INSIGHTS Changes to European MMF Definitions

-

Upload

john-j-kundi -

Category

Documents

-

view

220 -

download

0

Transcript of INSIGHTS Changes to European MMF Definitions

-

8/6/2019 INSIGHTS Changes to European MMF Definitions

1/2

Changes to European money

market und defnitionsLIQUIDITYINSIGHTS

Please visit

www.jpmgloballiquidity.com

for access to all of our

Insights publications.

The independent fnancial supervisory authority o the

European Union, the European Securities and Markets

Authority, has introduced new defnitions to clariy what

is meant by the term money market und. This paper

summarises the changes and explains the impact on

J.P. Morgans money market und range.

New fund categorisations

In the past, the term money market und has been used as a catch-all or many

dierent kinds o unds in the European marketplacerom the most conservative,

AAA-rated, stable net asset value (NAV) unds to more risky and less regulated products.

The European Securities and Markets Authority (ESMA, previously known as the

Committee o European Securities Regulators) has sought to improve investor

protection by introducing a two-tiered approach to the classiication o money market

unds. It is envisaged that the harmonised deinitions will help provide a more

detailed understanding o the distinction between unds. This will allow investors to

choose more easily between unds that are tightly constrained to holding short-dated

investments and those that hold longer-dated instruments. Any und identiying itselas a money market und must conorm to the ESMA established deinitions o

either a short-term money market und or a money market und.

As o 1 July 2011, any newly launched money market und must all into one o the

two categories. Fund managers have until the end o 2011 to bring existing unds

into compliance.

Requirements for funds in both categories

ESMA has provided a set o guidelines that both categories o money market unds

must meet:

Objective: The primary objective o the und must be to maintain principal and

provide returns in line with money market rates.

Permitted instruments: The und must invest in money market instruments that

comply with criteria set out under UCITS IV, or in deposits with credit institutions.

Daily pricing and transactions: The und must provide daily NAV igures and price

calculations, and must allow daily subscriptions and redemptions.

FOR INSTITUTIONAL AND PROFESSIONAL INVESTORS | NOT FOR PUBLIC DISTRIBUTION

-

8/6/2019 INSIGHTS Changes to European MMF Definitions

2/2

Changes to European money

market und defnitions

To learn more about the Liquidity Insights program,

please visit us at www.jpmgloballiquidity.com.

Opinions and estimates oered constitute our judgment and are subject to change without notice, as are statements o fnancial market trends, which are based oncurrent market conditions. We believe the inormation provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as anoer or solicitation or the purchase or sale o any fnancial instrument. The views and strategies described may not be suitable or all investors. This material has beenprepared or inormational purposes only, and is not intended to provide, and should not be relied on or, accounting, legal or tax advice. Reerences to uture returns

are not promises or even estimates o actual returns a client portolio may achieve. Any orecasts contained herein are or illustrative purposes only and are not to berelied upon as advice or interpreted as a recommendation.

J.P. Morgan Asset Management is the brand or the asset management business o JPMorgan Chase & Co. and its afliates worldwide. This communication is issuedby the ollowing entities: in the United Kingdom by JPMorgan Asset Management (UK) Limited which is regulated by the Financial Services Authority; in other EUjurisdictions by JPMorgan Asset Management (Europe) S. r.l., Issued in Switzerland by J.P. Morgan (Suisse) SA, which is regulated by the Swiss Financial MarketSupervisory Authority FINMA; in Hong Kong by JF Asset Management Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia)Limited, all o which are regulated by the Securities and Futures Commission; in Singapore by JPMorgan Asset Management (Singapore) Limited which is regulatedby the Monetary Authority o Singapore; in Japan by JPMorgan Securities Japan Limited which is regulated by the Financial Services Agency, in Australia by JPMorganAsset Management (Australia) Limited which is regulated by the Australian Securities and Investments Commission and in the United States by J.P. Morgan InvestmentManagement Inc. which is regulated by the Securities and Exchange Commission. For U.S. registered mutual unds, J.P. Morgan Institutional Investments Inc., memberFINRA/SIPC. Accordingly this document should not be circulated or presented to persons other than to proessional, institutional or wholesale investors as defned inthe relevant local regulations. The value o investments and the income rom them may all as well as rise and investors may not get back the ull amount invested.

2011 JPMorgan Chase & Co.

At a glance: key differences

The ollowing table illustrates the key dierences between

short-term money market unds and money market unds.

WAM and WAL calculations

Weighted average maturity (WAM) is the average time to

maturity o the underlying securities in a und, weighted

according to the current market value o each security.

When calculating WAM, we assume that the maturity o any

loating rate instrument is the time until the next interest rate

reset date.

Weighted average lie (WAL) is the average time until the

principal is repaid in ull on the underlying securities in a

und, again weighted according to the current market value o

each security. In contrast with the WAM calculation, when

calculating WAL the maturity o any loating rate instrument is

taken to be the legal inal maturity on the instrument and so

does not take account o interest rate resets.

Impact on J.P. Morgan Liquidity Funds

The ollowing unds in our J.P. Morgan Liquidity Funds range

already meet the guidelines or classiication as short-term

money market unds under the new deinition:

Australian Dollar Liquidity Fund

Euro Government Liquidity Fund

Euro Liquidity Fund

Singapore Dollar Liquidity Fund

Sterling Gilt Liquidity Fund

Sterling Liquidity Fund

U.S. Dollar Government Liquidity Fund

U.S. Dollar Treasury Liquidity Fund

The U.S. Dollar Liquidity Fund holds securities with longer

maturities in compliance with current SEC 2a-7 rules or

money market unds, and will be compliant with the guidelines

or classiication as a short-term money market und beore

the ESMA deadline o the end o the year.

The U.S. Dollar Current Reserves Fund will be classiied as a

money market und under the new deinition due to its longer

WAM/WAL.

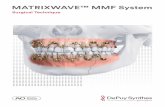

EXHIBIT 1: KEY DIFFERENCES BETWEEN SHORT-TERM MONEY MARKET

FUNDS AND MONEY MARKET FUNDS

Short-term moneymarket funds Money market funds

NAV Either stable or

luctuating

Fluctuating

Required security

maturity

397 days 2 years, provided next

interest rate reset date isin 397 days

WAM 60 days 6 months

WAL 120 days 12 months

Credit ratings Instruments must

hold one o the two

highest short-term

credit ratings (A-2/P-2/F2 or above)

Instruments must hold one

o the two highest short-term

credit ratings (A-2/P-2/F2 or

above); in addition, sovereignissuances are permitted down

to investment grade

Permitted to hold

other collective

investment

undertakings?

Yes, short-term

money market undsonly

Yes, short-term money

market unds or moneymarket unds

Source: J.P. Morgan Asset Management