much more debate and anxiety as trade relations are notoriously arduous to negotiate. Most trade deals take multiple years and Johnson’s government is tasked with negotiating its most important trade deal with its current closest trading partner within a year.

However, unlike his predecessor Theresa May, Johnson is now in a position of strength, boasting his significant majority which will give him some leeway in relation to factions within his party like the European Research Group. He will initially need to pass his negotiating objectives through Parliament, which will be the first test of how strong a grip he has on his party. Despite party unity on the need to do Brexit, unity on how close the UK should remain to the EU in terms of standards and regulations remains to be seen. According to Joe Mayes, the Brexit correspondent for Bloomberg: “The contradiction Johnson will have to resolve in the trade deal is his desire for both autonomy from EU rules and access to the single market. The EU has indicated it is willing to give Britain a zero-tariff, zero-quota deal -- on condition the U.K. doesn’t become a lightly-regulated Singapore-on-Thames. “The EU is also likely to take a tough line on key priorities for big member states like France and Spain. Expect to hear more on access to fishing waters and the status of Gibraltar, the tiny British territory to which Madrid lays claim.

“If Johnson wants access to the bloc’s single market, he will have to give up control in some areas -- in particular taxation, labour and environmental standards. Hard-liners in his party are likely to object to that, and push for a clean break at the end of the year.

“But a big majority could allow him to marginalize them and cut a deal that keeps the U.K. more closely aligned with the EU.”

July 2020: Decision on extending the Transition A decision on whether an extension needs to be made to the transition period must be made by July 1st. Throughout the campaign the Conservative leadership has made it clear that it would not seek an extension, such was the conviction of its ‘Get Brexit Done’ motto. However, should the negotiations be fraught with debate and disagreements – as trade negotiations often are – an extension may suit both sides, and the EU has already indicated that it is strongly considering one. Again, Johnson’s strong majority in Parliament may allow him to pass an extension despite hard-line opposition within his party, and he would have plenty of time in this parliamentary term to withstand any voter backlash to another delay on Brexit. If the UK declines the extension, it will then be left with six months to scramble for a deal or we will all be bracing ourselves for a repeat of the ‘No Deal Brexit’ deadline saga at the end of the year.

January 2021: Done Deal Brexit? January 1st 2021 could be the start of a new era, should a deal be agreed or ratified. Alternatively, it could mark the introduction of WTO rules as the UK’s basis for trade with the EU, or we could still be a period of months or years away from Brexit should an extension be made to the transition.

A Year of Greater Certainty Ahead? A potential benefit of such a strong government is that there should be greater certainty for businesses, allowing for better planning and increased confidence. We probably won’t be as embroiled in parliamentary process as we have been throughout 2019, in which we’ve had a minority government hamstrung by division within its party. The major uncertainty of the year will likely centre on whether an extension will be made to the Brexit deadline, but even if it isn’t, businesses will have six months to prepare for a pretty clear either-or situation of last-minute deal versus WTO rules.

The major result of the election is that Brexit will almost certainly happen, so things will change. As such, the need for British businesses to prepare for a changed trading situation is now paramount. The government grants for training in key Customs processes, such as completing Customs Declarations, already provide a fantastic opportunity for businesses to gain the trade skills that will be essential in the years to come. The deadline to apply for these grants is currently January 31st so we really suggest that you prioritise applying for them either before or straight after the Christmas break. We will continue to update members on this grant funding, and we will be providing training courses that will enable you to plan for post Brexit throughout the year.

4 New appointments to the Board of Trustee Directors The Institute of Export & International Trade is delighted to announce 4 new additions to its Board of Trustee Directors ahead of a vital year for the UK trade. Sandy Gullis MBE, MIEx (Grad), Caroline Gumble MIEx, Sangeeta Khorana MIEx and Allen Matty MBE MIEx have been appointed to the Board and will work under the Chairman, Terry Scuoler MBE, in directing the Institute as it looks to support UK businesses through the challenging years ahead. The new look board will be working closely with the Institute’s new Director General, Marco Forgione, who will be taking up his role in January 2020. Sandy Gullis returns to the board having previously served on it between 2014 and 2017. Sandy left the Army in 1999 and in the intervening years has worked for BOC Transhield moving food for Marks and Spencer’s, Honda Manufacturing providing ‘Just In Time’ logistics to the Swindon Factory. Additionally, he worked for Kellogg Brown and Root undertaking MoD contracts around the world, including operational areas of Iraq and Afghanistan, before moving on to be General Manager of the Wincanton site in Bicester. He now works for Essentra Components as a Supply Chain Project Manager.

Caroline Gumble is Chief Executive of the Chartered Institute of Building and has extensive business leadership experience, gained in the UK and overseas, within the Automotive and Capital goods sectors working with Lucas Industries, Ransomes Sims & Jefferies and Textron Inc, as well as Membership organisation leadership experience within EEF Ltd / Make UK. Sangeeta Khorana is Professor of Economics at Bournemouth University in the United Kingdom. She has a PhD. in International Economics from the University of St. Gallen in Switzerland and a summa cum laude Masters’ degree in International Law and Economics from the World Trade Institute in Berne, Switzerland. Allen Matty has been involved with overseas sales and operations in the petrochemical and engineering sectors in the UK, Scandinavian and Middle Eastern markets. He is also experienced in managing public sector service delivery contracts where, as Managing Director at West Midlands Chambers of Commerce LLP since 2010, he has been responsible for the delivery of the Department for International Trade (DIT) services in the West Midlands, where he manages a team of 35 International Trade Advisers and 8 support staff. You can read more about the Sandy, Caroline, Sangeeta, Allen and the rest of the Board here: https://www.export.org.uk/page/The_Board

International Trade News

New report reveals UK exporting wind and marine energy to 37

countries

A report published today by RenewableUK shows that UK-based onshore and offshore wind, wave and tidal energy companies are now exporting their products and services to 37 countries across 6 continents. Using an illustrative sample of companies involved in the sector, “Export Nation” reveals that 47 UK firms signed 465 contracts worth up to £53m per company in the past year, working on hundreds of projects in Europe, Asia, North and South America, Africa and Australia. Overall, UK exports of wind energy products and services are worth £525m a year, according to the Office for National Statistics. The new report reveals that current top ten export destinations for UK wind and marine energy companies are, in order of importance, Germany, Taiwan, Denmark, the USA, the Netherlands, France, Belgium, China, Ireland and South Korea. Nearly 70% of the contracts were in the offshore wind sector. The companies featured in the report won offshore wind contracts in 15 countries across 4 continents.

Germany is the most popular destination, followed in order by Taiwan, Denmark, the Netherland and the USA. The report also notes that, despite of the Government’s policies hindering onshore wind development domestically, the UK is exporting onshore wind products and services to 23 countries. Similarly, while Government policy does not support the development of wave and tidal energy, we are still exporting marine energy products and expertise to 12 countries. The survey reveals that the range of exports from the UK’s wind and marine is extraordinarily wide. UK firms are designing, building and maintaining wind farms onshore and offshore, as well as wave and tidal projects. Exports from our domestic supply chain include manufacturing blades, supplying and installing UK-made power cables on land and underwater, fabricating specialist steelwork, providing helicopters and crew transfer vessels, producing software to maximise power generation, conducting geological surveys, monitoring wildlife and providing legal and financial services. If you'd like to download the

report, please click here

Click here for more information on the article

Financial & political uncertainty takes its toll on global trade New data from the OECD shows that EU growth is contracting, as Brexit and US-China trade tensions take their toll. According to the new report released by OECD, exports from the EU contracted 1.8% in the 3rd quarter compared to the previous quarter whilst imports dropped by 0.4%. Even though all EU major economies were affected, Italy has been one of the worst hit with a drop in trade for the last consecutive 6 quarters. Imports from G20 countries, which account for 85% of world output, have also dropped 0.9%. Laurence Boone, OECD chief economist, warned that high levels of uncertainty on trade policy and geopolitics had resulted in stagnating global trade, which is dragging down economic activity in almost all major economies. The decrease in exports across the world is being held responsible for lower oil prices as well as the depreciation in other major currencies against the dollar. EU countries are heavily reliant on trade, explaining the significant dip in figures in the EU. For example, in Germany, trade is equivalent to 87% of gross domestic product, compared with 27% for the US.

Timme Spakman, an economist at ING, said: “European merchandise trade has been impacted significantly by uncertainty surrounding the trade war and Brexit,” He added: “the slowdown of German industry had an impact on European trade, as German producers ran down inventories rather than importing new intermediates”. Surveys being published are also showing that more than 70% of EU & US businesses have mentioned uncertainty is a big factor for them not to invest. Brexit uncertainty has also impacted UK exports negatively as well as causing the value of the sterling to fall against the dollar. Looking more further afield, when we asked Ana Boata, lead Eurozone and UK economist at Euler Hermes if there are any positive signals beyond the established trading nations, she told us: "The major drivers are the US-China trade dispute and the monetary reaction, but we also hear alarm bells ringing in the emerging markets, particularly Argentina, Turkey and South Africa. China slowing down quicker than expected definitely has an impact – especially on South East Asia markets – but there’s also oil prices.' “Policy easing in the US, China and the eurozone is not yet feeding through so all remain a drag on trade growth.” said Adam Slater, lead economist at Oxford Economics. "While there are some signs of stabilisation in forward-looking sentiment indicators, the picture for the near future remains gloomy." Mr Slater added: Any

improvement in the trade picture looks fragile and limited.” You can read the full OECD report here: http://www.oecd.org/sdd/its/International-trade-statistics-Q3-2019.pdf

Experts encourage greener shipping

As pressures increase for businesses to operate in a 'greener' environment, efforts are being made by the International Maritime Organisation to help with this. From 1st January 2020 new stricter regulations are being introduced regarding sulphur emissions released from ships. Telford-based Global Freight Services Ltd has welcomed the action which aims to make exporting by sea a much greener practice, however it says the move is likely to force up the cost of shipping goods. “One of the biggest ways to bring costs down is to increase the size of shipments and reduce the frequency of consignments. This will not only have cost benefits but is also much better for the environment too.” GFS's Managing director Anton Gunter said. The current limit for sulphur in fuel oil sits at 3.5% m/m whilst the new regulations introduced

by International Maritime Organisation will see the limit reduced to 0.5% m/m. Source: https://www.shropshirestar.com/news/business/2019/12/10/international-trade-expert-welcomes-action-for-greener-shipping/

International investment took a hit in 2018, but global trade remained steady

One of the big factors that has contributed to a decline in foreign direct investment, has been US tax policy changes prompting repatriation of earnings held abroad, a legislation introduced in 2017. Adding to this, there has been a decrease in US imports from China, even before the trade conflict between the two nations. This is being seen as 'stablising rather than shrinking relative to the size of the US economy'. “While current geopolitical tensions could seriously disrupt global connectedness, this 2019 update finds that most international flows have remained surprisingly resilient so far,” said John Pearson, chief executive of DHL Express. Steven Altman, senior research scholar at NYU Stern School of Business and lead author of GCI declined claims of a shift towards

regionalisation. 'Our analysis does not confirm a robust regionalisation trend. Instead, we see that the average distance across which countries trade has held steady since 2012' The GCI also remarked on discrepancy between perception and reality in regard to global connectedness. Mr Altman shared that exports actual share of GDP worldwide worldwide stood at 21% for trade, 6% for capital flows, 7% for information flows and 3% for people movement, as opposed to estimates of, respectively, 41%, 38%, 36% and 30%. This decline doesn't seem to be showing any signs of slowing down with forecast for 2020 suggesting that trade is on track for a small decrease. The disputes between US & China are being held partially responsible for the decreases happening in global trade with 66% of participants in a survey reporting that they had been impacted by the disruptions and operational challenges brought by the two nations.

The resolution doesn't seem to be around the corner anytime soon, with Washington showing very little willpower to co-operate with Chinese/US negotiators. President Trump said on 3rd December that a decision might be on hold until next year's presidential elections. Authoritive bodies within the international trade industry have all stressed the negative impact that uncertainty & volatility could

have on a global scale, business hope for clarity & guidance going into the new decade. Source: https://theloadstar.com/global-trade-flowing-nicely-but-international-investment-is-sticky/

‘Europe’s man on the moon moment’ - European Green Deal

Described as 'Europe's man on the moon moment', the new green deal released by the EU will aim to make Europe the world's first carbon-neutral continent by 2050. Published on Wednesday 12th December 2019, the environmental initiative included 50 policies to be rolled out over the next 3 years. “Our goal is to reconcile the economy with our planet. The old growth model that is based on fossil fuels and pollution is out of date and out of touch with our planet. It will be a long and bumpy road. But we are determined to succeed”. said Ms von der Leyen on Wednesday, the newly elected President of the European Commission.

Even though the release of the deal has been met with a positive sentiment overall, some member states have shared that they will not be able to commit to the target until they can secure billions of euros in financial aid to make the transition. €100 billion has been held back by the EU to assist with this. Another stumbling block for the EU commission has been France, UK & some eastern members claiming they couldn't support the deal if nuclear energy wasn't given a clear green light. Paul Tang, a Dutch centre-left MEP, said it was “shocking that on the same day the Green New Deal is presented, the compromise on a sustainable standard for investment is refused. Emmanuel Macron wants to be champion of sustainable finance but also wants to let nuclear contaminate the standard”, he said. Policies part of the plan include taxation to discourage unnecessary carbon emissions such as jet fuel in the aviation industry. This has been met with some resistance from EU members that see taxation as a national power not something to be imposed by the EU. Running alongside the green deal, Brussels wants to be able to reserve the right to impose fines to outside nations that pose a threat to EU members by trying to gain an unfair competitive advantage without following climate initiatives. Source: https://www.ft.com/content/913c15ce-1c1e-11ea-97df-cc63de1d73f4

Trade groups in the US try to revert export restrictions

Following the dispute between Huawei & US, the Trump administration is considering significant changes to the Export Administration Regulations (AER). The Department of Commerce heading up these changes are lowering the threshold of US origin controlled content in products, from 25% to 10%. The regulations that have been in place for 30 years have agreed that if an export has 25% or less of US content, it will not be subject to EAR and therefore not require an export license. “The proposed rules under consideration could negatively impact a wide range of commercial transactions

involving items that are not sensitive for any national security reason.” Trade associations have warned 'Creating a special rule for one set of targeted entities sets a dangerous precedent for future rules, while also increasing the compliance risk for U.S. exporters, big and small.’ Both proposed changes undermine the administration’s national security objectives to promote American prosperity and preserve our nation’s lead in research, technology inventions and innovations,” they said. When interviewed by The Globe and Mail newspaper, Huawei Founder, Ren Zhengfei, said the company is planning to move their California offices to Canada. “According to the U.S. ban, we couldn’t communicate with, call, email or contact our own employees in the United States,” he told the newspaper.

The trade groups are coming together and asking the Department of Commerce to consider stakeholder input before changing the existing de minimis and foreign direct product rules. Trade groups that have signed the letter to Commerce Secretary Wilbur Ross: - BSA/The Software Alliance, - Computing Technology Industry Association - Information Technology Industry Council - IPC - National Association of Manufacturers - National Foreign Trade Council - SEMI - Semiconductor Industry Association - Software & Information Industry Association and - U.S. Council for International Business Source: https://www-freightwaves-com.cdn.ampproject.org/c/s/www.freightwaves.com/news/us-exporters-attempt-to-head-off-new-content-restrictions/amp

Forthcoming training courses

No matter what level you are at, our courses will give you the skills and expertise you need to gain a competitive advantage in the challenging and complex world of international trade. 08/01/2020 Step by Step guidance on completing Customs Declarations – London 14/01/2020 Customs Classification and Tariff Codes – London 15/01/2020 Introduction to Exporting – Manchester 15/01/2020 Customs Procedures and Documentation – London 16/01/2020 Advanced Exporting – Manchester 16/01/2020 Post Brexit Documentation and Compliance - London 20/01/2020 Incoterms 2020 – Birmingham 22/01/2020 Introduction to Importing – London

See our full training calendar at www.export.org.uk/coursecalendar

2020 training dates now available... Our training calendar for 2020 is now live and available to book via our website. The Institute offers a range of one-day training courses, designed to give you the skills and expertise you need to gain a competitive advantage in the challenging and complex world of export, import and international trade. Our suite of training courses includes: • Step by Step guidance on completing Customs Declarations • Customs Procedures and Documentation • Customs Classification and Tariff Codes • Understanding Rules of Origin, Free Trade Agreement and Export Preference • Introduction to Exporting • Introduction to Importing • Advanced Exporting • Advanced Importing • Post Brexit Planning Workshop • Post Brexit Documentation and Compliance

Don’t forget that HMRC training grants are still available – you can get 100% of the cost of training for your employees covered by the grant, up to a limit of £2,250 per person.

View the full range of courses

The UK Customs Academy has been developed at the request of HM Revenue and Customs (HMRC) to support the development of a robust and sustainable customs intermediaries sector of the future, through investing in quality training and learning, up-skilling more people and making learning opportunities more flexible and accessible to all. To this end, the UK Customs Academy has been developed by KGH Customs Services UK in collaboration with the Institute of Export & International Trade and the Centre for Customs & Excise Studies. It has been made possible through Treasury and HMRC investment in training provision in this area.

Level 2 Customs Practice & Procedure Award – now available

Level 3 Certificate in Customs Compliance – now available

Level 4 Certificate in Advanced Customs Compliance – now available

Level 5 Diploma in Advanced Customs Compliance – now available

All of the courses are delivered online, with additional tutor support for Level 4 and 5 students.

Students of the Level 3, 4 and 5 courses will also receive FREE access to the UCC Navigator and Declaration Assistant Tools.

You can claim government grant funding to cover the full cost of the Level 2 – Level 5 qualifications. Find out more

www.UKCustomsAcademy.co.uk

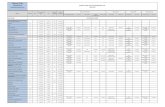

2020 Webinar Programme

The programme is not fixed and is subject to change. Dates will be announced in due course and registration opened to each session a month before it is due to take place. January 22nd: What you need to know about Brexit in 2020 – register now February: Export Controls and Licences February: Moving people over borders March 5th: Getting your goods on a boat March 19th: International IP, Copyrights, Trademarks and Patents April: Making sure you’re covered – what insurance options exporters need to consider May: Reaching customers overseas – SEO, Social Media and Translation June: Beyond the EU: Middle East June: Beyond the EU: Russia and CIS states July: Beyond the EU: South Korea July: Career opportunities in Global Trade August: Inspiring Exporters – export tips from winners of The Queen’s Awards September: Brexit – where are we now? October: Trade Association Series November: Free Trade Agreements – what you’ll need to know December: Planning for 2021